Business

As Oil Goes Up, Stocks Go Down

The world’s flip from Russian oil

The I.M.F. mentioned over the weekend that the conflict in Ukraine and sanctions in opposition to Russia would have a “extreme influence” on the worldwide economic system, additional disrupting provide chains and stoking already excessive inflation. Buyers have been processing the newest developments, and markets opened on Monday with sharp strikes: Most notably, power costs are hovering and shares are sinking.

Brent crude oil, the worldwide benchmark, briefly rose above $130 a barrel, roughly double the worth a 12 months in the past. The worth of European pure fuel continued to soar, and is triple its degree a month in the past. Shares fell in Asia and in Europe many markets have slipped into bear-market territory, down 20 % from current highs. Shares within the U.S. are poised to open decrease in what’s shaping as much as be one other tumultuous session.

Power costs are reacting to speak of an embargo on Russian oil. Western lawmakers have begun discussing a ban, lengthy seen as unlikely. (The Treasury Division confused that Wall Avenue might nonetheless commerce Russian oil and fuel, after some monetary companies stopped.)

Shell reveals how troublesome a complete ban can be to implement. The oil large confirmed that it purchased some Russian crude to keep up gasoline provides to Europe, even because it mentioned it might get out of its Russia operations. “We are going to additional scale back our use of Russian oil as various crudes turn into available for purchase,” an organization spokesman advised Reuters, however “within the present, tight market there’s a relative lack of alternate options.”

Analysts are rethinking their stock-market forecasts. One theme that’s taking form, strategists at Goldman Sachs observe in a report, is a shift towards “pricing extra threat premium in European property.” Fairness and forex markets in Europe have already blown previous the financial institution’s pre-invasion draw back situation, whereas U.S. property have solely priced in about half of the forecast worst-case decline. (Relatedly, Goldman not too long ago upped its expectations for buybacks and dividends at S&P 500 companies.) Holger Schmieding of Berenberg expects shares to recuperate a few of their losses in three to 6 months, however “for some time, markets can tackle a self-sustaining dynamic of their very own. Concern can beget concern.”

The newest on the Russia-Ukraine conflict:

HERE’S WHAT’S HAPPENING

China indicators full steam forward for its economic system. Beijing officers over the weekend introduced their financial priorities for the 12 months, together with a development goal of 5.5 %, job creation and elevated welfare spending.

The pandemic’s international loss of life toll nears 6 million. Researchers at Johns Hopkins College predicted that the world would surpass that whole at present.

A trucker convoy targets Washington. A whole lot of autos, impressed by antigovernment protests in Canada, encircled the District of Columbia yesterday, driving slowly to snarl site visitors and protest Covid restrictions. It appeared to have petered out by the afternoon, however organizers mentioned they plan to hit the street once more at present.

Robert Smith might have performed an even bigger function in a tax avoidance scheme than beforehand thought. Court docket paperwork present that the billionaire financier was concerned in planning a 2004 deal that permit a key investor, Robert Brockman, keep away from U.S. taxes, The Wall Avenue Journal stories. Smith reached a nonprosecution settlement with federal authorities in 2020.

“The Batman” cleans up on the field workplace. The newest superhero film took practically $129 million within the U.S. and Canada on its opening weekend, vastly exceeding expectations.

The manufacturers nonetheless doing enterprise in Russia

This weekend noticed a gentle stream of corporations pausing or ending their operations in Russia. American Specific, Mastercard and Visa mentioned they might droop operations within the nation; Netflix stopped streaming there and TikTok halted uploads; KPMG and PWC pulled out, becoming a member of a number of consultancies and legislation companies. (Yale’s enterprise faculty is retaining an inventory of what corporations are doing.)

Numerous distinguished shopper manufacturers are retaining quiet, together with Coca-Cola, Mars, McDonald’s, PepsiCo and Procter & Gamble. (None responded to a request for remark.) Many shopper corporations have spent closely to construct their manufacturers in Russia, and have intensive infrastructure to think about.

