Crypto

Here’s How to Fix * TorrentFreak

While BitTorrent client functionality hasn’t fundamentally changed over the past 20 years, developers of leading clients haven’t let their software stagnate.

A good example is the excellent qBittorrent, a feature-rich open source client which still receives regular updates. In common with similar clients, qBittorent can be found on GitHub along with its source and installation instructions.

Elsewhere on the same platform, users were recently trying to work out how a standard qBittorrent install suddenly led to the appearance of unwanted cryptocurrency mining software on the same machine.

Proxmox and LXC

For those unfamiliar with Proxmox VE, it’s an environment for virtual machines that once tried becomes very useful, extremely quickly. It’s also free for mere mortals and in most circumstances, very easy to install and get up and running.

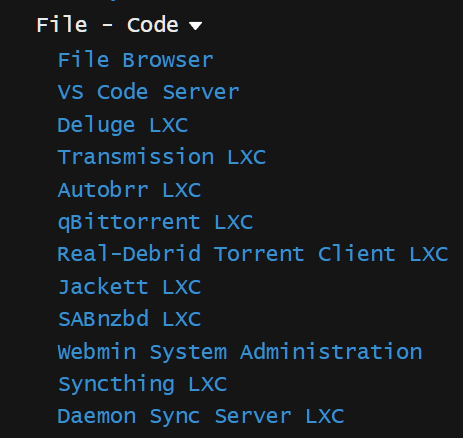

With help from various Proxmox ‘helper scripts’ offered by tteck on GitHub (small sample to the right), even beginners can install any of dozens of available software packages in a matter of seconds using LXC containers.

With help from various Proxmox ‘helper scripts’ offered by tteck on GitHub (small sample to the right), even beginners can install any of dozens of available software packages in a matter of seconds using LXC containers.

Even if none of that makes sense, it doesn’t matter. Those who want qBittorrent installed, for example, can copy and paste a single line of text into Proxmox…and that’s it. Given that the whole process is almost always flawless, user issues are very rare, so to hear of a possible malware infection came as a real shock recently

Cryptominer Discovery

In summary, a Proxmox user deployed a tteck script to install qBittorrent and then a month later found his machine being worked hard by cryptomining software known as xmrig. While he investigated the problem, tteck removed the qBittorrent LXC script as a basic precaution, but it soon became clear that neither Proxmox or tteck’s script had anything to do with the problem.

The unwelcome software was indeed installed maliciously, but due to a series of avoidable events, rather than a genius hack.

When a qBittorrent installation like this completes and the software is launched, access to qBittorent takes place through a web interface accessible from most web browsers. By default, qBittorrent uses port 8080 and since many users like to access their torrent clients from remote networks, qBittorrent uses UPnP (Universal Plug and Play) to automate port forwarding, thereby exposing the web interface to the internet.

Having this working in record time is all very nice, but that doesn’t mean it’s safe. To ensure that only the operator of the client can access the web interface, qBittorrent allows the user to configure a username and a password for authentication purposes.

This generally means that random passers-by will need to possess these credentials before being able to do damage. In this case, the default admin username and password were not changed and that allowed an attacker to easily access the web interface.

Attacker Told qBittorrent to Run an External Program

To allow users to automate various tasks related to downloading and organizing their files, qBittorrent has a feature that can automatically run an external program when a torrent is added and/or when a torrent is finished.

The options here are limited only by the imagination and skill of the user but unfortunately the same applies to any attacker with access to the client’s web interface.

In this case the attacker told the qBittorrent client to run a basic script on completion of a torrent. The script accessed the domain http://cdnsrv.in from where it downloaded a file called update.sh and then ran it. The consequences of that are explained in detail by tteck, but the main points are a) unauthorized cryptomining on the host machine and b) the attacker maintaining root access via SSH key authentication.

Easily Avoided

The default admin username for qBittorrent is ‘admin’ while the default password is ‘adminadmin’. Had these common-knowledge defaults been changed following install, the attacker would still have found the web interface but would’ve had no useful credentials for conventional access.

More fundamentally, possession of the correct credentials would’ve had limited value if the qBittorrent client hadn’t used UPnP to expose the web interface in the first place. Taking another step back, if UPnP hadn’t been enabled in the user’s router, qBittorrent would’ve had no access to UPnP, and wouldn’t have been able to forward ports or expose the interface to the internet.

