Massachusetts

Carlozzi: Are Massachusetts lawmakers serious about competing?

It seems evident that Governor Maura Healey recognizes Massachusetts is at an inflection point and must act to prevent a mass exodus of residents from leaving the Commonwealth and heading to lower-cost states. This is undoubtedly why her first major legislative package was a tax reform bill designed to help make living and working in Massachusetts more affordable. But once state legislators are done putting their stamp on tax relief, will it be enough to stop the hemorrhaging and keep residents and businesses, along with their tax dollars, in the Bay State?

From a small business perspective, there is not enough meaningful relief in the Legislature’s version of the tax package to effectively move the needle on competitiveness.

Gov. Healey proposed raising the exemption for the onerous estate tax to $3 million, but the House and Senate lowered it to $2 million. Therefore, instead of being worst among the handful of states that still levy an estate tax, Massachusetts will be third worst – take that Oregon and Rhode Island! Making matters worse, the Senate opted to include in the long-awaited tax reform bill a tax increase for married couples subjected to the newly imposed 4% income tax surcharge. When it comes to over-taxation, these are hardly great strides towards improving small business competitiveness.

Indeed, Massachusetts’ Main Street businesses face an ever-increasing number of challenges following the pandemic. Anecdotally, we’ve all spent more time in store checkout lines or sat longer at a restaurant waiting for our food because businesses are short-staffed. In fact, the May 2023 National Federation of Independent Business Small Business Optimism Index shows 44% of small business owners reporting positions they cannot fill. Even when employers attempt to hire for a job opening, 89% find no, or too few qualified applicants. Now, factor in prolonged inflation and supply chain disruptions, and the last thing small businesses need are additional hurdles caused by the policies emanating from Beacon Hill.

The cost of doing business here is already too high compared to other states. Massachusetts was ranked worst in the nation for unemployment insurance taxes, something all employers pay. This problem only became more pronounced when other states used billions of dollars in federal aid to cover the cost of layoffs resulting from state mandated shutdowns and Massachusetts only allocated a fraction of what was required. Now, employers are charged with repaying $2.7 billion in COVID assessments on top of their UI taxes. Even scarier is the prospect that business owners may be on the hook to refund another $2.5 billion in UI funds to the federal government due to a billing error the state made during the pandemic.

Further, the cost of hiring and retaining employees is also elevated compared to other states. Massachusetts has one of the highest state minimum wages in the nation at $15 per hour. Legislation was filed this year to elevate that base wage by 33% to a whopping $20 per hour. And when energy bills skyrocketed for Massachusetts residents this past winter, they shot up for small businesses as well. Businesses require affordable energy to run machinery and heat or cool facilities in order to compete with parts of the nation that enjoy far lower energy expenses. Offering affordable health insurance coverage is also a longtime challenge for small businesses who experience some of the highest expenses in the nation. Smaller employers and their workers continue to be at a disadvantage with limited options, annual premium hikes, and higher deductibles.

So, with all of these challenges and disadvantages, what are the solutions being presented by lawmakers to actually make the state more competitive, strengthen the economy, and encourage job creation? Sadly, few. What we instead witness are energy policies that result in higher utility bills, healthcare proposals that never address rising premiums for small businesses, tax relief that falls short of substantive reforms, and labor mandates that make it more expensive to run a small business. And in the end, those costs are all passed along to Massachusetts consumers, making the state all the more unaffordable. If legislators are honestly serious about making Massachusetts a real contender against lower cost states, it’s time to consider broad-based tax relief, eliminate impediments to operating a business, and tackle energy and healthcare affordability.

Christopher Carlozzi is state director of the National Federation of Independent Business