-

PepsiCo, which began promoting within the Soviet Union within the early Seventies, acquired a Russian juice and dairy firm in a $5.4 billion deal a decade in the past.

-

Coca-Cola, which entered the Soviet Union after the autumn of the Berlin Wall, has spent closely to meet up with Pepsi. Coke has “an extended historical past of eager to be in each nation on this planet,” mentioned Mark Pendergrast, writer of “For God, Nation and Coca-Cola.”

-

Mars began enterprise in Russia in 1991 and has invested greater than $2 billion out there, in line with the Roscongress Basis.

Ought to they keep or ought to they go? Some query whether or not corporations ought to must take a stand on Russia, given strife elsewhere on this planet. There are additionally considerations that if manufacturers act in Russia, they is perhaps requested to do the identical in China, the place their companies are larger.

Quitting Russia hurts bizarre Russians. McDonald’s has about 850 Russian shops, with hundreds of staff. Danone said yesterday that it might droop “all funding tasks” in Russia, however nonetheless promote dairy merchandise and toddler formulation to satisfy “important meals wants.” However some specialists say that for sanctions to work, they’ve to harm, together with within the nations imposing the punishments.

Extra on company motion over Russia:

“It’s just like the banks have colluded with the sleazebags on the road to have the ability to steal.”

— Bruce Barth, who had cash stolen from his digital pockets through the fee app Zelle. Regardless of rising fraud on the cash switch service, which was created by the nation’s largest banks, many shoppers haven’t been refunded.

Being pregnant within the Zoom period

Expectant fathers can management after they inform the workplace their information. They may select to say they’re anticipating a baby to shut colleagues, however not at a gathering with purchasers. Pregnant ladies finally don’t have a selection: Their altering our bodies do the telling — except they work remotely.

Pregnant ladies within the Zoom period have been in a position to work with out broadcasting their pregnancies, and lots of of them are having fun with it, DealBook’s Sarah Kessler stories. It’s not nearly avoiding awkward feedback (“Have been you attempting?”). Many additionally say having their bellies cropped out of video chats allayed their fears of being handled in another way by colleagues.

The Russia-Ukraine Battle and the International Financial system

Stereotypes about working moms additionally have an effect on pregnant ladies. Each teams are usually seen as much less competent, extra needing of lodging and fewer dedicated to work, mentioned Eden King, a professor of psychology at Rice College. In a 2020 research, King and her colleagues requested greater than 100 pregnant ladies to trace how a lot their supervisors, with out having been requested for assist, did issues like assign them much less work. Girls who obtained extra undesirable assist reported feeling much less succesful, they usually have been extra more likely to stop.

The digital workplace doesn’t resolve these issues, however it could assist. “Some ladies do need assistance, and a few ladies do need lodging,” King mentioned. However “you need to ask ladies what they need and what they want and never assume that we all know.”

Russia checks Wall Avenue’s definition of ‘social duty’

Investments linked to environmental, social and governance points are anticipated to succeed in as a lot as $41 trillion by the tip of this 12 months, in line with Bloomberg Intelligence. However the conflict in Ukraine is highlighting how the E.S.G. label has been stretched.

Are army shares socially accountable? Charles Armitage, Citigroup’s European protection trade analyst, not too long ago mentioned that given Russia’s assault on Ukraine, the E.S.G. label must be prolonged to arms producers, which have historically been excluded. “Defending the values of liberal democracies and making a deterrent, which preserves peace and international stability” makes this warranted, he mentioned. A number of E.S.G. specialists dismissed the proposal, but it surely captures a thorny debate.

-

Blackrock’s iShares ESG Conscious MSCI USA, the world’s largest “socially accountable” exchange-traded fund, held $127 million price of shares on the finish of final 12 months within the army contractor Raytheon, a significant provider of arms to Saudi Arabia, which used them to bomb civilians in Yemen.

