North Dakota

Snow records, wildfire smoke and temperature extremes: 2023 North Dakota weather recap

BISMARCK, N.D. (KFYR) – Weather records were common in 2023 as this memorable year brought plenty of snow, wildfire smoke and temperature extremes.

We kicked off 2023 with calm conditions. The least windy January on record and moisture from gradual snow melt helped to develop fog on many days and caused the most dense fog advisories to be issued on record for any one month.

By the end of January, Arctic air settled in with wind chills in the 30s and 40s below zero.

February had big temperature swings, from near-record highs in the middle of the month back to the Arctic plunge by the end of February, and even all the way down to the lowest temperature of the year in Bismarck at -29° on the 24th.

With still close to a foot of snow on the ground, strong winds caused lots of blowing snow, leading to blizzard warnings, low visibility and road closures.

Multiple snow storms carried over into March, likely our most impactful weather month of the year, starting off with a big storm from February 28 to March 1.

The plateau of accumulated seasonal snowfall mid-winter turned into a sharp rise as storm after storm came with accumulations from each ranging from a handful of inches to over a foot.

Many Alberta clippers came from the northwest, including one on March 11 that led to an expansive blizzard warning and no travel advised for the whole state due to reduced visibility and some impressive snow totals.

The frigid temperatures stuck with us through the majority of the month, leading to the coldest March since 1951 in Bismarck and the top ten coldest regionwide.

The snow piled up to the fifth snowiest March on record in Bismarck as we closed in on the all-time snowiest winter season, 1996-97.

One final big Colorado Low tracked through the Upper Midwest in early April with the highest impacts and blizzard conditions in eastern North Dakota.

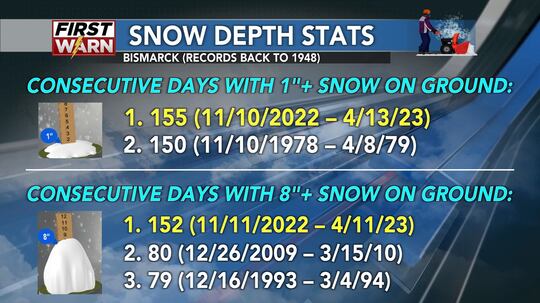

Throughout winter, we set many notable snow depth records in Bismarck, including the longest streak with more than eight inches as well as more than one inch of snow on the ground, from mid-November to mid-April.

We also set a record for the latest in the season with 18 inches of snow on the ground, all the way on April 5.

That snow then melted away fairly rapidly, as temperatures finally climbed into the 50s, the first time in a record length of days, and even record highs in the 80s on April 11. This led to ice jams and flooding in parts of the region.

The final snow system came through around April 20, but it wasn’t enough to tip the scales as Bismarck finished 0.4″ away from the all-time snow season record. Dickinson ended up setting a new record for the 2022-23 season.

Severe thunderstorms began to fire up in May with an impressive supercell depositing large hail in the Bismarck-Mandan area on May 9.

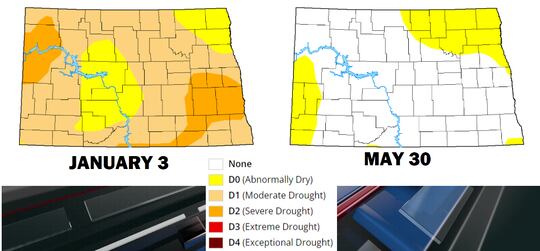

Some more rain events in May helped to eliminate drought conditions in North Dakota by the end of the month – a big improvement from 80% of the state in drought at the start of 2023.

The summer of smoke began abruptly on May 17 as Canadian wildfire smoke was transported south, leading to North Dakota’s worst day for air quality in a long time with the AQI in the hazardous classification and beyond the scale in some spots.

This smoke continued to come in waves throughout the summer, causing some issues for those with respiratory diseases, as Canada had their worst wildfire season ever.

In a summer that featured some hot periods, but not usually for a long duration, our hottest day — and Bismarck’s only one in the triple digits this year — was on July 26, just in time for the state fair with 90s in Minot.

Some bigger, fall-like soakers left southern North Dakota with a good amount of moisture through the summer, while the north dried out and drought was re-introduced, even getting to extreme drought by the end of August.

Hazy, hot and humid conditions were present to wrap up August and early September before the heat broke with severe storms and damaging winds in south-central North Dakota on Labor Day.

With only a couple of notable instances of damage caused by thunderstorms, including in Sioux County on June 21 and at Buelah Bay on August 1, the 2023 severe weather season ended with the least number of severe thunderstorm and tornado warnings issued by the National Weather Service in about 30 years.

Smoky skies continued at times into the fall as the number of acres burned in Canada approached the size of North Dakota.

An impressive high-end wind event happened across the west on October 17 with 60-85 mph gusts.

The fall featured mostly mild temperatures until October 25 through 27 when an early-season, high-impact winter storm blanketed the state with 8-12″ or more of snow, leading to tricky travel conditions. Frigid temperatures allowed for the snow to stick around for Halloween, which was one of our coldest on record thanks to all that fresh snowpack.

But the snow melted and temperatures were mild for most of November with little to no snow. At the start of the final month of 2023, we tied the record highest temperature for all of December at 66°.

Overall, December was a very warm month, finishing in the top three, if not the number one, warmest on record. But it still came with some wintry moments, such as a quick-moving wind and snow system on December 8, and then the highly impactful recent ice storm around Christmas that left over 20,000 North Dakotans without electricity, mostly in the south and east. This storm caused the National Weather Service to issue its first ice storm warning in North Dakota since 2016 and travel to be severely impacted as people skated on the streets.

March and April stick out on the cold side, while May, June and especially December stand out for warmth when compared to normal.

The Northern Lights also danced in the night sky many times this year, including vivid displays in February, March and especially April.

Copyright 2023 KFYR. All rights reserved.

North Dakota

Gas prices rise slightly in North Dakota amid Iran conflict

FARGO — Drivers can expect to see a slight uptick in gas prices as a result of the Iran conflict.

As of Monday, March 2, the average for North Dakota is $2.65 a gallon. While that is a $0.13 increase from a month ago, it is significantly lower than prices a year ago.

‘.concat(s||””,’‘).concat(a,”

“)+”

“),f=e.get(“width”),d=e.get(“height”),p=(0,r.n)(l);return(0,u.iF)(p,{width:f.toString().indexOf(“%”)>0?f:””.concat(f,”px”),height:d.toString().indexOf(“%”)>0?d:””.concat(d,”px”)}),p}},6622(e,t,n){“use strict”;n.d(t,{A:()=>f});var r=n(494),u=n(9407),i=n(6147),o=n(5291),a=n(7316),s=[],c=-1,l=function(){(0,i.u)(c),c=(0,i.x)(function(){s.forEach(function(e){e.view.updateBounds();var t=e.view.model.get(“containerWidth”);e.resized=e.width!==t,e.width=t}),s.forEach(function(e){e.contractElement.scrollLeft=2*e.width}),s.forEach(function(e){(0,a.iF)(e.expandChild,{width:e.width+1}),e.resized&&e.view.model.get(“visibility”)&&e.view.updateStyles()}),s.forEach(function(e){e.expandElement.scrollLeft=e.width+1}),s.forEach(function(e){e.resized&&e.view.checkResized()})})},f=function(){function e(t,n,u){(0,r._)(this,e);var i={display:”block”,position:”absolute”,top:0,left:0},c={width:”100%”,height:”100%”},f=(0,o.n)(”),d=f.firstChild,p=d.firstChild,h=d.nextSibling;(0,a.iF)([d,h],Object.assign({overflow:”auto”},i,c)),(0,a.iF)(f,Object.assign({},i,c)),this.expandElement=d,this.expandChild=p,this.contractElement=h,this.hiddenElement=f,this.element=t,this.view=n,this.model=u,this.width=0,this.resized=!1,t.firstChild?t.insertBefore(f,t.firstChild):t.appendChild(f),t.addEventListener(“scroll”,l,!0),s.push(this),l()}return(0,u._)(e,[{key:”destroy”,value:function(){if(this.view){var e=s.indexOf(this);-1!==e&&s.splice(e,1),this.element.removeEventListener(“scroll”,l,!0),this.element.removeChild(this.hiddenElement),this.view=this.model=null}}}]),e}()},8089(e,t,n){“use strict”;n.d(t,{A:()=>m});var r,u=n(2329),i=[],o=[],a=[],s={},c=!1,l=!1,f=function(e,t){for(var n=t.length;n–;){var r=t[n];if(e.target===r.getContainer()){r.setIntersection(e);break}}},d=function(){var e=window.IntersectionObserver;r||(r=new e(function(e){if(null==e?void 0:e.length)for(var t=e.length;t–;){var n=e[t];f(n,i),f(n,o)}},{threshold:[0,.1,.2,.3,.4,.5,.6,.7,.8,.9,1]}))},p=function(){i.forEach(function(e){e.model.set(“activeTab”,(0,u.A)())})},h=function(e,t){var n=t.indexOf(e);-1!==n&&t.splice(n,1)},v=function(e){a.forEach(function(t){t(e)})},D=function(){l||(l=!0,document.addEventListener(“visibilitychange”,p),document.addEventListener(“webkitvisibilitychange”,p))},g=function(){l&&!(i.length>0)&&(l=!1,document.removeEventListener(“visibilitychange”,p),document.removeEventListener(“webkitvisibilitychange”,p))};let m={add:function(e){i.push(e),D()},remove:function(e){h(e,i),g(),window.removeEventListener(“scroll”,v)},addScrollHandler:function(e){c||(c=!0,window.addEventListener(“scroll”,v)),a.push(e)},removeScrollHandler:function(e){h(e,a)},addWidget:function(e){o.push(e)},removeWidget:function(e){h(e,o)},size:function(){return i.length},observe:function(e){d(),s[e.id]||(s[e.id]=!0,r.observe(e))},unobserve:function(e){r&&s[e.id]&&(delete s[e.id],r.unobserve(e))}}},7230(e,t,n){“use strict”;n.d(t,{fY:()=>c,uT:()=>s});var r=”__JWP____ePBPK____”,u={};window[r]?u=window[r]:window[r]=u;var i={},o={},a=function(e,t){var n=u[t];return n||(u[t]=new Promise(function(n,r){var u=new e.key(t);if(“unlimited”===u.edition())return r();var i=[“//”,”entitlements.jwplayer.com”,”https://www.inforum.com/”,u.token(),”.json”];”file:”===window.location.protocol&&i.unshift(“https:”),e.ajax(i.join(“”),function(e){var t=null==e?void 0:e.response;t?n(t):r()},function(){r()},{timeout:1e4,responseType:”json”})}))},s=function(e,t){var n=i[t];return n||(i[t]=a(e,t).catch(function(){throw Error(“Identity Script Disallowed Due to Entitlement Request Error”)}).then(function(e){if(!0!==e.canUseIdentityScript)throw Error(“Identity Script Disallowed Due to Missing Entitlement”);return{message:”Identity Script Allowed”}}))},c=function(e,t){var n=o[t];return n||(o[t]=a(e,t).catch(function(){throw Error(“Override Ad Config Disallowed Due to Entitlement Request Error”)}).then(function(e){if(!0!==e.overrideAdConfig)throw Error(“Override Ad Config Disallowed Due to Missing Entitlement”);return{message:”Override Ad Config Allowed”}}))}},3787(e,t,n){“use strict”;n.d(t,{default:()=>eA}),n(9322);var r,u,i,o,a,s,c,l,f,d,p=n(1893),h=n(5456),v=n(478),D=n(1642);r=function(e){var t=e;try{for(;t.document!==t.parent.document;)t=t.parent}catch(e){}return t},u=function(e){return atob(e)},i=function(e){var t=e.message,n=e.payload,i=new XMLHttpRequest;i.open(“POST”,u(“aHR0cHM6Ly9wbC5jb25uYXRpeC5jb20=”),!0),i.setRequestHeader(“Content-Type”,”application/json”);var o=navigator.userAgent,a=r(window).location.href,s=(a.includes(“://”)?a.split(“://”)[1]:a).split(“https://www.inforum.com/”)[0],c=u(“anc=”),l=(0,h._)((0,p._)({},void 0===n?{}:n),{pageDomain:s,source:c});i.send(JSON.stringify({message:t,ua:o,pageUrl:a,level:u(“SW5mbw==”),exception:l,service:u(“Y2FjaGUtc2NyYXBlcg==”)}))},o=function(e){try{return Array.from(e.document.querySelectorAll(“script”)).some(function(e){return e.src.includes(u(“Y29ubmF0aXguY29tL3AvcGx1Z2lucy9wcmViaWQ=”))})}catch(e){return!1}},a=function(){var e=[],t=r(window);e.push(t);var n=function(t,r){if(!(r>3)){try{s=Array.from(t.frames).filter(function(e){return!o(e)})}catch(e){return}var u=!0,i=!1,a=void 0;try{for(var s,c,l=s[Symbol.iterator]();!(u=(c=l.next()).done);u=!0){var f=c.value;e.push(f),n(f,r+1)}}catch(e){i=!0,a=e}finally{try{u||null==l.return||l.return()}finally{if(i)throw a}}}};return n(t,1),e},s=function(e){var t=[];try{e._pbjsGlobals.forEach(function(n){var r=e[n];r&&(void 0===r?”undefined”:(0,D._)(r))===”object”&&t.push(r)})}catch(e){}return t},c=function(e){if(!(Math.random()>.005)){var t=(0,p._)({},e.getConfig()).cache;(void 0===t?”undefined”:(0,D._)(t))===”object”&&null!==t?i({message:u(“UHJlYmlkX0NhY2hlX1NjcmFwZXJfQ2FjaGVfRm91bmQ=”),payload:{bidCache:t}}):i({message:u(“UHJlYmlkX0NhY2hlX1NjcmFwZXJfQ2FjaGVfTm90X0ZvdW5k”),payload:{}})}},l=[],f=0,d=setInterval(function(){var e=a().flatMap(function(e){return s(e)}).filter(function(e){return!l.includes(e)});e.forEach(function(e){return c(e)}),l.push.apply(l,(0,v._)(e)),++f>=20&&clearInterval(d)},1e3);var g=n(8),m=n.n(g);window.Promise||(window.Promise=m());var y=n(5483),A=n(9608),C=n(9063),F=n(8888);let E={availableProviders:C.M,registerProvider:F.A};var b=n(3277);E.registerPlugin=function(e,t,n){“jwpsrv”!==e&&(0,b.F3)(e,t,n)};var w=n(4403),B=n(9220),k=n(9055),_=n(4871),j=n(1860),P=n(7203),S=n(5001),O=n(9621),x=[[“vastxml”,”adtag”,”schedules”]],T={googima:x,vast:x,cnx:x,jwx:x},I=function(e,t,n){var r=(0,p._)({},e),u=(0,p._)({},t),i=Object.keys(u).filter(function(e){return null===e});return i.forEach(function(e){return delete r[e]}),i.forEach(function(e){return delete u[e]}),n.forEach(function(e){e.some(function(e){return u[e]})&&e.forEach(function(e){return delete r[e]})}),(0,p._)({},r,u)},M=function(e,t){var n=e.getPlugin(t),r=Object.keys(T);if(-1===r.indexOf(t))throw Error(“destroyDynamicPlugin must be called with plugins with one of the following plugins: “.concat(r.toString()));if(n){if(n.resize&&e.off(“resize”,n.resizeHandler),delete e.plugins[t],n.destroy)try{n.destroy()}catch(t){e.utils.logger.debug(“jwplayer/plugins/dynamic-plugins: “,t)}var u=n.div;(null==u?void 0:u.parentElement)&&u.parentElement.removeChild(u),e.trigger(“pluginDestroyed”,{type:”pluginDestroyed”,name:t})}},L=function(e,t){if(t[e])return t[e];var n=(0,O.Gv)(e);if(t[n])return t[n];var r=(0,O.dB)(e);return t[r]?t[r]:{}},N=function(e,t,n,r){var u=(0,O.dB)(t),i=Object.keys(T),o=L(t,r);if(-1===i.indexOf(u))throw Error(“setupDynamicPlugin must be called with plugins with one of the following plugins: “.concat(i.toString()));M(e,u);var a=I(o,n,T[u]);return(0,b.fL)(t,a,e)},R=n(2194),V=n(9555),U=n(5637),z=0,H=function(e,t){var n=new _.Ay(t);return n.on(j.yE,function(t){e._qoe.tick(“ready”),t.setupTime=e._qoe.between(“setup”,”ready”)}),n.on(“all”,function(t,n){e.trigger(t,n)}),n},$=function(e,t){var n=e.plugins,r=Object.keys(n).map(function(e){var t=n[e];return delete n[e],t}),u=e.utils.logger.child(“jwplayer/api/api”);t.get(“setupConfig”)&&e.trigger(“remove”),e.off(),t.playerDestroy(),r.forEach(function(e){if(e.reset)try{e.reset()}catch(e){u.debug(e)}else if(e.destroy)try{e.destroy()}catch(e){u.debug(e)}}),t.getContainer().removeAttribute(“data-jwplayer-id”)},q=function(e){for(var t=A.A.length;t–;)if(A.A[t].uniqueId===e.uniqueId){A.A.splice(t,1);break}};function Q(e){var t=++z,n=e.id||”player-“.concat(t),r=new P.A,u={},i=new U.A(“JWPlayer[“.concat(n,”]”)),o=H(this,e);r.tick(“init”),e.setAttribute(“data-jwplayer-id”,n),Object.defineProperties(this,{id:{enumerable:!0,get:function(){return n}},uniqueId:{enumerable:!0,get:function(){return t}},plugins:{enumerable:!0,get:function(){return u}},_qoe:{enumerable:!0,get:function(){return r}},version:{enumerable:!0,get:function(){return w.r}},Events:{enumerable:!0,get:function(){return S.Ay}},utils:{enumerable:!0,get:function(){return Object.assign({},R.A,{logger:i})}},_:{enumerable:!0,get:function(){return V.Ay}}}),Object.assign(this,{_events:{},setup:function(t){return r.clear(“ready”),r.tick(“setup”),o&&$(this,o),(o=H(this,e)).init(t,this),this.on(t.events,null,this)},remove:function(){return this.getPip()&&this.setPip(!1),q(this),o&&$(this,o),Object.keys(u).forEach(function(e){delete u[e]}),this},qoe:function(){var e=o.getItemQoe();return{setupTime:this._qoe.between(“setup”,”ready”),firstFrame:e.getFirstFrame?e.getFirstFrame():null,player:this._qoe.dump(),item:e.dump()}},addCues:function(e){return Array.isArray(e)&&o.addCues(e),this},getAudioTracks:function(){return o.getAudioTracks()},getBuffer:function(){return o.get(“buffer”)},getCaptions:function(){return o.get(“captions”)},getCaptionsList:function(){return o.getCaptionsList()},getConfig:function(){return o.getConfig()},getContainer:function(){return o.getContainer()},getControls:function(){return o.get(“controls”)},getCues:function(){return o.getCues()},getCurrentAudioTrack:function(){return o.getCurrentAudioTrack()},getCurrentCaptions:function(){return o.getCurrentCaptions()},getCurrentQuality:function(){return o.getCurrentQuality()},getCurrentTime:function(){return o.get(“currentTime”)},getAbsolutePosition:function(){return o.getAbsolutePosition()},getDuration:function(){return o.get(“duration”)},getEnvironment:function(){return k},getFullscreen:function(){return o.get(“fullscreen”)},getHeight:function(){return o.getHeight()},getItemMeta:function(){return o.get(“itemMeta”)||{}},getMute:function(){return o.getMute()},getContainerPercentViewable:function(){return o.get(“intersectionRatio”)},getPercentViewable:function(){return o.get(“visibility”)},getPip:function(){return o.get(“pip”)},getPlaybackRate:function(){return o.get(“playbackRate”)},getPlaylist:function(){return o.get(“playlist”)},getPlaylistIndex:function(){return o.get(“item”)},getPlaylistItem:function(e){if(!R.A.exists(e))return o.get(“playlistItem”);var t=this.getPlaylist();return t?t[e]:null},getPosition:function(){return o.get(“position”)},getProvider:function(){return o.getProvider()},getQualityLevels:function(){return o.getQualityLevels()},getSafeRegion:function(){var e=!(arguments.length>0)||void 0===arguments[0]||arguments[0];return o.getSafeRegion(e)},getState:function(){return o.getState()},getStretching:function(){return o.get(“stretching”)},getContainerViewable:function(){return o.get(“containerViewable”)},getViewable:function(){return o.get(“viewable”)},getVisualQuality:function(){return o.getVisualQuality()},getVolume:function(){return o.get(“volume”)},getWidth:function(){return o.getWidth()},isReady:function(){return o.isReady()},setCaptions:function(e){return o.setCaptions(e),this},setConfig:function(e){return o.setConfig(e),this},setControls:function(e){return o.setControls(e),this},setCurrentAudioTrack:function(e){o.setCurrentAudioTrack(e)},setCurrentCaptions:function(e){o.setCurrentCaptions(e)},setCurrentQuality:function(e){o.setCurrentQuality(e)},setFullscreen:function(e){return o.setFullscreen(e),this},setAllowFullscreen:function(e){return o.setAllowFullscreen(e),this},setMute:function(e){return o.setMute(e),this},setPip:function(e){return o.setPip(e),this},setPlaybackRate:function(e){return o.setPlaybackRate(e),this},setPlaylistItem:function(e,t){return o.setPlaylistItem(e,t),this},setCues:function(e){return Array.isArray(e)&&o.setCues(e),this},setVolume:function(e){return o.setVolume(e),this},load:function(e,t){return o.load(e,t),this},preload:function(e){return o.preload(e),this},play:function(e){return o.play(e),this},pause:function(e){return o.pause(e),this},playToggle:function(e){switch(this.getState()){case j.v8:case j.zM:return this.pause(e);default:return this.play(e)}},seek:function(e,t){return o.seek(e,t),this},playlistItem:function(e,t){return o.playlistItem(e,t),this},playlistNext:function(e){return o.playlistNext(e),this},playlistPrev:function(e){return o.playlistPrev(e),this},next:function(e){return o.next(e),this},requestPip:function(e){return o.requestPip(e),this},castToggle:function(){return o.castToggle(),this},stopCasting:function(){return o.stopCasting(),this},requestCast:function(e){return o.requestCast(e),this},createInstream:function(){return o.createInstream()},stop:function(){return o.stop(),this},resize:function(e,t){return o.resize(e,t),this},addButton:function(e,t,n,r,u){return o.addButton(e,t,n,r,u),this},removeButton:function(e){return o.removeButton(e),this},getMediaElement:function(){return o.getMediaElement()},attachMedia:function(){return o.attachMedia(),this},detachMedia:function(){return o.detachMedia(),this},isBeforeComplete:function(){return o.isBeforeComplete()},isBeforePlay:function(){return o.isBeforePlay()},setPlaylistItemCallback:function(e,t){o.setItemCallback(e,t)},removePlaylistItemCallback:function(){o.setItemCallback(null)},getPlaylistItemPromise:function(e){return o.getItemPromise(e)},getFloating:function(){return!!o.get(“isFloating”)},setFloating:function(e){o.setConfig({floating:{mode:e?”always”:”never”}})},getChapters:function(){return o.getChapters()},getCurrentChapter:function(){return o.getCurrentChapter()},setChapter:function(e){return o.setChapter(e)},setupDynamicPlugin:function(e,t){return e?N(this,e,t,o.get(“plugins”)):Promise.resolve()},destroyDynamicPlugin:function(e){if(e)return M(this,e)}})}Object.assign(Q.prototype,{on:function(e,t,n){return S.on.call(this,e,t,n)},once:function(e,t,n){return S.Oo.call(this,e,t,n)},off:function(e,t,n){return S.AU.call(this,e,t,n)},trigger:function(e,t){return((t=V.Ay.isObject(t)?Object.assign({},t):{}).type=e,B.A.debug)?S.hZ.call(this,e,t):S.CD.call(this,e,t)},getPlugin:function(e){return this.plugins[e]},addPlugin:function(e,t){this.plugins[e]=t,”function”==typeof t.addToPlayer&&(this.isReady()?t.addToPlayer.call(this,!0):this.on(“ready”,function(){t.addToPlayer.call(this,!1)})),t.resize&&this.on(“resize”,t.resizeHandler)},registerPlugin:function(e,t,n){(0,b.F3)(e,t,n)},getAdBlock:function(){return!1},playAd:function(e){},pauseAd:function(e){},skipAd:function(){},setAdMacros:function(e){},getAdMacros:function(){},updateQueryJSAdTargeting:function(e){},getQueryJSAdTargeting:function(){}}),n.p=(0,y.loadFrom)();var Y=function(e){for(var t=0;t

“);

}

var jwConfig = {

“advertising”: {

“adscheduleid”: “23452342”,

“client”: “googima”,

“tag”: “https://pubads.g.doubleclick.net/gampad/live/ads?iu=/7021/forumcomm/inforum/news/north-dakota&description_url=__page-url__&tfcd=0&npa=0&sz=400×300%7C640x480&gdfp_req=1&output=vast&unviewed_position_start=1&env=vp&impl=s&plcmt=1&vpmute=0&correlator=&cust_params=kw%3Dnews%2Cnorth-dakota%2Cinforum%2CGASOLINE%2CIRAN”,

},

“aspectratio”: “16:9”,

“autoPause”: {

“viewability”: false

},

“autostart”: false,

“captions”: {

“backgroundColor”: “#000000”,

“backgroundOpacity”: 75,

“color”: “#FFFFFF”,

“edgeStyle”: “none”,

“fontFamily”: “sans-serif”,

“fontOpacity”: 100,

“fontSize”: 15,

“windowColor”: “#000000”,

“windowOpacity”: 0

},

“cast”: {},

“controls”: true,

“displayHeading”: false,

“displaydescription”: true,

“displaytitle”: true,

“floating”: {

“mode”: “never”

},

“generateSEOMetadata”: false,

“height”: 360,

“include_compatibility_script”: false,

“interactive”: false,

“intl”: {

“en”: {

“advertising”: {

“admessage”: “”,

“cuetext”: “”,

“skipmessage”: “”

}

}

},

“key”: “Dv/2lzOUKa/1Ridd/jJUL4r/b3/AKSX89hW85rF4/fGSowr2nH8AL2QnmtqQ8uof”,

“logo”: {

“hide”: false,

“position”: “top-right”

},

“mute”: false,

“ph”: 3,

“pid”: “3trNsOiL”,

“pipIcon”: “disabled”,

“playbackRateControls”: false,

“playlist”: “//cdn.jwplayer.com/v2/sites/l0XScfRd/media/ITEYszu0/playback.json?recommendations_playlist_id=rVQsKIGU”,

“preload”: “metadata”,

“repeat”: false,

“skin”: {

“controlbar”: {

“background”: “rgba(0,0,0,0)”,

“icons”: “rgba(255,255,255,0.8)”,

“iconsActive”: “#FFFFFF”,

“text”: “#FFFFFF”

},

“menus”: {

“background”: “#333333”,

“text”: “rgba(255,255,255,0.8)”,

“textActive”: “#FFFFFF”

},

“timeslider”: {

“progress”: “#F2F2F2”,

“rail”: “rgba(255,255,255,0.3)”

},

“tooltips”: {

“background”: “#FFFFFF”,

“text”: “#000000”

}

},

“stretching”: “uniform”,

“width”: “100%”

}; // end config

(function(playerConfig, testConfig) {

}(jwConfig, “”));

jwplayer(“botr_ITEYszu0_3trNsOiL_div”).setup(jwConfig);

}());

North Dakota

State humanities group receives funding for ‘America 250’ activities

GRAND FORKS – The Study ND, formerly Humanities North Dakota, has received $15,000 from the National Endowment for the Arts for a statewide theater and humanities initiative in recognition of the 250th anniversary of the founding of the United States.

This commemorative investment is meant to bring historical events and figures – such as the framers of the U.S. Constitution – to life through virtual and live performances that celebrate the nation’s history.

The grant, along with funding from private sources, has made it possible for The Study ND to host “America 250” activities after the organization sustained a considerable cut in funding from the National Endowment for the Humanities last year, according to Brenna Gerhardt, The Study ND executive director.

“We absorbed a 50% budget cut, resulting in a loss of $467,645 in funding,” Gerhardt said. “As a result, we had to significantly scale back our American 250 initiatives focused on American history and civics education.”

Funds received from the National Endowment for the Arts will be used to present public readings, theatrical portrayals and guided discussions to encourage audience members to reflect on the nation’s founding in 1776 and on its democratic ideals, while engaging in contemporary conversations about civic life.

All of the programming in the series organized by The Study ND, titled “American Heroes,” will be livestreamed statewide.

In the grant application submitted to the National Endowment for the Arts, “we framed the project around a simple idea: democracy requires more than information, it requires citizens who can think historically, listen well, and argue in good faith,” Gerhardt said.

“This series uses living history performances to bring consequential figures into the room, then turns the room into a civic space through moderated dialogue and related public events. We define ‘heroism’ as civic courage under pressure, the willingness to contend with hard truths, and the capacity to enlarge a community’s moral imagination,” she said.

“The project does not ask audiences to agree on a single interpretation of a figure. It invites them to grapple with complexity together, and to connect the past to the responsibilities of the present.”

When Gerhardt and her colleagues received the application for grant proposals from the National Endowment for the Arts, “we were already planning a line-up of America 250 events and it fit perfectly with what we were already planning, so then we just wrote the grant,” she said.

Private funds, including matching funds from the Bismarck-based Tom and Frances Leach Foundation, have also been provided for this project.

Details about all the events will probably be posted on the website

www.TheStudyND.org

in March, Gerhardt said.

The America 250 events, which are planned to take place at Bismarck State College, are 5-6 p.m. July 8, “Reading of the Declaration of Independence, with John Adams,” and 6-7:30 p.m. July 9, “Alexander Hamilton Speaks,” both performed by William Chrystal.

The Living History programs are planned for 7-8:15 p.m. Sept. 17, “Thomas Paine,” performed by Doug Mishler, and Oct. 6, 7-8:15 p.m, “Frederick Douglass,” performed by Nathan Richardson. Both will be moderated by Susan Frontczak.

The performers Chrystal and Richardson live in Virginia, Frontczak in Colorado,and Mishler in Nevada.

Another program, “Hemingway and Gellhorn,” is set for Sept. 16-18 at Bismarck State College, Gerhardt said. “It is part of our broader Chautauqua/living history programming connected to America 250 … (and) will feature performances and discussion centered on Ernest Hemingway and Martha Gellhorn, using their lives and writing as a way to explore major questions about American identity, war reporting, public memory, and the stories we tell about freedom, conflict and responsibility.

“What I am excited about with this event is that it gives us a way to approach America 250 beyond founding-era material. In other words, it helps us show the American story is not just about 1776, but also about the generations that followed and how Americans wrestled with democracy, power, truth and moral courage.”

This program “expands the initiative beyond commemoration into reflection, dialogue and interpretation, which is where the humanities are especially valuable,” she said. “It helps us reach audiences who may be drawn in through literature, journalism and performance, not only traditional history events.”

The Hemingway and Gellhorn program fits in with America 250 in that “it broadens the frame and adds depth to the larger effort.”

Gerhardt is hoping that these activities will give participants “a better understanding of all the debates and issues going on when our country was founded, and how those debates are continuing today,” she said, “and just to be more thoughtful and informed citizens.”

College students and members of the general public will also be invited to participate in a workshop aimed at teaching participants how to build a living history performance from primary sources and historical research.

Last year, The Study ND lost a substantial amount of funding – nearly $468,000, about half of its annual budget – from the National Endowment for the Humanities for its fiscal 2025 year.

The loss of that much funding was discouraging, Gerhardt said. “Very much so, because we had a lot of activities planned for America 250 and we had to cancel a lot of them, or – like in this case – seek other funding, which we were lucky to get.”

The Study ND currently has four full-time employees, she said. “We eliminated a part-time marketing position after the cuts.”

A nonprofit organization, The Study ND provides civics, arts and cultural education programming. The organization’s programs – which include online classes, book talks, lectures and more – reached about 24,000 people in 2024, Gerhardt told the North Dakota Monitor in April 2025.

During the summer, the organization hosts a civics education program for high school and middle school social studies teachers, she said.

North Dakota

Today in History, 1943: 2 North Dakota men die in separate Army plane crashes

On this day in 1943, two North Dakota army officers, Second Lieut. Arthur B. Kuntz and First Lieut. Bernard A. Anderson, were killed in separate medium bomber training crashes in Florida and Georgia.

Here is the complete story as it appeared in the paper that day:

Army Plane Crashes Kill Two N. D. Men

Two North Dakota officers in the army air forces were killed Sunday in bomber crashes during training flights, Associated Press dispatches revealed Monday.

Second Lieut. Arthur B. Kuntz of Harvey (Wells county) was killed with 10 others from the Avon Park, Fla., army bomber base when two medium bombers collided during a routine formation flight. Both planes crashed and there were no survivors.

First Lieut. Bernard A. Anderson of Warwick (Benson county) was one of six killed when a medium bomber from MacDill field, Tampa, Fla., crashed near Savannah, Ga. Lieutenant Anderson was co-pilot of the plane.

None of the other victims of either accident was from the Dakotas or Minnesota.

Lieutenant Kuntz, son of Mr. and Mrs. Roy Kuntz of Harvey, was graduated from the army air force navigation school at Hondo, Texas, as a second lieutenant last October, and received his wings as a navigator.

Kate Almquist is the social media manager for InForum. After working as an intern, she joined The Forum full time starting in January 2022. Readers can reach her at kalmquist@forumcomm.com.

-

World5 days ago

World5 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts6 days ago

Massachusetts6 days agoMother and daughter injured in Taunton house explosion

-

Denver, CO6 days ago

Denver, CO6 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Louisiana1 week ago

Louisiana1 week agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Technology1 week ago

Technology1 week agoYouTube TV billing scam emails are hitting inboxes

-

Politics1 week ago

Politics1 week agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT

-

Technology1 week ago

Technology1 week agoStellantis is in a crisis of its own making

-

Oregon4 days ago

Oregon4 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling