Georgia

Paper ballots focus of latest election reform push in Georgia legislature

ATLANTA – Five years ago, the General Assembly’s Republican majorities passed legislation providing for a paper backup to electronic ballots, a move aimed at giving Georgians more confidence their votes are being counted correctly.

But legislative leaders aren’t content with that election reform measure. This year, they’re pushing a series of bills aimed largely at paper ballots responding to election watchdog groups clamoring for more tools to ensure accurate outcomes.

“It will bring more confidence,” state Rep. Steve Tarvin, R-Chickamauga, said on the House floor Jan. 31. “It’s something we need to restore.”

The 2024 crop of election bills includes:

- Senate Bill 89 and House Bill 975, requiring use of the text portion of paper ballots in tabulating votes rather than QR codes.

- House Bill 974, requiring Georgia’s secretary of state to develop and implement a statewide system allowing members of the voting public to scan paper ballots.

- House Bill 976, requiring a “visible security device” in the form of a watermark on paper ballots.

- House Bill 977, expanding the number of races subject to “risk-limiting” audits.

The QR codes bill already has cleared the Senate Ethics Committee but remains pending before the House Governmental Affairs Committee. Republican lawmakers have cited numerous complaints from constituents about the use of QR codes.

“There’s been a lot of doubt surrounding the QR code, voters questioning whether the QR code is interpreting their vote accurately,” said Rep. John LaHood, R-Valdosta, chairman of the House Governmental Affairs Committee. “Having the actual text they can see and interpret themselves … is the right correction for us to go in.”

Former Republican Rep. Scot Turner of Cherokee County told members of the House panel he tried unsuccessfully to amend the 2019 bill to get rid of the QR code.

“Nobody’s going to trust the QR codes,” he said.

Senate Ethics Committee Chairman Max Burns, R-Sylvania, said the Dominion touch-screen voting system the state uses is capable of allowing the text portion of paper ballots to tabulate votes instead of the QR code.

“We’re going to leave the details and technical requirements up to the secretary of state,” he said.

But those technical requirements are giving the House committee pause. The panel has yet to act on the House version of the legislation amid questions surrounding the cost and who’s going to pay for it.

“This could require a heavy purchase of equipment,” LaHood said.

“I’m opposed to any unfunded mandates on counties until we have more information,” added Rep. Shea Roberts, D-Atlanta.

The House hasn’t hesitated on the watermark bill, the only one of the four measures that has cleared a legislative chamber. The House passed House Bill 976 Jan. 31 with only one “no” vote.

LaHood told his House colleagues before the vote the legislation would require a one-time cost of $110,000.

“This is a low-cost, high-value measure,” he said.

The other two bills – House Bill 974 and House Bill 977 – have passed the Governmental Affairs Committee but not yet reached the House floor.

House Bill 974 would expand to a statewide program an existing pilot project giving voters the ability to scan paper ballots online.

More: Bipartisan sports betting bill passes in Georgia Senate, but late amendment might capsize it

“This is something that can be implemented right away,” LaHood said. “(The secretary of state) is making provisions to do this.”

House Bill 977 would expand the number of election contests subject to audits from just the race at the top of the ballot to a second race involving one of the statewide races. The second race to be audited would be chosen by a committee of five officials: the governor, lieutenant governor, the speaker of the state House of Representatives, and the House and Senate minority leaders.

Anne Herring, policy analyst for Common Cause Georgia, raised concerns about the latter provision.

“The governor and lieutenant governor get to vote on whether their own races will be audited,” Herring told LaHood’s committee. “That’s a little concerning to me in terms of public confidence in elections.”

LaHood said including the two minority leaders and bringing the membership to five should allay those concerns.

“One or two people couldn’t sway that decision,” he said. “We need three people to vote together.”

The full House and Senate are expected to act on all of the election reform bills this month.

Georgia

Daily Briefing: All eyes on Rome, Georgia

Welcome to the Daily Briefing. Here’s what’s breaking this morning:

Nicole Fallert here, wishing I were frolicking in this superbloom. Wednesday’s headlines begin with a Georgia special election and then we’ll talk about that Team USA World Baseball Classic loss.

Who will replace Marjorie Taylor Greene?

Trump-endorsed Republican Clay Fuller, a former prosecutor, came in second among a field of more than a dozen candidates in Georgia’s special election on Tuesday to replace Marjorie Taylor Greene, who resigned from the U.S. House of Representatives in January after months of clashing with the president.

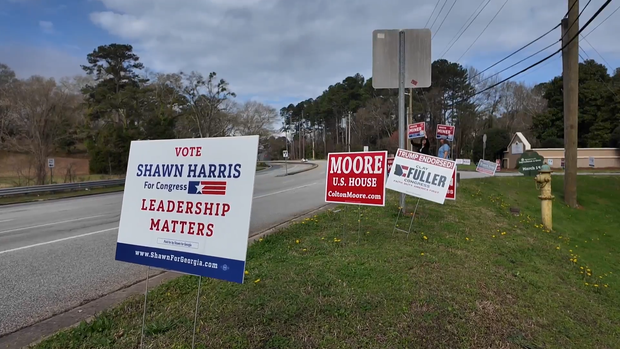

Retired Brigadier General Shawn Harris, one of just three Democrats on the ballot, topped the votes after consolidating most of his party’s support. But neither candidate received the required threshold under Georgia law of more than 50% to win outright. That means the two are headed for an April 7 runoff election.

Mississippi also had a primary election on Tuesday. See the results.

And this all begs the question: Can Trump run both a war and a midterm campaign at the same time?

More news to know now

- Should we worry about Iran sleeper cells? Trump said the administration is “on top of” possible Iranian sleeper cells operating inside the U.S. — offering few details about their existence and level of potential threat.

- Don’t miss your flight! Americans are enduring long wait times as a partial federal government shutdown strains staffing at the Transportation Security Administration. Check these resources before waiting too long to leave for the airport.

- It’s been six years since the COVID-19 pandemic began. On March 11, 2020, the World Health Organization (WHO) declared COVID-19 a global pandemic. Here’s a look back at what happened since.

Dunk!

NBA history made

Miami Heat’s Bam Adebayo scored 83 points on Tuesday against the Washington Wizards. Yes, 83. That’s the second-most points scored in an NBA game, surpassing late Basketball Hall of Famer Kobe Bryant.

Something to talk about

Italy just upset USA baseball

Team USA suffered one of the most embarrassing losses in World Baseball Classic history, 8-6 to Italy in front of a stunned crowd at Daikin Park on Monday. Now, they must rely on Italy to beat Mexico on Wednesday night, or hope a tiebreaker works in their favor.

Before you go

Have feedback on the Daily Briefing? Shoot Nicole an email at NFallert@usatoday.com.

Georgia

With voting over, Georgia’s election to replace Marjorie Taylor Greene could be test of Trump’s influence

Polls have closed in the Georgia 14th Congressional District special election to elect who will replace Marjorie Taylor Greene in Congress.

The seat has been vacant since January, when Greene resigned following a monthslong public fight with President Trump over foreign policy issues and the release of documents involving the Jeffrey Epstein case. A week before she announced her plans to resign, Mr. Trump said he would support a primary challenge against her.

Twenty-two candidates filed to run for the seat, but the number dropped to 17 candidates — 12 Republicans, three Democrats, one Libertarian, and one independent — all of whom appeared on Tuesday’s ballot.

Among the top candidates are former District Attorney Clay Fuller, who was endorsed by Mr. Trump, former Republican state Sen. Colton Moore, and Democrat Shawn Harris, a retired Army brigadier general who lost to Greene in the 2024 race for the seat.

Harris has raised more than $4.3 million for the race, with about $290,000 in the bank.

Greene has declined to endorse anyone in the race.

Georgia voters enthusiastic to choose their representative

Voters in Rome, Georgia, said they expect to return and vote in what is likely to be a runoff election because of the number of candidates.

“Too many people that think they’re politicians — some I know personally that has no experience, that, you know, Washington would just swallow them up like it does most people,” one voter said.

“What I look for in a candidate is tell me your policies. That’s the problem that I have with both sides today,” another voter said. “They attack each other, they hate each other, and they don’t ever get around to telling you what their actual policies are.”

Despite voters saying they planned to return to the ballot box, Floyd County Republican Vice Chair David Guldenschuh said the complicated schedule had party heads worried.

“There’s real fatigue out there, and I sense and feel for them,” he said.

Still, Guldenschuh said he doesn’t feel like the crowded field would hurt the GOP’s chance to hold the seat that Greene once occupied.

“I think that, you know, we have an unusual situation here. We all appreciated and loved Marjorie. And when she and Trump had the falling out, we still supported both here in this district, even though they weren’t getting along very well. And still are, as I understand,” he said. So I do know that this district is very solid conservative, and from Floyd County north, it’s really conservative. So I don’t see a big change going on now.”

Vincent Mendes, the chair of the county’s Democratic Party, expected Harris to get to the runoff, but said it would take effort to flip the seat.

“We will have to work our butts off to make him win if he gets to a runoff, but that’s how we should treat every single election,” Mendes said.

A local race with national implications

CBS News Political Director Fin Gómez said this special election is about more than just one seat in Congress. It’s being watched by politicians across the state and around the nation as an early indicator of where the Republican Party and its voters stand right now.

Gómez said this race could offer one of the first real tests of Mr. Trump’s influence within the party, with the president throwing his support behind Fuller.

The results could show whether the Republican base is still fully aligned with him after his rift with Greene.

The key question, according to Gómez: Does the president still have the influence that he did back in 2024?

“I do think that if Clay Fuller does well, even if he doesn’t clear the threshold that’s needed to avoid a runoff, I think that bodes well for the president, because that means Republican voters are still adhering to what the president says, and it shows the influence that that the president still has on the Republican Party, including in northwest Georgia,” he told CBS News Atlanta.

If another candidate, such as Moore, pulls off a win, it could signal the Republican base isn’t always following the president’s lead.

“If Fuller does not when I think it would surprise a lot of the Trump faithful who really adhere to who he supports in these type of elections, but if, let’s say, if it doesn’t go Fuller’s way and Moore picks off this win, I think what you are seeing is that the base might be a little more unpredictable, similar to what we saw perhaps in 2010.”

Special election marks start of busy campaign stretch

With how crowded the field is, it is very likely that this will be only the first step to choosing Greene’s replacement. Georgia’s special election rules require a candidate to win a majority of votes. If that threshold is not met, the top two candidates will go on to the April 7 runoff.

Whoever eventually wins the seat will serve out the rest of Greene’s term — a relatively short time in office. If they want to remain in the seat, they’ll have to run again in the May 19 party primaries. That race could possibly go to a party runoff, which would take place on June 16. The winners of the primaries will advance to the general election in November.

Last week, 10 Republicans, including Fuller and Moore, qualified to run in November’s election for a full two-year term. Harris also qualified, the sole Democrat who did in what has been rated as the most Republican-leaning district in Georgia by the Cook Political Report.

Mr. Trump carried the 14th Congressional District with 68% of the vote in the 2024 election, with Greene receiving over 64%. Republicans want that rightward trend to continue in the district. Democrats are hoping that the potential GOP infighting and crowded field could help them secure a surprise electoral win, shrinking the already-narrow margins in the U.S. House of Representatives.

Republicans currently control 218 House seats to the Democrats’ 214.

Georgia

Georgia special election to replace MTG tests the power of Trump’s endorsement

People cheer for President Trump en route to his speaking engagement at the Coosa Steel Corporation on Feb. 19 in Rome, Ga. Trump delivered remarks on the economy and affordability as the state started voting to replace the seat vacated by former Republican Rep. Marjorie Taylor Greene.

Chip Somodevilla/Getty Images

hide caption

toggle caption

Chip Somodevilla/Getty Images

Stay up to date with our Politics newsletter, sent weekly.

ATLANTA — Voters in Northwest Georgia are choosing who should replace former Republican Rep. Marjorie Taylor Greene. Voting closes in the district’s special election on Tuesday night.

The election will test the weight of President Trump’s endorsement of one of the candidates in a crowded race. Some voters say the president’s choice is not who they think would best support the conservative MAGA movement championed by both Trump and Greene.

Greene resigned at the beginning of this year, leaving Georgia’s 14th Congressional District without representation in Congress — and slimming the GOP’s majority in the House — following a bitter split with Trump.

Greene rose to prominence over five years in office as a strong ally of Trump, bombastically attacking critics and pushing the MAGA movement’s “America First” policy. Yet the two had a very public clash after she pushed for the release of documents related to convicted sex offender Jeffrey Epstein. Greene has also been sharply critical of Trump’s actions abroad, saying he has strayed from his promises to focus domestically.

With Trump now in the second year of his second term, other high-profile spats with key parts of his MAGA coalition have erupted over his administration’s handling of other issues, including sweeping tariffs, immigration policy and more. More recently, rifts have emerged over the war with Iran.

Some, like Greene, argue that though Trump helped create the “America First” worldview, he is not the sole arbiter of what it looks like.

Most of the GOP candidates in the special election have said they want to focus on Trump’s priorities and the concerns of their district, rather than become headlines themselves — an approach they say Greene embraced in her public disputes with Democrats and even with members of her own party.

“The difference between Marjorie and I is I will not use the press to become a celebrity,” Republican Star Black said during a candidate forum on Feb. 16. “I will use the press to actually show what I have done — the accomplishments,”

Trump has endorsed Clay Fuller, a district attorney in northwest Georgia for the state’s Lookout Mountain Judicial Circuit. He emphasized his support last month during a visit to Rome, part of the state’s 14th District, where he held a rally to tout his administration’s economic policy.

Fuller called himself a “MAGA warrior” at the event.

Republican congressional candidate Clay Fuller (left) shakes hands with President Trump as he arrives on Air Force One at Russell Regional Airport on Feb. 19 in Rome, Ga.

Chip Somodevilla/Getty Images

hide caption

toggle caption

Chip Somodevilla/Getty Images

“I really like him,” said rally attendee Jill Fisher. “I think he’s a strong candidate, seems like a very nice family man with some great values. And I think he’ll add a lot to Congress.”

Highlighting Fuller’s military service as an Air Force veteran, an ad for his campaign says, ” ‘America First’ is the story of his life.”

Fuller faces several other GOP candidates in the primary, including former state Sen. Colton Moore. Moore won elections for the state Legislature in the district before and is considered one of the most right-leaning lawmakers at the state level.

“I’m 100% pro-Trump,” Moore declared in his campaign announcement video.

He’s made a few headlines of his own. Last year, Moore was arrested for attempting to enter the House chambers in Atlanta to attend the State of the State address by GOP Gov. Brian Kemp. Moore argued he had a constitutional right to enter the chamber. Moore had been banned from entering the chambers by the state’s Republican House Speaker Jon Burns for disparaging comments he made about a late Georgia lawmaker at his portrait unveiling.

Moore’s record matters for some GOP voters even more than Trump’s endorsement. Less Dunaway, 14th district voter, says he’s a strong supporter of Trump, but thinks Moore will do a better job carrying out the president’s agenda than Trump’s own pick.

“He actually knows what he’s doing,” Dunaway said of Moore. “He was a state representative, a state senator. He was the first one to fight the people over the 2020 election in Georgia.”

Moore was one of a group of GOP state lawmakers who called on lawmakers to investigate or impeach Fulton County District Attorney Fani Willis after she charged Trump and others with trying to overturn the 2020 election in Georgia, when Trump and his allies pushed baseless claims of widespread election fraud.

Fuller insists Trump made the right choice in supporting his bid.

“I think they’re looking for someone to carry President Trump’s banner, support his agenda, and fight for him on Capitol Hill,” Fuller told Georgia Public Broadcasting last month.

Still some Republicans who attended the February rally left undecided.

“I don’t just blindly follow what [Trump] says,” said Clay Cooper of Rome.

Still, Cooper said that Trump’s endorsement means he will give Fuller more thought. “[Fuller is] someone that [Trump] thinks aligns very much with his messaging, with his actions, so that certainly weighs in,” Cooper said.

Unlike a partisan primary, all the candidates — Republicans, Democrats and third party candidates — will be on the same ballot for voters in the special election. If no one gets over 50% of the vote, the two top vote-getters regardless of party will advance to a runoff on April 7.

Follow the results below as polls close on Tuesday at 7 p.m. ET.

NPR’s Padmananda Rama contributed to this report.

-

Wisconsin1 week ago

Wisconsin1 week agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Massachusetts1 week ago

Massachusetts1 week agoMassachusetts man awaits word from family in Iran after attacks

-

Detroit, MI5 days ago

Detroit, MI5 days agoU.S. Postal Service could run out of money within a year

-

Pennsylvania6 days ago

Pennsylvania6 days agoPa. man found guilty of raping teen girl who he took to Mexico

-

Miami, FL7 days ago

Miami, FL7 days agoCity of Miami celebrates reopening of Flagler Street as part of beautification project

-

Sports7 days ago

Sports7 days agoKeith Olbermann under fire for calling Lou Holtz a ‘scumbag’ after legendary coach’s death

-

Virginia7 days ago

Virginia7 days agoGiants will hold 2026 training camp in West Virginia

-

Culture1 week ago

Culture1 week agoTry This Quiz on the Real Locations in These Magical and Mysterious Novels