Finance

Securrency Opens “Liquidity Lounge” in Davos: Cutting Edge Discussions on the Evolution of Capital Markets & the Future of Finance

Securrency is joined by Abu Dhabi International Market, Halo Investing, State Road, Stellar Growth Basis, and different companions, for a week-long program of devoted talks and engagements centered on the motion in direction of a worldwide liquidity community.

WASHINGTON, Could 13, 2022 /PRNewswire/ — Securrency, a number one developer of institutional-grade blockchain-based monetary and regulatory know-how, opens the “Liquidity Lounge” on the sidelines of the World Financial Discussion board in Davos going down Could 22-26.

Positioned within the coronary heart of Davos, the Liquidity Lounge serves because the hub for centered discussions overlaying the evolution of worldwide capital markets and the ramifications for present and future market members. From the usage of distributed ledger know-how (DLT) to reinforce present market infrastructures to new laws to progressive merchandise, providers, and practices that take away friction in international monetary markets to opening up new alternatives for the financially underserved and excluded, the Liquidity Lounge presents members and attendees the chance to achieve a first-hand view of the place the way forward for finance is headed.

Securrency and its world-class companions invite all World Financial Discussion board attendees to affix them within the Liquidity Lounge at ESCHER Raumdesign, Promenade 115, 7270 Davos Platz, Switzerland. A seminal occasion, bringing collectively international leaders in digital asset finance, compliance and regulation, the Liquidity Lounge is co-hosted by a number of distinguished stakeholders together with, Abu Dhabi International Market, Halo Investing, State Road, and the Stellar Growth Basis, and presents a full program on the innovative of worldwide digital finance.

“Securrency’s presence on the bottom at Davos additional demonstrates our ongoing dedication to help the accountable evolution of worldwide monetary markets,” stated, Dan Doney, Chief Govt Officer of Securrency. “We’re on the forefront of the outstanding convergence of legacy monetary techniques with progressive new applied sciences which might be able to bettering international capital markets for all who use them. The facility of blockchain know-how, harnessed by accountable innovators, is driving this transformation in a means that appropriately balances the necessity for monetary privateness with superior institutional and regulatory oversight capabilities. The outcome will likely be unprecedented international liquidity and a sea-change from how fashionable markets work and the way we work together with them.”

John Hensel, Chief Working Officer of Securrency, stated, “We’re excited to be curating this dialogue on the way forward for finance. We’re additionally proud to convey collectively a few of our closest companions, equivalent to Stellar Growth Basis, Halo Investing, State Road, and Abu Dhabi International Market, to share their professional insights, alongside different key figures concerned within the evolution of our markets. We’re assured that this spectacular group of thought leaders will drive the dialogue and trade ahead.”

Starting with a welcoming reception on Sunday, Could 22, the Liquidity Lounge will supply a wide-ranging and spirited dialogue on the way forward for finance within the ambiance of the World Financial Discussion board. The day by day program themes embody:

- Monday, Could 23: Institutionalization of Digital Belongings

- Tuesday, Could 24: Alternatives for Regulatory Innovation

- Wednesday, Could 25: Designing Capital Markets for the twenty first Century

- Thursday, Could 26: Convergence of Worth: From Siloed Networks to Interoperable Markets

Additional particulars on the agenda may be discovered on the following hyperlink: https://wef.securrency.com/

About Securrency, Inc.

Securrency is a blockchain-based monetary markets infrastructure firm centered on constructing a monetary ecosystem to optimize monetary logistics to reinforce capital formation and stimulate international liquidity. Securrency is driving change on the core of monetary providers by way of a fully-interoperable distributed id and compliance framework with state-of-the-art infrastructure designed to bridge legacy monetary platforms to next-generation blockchain networks. Probably the most superior regulatory know-how suppliers within the trade, Securrency has developed built-in, scalable, and common compliance instruments that automate enforcement of multi-jurisdictional regulatory coverage.

Media Contacts

Anna Ryan

Wachsman

E: [email protected]

SOURCE Securrency

Finance

Lument Finance Trust Reports First Quarter 2024 Results

NEW YORK, May 9, 2024 /PRNewswire/ — Lument Finance Trust, Inc. (NYSE: LFT) (“we”, “LFT” or “the Company”) today reported its first quarter results. Distributable earnings for the first quarter were $7.6 million, or $0.15 per share of common stock. GAAP net income attributable to common shareholders for the first quarter was $5.8 million, or $0.11 per share of common stock. The Company has also issued a detailed presentation of its results, which can be viewed at www.lumentfinancetrust.com.

Conference Call and Webcast Information

The Company will also host a conference call on Friday, May 10, 2024, at 8:30 a.m. ET to provide a business update and discuss the financial results for the first quarter of 2024. The conference call may be accessed by dialing 1-800-836-8184 (U.S.) or 1-646-357-8785 (international). Note: there is no passcode; please ask the operator to be joined into the Lument Finance Trust call. A live webcast, on a listen-only basis, is also available and can be accessed through the URL:

https://app.webinar.net/Mdk5ymjEwRV

For those unable to listen to the live broadcast, a recorded replay will be available for on-demand viewing approximately one hour after the end of the event through the Company’s website https://lumentfinancetrust.com/ and by telephone dial-in. The replay call-in number is 1-888-660-6345 (U.S.) or 1-646-517-4150 (international) with passcode 31313.

Non-GAAP Financial Measures

In this release, the Company presents certain financial measures that are not calculated according to generally accepted accounting principles in the United States (“GAAP”). Specifically, the Company is presenting distributable earnings, which constitutes a non-GAAP financial measure within the meaning of Item 10(e) of Regulation S-K and is net income under GAAP. While we believe the non-GAAP information included in this press release provides supplemental information to assist investors in analyzing our results, and to assist investors in comparing our results with other peer issuers, these measures are not in accordance with GAAP, and they should not be considered a substitute for, or superior to, our financial information calculated in accordance with GAAP. The methods of calculating non-GAAP financial measures may differ substantially from similarly titled measures used by other companies. Our GAAP financial results and the reconciliations from these results should be carefully evaluated.

Distributable Earnings

Distributable Earnings is a non-GAAP measure, which we define as GAAP net income (loss) attributable to holders of common stock computed in accordance with GAAP, including realized losses not otherwise included in GAAP net income (loss) and excluding (i) non-cash equity compensation, (ii) depreciation and amortization, (iii) any unrealized gains or losses or other similar non-cash items that are included in net income for that applicable reporting period, regardless of whether such items are included in other comprehensive income (loss) or net income (loss), and (iv) one-time events pursuant to changes in GAAP and certain material non-cash income or expense items after discussions with the Company’s board of directors and approved by a majority of the Company’s independent directors. Distributable Earnings mirrors how we calculate Core Earnings pursuant to the terms of our management agreement between our manager Lument Investment Management, LLC (“Manager”) and us, or our management agreement, for purposes of calculating the incentive fee payable to our Manager.

While Distributable Earnings excludes the impact of any unrealized provisions for credit losses, any loan losses are charged off and realized through Distributable Earnings when deemed non-recoverable. Non-recoverability is determined (i) upon the resolution of a loan (i.e. when the loan is repaid, fully or partially, or in the case of foreclosures, when the underlying asset is sold), or (ii) with respect to any amount due under any loan, when such amount is determined to be non-collectible.

We believe that Distributable Earnings provides meaningful information to consider in addition to our net income (loss) and cash flows from operating activities determined in accordance with GAAP. We believe Distributable Earnings is a useful financial metric for existing and potential future holders of our common stock as historically, over time, Distributable Earnings has been a strong indicator of our dividends per share of common stock. As a REIT, we generally must distribute annually at least 90% of our taxable income, subject to certain adjustments, and therefore we believe our dividends are one of the principal reasons stockholders may invest in our common stock. Furthermore, Distributable Earnings help us to evaluate our performance excluding the effects of certain transactions and GAAP adjustments that we believe are not necessarily indicative of our current loan portfolio and operations and is a performance metric we consider when declaring our dividends.

Distributable Earnings does not represent net income (loss) or cash generated from operating activities and should not be considered as an alternative to GAAP net income (loss), or an indication of GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs.

GAAP to Distributable Earnings Reconciliation

|

Three Months Ended |

||

|

March 31, 2024 |

||

|

Reconciliation of GAAP to non-GAAP Information |

||

|

Net Income attributable to common shareholders |

$ 5,795,183 |

|

|

Adjustments for non-Distributable Earnings |

||

|

Unrealized loss (gain) on mortgage servicing rights Unrealized provision for credit losses |

(4,627) 1,776,873 |

|

|

Subtotal |

1,772,246 |

|

|

Other Adjustments |

||

|

Adjustment for income taxes |

10,892 |

|

|

Subtotal |

10,892 |

|

|

Distributable Earnings |

$ 7,578,321 |

|

|

Weighted average shares outstanding – Basic and Diluted |

52,249,299 |

|

|

Distributable Earnings per weighted share outstanding – Basic and Diluted |

$ 0.15 |

About LFT

LFT is a Maryland corporation focused on investing in, financing and managing a portfolio of commercial real estate debt investments. The Company primarily invests in transitional floating rate commercial mortgage loans with an emphasis on middle-market multi-family assets.

LFT is externally managed and advised by Lument Investment Management LLC, a Delaware limited liability company.

Additional Information and Where to Find It

Investors, security holders and other interested persons may find additional information regarding the Company at the SEC’s Internet site at http://www.sec.gov/ or the Company website www.lumentfinancetrust.com or by directing requests to: Lument Finance Trust, 230 Park Avenue, 20th Floor, New York, NY 10169, Attention: Investor Relations.

Forward-Looking Statements

Certain statements included in this press release constitute forward-looking statements intended to qualify for the safe harbor contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act, as amended. Forward-looking statements are subject to risks and uncertainties. You can identify forward-looking statements by use of words such as “believe,” “expect,” “anticipate,” “project,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,” “will,” “seek,” “would,” “could,” or similar expressions or other comparable terms, or by discussions of strategy, plans or intentions. Forward-looking statements are based on the Company’s beliefs, assumptions and expectations of its future performance, taking into account all information currently available to the Company on the date of this press release or the date on which such statements are first made. Actual results may differ from expectations, estimates and projections. You are cautioned not to place undue reliance on forward-looking statements in this press release and should consider carefully the factors described in Part I, Item IA “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which is available on the SEC’s website at www.sec.gov, and in other current or periodic filings with the SEC, when evaluating these forward-looking statements. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company’s control. Except as required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SOURCE Lument Finance Trust, Inc.

Finance

Spring Finance Forum 2024: CRE Financiers Eye Signs of Recovery

The weather in Manhattan was sunny with temperatures in the 70s on May 7 during Commercial Observer’s eighth annual Spring Finance CRE Forum, which attendees no doubt hope signals brighter days ahead for a commercial real estate market that has battled icy conditions the last two years.

The annual CO event was held six days after the Federal Reserve held interest rates steady with no indication of when borrowing conditions may begin to ease after 12 hikes were implemented by the central bank from March 2022 to July 2023. However, lenders and brokers who spoke at the forum inside the Metropolitan Club of New York voiced plenty of optimism that a recovery for the CRE market was around the corner.

“You’re starting to see the early signs of recovery within the real estate capital markets,” said Tim Johnson, global head of real estate debt strategies at Blackstone (BX) during opening remarks discussion moderated by Cathy Cunningham, CO’s executive editor. “It feels to me and to us at Blackstone that we’re generally on a path toward recovery.”

While the Fed is expected to keep interest rates higher for longer than what was initially anticipated entering 2024, Johnson stressed that market confidence of rates peaking has helped spur more financing activity this year, as evident by credit spreads tightening with commercial mortgage-backed securities (CMBS) deals. He added that a prolonged period of owners holding onto assets will likely result in more transaction volume as investors seek some for opportunities for “capital recycling”

Among asset classes, Blackstone is sticking to its high conviction themes of industrial and multifamily lending with a particular focus of late on data centers given technological demands like artificial intelligence driving the sector, according to Johnson. He noted though that, even with healthy performing sectors, Blackstone is careful to “pick and choose” which properties to target based on geographic areas with strong population drivers.

The office sector remains severely challenged four years after the COVID-19 pandemic unleashed increasing remote-work trends, but Johnson said there are pockets of opportunities on the lending side in certain submarkets like Manhattan’s Park Avenue, where occupancy levels are strong for newer Class A properties.

“I think you could see us dip our toes a bit more into lending on high-quality office buildings in geographies where fundamentals are pretty strong given a lack of supply in some of these core markets,” Johnson said. “There is clearly a subset of tenants out there that feel like they need to be in the office and are gravitating toward some of these high-performing submarkets.”

While some modern office buildings are managing to thrive despite continued headwinds from COVID, there remains a myriad of challenges for the overall market with older Class B properties resulting in wider bid-ask spreads.

Indeed, the uncertainty around valuations in office and other property types is one of the biggest differences between the current market location and what transpired with the CRE industry during the Global Financial Crisis, according to Rob Verrone, principal at Iron Hound Management, which specializes in CMBS restructurings.

“Back then there wasn’t as much of a gray area on what the property is worth,” said Verrone during a fireside chat moderated by Tony Fineman, head of originations at Acore Capital. “Now with remote work and with taxes and insurance through the roof, and then the politics that are going on and no-eviction [rules], no one knows what the property is worth and it’s hard to convince someone unless they have a real upside-down tax position to throw a bunch of money in on black and restructure a deal.”

Verrone, who was previously a CMBS lender at Wachovia before co-founding Iron Hound with Chris Herron in 2009, said workouts have become harder to get done in the current market due to bid-ask spread dynamics, with the process now taking around nine months for the average deal. He said he prefers to close modifications with a private individual or family office than the larger firms that have third-party investors that can often complicate ironing out key details.

There has been some progress of late in steering the CRE market toward a better future, but not enough to open the floodgates due to persistent elevated interest rates and a “steeper” forward curve, according to Dennis Schuh, chief originations officer at Starwood Capital Group.

“You are only selling if you are forced to sell right now,” said Schuh during the third session panel titled “Real Estate Finance Forecast: Comfort Levels Amidst New Changes.”

“I think people do think real estate is for sale right now and they want to get in, but there’s still a pretty big bid-ask,” Schuh added.

Lauren Hochfelder, co-CEO and head of Americas at Morgan Stanley Real Estate Investments, said while the majority of sellers now are “forced,” her platform has managed to sell some multifamily assets with interest rates between 4 and 5 percent. She also noted that some industrial properties along the southern border are also attracting investor interest due to nearshoring trends.

“Where you have secular trends or mega trends repelling demand, I think you are seeing capital really go there,” Hochfelder said. “But the aperture of what people want to invest in has narrowed.”

The panel — moderated by Jay Neveloff, partner and chair, real estate, at Kramer Levin Naftalis & Frankel — also featured Morris Betesh, senior managing director at Meridian Capital, and Sten Sandlund, CEO of Willowbrook Partners, a newly formed private credit lending arm launched by Peebles Corporation.

Hochfelder stressed the importance of not painting every asset class with a “broad brush,” noting there are bright spots in the office sector globally such as Tokyo, which has an 88 percent utilization rate, and Seoul at 94 percent. She said even struggling office markets in the U.S. have some positive characteristics, with San Francisco having higher rents today than before the COVID pandemic.

The panelists concurred that financing sources for deal flow in 2024 will largely be centered around private lenders given the highly regulated environment facing banks coupled with higher interest rates.

“After coming out of a crisis, usually the water has to be really warm for some of those traditional sort of lenders to creep back in, so I think they will be slow like they were coming out of the GFC,” Schuh said.

Insurance capital is undoubtedly playing an increased role filling the lending void of late with the line between debt funds and insurance companies becoming increasingly “blurred,” according to Nishant Nadella, head of single-asset, single-borrower and transitional lending at 3650 REIT. Nadella noted that Insurance funds managed by asset management firms have soared from $200 billion to $800 billion in the last six years, which does not even account for 3 percent of the global insurance market.

“If you look at where the market is going, it seems like it’s going to be insurance dominated and it’s going to be run by folks who get large insurance allocations or reinsurance allocations, and allocate 20 percent to real estate,” Nadella said during the forum’s fourth session in a panel titled “Shifting Lender-Borrower Dynamics & Getting Capital Stacks in Line”

Matt Pestronk, co-managing partner at Post Brothers, noted that insurance companies have an advantage now over banks in terms of driving more CRE capital in the current climate since they can sell five-year annuities that are attractive to investors amid higher interest rates. He said the trend is in the “early stages” and is “growing at an incredibly fast pace.”

The panel — moderated by Kathleen Mylod, partner at Dechert — also included Elliot Markus, vice president in the real estate private credit group at Cerberus Capital Management; Adam Schwartz, senior managing director at Walker & Dunlop; and Adam Piekarski, co-head of real estate credit at BDT & MSD Partners.

Piekarski stressed that with around $900 million in looming CRE loan maturities on tap this year, surviving for another day is the key, but comes with risks if interest rates aren’t reduced soon.

“Everyone is trying to survive to buy time and hope that rate cuts come so they can salvage some equity,” Piekarski said. “The game theory of that isn’t it doesn’t come. What ends up happening is that sponsors think their equity is sunk cost and they move on, or is there opportunity for people who’ve been patient with the capital? And all of that is TBD.”

After a short networking break, Goldman Sachs (GS)’ Siddharth Shrivastava, managing director of investment banking, held court during a fireside chat where he made it clear to attendees that much of the pain commercial real estate has experienced since 2020 is now largely in the rearview mirror.

Shrivastava noted that capital markets in 2024 have seen “a lot of activity in CMBS markets.” Yet despite only $40 billion in CMBS securitization originating across the system in 2023, the first quarter of 2024 saw $20 billion, he said, and “in one quarter we traded half of what was done last year.”

He also pointed out that while refinancings have dominated Goldman Sachs’ real estate activity thus far in 2024, some of the nation’s biggest asset managers — Blackstone, Brookfield (BN) and KKR (KKR) — have made major acquisitions in recent months, and that his own bank is providing an increased amount of credit financed compared to 2023.

“You’re seeing acquisitions start with clients requiring commitments, and now you’re seeing an environment where commitments can once again be done,” Shrivastava said. “The overarching thing in all of these is we’re doing it for our best sponsors, our best clients, and so [for them] we’re certainly open to deploying our balance sheet and that’s how we’re thinking about opportunities that come to us.”

He even hinted that office — no joke — is now attracting CMBS financing after carrying the scarlet letter of shame across CRE since the pandemic hit.

“We are getting office deals in the CMBS market, there’s conduit deals, there’s been SASB, so that’s been a change in the office side,” Shrivastava said. “The environment for office financing is slightly better than it was last year. And if rates come down and keep coming down, the spigot of office that’s financeable will open up more and more.”

The optimism about the market continued during the next panel, where four executives at top investment firms pondered whether the pullback of the traditional banking sector away from CRE lending has inaugurated a golden age of private credit.

“Time will tell,” said Yorick Starr, managing director and investment officer at Invesco. “The retrenchment of banks and some other capital that’s provided here has made the setup an interesting one to sort of be lending at overleverage with great sponsors in great markets.”

Starr noted that his firm originated $900 million in CRE loans last year but has already hit that total in the first quarter of 2024. “We’re looking at the more distress opportunities out there, not that there’s a whole lot of them, but that’s kind of the opportunity set we’ve found that’s interesting and available to be putting out a lot of capital for use,” he added.

Mark Silverstein, senior managing director at NewPoint Real Estate Capital, oversees the firm’s proprietary lending products. He said agency lending has increased during a time of high interest rates, as agencies are willing to lend at rates even lower than attractive CMBS financing. And if you can lend at a low rate, he noted, you can obviously lend with a little more leverage.

“Agencies have been very stable, and they’ve been available for large deals and small deals,” said Silverstein. “They love affordable [housing] and if there’s some affordable component or a green component [in there], the agencies will lean in and drive pricing that will be significantly better.”

Robert Rothschild, senior vice president at InterVest Capital Partners, added that while the current market has good fundamentals, there’s been a break in the capital stack for many assets. With the increase in interest rates, sponsors aren’t able to refinance on deals that they put out in 2021 — creating sizable holes in loans where agencies might have lent at 55 percent loan-to-value, and debt funds might have lent at a 75 percent loan-to-value clip, he said.

“There’s an opportunity to provide gap finance, to fill that hole between refinancing a floating-rate multifamily loan into an agency deal,” said Rothschild. “That opportunity won’t be around forever. As interest rates ultimately start to come down, those borrowers will get bailed out and be able to refinance and put in only a little bit of equity as opposed to 20 percent of the capital stack.”

Finally, Laura Rapaport, CEO and founder of North Bridge, broke down the intricacies of C-PACE lending, a form of fixed-rate lending that has historically been used to pay for energy-efficient improvements in commercial buildings.

Today, Rapaport noted, C-PACE lending has been turned into “a very effective credit product,” as its priced off the 10-Year Treasury at a fixed rate upon closing and usually carries a duration of 20 to 30 years, which allows it to be flexibly used not just for green renovations, but also to finance construction loans, refinancings, rescue capital, and synthetic A notes.

“We’re coming in and working with lenders at TCO [total cost of ownership] takeouts as an alternative to bridge financing,” she said. “Our biggest hurdle is lack of knowledge of how to use it. People are still figuring it out.”

The final panel of the morning examined lender appetite across asset classes. Contrary to popular opinion, there is an appetite out there to lend on older assets, even office.

Michael Hoffenberg, founder and managing principal of Trevian Capital, said his firm “loves the `70s and `80s vintage stuff that no one else wants,” namely vintage workforce housing, strategic retail, older student housing and medical office.

“We’ll take what’s boring and falls into our space,” he said. “We’re going where others won’t, we’re charging a modest premium for it, and we’re helping borrowers get from point A to point B.”

Zach Hoffman, director of AllianceBernstein, admitted that his firm is spending time in the office space, as he views it as overlooked, but stressed that he’d rather place capital into the ever-dependable multifamily space.

“Relative to office, we’re spending time, as everyone else is, in the multifamily space,” he said. “We have a fixed-rate mandate from our parent, Equitable, and so we put out a significant amount of capital in that asset class. Most of that is kind of a bridge to a better capital markets environment.”

Catherine Chen, managing director of real estate assets at Apollo Global Management (APO), reminded the audience that while her private equity firm’s loans run the spectrum of $30 million to $900 million (and even $1 billion), every deal and transaction is nuanced due to lending ratios and property types. Citing an example, Chen said a $40 million fixed-rate loan with a longer duration is far different than a $40 million loan carrying binary leasing risk, where if things go great the lender gets repaid in 18 months, but if they don’t then they’re stuck with the property for five years.

To this end, her team originates across multiple vehicles that can do a combination of fixed-rate and floating-rate debt, where she’s found a healthy appetite for multifamily, industrial and retail lending in 2024. However, she caveated this binary lending strategy by emphasizing that base rates haven’t yet hit that anticipated forward curve that makes floating-rate debt so attractive.

“If you have the cash flow to support debt service, even if it’s interest-only, I think the cost to get that financing done in our fixed-rate bucket is much more attractive than on the floating-rate side,” she said. “If you look at relative value where we can offer on a portfolio side, as well as pricing from a borrower perspective, fixed-rate ends up being more attractive from a relative value, if you have the asset that can qualify for it.”

Max Herzog, executive managing director IPA Capital Markets, said there’s liquidity in the market today for “all asset classes,” even hospitality, which he described as “overlooked, more expensive capital.”

However, Herzog put a damper on the idea that office conversions will be the white knight for a beleaguered sector struggling with millions of square feet of antiquated, out-of-date space threatened by record vacancies.

“There’s going to be more conversions than we’ve ever seen over these next two years, but not as many as people think,” said Herzog. “You need to have the right layout, you have to be vacant, a lot needs to make sense for these conversions to happen — it might take care of some part of the office problem, but nowhere near as much as we might hope.”

Andrew Coen can be reached at acoen@commercialobserver.com and Brian Pascua can be reached at bpascus@commercialobserver.com

Finance

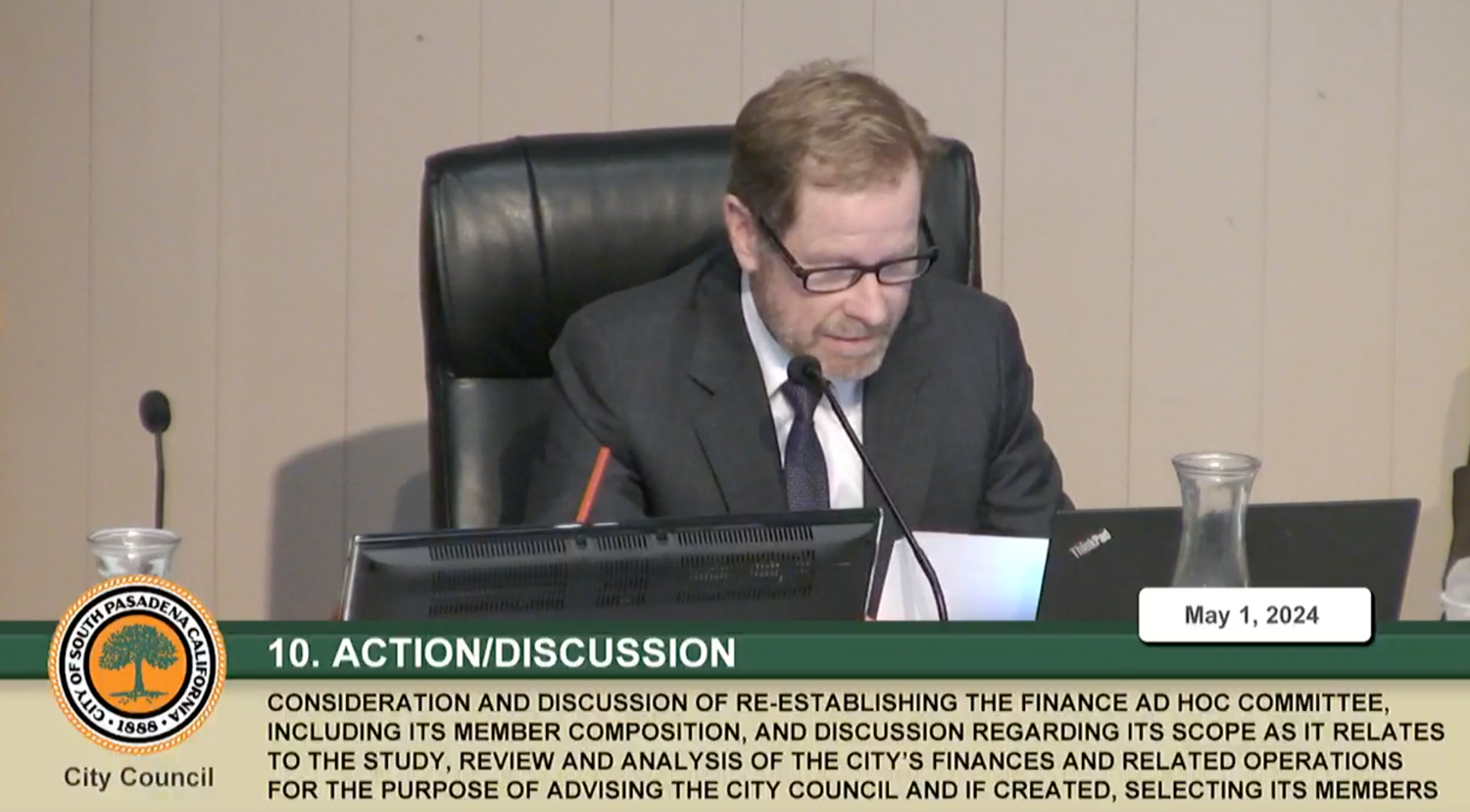

City Council South Pasadena | Primuth Apologizes, Finance Ad Hoc Reauthorized | The South Pasadenan | South Pasadena News

In another dramatic reversal, the South Pasadena City Council last Wednesday unanimously voted to re-instate the financial advisory board it abruptly dissolved only six weeks earlier. The lead up to the vote featured an apology from Council Member Jon Primuth for comments he made about Sheila Rossi, Vice Chair of the newly reauthorized Finance Ad Hoc Committee (FAHC).

Despite impassioned pleas from a group of influential citizens, council members initially seemed poised to reject reinstatement. The fog over what drove the alarming deficit projections that prompted Council in February to create the FAHC was clearing; possible savings in the current fiscal budget that ends June 30 were emerging; and both Council and its standing Finance Commission had since approved the mid-year budget report they’d previously delayed in the wake of the deficit projections.

“Their work is done,” Council Member Jack Donovan said of the FAHC.

Council Member Michael Cacciotti said a renewed FAHC would constitute an unduly heavy demand and inefficient use of staff, particularly in light of the many recent and planned joint council- finance commission meetings. He rejected the mayor’s notion there is a “fiscal emergency” and other “sensationalized” descriptions of the budget, suggested the city spends too much on the finance commission now and blamed concerns over “chronic instability” in finance department staffing on “pressure and comments from community members creating an unwelcome and stressful employment environment.”

But then Primuth, who on March 20 cited Rossi’s “misrepresentations” as the reason for both his loss of confidence in and vote to kill the FAHC, read a long prepared statement. “People are worried the city is running at too much of a deficit. They’re concerned about the integrity of the city’s financial reporting. They are concerned about the anger with which some council members” spoke of the FAHC. “That would have been me.”

Although it was not his intent, Primuth said, “it appears my words had the impact of accusing her of intentionally misrepresenting. And for that I apologize.”

Starting with some “background,” Primuth then explained why he now felt the FAHC should be re-instated. Since the vote to disband it, Finance Director John Downs apologized for the “financial reporting discrepancies that had caused so much turmoil.” One citizen told Primuth he’d counted six times incorrect reports had been pushed out. This caused “a collapse of confidence in some people in the city’s own numbers.”

Now the department is producing reliable monthly reports, though “more improvement is needed” Primuth continued. The alarming projections were based on an inflated baseline. Council and the Finance Commission have taken steps to ensure more reliable projections, given staff direction to update policies, and discerned long- and short-term cost saving–without major staff cuts–by recognizing a slowdown in capital improvement spending, savings from budgeted-but-unfilled staff positions, and that some large costs–such as Caltrans housing, legal expenses, temporary contract staffing, and Housing Element development–are one-time or diminishing expenses.

The city’s financial troubles must be addressed in a way that is “transparent, collaborative and respectful,” Primuth concluded. The FAHC, with its original four members, should now be charged with making recommendations on how the city can improve its financial reporting, precisely because they have experienced what things are like without it. Therefore “they should be the ones to lead the way. That will improve public confidence.”

“There’s been a kerfuffle over the last couple months,” summarized Council Member Janet Braun, who along with Mayor Evelyn Zneimer and citizens Peter Giulioni and Sheila Rossi made up the FAHC. But it’s been good, because it brought out issues–“where things stand, what needs to be looked at.” Sometime, Braun said, “you need a little bit of kerfuffle to get to the bottom line.”

She said the FAHC should be reauthorized to focus on actual financial figures and the protocols for their presentation, rather than be left trying to reconcile budget figures with unreliable or unavailable interim actuals. The FAHC could also help with prioritization of the capital improvement program (CIP).

Mayor Zneimer agreed, adding the FAHC could address the “inadequacies” of the city’s Springbrook financial software, the antiquity of which has contributed to the financial reporting problems.

Citing the heavy calendar of budget meetings and milestones over the next month, and a renewed sense that council, finance commission and finance staff are working more smoothly together, the council ultimately elected reauthorize the FAHC to commence in July after the new budget is adopted, and charged it with reviewing the city’s year-end actual financial results, making recommendations for the presentation and reporting of the actuals, and advising on CIP priorities.

-

World1 week ago

World1 week agoStrack-Zimmermann blasts von der Leyen's defence policy

-

Politics1 week ago

Politics1 week agoThe White House has a new curator. Donna Hayashi Smith is the first Asian American to hold the post

-

Politics1 week ago

Politics1 week agoStefanik hits special counsel Jack Smith with ethics complaint, accuses him of election meddling

-

Politics1 week ago

Politics1 week agoDemocratic mayor joins Kentucky GOP lawmakers to celebrate state funding for Louisville

-

World1 week ago

World1 week agoTurkish police arrest hundreds at Istanbul May Day protests

-

News1 week ago

News1 week agoVideo: Police Arrest Columbia Protesters Occupying Hamilton Hall

-

Politics1 week ago

Politics1 week agoNewsom, state officials silent on anti-Israel protests at UCLA

-

News1 week ago

News1 week agoPolice enter UCLA anti-war encampment; Arizona repeals Civil War-era abortion ban