The S.E.C. is wanting into E.S.G. fund rules. Final week, its chair, Gary Gensler, said that the trade might use easier labels, akin to these on milk cartons. Funds must be extra particular about what social points drive funding choices, Rachel Robasciotti, the supervisor of the Adasina Social Justice All Cap International exchange-traded fund, advised DealBook: “There are completely some funds which might be simply placing on the veneer of social duty.”

THE SPEED READ

Offers

-

Warren Buffett’s Berkshire Hathaway introduced a $5 billion stake in Occidental Petroleum, from which Carl Icahn offered out. (CNBC, WSJ)

-

The homeowners of the Chicago Cubs M.L.B. crew might reportedly be part of the bidding for Chelsea F.C., the English soccer crew owned by the Russian billionaire Roman Abramovich. (Bloomberg)

-

Ryan Cohen, the billionaire co-founder of Chewy and director at GameStop, has taken an almost 10 % stake in Mattress Tub & Past and is pushing to shake up the retailer’s technique. (WSJ)

Coverage

-

Buyers in Amazon plan to demand that the e-commerce large present extra element about its tax payments. (FT)

-

Disney is dealing with criticism for not talking out in opposition to a Florida state invoice that will restrict what colleges educate about sexual orientation. (Wrap)

-

Democrats and Republicans are drawing totally different classes from processing delays on the I.R.S. (NYT)

Better of the remainder

-

Activision Blizzard’s C.E.O., Bobby Kotick, is stepping down from Coca-Cola’s board amid criticism over how he handled accusations of office harassment and abuse at Activision. (CNBC)

-

Apple shareholders authorized proposals recommending an audit of the corporate’s civil-rights influence, which the corporate opposed. (Bloomberg)

-

Ken Griffin of Citadel admitted that he might have been mistaken to dismiss crypto. (Insider)

We’d like your suggestions! Please e-mail ideas and solutions to dealbook@nytimes.com.

Business

Fresh Brothers pizza chain expanding beyond Southern California after sale to Craveworthy Brands

Fresh Brothers, the Southern California pizza chain, will expand into a national brand after being acquired this week by a Chicago-based company.

Founded in 2008, the popular pizza chain currently has 25 locations from Los Angeles to San Diego including shops in Manhattan Beach, Brentwood and Hollywood. The operation was appealing to Craveworthy Brands, which operates 15 restaurant brands with 225 locations nationally, said Chief Executive Gregg Majewski.

Majewski declined to disclose how much Craveworthy Brands paid to acquire Fresh Brothers. Under Craveworthy’s franchise model, new Fresh Brothers pizza locations will be independently owned, he said.

There are plans to open a Fresh Brothers in the Chicago area and begin franchising in other states by March, Majewski said. And while he eventually hopes to make some inroads in Florida and other states, Majewski said he doesn’t have plans to make an aggressive push into the Northeast.

“We’re going to work our way east from Los Angeles and west from Chicago, and we’ll meet somewhere in the middle when we’re done,” Majewski said.

He also plans to expand the Fresh Brothers footprint in California.

The restaurants’ affordable prices and use of higher-quality ingredients set Fresh Brothers apart in the crowded field of pizza chains, Majewski said.

“That’s a niche we want to be in,” he said. “We think Fresh Brothers is absolutely prime to be a higher level franchise concept in the pizza world.”

The expansion of Fresh Brothers is somewhat of an outlier in the fast-casual dining industry, where many chains have been struggling amid inflation and high labor costs. Average consumers are pulling back on discretionary spending, experts say, and may be frequenting their favorite restaurants less.

Mod Pizza, a fast-casual chain with more than 40 locations in California, was acquired by a Los Angeles-based restaurant group in July after teetering on the edge of bankruptcy. Popular burger joint Shake Shack closed nine locations in September, including five in the Los Angeles area.

But Majewski is optimistic about Fresh Brothers’ future and said the brand is a perfect fit for his restaurant platform.

“Backed by a deep understanding of market dynamics and a commitment to operational excellence, Craveworthy is uniquely positioned to guide Fresh Brothers’ journey from its Southern California foundation to nationwide expansion,” the company said in a statement.

