Maine

Opinion: A recent history of Maine’s swiftly evolving tax code

For many of the Nineteen Nineties and 2000s, Maine’s tax code remained comparatively secure. Company and earnings tax charges had been unchanged and aside from modifications to how the state calculates what portion of company earnings are taxable, issues largely stayed the identical.

In 2004, Maine voters required the state to select up 55% of Ok-12 training prices in order that training funding could be much less reliant on property taxes. Maine was then hit by the Taxpayer Invoice of Rights (TABOR) initiatives sweeping the nation, as voters had been requested to contemplate proposals in 2006 and 2009 that will have restricted state spending and progressively eradicated the earnings tax. Whereas the 2004 training initiative succeeded and the TABOR initiatives failed, the problem of taxes moved nearer to the middle of the coverage debate.

In 2009, then-Gov. John Baldacci championed an earnings tax reduce with a big enlargement of the gross sales tax base. The enlargement included taxes on some providers comparable to amusement parks, sporting occasions, and a spread of upkeep and repair transactions, together with auto restore and dry cleansing. The proposal additionally elevated the meals and lodging tax and changed the state’s graduated earnings tax construction with a flat 6.5% charge and a 0.35 proportion level surcharge on earnings over $250,000. Nonetheless, a ensuing poll initiative overturned the complete bundle, reverting to the prior tax construction.

After Gov. Paul LePage took workplace in 2011, he used his finances proposals to advance his fundamental precedence: elimination of the earnings tax, a stream that represented 48% of revenues on the time. In response, the legislature reduce earnings tax charges and elevated reliance on gross sales taxes within the budgets handed below the LePage administration.

Whereas LePage was in the end unsuccessful in repealing the earnings tax throughout his tenure as governor, Maine went from having a largely secure tax code that had undergone few modifications to at least one that quickly advanced. Regardless of some income elevating efforts, comparable to increasing the gross sales tax to extra items and providers, the tax modifications below LePage had been web losses to the state’s income system and resulted in earnings tax accumulating $895 million much less per yr in 2022 {dollars}. A few of these tax modifications helped enhance after-tax incomes for households with low earnings, however a staggering 46% of this tax reduce advantages the wealthiest 20% of households making greater than $115,000 a yr.

Along with these modifications, in the midst of LePage’s tenure, he led a cost in opposition to the 2016 voter permitted poll measure to enact a 3 % surcharge on family earnings over $200,000. This surcharge would increase $219 million for training (utilizing 2022 {dollars} and incomes) however LePage instantly proposed eliminating the surcharge and the legislature in the end adopted by way of within the finances that handed in 2017, returning Maine’s high charge to 7.15%. This tax reduce is on high of the opposite $895 million reduce out of the earnings tax. Elimination of the training surcharge represents a median tax reduce of $23,400 to Maine’s high 1% as we speak.

LePage additionally constantly pursued insurance policies that will shift the price of providers onto cities and property taxpayers. He repeatedly tried to remove the homestead property tax exemption for households with folks below the age of 65, gutted the state’s “circuit breaker” program that lowered property tax payments for households with low incomes, and failed to completely fund income sharing and training prices to assist native providers and faculty districts, driving up property taxes.

Underneath the Mills administration, the governor and legislature proceed to contemplate and go modifications to the tax code that erode the earnings tax, however the proposals have been narrower in scope than the sweeping modifications LePage tried to push by way of. And fairly than specializing in slicing tax charges for the wealthiest households and companies, Mills has labored to enhance packages that cut back taxes for households and younger professionals with low earnings and has restricted her broad cost packages to one-time bills that don’t compromise revenues in future years.

Since Mills took workplace, the state’s Earned Earnings Tax Credit score, a profit for practically 100,000 working Mainers with low earnings, has elevated five-fold and a number of expansions of the state property tax equity credit score have tried to alleviate excessive hire and property tax prices for households with low incomes. To strengthen the tax code, the governor and legislature have additionally handed payments that restrict loopholes for firms taking the Maine Capital Funding Credit score and Overseas Derived Intangible Earnings deduction. Moreover, Mills and the legislature have labored to streamline and broaden the state’s pupil mortgage reimbursement earnings tax credit score that may reimburse Mainers for prices paid towards pupil loans as much as $2,500 a yr.

