Business

An afternoon with Robbi Jade Lew, the woman at the center of the poker cheating scandal

Robbi Jade Lew is set to show the $120,000 ruby ring on her center finger doesn’t vibrate, is just not concealing a tiny digital camera and was not in any other case tampered with to assist her win a controversial Texas Maintain ’Em hand final week that has gone viral and rocked the poker world.

Similar goes for the supposed bulge within the facet of her Versace leggings, which on-line conspiracy theorists posit might have been hiding an digital machine that was feeding her data from an confederate. The Hustler On line casino chair she was sitting in has additionally been scrutinized, as have her $480 rose-tinted Fendi sun shades.

She denies all of it — and has invited me to a Beverly Hills jeweler in her quest to clear her title.

“Individuals are saying, ‘She did it for fame; she did it for cash.’ I didn’t want the cash, in order that’s hilarious,” stated Lew, 37. As for fame, “I clearly look a sure pretend Hollywood method. If I needed to be well-known, there are far simpler methods to do it than this.”

The previous biopharmaceuticals account supervisor from Pacific Palisades was comparatively unknown on the poker circuit earlier than the dishonest scandal. She realized to play 4 years in the past, initially selecting up a “Poker for Dummies” e book earlier than having her husband train her the fundamentals.

They started taking part in commonly throughout the pandemic, internet hosting video games with family and friends as a solution to go the lengthy days at residence. Realizing she had a knack for it, Lew employed two big-name poker coaches and turned totally to the sport this spring, touring to Las Vegas for the World Sequence of Poker and taking part in in smaller tournaments and money video games there and round Southern California.

On Sept. 29, Lew appeared for the third time on “Hustler On line casino Reside,” a well-liked YouTube poker present with greater than 180,000 subscribers that streams from the Gardena on line casino 5 nights per week. The high-stakes desk included Garrett Adelstein, a 2013 “Survivor” contestant and one among L.A.’s greatest skilled poker gamers; since “Hustler On line casino Reside” started streaming 14 months in the past, he has grow to be one among its regulars and the face of the present.

A wild hand between the 2 ensued a few hours into the stream, which was broadcast on a delay to stop gamers from getting tipped off in actual time (they’re additionally required to show over their telephones, smartwatches and another digital gadgets).

Robbi Jade Lew needs to inform her facet of the story.

(Luis Sinco / Los Angeles Instances)

Adelstein was holding the seven and eight of golf equipment; Lew the jack of golf equipment and the 4 of hearts. After the flop — the primary three communal playing cards — Adelstein had a straight flush draw, a hand with a variety of potential to win. Lew’s hand at that time was objectively horrible, however she referred to as his wager anyway.

The fourth communal card, referred to as the flip, didn’t assist both participant. Adelstein semi-bluffed and wager out once more; Lew re-raised. Adelstein responded by pushing all in for the rest of Lew’s chips: $109,000.

Lew referred to as — a surprisingly unorthodox transfer that paid off. She took down the massive $269,000 pot when Adelstein failed to enhance his hand after all of the playing cards had been dealt.

The result shocked viewers, the remainder of the desk and Adelstein, who regarded dumbfounded and was speechless for greater than 90 seconds after Lew revealed her hand.

“I’ll simply say it: Garrett thinks that this hand was not straight in a roundabout way — there’s little question about it,” commentator Bart Hanson informed the greater than 20,000 viewers who had been tuned in on YouTube. “That is probably the most disturbed I’ve ever seen Garrett look.”

After an off-camera dialog among the many two gamers and a producer, Lew gave Adelstein again half the pot, additional elevating suspicions; Lew says she was cornered into returning the cash “to alleviate the stress of the scenario” and regrets the choice.

I’m not nervous about any of this. I’ve nothing to cover, you understand? I really feel like if I keep quiet and let the world provide you with their very own tales and their very own storyline, that for me mentally is extra detrimental than popping out and talking my very own piece.

