Crypto

Ethereum (ETH) Shows Who’s King of Alts By U.Today

Ethereum (ETH) Shows Who’s King of Alts

U.Today – Ethereum continues to assert its dominance, proving to investors and enthusiasts why it reigns supreme among altcoins. The recent price action of Ethereum paints a bullish narrative, with potential signals pointing toward an ongoing growth cycle that could redefine its market stature.

Ethereum’s market movement has been extremely dominant following the approval of the ETF, with the asset recently piercing through significant resistance levels. After a sustained period above the 50-day and 100-day EMAs, ETH has shown formidable strength.

Currently, Ethereum’s price hovers around $2,600, with the immediate resistance level now likely forming near the $2,700 mark, a point at which sellers previously stepped in. A decisive break above this level could open the gates for further escalation toward the $3,000 psychological barrier.

Chart by TradingViewOn the flip side, local support can be identified at around the $2,500 level, where a confluence of the EMAs and historical price reactions provides a safety net against potential pullbacks. Should Ethereum retreat from its current levels, the $2,400 and $2,300 levels stand ready to act as secondary and tertiary support zones, where buying interest has coalesced in the past.

The backdrop to this vigorous market movement is the speculation regarding the potential approval of an Ethereum ETF. The recent green light for a Bitcoin spot ETF has amplified discussions around its Ethereum counterpart. Such approval would be a significant catalyst for Ethereum, potentially drawing in a new wave of institutional and retail investment.

The primary strength of a spot Ethereum ETF lies in its direct exposure to the actual asset, rather than the derivatives market that futures-based ETFs represent. This means that an ETF would purchase actual Ethereum, providing direct support to its price and reflecting true market sentiment more accurately. Moreover, it would offer investors a way to gain exposure to Ethereum without the complexities of managing cryptocurrency wallets and keys, thereby simplifying entry onto the crypto market.

The approval of an Ethereum ETF would not only validate the asset’s maturity and market significance but also solidify its position as a mainstay in the portfolios of diverse investors. Given Ethereum’s foundational role in the development of DeFi and NFTs, an ETF would be a testament to its integral place in the digital economy.

Spot Bitcoin ETF here

Despite the approval of one of the most long-awaited financial products for the cryptocurrency market, Bitcoin displayed a stoic reaction, subverting the expectations of many investors, who were bracing for a significant market upheaval. The cryptocurrency’s price stability post-ETF news, while surprising to some, has been a more favorable outcome compared to the sell-off that many had predicted.

The relative calmness in Bitcoin’s price has provided a conducive backdrop for altcoins to shine. Ethereum (ETH) notably breached the $2,500 mark, and (SOL) regained a $100 valuation, underscoring a night of triumph for alternative cryptocurrencies. This decoupling of Bitcoin’s movement from altcoin performance is a phenomenon that has been increasingly observed, suggesting a maturing market where assets can thrive on individual merit and ecosystem developments.

The chart at hand paints a picture of consolidation for Bitcoin, with the price hovering around the $45,000 region. The lack of a significant corrective move post-ETF news has lent a supportive floor to the broader crypto market. Trading volumes, alongside price action, indicate a steady holding pattern, a sign that the market is digesting the recent developments without panic or overenthusiasm.

Despite the current stability, the market should not discount the potential for an uptick in Bitcoin’s value. Historically, actual capital inflow following such regulatory milestones has been a precursor to upward movements in the cryptocurrency’s price. If history is to serve as a reference, the approval of a Bitcoin ETF may yet act as a delayed fuse, igniting a rally as new capital finds its way onto the market.

Investors are advised to maintain cautious optimism. While current market conditions have not triggered the volatility many feared, the introduction of ETFs is a substantial change to the investment landscape of Bitcoin. As traditional investors and institutions increasingly engage with Bitcoin through these new financial products, the potential for a significant impact on the cryptocurrency’s value trajectory is tangible.

This article was originally published on U.Today

Crypto

HSBC Says Lasting Iran Conflict Would Boost Oil, Gold, USD and Hurt Equities

Crypto

Crypto Sector Suffers Exodus of Reliable Retail Investors | PYMNTS.com

Retail investors are reportedly leaving the cryptocurrency sector, robbing the industry of a dependable driver.

Crypto

The Last Frontier For Cryptocurrency Adoption

While studies reveal institutional investors and wealth managers believe tokenized ETFs will drive mainstream market adoption for cryptocurrency, there looms the theft of bad actors that most often go untraceable.

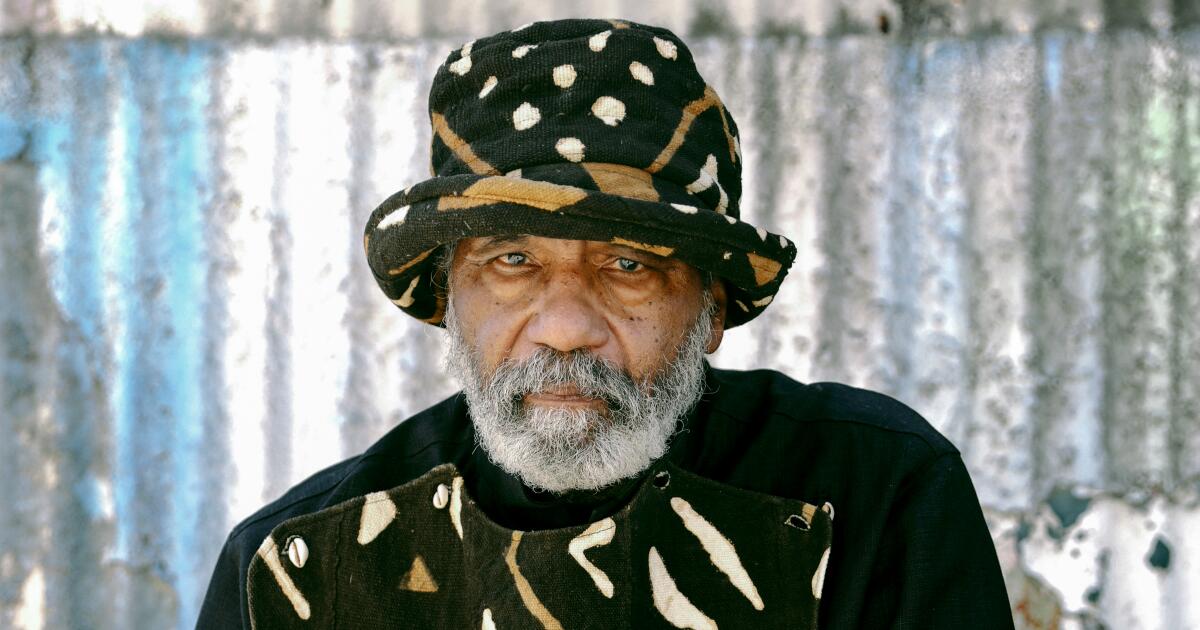

Currency throughout history that became mainstream

ShutterStock

Barriers to the expansion of tokenization are starting to fall as major investment firms consider launching tokenized ETFs, according to new global research by London-based Nickel Digital Asset Management (Nickel), Europe’s leading digital assets hedge fund manager founded by alumni of Bankers Trust, Goldman Sachs and JPMorgan.

Its study with institutional investors (pension funds, insurance asset managers and family offices) and wealth managers at organisations which collectively manage over $14 trillion in assets found almost all (97%) believe the potential launch of tokenized ETFs such as BlackRock’s will be important to the expansion of the sector with nearly one in three (32%) rating the development as very important.

The study also reflected the belief that tokenization will continue to grow, with nearly 70% of respondents believing that fund managers looking to tokenize investment funds and asset classes will increase over the next three years.

Nickel’s research with firms in the US, UK, Germany, Switzerland, Singapore, Brazil and the United Arab Emirates found growing awareness of the benefits of tokenization. Private markets are seen as offering the greatest potential for tokenization, with almost 70% seeing private equity funds as the asset class with the most opportunity, followed by fixed income (55%) and public equities (42%).

Anatoly Crachilov, CEO and Founding Partner at Nickel Digital, said: “Tokenization is quickly moving from theory to real-world adoption as institutional investors grow more comfortable with its benefits and see major players enter the space. When firms like BlackRock step in, it fundamentally shifts the conversation. This development is timely for our multi-manager vehicle as expanding liquidity depth will allow some of our pods to start trading tokenized assets in the coming months.”

To address potential criminal threat, an advanced detection system to identify and trace blockchain funds connected with criminal activity was presented earlier this week at the Annual CyberASAP Demo Day in London.

The system, called SynapTrack, enables faster and more accurate detection of fraudulent activity using blockchains and cryptocurrencies, where traditional anti-money laundering and counter-terrorist financing systems struggle to keep pace.

Although current fraud detection methods pick up unusual activity, they deliver an extremely high rate (40%) of false positive reports. These require manual checking by compliance professionals, resulting in backlogs in identifying and acting on suspicious activity.

The SynapTrack system is designed to deliver a substantially lower rate of false positives. It has already been tested using real-life data from the notorious 2025 Bybit hack, where criminals stole $1.5bn of digital tokens from a cryptocurrency exchange. SynapTrack traced the hacker with 98% accuracy.

The team behind SynapTrack is keen to hear from exchanges, financial regulators or law enforcement agencies who want to test the prototype in real-world conditions.

SynapTrack uses a validated methodology to score the likelihood of transactions being part of a money laundering scheme. It has a self-improving algorithm that continuously adapts to new tactics – dynamically identifying suspicious patterns in blockchain transactions. It has a universal cross-chain capability, and is designed around how compliance teams work, presenting results in a dashboard. No infrastructure changes are needed for installation.

It is relatively easy to obscure fraudulent or criminal activity by moving funds between blockchains, or dispersing them across many blockchains, in what are known as ‘cross-chain’ transactions. It is these transactions that pose the greatest difficulty for existing anti-money laundering systems.

SynapTrack was developed by University of Birmingham computer scientists Dr Pascal Berrang and PhD student Endong Liu, in collaboration with blockchain developer Nimiq. Dr Berrang’s research is in IT security and privacy on blockchain, artificial intelligence and machine learning. The subject of Endong Liu’s PhD is transaction tracing. Nimiq is supporting with blockchain-specific insights, knowledge of real-world constraints, and implementation.

The team is currently fundraising to ensure regulatory readiness and complete the team with a CEO and software developers.

Dr Berrang said: “The last few years have seen a near-exponential growth in blockchain transactions. While many of these are legitimate, blockchains are attractive to criminals as funds can be moved very quickly to other jurisdictions. Our work with Nimiq and the creation of SynapTrack is addressing this black spot, and will enable more effective regulation, making the whole ecosystem of blockchain safer and more trustworthy.”

With the financial market and cybersecurity industry converging, cryptocurrency is here to stay.

-

World5 days ago

World5 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts5 days ago

Massachusetts5 days agoMother and daughter injured in Taunton house explosion

-

Denver, CO5 days ago

Denver, CO5 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Louisiana1 week ago

Louisiana1 week agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Technology1 week ago

Technology1 week agoYouTube TV billing scam emails are hitting inboxes

-

Politics1 week ago

Politics1 week agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT

-

Technology1 week ago

Technology1 week agoStellantis is in a crisis of its own making

-

News1 week ago

News1 week agoWorld reacts as US top court limits Trump’s tariff powers