San Francisco, CA

Explore: How will S.F.’s rezoning affect your neighborhood?

The buildings most likely to be affected by San Francisco’s new upzoning plan are those where apartments and multi-family housing already sit, according to an analysis of the plan by Mission Local. Single-family homes, meanwhile, are likely to see very little change.

The newest, amended version of the plan to make the northern and western parts of the city taller and denser, which was announced by Supervisor Myrna Melgar and Mayor Daniel Lurie on Thursday, would no longer affect some 84,000 units of rent-controlled housing.

Mission Local’s map of that proposal, which will go to the Board of Supervisors Land Use Committee on Monday, showed that 33 percent of multifamily units would see even higher and denser zoning. These are in buildings currently zoned for apartments, many of which have commercial storefronts on the ground floor.

The low-lying areas of neighborhoods like West Portal, Forest Hill, the Sunset, and the Richmond, meanwhile, are unlikely to see drastic change outside of commercial and transit corridors.

See how the new upzoning plan affects your neighborhood. Switching tabs shows the kinds of parcels affected in the amended plan.

Just 13 percent of single-family homes and condos in the plan would be upzoned. The large majority of those units would remain as-is: They were already allowed to be up to 40 feet tall before, and will remain at 40 feet if the plan passes.

That’s by design: The upzoning plan has focused on increasing heights along commercial streets and transit lines, including Geary in the Richmond, Judah in the Sunset, and Van Ness in Nob Hill.

If you don’t live in a single-family home or condo, your building is more likely to be impacted. Multifamily residences — a category that includes apartment buildings — are located along transit and commercial corridors far more frequently. They are more than twice as likely to receive height limit increases in the proposed changes.

That’s true even under the amendment that would exempt any rent-controlled buildings with three or more units, the majority of multifamily housing in the plan.

All buildings, regardless of type, will be subject to “density decontrol,” however. That lets developers build any number of units on a single lot, as long as height limits don’t exceed those in the plan and design standards are followed. Effectively, that means no more exclusively single-family zoning.

And businesses? Since many exist on commercial corridors, 84 percent would be upzoned.

That has some business owners, like the owner of Joe’s Ice Cream on Geary Boulevard, worried.

Sean Kim’s building was bought in 2022 by an architecture company. The firm then met with the Planning Department to discuss potentially redeveloping the site to add housing atop what is currently a single-story commercial building housing the ice cream shop.

Kim fears that his lease won’t be renewed when it expires in three years, forcing him to either relocate or close the business.

“Probably, once we’re displaced, we cannot come back,” Kim said with a sigh.

Relocating is extremely costly. If Kim can find another building that already has the freezers and grills needed for ice cream and burgers, he thinks it would cost between $100,000 and $200,000 to move. If the building doesn’t already have that infrastructure in place, it’s more like $500,000.

Kim and other business owners worry that building owners will have an extra incentive under the new upzoning to let commercial leases expire and then sell their properties for redevelopment. Taller buildings would let developers profit more.

The Planning Department, for its part, said development tends to occur on vacant commercial buildings and lots, not ones with profitable businesses that pay rent.

Planning staff explained that the upzoning focuses on commercial and transit corridors so that new housing is transit-oriented and more environmentally friendly. With housing near transit and businesses, residents can walk, bike, and bus more, and drive less.

That will ultimately help small businesses, staff said. “Locating new housing on or near these corridors means more vibrancy, more foot traffic and more customers for our local small businesses, especially over the long term,” Planning Director Sarah Dennis Phillips wrote in an email to Mission Local.

District 7 Supervisor Melgar, who introduced the rent-control amendment, is also concerned. She introduced the “Small Business Rezoning Construction Relief Fund” to give funding for small businesses displaced and impacted by neighboring construction, though it’s unclear how much the city will be able to afford.

Kim is worried it won’t be enough. A grant of around $10,000, for instance, “doesn’t even help one month,” of relocation, Kim said.

Tenant advocates, meanwhile, are also worried about displacement. Though rent-controlled buildings with three or more units will now be removed from the plan, two-unit buildings, plus non-rent controlled apartment buildings, are still included. Advocates say building owners may displace tenants in order to redevelop their property.

“The stress that it causes is so extraordinary,” said Joseph Smooke, an organizer with the Race and Equity Coalition. “You get this feeling of hopelessness. Your whole life is built around how you commute to work and where you get your groceries.”