Business

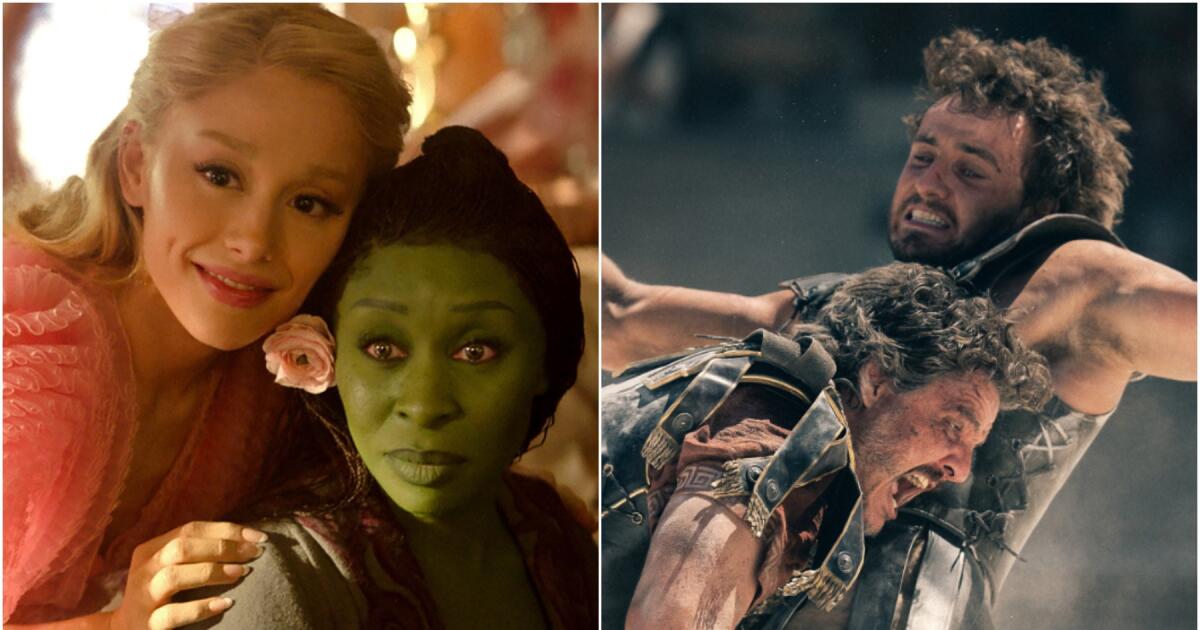

'Wicked' and 'Gladiator' set the stage for gravity-defying box office weekend

Universal Pictures’ “Wicked” and Paramount Pictures’ “Gladiator II” are expected to post gravity-defying numbers at the domestic box office this weekend.

On the heels of a solid summer (“Inside Out 2,” “Deadpool & Wolverine”) and a mildly disappointing fall (“Megalopolis,” “Joker: Folie à Deux”), the witches of Oz and the warriors of ancient Rome are joining forces to kick off the holiday movie season.

Each buoyed by star power, aggressive marketing and beloved intellectual property, “Gladiator II” is projected to launch somewhere between $65 million and $75 million, while “Wicked” is expected to conjure $120 million to $140 million in the United States and Canada, according to estimates from Boxoffice Pro.

Studio projections are lower, putting “Gladiator II” around $60 million and “Wicked” around $100 million.

“‘Wicked’ is the one that’s really moving up. ‘Gladiator II’ has been consistent,” said Daniel Loria, editorial director and senior vice president of content strategy at Boxoffice Pro.

“A lot of that is driven by a very healthy fan culture. This is a musical that has been around for a long time. People are familiar with it. I know musicals haven’t had the best track record at the box office, but ‘Wicked’ is the blockbuster musical of this generation.”

