Health

$158,000 price tag for new ALS drug reignites anger at Big Pharma

A brand new ALS drug remedy is reawakening frustration with Huge Pharma after its drugmaker priced it at $158,000 yearly, resulting in exorbitant insurance coverage processes to entry it.

Relyvrio, a drug produced by Amylyx Pharmaceutical, has been discovered to gradual the progress of Amyotrophic Lateral Sclerosis, a illness that sometimes proves deadly inside 5 years. ALS sufferers undergo a gradual lack of management over their motion, shedding the flexibility to stroll and even discuss because the illness progresses.

Consequently, getting on a drug that slows development rapidly is significant to many sufferers, however the excessive price ticket set by Amylyx causes insurance coverage firms to lock the drug behind a prolonged software course of, and the drug is usually cost-prohibitive for sufferers even with protection, in accordance with the Related Press.

“When somebody’s lifespan is measured in months, making folks undergo these a number of rounds of evaluation is simply merciless,” stated Neil Thakur, the chief mission officer on the ALS Affiliation.

DEMOCRATS’ PLANS FOR DRUG PRICE CONTROLS WILL HURT, NOT HELP AMERICANS BY SQUELCHING INNOVATION AND CURES

A Physician talks with a affected person throughout a check-up.

(iStock)

Amylyx developed Relyvrio–its first ever product–by combining a liver remedy drug with a complement utilized in conventional Chinese language medication, two substances which might be comparatively cheap.

Nonetheless, pharmaceutical firms argue the sky-high worth of medicine comes because of the prolonged approval course of imposed by the FDA. Amylyx expects to make a revenue of $450 million from Relyvrio, in accordance with the AP.

BIDEN SLAMS ‘MAGA POLICIES,’ PROPOSALS TO SUNSET MEDICARE, TOUTS EFFORTS TO LOWER PRESCRIPTION DRUG COSTS

Huge pharma stays one of many least widespread industries within the U.S., with firms routinely releasing medication at exorbitant costs.

President Biden’s administration has sought to unilaterally decrease drug prices by authorities regulation, however Republicans on Capitol Hill have argued such a transfer would stifle the trade.

President Joe Biden holds a press convention.

(Fox Information )

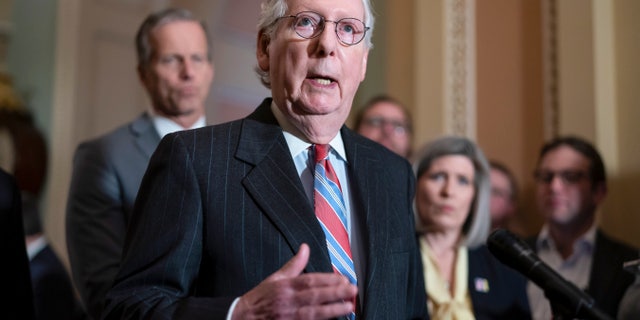

Senate Minority Chief Mitch McConnell, R-Ky., speaks to reporters after a Republican technique assembly on the Capitol in Washington, Tuesday, March 8, 2022.

((AP Picture/J. Scott Applewhite))

“The American folks know that authorities can’t magically make issues value much less by passing legal guidelines saying issues ought to value much less,” Senate Minority Chief Mitch McConnell when discussing laws in July. “The bill will probably be delivered to the American people who find themselves dwelling with precise well being challenges.”

“The value of larger authorities will probably be fewer lifesaving cures, much less innovation sooner or later,” he added.

The Related Press contributed to this report.

Health

FDA Moves Forward With Last-Minute Push to Cut Nicotine Levels in Cigarettes

The Biden administration unveiled a proposal on Wednesday to cut the level of nicotine in cigarettes, a last-minute push on a plan that could meaningfully cut cancer rates nationwide and extend the lives of millions of cigarette smokers.

If finalized, the proposal would require cigarette makers to significantly reduce the levels of nicotine in their products in an effort to make smoking less addictive and less satisfying. Research has suggested that the move would result in fewer people taking up the habit and would help the nation’s roughly 30 million smokers quit or switch to less harmful alternatives like e-cigarettes.

The policy is a centerpiece of antismoking initiatives by Dr. Robert Califf, commissioner of the Food and Drug Administration, who has recounted treating cardiology patients ravaged by smoking during his medical career.

“It’s the biggest thing I’ve ever seen in terms of societal benefit, cost saving and lives saved, and strokes prevented and cancers prevented,” Dr. Califf said.

The policy’s companion effort to ban menthol cigarettes has been set aside indefinitely after vehement opposition from cigarette makers and other opponents, including convenience store retailers.

Whether the nicotine reduction plan would survive the incoming administration of President-elect Donald J. Trump is unclear. Mr. Trump has traditionally been industry friendly and opposed to heavily regulating businesses. In addition, he has had the support of tobacco companies, including Reynolds American, which contributed at least $8 million to Mr. Trump’s main super PAC during the presidential campaign. Reynolds has already expressed its opposition to the proposed requirement.

Mr. Trump’s campaign co-chair and incoming chief of staff, Susie Wiles, is a former lobbyist for Swisher, a company that makes cigars. The rule applies to cigarettes, roll-your-own tobacco, pipe tobacco and cigars (though not premium cigars).

Some public health advocates are holding out hope that the Trump administration will allow the proposal to move forward, given that a previous version was considered by the F.D.A. during his first term. At minimum, officials could continue to allow the public to comment on the initiative without killing it or putting it into effect.

The F.D.A.’s proposal includes projections that by 2100, the nicotine reduction measure would prevent an estimated 48 million young people from starting to smoke. By 2060, the agency also estimates that 1.8 million tobacco-related deaths would be prevented, and that $30 trillion in benefits would accrue over 40 years, mostly from the generation that would not begin smoking.

“We do have an extremely toxic and addictive product with cigarettes that remain on the marketplace, that still kills almost a half a million people a year,” said Dorothy Hatsukami, a tobacco researcher from the University of Minnesota who has studied low-nicotine cigarettes for about 15 years. “So it’s really kind of an unfortunate situation that we haven’t really done anything dramatically about it.”

In 2022, Dr. Califf released an updated proposal to lower nicotine levels, and opposition began to grow almost immediately.

Tobacco companies have viewed the initiative as a major threat to their business. Luis Pinto, a spokesman for Reynolds American, said the proposal would “effectively eliminate legal cigarettes and fuel an already massive illicit nicotine market.”

“These actions would also have a significant negative economic impact on farmers, retailers and others,” he added.

Convenience store retailers have also opposed earlier versions of the proposal, saying they would sustain substantial losses in revenue from a projected decline in cigarette sales.

Congressional Republicans have also tried to thwart restrictions on nicotine levels. In 2023, members of an influential House subcommittee passed a measure that would have prevented the F.D.A. from spending any money to advance limits on nicotine, with nearly all of the supporting votes by Republicans. The Senate did not include the provision in a final budget package.

Still, supporters of the plan point to signs that incoming public health officials may be receptive to it, including to the popularity of Robert F. Kennedy Jr.’s pledge to tackle chronic diseases and improve the health of Americans if he is confirmed to lead the nation’s top health agency. Mr. Trump himself has said that he is personally opposed to cigarette smoking.

“Given these enormous benefits, we urge the incoming Trump administration to move forward in finalizing and implementing this rule,” Yolonda C. Richardson, the president of Campaign for Tobacco-Free Kids, said in a statement. “Few actions would do more to fight chronic diseases such as cancer and cardiovascular disease that greatly undermine health in the United States, and that the incoming administration has indicated should be a priority to address.”

Health

Wildfire health impacts, plus FDA bans red food dye

Fox News’ Health newsletter brings you stories on the latest developments in health care, wellness, diseases, mental health and more.

TOP 3:

– Los Angeles wildfires spark loss and grief, affecting mental health

– Experts warn of physical effects of wildfire smoke

– FDA bans red food dye due to cancer risk: ‘Long time coming’

A woman reacts as she evacuates following powerful winds fueling devastating wildfires in the Los Angeles area on Jan. 8, 2025. (David Swanson/Reuters)

MORE IN HEALTH

FAMILY SUPPORT – Experts share the signs that your loved one may be ready for assisted living. Continue reading…

NO SUGARCOATING – A new study reveals the one big factor driving the spike in diabetes cases. Continue reading…

HEALTH HELPERS – Crush your New Year’s wellness goals with the help of these picks. Continue reading…

FOLLOW FOX NEWS ON SOCIAL MEDIA

YouTube

SIGN UP FOR OUR NEWSLETTERS

Fox News First

Fox News Opinion

Fox News Lifestyle

Fox News Health

Fox News Autos

Fox News Entertainment (FOX411)

DOWNLOAD OUR APPS

Fox News

Fox Business

Fox Weather

Fox Sports

Tubi

WATCH FOX NEWS ONLINE

Fox News Go

STREAM FOX NATION

Fox Nation

Health

Ramaswamy Has a High-Profile Perch and a Raft of Potential Conflicts

Vivek Ramaswamy is the less famous and less wealthy half of the duo of billionaires that President-elect Donald J. Trump has designated to slash government costs.

His better-known co-leader, Elon Musk, stands to benefit from the job in ways that are numerous and glaring. Mr. Musk’s companies have tremendous influence, billions of dollars in government contracts and ongoing battles with federal regulators.

Less attention has been paid to the potential conflicts that could stem from Mr. Ramaswamy’s complex web of financial interests, which span biotechnology, finance and other holdings.

At 39, he is one of the world’s youngest billionaires, having made his fortune in the pharmaceutical industry. As he reaches into the federal bureaucracy that shapes the fortunes of American companies, he could recommend spending cuts that ultimately make him and his investors richer.

Mr. Ramaswamy, who owns a stake currently valued at nearly $600 million in a biotechnology company he started, has called for changes at the Food and Drug Administration that would speed up drug approvals. He could help shape energy policy to promote fossil fuels, making it more attractive for investors to put their money into an oil-and-gas fund, provocatively called DRLL, offered by his investment firm.

And if he were to boost officials who embrace cryptocurrency, it may benefit his firm’s new Bitcoin business.

It is not yet known whether leaders of the so-called Department of Government Efficiency, or DOGE, which is not a governmental department but more of an outside advisory organization, will have to meet the same standard divestment requirements that many high-level federal appointees face.

Mr. Ramaswamy waded into controversy late last month when he blamed American culture for failing to produce enough workers suited for technical jobs. He also endorsed continuing to allow certain skilled immigrants into the U.S. labor market, a position shared by Mr. Musk and Mr. Trump but opposed by immigration hard-liners. The episode raised questions as to how long Mr. Ramaswamy will remain with the DOGE effort.

Mr. Ramaswamy, who two years ago stepped away from running his businesses, declined to say whether he plans to divest from any of his holdings.

With a stake valued at $150 million or more, he is the majority owner of his investment fund, Strive Enterprises, which he branded as a nemesis of liberal politics, and which is suddenly in line with the philosophies now ascendant in Washington. Several of Strive’s financial backers have close ties to the incoming Trump administration.

Investment funds like Strive generate revenue as a percentage of the money they manage. Luring new investors quickly raises the revenues of the firm. Mr. Ramaswamy’s elevated profile advising the Trump administration could help the firm bring in new clients.

Mr. Ramaswamy declined to be interviewed for this article. Strive’s current leadership, Mr. Musk and the Trump transition team also declined to comment.

Anson Frericks, a high school friend of Mr. Ramaswamy’s who co-founded Strive with him and is now a senior adviser at the firm, dismissed concerns about potential conflicts of interest for a firm offering investments in industries under federal regulation.

“We will always have to have a strict separation of church and state and comply with all the rules and regulations,” Mr. Frericks said.

Since being named to jointly lead DOGE, Mr. Ramaswamy had until recently been posting on Mr. Musk’s social media site X, hinting about where he may look to make changes in the government.

He called for slashing regulation, not just cutting government spending. He pointed to federal workers focused on diversity as potential targets for “mass firings.”

And he has been taking aim at the F.D.A. “My #1 issue with FDA is that it erects unnecessary barriers to innovation,” he wrote on X. He criticized the agency’s general requirement that drugmakers conduct two successful major studies to win approval rather than one.

Mr. Ramaswamy founded his biotechnology company, Roivant Sciences, in 2014, betting that he could find hidden gems whose potential had been overlooked by large drugmakers. The idea was to hunt for experimental medications languishing within large pharmaceutical companies, buy them for cheap and spin out a web of subsidiaries to bring them to market.

The venture is best known for a spectacular failure.

In 2015, Mr. Ramaswamy whipped up hype and investment around one of his finds, a potential treatment for Alzheimer’s disease being developed by one of his subsidiaries, Axovant. Two years later, a clinical trial showed that it did not work, erasing more than $1.3 billion in Axovant’s stock value in a single day.

Mr. Ramaswamy personally lost money on paper on the failure, but thanks to the savvy way he had structured his web of companies he and Roivant weathered the storm. Six products have won F.D.A. approval, and today Roivant has a market valuation of $8 billion.

Mr. Ramaswamy sold some of his Roivant stock to take a large payout in 2020, reporting nearly $175 million in capital gains on his tax return that year. But he is still one of the company’s largest shareholders.

If Mr. Ramaswamy recommends changes that speed up drug approvals through DOGE, that could be good news for Roivant, which is developing drugs that might come up for approval during Mr. Trump’s second term. The faster it can get medicines onto the market, the more valuable the company — and Mr. Ramaswamy’s stake in it — stands to become.

Fighting ‘woke’

In 2020, Mr. Ramaswamy started writing opinion pieces attacking the environmental, social and governance, or E.S.G., movement.

He found a perfect foil in the world’s biggest asset manager, BlackRock, and its chief executive, Laurence D. Fink. At the time, Mr. Fink was vocal about pushing companies to rethink their carbon footprints. Mr. Ramaswamy viewed that position as a breach of BlackRock’s duty to try to maximize returns for investors.

Mr. Ramaswamy was taking on a niche subject that was being debated in obscure journals and business school classrooms but one that was hardly front of mind for most investors.

In July 2020, Mr. Ramaswamy asked D.A. Wallach, a health care investor, to read a proposal for what would become his first book, “Woke, Inc.” Mr. Wallach said he was initially skeptical.

“Do average people really care about Larry Fink putting carbon emissions requests on the board of Exxon?” Mr. Wallach recalled wondering at the time. But Mr. Wallach later became a seed investor in Strive, persuaded by Mr. Ramaswamy over dinner at the upscale Polo Lounge at the Beverly Hills Hotel in Southern California.

In 2021, Mr. Ramaswamy stepped down as chief executive of Roivant. He fished around for a new business idea.

A classmate of Mr. Ramaswamy’s from an all-boys Catholic high school in Cincinnati, Mr. Frericks, had worked as an executive at Anheuser-Busch and shared Mr. Ramaswamy’s views about the E.S.G. movement.

Mr. Frericks said they knocked several ideas around: “Merit Airlines,” which would hire the top 5 percent of pilots, regardless of race, sex or background; “Pop Without Politics,” an alternative to Coca-Cola; and a “free-speech” version of Twitter, before Mr. Musk ran with the idea and bought the social media platform.

They ultimately landed on a different idea. They would start an investment firm near Columbus, Ohio, that would court an audience they believed had been neglected by Wall Street: everyday investors and public pension fund managers who were alienated by companies adopting liberal policies pushed by money managers like Mr. Fink.

Mr. Ramaswamy recruited financial backers who now have deep ties to the incoming Trump administration. Among them were Howard Lutnick, whom Mr. Trump has picked to be commerce secretary; the former investment firm of Vice President-elect JD Vance; and other large Republican donors and influential voices, including Doug Deason and the billionaire fund manager Bill Ackman.

Releasing the handcuffs

Strive’s first offering, in August 2022, was the energy fund DRLL.

In television appearances, Mr. Ramaswamy drummed up demand for the fund. He pitched viewers on an opportunity to be part of a renaissance in the American energy sector, which he said had been constrained for too long by “E.S.G. handcuffs.”

The reality was more complicated. Energy stock price growth has been sluggish for reasons that have nothing to do with diversity quotas and emissions caps. For years, U.S. producers spent big in pursuit of growth, costing investors billions and causing many to sour on the industry. Lower oil prices have further reduced the incentive to drill.

And what Mr. Ramaswamy was pitching was more commonplace than he made it sound.

DRLL was a basket of stocks known as an exchange-traded fund, or an E.T.F., an unglamorous investment vehicle that has grown popular among investors looking for less risk than betting on individual stocks. Mr. Ramaswamy’s E.T.F. was nearly identical to popular offerings from BlackRock and other providers, containing a standard mix of stocks like Exxon, Chevron and dozens of other oil and gas companies.

What Strive promised investors in DRLL was essentially a sustained pressure campaign. Strive would meet with chief executives, carefully vote on board seats and shareholder proposals and publicize its efforts, all with the aim of pushing energy companies to shun liberal policies.

“We wanted a seat at the table, to be able to vote on shareholder resolutions, to engage with management, write letters on our views,” Mr. Frericks said.

Mr. Ramaswamy sent an angry letter to Chevron, criticizing the company for how it responded to pressure from climate activists to cap emissions produced by its suppliers and consumers. (Chevron set goals related to how clean those emissions should be, but it didn’t limit them overall.)

In November 2022, Mr. Ramaswamy flew to Houston for a meeting with the Exxon chief executive, Darren Woods. When the oil giant subsequently appointed two Strive-approved board members, Strive declared victory.

As a presidential candidate in mid-2023, Mr. Ramaswamy reported that he had between $5 million and $25 million of his own money invested in DRLL.

From C.E.O. to candidate

Strive employees watched with intrigue, and sometimes tagged along, as Mr. Ramaswamy met with governors, other state officials and wealthy contacts. Often, it wasn’t clear whether the motivation was to seek an investment or perhaps to make connections that could fuel Mr. Ramaswamy’s bigger ambitions.

He set a busy pace, using private jets to crisscross the United States and traveling with a body guard. He hated staying in hotel rooms, so if he traveled he would nearly always fly home to sleep.

He met with heads of public pension funds in Republican-led states, urging them to move their money to Strive from providers like BlackRock.

But Strive’s pitch struggled to land with that audience. According to S&P Global’s Capital IQ database, only one public pension fund, in Texas, appears to have put money in a Strive E.T.F., and it quickly withdrew its position. One official at a public pension fund in a Republican-led state who met with a Strive representative said it was confusing how Strive was different from the competition, or how its mission would generate the best returns.

Employees at Strive were often surprised by the relative extravagance of Strive’s spending.

Before the firm was generating much revenue, many employees were issued a company credit card and had the impression that they could spend freely. The firm built out a new office, with room for some 100 employees, despite having a staff of about 35.

Mr. Ramaswamy was a regular presence in Strive’s office, often dressed in shorts and flip flops.

In December 2022, the firm held a holiday party in downtown Columbus at The Vault, a former bank repurposed as a lavish event space. In front of his delighted colleagues that evening, Mr. Ramaswamy performed a karaoke rendition of Eminem’s “Lose Yourself.”

Employees were given a pointed holiday gift: a copy of a book, “Fossil Future” by Alex Epstein, arguing for more oil, coal and natural gas consumption.

Two months later, Mr. Ramaswamy announced that he was running for president. He stepped down as chairman and chief executive of Strive. That summer, as a candidate on the campaign trail, he reprised his performance of “Lose Yourself” onstage at the Iowa State Fair.

A crypto arm

As Mr. Ramaswamy’s political profile has risen, the ideas he railed against have receded on Wall Street and in American life.

In 2023, Mr. Fink of BlackRock said that he would no longer use the term E.S.G. Last week, BlackRock pulled out of an international climate coalition supporting the goal of net zero greenhouse gas emissions by 2050, while Meta and Amazon ended internal diversity programs.

Mr. Ramaswamy has taken credit for the change of heart. “Strive’s success, I think, was probably the single greatest factor in the United States of America that turned E.S.G. from the dogma,” he said.

Today, Strive manages over $2 billion in assets, a strong start for a new player in the market, but a drop in the bucket compared with the largest money managers. BlackRock, by comparison, manages $11.6 trillion in assets.

“Strive did better than we thought it would,” said Eric Balchunas, a Bloomberg analyst who tracks E.T.F.s.

But the growth of Strive, which in some cases charges higher fees than its competitors for its E.T.F.s, has been constrained by a mundane reality: Many E.T.F. investors are just looking for low fees and the ability to swiftly and easily make transactions. Politics isn’t a factor.

“Most of them don’t care,” Mr. Balchunas said. “People just want cheap access to stocks.”

After years in the unglamorous world of traditional E.T.F.s, Strive has been expanding into a more buzzy world of finance after raising $30 million in new funding from a group of backers including Cantor Fitzgerald, the financial services firm led by Mr. Lutnick.

Late last year, Strive poached the leadership team of a firm in Dallas that managed money for wealthy families and individuals, providing Strive a new arm, and a new headquarters, in Texas.

The move got Strive into cryptocurrency, which helped finance Mr. Trump’s campaign but has faced regulatory headwinds in Washington. The firm’s website now points to its “focus as a transformative Bitcoin-company.”

It also opened up a new potential area for conflict in Mr. Ramaswamy’s role at DOGE: the potential power to alter the approach of agencies that regulate the financial sector.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology7 days ago

Technology7 days agoMeta is highlighting a splintering global approach to online speech

-

Science5 days ago

Science5 days agoMetro will offer free rides in L.A. through Sunday due to fires

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png) Technology1 week ago

Technology1 week agoLas Vegas police release ChatGPT logs from the suspect in the Cybertruck explosion

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘How to Make Millions Before Grandma Dies’ Review: Thai Oscar Entry Is a Disarmingly Sentimental Tear-Jerker

-

Health1 week ago

Health1 week agoMichael J. Fox honored with Presidential Medal of Freedom for Parkinson’s research efforts

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: Millennials try to buy-in or opt-out of the “American Meltdown”

-

News1 week ago

News1 week agoPhotos: Pacific Palisades Wildfire Engulfs Homes in an L.A. Neighborhood

-

World1 week ago

World1 week agoTrial Starts for Nicolas Sarkozy in Libya Election Case