In summary: disable UPnP in the router and only enable it once its function is fully understood and when absolutely necessary. Never leave default passwords unchanged, and if something doesn’t need to be exposed to the internet, don’t expose it unnecessarily.

Finally, it’s worth mentioning that tteck‘s response, to a problem that had nothing to do with Proxmox or his scripts, has been first class. Anyone installing the qBittorrent LXC from here will find the default admin password changed and UPnP disabled automatically.

Any time saved can be spent on automated installs of Plex, Tautulli, Emby, Jellyfin, Jellyseerr, Overseerr, Navidrome, Bazarr, Lidarr, Prowlarr, Radarr, Readarr, Sonarr, Tdarr, Whisparr, and many, many more.

Crypto

Coinbase Investigates ‘Delayed Sends’ for XRP on Its Platform | PYMNTS.com

Cryptocurrency exchange Coinbase said Tuesday (Jan. 14) that it is investigating a problem with delayed sends of Ripple (XRP) on its platform.

“We are aware that some users may be experiencing delayed sends for Ripple (XRP),” Coinbase said in an incident report on its status page. “Buys, Sells and Fiat withdrawals/deposits are not affected. We are investigating this issue and will provide an update shortly.”

In an earlier, separate report on its status page, Coinbase said some users experienced delayed sends and receives for Stellar (XLM) on Friday (Jan. 10). That incident was resolved within 90 minutes.

On Thursday (Jan. 9), some users experienced latency or degraded performance with buys, sells, sends, Coinbase Onramp and Advanced Trade. That issue was resolved within two hours, according to the page.

In other, separate news about the company, it was reported Thursday (Jan. 9) that Coinbase told customers that it may have to share data demanded by the Commodity Futures Trading Commission (CFTC).

The regulator sent a subpoena to the firm that seeks information about Coinbase customers’ interactions with prediction market firm Polymarket, and Coinbase emailed some customers saying it may have to share that data with the CFTC.

“When we receive requests for information from a government, each request is carefully reviewed by a team of trained experts using established procedures to determine its legal sufficiency,” a Coinbase spokesperson told CoinDesk.

On Dec. 9, cryptocurrency payments solution firm Triple-A announced an integration with Coinbase that it said it designed to let Coinbase users make payments to select merchants in the Triple-A network.

“Triple-A’s integration with Coinbase Commerce will empower merchants to offer a Coinbase-specific payment option, enhancing the convenience for Coinbase users and allowing Coinbase to connect with a wider network of merchants, to drive the broader adoption of cryptocurrency payments,” the company said in a press release.

Coinbase upgraded its Coinbase One subscription program and launched a new tier called Coinbase One Premium on Dec. 4, saying that with these new offerings, “Coinbase One now truly benefits all types of traders.”

Coinbase One membership has reached 600,000 across 42 countries, the company added.

Crypto

Credissential Inc. Adopts Cryptocurrency Policy, Plans XRP and XLM Purchases – TipRanks.com

Stay Ahead of the Market:

An update from Axiom Capital Advisors, Inc. ( (TSE:WHIP) ) is now available.

Credissential Inc. announced a new Cryptocurrency Acquisition Policy aimed at enhancing shareholder value by purchasing digital assets like XRP and XLM. This move aligns with the company’s cryptocurrency initiatives and allows investors exposure to the growing digital asset market. The policy is also seen as a strategy to navigate inflationary pressures while diversifying the company’s treasury holdings, indicating a proactive approach to adapting to market trends and delivering long-term shareholder value.

More about Axiom Capital Advisors, Inc.

Credissential Inc. is a vertically integrated AI software development company focusing on advancing financial technology solutions. The company is committed to developing innovative products such as Antenna, a payment platform enhanced with AI and quantum encryption technologies, and DealerFlow, an AI-driven dealer management system designed to streamline operations and enhance efficiency.

YTD Price Performance: -6.45%

Average Trading Volume: 298,973

Technical Sentiment Consensus Rating: Buy

Current Market Cap: C$6.17M

Find detailed analytics on WHIP stock on TipRanks’ Stock Analysis page.

Crypto

Why Is Bitcoin Price Going Up? BTC Prediction After Bullish Buy Signal

Bitcoin’s

price (BTC) is making significant gains on Tuesday, January 14, 2025, adding

over $2,000 to its value. However, Monday saw the market shaken, with the price

briefly dropping to a two-month low below the critical $90,000 psychological

level.