Massachusetts

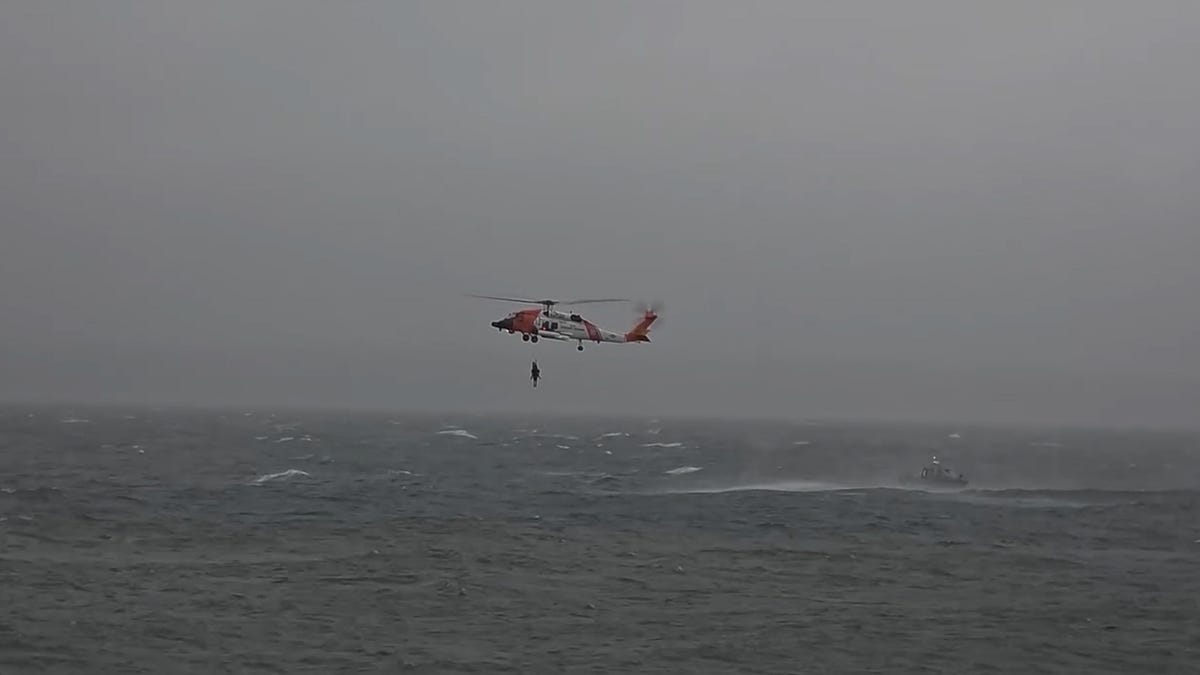

Massachusetts woman worries for family in Jamaica as Hurricane Melissa could bring mud slides, flooding

A woman in Massachusetts is worried for her family in Jamaica as Hurricane Melissa could bring catastrophic flooding to the island.

Hurricane Melissa is currently a Category 4 hurricane, but could strengthen to a Category 5 before it hits Jamaica and Haiti in the coming days. The storm could bring up to 30 inches of rain to the island and cause damage to infrastructure.

“I am really concerned about mud slides,” Framingham resident and real-estate agent JoAnn Frye said.

Frye owns an Airbnb in Ocho Rios, Jamaica, at Pyramid Point. She said that she has already lost power to her outdoor video cameras and that her home manager moved everything inside in anticipation of the storm.

“I’m very nervous. I’ve been watching this WhatsApp group because that’s how we communicate in the community,” Frye said.

Residents in Jamaica prepare for Hurricane Melissa

Jamaica’s Prime Minister, Andrew Holness, urged residents to take the storm very seriously.

“We’ve been prepared for a couple of days now. We have gas generators. We have extra water in the rooms, and then we have some larger tanks of water prepared for that, just in case power goes out. We have some solar lights,” said Frye’s cousin, Mark Walker, who lives on the island.

He plans on hunkering down with his family for the next few days.

“It’s one of those scenarios where it’s not just us, it’s everyone else, but we have a pretty good group of neighbors and friends that are close by, kind of looking out for each other,” Walker said.

Joanne says she’s glad she’s not there, but is praying for her people in Jamaica.

“I’m still scared for the people I know and love there. I’m scared for the community,” Frye said.

She said that she plans to fly down once the storm passes to check on her loved ones and her home.

For more information on Hurricane Melissa and to see its potential path, click here.

Massachusetts

Who is Michael J. Curll? 5 facts about man who attacked Trump supporter in Massachusetts

Published on: Oct 26, 2025 11:50 am IST

Michael J. Curll, 48, is facing criminal charges after allegedly attacking a man in an inflatable costume of Donald Trump in Swampscott, Massachusetts.

Massachusetts

Massachusetts millionaire’s tax supporting MBTA projects

The MBTA is dumping nearly a billion dollars in revenue from the Massachusetts millionaire’s tax on projects officials say are aimed at enhancing safety and reliability, while the agency transitions to an in-house bus maintenance program.

The network’s Board of Directors has approved using $850 million from the millionaire’s tax to fund four “major infrastructure projects,” including a battery-electric bus maintenance facility that will support up to 200 vehicles.

This is the second allocation that the T has used to bolster its infrastructure from what officials refer to as the Fair Share Amendment. The board approved a $200.8-million initial pool in January 2024 that addressed safety and hiring and retaining employees.

Bay State voters in November 2022 approved a 4% surtax on incomes above $1 million annually, with the revenue dedicated to improving education and transportation.

With the second batch generated from the tax in hand, the MBTA is set to complete power upgrades, track reconfigurations and signal system updates on the Green Line; procure new Commuter Rail locomotives; and work on the first phase of a Widett Regional Rail Layover Facility project

“The MBTA has been making significant progress to improve safety and reliability across the system, and this funding will help them continue this essential work,” Gov. Maura Healey said in a statement. “Together with the Legislature, we are making sure that the T has a balanced budget and the resources it needs to deliver the world-class service that the people of Massachusetts deserve.”

The MBTA is expecting to bring in massive savings, in the tens of millions, as the transit network moves to “in-house” bus repair services instead of contracting with a third-party to overhaul the vehicles.

A fleet of 175 buses that the agency purchased in 2016 and 2017 is due for what officials describe as a “mid-life overhaul,” and they’ve determined that the repair work can be completed within the agency rather than paying an outside vendor to do the job.

The move is expected to generate some $73 million in savings – the difference between the $116 million that it costs to outsource the work and the $43 million it would take for the MBTA workforce to get the job done.

