Finance

Economic strength is forcing the Fed to get more aggressive

On Tuesday, we discovered U.S. employers had a document 11.5 million job openings as of March. That’s arguably the clearest signal that the financial system is booming, as hiring employees isn’t low-cost and most employers would solely do it in the event that they didn’t have already got the workers to maintain up with demand.

Presently, there are simply 5.9 million people who find themselves unemployed. In different phrases, there are almost two job openings per unemployed individual. The mismatch implies that employees have plenty of choices, which implies they’ve plenty of leverage to ask for extra pay. Certainly, employers are paying up at a historic fee.

However booming demand, document job openings, and better wages… are unhealthy?

The Federal Reserve and lots of within the economics occupation will not be placing it so bluntly. However that’s successfully their message.

The state of play: Demand for items and companies has been considerably outpacing provide,1 which has been sending inflation to decades-high charges. That is partly as a consequence of the truth that greater wages imply greater prices for companies, lots of which have been elevating costs to protect profitability. Sarcastically, these greater wages have helped bolster the already-strong funds of shoppers, who’re willingly paying up and thereby primarily enabling companies to maintain elevating costs.

It’s vital so as to add that this booming demand has been bolstered by job creation (i.e., a phenomenon the place somebody goes from incomes nothing to incomes one thing). The truth is, the U.S. has created a whopping 2.1 million jobs in 2022 to this point.

The Bureau of Labor Statistics has a metric referred to as the index of combination weekly payrolls, which is the product of jobs, wages, and hours labored. It’s a tough proxy for the overall nominal spending capability of the workforce. This metric was up 10% year-over-year in April and has been above 9.5% since April 2021. Earlier than the pandemic, it was trending at round 5%.

This mix of job progress and wage progress has solely been exacerbating the inflation downside.

And so one of the best resolution, at this level, appears to be to tighten financial coverage in order that monetary situations grow to be just a little tougher, which ought to trigger demand to chill, which in flip ought to alleviate a few of these persistent inflationary pressures.

In different phrases, the Fed is working to take the legs out of a number of the excellent news coming from the financial system as a result of that excellent news is definitely unhealthy.2

The Fed strikes to trim ‘extra demand’ ?

In a widely-anticipated transfer, the Fed raised short-term rates of interest on Wednesday by 50 foundation factors to a variety of 0.75% to 1.00%. It was the biggest enhance the central financial institution made in a single announcement since Could 2000.

Moreover, Fed Chair Jerome Powell signaled the Federal Open Market Committee’s (i.e., the Fed’s committee that units financial coverage) intention to maintain mountaineering charges at an aggressive tempo.

“Assuming that financial and monetary situations evolve according to expectations, there’s a broad sense on the Committee that extra 50 foundation level will increase must be on the desk on the subsequent couple of conferences,” Powell stated. “Our overarching focus is utilizing our instruments to carry inflation again right down to our 2% purpose.“

To be clear, the Fed isn’t making an attempt to power the financial system right into a recession. Reasonably, it’s making an attempt to get the surplus demand — as mirrored by there being extra job openings than unemployed — extra according to provide.

“There’s plenty of extra demand,” Powell stated.

Presently, there are huge financial tailwinds, together with extra client financial savings and booming capex orders, that ought to propel financial progress for months, if not years. And so there’s room for the financial system to let off some pent-up stress from demand with out going into recession.

Right here’s extra from Powell’s press convention on Wednesday (with related hyperlinks added):

It’d be a much more dangerous state of affairs if client and enterprise funds had been stretched along with there being no extra demand. However that’s not the case proper now.

And so, whereas some economists are saying that the chance of recession is rising, most don’t have it as their base-case state of affairs for the close to future.

Is it unhealthy information for shares? Not essentially.

When the Fed decides it’s time to chill the financial system, it does so by making an attempt to tighten monetary situations, which implies the price of financing stuff goes up. Typically talking, this implies some mixture of upper rates of interest, decrease inventory market valuations, a stronger greenback, and tighter lending requirements.

Does this imply shares are doomed to fall?