In this

article, I review what triggered the sudden drop, why the Bitcoin price is

going up today, and how to interpret the bullish pin bar above the 50-day

exponential moving average—a potentially strong buy signal.

On Tuesday,

Bitcoin is trading above $97,000 on Binance, marking its highest value in a

week. The cryptocurrency is currently up 2.7%, with altcoins following suit.

Ethereum (ETH) has gained 4.9% over the past 24 hours, reaching

$3,200, while XRP, the third-largest cryptocurrency by market cap, has

risen 7% to $2.56.

As shown in Bitcoin price is currently inside a consolidation. Source: Tradingview.com

the chart below, Bitcoin’s price remains in a consolidation phase that has been

in place since November, with the lower boundary near $92,000 and the upper

limit at its previous high of $98,000.

However,

Monday painted a less optimistic picture as

Bitcoin briefly dipped to just $89,398, causing significant panic and

confusion among retail investors.

The

temporary panic was also evident in the derivatives market: within four days,

investors pulled $1.6 billion from cryptocurrency exchange-traded funds (ETFs),

marking one of the longest selling streaks in recent times.

Over the Source: Coinglass.com

past 24 hours, both bulls and bears have incurred losses. Approximately $500

million in leveraged positions were liquidated across the market, with nearly

equal distribution between long and short positions. Bitcoin accounted for over

20% of this activity, with $44 million liquidated from long positions and $72

million from shorts.

Analysts

attribute the recent decline in Bitcoin and the broader cryptocurrency market

to two primary factors: so-called “Trump Trade” and monetary policy.

Why Bitcoin Fell? Fed

Policy and Market Uncertainty Shake BTC Price

The

cryptocurrency market’s downturn is primarily driven by shifting expectations

about Federal Reserve (Fed) interest rate policies. Strong economic indicators

have led investors to anticipate a longer period of higher interest rates. The

robust U.S. job market, with 256,000 new nonfarm payrolls and a 4.1%

unemployment rate, has particularly influenced this outlook.

According The chances that the Fed will lower rates this month are almost zero. Source: CME

to the CME’s FedWatch tool, the probability of a rate cut at the next meeting,

scheduled for January 29, is just 2.7%. The market is currently pricing in a

stronger likelihood (around 40%) of a cut to the 4.00–4.25% range in the second

half of the year. Earlier expectations were for a more aggressive path of rate

cuts, which was expected to fuel risk assets such as cryptocurrencies and

stocks.

Moreover, the

initial euphoria surrounding Trump’s pro-crypto stance has given way to more

cautious market sentiment. While Trump’s upcoming presidency promised to make

the U.S. the “crypto capital of the world,” investors are now

focusing on immediate economic realities rather than future policy promises.

The

cryptocurrency decline isn’t occurring in isolation. The selloff in Treasury

markets has created a ripple effect across various asset classes, affecting

both crypto and traditional markets. This broader market reaction demonstrates

Bitcoin’s increasing correlation with conventional risk assets.

Will Bitcoin Keep Going

Up? BTC Price Prediction and Technical Analysis

The

candlestick I want to highlight in the technical analysis of Bitcoin ‘s price

chart may seem modest and even barely noticeable. However, in my view, it

carries significant strength and buying potential. This is a bullish pin bar

(or doji candle) with an almost invisible body and a very long lower wick,

indicating that bears were in control but had to concede to bulls by the

session’s close.

What

does the chart show?

- The bullish

pin bar tested the 50 EMA and two critical support levels: $92,000 and $90,000. - All three

levels held, and the price responded with an immediate increase the following

day. - This strong

bullish signal confirmed the lower boundary of the consolidation range,

signaling that buyers are likely to actively defend the green-marked support

zone.

Bitcoin technical analysis: BTC price chart drew a bullish pin bar candle. Source: Tradingview.com

While

Bitcoin remains in consolidation, this reaction suggests, from a purely

technical standpoint, the potential for a move towards $103,000 (the 2025

highs) and ultimately $108,000, the all-time high (ATH) to date.

Bitcoin Price Key Support

and Resistance Levels

|

Support |

Resistance |

|

$90,000 – psychological round |

$100,000 – psychological round |

|

$92,000 – local lows tested in |

$103,000 – highs from 2025 |

|

50 EMA – currently at $94,482 |

$108,000 – current ATH |

Breaking

above the current all-time high is a necessary condition for considering

ambitious forecasts for 2025 and beyond. Some of these projections are

truly bold.

Bitcoin Price Prediction:

Will BTC Reach $1 Million?

Late last

year, I explored the question, “Will

Bitcoin hit $1 million?” According to Jeff Park, Head of Alpha

Strategies at Bitwise Asset Management, this could be possible if the U.S.

government were to adopt a Bitcoin reserve strategy. However, he currently

assigns only a 10% probability to this scenario.

Arthur

Hayes, the Founder of the cryptocurrency exchange BitMEX, has frequently

mentioned such ambitious levels as $1 million. Last week, he appeared as a guest on

Tom Bilyeu’s show, where he discussed the current state of the

cryptocurrency market during a nearly two-hour interview. Hayes suggested that

Bitcoin is gradually heading toward seven-figure valuations and could

potentially reach them within the next five years.

“It’s the bull market. When the music is playing you gotta $DANCE.” ~ Arthur Hayes x Tom Bilyeu#crypto #dance #memecoin #solana #bullrun pic.twitter.com/g9MdkEtIZe

— DANCE MEMECOIN 🤩 (@dancememecoin) January 7, 2025

“Bitcoin

has already survived for 15 years. This makes investors start to believe that

it can last for decades to come.” – Hayes commented. “BTC will be here for

the next 15, 20, 100 years. I think it will be a store of value. I can use it

to pay for things I need, so I’m going to take 2%, 3%, 4%, 5%, 10% of my

retirement income or savings and start buying that asset now.”

Other

experts, including VanEck analysts, predict more down to earth numbers. Month

ago, they

forecasted that Bitcoin price could reach $180,000 in 2025.

JUST IN: $118 billion VanEck predicts $180,000 #Bitcoin and the U.S. will embrace a Strategic BTC Reserve in 2025 🇺🇸 pic.twitter.com/s7lnNgkyhn

— Bitcoin Magazine (@BitcoinMagazine) December 13, 2024

Bitcoin Price, FAQ

Why Is the Price of

Bitcoin Going Up?

Bitcoin’s

price is rising due to a strong bullish pin bar forming above critical support

levels, signaling strong buying activity. Market sentiment improved as Bitcoin

rebounded from a two-month low of $89,398 to trade above $97,000. This movement

reflects consolidation within the $92,000–$98,000 range, supported by technical

indicators and broader market optimism.

Will Bitcoin Rise Again?

Bitcoin’s

price is expected to rise further based on technical analysis. If it breaks

through key resistance at $103,000, it could test the all-time high of

$108,000. Long-term projections remain optimistic, with some experts predicting

significant gains by 2025, assuming market conditions remain favorable.

Why Is Bitcoin So Valuable

Today?

Bitcoin’s

value stems from its status as a decentralized digital asset with limited

supply, serving as a hedge against inflation and a potential store of value.

Its increasing adoption, network security, and potential as a global reserve

asset contribute to its high valuation.

Why Did Bitcoin Fall

Recently?

Bitcoin’s

recent decline was driven by market reactions to expectations of prolonged

higher interest rates from the Federal Reserve. Strong U.S. economic data

reduced the likelihood of rate cuts, pressuring risk assets like

cryptocurrencies. Additionally, shifting sentiment around pro-crypto policies

under the upcoming U.S. administration added to market uncertainty.

How Much Will Bitcoin Cost

in 2025?

Bitcoin’s

2025 price predictions vary widely. Analysts forecast potential highs ranging

from $180,000 (VanEck) to over $1 million (Arthur Hayes), depending on adoption

trends, macroeconomic conditions, and regulatory developments. A more

conservative estimate places Bitcoin at $180,000, reflecting steady growth

without speculative excess.

Bitcoin’s

price (BTC) is making significant gains on Tuesday, January 14, 2025, adding

over $2,000 to its value. However, Monday saw the market shaken, with the price

briefly dropping to a two-month low below the critical $90,000 psychological

level.

In this

article, I review what triggered the sudden drop, why the Bitcoin price is

going up today, and how to interpret the bullish pin bar above the 50-day

exponential moving average—a potentially strong buy signal.

On Tuesday,

Bitcoin is trading above $97,000 on Binance, marking its highest value in a

week. The cryptocurrency is currently up 2.7%, with altcoins following suit.

Ethereum (ETH) has gained 4.9% over the past 24 hours, reaching

$3,200, while XRP, the third-largest cryptocurrency by market cap, has

risen 7% to $2.56.

As shown in Bitcoin price is currently inside a consolidation. Source: Tradingview.com

the chart below, Bitcoin’s price remains in a consolidation phase that has been

in place since November, with the lower boundary near $92,000 and the upper

limit at its previous high of $98,000.

However,

Monday painted a less optimistic picture as

Bitcoin briefly dipped to just $89,398, causing significant panic and

confusion among retail investors.

The

temporary panic was also evident in the derivatives market: within four days,

investors pulled $1.6 billion from cryptocurrency exchange-traded funds (ETFs),

marking one of the longest selling streaks in recent times.

Over the Source: Coinglass.com

past 24 hours, both bulls and bears have incurred losses. Approximately $500

million in leveraged positions were liquidated across the market, with nearly

equal distribution between long and short positions. Bitcoin accounted for over

20% of this activity, with $44 million liquidated from long positions and $72

million from shorts.

Analysts

attribute the recent decline in Bitcoin and the broader cryptocurrency market

to two primary factors: so-called “Trump Trade” and monetary policy.

Why Bitcoin Fell? Fed

Policy and Market Uncertainty Shake BTC Price

The

cryptocurrency market’s downturn is primarily driven by shifting expectations

about Federal Reserve (Fed) interest rate policies. Strong economic indicators

have led investors to anticipate a longer period of higher interest rates. The

robust U.S. job market, with 256,000 new nonfarm payrolls and a 4.1%

unemployment rate, has particularly influenced this outlook.

According

to the CME’s FedWatch tool, the probability of a rate cut at the next meeting,

scheduled for January 29, is just 2.7%. The market is currently pricing in a

stronger likelihood (around 40%) of a cut to the 4.00–4.25% range in the second

half of the year. Earlier expectations were for a more aggressive path of rate

cuts, which was expected to fuel risk assets such as cryptocurrencies and

stocks.

The chances that the Fed will lower rates this month are almost zero. Source: CME

Moreover, the

initial euphoria surrounding Trump’s pro-crypto stance has given way to more

cautious market sentiment. While Trump’s upcoming presidency promised to make

the U.S. the “crypto capital of the world,” investors are now

focusing on immediate economic realities rather than future policy promises.

The

cryptocurrency decline isn’t occurring in isolation. The selloff in Treasury

markets has created a ripple effect across various asset classes, affecting

both crypto and traditional markets. This broader market reaction demonstrates

Bitcoin’s increasing correlation with conventional risk assets.

Will Bitcoin Keep Going

Up? BTC Price Prediction and Technical Analysis

The

candlestick I want to highlight in the technical analysis of Bitcoin ‘s price

chart may seem modest and even barely noticeable. However, in my view, it

carries significant strength and buying potential. This is a bullish pin bar

(or doji candle) with an almost invisible body and a very long lower wick,

indicating that bears were in control but had to concede to bulls by the

session’s close.

What

does the chart show?

- The bullish

pin bar tested the 50 EMA and two critical support levels: $92,000 and $90,000. - All three

levels held, and the price responded with an immediate increase the following

day. - This strong

bullish signal confirmed the lower boundary of the consolidation range,

signaling that buyers are likely to actively defend the green-marked support

zone.

Bitcoin technical analysis: BTC price chart drew a bullish pin bar candle. Source: Tradingview.com

While

Bitcoin remains in consolidation, this reaction suggests, from a purely

technical standpoint, the potential for a move towards $103,000 (the 2025

highs) and ultimately $108,000, the all-time high (ATH) to date.

Bitcoin Price Key Support

and Resistance Levels

|

Support |

Resistance |

|

$90,000 – psychological round |

$100,000 – psychological round |

|

$92,000 – local lows tested in |

$103,000 – highs from 2025 |

|

50 EMA – currently at $94,482 |

$108,000 – current ATH |

Breaking

above the current all-time high is a necessary condition for considering

ambitious forecasts for 2025 and beyond. Some of these projections are

truly bold.

Bitcoin Price Prediction:

Will BTC Reach $1 Million?

Late last

year, I explored the question, “Will

Bitcoin hit $1 million?” According to Jeff Park, Head of Alpha

Strategies at Bitwise Asset Management, this could be possible if the U.S.

government were to adopt a Bitcoin reserve strategy. However, he currently

assigns only a 10% probability to this scenario.

Arthur

Hayes, the Founder of the cryptocurrency exchange BitMEX, has frequently

mentioned such ambitious levels as $1 million. Last week, he appeared as a guest on

Tom Bilyeu’s show, where he discussed the current state of the

cryptocurrency market during a nearly two-hour interview. Hayes suggested that

Bitcoin is gradually heading toward seven-figure valuations and could

potentially reach them within the next five years.

“It’s the bull market. When the music is playing you gotta $DANCE.” ~ Arthur Hayes x Tom Bilyeu#crypto #dance #memecoin #solana #bullrun pic.twitter.com/g9MdkEtIZe

— DANCE MEMECOIN 🤩 (@dancememecoin) January 7, 2025

“Bitcoin

has already survived for 15 years. This makes investors start to believe that

it can last for decades to come.” – Hayes commented. “BTC will be here for

the next 15, 20, 100 years. I think it will be a store of value. I can use it

to pay for things I need, so I’m going to take 2%, 3%, 4%, 5%, 10% of my

retirement income or savings and start buying that asset now.”

Other

experts, including VanEck analysts, predict more down to earth numbers. Month

ago, they

forecasted that Bitcoin price could reach $180,000 in 2025.

JUST IN: $118 billion VanEck predicts $180,000 #Bitcoin and the U.S. will embrace a Strategic BTC Reserve in 2025 🇺🇸 pic.twitter.com/s7lnNgkyhn

— Bitcoin Magazine (@BitcoinMagazine) December 13, 2024

Bitcoin Price, FAQ

Why Is the Price of

Bitcoin Going Up?

Bitcoin’s

price is rising due to a strong bullish pin bar forming above critical support

levels, signaling strong buying activity. Market sentiment improved as Bitcoin

rebounded from a two-month low of $89,398 to trade above $97,000. This movement

reflects consolidation within the $92,000–$98,000 range, supported by technical

indicators and broader market optimism.

Will Bitcoin Rise Again?

Bitcoin’s

price is expected to rise further based on technical analysis. If it breaks

through key resistance at $103,000, it could test the all-time high of

$108,000. Long-term projections remain optimistic, with some experts predicting

significant gains by 2025, assuming market conditions remain favorable.

Why Is Bitcoin So Valuable

Today?

Bitcoin’s

value stems from its status as a decentralized digital asset with limited

supply, serving as a hedge against inflation and a potential store of value.

Its increasing adoption, network security, and potential as a global reserve

asset contribute to its high valuation.

Why Did Bitcoin Fall

Recently?

Bitcoin’s

recent decline was driven by market reactions to expectations of prolonged

higher interest rates from the Federal Reserve. Strong U.S. economic data

reduced the likelihood of rate cuts, pressuring risk assets like

cryptocurrencies. Additionally, shifting sentiment around pro-crypto policies

under the upcoming U.S. administration added to market uncertainty.

How Much Will Bitcoin Cost

in 2025?

Bitcoin’s

2025 price predictions vary widely. Analysts forecast potential highs ranging

from $180,000 (VanEck) to over $1 million (Arthur Hayes), depending on adoption

trends, macroeconomic conditions, and regulatory developments. A more

conservative estimate places Bitcoin at $180,000, reflecting steady growth

without speculative excess.

-

Health1 week ago

Health1 week agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology6 days ago

Technology6 days agoMeta is highlighting a splintering global approach to online speech

-

Science4 days ago

Science4 days agoMetro will offer free rides in L.A. through Sunday due to fires

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png) Technology1 week ago

Technology1 week agoLas Vegas police release ChatGPT logs from the suspect in the Cybertruck explosion

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘How to Make Millions Before Grandma Dies’ Review: Thai Oscar Entry Is a Disarmingly Sentimental Tear-Jerker

-

Health1 week ago

Health1 week agoMichael J. Fox honored with Presidential Medal of Freedom for Parkinson’s research efforts

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: Millennials try to buy-in or opt-out of the “American Meltdown”

-

News1 week ago

News1 week agoPhotos: Pacific Palisades Wildfire Engulfs Homes in an L.A. Neighborhood