Alongside these modifications, nevertheless, the legislature included a provision in the latest finances to extend the quantity of untaxed pension earnings from $10,000 to $35,000 over the course of 4 years. This adjustment comes at an important price to state revenues, amounting to $85 million per yr as soon as totally phased in, two-thirds of which is able to profit the wealthiest 20% of Mainers.

Along with bettering the property tax equity credit score, Mills has totally funded the state’s share of training prices and income sharing for cities to assist stabilize property taxes whereas additionally rising the exemption quantity of the homestead exemption program from $20,000 to $25,000 and phasing in full funding for this system on the state stage as an alternative of requiring cities choose up half the fee.

We pay for issues that profit all of us — like faculties, roads, parks, public security, and clear water — with the sources raised by way of taxes. As Maine continues to revise strategies of accumulating important income, the Maine Heart for Financial Coverage urges elected leaders to weigh the selection between tax cuts that compromise sources and ensuring all staff, households, and communities have the instruments and alternatives they want.

This submit was initially revealed on the Maine Heart for Financial Coverage weblog.

Photograph: Ervins Strauhmanis, Inventive Commons by way of Flickr

Maine

Maine real estate mostly unaffected by commission changes

New rules that went into effect in August changing who pays real estate commissions have resulted in more paperwork and some anxiety for home buyers and sellers but have had little, if any, impact on home prices in the state’s hot real estate market.

The changes, which stem from a settlement in a lawsuit accusing real estate agents of conspiring to keep their commissions high, altered the way commission fees are set nationally.

For decades, most home sales in the United States have included a commission fee, typically between 5 and 6 percent of the sale price.

The typical Maine home went for around $400,000 this fall. A 5 to 6 percent commission on a $400,000 home would be between $20,000 and $24,000, split between the agents for the buyer and the seller.

Before the changes in August, the split for each agent was predetermined by the seller, who paid the fee for both agents. That usually resulted in fees being baked into the list price of a home.

In some states (although not in Maine) agents were able to search the multiple listing service, a catalogue of homes for sale, by the commission split, which critics said incentivized agents to steer clients toward more expensive properties with higher commissions.

Now, fees are negotiated sale-by-sale. Buyers and sellers are now each responsible for paying their own agents, meaning a buyer may have to come with more cash up front if a seller doesn’t want to pay the commission fee for a buyer’s agent. Sellers are also no longer allowed to include commission fees in their listings.

Tacy Ridlon, a listing agent with Better Homes and Gardens Real Estate The Masiello Group in Ellsworth, who has been in real estate for 32 years, said it is a bit jarring to have a conversation with buyers about whether they are willing to pay part of their agent’s commission.

Once the commission is established and the agreement signed, she said, the buyer’s agent then approaches the seller’s agent to see what part of their commission the seller is willing to cover, if any.

Ridlon said 3 percent for the buyer’s agent is a typical starting point.

“We have to start high. If the seller is willing to offer 2 percent for the buyer’s agent, then our buyer only has to pay one percent… If the seller is not offering anything, then we ask the buyer to pay a certain amount. Some can pay and some can’t. For some it’s very difficult because they don’t have a lot of money to play around with.”

Some agents said they found the changes minimal; others find the paperwork and negotiating with buyers daunting. One agency owner said the ruling has done little to bring prices down.

“This ruling has done nothing to save buyers or sellers any money,” said Billy Milliken, a designated broker and owner of Bold Coast Properties, LLC, in Jonesport. “If anything, it’s made the cost of buying a home even more expensive.”

Milliken said his sellers have had no problem agreeing to pay both buyers’ and sellers’ commissions. The cost has been embedded in the price of the property.

“The real loser is first time home buyers who are not educated in buying a home and also have limited cash resources,” said Milliken. “It puts them at a disadvantage.”

The change has resulted in some confusion for many buyers and even some agents around the country, as rules differ from state-to-state.

People are slowly getting used to the changes, said Monet Yarnell, president of the Midcoast Board of Realtors, who owns her own agency, Sell 207 in Belfast, adding that Maine’s real estate practices were already more transparent than many other areas of the country.

“I think it was a little confusing in the beginning, more doom and gloom,” said Yarnell. But sellers are still incentivized to offer something to the buyers’ agents, she said. And the changes have increased the level of communication between agents and their clients.

“It’s more how the money flows rather than the actual dollars.”

Ridlon, in Ellsworth, said she has been fortunate that most sellers have offered some compensation toward the buyer’s agent commission. “I have not had a buyer who can’t do the 3 percent.”

Ridlon had one seller who was not willing to pay any part of the buyer’s agent’s commission. The property had a lot of showings, but many of the buyers asked for closing costs to be covered or for concessions in lieu of picking up part of the commission.

“That didn’t really work for my seller either,” she said. “Then he relented and said he would pay one percent.”

The property sold.

Debbie Walter sold her condominium in Stockton Springs via Yarnell and then bought another condominium in New London, N.H., with another real estate agent.

“We’re kind of guinea pigs,” said Walter. “We were very concerned about that whole piece, both as sellers and buyers.”

Fearful the sale of their house might not proceed smoothly the couple readily agreed to pay a 3 percent commission for the buyer’s agent.

When they made their offer to buy the condominium in N.H., they offered as buyers to cover their buyer’s agent’s commission as well. But the seller in that case took an equally cautious approach and offered to cover 2.5 percent of the buyer’s agent’s commission, which Walters’ agent accepted.

“It was very stressful,” Walter said. Offering to cover their buyer’s agent’s commission, she said, created “one less headache for the whole closing procedure.”

Tom McKee, president of the Maine Realtors Association, said the settlement and new rules have had little impact.

“It hasn’t changed anything for me,” said McKee, who is with Keller Williams in Portland. Now that the commission split is no longer listed in the M.L.S., said McKee, “there are just more questions in the transaction.”

McKee said there is no set percentage, that everything is negotiable.

“If we do our job right and are meeting with the client first, they already understand.”

Maine

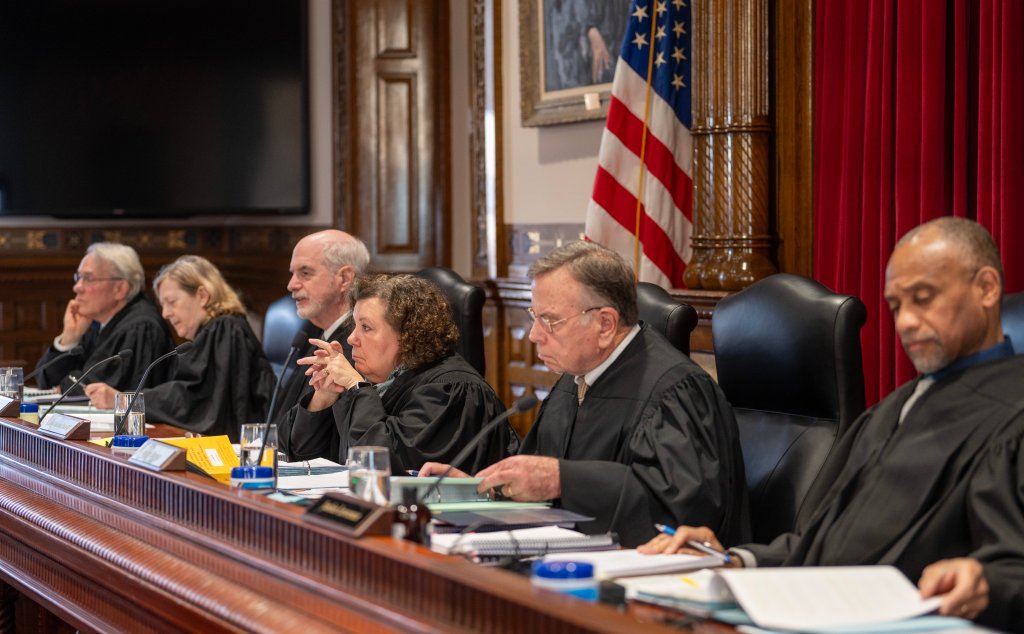

Maine’s highest court proposes barring justices from disciplining peers

The Maine Supreme Judicial Court has proposed new rules governing judicial conduct complaints that would keep members of the high court from having to discipline their peers.

The proposed rules would establish a panel of eight judges — the four most senior active Superior Court justices and the four most senior active District Court judges who are available to serve — to weigh complaints against a justice of the Maine Supreme Judicial Court. Members of the high court would not participate.

The rule changes come just weeks after the Committee on Judicial Conduct recommended the first sanction against a justice on the Maine Supreme Judicial Court in state history.

The committee said Justice Catherine Connors should be publicly reprimanded, the lowest level of sanction, for failing to recuse herself in two foreclosure cases last year that weakened protections for homeowners in Maine, despite a history of representing banks that created a possible conflict of interest. Connors represented or filed on behalf of banks in two precedent-setting cases that were overturned by the 2024 decisions.

In Maine, it’s up to the Supreme Judicial Court to decide the outcome of judicial disciplinary cases. But because in this case one of the high court’s justices is accused of wrongdoing, the committee recommended following the lead of several other states by bringing in a panel of outside judges, either from other levels of the court or from out of state.

Connors, however, believes the case should be heard by her colleagues on the court, according to a response filed late last month by her attorney, James Bowie.

Bowie argued that the outcome of the case will ultimately provide guidance for the lower courts — a power that belongs exclusively to the state supreme court.

It should not, he wrote, be delegated “to some other ad hoc grouping of inferior judicial officers.”

The court is accepting comments on the proposal until Jan. 23. The changes, if adopted, would be effective immediately and would apply to pending matters, including the Connors complaint.

Maine

Maine’s marine resources chief has profane exchange with lobstermen

Maine Department of Marine Resources Commissioner Patrick Keliher said “f— you” to a man during a Thursday meeting at which fishermen assailed him for a state plan to raise the size limit for lobster.

The heated exchange came on the same day that Keliher withdrew the proposal, which came in response to limits from regional regulators concerned with data showing a 35 percent decrease in lobster population in the state’s biggest fishing area.

It comes on the heels of fights between the storied fishery and the federal government over proposed restrictions on fishing gear that are intended to preserve the population of endangered whales off the East Coast. It was alleviated by a six-year pause on new whale rules negotiated in 2022 by Gov. Janet Mills and the state’s congressional delegation.

“I think this is the right thing to do because the future of the industry is at stake for a lot of different reasons,” Keliher told the fishermen of his now-withdrawn change at a meeting in Augusta on Thursday evening, according to a video posted on Facebook.

After crosstalk from the crowd, Keliher implored them to listen to him. Then, a man yelled that they don’t have to listen to him because the commission “sold out” to federal regulators and Canada.

“F— you, I sold out,” Keliher yelled, prompting an angry response from the fishermen.

“That’s nice. Foul language in the meeting. Good for you. That’s our commissioner,” a man shouted back.

Keliher apologized to the crowd shortly after making the remark and will try to talk with the man he directed the profanity to, department spokesperson Jeff Nichols said. The commissioner issued a Friday statement saying the remarks came as a result of his passion for the industry and criticisms of his motives that he deemed unfair, he said.

“I remain dedicated to working in support of this industry and will continue to strengthen the relationships and build the trust necessary to address the difficult and complex tasks that lay ahead,” Keliher said.

Spokespeople for Gov. Janet Mills did not immediately respond to a request for comment on whether she has spoken to Keliher about his remarks.

Lobstermen pushed back in recent meetings against the state’s plan, challenging the underlying data. Now, fishermen can keep lobsters that measure 3.25 inches from eye socket to tail. The proposal would have raised that limit by 1/16 of an inch and would have been the first time the limit was raised in decades.

The department pulled the limit pending a new stock survey, a move that U.S. Rep. Jared Golden, a Democrat from Maine’s 2nd District, hailed in a news release that called the initial proposal “an unnecessary overreaction to questionable stock data.”

Keliher is Maine’s longest-serving commissioner. He has held his job since former Gov. Paul LePage hired him in 2012. Mills, a Democrat, reappointed the Gardiner native after she took office in 2019. Before that, he was a hunting guide, charter boat captain and ran the Coastal Conservation Association of Maine and the Maine Atlantic Salmon Commission.

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics7 days ago

Politics7 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health6 days ago

Health6 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoSouth Korea extends Boeing 737-800 inspections as Jeju Air wreckage lifted

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology2 days ago

Technology2 days agoMeta is highlighting a splintering global approach to online speech

-

World1 week ago

World1 week agoWeather warnings as freezing temperatures hit United Kingdom

-

News1 week ago

News1 week agoSeeking to heal the country, Jimmy Carter pardoned men who evaded the Vietnam War draft