Illinois

Illinois passes $55B budget, with over $800 million in revenue changes

Illinois state lawmakers’ spending plan surpasses last year’s budget by $2 billion, requiring taxpayers to pay over $800 million in additional costs for yet another year of record spending.

With just over 24 hours to conduct a full review, the Illinois General Assembly approved a record-setting $55.2 billion budget for 2026, after a 75-41 House vote sent the 3,000-plus page plan to Gov. J.B. Pritzker. lt follows a familiar fiscal playbook: spend more, fix nothing, hand taxpayers the bill – and toss in a raise for those casting the votes.

To cover the rising costs of education, state pensions and health benefits for government workers, the budget uses short-sighted fixes and ignores structural problems. Once again, it’s taxpayers who will pay the price.

Just before its deadline, Illinois lawmakers passed a record $55.2 billion budget, featuring over $394 million in tax increases, $237 million in fund sweeps and $216 million in delaying funds.

Despite lawmaker claims of budget cuts, the 2026 budget increased by $2 billion compared to 2025. Gov. J.B. Pritzker has grown Illinois’ budget by $16 billion and enacted over 50 tax hikes since taking office in 2019.

Notably, the budget cuts the state’s Property Tax Relief Grant, resulting in an effective $43 million property tax hike. Lawmakers will also receive more than $6,000 in pay raises for the coming year, while public pensioners will receive a benefit spike valued at more than $13 billion. Meanwhile, the budget contributes $5 billion less in pension funding than is necessary to keep the system solvent for future retirees, according to the pension system’s actuaries.

On the revenue side the budget features more than $800 million in revenue gimmicks featuring tax hikes, fund sweeps and temporary measures that fail to truly balance the state’s budget. The process was so rushed that even bill sponsors seem unclear on the exact amount taxpayers will be asked to pay. Among the revenue adjustments are:

- $195 million – $228 million from a new tax amnesty program.

- $171 million from delaying motor fuels tax revenue transfers to the Road Fund.

- $237 million in fund sweeps.

- $72 million in corporate tax hikes.

- $45 million from shorting the state’s Budget Stabilization Fund.

- $36 million from a new sports wagering tax.

- $15 million from removing hotel tax exemptions from short term rental platforms.

- An additional tax on nicotine analogs.

The 2026 budget continues Illinois’ practice of irresponsible and speculative budgeting. Rather than focusing on policy solutions such as a spending cap, right-sizing employee health care costs and constitutional pension reform, lawmakers have opted for a status quo budget. Constantly relying on taxes and fund sweeps encourages irresponsible budgeting, which erodes voters’ trust in Springfield. These tactics reduce the state’s competitiveness, risk potential credit downgrades and can worsen Illinois’ challenges with high unemployment and sluggish growth.

Illinois’ 2026 budget continues the state’s habit of patching budget problems using short-sighted fixes with long-term consequences. Without structural solutions, such as adopting a spending cap and constitutional pension reform, Illinois has continued its cycle of reactive budgeting at taxpayers’ expense.

Illinois

Firefighter faces arson charges after Illinois wildfire burns hundreds of acres

A volunteer firefighter is facing arson charges after he allegedly set a fire in a Lee County wildlife preserve, scorching hundreds of acres.

According to authorities, 21-year-old Trent Schaefer, a volunteer firefighter in Ohio, Illinois, was charged with one count of arson in connection to a fire that occurred in the Green River State Wildlife Management Area Friday.

On that date, temperatures had soared into the 60s, winds were whipping at more than 30 miles per hour, and humidity plunged below 30%, leading the National Weather Service to issue warnings on the danger of wildfires in Illinois.

It is alleged that Schaefer was seen by witnesses getting out of a vehicle and igniting multiple small fires within the nature preserve, which then coalesced into a larger blaze.

Those witnesses were able to restrain the suspect until Lee County sheriff’s deputies arrested him.

Image taken by Lee County Sheriff’s Office

By the time firefighters arrived on scene the blaze had already spread, and multiple departments were called in to assist with the fire, including the Illinois Department of Natural Resources.

Firefighters were able to bring the blaze under control by the late afternoon, but not before it burned more than 700 acres, according to authorities.

Schaefer is also a suspect in several other arsons around Lee County, but he has not been charged in any other fires at this time.

Illinois State Police are assisting with the investigation, and no further information was immediately available.

Illinois

Who is running for Illinois governor in 2026? What to know as primary Early Voting sites open

With Election Day for the 2026 Primary quickly approaching, many voters are considering who to mark their support for when they cast their ballot.

There are several big races on the ballot, including the gubernatorial race that has the potential to make history.

Though rumors are swirling that sitting Governor J.B. Pritzker has his eyes on a potential run for president in 2028, he’s still in the running for re-election. If he retains his seat, he’ll be the first Democratic governor to secure a third term in office in Illinois history.

While Pritzker is the only Democrat aiming for governor on the ballot, there is a slew of Republican candidates vying for a face-off with the incumbent in November.

Voters with their mind made up on which candidate they support can head to their local early voting site to cast their ballot before Election Day.

Though downtown sites and some across the suburbs have been open since early February, early voting sites will open in all 50 of Chicago’s and in several suburb on Monday, March 2.

For those still deciding how to mark their ballot, here’s a look at the gubernatorial candidates.

Democrats:

Governor J.B. Pritzker and Christian Mitchell

Current Governor of Illinois J.B. Pritzker is taking aim at a third term, promising to continue building on the work of his first two terms. According to his campaign website, some of his intentions for a third term include “[tackling] the affordability crisis,” continuing to protect access to reproductive health care in Illinois, and investing in education.

Chrisitan Mitchell is running alongside Pritzker for lieutenant governor. After representing the 26th District in the Illinois House of Representatives from 2013 to 2019, Mitchell served as deputy governor to Pritzker from 2019 to 2023. Mitchell led efforts to ban assault weapons, make Illinois a leader in clean energy and create jobs through infrastructure projects as deputy governor, according to his campaign bio.

Republicans:

Ted Dabrowski and Dr. Carrie Mendoza

Ted Dabrowski is a Wilmette resident and former president of Wirepoints, a media outlet focused on conservative economic policies and financial data. From 2011 to 2017, Dabrowski worked as a spokesperson and Vice President of Policy at the Illinois Policy Institute, a right-leaning think tank.

Dabrowski, who has never previously held political office, aims to cut and cap property tax rates, veto any and all tax increases, and repeal both Illinois’ sanctuary laws and zero-emissions energy policy, according to his campaign website.

“We must return power to the people, remove barriers to prosperity, embrace educational freedom, push political power down to its lowest level and restore the rule of law,” his campaign website says.

Dr. Carrie Mendoza, a Chicago-native with more than 25 years of experience as a physician, is running to be Dabrowski’s lieutenant governor, according to her campaign biography. Like Dabrowski, Mendoza has never held political office. Her campaign biography says she is “driven by innovation and a passion for justice.”

James Mendrick and Dr. Robert Renteria

The first Republican candidate to enter the race, DuPage County Sheriff James Mendrick is campaigning on a push for public safety initiatives.

Sheriff since 2018, Mendrick has partnered with DuPage County Health Department to provide Medicated Assisted Treatment to inmates fighting opioid addiction and advocated for the use of a drug deactivation pouch system to protect people and the state’s waterways from dangerous medications, according to his campaign website.

“He is committed to ending soft-on-crime policies, defending parental rights, and delivering quality education to every child in the state,” his campaign website says.

Dr. Roberta Renteria veteran of the U.S. Army and is a prolific author and activist, according to his campaign biography.

“Dr. Renteria uses his personal story, business acumen and leadership skills to address bullying, gangs, violence, drugs, suicides and school dropout,” his campaign biography says. His books and curriculums are taught in 25 countries around the world, and he has given many Ted Talks.

Darren Bailey and Aaron Del Mar

Former state senator Darren Bailey, who unsuccessfully ran for governor of Illinois in 2022, is giving another go at assuming the political seat. A third-generation downstate farmer, Bailey’s campaign is focused on reducing government spending, cutting taxes, and cracking down on crime, according to his campaign website.

In addition to his farm work, Bailey founded a private Christian school with his wife Cindy.

He fought against spending, raising taxes and sanctuary state policies while in the Illinois House and later in the State Senate.

Aaron Del Mar is an entrepreneur who became the youngest-ever Councilman for the Village of Palatine at 29 years old in 2016. He oversees public safety and infrastructure and guides community organizations in the position, according to his campaign biography.

Rick Heidner and Christina Neitzke-Troike

Though businessman Rick Heidner has never held office, he has led several notable companies, including Gold Rush Gaming, Ricky Rocket’s Fuel Centers, Prairie State Energy, and Heidner Properties, according to his campaign website.

A lifelong Illinoisian, Heidner is “running to make Illinois safe again, affordable again, and full of opportunity again,” his website says.

Christina Neitzke-Troike is looking to step up into the lieutenant governor seat from her current role as Mayor of Homer Glen after nearly two decades in several elected positions.

Neitzke-Troike hopes to bring her “unparalleled understanding of how state mandates affect local budgets, property taxes, and public services” to Springfield, according to her campaign biography.

Illinois

As Trump launches Iran attack, here’s what Missouri and Illinois legislators are saying

Members of the Missouri and Illinois congressional delegations are split over President Donald Trump’s decision to attack Iran.

And some Democrats are criticizing Trump for launching the attack without conferring with Congress — and before lawmakers could vote on a war powers resolution that would have restricted the president from using force against Iran.

American and Israeli troops launched airstrikes around Iran on Saturday. In a statement posted on Truth Social, Trump cited Iran’s refusal to abandon its nuclear weapon and ballistic missile programs as rationale for the attack. The Republican chief executive added that “the lives of courageous American heroes may be lost and we may have casualties that often happens in war, but we’re doing this not for now.”

“We’re doing this for the future, and it is a noble mission,” Trump added.

Early reaction to Trump’s decision among Missouri and Illinois political figures broke down along party lines.

Jason Rosenbaum

/

St. Louis Public Radio.

Congresswoman Ann Wagner, R-Missouri, said in a statement that “for nearly fifty years, the Islamic Republic of Iran has proven itself to be utterly committed to violence, chaos, and instability.” Wagner, a member of the House Intelligence Committee, added that “the United States, along with the support from many of our allies around the world, will no longer allow this regime to wreak havoc at will.”

“As the President stated, Operation Epic Fury is a clear and necessary action to raze the Iranian ballistic missile industry to the ground, annihilate the Ayatollah’s navy, and ensure Iranian terrorism and nuclear threats can no longer destabilize the globe,” Wagner said. “The multiple statements of support from across the Western world illustrate the importance of this action.”

Wagner is alluding to how the leaders from a number of countries, including Canada, Australia and Ukraine, backed Trump’s decision to attack Iran.

U.S. Rep. Mark Alford, R-Missouri, said in a statement on X that he backed Trump’s “swift and bold action to finally hold the regime accountable.”

“The Iranian regime is the world’s leading state sponsor of terror, a destabilizing force across the region, and a threat to U.S. allies, interests, and bases in the Middle East,” Alford said. “Tehran is directly responsible for the deaths of countless Americans over the years.”

“As I’ve said for weeks, through either the easy way or the hard way, the Ayatollah needs to go,” Alford added.

Missouri Congressman Sam Graves said in a statement that Trump “took decisive action to protect our service members, our homeland, and our national security before that threat could grow.” And Congressman Mike Bost, R-Illinois, applauded President Trump acting decisively to protect America’s national security interests.

“God bless our military men and women in harm’s way; may the uncertain days ahead lead to a lasting peace for years to come,” Bost said.

U.S. Rep. Mary Miller, R-Illinois, said Trump has “taken decisive action to defend America’s interests and confront those who threaten our security.”

“As our elite Armed Forces carry out Operation Epic Fury in Iran, we lift up our brave service members and the allies standing beside them in prayer for their safety and success in the mission,” Miller said in a statement on X.

Eric Lee

/

St. Louis Public Radio

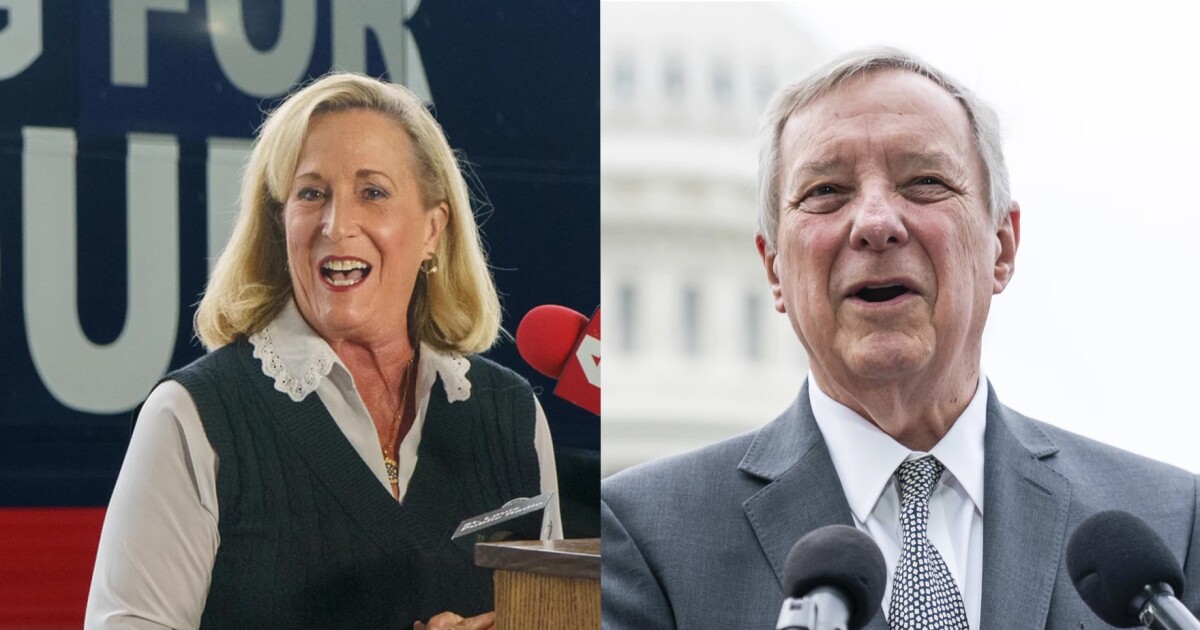

Durbin, Pritzker decry decision

Democrats representing Illinois and Missouri roundly condemned Trump’s decision to attack Iran, including Illinois Sens. Dick Durbin and Tammy Duckworth.

Duckworth said in her statement that “too many Americans believed him when he promised that he would get our nation out of foreign wars and bring prices down for families.” The Democratic lawmaker added Americans “can clearly see with their own eyes that he was lying”

“Instead, Donald Trump chose to put American lives and national security at risk while threatening to draw us into yet another expensive, taxpayer-funded forever war without Constitutionally-required authorization, a defined end-state or a real plan to prevent the instability that could come next,” Duckworth said. “He is making that choice while his chaotic policies here at home continue driving costs for middle-class Americans to record highs.”

While noting “there is bipartisan support for stopping the development of nuclear weapons in Iran, there is no consensus for another interminable war in the Middle East.”

Durbin, who is not seeking reelection this year, pointed out he was one of 23 senators to vote against authorizing military force in Iraq in 2002. Trump attacked Iran without receiving any authorization from Congress — and before lawmakers could vote on a war powers resolution aimed at restricting military force without permission from the country’s legislative branch.

“A war in Iran with the goal of regime change could be another long-term military commitment with deadly consequences for thousands of American troops,” Durbin said. “The rash and unpredictable conduct of President Trump is a well-established worry in many ways but an impulsive commander in chief is a deadly combination.”

Brian Munoz

/

St. Louis Public Radio

Democratic Reps. Wesley Bell and Nikki Budzinski both released statements criticizing Trump’s decision to strike Iran. Budzinski, an Illinois Democrat, said “the Constitution is clear: only Congress has the power to send our nation to war.”

“This is a grave responsibility — one we take with the utmost seriousness. But the same cannot be said for President Trump,” said Budzinski, who added she would support a War Powers resolution. “Once again, he has disregarded the principle of coequal branches of government. And now, the consequences could be profound and dangerous.”

Bell said in his statement that “no one should mistake opposition to this war for sympathy toward that government.” But the Missouri Democrat added “launching a regime change campaign without a clear strategy, a defined end goal, or honest preparation for the costs is dangerous and shortsighted”.

“Military force is the most serious power our country can exercise,” Bell said. “It requires clarity of purpose, clearly defined objectives, and a credible plan for what comes next. War is not something you enter lightly, and it is not something you get to redo if it goes wrong. The American people and their Representatives deserve to know that every diplomatic option was fully exhausted before we put our troops in harm’s way.”

Illinois Gov. JB Pritzker, a potential presidential candidate in 2028, also blasted Trump’s decision for having “no justification, no authorization from Congress, and no clear objective.”

“But none of that matters to Donald Trump — and apparently neither do the safety and lives of American service members,” Pritzker said in a statement on BlueSky. “Donald Trump is once again sidestepping the Constitution and once again failing to explain why he’s taking us into another war. Americans asked for affordable housing and health care, not another potentially endless conflict. God protect our troops.”

Schmitt and Hawley mum for now

As of Saturday morning, Missouri Sens. Eric Schmitt and Josh Hawley had not released statements about Trump’s decision to attack Iran.

Both Missouri Republican senators were critical of Democratic President Joe Biden’s push to provide Ukraine with weapons to repel Russia’s invasion.

But they’ve been largely supportive of Trump’s foreign policy moves, even as some elements of the president’s political coalition have been fiercely critical of his interventionist decisions in Venezuela and Iran.

When asked about potential military action last week in Springfield, Hawley called Iran “a huge threat to the region, to our ally Israel — but also to our interests.”

“Iran absolutely cannot be allowed to have a nuclear weapon and needs to be put in their box and kept in their box,” Hawley said. “And we need our allies in the region, particularly Israel, to be strong, to keep them deterred, and contained long term.”

This story has been updated with additional comment.

-

World4 days ago

World4 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts4 days ago

Massachusetts4 days agoMother and daughter injured in Taunton house explosion

-

Denver, CO4 days ago

Denver, CO4 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Louisiana7 days ago

Louisiana7 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Technology1 week ago

Technology1 week agoYouTube TV billing scam emails are hitting inboxes

-

Politics1 week ago

Politics1 week agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT

-

Technology1 week ago

Technology1 week agoStellantis is in a crisis of its own making

-

News1 week ago

News1 week agoWorld reacts as US top court limits Trump’s tariff powers