Maine

Camp Kotok: 5 Maine Takeaways

Harry Collins/iStock through Getty Photographs

Bear in mind this age-old query?

Should you might decide three individuals to ask to dinner, who would they be?

Now, think about this query with a wild twist:

Should you might decide forty individuals to journey with on a five-day fishing journey to Maine, who would they be?

This second query helps outline my expertise over the past week. I had the glory to attend Camp Kotok this 12 months at Leen’s Lodge in Grand Lake Stream, Maine. What’s Camp Kotok? It’s an invitation-only occasion the place well-known economists, central bankers, politicians, funding managers, researchers, philanthropists, and journalists come collectively for a number of days of fishing, meals, and dialogue on the important thing problems with the day underneath Chatham Home Rule.

For sure, my time at Camp Kotok was a unprecedented expertise. Hardly ever does one have the chance to return along with so many thought leaders that you simply admire and respect multi functional place. Whereas those who have learn my articles over time know that I’m by no means at a loss for expressing an opinion, Camp Kotok was an ideal alternative for me to take a seat again and take heed to the insights and views from so many consultants.

The next are only a few of the various key takeaways from the keep:

1. The Fed is more likely to keep the course with price hikes. Whereas the inventory market has gotten itself all aflutter this summer time over the prospects that the Fed could have the flexibleness to start out decreasing rates of interest as quickly as the tip of the 12 months with inflationary pressures beginning to abate. The view of many attendees was that such an abrupt shift towards easing was extremely unlikely any time quickly. If something, it was extra possible that the Fed will proceed elevating rates of interest by means of the tip of the 12 months and into at the least early 2023 to completely extinguish any lingering pricing pressures even when the headline and core charges come again to earth.

It is very important emphasize that the artwork of central banking is far more complicated than it might first seem on the floor, notably in the case of the keeper of the worldwide reserve forex within the U.S. Federal Reserve. As we realized from the Nice Monetary Disaster greater than a decade in the past, the worldwide monetary system is an intricate mesh of assorted gamers and forces all interconnected to maintain the engine working easily. In consequence, it isn’t so simple as the Fed turning on a dime the second inflationary pressures come off a couple of proportion factors. Additionally it is vital to level out that the Fed just isn’t solely more and more battling a credibility downside, notably within the wake of the latest scorching inflation outbreak, however we live in a extremely polarized and politicized atmosphere extra broadly.

Thus, it might be greatest to maintain your Fed easing expectations in test for any time quickly. The truth that CME Fed Fund futures are at present pricing in lower than a 3% chance for at minimal a 25 foundation level price lower between now and the FOMC’s July 2023 assembly roughly a 12 months from now supplies added affirmation to this view.

2. China invading Taiwan could also be a lot simpler mentioned than finished. It’s comprehensible for armchair geopoliticians to ponder the chance that China could quickly take navy motion to deliver Taiwan totally again into the mainland fold. That is notably true given how simply China threw the “one nation, two programs” settlement overboard in Hong Kong and within the wake of Russia’s invasion of the Ukraine. However simply as Russia’s expertise up to now has reminded us that “amateurs focus on techniques, professionals focus on logistics”, some key elements associated to Taiwan that aren’t typically extensively mentioned could meaningfully complicate China’s potential to efficiently conquer Taiwan.

First, in contrast to Russia invading Ukraine, which nonetheless just isn’t going nicely for Russia, the place crossing an adjoining land border was all that was required, China might want to journey at the least 80 miles or extra throughout water with their forces to invade Taiwan. That is A LOT of lumbering crusing vessels and plane bringing navy gear in addition to provides and meals and troopers and all the opposite issues wanted to make combating a warfare occur. The component of shock this isn’t. And keep in mind, for the entire speedy growth of the Chinese language navy forces, they’ve little to no latest expertise in partaking in precise stay battle.

This results in the following subject. Let’s simply assume the Chinese language are capable of efficiently make this journey that features passing Taiwan’s Penchu islands off the western coast and get every thing arrange into place. Then there may be the difficulty of Taiwan’s topography as soon as the invading pressure arrives. Taiwan is successfully an enormous mountain ridge lined by a dense forest. As for its largest cities the place the overwhelming majority of its 23 million individuals stay, they’re unfold out from the north finish to the south finish alongside the west facet of the island with complicated waterways offshore and only a few areas appropriate for troop landings. What if China resorted to carpet bombing Taiwan forward of the invasion? Even this proves difficult given how sprawling the Taiwanese inhabitants facilities are.

And none of this up to now even begins to contemplate the actions taken by the defending Taiwanese navy that has been lengthy getting ready for such an episode (because the occasions in Ukraine have reminded us, invading and occupying a rustic, even one that’s significantly smaller in inhabitants and never practically as nicely armed, is a tall order) or the worldwide response to such aggression in opposition to Taiwan together with most significantly from the USA.

Put merely, for the entire justifiable discuss and concern a few doubtlessly imminent China invasion of Taiwan, the precise execution is a much more complicated and unsure circumstance. In consequence, the response by threat asset markets to this potential menace ought to be measured and well-considered to keep away from any knee jerk reactions.

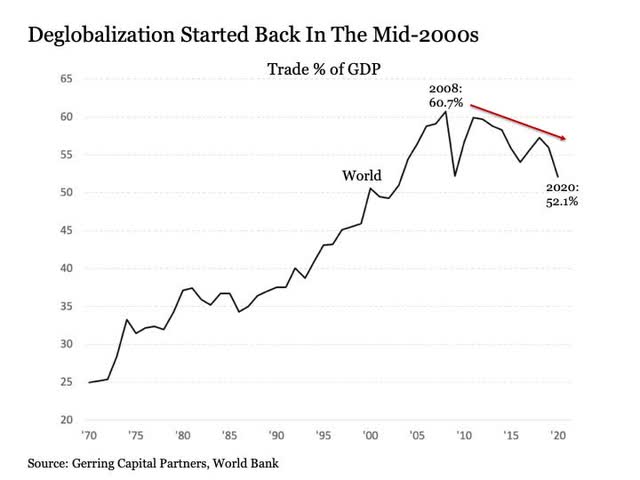

3. The beginning of deglobalization is so mid-2000s. Whereas it looks as if it’s a comparatively new theme for buyers to contemplate within the wake of the COVID pandemic, the truth is {that a} deglobalization pattern has been underway for the reason that onset of the Nice Monetary Disaster. If something, COVID together with the rising pattern towards nationalization throughout many elements of the globe have offered added juice to a pattern that obtained began greater than a decade in the past.

World Financial institution

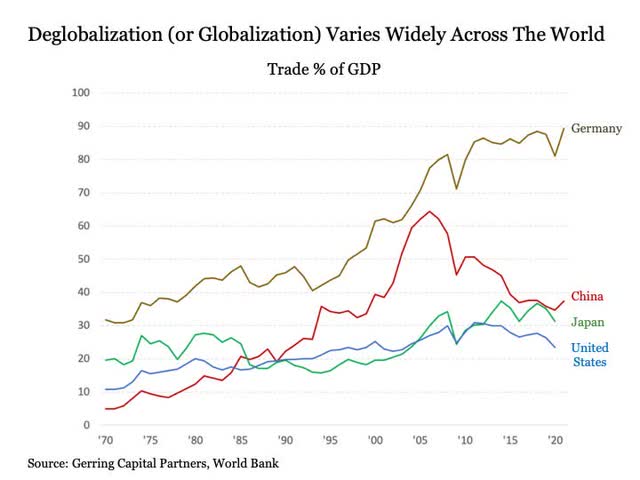

Furthermore, it’s notable that this deglobalization pattern is being pushed partly by China. That is vital to emphasise, for whereas many nations together with the USA have certainly been shifting towards deglobalization, different main economies like Germany are persevering with to more and more globalize, whereas others like Japan are holding typically regular.

World Financial institution

This results in some key takeaways for buyers to contemplate going ahead.

First, the view from some professional attendees is that deglobalization is more likely to proceed, however it’s unlikely to be a broadly investable theme. As a substitute, deglobalization (or continued globalization) is more likely to play out in a different way throughout areas and nations, every with its personal distinctive affect that ought to be thought of extra particularly. This results in potential alternative for these prepared to take the time to know the precise deglobalization dynamics enjoying out in a given area or nation at any cut-off date.

Subsequent, resist portray with a broad brush in the case of the potential inflation impacts related to deglobalization. Whereas the affordable abstract conclusion is that whereas globalization is inherently disinflationary whereas deglobalization is thus inflationary, the truth based on professional attendees is that every growth will include its personal particular pricing impacts. Similar goes for associated forex results together with the U.S. greenback.

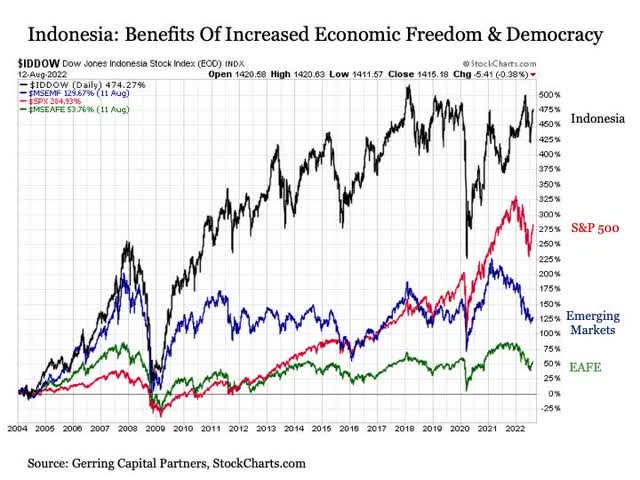

4. Dig deeper for alternatives in rising markets and past. Additionally it is tempting to color with a broad brush when contemplating the funding alternative set in rising markets. That is notably true given its -33% peak-to-trough return since early 2021 on the MSCI Rising Markets Index.

StockCharts.com

However it is very important acknowledge that China makes up a serious a part of the market with an over 31% weighting to your entire index. Taking this one step additional, the three nations of Taiwan, India, and South Korea, all of that are carefully linked to China in varied methods, make up one other 40% of the rising market index weighting. The truth that these 4 markets making up greater than 70% of the index have fallen wherever between -20% and -55% peak-to-trough since early 2021 has made it powerful for another nations within the house to face out to buyers.

This supplies alternative for these buyers prepared to analyze chosen rising, frontier, and non-index nations which may in any other case be ignored partly because of the dominant weighting of the 4 nations within the rising market house.

So the place precisely is an investor greatest to focus their analysis efforts in in search of such alternatives? One professional attendee recognized a couple of key elements to contemplate when pursuing extra returns in rising markets. These embrace nations that rise from a low degree of financial freedom based on the Fraser Institute and prioritize democracy over autocracy which have fairness markets which have proven a propensity to outperform international fairness indices over time.

Let’s think about Indonesia for instance (I ought to word that this nation just isn’t an instance offered by the professional attendee, however one which I got here up with individually when in search of to use the said standards – the professional could disagree with this nation instance). Since 2000, Indonesia has seen their Fraser Institute Financial Freedom abstract ranking steadily enhance from 6.06 in 2000 to 7.26 in 2019, inflicting their nation rating to rise fifteen spots from 85 to 70. This time interval started not lengthy after the tip of Suharto’s 32-year presidency and the autumn of the New Order in 1998 with main democratic oriented reforms to Indonesia’s three branches of presidency that adopted. Within the course of, Indonesia has seen measurable positive aspects in its scoring for Authorized System and Property Rights (3.33 in 2000 to 4.90 in 2019), Sound Cash (6.20 in 2000 to 9.64 in 2019), and Regulation (5.61 in 2000 to six.58 in 2019).

StockCharts.com

Alongside the best way throughout this transformation, the Indonesia inventory market, as measured by the Dow Jones Indonesia Inventory Index, has generated a complete return for the reason that begin of 2004 that has meaningfully outperformed not solely the MSCI Rising Market Index but additionally the S&P 500 and the developed market MSCI EAFE Index.

Thus, buyers in search of enticing chosen nation complete return alternatives throughout rising, frontier, and non-index markets could also be nicely served in figuring out nations which might be prioritizing rising financial freedom from a comparatively low degree whereas additionally emphasizing democracy over autocracy.

5. Fairness market alternatives. A number of esteemed attendees centered on the fairness markets emphasised their precedence to chubby navy protection and well being care. Provided that I’m meaningfully chubby each of those industries, the shows heard and conversations had with a number of thought consultants offered reaffirmation to those allocations in my portfolio technique.

On the identical time, quite a lot of professional attendees additionally highlighted a few of the challenges confronting the monetary sector that require elevated selectivity over the approaching 12 to 24 months. With that mentioned, the notion that JPMorgan Chase (JPM) stays among the many most important gamers within the monetary area was meaningfully bolstered alongside the best way.

Bonus takeaway. Fishing in Maine is completely pristine. Whereas I’ve travelled to Maine prior to now (my final go to was all the best way again in 2004), this journey was my first time to the fishing areas of Washington County. And what a exceptional expertise it was. Think about carving out a gap as deep as 125 ft unfold throughout 25,000 acres; filling it up with crystal clear spring water; and throwing in an abundance of bass, white perch, salmon, and pickerel amongst different fish. In case you have not been and also you wish to fish (and even when you have no thought how you can fish!), visiting the Grand Lake Stream space of Maine is an absolute should to your future itinerary.

Backside line. It was a exceptional time in Maine, and it meaningfully enhanced my views on the asset allocation course of for the months forward. As we progress by means of the second half of 2022, I proceed to keep up a significant allocation to short-term bonds as a guard in opposition to additional draw back threat throughout capital markets within the months forward. The inventory rally this summer time has actually been welcome, however it might in the end show fleeting. As for my threat asset allocations, I proceed to keep up a balanced allocation to long-term U.S. Treasuries and shares which might be nearly completely primarily based within the U.S. Inside my fairness allocation, I proceed to chubby trade allocations to navy protection, well being care, built-in oil and gasoline, meals, and financials. I additionally keep a devoted allocation to Treasury Inflation Protected Securities (TIPS) and gold.

Maine

Maine real estate mostly unaffected by commission changes

New rules that went into effect in August changing who pays real estate commissions have resulted in more paperwork and some anxiety for home buyers and sellers but have had little, if any, impact on home prices in the state’s hot real estate market.

The changes, which stem from a settlement in a lawsuit accusing real estate agents of conspiring to keep their commissions high, altered the way commission fees are set nationally.

For decades, most home sales in the United States have included a commission fee, typically between 5 and 6 percent of the sale price.

The typical Maine home went for around $400,000 this fall. A 5 to 6 percent commission on a $400,000 home would be between $20,000 and $24,000, split between the agents for the buyer and the seller.

Before the changes in August, the split for each agent was predetermined by the seller, who paid the fee for both agents. That usually resulted in fees being baked into the list price of a home.

In some states (although not in Maine) agents were able to search the multiple listing service, a catalogue of homes for sale, by the commission split, which critics said incentivized agents to steer clients toward more expensive properties with higher commissions.

Now, fees are negotiated sale-by-sale. Buyers and sellers are now each responsible for paying their own agents, meaning a buyer may have to come with more cash up front if a seller doesn’t want to pay the commission fee for a buyer’s agent. Sellers are also no longer allowed to include commission fees in their listings.

Tacy Ridlon, a listing agent with Better Homes and Gardens Real Estate The Masiello Group in Ellsworth, who has been in real estate for 32 years, said it is a bit jarring to have a conversation with buyers about whether they are willing to pay part of their agent’s commission.

Once the commission is established and the agreement signed, she said, the buyer’s agent then approaches the seller’s agent to see what part of their commission the seller is willing to cover, if any.

Ridlon said 3 percent for the buyer’s agent is a typical starting point.

“We have to start high. If the seller is willing to offer 2 percent for the buyer’s agent, then our buyer only has to pay one percent… If the seller is not offering anything, then we ask the buyer to pay a certain amount. Some can pay and some can’t. For some it’s very difficult because they don’t have a lot of money to play around with.”

Some agents said they found the changes minimal; others find the paperwork and negotiating with buyers daunting. One agency owner said the ruling has done little to bring prices down.

“This ruling has done nothing to save buyers or sellers any money,” said Billy Milliken, a designated broker and owner of Bold Coast Properties, LLC, in Jonesport. “If anything, it’s made the cost of buying a home even more expensive.”

Milliken said his sellers have had no problem agreeing to pay both buyers’ and sellers’ commissions. The cost has been embedded in the price of the property.

“The real loser is first time home buyers who are not educated in buying a home and also have limited cash resources,” said Milliken. “It puts them at a disadvantage.”

The change has resulted in some confusion for many buyers and even some agents around the country, as rules differ from state-to-state.

People are slowly getting used to the changes, said Monet Yarnell, president of the Midcoast Board of Realtors, who owns her own agency, Sell 207 in Belfast, adding that Maine’s real estate practices were already more transparent than many other areas of the country.

“I think it was a little confusing in the beginning, more doom and gloom,” said Yarnell. But sellers are still incentivized to offer something to the buyers’ agents, she said. And the changes have increased the level of communication between agents and their clients.

“It’s more how the money flows rather than the actual dollars.”

Ridlon, in Ellsworth, said she has been fortunate that most sellers have offered some compensation toward the buyer’s agent commission. “I have not had a buyer who can’t do the 3 percent.”

Ridlon had one seller who was not willing to pay any part of the buyer’s agent’s commission. The property had a lot of showings, but many of the buyers asked for closing costs to be covered or for concessions in lieu of picking up part of the commission.

“That didn’t really work for my seller either,” she said. “Then he relented and said he would pay one percent.”

The property sold.

Debbie Walter sold her condominium in Stockton Springs via Yarnell and then bought another condominium in New London, N.H., with another real estate agent.

“We’re kind of guinea pigs,” said Walter. “We were very concerned about that whole piece, both as sellers and buyers.”

Fearful the sale of their house might not proceed smoothly the couple readily agreed to pay a 3 percent commission for the buyer’s agent.

When they made their offer to buy the condominium in N.H., they offered as buyers to cover their buyer’s agent’s commission as well. But the seller in that case took an equally cautious approach and offered to cover 2.5 percent of the buyer’s agent’s commission, which Walters’ agent accepted.

“It was very stressful,” Walter said. Offering to cover their buyer’s agent’s commission, she said, created “one less headache for the whole closing procedure.”

Tom McKee, president of the Maine Realtors Association, said the settlement and new rules have had little impact.

“It hasn’t changed anything for me,” said McKee, who is with Keller Williams in Portland. Now that the commission split is no longer listed in the M.L.S., said McKee, “there are just more questions in the transaction.”

McKee said there is no set percentage, that everything is negotiable.

“If we do our job right and are meeting with the client first, they already understand.”

Maine

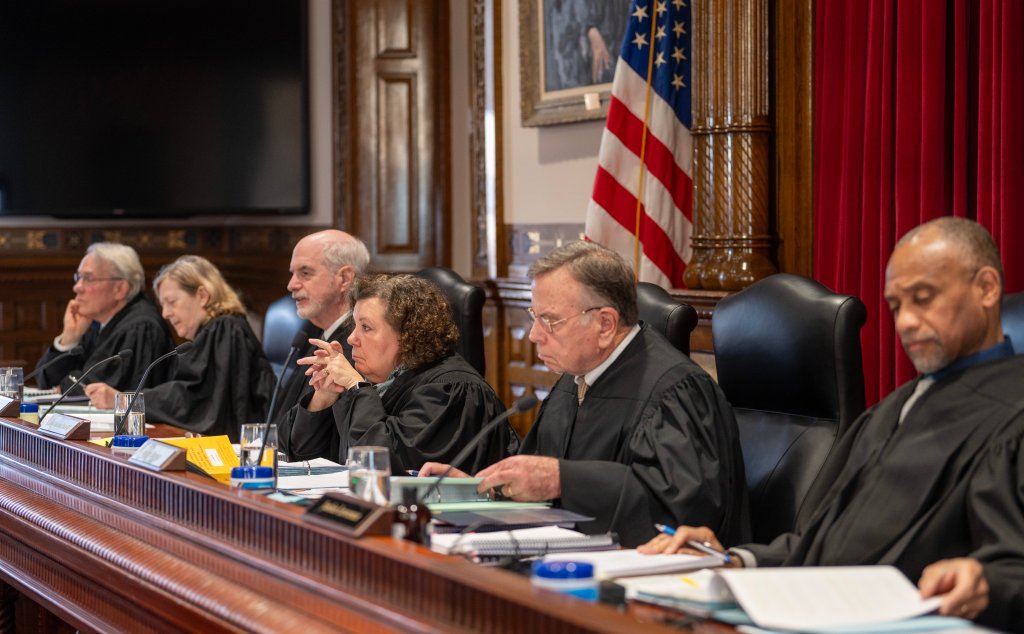

Maine’s highest court proposes barring justices from disciplining peers

The Maine Supreme Judicial Court has proposed new rules governing judicial conduct complaints that would keep members of the high court from having to discipline their peers.

The proposed rules would establish a panel of eight judges — the four most senior active Superior Court justices and the four most senior active District Court judges who are available to serve — to weigh complaints against a justice of the Maine Supreme Judicial Court. Members of the high court would not participate.

The rule changes come just weeks after the Committee on Judicial Conduct recommended the first sanction against a justice on the Maine Supreme Judicial Court in state history.

The committee said Justice Catherine Connors should be publicly reprimanded, the lowest level of sanction, for failing to recuse herself in two foreclosure cases last year that weakened protections for homeowners in Maine, despite a history of representing banks that created a possible conflict of interest. Connors represented or filed on behalf of banks in two precedent-setting cases that were overturned by the 2024 decisions.

In Maine, it’s up to the Supreme Judicial Court to decide the outcome of judicial disciplinary cases. But because in this case one of the high court’s justices is accused of wrongdoing, the committee recommended following the lead of several other states by bringing in a panel of outside judges, either from other levels of the court or from out of state.

Connors, however, believes the case should be heard by her colleagues on the court, according to a response filed late last month by her attorney, James Bowie.

Bowie argued that the outcome of the case will ultimately provide guidance for the lower courts — a power that belongs exclusively to the state supreme court.

It should not, he wrote, be delegated “to some other ad hoc grouping of inferior judicial officers.”

The court is accepting comments on the proposal until Jan. 23. The changes, if adopted, would be effective immediately and would apply to pending matters, including the Connors complaint.

Maine

Maine’s marine resources chief has profane exchange with lobstermen

Maine Department of Marine Resources Commissioner Patrick Keliher said “f— you” to a man during a Thursday meeting at which fishermen assailed him for a state plan to raise the size limit for lobster.

The heated exchange came on the same day that Keliher withdrew the proposal, which came in response to limits from regional regulators concerned with data showing a 35 percent decrease in lobster population in the state’s biggest fishing area.

It comes on the heels of fights between the storied fishery and the federal government over proposed restrictions on fishing gear that are intended to preserve the population of endangered whales off the East Coast. It was alleviated by a six-year pause on new whale rules negotiated in 2022 by Gov. Janet Mills and the state’s congressional delegation.

“I think this is the right thing to do because the future of the industry is at stake for a lot of different reasons,” Keliher told the fishermen of his now-withdrawn change at a meeting in Augusta on Thursday evening, according to a video posted on Facebook.

After crosstalk from the crowd, Keliher implored them to listen to him. Then, a man yelled that they don’t have to listen to him because the commission “sold out” to federal regulators and Canada.

“F— you, I sold out,” Keliher yelled, prompting an angry response from the fishermen.

“That’s nice. Foul language in the meeting. Good for you. That’s our commissioner,” a man shouted back.

Keliher apologized to the crowd shortly after making the remark and will try to talk with the man he directed the profanity to, department spokesperson Jeff Nichols said. The commissioner issued a Friday statement saying the remarks came as a result of his passion for the industry and criticisms of his motives that he deemed unfair, he said.

“I remain dedicated to working in support of this industry and will continue to strengthen the relationships and build the trust necessary to address the difficult and complex tasks that lay ahead,” Keliher said.

Spokespeople for Gov. Janet Mills did not immediately respond to a request for comment on whether she has spoken to Keliher about his remarks.

Lobstermen pushed back in recent meetings against the state’s plan, challenging the underlying data. Now, fishermen can keep lobsters that measure 3.25 inches from eye socket to tail. The proposal would have raised that limit by 1/16 of an inch and would have been the first time the limit was raised in decades.

The department pulled the limit pending a new stock survey, a move that U.S. Rep. Jared Golden, a Democrat from Maine’s 2nd District, hailed in a news release that called the initial proposal “an unnecessary overreaction to questionable stock data.”

Keliher is Maine’s longest-serving commissioner. He has held his job since former Gov. Paul LePage hired him in 2012. Mills, a Democrat, reappointed the Gardiner native after she took office in 2019. Before that, he was a hunting guide, charter boat captain and ran the Coastal Conservation Association of Maine and the Maine Atlantic Salmon Commission.

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics7 days ago

Politics7 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health6 days ago

Health6 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoSouth Korea extends Boeing 737-800 inspections as Jeju Air wreckage lifted

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology2 days ago

Technology2 days agoMeta is highlighting a splintering global approach to online speech

-

World1 week ago

World1 week agoWeather warnings as freezing temperatures hit United Kingdom

-

News1 week ago

News1 week agoSeeking to heal the country, Jimmy Carter pardoned men who evaded the Vietnam War draft