Missouri

Patrol reports 12 arrests in north Missouri between May 27 and May 31, 2025

Click the + Icon To See Additional Sharing Options

The Missouri State Highway Patrol recently released a report detailing the number of arrests made in north Missouri between May 27 and May 31, 2025. The report indicates that a total of 12 individuals were arrested during this period. Some of the reasons for these arrests include driving while intoxicated, drug possession, and outstanding warrants.

It is important to note that, while all the individuals listed below have been reported as arrested, they may not have been physically transported to a detention center. Depending on the circumstances, an individual may be issued a summons, which includes a court date. When the Missouri State Highway Patrol issues a summons with a court date, it is considered an arrest, even if the individual is not physically transported to a detention center.

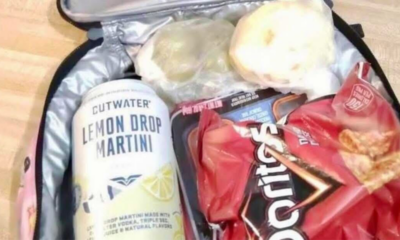

Chelsea R. Ingino, 37, of St. Joseph, Missouri, was arrested on May 27 at 4:25 p.m. in Andrew County. Ingino was charged with driving while intoxicated resulting in the death of another person. She was also charged with driving in the wrong direction on a highway divided into two or more roadways and felony endangering the welfare of a child. She was taken to Mosaic Medical Center in St. Joseph and was released following the incident.

Brandi M. Davis, 35, of Cameron, Missouri, was arrested on May 27 at 6:05 p.m. in Clinton County. She was charged with felony possession of methamphetamine and felony possession of a synthetic narcotic. In addition, she was cited for misdemeanor unlawful possession of drug paraphernalia, failure to wear a seat belt, and speeding. Davis was held at the Clinton County Sheriff’s Department on a 24-hour hold.

Tyler C. Leonard, 22, of Lawson, Missouri, was arrested on May 28 at 9:48 p.m. in Clinton County. He was charged with misdemeanor driving while intoxicated, operating a vehicle in a careless and imprudent manner involving a crash, and operating a motor vehicle without a valid license. Leonard was transported to the Clinton County Jail and held on a 12-hour hold.

Jesse L. Politte, 24, of Linn Creek, Missouri, was arrested on May 28 at 9:51 p.m. in Schuyler County. He was charged with driving while intoxicated by drugs. Politte was taken to the Schuyler County Jail and later released.

Elliot J. Sandefur, 18, of Kirksville, Missouri, was arrested on May 29 at 12:45 a.m. in Adair County. He was charged with felony driving while intoxicated as a persistent offender and careless and imprudent driving involving an accident. Sandefur was released to seek medical treatment following his arrest.

William R. Barrett, 51, of Gilmer, Texas, was arrested on May 29 at 1:49 p.m. in Macon County. He was charged with driving while intoxicated, leaving the scene of a motor vehicle crash, and failure to drive on the right half of the roadway resulting in an accident. Barrett was released after the arrest.

Daniel E. Graves, 35, of Kirksville, Missouri, was arrested on May 30 at 1:39 p.m. in Randolph County. He was charged with driving while intoxicated and failing to drive in the right lane on a highway with two or more lanes. Graves was taken to the Randolph County Jail and was bondable.

Brian F. Smith, 32, of Mercer, Missouri, was arrested on May 30 at 2:55 p.m. in DeKalb County. He was taken into custody on a Buchanan County warrant for receiving stolen property. Smith was held at the Buchanan County Law Enforcement Center and was bondable.

Rachel N. Clark, 40, of Forest City, Missouri, was arrested on May 31 at 3:44 p.m. in Holt County. She was charged with failure to appear in court on an original charge of operating a motor vehicle without maintaining financial responsibility. Clark was held at the Holt County Sheriff’s Office and was bondable.

Kevin D. Ford, 59, of Lathrop, Missouri, was arrested on May 31 at 4:30 p.m. in Clinton County. Ford was charged with felony leaving the scene of a crash with physical injury. He also faced three misdemeanor charges including operating in a careless and imprudent manner involving a crash, failure to display valid plates on a motor vehicle, and operating a motor vehicle without maintaining financial responsibility. He was held at the Clinton County Sheriff’s Department on a 24-hour hold.

