Boston, MA

Here’s how a Boston Pops musician made a fortune on Wall Street – The Boston Globe

Add in a outstanding run of fine luck and the facility of compounding good points over 4 a long time, and Avedisian improbably turned a modest preliminary outlay right into a fortune that would underwrite one among BU’s largest items ever.

“Success is the intersection of alternative and preparation,” Avedisian, 85, informed me once we talked on Wednesday, the week after his contribution to BU’s medical faculty was made public.

The chance was “no matter financial savings I had,” he mentioned, placing his upfront funding at between $10,000 and $20,000. “I used to be single. I lived modestly,” so there was cash and the flexibleness to make bets different buyers may not be capable to abdomen, he defined.

The preparation concerned digging deep into firm monetary statements, prospectuses for preliminary public choices, the newspaper Investor’s Enterprise Every day, and another sources of data and perception that may assist him select the place to place his cash.

“You needed to do your homework,” Avedisian mentioned, recalling how he would load up on analysis materials to review at any time when he needed to journey lengthy distances for a efficiency.

In that regard, Avedisian landed on the identical form of old-school “purchase what you perceive” strategy espoused by Constancy Investments legend Peter Lynch in his best-selling e book “One Up on Wall Avenue.”

“That man was a magician,” Avedisian mentioned.

Avedisian is the son of Armenian immigrants who grew up in Pawtucket, R.I. He earned a scholarship to review clarinet at BU’s School of Nice Arts, however he was a self-taught investor. When he bought going within the early Nineteen Eighties, it wasn’t lengthy earlier than he found the burgeoning world of fast-growing tech shares. It was a time when getting in early on the proper shares may ship big payoffs.

“Lotus, Amazon, Microsoft, Solar Microsystems, Cisco . . . you may throw a dart and decide a winner,” he mentioned.

He was a buy-and-hold investor, and when he did take some earnings or promote at a loss, he put the cash proper again into different shares.

“It was like Las Vegas. You win one, you retain pushing it again on the desk,” he mentioned.

So how a lot cash did he make?

Avedisian, who retired from performing in 2009, mentioned he’s by no means calculated his annual common funding return again to the early ‘80s.

“As soon as the 12 months is over, that’s historical past,” he mentioned.

He additionally declined to debate the worth of his portfolio.

Avedisian mentioned he amplified his returns utilizing two methods that many buyers eschew as a result of they will simply backfire.

First, he used margin — that’s, he borrowed in opposition to his brokerage account balances to extend how a lot he invested. Margin investing can considerably multiply returns, however when inventory costs fall, issues can flip ugly. The dealer can ask for money to again up the loans, usually forcing the investor to promote shares to pay again the cash.

What did Avedisian do throughout bear markets?

“I rode it out,” he mentioned. “In the course of the dot-com bust, I believed I ought to dump, however I didn’t, thank God.”

He additionally offered inventory choices, a sophisticated and dangerous technique that may juice returns.

“This isn’t for the typical particular person to do,” Avedisian mentioned, referring to his use of margins and choices. “If I did it yet again, I might in all probability lose my shirt — and my footwear and socks.”

Avedisian mentioned he invested in lots of preliminary public choices, when an organization debuts on the inventory market. Then, as now, sizzling IPOs have been exhausting for particular person buyers to get in on.

Avedisian mentioned that he maintained a roster of greater than a dozen brokers, and that he often may piece collectively 200 shares from one, 200 extra shares from one other.

In contrast to many IPO buyers, he didn’t promote the brand new inventory if it popped huge on the primary day.

“I didn’t go for the out and in,” he mentioned.

The investment-industrial complicated has lengthy pushed the concept people can’t win selecting shares. The massive weapons on Wall Avenue have an insurmountable benefit, with their legions of analysts and high-speed buying and selling methods.

As a substitute, the plenty ought to depend on mutual funds managed by professionals, and index funds that monitor broad market indexes, which over the lengthy haul often go up.

I’ve heeded the recommendation, dutifully maxing out my 401(ok) contributions annually and just about ignoring what’s occurring out there. I don’t have the time or the temperament to do what Avedisian did.

However success tales like his are why so many individuals ignore the standard knowledge and plunge into DIY investing. The chances of beating the professionals are lengthy, however loads of individuals do hit the jackpot.

“It was partaking and entertaining, and plenty of enjoyable,” Avedisian mentioned. “And severe.”

Avedisian started giving cash away within the Nineteen Nineties, together with earlier donations to BU. He’s out of the investing recreation, however he had some recommendation for dealing with the present bear market.

”In case you personal good things, stick with it.” he mentioned. The market “will flip round quickly sufficient. . . . There’s plenty of alternative coming.”

That’s music to the investor’s ears.

Larry Edelman will be reached at larry.edelman@globe.com. Comply with him on Twitter @GlobeNewsEd.

Boston, MA

Frigid wind chill temperatures today

The wind is back. And no one is happy.

Well, at least it won’t be 10 days of it. Instead, you’ll have to settle for two, with occasional gusts to 35-40 mph. Not nearly as intense as the last go-round, but still enough to produce wind chills in the single digits and teens through Wednesday. Thursday the winds are much lighter, but even with a slight breeze, we may see wind chills near zero in the morning.

