Crypto

Ethereum: The Future of Cryptocurrency » FINCHANNEL

What’s Ethereum/Ether?

Ether is a blockchain-based cryptocurrency that has many alternative functions, together with good contracts and different monetary agreements. It was invented by Vitalik Buterin in 2013, and it’s presently the second most respected cryptocurrency on the earth. You should purchase Ether via buying and selling platforms, or you should utilize foreign money exchanges to transform different cryptocurrencies into Ether. There are additionally Ether mining swimming pools you’ll be able to be a part of in case you have laptop {hardware} to spare.

How does it evaluate to different cryptocurrencies?

Ether is a public, open-source, blockchain-based distributed computing platform and working system that options good contracts. It’s primarily based on a modified model of the Nakamoto consensus. Whereas Ether will not be the primary decentralized ledger, it differs from Bitcoin in its capability to execute good contracts and its use as a programming language. Ether’s image is ETH and will be mined with the ASIC {hardware} that has been developed for bitcoin.

Bitcoin is the best-known cryptocurrency available on the market, nevertheless it’s not the one possibility. Ether is a digital foreign money that has soared in recognition over the previous few months. It’s now used to facilitate contracts and different functions on its community whereas appearing as its personal unit of foreign money. Bitcoin transactions are processed via mining, which requires computer systems to unravel advanced math issues earlier than they’re added to a blockchain ledger. Ether doesn’t require miners, making it simpler and cheaper to make use of than Bitcoin. As a result of Ether makes use of an open-source code base, builders can create their very own functions for it extra simply than with Bitcoin.

What are its options?

Ether is a decentralized platform that runs good contracts: functions that run precisely as programmed with none chance of downtime, censorship, fraud, or third-party interference. Ether’s foreign money known as ether. It’s used to pay transaction charges and computational companies on the Ether community. It was invented by Vitalik Buterin in 2013, in line with his white paper A Subsequent-Technology Good Contract and Decentralized Software Platform. Ether can be utilized by utility builders to pay for items and companies inside the Ether ecosystem when different types of cost will not be out there.

Why is it the way forward for cryptocurrency?

The explanations that Ethereum crypto is the way forward for cryptocurrency, and why it has the potential to be value greater than Bitcoin, are easy. It’s a decentralized platform that enables builders to create their very own functions on high of it, versus Bitcoin which solely permits for one utility. Which means Ether has way more room for progress as a result of there are a lot of attainable makes use of for its know-how.

How do you retailer it?

The pockets software program will create an tackle for you, which you’ll be able to share with others. Transactions are signed electronically and saved on the blockchain. You may export your personal key and use it with different Bitcoin purchasers.

The blockchain is a shared public ledger on which your entire Ether system depends. All transactions are made with ether, which is principally a cryptocurrency that fuels the entire community. Ether has been used to assemble different cryptocurrencies comparable to DOGECOIN and LITECOIN from the bottom up with out Bitcoin’s reliance on the SHA-256 hash operate. These currencies had been designed to be very uncommon – solely about 20 million tokens will ever be created – to maintain costs from getting uncontrolled, like what occurred with bitcoins.

Potential dangers

Ethereum continues to be a comparatively new kind of foreign money, so it has its dangers. For example, the method for mining Ethereum crypto is by fixing advanced algorithms via a pc. This may be an costly and time-consuming endeavor; mining rigs can price 1000’s and take years to pay themselves off. These computer systems are additionally susceptible to malware that might trigger you to lose all of your cash in a matter of minutes if it infects your laptop. Moreover, as a result of the worth of this kind of foreign money adjustments so rapidly and unpredictably, investing in Ether may very well be very dangerous in case you would not have the time or endurance to attend for the worth to rise once more after it falls.

Remaining Phrases

We live in an thrilling time for cryptocurrency. New cash are being created, and with new cash come new alternatives. As such, it’s vital to remain up-to-date with the newest traits within the crypto world. For example, do you have to make investments your cash in Ethereum crypto? This query will be answered solely by you. Do a little analysis, ask individuals round you who know greater than you do, and resolve whether or not or not investing in Ether is best for you.

To summarize, Ether has three important advantages over Bitcoin: transactions are processed sooner; it helps good contracts, and there’s much less threat of fraud (because of its Turing full scripting language).

Crypto

Bank of America Embraces On-Chain Data Analysis for Cryptocurrency Insights

Bank of America has been discreetly preparing for potential disruptions in the cryptocurrency market by focusing on on-chain data analysis. This strategic move is aimed at better understanding the volatile nature of digital currencies and gaining deeper insights into market trends, investor behavior, and potential risks. The bank has been conducting extensive research and analysis on blockchain data, which allows for a more granular understanding of the market compared to traditional financial metrics.

By analyzing blockchain data, Bank of America can track transactions, monitor wallet activity, and assess the overall health of the cryptocurrency ecosystem. This approach enables the bank to make more informed decisions and mitigate risks associated with the cryptocurrency market. The shift towards on-chain data analysis reflects a broader trend within the financial industry, as institutions increasingly recognize the need to integrate blockchain analysis into their risk management strategies.

This proactive approach by Bank of America underscores its commitment to staying ahead in an ever-evolving financial landscape. The bank’s efforts are part of a larger initiative to enhance its capabilities in the digital asset space. By leveraging on-chain data, Bank of America aims to provide more comprehensive and accurate assessments of the cryptocurrency market, thereby better serving its clients who are increasingly interested in digital currencies and blockchain technology.

The move by Bank of America to focus on on-chain data analysis is a significant development in the financial industry. It highlights the growing importance of blockchain technology and the need for financial institutions to adapt to the changing landscape. As the cryptocurrency market continues to evolve, Bank of America’s proactive approach positions it well to navigate the challenges and opportunities that lie ahead. This strategic shift not only enhances the bank’s risk management capabilities but also demonstrates its readiness to embrace the future of finance.

Crypto

House Votes on Key Cryptocurrency Bills This Week

The U.S. House of Representatives is poised to vote on several pivotal cryptocurrency bills this week, marking a crucial juncture in the regulatory evolution of digital assets. The legislative package under consideration includes the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act, each addressing distinct facets of the cryptocurrency ecosystem to foster a more structured and transparent market.

The CLARITY Act, formally known as the Digital Asset Market Clarity Act of 2025, is designed to establish clear, functional requirements for participants in the digital asset market. This legislation aims to enhance consumer protection while encouraging innovation, ensuring that the market operates within a well-defined regulatory framework. The GENIUS Act, meanwhile, focuses on stablecoin regulations, offering a comprehensive approach to managing these digital assets. The Anti-CBDC Surveillance State Act seeks to prohibit the Federal Reserve from issuing a central bank digital currency (CBDC), underscoring the importance of privacy and individual control over financial transactions.

The White House has highlighted the significance of this legislative push, with digital asset adviser Bo Hine referring to it as “Crypto Week.” This initiative is part of a broader effort to integrate cryptocurrencies into the mainstream financial system, balancing the need for regulation with the potential for innovation. The House Committee on Financial Services, led by Chairman French Hill, has been at the forefront of this agenda, emphasizing the importance of these bills in providing a clear regulatory framework for digital assets. This framework is essential for both consumer protection and market stability, and the committee’s efforts have garnered support from various stakeholders, including industry experts and policymakers.

The voting process is anticipated to attract close scrutiny from industry participants and regulators, as the outcomes will have wide-ranging implications for the future of digital assets in the U.S. The CLARITY Act is particularly notable, as it is seen as a foundational element of the regulatory framework, offering much-needed clarity on the legal status of digital assets and the responsibilities of market participants. The GENIUS Act and the Anti-CBDC Surveillance State Act complement this effort by addressing specific areas of concern within the cryptocurrency ecosystem.

As the House of Representatives prepares to vote on these bills, the focus remains on creating a balanced regulatory environment that supports innovation while protecting consumers. The outcomes of these votes will significantly influence the future trajectory of digital assets in the U.S., setting the stage for further developments in this dynamic and rapidly evolving field.

Crypto

The Best Crypto and Bitcoin Blackjack Websites [2025]

![The Best Crypto and Bitcoin Blackjack Websites [2025] The Best Crypto and Bitcoin Blackjack Websites [2025]](https://www.bitcoin.com/images/uploads/facebook.png)

The Top 15 Online Blackjack Sites with Bitcoin and Other Cryptos

BC.Game Review

BC.Game has one of the more generous signup bonuses percentage-wise. A sizable welcome package awaits you to open your account and send money to it. Up to four deposits are boosted by the welcome package of BC.Game, each of which is eligible for a humongous percentage match. You just need to ensure that you put in an amount equal to or more than what’s required. You are invited to check the BC Originals and the new releases, as these categories are put topmost on the main drop-down menu. All proprietary games of BC.Game are provably fair and feature clean but beautiful graphics. These titles also stand out with a high RTP.

Committed to excellence, BC.Game operates in conjunction only with licensed and reputable gaming entities such as software providers 1×2 Gaming, 7Mojos, Amatic, and Belatra. When it comes to online blackjack with Bitcoin, the operator has chosen software developers like BGaming, NetEnt, Evolution, and Playtech to cater to the gamblers. You get information about the RTP and publisher of each game before launching it. Just hover over the information icon to get this data revealed. As is customary with blackjack, the RTP is between 99% and 99.6%. These are other features of BC.Game worth noting:

Perks

Welcome bonus

360% Bonus up to $100,000 + 400 Free Spins + 20% Rakeback | No KYC, No Withdrawal Limits 👑

Supported languages

English, Chinese, Filipino, Turkish, Russian, Korean, Arabic, Finnish, Vietnamese, French, Portuguese, Polish, Indonesian, Spanish, German, Italian, and Hebrew

Accepted cryptocurrencies

BTC, ETH, DOGE, XRP, ADA, DOT, TRX, BNB, AVAX, SOL, MATIC, CRO, FTM, RUNE, ATOM, NEAR

License

Curaçao Gaming License

Year operation started

2017

360% Bonus up to $100,000 + 400 Free Spins + 20% Rakeback | No KYC, No Withdrawal Limits 👑

Get Bonus

Stake Review

If you were wondering how a textbook, licensed casino site looks, you could take Stake as the perfect example. It is not a new platform by any means, founded in 2017. For several years in the most competitive market, Stake has already proven to be a proponent of responsible gambling as it holds an international gambling license. Financing your gambling sessions is easy if you have crypto handy. You can pick one from the payment systems of Dogecoin, Ethereum, Bitcoin Cash, or Tether to fund or reload your account. Tron and Ripple are also workable solutions. Once you have crypto in your account, we recommend trying the Stake Originals. The randomness of their RNGs is verifiable.

Stake.com will match your passion for Bitcoin gambling on blackjack with eleven tailor-made games. The software developers with a share in the pool of blackjack games at Stake are Stake Originals, Relax Gaming, Evolution, Pragmatic Play, Play’n GO, and BGaming. You will be able to play multi-handed, play Pontoon, and even the ever-popular Lightning Blackjack. Before loading any of these or other games, you get to choose the cryptocurrency you want to play with, including USDT. There are live Bitcoin blackjack tables with a minimum accepted bet of $1, such as a minimum bet of $5 or $10. All in all, an inclusive betting limits range is covered that accommodates wagers of up to $50,000 for blackjack. Here are some pros and cons of Stake:

Perks

Welcome bonus

Exclusive 10% Rakeback and 200% Welcome Bonus up to $1,000 in Crypto.

Supported languages

German, British English, Spanish, French, Hindi, Indonesian, Japanese, Korean, Polish, Portuguese, Russian, Turkish, Vietnamese, Chinese, Finnish

Accepted cryptocurrencies

USDT, BTC, ETH, LTC, DOGE, BCH, XRP, TRX, EOS, BNB, USDC, APE, CRO, LINK, SHIB

License

Established under the laws of Costa Rica

Year operation started

2017

200% Bonus, Instant Withdrawals, Best VIP Club, 100K daily Giveaways, Exclusive Sports Promos 🔥

Get Bonus

Weiss Casino

Weiss Casino, a crypto casino established in 2023 and licensed under Curacao, offers a unique gaming experience with its tokenized rakeback system. The casino provides various incentives, including a generous welcome package of 350% Bonus up to 7,000 USDT + 260 Free Spins + No KYC, along with a multi-tiered loyalty program spanning 30 levels. Players can enjoy daily and weekly cashback rewards of up to 40%, facilitated by the casino’s own token, WEFT.

New players can choose from three exciting first-deposit bonus options. The 1st Welcome Bonus offers a 100% bonus up to 1,000 USDT plus 80 free spins, with a minimum deposit of 20 USDT. Alternatively, the 1st Boost Bonus provides a 110% bonus up to 3,000 USDT and 80 free spins, requiring a minimum deposit of 500 USDT. For high rollers, the 1st High Roller Boost delivers a 125% bonus up to 3,000 USDT and 100 free spins, with a minimum deposit of 1,000 USDT. All bonuses come with a wagering requirement of x45 for the bonus amount and x55 for free spins.

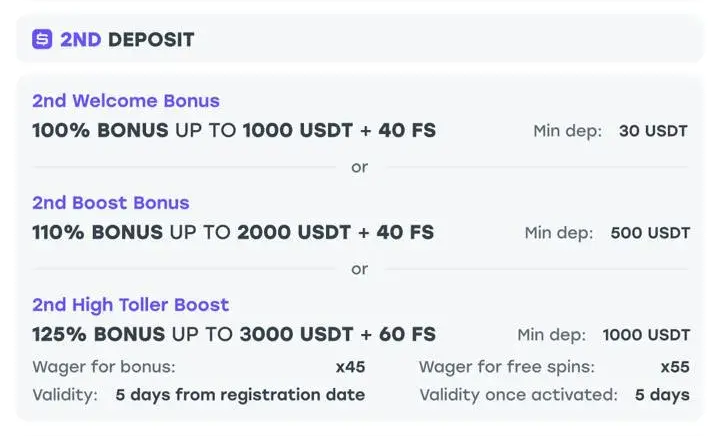

The second deposit also comes with tailored bonus options. The 2nd Welcome Bonus offers a 100% bonus up to 1,000 USDT and 40 free spins for a minimum deposit of 30 USDT. The 2nd Boost Bonus increases the offer to a 110% bonus up to 2,000 USDT plus 40 free spins with a minimum deposit of 500 USDT. High rollers can enjoy the 2nd High Roller Boost, which features a 125% bonus up to 2,000 USDT and 60 free spins for deposits starting at 1,000 USDT. Wagering requirements remain x45 for bonuses and x55 for free spins.

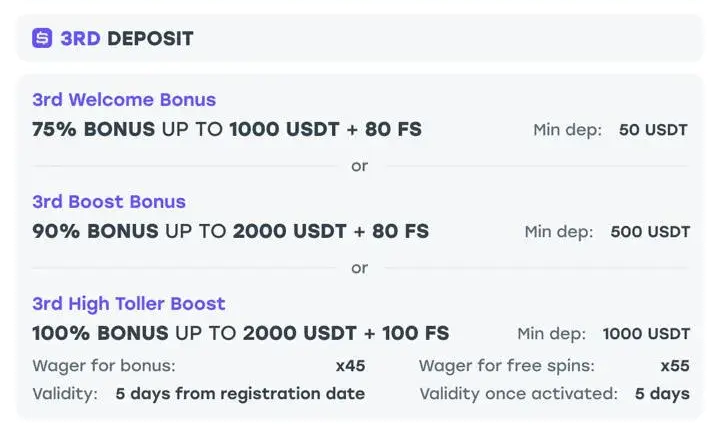

The third deposit continues the rewarding trend. Players can select the 3rd Welcome Bonus, which offers a 75% bonus up to 1,000 USDT and 80 free spins for a minimum deposit of 50 USDT. The 3rd Boost Bonus provides a 90% bonus up to 2,000 USDT plus 80 free spins, with a minimum deposit of 500 USDT. Lastly, the 3rd High Roller Boost delivers a 100% bonus up to 2,000 USDT and 100 free spins for deposits of 1,000 USDT or more. Bonuses must be activated within 5 days of registration and are valid for 5 days from activation, with the same wagering requirements as the previous bonuses.

In addition to the standard welcome pack, which includes bonuses and free spins across multiple deposits, Weiss Casino offers token gifts to players upon registration and email verification, allowing them to accumulate up to 25 tokens. The casino’s cashback program offers up to 40% cashback on losses, with different rates for daily and weekly cashbacks, both with and without wagering requirements.

WEFT Tokens serve as the real cryptocurrency of the casino, powering its tokenized loyalty program. Players can stake tokens for additional rewards through the “Hold to Earn” program and earn tokens from each bet through the “Play to Earn” rakeback program. The loyalty program also provides benefits such as increased staking limits and token gifts upon leveling up.

Weiss Casino supports a wide range of payment methods, including crypto, credit cards, and e-wallets, with a minimum deposit requirement as low as $1 for crypto and $10 for credit cards and e-wallets. Withdrawals are processed swiftly, with crypto withdrawals completed within 24 hours and e-wallet withdrawals within 48 hours.

With an extensive list of game providers and a live casino offering, Weiss Casino ensures an immersive gaming experience for players worldwide. The platform is available in multiple languages and compatible with both instant play and mobile devices, catering to a diverse player base.

However, certain countries are restricted from accessing the platform due to regulatory reasons. Nevertheless, Weiss Casino offers robust customer support through live chat, email, and multilingual phone support, ensuring a seamless gaming experience for its users. Additionally, the casino provides comprehensive legal and privacy policies to safeguard players’ interests.