The worry about the zoning changes comes after the state weakened cities’ ability to control demolitions in 2019. While the city used to be able to unilaterally decide whether to issue a demolition permit, now a series of objective criteria have to be laid out for developers to meet.

The criteria are written in Supervisor Chyanne Chen’s separate ordinance, and include the building being free of inspection violations and the landlord having no history of tenant harassment or wrongful eviction.

Once demolition permits are acquired, developers must notify tenants about their rights, hire a relocation specialist, pay the difference between the tenant’s old and new rent for 42 months, and, once the new building is complete, offer any low income tenants a unit in the new building for at least the same rent as before (or a condo at a below market rate price).

The Planning Department emphasizes that demolition of existing housing has been extremely rare. Since 2012, the department said, an average of just 18 units a year have been demolished, 11 of them single-family homes. This is 0.00004 percent of the city’s 420,000 units.

Or, as one market-rate developer put it: “If you’re a developer and you can have two buildings, one is vacant and one you’re going to have a fight with tenants that’s going to drag out for years and cost hundreds of thousands of dollars, which one would you do?”

Methodology

The San Francisco Planning Department provided the latest zoning files, from Sept. 30 2025. We joined this dataset with another one on property assessments from the Assessor Recorder’s office. This allowed us to gather more information about the properties on each parcel affected by the zoning changes. When we joined both datasets, a very small portion of the rows did not match (0.37 percent).

We isolated parcels eligible for rent control by including the following: Buildings built before or during 1979, with more than one unit, from selected class codes (that include apartments, dwellings, flats and exclude condos and TICs). This does not necessarily mean those parcels are currently tenant occupied – there is limited data on how many buildings have rental units that are rent controlled. For the amended plan, the same parameters apply but for buildings built before 1979 that have at least three units.

To run calculations about change in existing height limit compared to the proposed ones, we excluded parcels that fall under several zoning classifications (representing 0.3 percent of parcels — 310 of 92,744). On the map, these parcels are shaded light gray.

San Francisco, CA

San Francisco schools chief ripped for ‘crocodile tears’ during strike as her salary and kids’ education revealed

San Francisco schools chief Maria Su was blasted for shedding “crocodile tears” while discussing school closures because of the teachers’ strike — as it was revealed she rakes in $385,000 a year while sending her kids to private school.

Su came under intense scrutiny this week as Bay Area public school teachers hit the picket lines over pay increases and better benefits. The strike ended Friday.

The schools chief — who earns five times more than a 10-year teacher with tenure — choked up Feb. 6 while discussing the impending strike and its impact on students “with the greatest needs.”

But she also dodged questions about making significantly more than her teachers — and also refused to answer a question about her own kids attending private school, KTVU reported.

“I’m a mom, I have kids, I know the importance of education,” Su replied.

“I know the importance of our teachers having fair and competitive and livable wages,” she said. “It is expensive to be here in the city.”

Su sat on her pile of cash while teachers stood on the San Francisco picket line for nearly a week before they landed a 5% raise for teachers over two years on Friday. The teachers also got their healthcare demands approved, receiving fully funded healthcare contributions for dependents.

Teachers didn’t have much sympathy for Su during the process of the strike — one picket sign on a wet day Tuesday said, according to the San Francisco Standard, “Is this rain or Maria Su’s crocodile tears pretending she cares about our kids?”

An eighth-grade science teacher in the area, Jennifer Erskine-Ogden, held the sign.

“Give me a break,” she told the San Francisco Standard about the tears. “It’s just fake.”

Su wasn’t the only San Francisco pol virtue-signaling about public education while sending her own kids to private schools, which can cost upward of $60,000 per year.

Saikat Chakrabati, a lefty candidate for Congress and tech multimillionaire, campaigned on behalf of the teachers union in a series of attention-grabbing videos — but sends his own child to a pricey private school, The Post is told.

Christine Pelosi, daughter of Rep. Nancy Pelosi and candidate for state senate, was shown on the picket lines as her own children enjoy an expensive private education.

San Francisco, CA

Jorge Diaz Graham, Oregon State rout San Fransisco

In another game with significant implications in the WCC standings, Oregon State dominated and is still in contention for a top four finish.

Jorge Diaz Graham scored 18 points to lead four players in double-figures for the Beavers in a 90-63 win over San Francisco on Thursday night at Sabrato Center.