MBTA General Manager Phil Eng is looking at the transition as a short- and long-term investment that he believes will improve bus maintenance and service, making the vehicles durable for longer stretches.

“The investment in transportation, the investment in our workforce,” Eng told the Board of Directors on Thursday, “we have an obligation to show that that investment is delivering for the public, not only with improved service, safe service, better service, but we can actually save taxpayer dollars, and that we can do quality work.”

Thursday’s meeting marked the first time Eng has addressed the board as the state’s transportation secretary. He is maintaining his GM role, but he has replaced Monica Tibbits-Nutt as the leader of MassDOT in the interim.

Tibbits-Nutt will stay on until the end of the year in an advisory capacity, on the taxpayer’s dime, as she is also keeping her $200,000 pay.

To support the in-house bus repairs, officials say the agency will be looking to a crew of machinists, sheet metal workers, painters and an engineer. The work will be implemented in three phases over four years at four buses per month.

“It’s a massive, massive savings,” Chief Operating Officer Ryan Coholan said. “And it goes beyond dollars, because when you talk about the quality of a program like this, the pride that a program like this can build in-house with our workforce. … I’m going to put the value even higher than the cost savings.”

-

New York3 days ago

New York3 days agoVideo: How Mamdani Has Evolved in the Mayoral Race

-

World6 days ago

World6 days agoIsrael continues deadly Gaza truce breaches as US seeks to strengthen deal

-

News5 days ago

News5 days agoVideo: Federal Agents Detain Man During New York City Raid

-

News5 days ago

News5 days agoBooks about race and gender to be returned to school libraries on some military bases

-

Technology6 days ago

Technology6 days agoAI girlfriend apps leak millions of private chats

-

Politics6 days ago

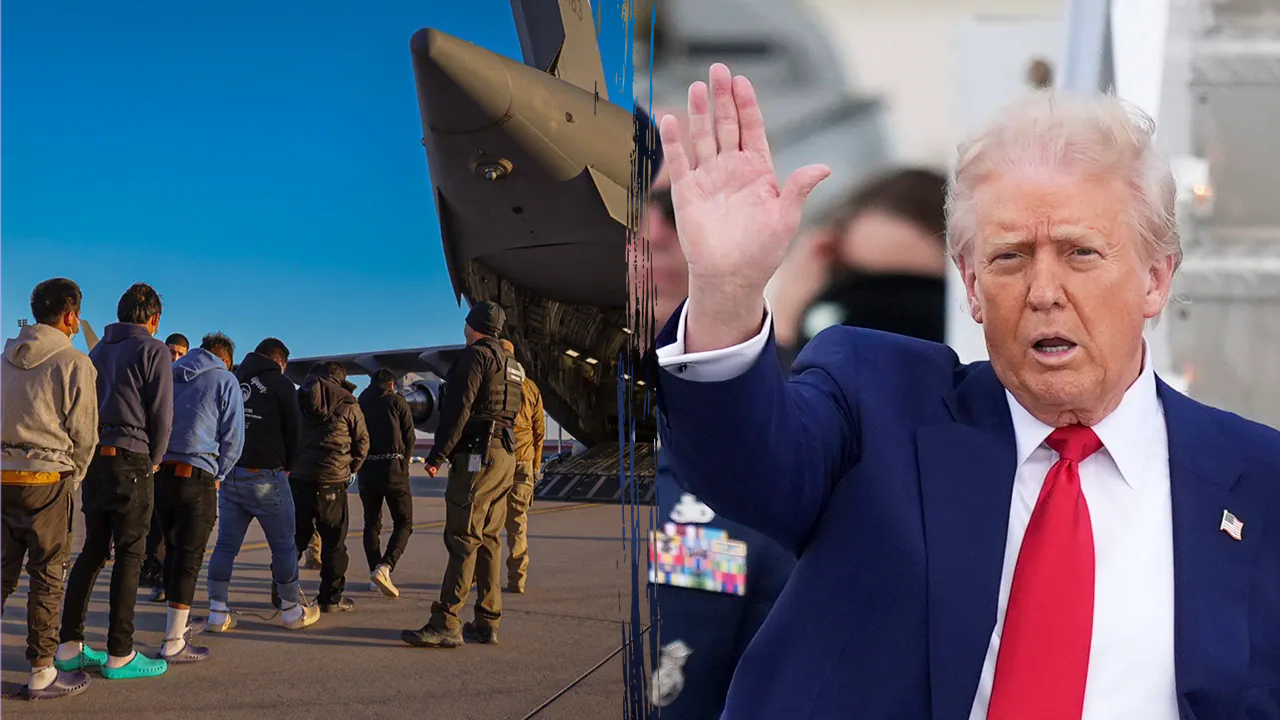

Politics6 days agoTrump admin on pace to shatter deportation record by end of first year: ‘Just the beginning’

-

News6 days ago

News6 days agoTrump news at a glance: president can send national guard to Portland, for now

-

Business6 days ago

Business6 days agoUnionized baristas want Olympics to drop Starbucks as its ‘official coffee partner’