Perks

Welcome bonus

🔥 350% Bonus up to 7,000 USDT + 260 Free Spins + No KYC 🥷 VIP friendly 😎

Supported languages

They support the following languages on their site, English, German, Spanish, French, Indonesian, Japanese, Portuguese, Russian, Turkish, Hungarian, Czech, Slovak, Romanian, Brazil

Accepted cryptocurrencies

USDT, USDTT, BTC, ETH, TRX, XRP, BNB, USDC, LTC, DOGE, BUSD, DAI, BCH

License

Curaçao Gaming License

Year operation started

2023

🔥 350% Bonus up to 7,000 USDT + 260 Free Spins + No KYC 🥷 VIP friendly 😎

Get Bonus

Lucky Block

Lucky Block Casino, emerging in late 2022, swiftly establishes itself as a premier destination for crypto gambling enthusiasts, offering a vast array of casino games, sports betting options, and enticing rewards facilitated through major cryptocurrencies like Bitcoin, Ethereum, and Tether.

Featuring over 2,700 games from 50+ leading software providers, Lucky Block presents a diverse gaming experience, encompassing slots, table games, live dealers, and an extensive sportsbook, ensuring every player finds their preferred avenue of entertainment.

The casino’s slots selection boasts over 2,000 titles, ranging from classic 3-reel slots to modern video slots and high-volatility games, with popular titles from renowned developers like Pragmatic Play and NetEnt, including themed slots such as Narcos and Game of Thrones.

Progressive jackpot slots like Divine Fortune and Mega Moolah offer players the chance to win life-changing sums, with daily jackpot drops adding excitement and additional winning opportunities to the gameplay experience.

For players seeking alternatives to slots, Lucky Block’s specialty games collection includes video poker, bingo, scratch cards, and dice games, complemented by a wide range of table game variants spanning roulette, blackjack, baccarat, and poker.

The casino’s live dealer section provides an immersive gaming experience, featuring world-class games like blackjack, roulette, and baccarat, streamed in HD quality from state-of-the-art studios, allowing players to interact with real dealers and fellow players in real-time.

In addition to its extensive casino offerings, Lucky Block hosts a comprehensive sports betting platform covering over 20 sports, including esports, with competitive odds and a wide range of betting markets, ensuring a thrilling betting experience for sports enthusiasts.

Further distinguishing itself in the crypto gambling space, Lucky Block offers unique products such as a digital lottery and an NFT marketplace, enhancing the overall gaming experience and providing additional avenues for players to engage and interact.

With its generous welcome bonus offering a 200% match on first deposits up to €10,000, along with fair bonus terms and low minimum bets starting from just $1, Lucky Block aims to reward new players and provide an inclusive and enjoyable gaming environment for all.

Perks

Welcome bonus

200% Bonus up to €25,000 + 50 Free Spins | VPN Friendly | 24/7 Support

Supported languages

English, French, Italian, German, Vietnamese, Chinese, Japanese, Portuguese, Spanish, Korean, Turkish, Norwegian, Hungarian, Czech, Romanian, Russian, Polish, Finnish

Accepted cryptocurrencies

BTC, BCH, ETH, USDT, USDC, SOL, BNB, ADA, TRX, LTC, DOGE

License

Curaçao Gaming License

Year operation started

2022

200% Bonus up to €25,000 + 50 Free Spins | VPN Friendly | 24/7 Support

Get Bonus

Cloudbet Review

With Cloudbet, you get one of the top casinos that accept Litecoin and unique remote gambling offerings for sports betting, live casino, and esports betting. All these services the operator offers under the supervision of the Curacao Gaming Control Board. As is to be expected from someone who plays by the book, the casino stays upfront with its clients at all times and even quotes the theoretical return-to-player percentage of its live dealer games right under the thumbnail of each.

If this is something, wait until you visit the RNG table games of Cloudbet. There are seven baccarat variations, and 31 blackjacks, with the same detail added – the respective RTP below the thumbnail. Some of the highlights in this segment are European Blackjack Gold by Microgaming, BlackJack MH by Play’n GO, and First Person Lightning Baccarat by Evolution. There are so many options that it will take us quite a while to talk them all over. Believe it or not, there are notable jackpot slot games, too, which you can play with crypto thanks to NetEnt, Betsoft, Playson, and others.

Safeguarding your money and processing your payment requests quickly is another thing Cloudbet does very well. On top of that, you can win up to 50 LTC as a welcome bonus. Your Litecoin deposit has to be of value no less than 0.1 to qualify for this promo offer. Things are fairly standard regarding the technical part of sending and receiving Litecoin payments. You have to sign in, go to the designated section, initiate the transaction from there if it’s a withdrawal, or copy your casino wallet address and use it to deposit. These are the most notable pros and cons of Cloudbet:

Perks

Welcome bonus

Up to 2,500 USDT + 150 FS + Up to 30% Rakeback, All Cash No Rollover 🤑

Supported languages

They support a variety of languages on their site such as English, Spanish, German, Italian, French, Swedish, Dutch, Greek, Hungarian, Turkish, Indonesian, Polish, Portuguese, Portuguese (BR), Russian, Korean, Japanese, Thai, and Vietnamese

Accepted cryptocurrencies

ADA, ALGO, AVAX, BCH, BNB, BRETT, BSV, BTC, DAI, DASH, DEGEN, DOGE, DOGS, DOT, ENA, EOS, ETH, FTM, HBAR, HMSTR, stETH, LINK, LTC, POL, PAXG, PONKE, SHIB, SOL, SUSDE, TON, TOSHI, TRON, TRUMP, UNI, USDC, USDE, USDP, USDT, XLM, XRP, ZEC

License

Curaçao Gaming License

Year operation started

2013

Up to 2,500 USDT + 150 FS + Up to 30% Rakeback, All Cash No Rollover 🤑

Get Bonus

Gamdom

Gamdom stands as a prominent online gaming platform that has been captivating over 16 million users since its inception in 2016. Offering a wide array of gaming options ranging from traditional slots to esports betting and exclusive in-house games like Slot Battles, Gamdom caters to diverse gaming preferences. The platform ensures fairness and transparency through provably fair games, providing players with a sense of trust and security in their gaming experience.

Customer satisfaction is paramount at Gamdom, evident through their 24/7 live support and chat moderation available in multiple languages. This commitment to providing a safe and enjoyable environment is further emphasized by their rigorous responsible gaming measures, including self-exclusion and permanent account closure options.

Gamdom rewards its players generously, with perks such as up to 60% rakeback, free spins bonuses, and chat free rains. The “King of the Hill” leaderboard offers substantial prizes, with a prize pool that can reach up to $1,000,000, enhancing the excitement and competitiveness of the platform.

Security features like optional Two-Factor Authentication (2FA) add an extra layer of protection to player accounts, ensuring peace of mind while gaming. Additionally, Gamdom’s unique Community Connected feature allows creators and affiliates to host free spin raffles and cash tip giveaways directly from their Discord server, fostering a sense of community among players.

With a wide range of deposit options, including popular cryptocurrencies and over 100 bank deposit options, Gamdom makes it convenient for players to start playing. Crypto withdrawals are instant, ensuring swift access to winnings and a seamless gaming experience.

New players are welcomed with a generous 15% Rakeback for the first seven days, setting the stage for a rewarding journey from the outset. Furthermore, Gamdom has solidified its reputation in the gaming industry through notable partnerships with influential figures like Usain Bolt and sponsorship of professional esports teams, underscoring its commitment to excellence and innovation.

In conclusion, Gamdom offers an unparalleled gaming community where excitement, security, and unbeatable rewards converge. Join Gamdom today and embark on an exhilarating gaming adventure like no other.

Perks

Welcome Bonus

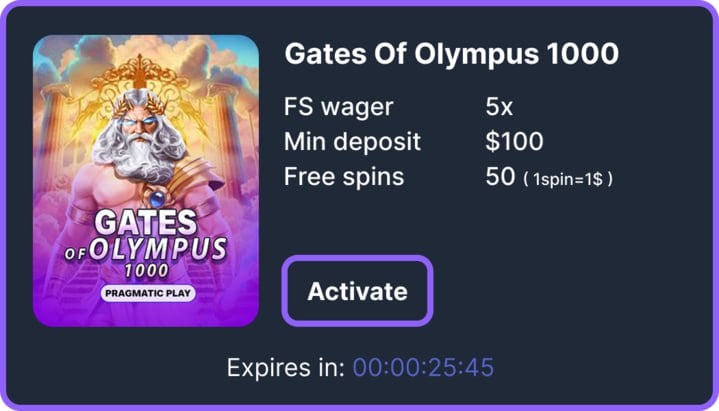

50 FS on Gates of Olympus 1000 with Code: BITCOINGATES – Limited offer 2500 Claims available min $50 Dep

Supported languages

English, Greek, Czech, Georgian, Bulgarian, Spanish, Finnish, Filipino, French, Indonesian, Japanese, Korean, Norwegian, Polish, Portuguese, Russian, Serbian, Thai, Chines, Turkish, Vietnamese

Accepted cryptocurrencies

USDT, BTC, ETH, LTC, TRX, XRP, DOGE

License

Curaçao Gaming License

Year operation started

2016

50 FS on Gates of Olympus 1000 with Code: BITCOINGATES – Limited offer 2500 Claims available min $50 Dep

Get Bonus

Mega Dice

Embark on an extraordinary online gambling adventure with Mega Dice, a pioneering platform that seamlessly merges the thrill of casino games and the excitement of sports betting. Operating under the prestigious license of Curacao, Mega Dice is a global sensation accessible in numerous countries, either directly or through the convenience of a VPN. Setting itself apart in the crypto casino trend, Mega Dice exclusively accepts cryptocurrency payments, offering players a secure and efficient gateway to engage in thrilling gaming experiences.

At Mega Dice, new players are greeted with open arms and an enticing bonus package that sets the stage for a rewarding journey. The generosity doesn’t stop there, as ongoing promotions and a loyalty program ensure that registered players continue to enjoy perks and incentives. Mega Dice’s commitment to keeping things fresh and exciting is evident in the continual updates to its bonuses for both casino games and sports betting, making every moment on the platform a potential win.

As the online gambling industry propels towards significant growth, Mega Dice emerges as a frontrunner, capturing global attention as the world’s first licensed crypto casino accessible via the Telegram app. Leveraging Telegram’s innovative bot capabilities, Mega Dice brings a new level of convenience and user-friendliness to crypto casino gaming. Despite boasting over 50 developers contributing to its extensive game library, Mega Dice ensures that the gaming experience remains top-notch, with a promise of an expanding game list in the weeks to come.

Mega Dice’s gaming repertoire is nothing short of spectacular. Delve into a world of vibrant slot games, featuring titles from renowned developers like NoLimit City, Hacksaw Gaming, Push Gaming, Pragmatic Play, and more. The inclusion of a free-play mode allows players to explore these captivating slots risk-free before diving into real-money bets. From the crime-thriller-themed “Rock Bottom” to the punk-inspired “Punk Toilet,” Mega Dice offers a diverse and entertaining selection.

Experience the thrill of live dealer games in Mega Dice’s second category, covering classics like Roulette, Blackjack, Baccarat, and Poker. Engage with professional dealers in an authentic gaming atmosphere. For those seeking a unique twist, explore the world of game shows featuring titles like Crazy Time and Deal or No Deal. Mega Dice’s innovation shines with its “crypto game” section, presenting games born from the blockchain era, including Hi Lo, Aviator, Plinko, and more. The graphics may be simplified, but the fun and impressive payouts remain a constant source of delight.

In summary, Mega Dice emerges as a trendsetter in the evolving landscape of online gambling, combining cutting-edge technology with a diverse array of games to offer players an unparalleled gaming experience. Join Mega Dice today and witness the future of crypto casino and sportsbook entertainment.

Perks

Welcome bonus

200% Bonus up to 1 BTC + 50 Free Spins + Sports Free Bet!

Supported languages

English, German, Spanish, French, Hungarian, Finnish, Norwegian, Czech, Italian, Polish, Portuguese, Romanian, Russian, Japanese, Turkish, Chinese, Indonesian, Arabic, Korean, Vietnamese, Thai

Accepted cryptocurrencies

BTC, BCH, ETH, USDT, USDC, SOL, BNB, ADA, TRX, LTC, DOGE

License

Curaçao Gaming License

Year operation started

2020s

200% Bonus up to 1 BTC + 50 Free Spins + Sports Free Bet!

Get Bonus

Flush

With a vast selection of over 5,000 games, Flush Casino partners with leading providers like Hacksaw Gaming, Evolution, Betsoft, and Quickspin. Popular titles include Big Bass-Hold & Spinner, Wanted Dead or Wild, and Gates of Olympus.

The platform boasts a massive game variety, offers tiered welcome bonuses up to $1,000, and features an extensive loyalty program. However, it lacks a sportsbook, and some players may need a VPN for access.

Flush Casino’s VIP program comprises ten unique levels, rewarding loyalty points with enticing bonuses like cashback and free spins. Additional promotions include monthly wager races, tournaments, VIP cashback, and free spins for high rollers.

Flush Casino runs an affiliate program, allowing existing players to earn commissions on referrals. Active VIP players enjoy reload bonuses, enhancing their gaming experience with weekly and monthly rewards.

Flush Casino caters to diverse gaming preferences, offering slots, roulette, blackjack, poker, live dealer games, and more. The platform stands out as one of the best crypto poker sites, with a selection of almost 60 poker games.

Flush Casino is licensed and regulated by the Curacao Gaming Authority, ensuring a secure gaming environment. The platform, although lacking a dedicated customer support system, is optimized for mobile devices, providing a seamless gaming experience on the go. Join Flush Casino for a licensed, secure, and diverse online gaming journey.

Perks

Welcome bonus

🔒 Fast & Secure – VPN Friendly | Instant Withdrawals ⚡ | 200% Bonus up to $1,000 | Personalized VIP Offers

Supported languages

English, French, Portuguese, Spanish, German, Russian, Japanese, Chinese, Italian, Czech

Accepted cryptocurrencies

BTC, ETH, LTC, USDT, USDC, MATIC, DOGE, BNB

License

Curaçao Gaming License

Year operation started

2020s

🔒 Fast & Secure – VPN Friendly | Instant Withdrawals ⚡ | 200% Bonus up to $1,000 | Personalized VIP Offers

Get Bonus

Bets.io

Bets.io, a licensed online crypto casino and sports betting platform, stands out as a premier destination for global gaming enthusiasts. Personally navigating the platform, it’s clear that Bets.io is committed to providing an authentic, cutting-edge, and user-friendly online gambling experience. The casino has earned prestigious SiGMA awards, including Best Crypto Casino 2023 and Rising Star Casino Operator 2022, underscoring its dedication to excellence.

One of Bets.io’s key attractions is its expansive game library, featuring over 10,000 diverse titles that cater to the varied tastes of players worldwide. Regular updates ensure a dynamic gaming environment, positioning Bets.io as an international hub of perpetual excitement. In a strategic move in 2023, Bets.io expanded into the sports betting industry, offering a network that spans 40+ sports categories. Punters can engage in various bet types, and the sportsbook adheres to industry standards while promising continued evolution.

The casino and sports betting rooms at Bets.io are adorned with enticing promotions, available from the moment players join until the conclusion of their gaming journey. Additionally, the platform’s loyalty program ensures that devoted players receive special treatment through seasonal custom offers and exclusive rewards. Bets.io’s commitment to seamless banking operations in both crypto and fiat currencies further enhances the overall gaming experience. With swift transactions and responsive 24/7 technical support, Bets.io solidifies its position as a top choice for those seeking a comprehensive and dynamic online gaming platform that seamlessly combines crypto casino and sports betting experiences.

Perks

Welcome bonus

250% Welcome Bonus up to 1 BTC + 250 FS | Bonus Code – BITBETS

Supported languages

They support a variety of languages on their site such as English, German, French, Arabic, Spanish, Japanese, Turkish, Hindi, Chinese, and Russian.

Accepted cryptocurrencies

BTC, BCH, DOGE, ETH, LTC, USDT, XRP, TRX, ADA, BNB, DAI

License

Government of the Autonomous Island of Anjouan, Union of Comoros

Year operation started

2021

250% Welcome Bonus up to 1 BTC + 250 FS | Bonus Code – BITBETS

Get Bonus

Casinopunkz

Casinopunkz.io offers an engaging gaming experience with a wide variety of games from top-tier providers, ensuring players always have something new to explore. The platform’s lobby features diverse categorie , such as Megaways, table games, and grid slots, making it easy for users to find their preferred games. Known for hosting popular providers like Pragmatic Play, Hacksaw Gaming, and Playso , Casinopunkz.io caters to both casual players and high rollers alike. With a streamlined search function and an impressive selection of new releases, it keeps the excitement flowing for all gaming enthusiasts.

The “New Games” section is particularly enticin , showcasing fresh titles from top developers such as Wazdan, Kalamba Games, and Nolimit City. These frequent updates provide users with cutting-edge slots and innovative features that keep the experience dynamic. Bonus Buy option , accessible within games from providers like Octoplay and Novomatic, add an extra layer of thrill, allowing players to fast-track into bonus rounds and enhance their winning potential.

Casinopunkz.io ensures fair play with its Provably Fair featur , giving players confidence in every spin and bet. Titles from Turbogames and Golden Rock Studios further strengthen the platform’s commitment to transparency. For those who enjoy strategy-based games, the table games section offers multiple variants of roulette, blackjack, and baccara , powered by Evolution Gaming and OneTouch, promising a highly immersive experience.

Fans of high volatility and Megaways slot will find a plethora of options from Pragmatic Play and Big Time Gaming, delivering the potential for substantial payouts. The grid slots and Hold and Win mechanics ensure plenty of engaging gameplay styles, with providers like 3Oaks and Booming Games contributing unique experiences. Whether users prefer classic gameplay or innovative twists, Casinopunkz.io meets all expectations.

The platform also nurtures its community with VIP programs, tournaments, and promotion , ensuring players remain engaged beyond the games themselves. Casinopunkz.io’s Punkz Playground adds a distinctive flair, providing niche-themed games and exclusive content. With seamless access to support, fair policies, and frequent challenges, it stands out as a well-rounded casino destination that keeps players returning for more action.

Perks

Welcome bonus

15% Weekly Cashback + €5,000 Bonus 🤑 New Anonymous Crypto Casino 🚀 No KYC & VPN-friendly 🥷🏿

Supported languages

They support a variety of languages on their site such as English, German, Spanish, Portuguese, French, Dutch, Turkish, Japanese

Accepted cryptocurrencies

BTC, ETH, USDT, LTC, BNB, DOGE, XRP, TRX, SHIB, SAND

License

Government of the Autonomous Island of Anjouan, Union of Comoros

Year operation started

2024

15% Weekly Cashback + €5,000 Bonus 🤑 New Anonymous Crypto Casino 🚀 No KYC & VPN-friendly 🥷🏿

Get Bonus

Celsius Casino

Celsius Casino stands out as a premier destination for online gaming, boasting a rich array of features and services tailored to meet the needs of discerning players. With a solid track record of four years under its belt, this licensed establishment in Curacao has earned its reputation as a trusted and reliable platform.

What sets Celsius Casino apart is its remarkable presence on popular streaming platforms like Kick and Twitch, where it ranks as the third most streamed casino. This popularity speaks volumes about the engaging and thrilling experience it offers to players worldwide.

At Celsius Casino, convenience reigns supreme with instant withdrawals available around the clock. Coupled with prompt and responsive support available 24/7 in both English and French, players can enjoy a seamless gaming experience without any hassles.

One of the standout features of Celsius Casino is its Instant Rakeback system, rewarding players instantly as they play. Moreover, the VIP Club with a dedicated host caters to high rollers, offering exclusive perks and privileges.

With an impressive lineup of 10 events per month and unique features like Bonus Buy battles, Celsius Casino ensures that there’s never a dull moment for its players. The ability to buy crypto onsite with 0% fees further enhances the convenience factor, making transactions swift and cost-effective.

For affiliates, Celsius Casino goes the extra mile by offering a lucrative No Deposit bonus. By simply clicking on the affiliate link, users are treated to 50 Free Spins without any conditions, adding extra value right from the start.

In summary, Celsius Casino combines cutting-edge technology, top-tier gaming providers, and unparalleled customer service to deliver an exceptional gaming experience. Whether you’re a seasoned player or new to online casinos, Celsius Casino promises excitement, rewards, and endless entertainment.

Perks

Welcome bonus

550% up to €2,000 + 250 Free spins | Instant Withdrawal | NO KYC

Supported languages

English, French, German

Accepted cryptocurrencies

BTC, ETH, LTC, TRX, BCH, DOGE, XRP, BNB, USDT (TRC-20), USDT (BEP-20)

License

Curaçao Gaming License

Year operation started

2021

550% up to €2000 + 250 Free spins | Instant Withdrawal | NO KYC

Get Bonus

MyStake

MyStake, a prominent player in the online gambling sphere, offers a myriad of gaming options, making it a compelling choice for enthusiasts. With over 7,000 games, including a diverse selection of slots, table games, and live dealer options, players have an extensive array to explore. Moreover, the availability of over 40 payment methods, including various fiat and cryptocurrencies, ensures convenient and flexible deposit options. Additionally, the platform caters to sports betting enthusiasts with over 70 different sports to wager on, accompanied by an extensive portfolio of bonuses and promotions, enhancing the overall gaming experience.

While MyStake presents an impressive array of offerings, it is not devoid of shortcomings. One notable drawback is the utilization of bots before human interaction in the live chat support system. Moreover, the absence of transparent information regarding the VIP system and relatively low withdrawal limits may deter some users.

Delving into MyStake’s background, the platform was founded in 2019 and is owned by Santeda International B.V., operating under a Curaçao license. With an array of supported currencies and languages, MyStake endeavors to cater to a diverse global audience, ensuring accessibility and inclusivity.

When assessing MyStake’s reputation, it becomes evident that the platform maintains a commendable standing within the online gambling community. Backed by Sainted International B.V., a reputable operator in the industry, MyStake benefits from its extensive experience and global presence. While occasional user complaints exist, primarily concerning deposit issues and withdrawal delays, MyStake’s overall positive reputation underscores its credibility and reliability.

Regarding safety measures, MyStake prioritizes user security by implementing standard encryption protocols, including SSL encryption, to safeguard sensitive information and transactions. Despite occasional user complaints, there have been no reported security breaches, indicating the platform’s commitment to providing a secure gaming environment.

MyStake’s gaming portfolio encompasses a vast array of options, including exclusive titles and provably fair games, ensuring diverse and entertaining experiences for players. Moreover, the platform’s user-friendly interface and seamless mobile optimization enhance the overall gaming experience, further solidifying its appeal among users.

In the realm of sports betting, MyStake offers an extensive selection of sports, covering traditional, esports, and virtual sports, catering to a wide range of preferences. Comprehensive coverage of major sporting events and leagues, coupled with engaging betting features, positions MyStake as a compelling destination for sports enthusiasts and bettors alike.

While MyStake lacks poker options beyond video poker games, it compensates with a plethora of bonuses and promotions, including welcome bonuses and ongoing rewards. However, the lack of transparency surrounding the VIP program remains a notable concern, warranting improved clarity and communication from the platform.

In conclusion, MyStake emerges as a formidable player in the online gambling sphere, offering a diverse array of gaming options, coupled with robust security measures and enticing bonuses. Despite certain drawbacks, its positive reputation and commitment to user satisfaction position it as a promising platform for gaming enthusiasts.

Perks

Welcome bonus

💰 Get a 300% Bonus Instantly – No KYC, No Fees | Play with Crypto & VIP bonuses 🤑

Supported languages

English, Spanish, German, Italian, French, Arabic, Portuguese (BR), Finnish, Swedish, Portuguese, Russian, Czech

Accepted cryptocurrencies

BTC, USDT, ETH, LTC, BCH, XRP, DASH, DOGE, USDC, BUSD, BNB, TRX, XMR

License

Curaçao Gaming License

Year operation started

2019

💰 Get a 300% Bonus Instantly – No KYC, No Fees | Play with Crypto & VIP bonuses 🤑

Get Bonus

Donbet

Donbet Online Casino offers a unique and immersive experience, transporting players into a luxurious mafia-themed world filled with deep purples, blacks, and elegant attire. This stylish backdrop sets the stage for an exciting gaming journey. The site features an impressive array of over 6,000 games sourced from top-tier providers, ensuring a diverse selection for all types of players. From thrilling slot machines and live casino games to classic table games and scratch cards, Donbet caters to every preference, making it a comprehensive online casino.

Navigating Donbet is a breeze thanks to its user-friendly interface. Clear game categories and intuitive filtering tools make it easy to find your favorite games or explore new ones. The extensive game library includes offerings from renowned providers such as NetEnt, Microgaming, and Evolution Gaming, ensuring high-quality entertainment. Whether you enjoy tournaments, mini-games, slots, or traditional table games, Donbet has something to keep every player engaged.

The bonuses and promotions at Donbet are generous and varied, appealing to both new and seasoned players. Newcomers can take advantage of a substantial welcome bonus, which matches deposits up to £750 and includes 50 free spins. Crypto users are also catered to with a 170% crypto welcome bonus and 100 free spins. Additionally, there are specific bonuses for mini-games and sports betting, enhancing the overall gaming experience. The unique VIP program rewards loyal players with exclusive bonuses and personalized promotions.

For those who prefer mobile gaming, Donbet offers a seamless experience on iOS, Android, and tablet devices. Although there isn’t a dedicated app, the mobile version of the site is designed to be intuitive and easy to navigate. The mobile platform retains all the functionality of the desktop version, ensuring that players can enjoy their favorite games and place bets on the go. Donbet’s sports betting section is equally impressive, with a wide range of sports and over 50,000 monthly events to bet on, including live betting options.

Donbet is committed to providing a secure and reliable gaming environment. Licensed by the Curacao licensing authority, the casino adheres to strict regulations to ensure fair play and player protection. Robust security measures, including TSL encryption and SSL certification, safeguard player data and transactions. Customer support is available 24/7 through live chat and email, with dedicated VIP managers for high-level players. While customer service is limited to English, German, and Russian, the support team is responsive and helpful, enhancing the overall player experience.

Perks

Welcome bonus

150% Match Bonus up to €750 + 50 Free Spins + Exciting Tournaments + Rewarding VIP Loyalty System!

Supported languages

English, Spanish, German, Italian, French, Arabic, Portuguese (BR), Finnish, Swedish, Portuguese, Russian, Czech

Accepted cryptocurrencies

BTC, USDT, ETH, LTC, BCH, XRP, DASH, DOGE, USDC, BUSD, BNB, TRX, XMR

License

Curaçao Gaming License

Year operation started

2023

150% Match Bonus up to €750 + 50 Free Spins + Exciting Tournaments + Rewarding VIP Loyalty System!

Get Bonus

1xBit

1xBit offers an unparalleled cryptocurrency betting experience, boasting a wide array of enticing bonuses and rewards. As a new user, you can enjoy a generous welcome bonus of up to 7 BTC across your first four deposits. This substantial incentive sets the stage for a thrilling journey, with opportunities to win big from the start. Additionally, 1xBit’s platform ensures you can earn unlimited cashback with bonus points on every bet you place, providing continuous rewards whether your bets win or lose. These points can be converted into funds for future bets, enhancing your overall betting experience.

1xBit hosts exciting games tournaments, offering players the chance to compete for valuable prizes. This feature adds an extra layer of excitement to the platform, as you engage in these challenges, play your favorite slots or live casino games, and showcase your skills to claim your share of the rewards. The Accumulator of the Day bonus further enhances your potential winnings by boosting your odds by 10% on selected sporting events. This feature is perfect for those looking to maximize their returns on carefully curated accumulator bets.

1xBit’s Win-Win Deal ensures you can place accumulator bets with peace of mind. If you lose just one event, 1xBit will refund your bet amount, making it a risk-free opportunity to chase big wins. This deal applies to both pre-match and live bets, across a variety of sports. Additionally, the Advancebet feature allows you to access bonus funds with unsettled bets in your account, ensuring the excitement never stops and you always have the chance to place more bets.

The platform’s VIP Cashback program rewards loyal players with increasing cashback percentages as they climb the loyalty levels. Each new level unlocks special rewards, making your gaming journey even more rewarding. Moreover, the 100% Bet Insurance option lets you secure your bets, either partially or in full, providing a safety net in case of losses. This insurance can be purchased for both single and accumulator bets, ensuring you can play confidently.

1xBit also features a Promo Code Store where you can exchange bonus points for free bets, allowing you to choose the value and type of sport you prefer. Beyond these bonuses, 1xBit offers an extensive range of markets, covering over 50 sports and esports with more than 1,000 markets available for each match. The platform provides sky-high odds in six different formats, ensuring you get the best value for your bets. With over 10,000 slots from top providers and more than 1,000 live dealer games, 1xBit caters to both sports betting and casino enthusiasts alike. Dive into 1xBit’s world and experience the thrill of winning with every bet.

Perks

Welcome bonus

Bonus up to 7 BTC 👑 + No Deposit code BITCOIN100 gives 50 FS wager 20x (!) on PRIMAL HUNT slot 🎁 + 70 FS after 1st Dep 💰 + NO KYC ️+ Instant Withdrawal 🚀

Supported languages

They support a variety of languages on their site such as Arabic, Portuguese (BR), Bengali, Chinese, English, Danish, German, Czech, Greek, French, Finnish, Spanish, Hungarian, Croatian, Hindi, Hebrew, Japanese, Italian, Farsi, Indonesian, Polish, Russian, Norwegian, Malaysian, Korean, Swedish, Romanian, Portuguese, Vietnamese, Turkish, Thai

Accepted cryptocurrencies

BTC, ETH, SOL, TRX, BCH, ETC, XRP, LTC, DOGE, DASH, XMR, ZEC, XEM, DGB, XVG, QTUM, ADA, EOS, DOT, TON, AVAX, ATOM, MATIC, ALGO, USDT, USDC, DAI, LINK, SHIB, USDC.e, BNB, PSG, JUV, ASR

License

Government of the Autonomous Island of Anjouan, Union of Comoros

Year operation started

2016

Bonus up to 7 BTC 👑 + No Deposit code BITCOIN100 gives 50 FS wager 20x (!) on PRIMAL HUNT slot 🎁 + 70 FS after 1st Dep 💰 + NO KYC ️+ Instant Withdrawal 🚀

Get Bonus

500 Casino

500 Casino has established itself as a premier online gaming platform, particularly popular among cryptocurrency users and fans of CS skin betting. Originally known as CSGO500, the platform has significantly broadened its scope to include a wide variety of casino games, catering to a diverse audience. Players can indulge in an impressive array of slots, table games, and live dealer games, all of which are powered by some of the most renowned developers in the industry. The site’s seamless integration of these games ensures that players have access to a top-tier gaming experience, whether they’re on a desktop or mobile device.

The gaming experience at 500 Casino is further enhanced by its commitment to player security and fair play. The platform uses advanced encryption technology to protect user data, and all games operate on provably fair algorithms, providing transparency and trust for players. This focus on safety, combined with its strict adherence to industry regulations, has helped 500 Casino build a reputation as a trustworthy and reliable platform for online gambling. The site also offers a variety of responsible gaming tools, allowing players to monitor their activity and set limits, ensuring a safe and enjoyable environment for all users.

In addition to its vast selection of games, 500 Casino offers a variety of promotions and bonuses designed to enhance the player experience. These incentives cater to both new and returning players, providing opportunities to maximize winnings and extend gameplay. The platform’s unique blend of traditional casino games and modern offerings, such as its popular ‘Crash’ and ‘Wheel of Fortune’ games, sets it apart from other online casinos. This variety, along with the platform’s dedication to user satisfaction, has made 500 Casino a top choice for online gamblers worldwide.

Customer support is another area where 500 Casino excels, offering 24/7 assistance through various channels, including live chat and email. The support team is comprised of knowledgeable professionals who are well-versed in the intricacies of online gaming, ensuring that any issues players encounter are resolved swiftly and efficiently. This high level of customer service, coupled with the platform’s user-friendly interface, makes for a smooth and hassle-free gaming experience, reinforcing 500 Casino’s position as a leader in the online gambling industry.

Overall, 500 Casino’s evolution from a CS skin betting site to a comprehensive online casino reflects its ability to adapt and grow in a competitive market. With its diverse game selection, robust security measures, generous bonuses, and exceptional customer service, the platform offers a well-rounded and enjoyable gaming experience for players of all levels. Whether you’re a seasoned gambler or new to the scene, 500 Casino provides a secure and entertaining environment that keeps players coming back for more.

Perks

Welcome bonus

300% deposit Bonus up to $15,000 + 50 Free Spins + Instant Withdrawals!

Supported languages

They support a variety of languages on their site such as English, Spanish, French, Portuguese, German, Hindi, Polish, Danish, Arabic, Japanese, Finnish, Russian, Turkish

Accepted cryptocurrencies

They offer a wide range of deposit options, including popular cryptocurrencies like BTC, ETH, LTC, BNB, USDT, USDC, TRX, BCH, XRP, XLM, EOS, SOL, DOGE, AVAX, MATIC, and ADA and many real-money deposit options.

License

Curaçao Gaming License

Year operation started

2016

300% deposit Bonus up to $15,000 + 50 Free Spins + Instant Withdrawals!

Get Bonus

7 Bit Casino

Players from all over the world can discover the excellent gaming platform 7BitCasino, which has been providing access to incredible service and quality facilities since 2014. The main focus of the platform aims to provide fair and transparent betting in casino games. When it comes to the games specifically, you’ll immediately want to say that at least 5,000 games will be available for your consideration. And since this platform is more focused on crypto betting, there are at least 4,000 games for that purpose. Since this is a crypto portal, it exists according to all canons of anonymity. But, in some exceptions, players may be asked to undergo verification.

Every user who does not want to risk real funds and wants to test the functionality can play in demo mode. This platform takes responsible gaming very seriously and offers some tools to help players set limits on various financial transactions.

As a result of the licensing of activities, the operator company Dama N.V. holds a Curacao license number 8048/JAZ2020-013. The existence of such a document obliges holders to maintain strict accountability and open operations to ensure security. The license also obliges the company to adhere to the rule of no multi-accounting. This means that the One IP-One Account conditions are strictly enforced here. As a consequence, this prevents the possibility of misuse of promotional offers and other bonuses.

The site has a policy of no commissions for crypto payments. However, if players choose fiat currencies, deposits and withdrawals may be subject to an additional 2.5% commission. In addition, players are interested in what limits exist on deposits and withdrawals. It is noteworthy that this information will vary significantly. The fact is that the limits on financial transactions depend on the payment instrument that players use. Reaching the bonus policy players will learn that the platform is constantly improving in this area. In addition to the First Deposit Bonus and Welcome Offer, players have access to various Free Spins, Reload Bonuses, and Cashback. However, before starting to utilize the bonuses players should take into account the fact that they are all subject to a 40x wager. These bonus offers can be spent in a variety of activities, as the platform offers the opportunity to play best-selling games such as Space Wars or Money Train 2, card games, roulette and a truly huge library of Live Games.

Processing of financial transactions on the site takes place in Instant mode and does not take much time. We can say that deposits are virtually instantaneous, and withdrawals can vary between 1 hour and 3 banking days. The gaming platform is designed for the audience all over the world. But, it is necessary to take into account the fact that some countries are prohibited by licensing requirements.

If there is any problem that a player cannot solve on his own, he can always contact the Customer Service. This service works 24/7 and can help everyone via online chat, Email or contact form.

Summarizing all of the above, it is safe to say that 7BitCasino relies on its experience gained over the years of providing services. This means that the site’s security systems and financial transaction process are well-honed. Thus, players get an incredible experience that borders on excellent service, with elaborate bonuses, minimal commissions and responsive Customer Service on the one hand. And on the other hand it is simply a fantastic set of entertainment where everyone can touch a dream.

Perks

Welcome bonus

Welcome pack – 325% up to 5 BTC + 250 Free Spins + No Deposit 30 Free Spins with code DEEPBIT

Supported languages

English, German, French, Italian.

Accepted cryptocurrencies

BTC, BCH, ETH, LTC, DOGE, USDT

License

Curaçao Gaming License

Year operation started

2014

Welcome pack – 325% up to 5 BTC + 250 Free Spins + No Deposit 30 Free Spins with code DEEPBIT

Get Bonus

Jackbit

JackBit online casino welcomes all players seeking boundless adventures and unparalleled experiences. Established in 2022 and licensed by Curacao, JackBit offers a diverse range of gaming options, from fast payments to outstanding content. With a user-friendly design and mobile compatibility, navigating the site is a breeze, enhancing the overall gaming experience. Whether you’re into Sportsbetting, Casino games, Aviator, or Exclusive Mini-Games, JackBit has something for everyone.

For those interested in bonuses and promotions, JackBit’s Rakeback VIP Club offers an exciting gaming experience where loyalty pays off. With no wagering requirements and instant rakeback, players can enjoy their rewards without any strings attached. Climbing the VIP levels unlocks even more privileges, ensuring a rewarding journey for loyal players.

In the realm of sports betting, JackBit stands out with its comprehensive offerings. With options like Prematch, Live, Virtual, Racing, and E-Sports, sports enthusiasts have access to a plethora of markets and events. Whether it’s traditional sports or E-Sports like Dota, LoL, or CS:GO, JackBit provides an immersive betting experience with top feed providers and live streaming capabilities.

JackBit boasts a vast selection of casino games from renowned providers, totaling over 7000 titles. From classic slots to jackpot games and bonus buy features, players can explore various categories to find their favorites. With providers like NetEnt, Microgaming, and Evolution, quality and diversity are guaranteed in the casino section.

The live casino at JackBit offers over 200 games, including classics like Live Baccarat, Blackjack, and Roulette, as well as exciting game shows. With providers such as Evolution and Ezugi, players can enjoy an authentic casino experience from the comfort of their homes.

For crypto enthusiasts looking for fast-paced entertainment, JackBit offers exclusive Mini-Games. These simple yet entertaining games provide an opportunity to have fun and potentially earn money effortlessly. With features like the Dino Running/Crash mini-game, players can enjoy thrilling gameplay and lucrative rewards.

In addition to gaming options, JackBit ensures seamless payment processes with instant deposits and withdrawals. Players can use a variety of cryptocurrencies, including BTC, ETH, and LTC, as well as fiat currencies like USD, EUR, and GBP. With 24/7 multilingual support and a commitment to responsible gaming, JackBit strives to provide a safe and enjoyable environment for all players.

In addition to its offerings, JackBit provides enticing welcome bonuses for both its casino and sportsbook sections. For casino enthusiasts, there’s a lucrative welcome bonus with straightforward terms. To qualify, players need to deposit a minimum of 50 USD using the bonus code WELCOME. Upon the first deposit, players receive 100 free spins on “Book of Dead.” The maximum winnings from these free spins are capped at 100 USD, and the best part is that winnings are directly credited to the real balance, with no wagering requirements attached.

For sports aficionados, JackBit offers a generous welcome bonus to kickstart their betting journey. Players can receive 100% of their first bet amount back if the bet is lost, up to a maximum of $100. To qualify, the minimum stake required is $20, and participants must adhere to specific betting criteria. Bets must include a minimum of three positions, with each position having odds of at least 1.4.

These welcome bonuses reflect JackBit’s commitment to providing value and excitement to its players, whether they prefer casino games or sports betting. With transparent terms and enticing rewards, players can embark on their gaming journey with confidence, knowing that JackBit has their entertainment and satisfaction in mind.

Perks

Welcome bonus

No wagering 100 Free Spins + 100% of the first bet amount back + Rakeback up to 30% + No KYC + Zero Fees

Supported languages

They support a variety of languages on their site such as English, German, French, Russian, Turkish, Spanish, Finnish, Italian, Korean, Portuguese (BR), Japanese

Accepted cryptocurrencies

BTC, ETH, XRP, LTC, BCH, XMR, DASH, DOGE, BNB, USDT, TRX, USDC, SOL, BUSD, MATIC, DAI, SHIBA, LINK, ADA

Year operation started

2022

License

Curaçao Gaming License

No wagering 100 Free Spins + 100% of the first bet amount back + Rakeback up to 30% + No KYC + Zero Fees

Get Bonus

Megapari

Megapari Casino is a top-tier online gambling platform renowned for its extensive collection of games and partnerships with leading software providers. Whether you’re a fan of slots, poker, or live casino games, Megapari offers a wide variety of options to keep players engaged. With popular titles from providers like NetEnt, Microgaming, and Playtech, players can explore everything from classic slot games to immersive live dealer experiences. This vast selection ensures that Megapari Casino caters to the preferences of all types of players, making it a standout choice in the online gaming industry.

The sportsbook at Megapari offers an impressive range of betting options, covering nearly 30 different sports. Whether you’re into football, cricket, or eSports, the platform provides a comprehensive betting experience with high odds and live betting opportunities. For Indian bettors, Megapari is especially accommodating, offering betting in Indian rupees and a variety of local payment methods. This tailored approach, combined with the platform’s extensive sports coverage, makes Megapari one of the best choices for sports enthusiasts looking to place bets online.

Megapari Casino’s payment methods are another strong point, offering over 60 options, including cryptocurrencies. The casino’s commitment to providing fee-free transactions for both deposits and withdrawals is a major advantage, ensuring that players can focus on enjoying their gaming experience without worrying about hidden fees. With fast processing times and secure payment options, Megapari Casino stands out as one of the best online platforms for convenient and hassle-free transactions.

Live casino enthusiasts will find plenty to enjoy at Megapari, with a wide range of games from top providers like Evolution Gaming and Pragmatic Play. Whether you’re playing classic table games like blackjack and roulette or trying your luck at exotic games like Dream Catcher and Crazy Time, the live casino section offers an immersive experience that brings the excitement of a real casino to your screen. The quality and variety of live games make Megapari a top destination for players seeking an authentic casino experience online.

For those looking to try their hand at something different, Megapari also offers unique options like Megagames and TV Games. These sections provide a variety of entertaining games that go beyond the usual offerings, including card games, lotteries, and instant win options. This diversity adds another layer of excitement to the platform, ensuring that players always have something new and engaging to explore. With its vast selection and innovative game options, Megapari Casino continues to be a leading choice for online gaming enthusiasts.

Perks

Welcome bonus

🎉 200% Welcome Bonus + 150 Free Spins + a Free Bet! 🏆 Get 3% Cashback 💰 Fast Withdrawals, High Odds, & Top Casino Games! 🎰⚽️

Supported languages

They support a variety of languages on their site such as English, Spanish, French, Portuguese, German, Japanese, Russian, Turkish, Czech, Italian, Chinese, Hindi, Hebrew, Greek, Norwegian, Finnish, Bangla, Arabic

Accepted cryptocurrencies

TRX, DOGE, XRP, USDT (TRC-20), BNB, USDT (BEP-20), BTC, USDT (AVAX C-CHAIN)

License

Government of the Autonomous Island of Anjouan, Union of Comoros

Year operation started

2019

🎉 200% Welcome Bonus + 150 Free Spins + a Free Bet! 🏆 Get 3% Cashback 💰 Fast Withdrawals, High Odds, & Top Casino Games! 🎰⚽️

Get Bonus

Dexsport

Dexsport.io is revolutionizing the world of online betting by leveraging the power of Web3 technology, ensuring a transparent and secure betting experience. As a blockchain-powered platform, Dexsport operates on multiple blockchains including BNB, Polygon, OKC, and Avalanche, providing users with a seamless and efficient betting environment. With no intermediaries, instant payouts, and no registration requirements, Dexsport eliminates the common hurdles faced by traditional betting platforms. This innovative approach to online betting not only enhances user trust but also attracts a growing community of sports bettors looking for a reliable and transparent platform.

The integration of Dexsport’s native token, $DESU, further enriches the user experience by offering unique bonuses and privileges. Token holders can enjoy early access to new sporting events, making their participation even more rewarding. Additionally, $DESU is easily tradable on popular exchanges like PancakeSwap, making it a versatile asset within the Dexsport ecosystem. The platform’s commitment to expanding its offerings by the end of the year promises even more attractive features for users, solidifying Dexsport’s position as a leader in the Web3 betting space.

Live betting at Dexsport is a highlight for many users, offering the excitement of wagering on sports events in real time. With coverage of an average of 30 live matches at any given time, the platform provides ample opportunities for bettors to engage with their favorite sports. However, the absence of a live-streaming feature may be a slight drawback for some users, though the platform’s transparency and user-friendly policies more than compensate for this limitation. Dexsport’s focus on providing a straightforward and honest betting experience resonates with the growing demand for blockchain-based solutions in the sports betting industry.

Dexsport’s casino section, while not as extensive as traditional online casinos, offers a unique selection of games that cater to different tastes. With titles like Dice Twice, Magic Keno, and Fruit Towers, the platform provides a refreshing alternative to the usual casino offerings. Although the absence of classic games like blackjack and roulette might be noticeable, the innovative mechanics of Dexsport’s available games ensure that users have a distinct and enjoyable gaming experience. The platform’s emphasis on safety and transparency extends to its casino operations, making it a trustworthy choice for online gaming enthusiasts.

The bonus and promotion offerings at Dexsport add another layer of appeal for users, especially those looking to maximize their crypto betting experience. The no-deposit bonuses, VIP loyalty program, and weekly cashback options provide significant incentives for both new and existing users. Additionally, the Dexsport airdrops and opportunities to acquire $DESU tokens offer further rewards, enhancing the overall value proposition of the platform. By continually updating its promotions and adding new features, Dexsport maintains a dynamic and user-centric approach, making it a top choice for anyone interested in Web3 betting.

Perks

Welcome bonus

Up to 25% Bonus on the first deposit | 10% weekly Cashback 🚀 | Best Web3 betting | NO KYC | Unlimited withdrawals

Supported languages

They support a variety of languages on their site such as English, Spanish, French, Portuguese, German, Japanese, Turkish, Chinese, Hindi

Accepted cryptocurrencies

ETH, USDT, BNB, BTC, USDC, LTC, DASH, AVAX, TON, TRX, PEPE, DOGE, BCH, NOT, METIS, POL

License

Government of the Autonomous Island of Anjouan, Union of Comoros

Year operation started

2022

Up to 25% Bonus on the first deposit | 10% weekly Cashback 🚀 | Best Web3 betting | NO KYC | Unlimited withdrawals

Get Bonus

Betplay

Betplay.io has quickly established itself as a reputable online casino since its inception in mid-2020, attracting a diverse range of players with its extensive selection of games from leading providers like Evolution Gaming and Push Gaming. The platform’s commitment to offering top-tier gaming experiences is evident in its comprehensive library, which includes everything from live dealer games and jackpot games to classic table games like baccarat and blackjack. The casino’s partnership with these renowned game developers ensures players enjoy high-quality graphics, immersive gameplay, and a seamless betting experience.

A standout feature of Betplay.io is its focus on cryptocurrency, accepting Bitcoin and other digital currencies for deposits and withdrawals. This approach not only provides an extra layer of anonymity for players but also facilitates quick and hassle-free transactions. The inclusion of Bitcoin Lightning payments further enhances this convenience, allowing players to make near-instant deposits and withdrawals. These crypto-friendly policies make Betplay.io an attractive option for players in regions where traditional banking options might be limited or slow.

The user interface of Betplay.io is designed with the player in mind, featuring a sleek, modern design that is easy to navigate. Whether accessing the site via desktop or mobile browser, users will find the layout intuitive, with key features like game categories, promotions, and customer support easily accessible. The casino supports both English and French, catering to a broader audience and ensuring that non-English speaking players can enjoy the platform without language barriers. Additionally, the customer support team is available via live chat and email, offering prompt and professional assistance.

Security and fairness are paramount at Betplay.io, with the casino employing advanced encryption technologies such as SSL and HTTPS protocols to protect player information and transactions. The use of provably fair gaming algorithms further assures players of the transparency and integrity of the games offered. Licensed by reputable authorities, Betplay.io adheres to strict regulatory standards, providing a safe and secure environment for online gambling. This commitment to security, combined with a broad selection of games, makes Betplay.io a reliable choice for both novice and experienced gamblers.

Betplay.io also offers a range of bonuses and promotions to enhance the player experience. New players can take advantage of a generous welcome bonus, while existing players can benefit from regular promotions such as rakeback, cashback, and entry into exclusive tournaments. The VIP program rewards loyal players with additional perks and benefits, creating a sense of community and incentivizing continued play. These promotional offers are not only enticing but also provide added value, making Betplay.io a compelling option for players looking for a rewarding online casino experience.

Perks

Welcome bonus

100% Welcome Bonus up to $5,000 | 10% Cashback | No KYC | VPN-Friendly 🎉

Supported languages

They support a variety of languages on their site such as English, German, Spanish, Portuguese, Finnish, French, Italian, Hungarian, Russian

Accepted cryptocurrencies

BTC, ETH, XRP, LTC, USDT, USDC, DOGE, TRX, SHIB, TON

License

Operating under the laws of Costa Rica

Year operation started

2020

100% Welcome Bonus up to $5,000 | 10% Cashback | No KYC | VPN-Friendly 🎉

Get Bonus

CasinoBet

CasinoBet stands out in the online gambling scene with its high-value bonuses and commitment to seamless gameplay. New users can take advantage of a massive 150% cash deposit match up to 1 BTC, complemented by as many as 500 free spins. This combination gives players a strong start and fuels extended gaming sessions across thousands of top-tier casino games.

Designed for crypto users, CasinoBet enables instant, fee-free deposits and withdrawals with no limits and no KYC requirements. Whether you’re using Bitcoin, Ethereum, or other digital currencies, the process is fast and user-friendly. The platform also supports Moonpay for easy fiat-to-crypto conversions, helping new players get started without friction.

CasinoBet’s game library features over 4,000 titles from leading developers, ensuring variety across slots, live casino, crash games, and more. With every $50 deposit, players unlock additional free spins, and higher deposits bring even more rewards. The wagering mechanics are designed to be transparent, with clear rules around bonus unlocking and free spin redemption.

Loyalty is rewarded generously through an elite VIP program that offers instant rakeback, cashback, and priority perks. High rollers and consistent players benefit from lifetime rewards and the ability to transfer VIP status from other platforms, enhancing long-term value for dedicated users.

Known for fast support and community-first features, CasinoBet also offers exceptional reliability with 24/7 email response and live chat assistance. It positions itself as a premium destination for crypto casino players who value privacy, speed, and top-tier incentives alongside a rich, diverse gaming experience.

Perks

Welcome bonus

150% Deposit Match up to 1 BTC + 500 Free Spins 🎰| Up to an Amazing 65% in Rakeback & Cashback 🤑| INSTANT, Unlimited Withdrawals ⚡ Zero Fees, No KYC, No Limits ⚡| Join the Elite! 👑

Supported languages

They support a variety of languages on their site such as English, Spanish, French, Portuguese, German

Accepted cryptocurrencies

BTC, ETH, LTC, XRP, USDT, DOGE

License

Curaçao Gaming License

Year operation started

2023

150% Deposit Match up to 1 BTC + 500 Free Spins 🎰| Up to an Amazing 65% in Rakeback & Cashback 🤑| INSTANT, Unlimited Withdrawals ⚡ Zero Fees, No KYC, No Limits ⚡| Join the Elite! 👑

Get Bonus

Winna

Winna.com has quickly become a preferred destination for crypto gambling enthusiasts seeking a blend of classic and innovative online gaming. With instant withdrawals and a no KYC, VPN-friendly setup, it caters to users who prioritize privacy and ease of access. Its vast selection of games includes over 4,000 slot machines from top developers such as Pragmatic, Hacksaw, Relax Gaming, and Play’n GO, ensuring a rich variety of themes and gameplay experiences. Furthermore, Winna’s live table games like blackjack and roulette offer a real casino feel right from the comfort of your home, enhanced by provably fair gaming technology that ensures transparency and fairness.

The platform extends its offerings to a robust sports betting experience at its crypto sportsbook, where users can bet on thousands of daily competitions and live events spanning global sports leagues. This feature-rich sportsbook supports major sports and leagues, including the NFL, NBA, UFC, MLB, and Premier League, making it a hub for sports betting aficionados. The integration of cryptocurrency makes transactions seamless and secure, catering to a global audience looking for a reliable betting experience in the crypto space.