Properly, a hawkish Fed is definitely a danger to shares. However nothing is ever sure relating to predicting the outlook for inventory costs.

To begin with, historical past says shares often rise when the Fed is tightening financial coverage. It is smart if you keep in mind that the Fed tightens financial coverage when it believes the financial system has some momentum.

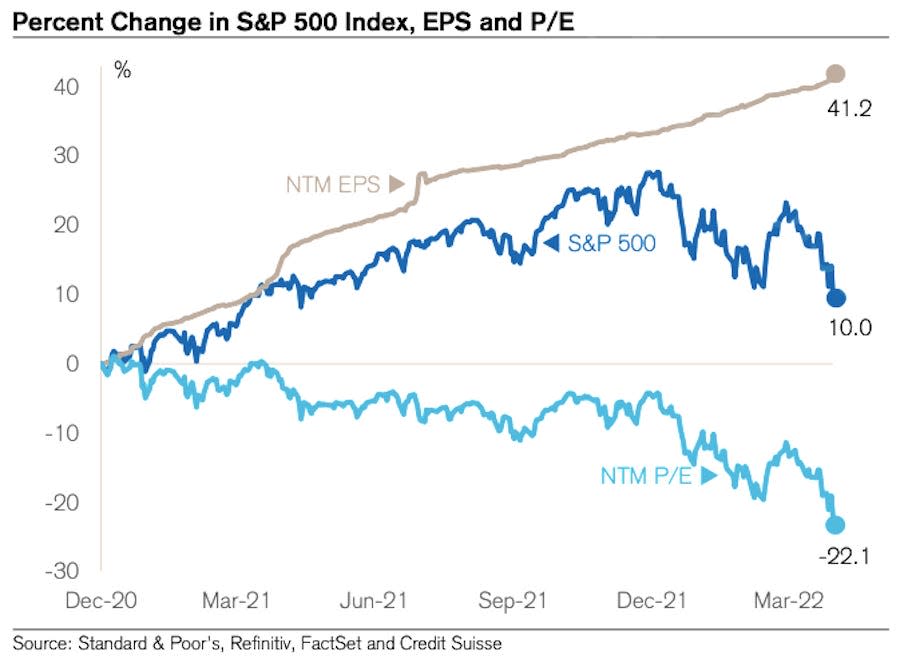

Nonetheless, the prospect for greater rates of interest is unquestionably a priority. Most inventory market specialists, like billionaire Warren Buffett, usually agree that greater rates of interest are bearish for valuations, like the following 12-month (NTM) P/E ratio.

However the important thing phrase is “valuations,” not shares. Inventory costs don’t have to fall to carry valuations down so long as expectations for earnings are going up. And expectations for earnings have been going up. And certainly, valuations have been falling for months.

The chart under from Credit score Suisse’s Jonathan Golub captures this dynamic. As you’ll be able to see, the NTM P/E has been trending decrease since late 2020. Nonetheless, inventory costs have largely been on the rise throughout this era. Even with the current market correction, the S&P 500 at the moment is greater than it was when valuations began to fall. Why? As a result of, the following 12 month’s value of earnings have primarily solely been going up.

To be clear, there’s no assure that shares received’t preserve falling from their January highs. And it’s definitely a risk that future earnings progress might flip damaging if the enterprise surroundings deteriorates.

However for now, the outlook for earnings continues to be remarkably resilient, and that would present some help for inventory costs, that are at the moment expertise a reasonably typical sell-off.3

Extra from TKer:

Rearview ?

???? Shares go haywire: The S&P 500 declined by simply 0.20% to spherical out an extremely unstable week. On Wednesday, the S&P surged 2.99% in what was the index’s largest one-day rally since Could 18, 2020. The following day, it plummeted 3.56% in what was the index’s second worst day of the yr.

The S&P is at the moment down 14.4% from its January 4 intraday excessive of 4,818. For extra on market volatility, learn this, this and this.

? Job creation: U.S. employers added a wholesome 428,000 jobs in April, in accordance with BLS information launched Friday. This was considerably greater than the 380,000 jobs that economists anticipated. The unemployment fee stood at 3.6%. For extra on the state of the labor market, learn this.