Theaters have been longing for a four-quadrant, double-feature moviegoing event since last year’s same-day release of Warner Bros.’ “Barbie” and Universal’s “Oppenheimer” created the global “Barbenheimer” sensation. Movie houses and entertainment companies have increasingly come to rely on movies that become viral, must-see cultural phenomena, a trend that accelerated after the COVID-19 pandemic scrambled audience behaviors and studio strategies.

“Wicked” and “Gladiator II” will be playing in thousands of theaters nationwide, with Disney’s highly anticipated “Moana 2” on the not-so-distant horizon, portending a much-needed period of healthy cinema attendance. Following multiple critical and commercial flops, morale is up among exhibitors betting on a strong end to 2024 and start to 2025.

A hat trick for “Gladiator II,” “Wicked” and “Moana 2” would be huge for the industry “coming off of the worst October of the post-pandemic era,” Loria said. Domestic box office so far this year is down 11% from the same span in 2023, and remains significantly lower than pre-pandemic levels, according to Comscore.

“I’m not sure this Venn diagram is going to be as big as the one we had for ‘Barbenheimer,’” Loria added. “But it’s another example of this industry responding to consumer demands and responding to the need for diversity … at the multiplex.”

Directed by Jon M. Chu, “Wicked” tells the origin story of Glinda, the Good Witch of the North, and Elphaba, the Wicked Witch of the West, before Dorothy arrived in Munchkinland and followed the yellow brick road. The long-awaited reframing of “The Wizard of Oz” — based on the hit Broadway musical of the same name — stars pop phenom Ariana Grande as Glinda and Tony Award winner Cynthia Erivo as Elphaba.

Universal has gone all out to promote the production, which cost an estimated $150 million to produce, not including marketing. The 2-hour, 40-minute film only covers the first act of the stage musical. Part two arrives in theaters next year.

Unlike the marketing around other films in the genre — such as Paramount Pictures’ “Mean Girls” and Warner Bros.’ “Wonka” — the “Wicked” campaign has not downplayed its musical elements. On the contrary, Grande and Erivo’s renditions of fan-favorite songs, from “Popular” to “Defying Gravity,” have featured prominently in trailers and TV spots promoting the movie.

“You couldn’t hide it if you wanted to,” said a studio source who was not authorized to comment.

But the “Wicked” marketing machine goes way beyond the music.

Universal partnered with 400 brands worldwide — including Starbucks, Ulta Beauty, Bloomingdale’s and Lexus — to douse retail shelves in pink and green, the signature colors of the movie’s leading sorceresses. There are “Wicked”-themed shoes, clothes, phone cases, laptop sleeves, luggage, candles, makeup palettes, jewelry, cups, office supplies, backpacks and hairdryers.

At least one of the brand collaborations drew unwanted attention. Mattel’s line of Glinda and Elphaba dolls made headlines recently when customers noticed that the packaging included the web address for a porn site instead of the movie’s official landing page. The toy company quickly apologized for the gaffe, calling the misprint an “unfortunate error.”

Unfortunate errors and all, Universal certainly has made a massive effort to live up to its source material’s fame with its ubiquitous rollout.

“Whenever you have a marketing campaign that can go to your exercise bike, that can go to your supermarket, that can really exit the theater and permeate the culture — that’s when you know the studio has really pulled out all the stops,” Loria said. “I’m not sure I can name a movie since ‘Barbie’ that has done that.”

The marketing team behind “Gladiator II” — director Ridley Scott’s lega-sequel to his early-aughts best picture winner, starring Paul Mescal, Pedro Pascal and Denzel Washington — has pulled out a few tricks as well.

For example: a Colosseum-shaped popcorn bucket with a virtual-reality twist and a controversial deal with Airbnb to bring Medieval Times-esque entertainment to the actual Colosseum in Rome.

“Gladiator II” cost an estimated $250 million to make, not including marketing costs.

Exhibitors are joining in on the fun too.

Look Cinemas — a dine-in theater chain with locations in Downey, Glendale, Monrovia and Redlands — has curated a special “Wickedator” menu with themed food and beverage items ranging from Arena Nachos (“Gladiator”) to Emerald City Sours (“Wicked”).

James Meredith, head of marketing and revenue at Look Cinemas, said the company has been preparing for this weekend for months, reserving premium screening rooms for both films, hosting advance screenings as early as Wednesday and expanding its showtimes and hours of operation to meet consumer demand reminiscent of the “Barbenheimer” craze.

“Our guests want to come in and escape for a while and have a big event or celebration around some of these popular movies,” Meredith said. “These types of movies … remind customers of how special the moviegoing experience is.”

Business

Column: It's the season for scams, so here's a piece of advice: Never do business with strangers

The text arrived midday, saying a delivery to me was on hold. To fix the problem, all I had to do was click on a web link and enter my ZIP Code.

“Have a great day from the USPS team!” the text said.

The awkwardly worded message (with bad punctuation and an international phone number) was clearly not from the Postal Service. And if I can hazard a wild guess, I don’t think the senders really wanted me to have a great day.

They wanted to rip me off and, so, a word to the wise this holiday season:

Watch your wallet.

California is about to be hit by an aging population wave, and Steve Lopez is riding it. His column focuses on the blessings and burdens of advancing age — and how some folks are challenging the stigma associated with older adults.

Fraud is a year-round, multibillion-dollar international enterprise. But for thieves, the season of joy is a wide-open window of opportunity, as AARP warned Nov. 18:

“With scammers looking to take advantage of consumers from all angles, new AARP survey research reveals that people need to be vigilant this holiday season as they buy gifts, book their travel arrangements, and donate to charities.”

Many of the scams are run by sophisticated international syndicates, said Kathy Stokes, director of fraud prevention at AARP’s Fraud Watch Network. Those crooks are working every channel, fishing for victims by email, phone calls, texts, fliers and regular mail.

Unwitting people are forking over money via gift cards, cryptocurrency, credit cards, cash and wire transfers. Losses often are virtually impossible to recover because the money is on foreign soil before the victims know they’ve been robbed.

Stokes said that in one common ripoff, thieves are going after people who own timeshares they’re trying to dump.

“There’s all this paperwork that makes it look legitimate, like you’re paying to get out of the timeshare,” Stokes said. But the crooks are pocketing thousands of dollars while the target is still stuck with the timeshare.

Last week, in a national conference on scams targeting older adults, Deborah Royster of the federal Consumer Financial Protection Bureau warned that consumers are being wiped out in a flash.

“Retirement savings and other resources that people have earned over a lifetime, and depend on,” Royster said, “can be gone in an instant.”

In that same conference, Virginia lawyer Julie M. Strandlie said her 85-year-old mother lost $80,000 between Thanksgiving and Christmas five years ago in a common scam that began with “flashing graphics and pounding voices” on her computer screen, warning of a virus.

“There’s a number to call for help, but it’s not the real Microsoft,” Strandlie said.

Her mother fell for the ruse, giving the criminals remote access to unlock her frozen computer. She was then duped into believing they had deposited money into her account, and she needed to pay it back in cash and gift cards from Best Buy and Target.

As LAPD Lead Officer Carlos Diaz, left, looks on, LAPD Det. Albert Smith leaves his card with Marta Barillas after a presentation about financial scams and physical abuse against seniors at St. Barnabas Senior Services in Los Angeles in June 2023.

(Genaro Molina / Los Angeles Times)

Steve McFarland, president and CEO of the Better Business Bureau region that runs from Palo Alto to Long Beach, said his office is getting 1,100 consumer complaints of all types each and every day.

He wasn’t kidding and repeated the number.

McFarland and other sources say a greater percentage of millennials report fraud than do older adults, but the latter group suffers greater losses. And across the age spectrum, McFarland said, gift card scams are hot right now.

Bar codes on those cards can be tampered with or photographed by someone before they’re sold, McFarland said. The buyer of the card goes to a checkout stand and puts, let’s say, $100 on the card to be redeemed at Target, Burger King or any number of establishments.

But when the recipient goes to redeem it, the funds are gone. It happened last year to L.A. County Supervisor Janice Hahn, who bought a $100 VISA gift card for a nephew who found that it wasn’t worth a nickel. Hahn later warned of the scam, along with McFarland, on L.A.’s Eyewitness News.

“It’s called gift card draining and these scammers have found several slick ways to victimize unsuspecting shoppers,” Hahn said.

In addition to outright scams, this is a time of year when solicitations for charitable donations can fill your mailbox.

“A lot of charities are trying to close out strong, and criminals know that and are vying for the same dollars,” Stokes said.

If it’s not an established organization that’s known for its good work, Stokes advised going to the Better Business Bureau’s give.org website, where you can type in the name of the charity to find out whether it’s legit. You can also find out what percentage of donations go to the cause versus overhead costs.

Your best policy, unfortunately, is to be suspicious of everything. I recently got a letter with my mortgage lender’s name in the window and opened it to find a warning that this was my “FINAL NOTICE” to avoid a monthly payment increase.

It looked hinky, and on the back page, in fine print, I learned that the mail was from a lender unaffiliated with my mortgage company.

If you see “final notice,” “urgent” or “benefit disbursement enclosed,” don’t even bother opening the envelope.

A friend shared a tall stack of mail that keeps coming for his mother, who died months ago, and as I sifted through it I found one attempt after another to separate her from her money. “Copy of Final Check Enclosed,” said one, and in the cellophane window was what looked like a check for $437.18 that said “Pay to the order of …”

But it wasn’t a check, of course. It was a solicitation from a lobbying firm claiming it will fight to preserve Social Security funding (and by the way, she had a lot of mail from organizations claiming they were out to do the same).

The fake check was described as an example of what she stood to lose if she didn’t immediately support the cause by pulling out her credit card and making an “urgent donation” to keep Social Security solvent.

And then there were solicitations from organizations representing a Noah’s Ark of endangered animals. Look, I’m an animal lover, but how does one begin to sort through all the pleas?

Save the pigs. The horses. The bees. The lions. The donkeys.

“Sunday, a baby donkey was ripped from his mother and brutalized,” said one envelope.

Lots of appeals for dogs, too. One included the photo of a dog with amazing verbal skills, judging by the quote attributed to the canine: “I wish for no one else to be hurt the way humans have hurt me.”

I feel for the dog, but if he can actually speak, let’s get him an agent and send him out on tour so the pup can raise a fortune for his cause.

Of course, there are plenty of good charities out there that are worthy of your generosity, but be careful.

With solicitations. With email. With texts. With phone calls.

All of it.

Banks should be doing more to prevent repeated, questionable, out-of-the-ordinary withdrawals and wire transfers. The gift card industry ought to be able to rein in rampant fraud with smarter security measures.

And people of all ages need to be more discerning, refuse to provide personal information such as Social Security numbers, and get some advice from a trusted friend or loved one before signing any checks or doing business with strangers.

Last year I wrote about two retired L.A. residents, a former teacher and a former banker, who were swindled out of roughly $80,000 apiece in internet scams. Earlier this year I wrote about a Redwood City woman who was taken for $1.8 million, and an Alhambra woman, Alice Lin, who lost $720,000 in an “investment” scheme introduced to her by a man she met on a chat app.

I reached out to Lin, who had some good advice on all forms of communication from sources you don’t know or trust.

“Do not respond,” Lin said. “Don’t touch it.”

steve.lopez@latimes.com

-

Business1 week ago

Business1 week agoColumn: Molly White's message for journalists going freelance — be ready for the pitfalls

-

Science4 days ago

Science4 days agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics6 days ago

Politics6 days agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology6 days ago

Technology6 days agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle7 days ago

Lifestyle7 days agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World6 days ago

World6 days agoProtesters in Slovakia rally against Robert Fico’s populist government

-

News6 days ago

News6 days agoThey disagree about a lot, but these singers figure out how to stay in harmony

-

News6 days ago

News6 days agoGaetz-gate: Navigating the President-elect's most baffling Cabinet pick