Tawnie S. Williams, 36, of St. Joseph, Missouri, was arrested on May 31 at 5:13 p.m. in Buchanan County. She was charged with driving while suspended and failing to wear a seat belt. Williams was also arrested on a misdemeanor warrant from the St. Joseph Police Department for failure to appear on a previous charge of driving while revoked or suspended. She was held at the Buchanan County Law Enforcement Center and was bondable.

Johnathan D. Miller, 42, of Callao, Missouri, was arrested on May 31 at 1:44 a.m. in Macon County. He was charged with driving while intoxicated and was taken to the Macon County Jail before being released.

Post Views: 204

Related

Click the + Icon To See Additional Sharing Options

Missouri

Top 25 Missouri Girls High School Basketball Rankings – March 2, 2026

The Missouri girls basketball postseason has arrived, and everything changes from this point forward. The regular season provided clarity on contenders, exposed weaknesses, and built résumés—but none of that guarantees anything in March.

District championships are being claimed, rotations are tightening, and every possession now carries real consequence. Depth matters more. Experience matters more. Discipline matters more. Some teams enter the bracket playing their best basketball of the year, while others are still searching for consistency at the most critical time.

Momentum, health, and matchups will ultimately decide who survives and who goes home. These rankings reflect not only what has been accomplished, but who looks built to handle the pressure that defines this stretch of the season.

Here’s the updated Missouri Girls Top 25.

Previous Rank: 1

This is the time of year when Incarnate Word’s dynasty takes center stage. The Red Knights haven’t lost a playoff game in nearly a decade, an astonishing run that stands as one of the most impressive feats in Missouri high school girls basketball history.

Previous Rank: 3

Staley moves back into the No. 2 spot after a strong final week of the regular season. The Falcons check every box. They’re one of the most talented and deepest Class 6 teams Missouri has seen in recent years.

Previous Rank: 2

The Chiefs opened the season 25-0 before suffering their first loss to Liberty North. That defeat could serve as valuable motivation heading into the postseason. This group still has the look of a serious contender.

Previous Rank: 4

Principia coasted through its first two playoff games. The Panthers are getting meaningful bench production while allowing starters to rest. That balance could pay dividends in the later rounds.

Previous Rank: 5

Wins over Glendale and West Plains keep an outstanding season rolling. Strafford is the clear favorite in Class 4. This playoff stretch could be their most significant since the 2020 championship run.

Previous Rank: 6

Jackson hasn’t played a close game in nearly a month. The Indians are eager for tougher competition in the Class 6 bracket and have the pieces to make a run to the state tournament.

Previous Rank: 7

A loss to Staley was followed by a strong bounce-back win over Liberty North. That stretch should serve as an ideal playoff tune-up. The Titans have the roster and ceiling to compete with anyone.

Previous Rank: 8

Wins over Troy Buchanan and Helias closed the regular season on a high note. It’s been a year of ups and downs, but the Bruins are defending well and playing their best basketball entering the postseason.

Previous Rank: 9

A win over Carl Junction capped off a successful regular season. Marshfield appears poised to make a deep playoff run.

Previous Rank: 10

A 78-54 win over Kennett showcased this team’s depth from top to bottom. The Donnettes are largely unchallenged in their region and are looking to repeat as state champions.

Previous Rank: 11

Centralia allowed just 61 combined points in its first two playoff games. That level of defense will make them a difficult out. Dixon (22-6) awaits on Monday night.

Previous Rank: 21

A 78-66 win over Kickapoo sparked a significant jump in the rankings. That victory confirmed the ceiling many believed this team had. Freshman Taytum Schnakenburg led the way with 25 points.

Previous Rank: 12

Tipton made its first two playoff games look routine. The Class 2 favorite is set to face Westran (21-8) on Monday night.

Previous Rank: 13

Closing the regular season with a win over Bolivar should provide confidence. In an interesting twist, they’ll face Bolivar again in the opening round of districts.

Previous Rank: 14

This ranking could be misleading. The Cougars have a high ceiling, with many losses coming against elite competition. The challenge is sharing a district with Incarnate Word.

Previous Rank: 16

Wins over Oak Park and North Kansas City were key to closing out the regular season. This playoff run marks the final chapter of Addison Bjorn’s standout prep career.

Previous Rank: 17

Republic’s season has been a steady climb. They’ve maintained consistency and look capable of winning multiple playoff games. The journey begins against Waynesville on Monday night.

Previous Rank: 18

Getting Lauren Ortwerth back makes a major difference. The senior forward scored 30 points in the regular-season finale. Cor Jesu is a co-favorite with Jackson in its district and has a track record of winning in big moments.

Previous Rank: 20

Wins over Oakville and Webster Groves wrapped up a strong regular season. Sophomore guard Bailey Owen scored 27 points in the finale, highlighting the Mustangs’ offensive firepower.

Previous Rank: 15

A 48-44 loss to St. Teresa’s Academy ended an 11-game winning streak. The Cardinals will look to respond and begin a Class 4 playoff push on Wednesday night.

Previous Rank: 19

A dominant 46-20 win over Savannah (21-5) showed this team can overwhelm quality Class 4 opponents. The Fighting Irish have been consistent all season.

Previous Rank: 22

A 64-58 loss to Strafford reflects the story of West Plains’ season. Despite more losses than most ranked teams, each defeat has come against quality competition. They can compete with anyone but must close games to make a deep run.

Previous Rank: 23

A competitive loss to Rock Bridge won’t shift their standing. This group continues to win games and compete at a high level. Fort Zumwalt West awaits in the playoff opener Monday night.

Previous Rank: Not ranked

The Hawks make their first appearance in the rankings late in the season. At 27-1—and undefeated within Missouri—they look capable of challenging for the Class 2 state championship.

Previous Rank: Not ranked

Liberty has battled all season long. A recent win over Oak Park propelled the Blue Jays into the rankings as the two teams swap places on the edge of the Top 25.

Missouri

Missouri Lottery Pick 3, Pick 4 winning numbers for March 1, 2026

The Missouri Lottery offers several draw games for those aiming to win big.

Here’s a look at March 1, 2026, results for each game:

Winning Pick 3 numbers from March 1 drawing

Midday: 0-6-1

Midday Wild: 3

Evening: 3-1-3

Evening Wild: 7

Check Pick 3 payouts and previous drawings here.

Winning Pick 4 numbers from March 1 drawing

Midday: 4-0-5-8

Midday Wild: 3

Evening: 8-8-4-7

Evening Wild: 3

Check Pick 4 payouts and previous drawings here.

Winning Cash Pop numbers from March 1 drawing

Early Bird: 14

Morning: 07

Matinee: 13

Prime Time: 12

Night Owl: 03

Check Cash Pop payouts and previous drawings here.

Winning Show Me Cash numbers from March 1 drawing

05-16-23-29-34

Check Show Me Cash payouts and previous drawings here.

Feeling lucky? Explore the latest lottery news & results

Are you a winner? Here’s how to claim your lottery prize

All Missouri Lottery retailers can redeem prizes up to $600. For prizes over $600, winners have the option to submit their claim by mail or in person at one of Missouri Lottery’s regional offices, by appointment only.

To claim by mail, complete a Missouri Lottery winner claim form, sign your winning ticket, and include a copy of your government-issued photo ID along with a completed IRS Form W-9. Ensure your name, address, telephone number and signature are on the back of your ticket. Claims should be mailed to:

Ticket Redemption

Missouri Lottery

P.O. Box 7777

Jefferson City, MO 65102-7777

For in-person claims, visit the Missouri Lottery Headquarters in Jefferson City or one of the regional offices in Kansas City, Springfield or St. Louis. Be sure to call ahead to verify hours and check if an appointment is required.

For additional instructions or to download the claim form, visit the Missouri Lottery prize claim page.

When are the Missouri Lottery drawings held?

- Powerball: 9:59 p.m. Monday, Wednesday and Saturday.

- Mega Millions: 10 p.m. Tuesday and Friday.

- Pick 3: 12:45 p.m. (Midday) and 8:59 p.m. (Evening) daily.

- Pick 4: 12:45 p.m. (Midday) and 8:59 p.m. (Evening) daily.

- Cash4Life: 8 p.m. daily.

- Cash Pop: 8 a.m. (Early Bird), 11 a.m. (Late Morning), 3 p.m. (Matinee), 7 p.m. (Prime Time) and 11 p.m. (Night Owl) daily.

- Show Me Cash: 8:59 p.m. daily.

- Lotto: 8:59 p.m. Wednesday and Saturday.

- Powerball Double Play: 9:59 p.m. Monday, Wednesday and Saturday.

This results page was generated automatically using information from TinBu and a template written and reviewed by a Missouri editor. You can send feedback using this form.

Missouri

Best Missouri Sportsbooks: Download MO Sportsbooks Today

Here are the best Missouri sportsbooks available. Learn about Missouri sportsbooks, features, welcome offers and more in this article.

Missouri bettors rejoice, launch day for Missouri sportsbooks has arrived! You can sign up for each of these brands to claim lucrative offers and get a good feel of which of these MO sportsbooks you want to bet with now that legal wagering is here!

Best Missouri Sportsbooks Today

These Missouri sportsbooks are some of the best sportsbooks in the gambling industry. Each of these brands have been broken down below to give you the finer, need-to-know details.

BetMGM Missouri Sportsbook

BetMGM is under the umbrella of one of the largest gambling brands in the world – MGM Resorts. The sportsbook offers a wide range of sports, frequent promotions to existing users and a great interface for desktop and mobile.

⭐️ Top Feature:

Frequent Odds Boosts

🎁 Welcome Offer:

Get up to $1,500 Back in Bonus Bet If You Lose Your First Bet

🤝 Partner:

Century Casinos

💰 Payout Speed:

1-5 Days

DraftKings Missouri Sportsbook

It’s no surprise that DraftKings has launched in Missouri, given its massive presence in sports betting states. This brand is my go-to as you can find the most betting markets available on most events at DraftKings.

⭐️ Top Feature:

Tons of Betting Markets

🎁 Welcome Offer:

Bet $5 Get $200 in Bonus Bets if Your First Bet Wins

🤝 Partner:

Untethered License

💰 Payout Speed:

1-5 Days

bet365 Missouri Sportsbook

bet365 is the biggest sportsbook globally, and the fact that it’ll be available in the Show-Me State is great news for Missouri bettors. This is a brand that boasts a fantastic user experience, coupled with great promotions and can’t-beat odds.

⭐️ Top Feature:

Early Payouts for Most Sports

🎁 Welcome Offer:

Bet $10, Get $365 in Bonus Bets

🤝 Partner:

St. Louis Cardinals

💰 Payout Speed:

1-5 Days

Caesars Missouri Sportsbook

Caesars is probably the biggest name in gambling, particularly in the US, so it’s no surprise that you’ve heard of Caesars. The Caesars Sportsbook is a great choice for Missouri bettors, and the Caesars Rewards program is THE best in the industry, so don’t miss out!

⭐️ Top Feature:

Caesars Rewards

🎁 Welcome Offer:

$250 Bet Match

🤝 Partner:

Harrah’s Kansas City, Horseshoe St. Louis, Isle of Capri Casino

💰 Payout Speed:

1-5 Days

FanDuel Missouri Sportsbook

FanDuel is king among sportsbooks given its breadth of betting markets, odds and lines. Most seasoned bettors will choose this brand given those options, not to mention a steady stream of odds boosts and no sweat bets for existing users.

| ⭐️ Top Feature: | Great Betting Odds & Lines |

| 🎁 Welcome Offer: | Bet $5, Get $200 In Bonus Bets |

| 🤝 Partner: | St. Louis CITY SC |

| 💰 Payout Speed: | 1-2 Days |

Fanatics Missouri Sportsbook

If you’re a fan of sports gear, you’ll love Fanatics Sportsbook! Bet with Fanatics and you can earn FanCash to use toward a new Chiefs jersey or whatever else you’d like to wear on game day!

⭐️ Top Feature:

FanCash Loyalty Program

🎁 Welcome Offer:

10x$100 Bet Match in FanCash

🤝 Partner:

Boyd Gaming

💰 Payout Speed:

1-3 Days

TheScore Bet Missouri Sportsbook

While not as recognizeable a brand, this sportsbook actually takes the place of ESPN BET as PENN Entertainment’s sports betting brand. TheScore Bet presents a clean interface that is also very easy to navigate.

⭐️ Top Feature:

Easy to Navigate Interface

🎁 Welcome Offer:

Bet $10, Get $100 in Bonus Bets

🤝 Partner:

Argosy Riverside Casino, River City Casino, Hollywood Casino St. Louis

💰 Payout Speed:

1-5 Days

Circa Missouri Sportsbook

Circa Sports is widely known as having the highest limits among sportsbooks, and the same should be expected in Missouri. Typically, Circa doesn’t offer a welcome bonus, so we’ll have to see whether that changes in the Show-Me State or not.

⭐️ Top Feature:

High Betting Limits

🎁 Welcome Offer:

N/A

🤝 Partner:

Untethered License

💰 Payout Speed:

1-2 Days

What Sportsbooks are in Missouri?

There are plenty Missouri sportsbooks to choose from, including online, mobile and retail, here is the full list of brands where you can bet on sports in MO:

- bet365 Missouri

- BetMGM Missouri

- Caesars Sportsbook Missouri

- Circa Sports Missouri

- DraftKings Missouri

- Fanatics Sportsbook Missouri

- FanDuel Missouri

- TheScore Bet Missouri

Online Sportsbooks in Missouri

Fortunately, the full list of sportsbooks in Missouri (bet365, BetMGM, Caesars, Circa, DraftKings, Fanatics, FanDuel and TheScore Bet) all have online and mobile operations, allowing you to bet from anywhere. I prefer using mobile sportsbooks given the convenience and friendly user interface of the apps. Additionally, you can only find welcome offers on mobile sportsbooks.

Retail Sportsbooks in Missouri

If you’re more a fan of betting in person, you’ll find the pickings quite slim in Missouri. Caesars, Fanatics and ESPN BET are the only operators who have been licensed for retail sports betting for their casino partners. In Missouri, you can only bet in person at local casinos or professional sports stadiums, depending on if those locations apply for retail licenses. Here are the current locations where you can bet on sports in person in Missouri:

- Ameristar Casino Kansas City (Fanatics Sportsbook)

- Ameristar Casino St. Louis (Fanatics Sportsbook)

- Argosy Casino & Hotel (TheScore Bet)

- Harrah’s Kansas City (Caesars Sportsbook)

- Hollywood Casino St. Louis (TheScore Bet)

- Horseshoe St. Louis (Caesars Sportsbook)

- Isle of Capri Casino (Caesars Sportsbook)

- River City Casino (TheScore Bet)

Bet Types at Missouri Sportsbooks

Fortunately, you can place the typical bets at Missouri Sportsbooks. Here’s what you can find:

- Moneylines

- Parlays

- Totals

- Point Spreads

- Futures

- Prop Bets

- Live Betting

- Teasers

Sports to Bet on at Sportsbooks in Missouri

Similar to bet types, you can find pretty much every sport to bet on at sportsbooks in Missouri. Here are some of the more popular options, but there are bound to me countless more:

- NFL

- NBA

- NHL

- MLB

- MLS

- WNBA

- Tennis

- Golf

- NASCAR

Sign up With Missouri Sportsbooks Today

Missouri sportsbooks are live! Now that you’ve read this article, you have a better understanding of sports betting in the state. So sign up today and make sure to claim Missouri sportsbook promos while you’re at it, where you can earn thousands in bonuses right now!

-

World5 days ago

World5 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts5 days ago

Massachusetts5 days agoMother and daughter injured in Taunton house explosion

-

Denver, CO5 days ago

Denver, CO5 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Louisiana1 week ago

Louisiana1 week agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Technology1 week ago

Technology1 week agoYouTube TV billing scam emails are hitting inboxes

-

Politics1 week ago

Politics1 week agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT

-

Technology1 week ago

Technology1 week agoStellantis is in a crisis of its own making

-

News1 week ago

News1 week agoWorld reacts as US top court limits Trump’s tariff powers