— Robbi Jade Lew

That night time, in a prolonged assertion posted on Twitter, Adelstein reasoned that Lew by no means would have continued taking part in with the playing cards she had until she was dishonest, and stated he was suspicious of what he characterised as her ever-changing “phrase salad explanations” afterward. Lew stated she misinterpret her playing cards, pondering she had a pair of threes as an alternative of jack excessive, however maintains she outplayed him nonetheless.

Adelstein, 36, declined to remark additional when reached Wednesday night time, however stated “that will definitely change in some unspecified time in the future.”

The fallout has infected the poker group, which has been burned by quite a few dishonest operations in casinos and on-line poker rooms through the years. It’s additionally the newest in a string of high-profile dishonest scandals just lately, together with on the highest ranges of chess and in aggressive fishing.

Execs and informal gamers world wide have weighed in, dissecting Lew’s physique language (was she tapping her fingers and twisting her ruby ring as a secret sign or simply fidgeting?), the garments she was carrying (was that “bulge” in her leggings one thing nefarious or a trick of the sunshine?), the chair she was sitting in (was it vibrating at a vital second or was she shaking her leg underneath the desk?) and her inconsistent statements about why she performed the best way she did (was she making an attempt to cowl her tracks or just flustered when questioned?).

“Primarily she performed a really dangerous hand in a method that recommended she might see her opponent’s gap playing cards,” stated poker professional Matt Berkey, who runs a widely known poker teaching academy. “Her hand was so dangerous that the worst participant on this planet wouldn’t need to put any cash into the pot.”

That stated, “it’s nonetheless very troublesome for me to wrap my head round how they might have pulled this off,” he added. “I don’t have an amazing diploma of confidence a method or one other.”

Lew supporters say it’s a basic instance of sexism by which a distinguished man is unable to take care of dropping to a much less skilled girl. In the meantime detractors have delved into her private life, questioning her wealth, her relationship together with her lawyer-entrepreneur husband, and her monetary preparations together with her poker backers (Lew purchased into the sport with $240,000 that was staked by one other participant on the desk).

Robbi Jade Lew denies that she cheated in final week’s poker recreation, saying she misinterpret her playing cards however nonetheless outplayed her opponent.

(Luis Sinco / Los Angeles Instances)

Now the manufacturing firm behind “Hustler On line casino Reside” has launched an investigation that includes combing via safety digital camera footage, conducting interviews and reviewing information. It stated it would ask Lew and its personal workers to undergo polygraph checks.

“We take the allegations very severely and perceive something is feasible,” Excessive Stakes Poker Productions stated in an announcement Saturday. “This investigation will probably be extraordinarily detailed and will take appreciable time to finish. As soon as the investigation is completed, we are going to launch the findings publicly — it doesn’t matter what they reveal. It’s essential for us to bolster that we have now discovered no proof of wrongdoing by anybody at this level.”

The corporate revealed the primary of its findings Thursday afternoon, precisely per week after the hand, saying it had found that one among its personal workers had stolen $15,000 in chips from Lew’s stack after the printed had ended. The worker was fired; Lew declined to press prices.

Inside hours, members of the poker group had been speculating that Lew’s determination to not pursue the case could possibly be an indication that she and the fired worker had been illicitly working collectively. Some who had been on her facet stated on social media that they’d modified their minds.

“Though extra data will quickly come to mild, I need to make clear I harbor no ailing will in the direction of anybody, particularly those that have reconsidered their place,” Adelstein, who lives in Manhattan Seashore, tweeted Thursday night time.

Of the newest rumors, Lew texted late Thursday: “Yea that’s insane.”

Lew arrived for our lunch in Beverly Hills 45 minutes late, pulling as much as the valet of Ocean Prime in a black matte Tesla. She defined that she’d been delayed by a physique language and habits skilled who had contacted her, providing to conduct an evaluation of her look on the poker stream.

“It’s simply so loopy as a result of I’ve been so personal,” she stated after ordering a double cappuccino. “Nobody’s actually dug that deep into my world.”

Lew stated she was born in Saudi Arabia to a physician mom and physicist father. She and her household — she additionally has an similar twin sister and a youthful brother — immigrated to Berkeley when she was 5 and later moved to Orinda, a quaint East Bay metropolis close by. She stated she attended UC Santa Barbara, double majoring in legislation and society and philosophy, and acquired married a decade in the past to Charles Lew.

“My husband is a really profitable man. You’ll be able to Google him,” Lew stated over the cellphone the day earlier than, the decision sometimes interrupted by the barking of her two 7-year-old Shih Tzus, Xena and Ninja.

“He has a large legislation agency referred to as the Lew Agency. He’s an owner-partner in a number of bars, eating places and a resort or two. He’s the No. 1 metaverse lawyer within the nation in addition to a professor at Loyola Regulation Faculty. He teaches a metaverse class each week. This can be a man who does have bankroll. I don’t know why cash surprises individuals. I suppose it’s as a result of most individuals don’t have it.”

Lew, who stated her pursuits embody vogue and high-quality jewellery, intentionally rewore a lot of her poker night time outfit to lunch: the identical lengthy, glittery necklaces, the identical black Louis Vuitton sling bag and Prada wedge booties, the identical seven-carat ruby ring.

“Isn’t it beautiful? It’s to die,” she stated, extending her fingers — accented by slender oval-shaped olive inexperienced acrylic nails — throughout the desk to indicate off the stone. “I’m like jewelry-obsessed. After which I’ve this tourmaline one on. I’ve all these diamond bands that I put on. Black diamonds. And that is rose gold.”

Lew requested to fulfill right here for a particular objective. She’d made a midafternoon appointment subsequent door at Kazanjian, a storied 109-year-old jeweler that had lent her the ring the day earlier than the poker recreation. She needed the shop to rigorously examine the piece for something suspicious, a course of she was planning to file on her iPhone so she might share it later together with her social media followers.

Lew spoke freely and quickly about what occurred at Hustler. Her chair appeared to vibrate, she stated, as a result of she was hungover and had forgotten to take her ADHD meds, inflicting her to shake her leg. She didn’t have something in her leggings apart from her mic pack within the again; the obvious rectangular bulge was simply glare from the on line casino lights. Having one other participant on the desk stake her is just not in opposition to the principles and she or he’s not obligated to disclose the phrases of the deal (she stated she and her backers usually break up her earnings 50-50).

“I’m not nervous about any of this. I’ve nothing to cover, you understand?” she stated. “I really feel like if I keep quiet and let the world provide you with their very own tales and their very own storyline, that for me mentally is extra detrimental than popping out and talking my very own piece.”

Lew is mystified by the flood of consideration — followers DMing her from “each friggin’ nation,” daytime discuss exhibits asking her to be a visitor, producers reaching out with leisure offers — and, although she insists she didn’t need any of this, she appears intrigued by the chances. She has retained a administration and public relations group to assist area requests.

Shortly after 2 p.m., Lew led the best way to Kazanjian, a closely guarded jewellery retailer on Camden Drive. Ft away from the diamond tiara that Madonna wore throughout her wedding ceremony to Man Ritchie and an 888.88-carat $5-million star sapphire named after Angelina Jolie, she introduced gallery supervisor Joseph Barrios with the now-infamous ring.

Joseph Barrios, gallery supervisor at Beverly Hills jeweler Kazanjian, inspects the seven-carat ruby ring worn by Robbi Jade Lew throughout a controversial poker hand.

(Luis Sinco / Los Angeles Instances)

“I don’t see something that may be thought-about as a technological add-on to it,” Barrios stated after a number of moments of analyzing the magenta-hued rock with a loupe magnifier. “It’s insane. Would which have occurred to a man? No.”

Charles Lew was additionally there, wearing a grey and black camouflage sweatsuit. He has his personal line of bijou that’s bought on the retailer, and got here by to pay for his spouse’s newest acquisition: a customized diamond-encrusted brushed rose gold horseshoe ring to match the black model she wore on her index finger throughout the poker recreation.

Lew had been uncertain about whether or not to maintain the ruby ring after what occurred final week. However whereas within the retailer, she made up her thoughts.

“I’m additionally gonna purchase that one — I need it,” she stated impulsively. “You understand why? It’s going to be story. I’ll most likely put on it on each stream.”

Business

Paramount's board approves bid by David Ellison's Skydance Media in sweeping Hollywood deal

Tech scion David Ellison’s months-long quest to win control of Paramount Global moved closer to the finish line Sunday, in a deal that marks a new chapter for the long-struggling media company and parent of one of Hollywood’s oldest movie studios.

Paramount Global board members on Sunday approved the bid by Ellison’s Skydance Media and its backers to buy the Redstone family’s Massachusetts holding firm, National Amusements Inc., said two sources close to the deal who were not authorized to comment.

A spokesperson for Paramount declined to comment.

The Redstones’ voting stock in Paramount would be transferred to Skydance, giving Ellison, son of billionaire Oracle Corp. co-founder Larry Ellison — a key backer of the deal — control of a media operation that includes Paramount Pictures, broadcast network CBS and cable channels MTV, Comedy Central and Nickelodeon.

The proposed $8.4 billion multipronged transaction also includes merging Ellison’s production company into the storied media company, giving it more heft to compete in today’s media environment.

The agreement, which mints Ellison as a Hollywood mogul, came together during the last two weeks as Ellison and his financing partners renewed their efforts to win over the Redstone family and Paramount’s independent board members.

Shari Redstone has long preferred Ellison’s bid over other those of potential suitors, believing the 41-year-old entrepreneur possesses the ambition, experience and financial heft to lift Paramount from its doldrums.

But, in early June, Redstone got cold feet and abruptly walked away from the Ellison deal — a move that stunned industry observers and Paramount insiders because it was Redstone who had orchestrated the auction.

Within about a week, Ellison renewed his outreach to Redstone. Ellison ultimately persuaded her to let go of the entertainment company her family has controlled for nearly four decades. The sweetened deal also paid the Redstone family about $50 million more than what had been proposed in early June. On Sunday Paramount’s full board, including special committee of independent directors, had signed off on the deal, the sources said.

Under terms of the deal, Skydance and its financial partners RedBird Capital Partners and private equity firm KKR have agreed to provide a $1.5-billion cash infusion to help Paramount pay down debt. The deal sets aside $4.5 billion to buy shares of Paramount’s Class B shareholders who are eager to exit.

The Redstone family would receive $1.75-billion for National Amusements, a company that holds the family’s Paramount shares and a regional movie theater chain founded during the Great Depression, after the firm’s considerable debts are paid off.

The proposed handoff signals the end of the Redstone family’s nearly 40-year reign as one of America’s most famous and fractious media dynasties. The late Sumner Redstone’s National Amusements was once valued at nearly $10 billion, but pandemic-related theater closures, last year’s Hollywood labor strikes and a heavy debt burden sent its fortunes spiraling.

In the last five years, the New York-based company has lost two-thirds of its value. Its shares are now worth $8.2 billion based on Friday’s closing price of $11.81 a share.

The struggles in many ways prompted Shari Redstone to part with her beloved family heirloom. Additionally, National Amusements was struggling to cover its debts, and the high interest rates worsened the outlook for the Redstone family.

Paramount boasts some of the most historic brands in entertainment, including the 112-year-old Paramount Pictures movie studio, known for landmark films such as “The Godfather” and “Chinatown.” The company owns television stations including KCAL-TV (Channel 9) and KCBS-TV (Channel 2). Its once-vibrant cable channels such as Nickelodeon, TV Land, BET, MTV and Comedy Central have been losing viewers.

The handover requires the approval of federal regulators, a process that could take months.

In May, Paramount’s independent board committee said it would entertain a competing $26-billion offer from Sony Pictures Entertainment and Apollo Global Management. The bid would have retired all shareholders and paid off Paramount’s debt, but Sony executives grew increasingly wary of taking over a company that relies on traditional TV channels.

Earlier this year, Warner Bros. Discovery expressed interest in a merger or buying CBS. However, that company has struggled with nearly $40 billion in debt from previous deals and is in similar straits as Paramount. Media mogul Byron Allen has also shown interest.

Skydance Media founder and Chief Executive David Ellison prevailed in his bid for Paramount.

(Evan Agostini/Invision/Associated Press)

Many in Hollywood — film producers, writers and agents — have been rooting for the Skydance takeover, believing it represents the best chance to preserve Paramount as an independent company. Apollo and Sony were expected to break up the enterprise, with Sony absorbing the movie studio into its Culver City operation.

The second phase of the transaction will be for Paramount to absorb Ellison’s Santa Monica-based Skydance Media, which has sports, animation and gaming as well as television and film production.

Ellison is expected to run Paramount as its chief executive. Former NBCUniversal CEO Jeff Shell, who’s now a RedBird executive, could help manage the operation. It’s unclear whether the Skydance team will keep on the three division heads who are now running Paramount: Paramount Pictures CEO Brian Robbins, CBS head George Cheeks and Showtime/MTV Entertainment Studios chief Chris McCarthy.

Skydance has an existing relationship with Paramount. It co-produced each film in the “Mission: Impossible” franchise since 2011’s “Mission: Impossible — Ghost Protocol,” starring Tom Cruise. It also backed the 2022 Cruise mega-hit “Top Gun: Maverick.”

Ellison first approached Redstone about making a deal last summer, and talks became known in December.

Redstone long viewed Ellison as a preferred buyer because the deal paid a premium to her family for their exit. She also was impressed by the media mogul , believing he could become a next-generation leader who could take the company her father built to a higher level, according to people knowledgeable of her thinking.

Larry Ellison is said to be contributing funding to the deal.

David Ellison was attracted to the deal because of his past collaborations with Paramount Pictures and the allure of combining their intellectual properties as well as the cachet of owning a historic studio, analysts said. Paramount’s rich history contains popular franchises including “Transformers,” “Star Trek,” “South Park” and “Paw Patrol.”

“Paramount is one of the major historic Hollywood studios with a massive base of [intellectual property], and so it seems to us that it’s more about using the capital that Ellison has and what he’s built at Skydance and leveraging that into owning a major Hollywood studio,” Brent Penter, senior research associate at Raymond James, said prior to the deal. “Not to mention the networks and everything else that Paramount has.”

The agreement prepares to close the books on the Redstone family’s 37-year tenure at the company formerly known as Viacom, beginning with Sumner Redstone’s hostile takeover in 1987.

Seven years later, Redstone clinched control of Paramount, after merging Viacom with eventually doomed video rental chain Blockbuster to secure enough cash for the $10-billion deal. Redstone long viewed Paramount as the crown jewel, a belief that took root a half-century ago when he wheeled-and-dealed over theatrical exhibition terms for Paramount’s prestigious films to screen at his regional theater chain.

Under Redstone’s control, Paramount won Academy Awards in the ’90s for “Forrest Gump” and “Saving Private Ryan.”

He pioneered the idea of treating films as an investment portfolio and hedging bets on some productions by taking on financial partners — a strategy now widely used throughout the industry.

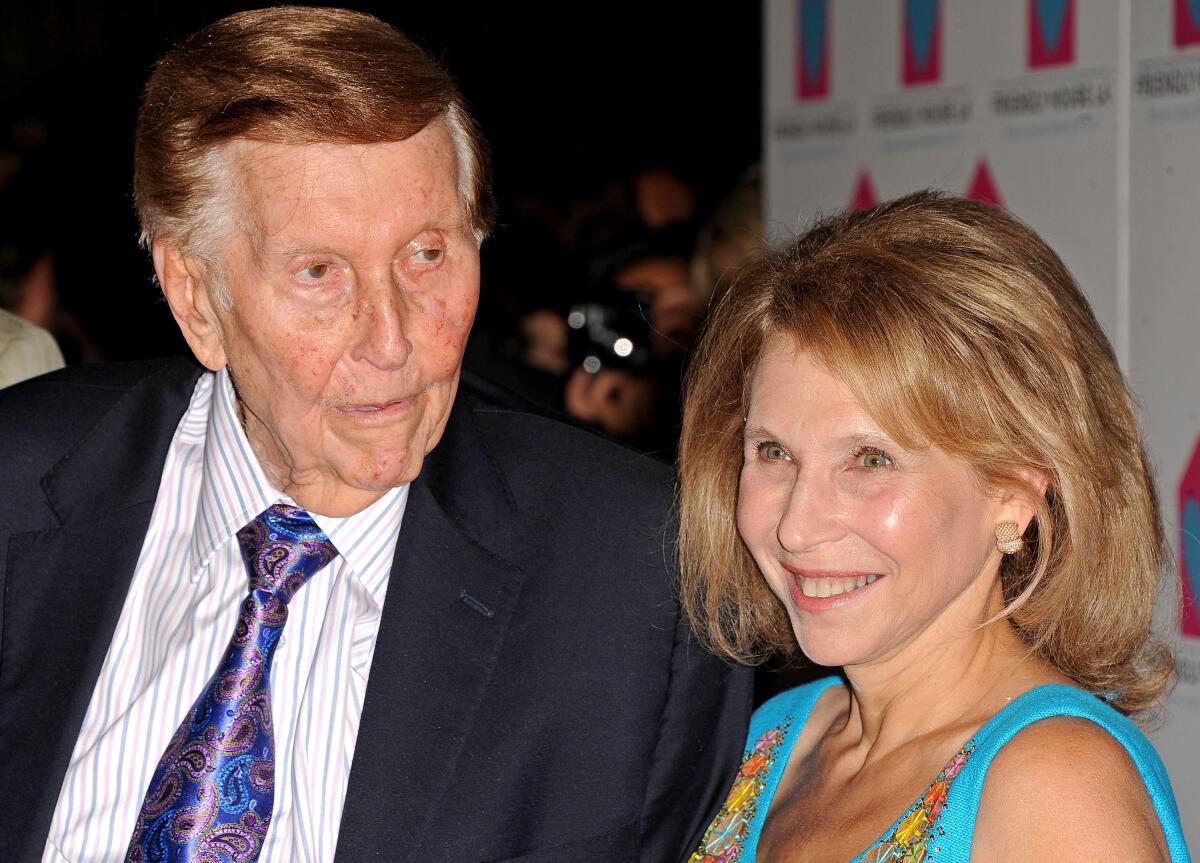

The late Sumner Redstone and his daughter Shari Redstone have owned a controlling interest in Viacom, which was rebranded as Paramount, through their family holding company, National Amusements Inc., since 1987.

(Katy Winn/Invision/Associated Press)

In 2000, Redstone expanded his media empire again by acquiring CBS, a move that made Viacom one of the most muscular media companies of the time, rivaling Walt Disney Co. and Time Warner Inc. Just six years later, Redstone broke it up into separate, sibling companies, convinced that Viacom was more precious to advertisers because of its younger audience. Redstone also wanted to reap dividends from two companies.

After years of mismanagement at Viacom, which coincided with the elder Redstone’s declining health, and boardroom turmoil, his daughter stepped in to oust Viacom top management and members of the board. Three years later, following an executive misconduct scandal at CBS, Shari Redstone achieved her goal by reuniting CBS and Viacom in a nearly $12-billion deal.

The combined company, then called ViacomCBS and valued at more than $25 billion, was supposed to be a TV juggernaut, commanding a major percentage of TV advertising revenue through the dominance of CBS and more than two dozen cable channels.

But changes in the TV landscape took a toll.

As consumer cord-cutting became more widespread and TV advertising revenue declined, ViacomCBS’ biggest asset became a serious liability.

The company was late to enter the streaming wars and then spent heavily on its Paramount+ streaming service to try to catch up with Netflix and even Disney. (In early 2022, the company was renamed Paramount Global in a nod to its moviemaking past and to tie in with its streaming platform of the same name.)

The company’s eroding linear TV business and the decline of TV ad revenue, as well as its struggles trying to make streaming profitable, will be major challenges for Ellison as he takes over Paramount. Though traditional TV is declining, it still brings in cash for Paramount.

And streaming is a whole different economic proposition from television, one that offers slimmer profits. Meanwhile, the company also faces larger industry questions about when — if ever — box office revenue will return to pre-pandemic levels.

“This is a company that is floating on hope,” said Stephen Galloway, dean of Chapman University’s Dodge College of Film and Media Arts. “And hope isn’t a great business strategy.”

Business

Missing the paperwork on your IRAs? All is not lost

Dear Liz: I have four daughters, now in their late 30s and early 40s. When they were very young, I started investing for them. As they began to earn their own money, I started Roth IRAs for them as well.

A decade ago, due to an unexpected divorce, a 30-day escrow and a move, I lost the paperwork for their accounts. After the investment company was acquired by another in 2015, I forwarded the new company’s contact information to my daughters. One transferred her account to another investment company, while her sisters left theirs in place.

Recently I found the old investment paperwork. The company has changed hands again, but the new company says it has no information about my three other daughters’ accounts. Can anything be done?

Answer: Since the latest company can’t find the accounts, your daughters should contact the escheat office of the state where you lived before your move.

Perhaps you didn’t update your address with the original company when you moved and the account statements or other mail were returned as undeliverable. If the company and its successor couldn’t find you — and some companies don’t look very hard — the accounts would be considered unclaimed and would have to be turned over to the state.

Links to state escheat offices can be found online at unclaimed.org, the website for the National Assn.

of Unclaimed Property Administrators.

The good news is that there’s no time limit for claiming previously unclaimed property.

The bad news is that some states will liquidate stocks and other investments after escheatment. If that’s the case, then the three daughters who didn’t move their accounts will have missed out on nearly a decade of investment returns.

Dear Liz: Is it common for a brokerage agreement to say the firm can close my account for any reason and without any notice? The agreement goes on to say that the brokerage can liquidate the investments in my account if it’s closed and that the brokerage is not responsible for any investment losses that result.

Answer: The short answer is yes — brokerage accounts can be closed at any time by the firm or by the client.

Such agreements often specify certain actions that can trigger a closure, such as failing to maintain a minimum required balance. But the agreements also typically have language that allows the brokerage to close your account at any time and for any reason.

Brokerages don’t commonly close customer accounts. If yours does, however, move quickly to transfer your investments to another firm.

Failure to act could result in your investments being liquidated, and you would owe capital gains taxes on any appreciation in their value.

Dear Liz: You have written that non-spouse beneficiaries are now required to drain their inherited IRAs within 10 years. Is this requirement retroactive?

I inherited an IRA from my mother in 2015. I have been taking out the minimum required each year. If I must drain the account within 10 years, will the increase in yearly income affect my Social Security benefits?

Answer: The 10-year requirement applies only to accounts inherited from people who died after Dec. 31, 2019.

IRA distributions don’t affect Social Security benefits, but could affect Medicare premiums if the withdrawal is large enough. Taxable income above certain limits triggers a Medicare surcharge known as an income-related monthly adjustment amount, or IRMAA.

Dear Liz: My husband passed away 10 months ago. I applied for widow benefits.

The Social Security Administration sent me a letter that said they cannot pay because my Social Security benefit would equal two-thirds of the amount of my pension. Please help me with this.

Answer: This is known as the government pension offset, and it applies to people who receive a pension from a job that didn’t pay into Social Security. Any survivor or spousal benefits you might receive are reduced by two-thirds of the pension amount. In your case, your entire benefit was offset.

People are understandably upset to learn they don’t qualify for survivor or spousal benefits through Social Security. But since your pension is large enough to offset any benefit, you’re financially better off with the pension than without it.

For more information, see the government pension offset pamphlet, available online at SSA.gov/pubs or by calling the Social Security Administration toll-free at (800) 772-1213.

Business

California’s workplace violence prevention law is now in effect. Here's how it changes things

Beginning this month, California businesses will be required to have plans in place to prevent violence in the workplace.

Senate Bill 553, signed by Gov. Gavin Newsom last fall, requires that employers develop plans to protect workplaces from foreseeable threats of violence, which can range from bullying and harassment to active shooter and hostage situations. Under the law, employers were to have these comprehensive plans in place by July 1.

Here’s what you should know about the new law:

Who pushed for the workplace violence prevention law, and why?

State Sen. Dave Cortese (D-San Jose), who wrote the legislation, said he began looking into regulating workplace violence after a major shooting in 2021 at a light-rail yard roiled his district. In the incident, an employee killed nine colleagues at the Santa Clara Valley Transportation Authority before taking his own life.

Surveying the scene soon after the shooting, Cortese said he felt there could have been a clear plan for how workers might respond in such a situation. “It would have saved lives,” he said.

Cortese said the requirements outlined by the law took cues from a regulation the California Division of Occupational Safety and Health had been in the process of developing. Their safety standard, however, given their lengthy rule-making process and bureaucratic delays, probably would have taken several more years to get final approval.

More than half of such shootings in 2021 occurred in places of commerce, including grocery stores and manufacturing sites, according to the FBI.

SB 553 was backed by several unions, among them the United Food and Commercial Workers Western States Council. The union sought a law that would help address what it described as a rash of violent attacks at grocery stores and pharmacies, as workers were being pressured by their employers to crack down on shoplifting.

Grocery and other retail workers who interact with the public have long worried about violence in the workplace. Notably, they faced harassment and at times assault from customers who refused to comply with mask mandates in the early years of the COVID-19 pandemic. Fast-food workers also have complained of violent and dangerous customers.

Did anyone oppose the legislation? If so, why?

Industry groups such as the National Retail Assn. had vehemently opposed SB 553, arguing the paperwork would be overly burdensome for businesses.

They also took issue with a provision the bill had in its early stages that prohibited businesses from requiring nonsecurity employees to confront shoplifters and active shooters. That language was later removed. Eventually, the trade groups dropped their opposition.

What exactly is required under the law?

Legal experts said many companies had already started loosely addressing workplace violence concerns as mass shootings and other violent incidents dominated headlines over the years. The law helps to clarify employers’ obligations in this arena, experts said.

The law defines four types of workplace violence employers should try to prevent: violent action by a third-party person with no real reason to be at the worksite — essentially, a stranger showing up and harming an employee; violence by parties that are entitled to be there, such as customers, clients, patients or other authorized visitors; violence committed against employees by another employee; and violence by a third party who has a romantic or other personal relationship with an employee.

Under the law, most California businesses with at least 10 employees are required to have a policy document identifying potential violence and plans to deal with it — either as a standalone document, or as part of an existing injury and illness prevention policy.

They must also make workers aware of the violence prevention plan through annual training, and maintain a log of incidents of violence over a minimum of five years.

What else should I know about the law?

The law makes it easier for employees — or the unions that represent them — to get temporary restraining orders if they are threatened by a coworker or someone else in the workplace.

“That’s a big thing — most employees don’t get to choose who they work with or what happens at work,” said Ian A. Wright, a labor and employment attorney at Alston & Bird. “It gives employees an additional form of protection that they can go and seek themselves.”

Noncompliance could be met with civil penalties, and businesses that haven’t yet implemented the law are already several days past the deadline.

“My advice would be to get it done as soon as possible,” Wright said.

-

World1 week ago

World1 week agoTension and stand-offs as South Africa struggles to launch coalition gov’t

-

Politics1 week ago

Politics1 week agoFirst 2024 Trump-Biden presidential debate: Top clashes over issues from the border to Ukraine

-

News1 week ago

News1 week ago4 killed, 9 injured after vehicle crashes into Long Island nail salon

-

News1 week ago

News1 week agoSupreme Court denies Steve Bannon's plea to stay free while he appeals

-

News1 week ago

News1 week agoVideo: How Blast Waves Can Injure the Brain

-

Politics1 week ago

Politics1 week agoTrump says 'biggest problem' not Biden's age, 'decline,' but his policies in first appearance since debate

-

News1 week ago

News1 week agoIncreasing numbers of voters don’t think Biden should be running after debate with Trump — CBS News poll

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie review: A Quiet Place, quivering since Day One