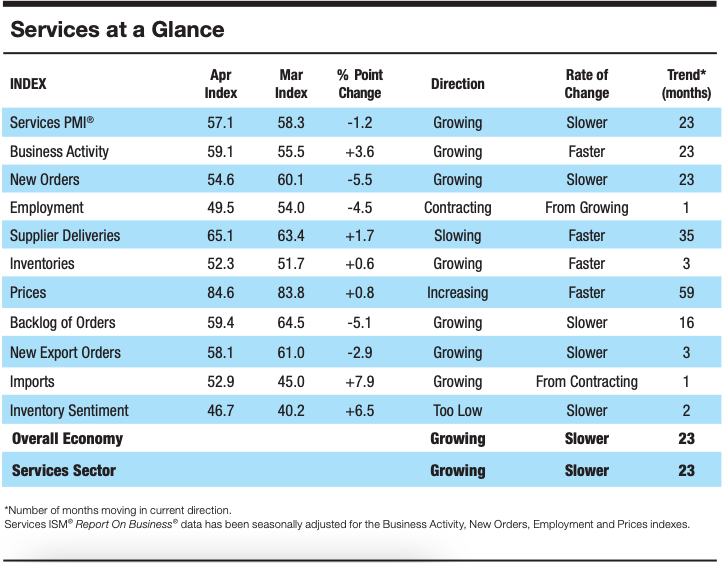

? Providers exercise progress cools: Based on survey information collected by the Institute of Provide Administration, companies sector exercise decelerated in April. From Anthony Nieves, chair of the ISM Providers Enterprise Survey Committee: “Progress continues for the companies sector, which has expanded for all however two of the final 147 months. There was a pullback within the composite index, largely because of the restricted labor pool and the slowing of latest orders progress. Enterprise exercise stays robust; nonetheless, excessive inflation, capability constraints and logistical challenges are impediments, and the Russia-Ukraine struggle continues to have an effect on materials prices, most notably of gasoline and chemical compounds.”

Up the highway ?

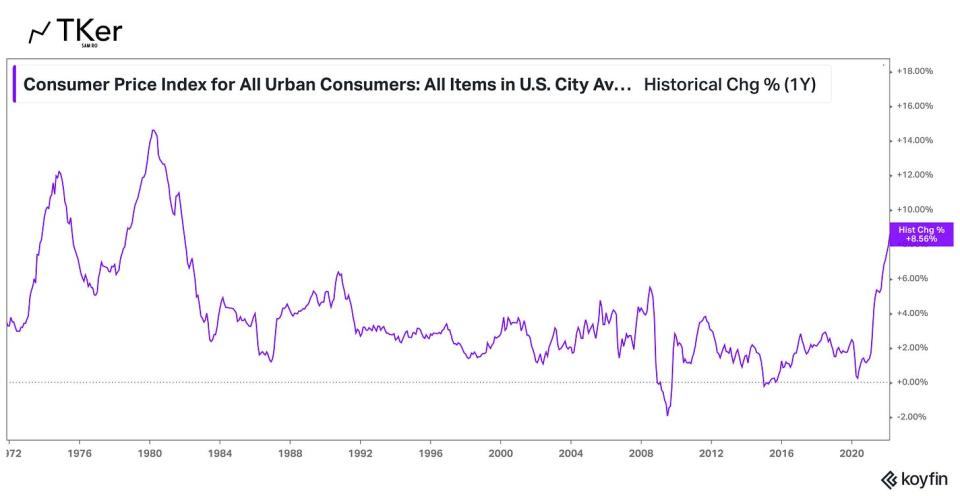

There’s no greater story within the financial system proper now than the course of inflation. So all eyes will likely be on the April client value index (CPI) report, which will get launched on Wednesday morning. Economists estimate that CPI was up 8.1% year-over-year throughout the month, which might be a deceleration from March’s 8.5% print. Excluding meals and vitality costs, core CPI is estimated to have elevated by 6.1%, down from 6.5% in March.

Take a look at the calendar under from The Transcript with a number of the huge names asserting their quarterly monetary outcomes this week.