Isaiah Sy scored 13 of his 17 points and Dez White had 11 of his 17 in a 50-28 first half for Oregon State (14-13, 7-7 WCC), which moves into sole possession of fifth place in the conference with four games left in the regular season. OSU is one game back of Pacific, which holds the tiebreaker.

The Beavers shot a season-high 56.3% from the field, including 60% from three, their best since Jan. 25, 2024 against Arizona.

Diaz Graham was 5 of 6 from the field, including 4 of 4 form three, made all four of his free throws and added five rebounds.

White (four rebounds, four assists) was 4 of 8 from behind the arc and Sy (six rebounds) was 3 of 5 from the perimeter.

Josiah Lake II had 16 points, five rebounds and seven assists for OSU, which led wire-to-wire.

Ryan Beasley had 17 points to lead four players in double-figures for San Francisco (14-13, 6-8), which shot just 20% from three.

Legend Smiley had 14 points for the Dons, who never got closer than 15 in the second half.

San Francisco, CA

Beloved firefighter tearfully reacts to insurance denial of stage 4 cancer drugs

A retired San Francisco firefighter, who spent nearly two decades willingly putting his life on the line for others, now finds himself fighting for survival while in a battle against his own insurance company.

I expected to be taken care of.

Ken Jones, former firefighter who recently received a denial from his insurance company regarding his stage 4 cancer treatment

Ken Jones and Helen Horvath hold one another in their living room. The couple, who met as fellow firefighters, have been married nearly 25 years and have spent the past year trying to navigate medical appointments, hospital bills, and insurance denials relating to Jones’ Stage 4 lung cancer which has spread to his bones, lymph nodes, and brain.

“You just automatically depend on that insurance being there,” said an emotional Ken Jones, who retired in 2012 after working for the San Francisco fire department for 17 years. “I expected to be taken care of.”

Jones, 71, was diagnosed with metastatic lung cancer last year, which has left him with painful tumors growing in his bones, lymph nodes, and brain. Jones’ doctor believes the stage 4 cancer is linked to Jones’ time on the front lines as a firefighter.

Ongoing exposure to smoke and other chemicals pose such a danger, the World Health Organization, beginning in 2022, started classifying firefighting as a “carcinogen.”

Leading up to his cancer diagnosis last year, Ken Jones has long been an avid cyclist and fitness enthusiast. His doctor believes his stage 4 lung cancer is linked to Jones’ 17 years working as a San Francisco firefighter.

The first denial letter

Part of Jones’ medical treatment, which was prescribed by his oncologist, was recently denied by his insurance company.

“It’s been horrible, said Helen Horvath, Jones’ wife. “It has been a huge burden.”

The couple met as young firefighters in San Francisco and have been married for close to 25 years.

Ken Jones and Helen Horvath met as firefighters in the 1990s and have been married close to 25 years.

Blue Shield deemed firefighter ineligible for immunotherapy

Blue Shield of California, which administers Jones’ Medicare Advantage plan, declined NBC Bay Area’s interview request.

In a denial letter to Jones, Blue Shield acknowledged the immunotherapy prescribed by Jones’ doctor is FDA approved and abides by Medicare guidelines, but only when it is used early as a “first-line therapy” following a cancer diagnosis. A Blue Shield oncologist and an independent reviewer, paid by Medicare, determined Jones is ineligible because he already underwent other types of treatments for his cancer.

“Sometimes though, there’s gray area in medicine,” said Dr. Matthew Gubens, an oncologist treating Jones. “There are gray areas and edge cases among our patients where those guidelines just don’t apply, where the data aren’t as robust, and we have to make clinical decisions in the clinic on the ground.”

Gubens, who heads UC San Francisco’s Thoracic Medical Oncology Clinic, says he is quite familiar with medical guidelines as someone who helped craft them. Gubens serves on an elite panel with the National Comprehensive Cancer Network, a self-described “not-for-profit alliance of 33 leading cancer centers.” Its guidelines for how to best treat cancer patients are widely used globally by hospitals, doctors, and insurance companies.

Dr. Matthew Gubens is Ken Jones’ oncologist and serves as medical director for UC San Francisco’s Thoracic Medical Oncology Clinic.

Oncologist blames denial on “misinterpretation” of medical guidelines

Gubens says his request for immunotherapy should be considered a continuation of Jones’ initial treatment, since it was never completed. Jones started chemo and immunotherapy last year, but his doctors urged him to stop ahead of schedule in order to try new medical trials.

“His first-line medication was interrupted,” said Horvath, who is also a registered nurse. “They thought he had a better chance with the clinical trial medication.”

The experimental drugs, however, were unable to halt the cancer’s progression as much as everyone had hoped. As a result, Jones’ medical team decided to turn back to chemo combined with immunotherapy. Then, came Blue Shield’s rejection.

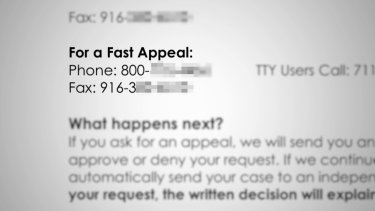

The ‘appeal’ phone number that led nowhere

Gubens decided to protest the decision by calling the designated “appeal” phone number listed on Blue Shield’s denial letter. After spending hours on the telephone, however, he says he was never able to connect with the appropriate person.

“I reached people who apologized, but they weren’t the right place to send the appeal to, and often referred me back to the first person I talked to,” Gubens told the Investigative Unit. “That day, I spent about three hours calling different phone numbers for this insurance company.”

Blue Shield would not comment on why the phone number listed on its denial letter did not lead to the correct person.

Gubens, ultimately, submitted his appeal in writing to Blue Shield but it was denied.

In its denial letter to Ken Jones, Blue Shield listed a phone number to lodge an appeal, but Jones’ oncologist said after dialing in, no one on the other line was ever able to connect him with an appropriate person to complete the appeals process.

“It’s very clear what the insurance company is doing,” Horvath said. “They’re trying to limit their costs, and they are doing that by interpreting Medicare rules in a very strict and impersonal way.”

In a statement, Blue Shield said its “medical reviews follow clinical guidelines and are not based on cost.” A spokesperson for the insurer also wrote, “our hearts go out to individuals and their families who are facing a cancer diagnosis or navigating treatment.”

Medical reviews follow clinical guidelines and are not based on cost.

Blue Shield spokesperson

“Who says ‘no’ to somebody with stage four lung cancer?” said Rachel Jones, Ken Jones’ daughter who is also registered nurse. She says she initially believed the denial must have been some kind of clerical error.

“I really did,” she said. “To me saying ‘no’ is saying, ‘I’m okay with you dying.’

A tearful Rachel Jones says Blue Shield’s denial of the immunotherapy prescribed for her father took an emotional and physical toll on her and her entire family.

San Francisco health oversight board urged to intervene

Last month, Rachel Jones took her disbelief to government officials.

“Today, I’m forced to stand here and beg because an insurance company has decided that profits matter more than the life of a man who spent his career protecting this city,” she said while speaking at a Jan. 8 public meeting for the city’s health oversight board.

As Ken Jones sat masked in the back row, lines of people urged the Health Service Board to intervene since it contracted with Blue Shield to provide insurance coverage for nearly 30,000 city employees and retirees, including Jones.

Former San Francisco Fire Chief Jeanine Nicholson says when she was diagnosed with cancer about a decade ago, Ken Jones drove her to her medical appointments for six months.

Former fire chief blames Blue Shield for ‘hastening’ firefighter’s death

“They are hastening his death,” Jeanine Nicholson said while at the podium, who served roughly five years as San Francisco’s fire chief until she retired in late 2024. “Firefighters, whether active or retired, should never have to beg for their lives.”

Firefighters, whether active or retired, should never have to beg for their lives.

Jeanine Nicholson, former San Francisco Fire Chief

When Nicholson was diagnosed with cancer more than a decade ago, she said it was Ken Jones who drove her to her medical appointments for six months.

“He’s the kind of safety net that a lot of different kinds of people can talk to,” said Horvath, Jones’ wife. “He’s able to talk to everybody.”

San Francisco Mayor Daniel Lurie stands alongside Helen Horvath on the steps of City Hall at a rally organized in support of Ken Jones.

Mayor Lurie weighs into insurance debate

That may help explain why so many firefighters decided to rally in his honor last month on the steps of City Hall. While Jones was too sick to show up, his family, friends, and even the mayor did all the talking for him.

“We got to make sure we take care of you,” Mayor Daniel Lurie told the crowd of firefighters during the Jan. 16 rally. “We as a city have to look out for each other.”

We as a city have to look out for each other.

Mayor Lurie, speaking at a rally organized in support of Ken Jones

Blue Shield ultimately approved an alternative treatment for Jones that included chemo but not immunotherapy. Gubens said his patient needs both.

“We are losing ground,” he said. “Any of our cancer treatments are harder to give and less effective, the weaker a patient is when we’re seeing them.”

According to Gubens, the appeals process wasted precious time.

“Our system is complex and it’s not easy to navigate,” said Monica Bryant, the co-founder and Chief Mission Officer of Triage Cancer, a nonprofit group that helps educate patients and physicians on the insurance approval and appeals process.

“We’ve been told in the past, dealing with the practical pieces, like health insurance and navigating your rights at work, is sometimes even harder than dealing with the physical aspects of a cancer diagnosis.”

Bryant, a cancer rights attorney who created the organization alongside her sister, grew up seeing the impact of cancer since both her parents were in the medical field focused on cancer research.

“People shouldn’t end up in financial ruin just because an insurance company denies their care,” she said. “If someone does get a denial, they shouldn’t take no for an answer.”

Since 2012, Triage Cancer has provided in-person and online educational events to more than 500,000 people across all 50 states, DC, Guam, Puerto Rico, and Canada.

“We are definitely hearing it from the healthcare professionals that we train that they are spending more and more of their time on prior authorizations and denials.“

Monica Bryant is the co-founder and Chief Mission Officer for Triage Cancer, which provides free education to patients, caregivers, and medical staff on how to best navigate the insurance approval process.

Doctors increasingly dealing with denials

Physicians, with the help of their staff, each spend an average of 13 hours a week on the insurance approval process, according to a survey by the American Medical Association.

“If they’re spending more time on paperwork, they’re spending less time with patients,” Bryant said. “I think we can probably all agree that that’s not the direction we want our healthcare system to go in.”

If they’re spending more time on paperwork, they’re spending less time with patients.

Monica Bryant, co-founder of Triage Cancer, speaking about the increasing demand on medical teams to spend more time navigating the insurance approval process on behalf of their patients

Advocates say denials and even delays can often force patients to forgo medical care or go into debt trying to pay for it.

About 80 percent of physicians say denials or delays in the insurance process ‘sometimes, often,’ or even ‘always’ lead to patients paying for their own care out of pocket, according to the same American Medical Association survey.

“It’s painful especially because of how unnecessary it is,” said Horvath, Jones’ wife. “The suffering of cancer is part of the human condition, but the suffering from insurance struggles is completely unnecessary pain.”

Ken Jones Ken Jones Ken Jones recently underwent a round of immunotherapy after an online fundraiser garnered the $50,000 needed to pay for the treatment.

The unbearable cost

An online fundraiser for Ken Jones managed to raise more than $50,000 to get him a round of the immunotherapy his insurance refused to pay for. However, his doctor says to see lasting progress, Jones would need to repeat the medication every three weeks for up to two years, at a cost of more than $1.7 million dollars – money the family doesn’t have.

But that doesn’t seem to be what worries Jones the most. He says he is speaking up to continue what he spent his entire career doing – looking out for others while sounding the alarm.

“I hate to see other people having to go through this,” Jones said tearfully. “You don’t stop just caring about other people just because you’re having a hard time.”

Contact The Investigative Unit

submit tips | 1-888-996-TIPS | e-mail Bigad

-

Politics1 week ago

Politics1 week agoWhite House says murder rate plummeted to lowest level since 1900 under Trump administration

-

Alabama6 days ago

Alabama6 days agoGeneva’s Kiera Howell, 16, auditions for ‘American Idol’ season 24

-

San Francisco, CA1 week ago

San Francisco, CA1 week agoExclusive | Super Bowl 2026: Guide to the hottest events, concerts and parties happening in San Francisco

-

Ohio1 week ago

Ohio1 week agoOhio town launching treasure hunt for $10K worth of gold, jewelry

-

Culture1 week ago

Culture1 week agoIs Emily Brontë’s ‘Wuthering Heights’ Actually the Greatest Love Story of All Time?

-

News1 week ago

News1 week agoThe Long Goodbye: A California Couple Self-Deports to Mexico

-

Politics1 week ago

Politics1 week agoTrump admin sued by New York, New Jersey over Hudson River tunnel funding freeze: ‘See you in court’

-

Science1 week ago

Science1 week agoTuberculosis outbreak reported at Catholic high school in Bay Area. Cases statewide are climbing