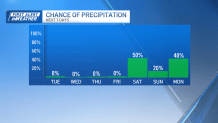

The pattern remains active, but we’ll have to wait a few days until our next batch of precipitation. And with temperatures warming, it looks like rain by Saturday afternoon. We’ll rise into the 40s through Sunday, then feel the full weight of the polar vortex early next week.

Yes, you read that right. The spin, the hype, and definitely the cold, are back. Much of the country will plunge into the deep freeze. The question remains whether we’ll spin up a storm early next week. Jury is still out on that, but we’re certain this will be the coldest airmass of the season.

Boston, MA

Boston College falls to Notre Dame, 78 – 60

Coming off back to back conference losses, the Eagles traveled to South Bend to try to earn their second conference win. Notre Dame has had a lack luster start to the year, as they also sit at 1-4 in conference play entering tonight’s matchup. Boston College defended much better in the first half tonight than they have in the past few games. More specifically, they guarded the 3 point line, holding Notre Dame to just 2 of 9 from beyond the arc. Boston College, in turn, shot 50% (5 of 10) from behind the 3 point line, which really kept them in the game. Donald Hand, Jr., in particular, had a nice first half with 11 points on 4 of 6 from the field. The one-two punch of Tae Davis and Markus Burton combined for 20 of Notre Dame’s 36 points in the first half. Notre Dame led at the break 36 to 33.

The second half was a different story for the Eagles. The Fighting Irish dominated the last 10 minutes of the game outscoring Boston College 22 to 10. Burton and Davis combined for 46 of the Irish’s 78 points. Davis had his way with BC scoring 26 points on 9 of 14 shooting. The Eagles just had no answer for him or his counterpart in the back court Markus Burton. Burton had 20 of his own on just 5 of 15 from the field. The Eagles did a great job of defending the 3 point line against the Irish as they shot 3 of 15 from beyond the arc, but they did a poor job defending everything else. The Eagles once again had trouble with consistency on the offensive side of the ball. The top performer was Hand, he finished with 17 points on 6 of 11 shooting. He seems to be one of the only Eagles’ who can create his own shot when the offense breaks down. Boston College fell to the Irish 78 to 60.

Overall, Boston College showed some glimpses tonight on the defensive end, especially in the first half. They did a great job of defending the three point line all night, but didn’t continue to defend after running the Irish off the line. The offense struggled again tonight despite shooting over 50% from the 3 point line.

Boston College has had a rough last two weeks, but it will only get tougher as Duke comes to town on Saturday. Cooper Flagg has seemingly hit his stride after dropping 42 on Notre Dame this weekend. After the performance from Tae Davis, BC and Earl Grant will need to scheme up some different defenses to try to slow down the Duke freshman. Duke and Boston College will tip off at 8 PM EST at Conte Forum.

Boston, MA

Boston’s Southern French Restaurant Marseille Calls It Quits

Marseille, an 18-month-old French restaurant located at 560 Harrison Avenue in the South End, has closed down. The restaurant posted a message on Instagram last week alerting diners that it would be shutting down the social media account (which is now gone), and its OpenTable page now reads that Marseille has permanently closed as of Monday, January 13. No specific reason was given for the shutter. Owned by French restaurateur Loic Le Garric, the restaurant was his ode to sunny Southern French cuisine in various forms, including grilled octopus, a rich seafood stew, trout almondine, and more. Le Garric did not immediately respond to questions about the restaurant’s closure. The restaurateur’s other French spots, including Batifol (in Kendall Square) and Petit Robert Bistro (also in the South End), plus bakery and cafe PRB Boulangerie, remain open.

Boston is getting a new Detroit-style pizzeria

Descendant Detroit Style Pizza, a Toronto-based company with two locations there, is opening up a third shop inside the Prudential Center, Boston Restaurant Talk reports. It’ll be the first U.S. location for the pizza shop, which bills itself as Canada’s first Detroit-style pizzeria, and is yet another addition to Boston’s burgeoning Detroit-style pizza scene, which includes stalwarts like the five-year-old Avenue Kitchen & Bar in Somerville and newer additions like Detroit Pizza Co. in Brighton.

A tiny Cape Cod restaurant steps into the spotlight at Raffles

Luxurious Portuguese restaurant Amar, located inside high-end Boston hotel Raffles, is hosting a one-night-only collaboration dinner with Cape Cod tasting menu spot Clean Slate Eatery this month. Amar chef George Mendes and Clean Slate Eatery chef Jason Montigel are putting together a six-course dinner with dishes such as local oysters with a lemon-horseradish granita, bay scallops with Eastham turnips, winter squash, country ham croquettes, and Satsuma citrus, and a quail roulade with quince-vanilla puree, Périgord black truffles, and maitake mushrooms. The event takes place on Wednesday, January 22. Tickets are $175 per person; reservations can be made here.

-

Politics1 week ago

Politics1 week agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health1 week ago

Health1 week agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology5 days ago

Technology5 days agoMeta is highlighting a splintering global approach to online speech

-

Science3 days ago

Science3 days agoMetro will offer free rides in L.A. through Sunday due to fires

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png) Technology6 days ago

Technology6 days agoLas Vegas police release ChatGPT logs from the suspect in the Cybertruck explosion

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘How to Make Millions Before Grandma Dies’ Review: Thai Oscar Entry Is a Disarmingly Sentimental Tear-Jerker

-

News1 week ago

News1 week agoTrump Has Reeled in More Than $200 Million Since Election Day

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: Millennials try to buy-in or opt-out of the “American Meltdown”