1. We’re not going to get into the entire nuances of provide chain points right here (e.g., how labor shortages within the U.S., COVID-related lockdowns in China, and the struggle in Ukraine are disrupting manufacturing and commerce). Nonetheless, we all know provide chain points persist as mirrored by persistently gradual suppliers’ supply instances.

2. For these of you new to TKer, I’ve written a bit about how good financial information has been “unhealthy” information. You possibly can learn extra about it right here, right here, right here, and right here.

3. Investing in shares isn’t simple. It means having to deal with plenty of short-term volatility as you anticipate these long-term features. Everybody’s welcome to attempt to time the market and promote and purchase in an effort to reduce these short-term losses. However after all, the chance is lacking out on these huge rallies that happen throughout unstable intervals, which may do irreversible injury to long-term returns. (Learn extra right here, right here and right here.) Bear in mind, there’s a complete business of execs aiming to beat the market. Few are capable of outperform in any given yr, and of these outperformers, few are capable of proceed that efficiency yr in and yr out.

Learn the most recent monetary and enterprise information from Yahoo Finance

Observe Yahoo Finance on Twitter, Fb, Instagram, Flipboard, LinkedIn, and YouTube

Finance

Recruiting Journeys | Finance: Max Yamamoto ’24, Dimensional Fund Advisors

What was your recruiting journey like?

In the first year of my MBA, I applied to internship positions at investment management firms. Unlike consulting or investment banking, the process is not very structured. I found a bunch of firms by doing research on the internet, utilizing a list of employers created by the Career Development Office (CDO), and making cold calls to alumni or people inside the company. I applied to about 50 internships, and eventually landed one at Dimensional Fund Advisors.

I didn’t immediately get a return offer at the end of my summer internship. When I returned to SOM in the fall, I started to re-recruit for full-time jobs, but ultimately a position opened up at Dimensional Fund Advisors, and I accepted a full-time offer.

Which SOM classes prepared you for your current role?

Quantitative Investment, a core class for the Master’s in Asset Management program taught by Professor Toby Moskowitz, teaches you to research financial markets with a quantitative review. It’s directly related to what I’m doing right now, and has been very helpful. Another important core course was Asset Pricing Theory, taught by Professors Saman Majd and Jeffrey Rosenbluth; we learned how the market works and how you should view the market based on mathematical or financial theory. A third course is Employer, which is now called Workforce. What I learned in that class helped me understand how a company works, and prepared me to navigate professional culture in my internship and current role.

Finance

Financial Services Legislation Is in the Spotlight as the 119th Congress Settles In | PYMNTS.com

The 119th Congress has now been seated, and is poised to consider, to take up — or to scuttle — financial services legislation that may touch on everything from credit cards to earned wage access (EWA) to digital assets.

The incoming majorities belong to the Republicans, of course, and it’s no secret that president-elect Trump and other members of his party have expressed misgivings about the Federal Deposit Insurance Corp. (FDIC) and the Consumer Financial Protection Bureau (CFPB), and the roles and scope of those agencies are as yet undetermined.

The House Financial Services Committee now is being chaired by Rep. French Hill, R-Ark. The Senate Banking Committee is being chaired by Sen. Tim Scott, R-S.C.

What May Be Up

As for what may still be considered “outstanding”:

Front and center will be what happens with the Credit Card Competition Act. It’s been a long road for the CCCA, which, among other things, would enable card payments to be routed over at least one network that competes with Mastercard and Visa. Since being introduced in 2023, the act has been stalled in Congress, and should it be taken up again, there’s no surety that it would make it through into law, but it may indeed come up for debate. Now vice president-elect JD Vance had signed on to the bill.

At issue will be the ways in which the bill would change the dynamics of the card industry. Supporters say that the routing provisions would open up competition. But as Karen Webster noted in a recent column, “Notwithstanding a lack of understanding of how dual routing would work for credit card transactions, the flaw in Sen. Durbin’s bill is a lack of understanding of how the current credit card ecosystem works. And, more fundamentally, how platform ecosystems ignite and scale — and are monetized.”

Separately, the Earned Wage Access Consumer Protection Act would define EWA providers and sets strict operational boundaries, specifically regulating both employee-sponsored programs and direct-to-consumer offerings.

Digital Assets

There have been various attempts to have legislation that would set frameworks for digital asset markets to be structured. One bill, the Financial Innovation and Technology for the 21st Century Act passed in the House but did not make it through the Senate. The act would, among other things, set standards for digital assets and consumer protections, and segregation of funds.

Crypto and artificial intelligence (AI), of course, will also be on the agenda.

In an interview with PYMNTS, Mike Katz, a partner in Manatt, Phelps and Phillips Financial Services Group, said that “despite the razor-thin Republican majorities, there is a growing bipartisan consensus in Congress around the need for thoughtful, innovation-focused crypto and AI legislation,” adding, “It will be interesting to see if any digital asset bills are part of the tax-and-border-focused reconciliation package already being discussed in Congress. I’d expect a strong stablecoin bill to move quickly given existing bipartisan support.”

And he added: “Keep an eye out early in 2025 for a repurposed or chopped up version of the pro-crypto bill FIT21 [which passed the House with a large bipartisan majority in May]. Regardless of form or timing, new legislation will finally provide clarity on the questions of whether crypto assets are ‘securities’ or ‘commodities’ … and on which regulatory authority is charged with oversight.”

Finance

Protecting Your Future: How Cognitive Decline Affects Financial Decision-Making | University of Denver

RadioEd co-host Emma Atkinson sits down with medical doctor and finance expert Eric Chess to break down why financial decisions can be an early indicator of cognitive decline.

Podcast •

News •

Hosted by Jordyn Reiland and Emma Atkinson, RadioEd is a triweekly podcast created by the DU Newsroom that taps into the University of Denver’s deep pool of bright brains to explore the most exciting new research out of DU. See below for a transcript of this episode.

Show Notes

As we get older, things change. Our priorities shift, viewpoints and opinions evolve, and our bodies—and brains—age.

Many of these changes are good—we can celebrate the process of aging as one that invites wisdom and joy. But there are natural consequences of getting older, and one of those consequences is cognitive decline.

Eric Chess is a former medical doctor who has also earned degrees in law and business. Chess is the director of the Paul Freeman Financial Security Program at DU. He seeks to identify the earliest signs of cognitive impairment—and works to protect the lives and financial assets of older people experiencing cognitive decline.

Dr. Eric Chess is a physician, lawyer and professor with a focus on prevention, comprehensive well-being, financial security and older adults. He has over a decade of

experience in internal medicine practice (board certified), as a hospitalist and as an outpatient physician. He is currently a Clinical Professor at the University of Denver’s Knoebel Institute for Healthy Aging, serving as the founder and director of Aging and Well-being/The Paul Freeman Financial Security Program. Additionally, he serves as an adjunct Professor at the University of Denver’s Sturm College of Law and Daniels College of Business. Dr. Chess has an undergraduate degree in economics and political science, and a graduate law degree with experience as an attorney and economic consultant.

The Knoebel Institute for Healthy Aging creates and implements solutions for aging issues through multidisciplinary research, education and outreach by serving as an information clearinghouse for media on matters related to aging; educating and training a diverse workforce to serve a rapidly aging population; and promoting innovation, research and business development related to aging.

The Paul Freeman Financial Security Program combines the expertise of faculty, researchers and students at the University of Denver. Their interdisciplinary team of researchers in law, finance, psychology, social work, business, neuroscience, and medicine is led by Eric Chess, MD, JD. Goals of impact include four main areas: Research and Development; Outreach and Collaboration; Education; and Policy. Part of the program’s core mission is to address the need for more impactful solutions regarding financial exploitation and fraud of older adults. Target areas currently include developing a financial vulnerability scale, leading a state-wide collaboration, developing a financial-protective team legal instrument, and addressing the significant transfer of wealth affecting older adults and potential future generations and clients.

More Information:

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics6 days ago

Politics6 days agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics5 days ago

Politics5 days agoCarter's judicial picks reshaped the federal bench across the country

-

Politics4 days ago

Politics4 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health3 days ago

Health3 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades