Business

Why American Mask Makers Are Going Out of Business

Mike Bowen has spent a lot of the pandemic saying, “I informed you so,” and you’ll hardly blame him. Again in 2005, simply as low-cost Chinese language producers have been taking on the non-public protecting tools business, Bowen joined a good friend who had began a small surgical masks firm referred to as Status Ameritech. The plan was to market his firm’s masks to American hospitals and distributors as a means to supply resilience — a way of guaranteeing home provide if the availability chain ever broke down.

“Each firm had left America,” he recalled not too long ago. “All the U.S. masks provide was beneath overseas management.” He remembers warning clients, “If there’s a pandemic, we’re going to be in bother.”

At first, Bowen’s gross sales pitch wasn’t very profitable. However in 2009, the swine flu virus triggered a masks scarcity in the US. Out of the blue, Status Ameritech had loads of clients. “We went from 80 workers to 250,” Mr. Bowen says. “The telephones have been ringing off the hook. We thought, ‘Individuals lastly get it. We’re going to repair this drawback.’”

He was incorrect. As quickly because the swine flu pandemic ended, the corporate’s new clients went proper again to purchasing cheap masks from China; Chinese language producers quickly managed 90 % of the American market. “The price financial savings was like crack cocaine for American hospitals,” Mr. Bowen mentioned.

Even so, Mr. Bowen by no means stopped telling anybody who would pay attention that the offshoring of non-public protecting tools — which incorporates nitrile gloves, hospital robes and respirators, in addition to surgical masks — would create huge issues for the U.S. the following time it confronted a pandemic.

Which, in fact, is strictly what occurred. Simply weeks into the Covid-19 pandemic in 2020, the availability chain for protecting tools had damaged down, creating extreme shortages that value lives. A black market emerged, stuffed with con males and get-rich-quick schemers.

A handful of U.S. entrepreneurs determined they might do their half by manufacturing masks.

In Miami, a family-owned surgical machine firm, DemeTech, spent a number of million {dollars} to broaden its amenities, construct machines and rent lots of of workers; by the autumn of 2020, it was able to churning out 5 million masks a day, based on Luis Arguello Jr., vice chairman of the corporate. “We took a threat as a household,” he mentioned.

In Houston, Diego Olmos, a producing professional who had not too long ago left a multinational firm, used his severance to assist begin a mask-making firm referred to as Texas Medplast. “My enterprise companion and I mentioned, ‘That is the correct factor to do,’” he mentioned.

In Lindon, Utah, an entrepreneur named Paul Hickey helped discovered PuraVita Medical to make KN95 respirators.

Perceive the Provide Chain Disaster

It’s arduous to know exactly what number of of those corporations have been born throughout the pandemic; 36 of them are members of the American Masks Producer’s Affiliation, which they shaped to foyer Washington. Nearly all skilled the identical growth and bust phenomenon that Mr. Bowen had in 2009. At first, clients who might not receive masks by their regular provide channels have been beating down their doorways. The identical was true throughout the Delta and Omicron waves, when masks have been additionally scarce.

However as quickly because the waves crested, and Chinese language corporations, decided to regain their market share, started exporting masks under value, the shoppers disappeared.

“All of the hospitals and authorities businesses and retailers that had been begging for American merchandise immediately mentioned, ‘We’re good,’” mentioned Mr. Hickey.

At the moment, these small U.S. masks producers are in dire straits — in the event that they haven’t gone out of enterprise already. DemeTech has laid off practically all the staff it employed to make masks, and it has shut most of its masks manufacturing heart. Mr. Olmos, his severance lengthy gone, expects Texas MedPlast to be out of enterprise quickly barring a miracle. And PuraVita Medical? “We’re on the verge of shedding all of it,” Mr. Hickey informed me.

The federal government’s reply to this sample is its personal shopping for energy. Throughout his State of the Union handle on Tuesday night time, President Biden promised that the federal government would start to carefully implement provisions within the legislation that decision for the federal businesses to purchase American-made items every time doable.

“All the pieces from the deck of an plane service to the metal on freeway guardrails” could be made in America, he vowed.

The plight of those small masks corporations, nonetheless, means that reviving American manufacturing — even when the underlying rationale is nationwide safety — received’t be straightforward.

The pandemic sparked the issue. The extremely intricate and interconnected world provide chain is in upheaval. A lot of the disaster could be traced to the outbreak of Covid-19, which triggered an financial slowdown, mass layoffs and a halt to manufacturing. Right here’s what occurred subsequent:

How the Provide Chain Disaster Unfolded

“Resilience is the byword of the day,” mentioned Marc Schessel, a hospital provide chain professional who’s working to develop different provide chains for private protecting tools. And resilience — that’s, creating further manufacturing capability that may get the nation by an emergency — is what the small masks makers say is their worth to the nation. Positive, they argue, a globalized, just-in-time provide chain for low-cost protecting tools is okay in extraordinary occasions. However we’ve realized these previous two years that the nation wants home producers if we hope to keep away from horrible shortages throughout the subsequent pandemic, and the one after that.

However how do you create that resilience? The federal authorities spent $682 billion shopping for items and providers from contractors in 2020, based on Bloomberg Authorities. That’s the sum the Biden administration needs to make use of to purchase American merchandise. And whereas it’s hardly chump change, it’s solely about 3 % of America’s $21.5 trillion economic system.

The masks producers I interviewed for this text mentioned the Biden administration had expressed curiosity in shopping for their masks, nevertheless it has but to occur. Even when it did, it might be unlikely to place a lot of a dent into Chinese language dominance. As Mr. Bowen put it in a current e mail to the White Home, “Hospitals drive the masks market.” Since their incentives are to cut back prices, he wrote, “Any plan that enables imported masks to value lower than U.S. made masks will lead to a overseas authorities managed U.S. masks provide — as at the moment exists.”

To place it one other means, the trendy crucial of maximizing shareholder worth will all the time put effectivity and price over resilience.

The masks producers are a microcosm of a bigger drawback. At the moment, there are shortages that go properly past private protecting tools. Issues as numerous as semiconductors and storage doorways are briefly provide — all merchandise whose manufacturing was offshored throughout the previous a long time as American corporations embraced just-in-time provide chains and cheap overseas labor. Economists and company executives ignored resilience, and now the nation doesn’t have a transparent concept tips on how to create it, at the same time as its necessity has turn out to be apparent.

Mr. Bowen informed me that the issue for small U.S. masks producers could possibly be solved by both banning imported masks or placing hospitals on discover that they might be legally liable if their purchases of imported masks meant they may not defend their workers or sufferers in a future emergency. He additionally acknowledged that neither scenario was real looking.

Early within the pandemic, in a transfer supposed to make sure entry to important provides throughout crises, the Japanese authorities earmarked $2.3 billion in subsidies to corporations that moved manufacturing to Japan from China. The U.S. federal authorities might take an analogous tack, which might permit U.S. masks producers to match Chinese language costs. The issue is that if the federal government sponsored each important product that required provide chain resilience, it might get awfully costly.

Regardless of the president’s vow to have the federal government purchase American, the almost definitely state of affairs stays what it has been for months: the small masks producers will exit of enterprise, hospitals will proceed to import Chinese language masks — and the nation will once more be caught brief when the following pandemic arrives.

What do you suppose? Ought to the federal government do extra to guard American producers of important provides? What could be simplest? Tell us: dealbook@nytimes.com.

Business

Will Meta’s Plan to End Fact Checking Work Politically?

Following the political winds

Meta’s bombshell announcement on Tuesday that it would end its fact-checking program was widely read as a major shift in policy meant to please President-elect Donald Trump and other conservatives.

In reality, the move was probably less radical than it initially seemed. But the turn still serves as a reminder that many corporate leaders see their highest priority as reading the room — one that Trump now dominates.

Mark Zuckerberg has been moving in this direction for some time. In relation to the 2016 election, the Meta chief, who has a history of tacking where political winds blow, followed other tech companies in partnering with fact-checking groups to police content on its platforms, including Facebook and Instagram. Since then, however, the tech mogul has fumed as Meta was criticized for both failing to do enough — and for removing too many user posts.

“It’s time to get back to our roots around free expression,” Zuckerberg said in a video announcing the changes, including a move to X-style user-policing known as Community Notes. (Katie Harbath, a former communications executive at Meta, told The Times, “This is an evolved return to his political origins.”)

The changes aren’t necessarily as big as they first appeared. Politico noted that Meta had been paring back its moderation efforts in recent years. And while Zuckerberg promoted plans to move such workers to Texas to “eliminate bias,” many such workers are already based there.

Zuckerberg isn’t alone: Tech companies haven’t ever wanted to be in the business of moderating user content. Last summer, YouTube began testing a version of Community Notes, though it was described as more of a supplemental feature.

Is the political payoff for Meta worth the criticism? Trump, who had railed against the company’s moves to police his content — including briefly shutting down his Facebook account after the Jan. 6, 2021, riot at the Capitol — said the tech giant had “come a long way.” (He also said his threats against Zuckerberg “probably” contributed to the new policy.)

Meta executives may hope that, along with the elevation of the longtime Republican executive Joel Kaplan to lead global affairs, a $1 million donation to the Trump inaugural fund and the addition of the Trump ally Dana White to its board, may get them into the president-elect’s good graces.

A factor worth watching: Zuckerberg said he would work with Trump to “push back against foreign governments going after American companies to censor more.” That was a thinly veiled shot against the European Union, which has sought to punish companies, including Meta, for insufficiently policing their platforms — and may increase its scrutiny of the tech giant after Tuesday’s move.

Will the move work? So far, advertisers aren’t publicly objecting. And Tuesday’s news most likely allays concerns that Trump regulatory picks, including Brendan Carr of the Federal Communications Commission, had about Meta.

But Senator Marsha Blackburn, Republican of Tennessee, wrote on X that Meta’s change was simply “a ploy to avoid being regulated.” She added, “We will not be fooled.”

HERE’S WHAT’S HAPPENING

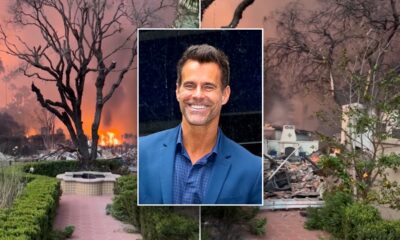

Wildfires near Los Angeles force widespread evacuations. Parts of Santa Monica and the Pacific Palisades were hit by a blaze that destroyed homes and forced at least 30,000 to flee for safety. Another fire, near Pasadena, was also causing issues as officials warned of devastating losses.

Anthropic is close to raising billions more in capital. The artificial intelligence start-up is in advanced talks to collect $2 billion in a round led by Lightspeed Venture Partners, The Times reports. If completed, the fund-raising would value Anthropic at $60 billion — roughly three times as much as it was worth a year ago — in another sign that the deal making frenzy around A.I. shows no signs of slowing.

JPMorgan Chase reportedly plans to call employees back to the office five days a week. That’s up from the requirement of three days a week, according to Bloomberg, though about 60 percent of Wall Street giant’s staff is already at the office full time. Other major companies have already reduced or eliminated work-from-home policies instituted during the coronavirus pandemic; JPMorgan’s C.E.O., Jamie Dimon, has long criticized hybrid working arrangements.

The markets are taking Trump seriously

Coming into 2025, the big questions hanging over President-elect Donald Trump’s second term included tax cuts, the Fed’s independence and potential new trade war.

But few could have foreseen the president-elect refusing to rule out military force or economic coercion against allies as he did on Tuesday at a wide-ranging news conference at Mar-a-Lago. It underscores that for markets, a Trump presidency brings plenty of potential black swan events.

A recap: Trump revealed an expansive vision of “America First,” doubling down on calls for the United States to gain control of Greenland and the Panama Canal. And he spoke of renaming the Gulf of Mexico to the “Gulf of America,” though it was unclear how serious he was about that.

The Trump effect can be seen in the markets on Wednesday. The S&P 500 looks set to open lower, and sectors like green energy and companies including Tesla slumped after Trump railed on Tuesday about wind turbines and grumbled about electric vehicles.

And the yield on the 10-year Treasury note hit a roughly nine-month high on Tuesday, a worrying sign for house hunters and credit-card holders.

Some market watchers still believe that markets could check the Trump agenda. Bond vigilantes could act as a brake on Trump’s policies if they reignite inflation.

And more broadly, the Trump team cares “about the verdict of financial markets,” Holger Schmieding, an economist at Berenberg, wrote in a research note on Wednesday. “If their actions were to impair the potential for growth and corporate earnings badly enough to trigger a sell-off, they might change tack.”

There are signs that might prove true. Trump acknowledged on Tuesday that it would be “hard” to bring down consumer prices, a major shift from what he told supporters on the campaign trail. His big inflation-fighting idea, expanding oil drilling, hasn’t yet affected the markets, with crude oil prices on a steady rise in recent weeks. (President Biden’s ban on new oil exploration in vast stretches of U.S. waters has contributed to that price surge, and may be hard for Trump to undo.)

That said, the VIX volatility index, known as Wall Street’s fear gauge, has been stable for weeks, a sign that equity investors are still bullish.

Trump’s record-breaking inauguration

Donald Trump’s transition team has already amassed a mega budget to throw an inauguration bash for the ages.

And the president-elect can thank the giants of the tech industry and Wall Street — some of the same figures who’ve met with him recently at Mar-a-Lago — for the record haul of at least $150 million. Few federal rules govern how Trump and his associates can spend the money.

Donors who have gone public include: Amazon, Bank of America, Goldman Sachs, Meta and Uber. Executives such as Tim Cook of Apple, Dara Khosrowshahi of Uber and Sam Altman of OpenAI have also chipped in.

Contributing to inauguration funds has become a corporate America tradition. “You’re giving money directly to the incoming president with no risk of backing the wrong horse,” Craig Holman, a lobbyist with Public Citizen, a consumer rights watchdog, told DealBook’s Sarah Kessler. Donors who give $1 million to the fund receive tickets to the inauguration plus other events such as a reception with cabinet picks and a pre-inauguration dinner with Trump.

There are only a few restrictions. Foreign nationals are not allowed to donate, and donations over $200 must be disclosed. And anti-bribery laws apply. “Beyond that, it’s pretty much open in terms of who may contribute and how they may spend it,” said Kenneth Gross, a lawyer specializing in campaign finance at Akin Gump.

The inauguration fund pays for the parties, dinners and the parade, while taxpayers foot the bill for security and the swearing-in ceremony.

What will happen to unspent funds? Two people involved in the fund-raising for Trump’s inauguration told The Times that donors expected the remaining money to go to Trump’s presidential library.

The last time, Trump’s team raised $107 million (the previous record). It was later revealed that a nearly $26 million payment went to an event planning firm created by an adviser to the first lady, Melania Trump.

Lawmakers have sought to change things. One bill introduced in 2023 would limit contributions to $50,000. But such efforts have gained little traction.

The big new corporate bet: Bitcoin

Corporate treasury departments are usually bastions of caution, preferring to invest their companies’ money in stable assets like Treasury bonds. But a growing number are choosing to go a different route by investing in crypto.

By one estimate, more than 70 publicly traded companies have invested in Bitcoin, despite some having nothing to do with crypto. At least a few have been inspired by MicroStrategy, a software company that began amassing Bitcoin in 2020 — and now sits on a stockpile worth over $40 billion. MicroStrategy’s stock price is up roughly tenfold over the past 18 months.

But it means that those companies are putting their money in a highly volatile asset that could imperil their finances if things go wrong, The Times’s David Yaffe-Bellany and Joe Rennison write:

The investments are a sharp pivot away from the cautious approach of the traditional corporate treasury department, whose focus is typically safeguarding cash rather than risking it for a higher return. Typical reserve assets include steady, predictable securities like U.S. government bonds and money market funds.

“I cannot understand how a risk-averse board could justify an investment in digital assets, given we know they swing quite significantly,” said Naresh Agarwal, an associate director at the Association of Corporate Treasurers, a trade organization. “It is quite an opaque market.”

Some investors aren’t on board with this new tactic. When Banzai, a publicly traded marketing firm, decided to invest in Bitcoin, some shareholders expressed alarm. Joe Davy, its C.E.O., told The Times: “I got a couple of phone calls from people who were like: ‘What the hell is going on over there? What are you thinking?’”

THE SPEED READ

Deals

Politics and policy

-

The Justice Department added six major landlords, including Blackstone’s LivCor, to a price-fixing lawsuit against the real estate software company RealPage. (WSJ)

-

Theodore Farnsworth, the former C.E.O. of MoviePass’s parent company, pleaded guilty to fraud over misleading investors about the business’ “unlimited” subscription plan. (NYT)

Best of the rest

We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com.

Business

Column: Here's one key reform that can fix U.S. healthcare

For more than 50 years, as the economics of American healthcare and health insurance have evolved, one theory has persisted, unchanged: To promote better and more efficient medical treatment, patients must have “skin in the game.”

The idea is that requiring fees for doctor or hospital visits — through co-pays, deductibles and other forms of cost-sharing — will prompt people to think twice before seeking treatment for anything but a truly serious condition.

“On the question of whether patients should have to pay part of the cost of their covered medical care, our profession’s advice has been unequivocal,” health economists Liran Einav of Stanford and Amy Finkelstein of MIT wrote in their 2023 book, “We’ve Got You Covered: Rebooting American Health Care.” “Patients must pay something for their care, otherwise they’ll rush to the doctor every time they sneeze.”

Among all advanced industrial countries, the U.S. goes furthest in using premiums, copays, and deductibles to influence access to care.

— Merrill Goozner, STAT

Einav and Finkelstein own up to having “preached the gospel” of skin-in-the-game “to generations of students.”

Now here’s their punchline: “We take it back.”

To healthcare reformers such as single-payer advocates Adam Gaffney, David U. Himmelstein and Steffie Woolhandler, the confessional by Einav and Finkelstein “may signal an encouraging shift in elite opinion, at least among economists,” as they wrote recently in the New York Review of Books.

Others have begun to take notice. “Among all advanced industrial countries, the U.S. goes furthest in using premiums, copays, and deductibles to influence access to care,” the veteran healthcare journalist Merrill Goozner observes. “It is time to put an end to this failed experiment.”

Yet the imposition of financial obstacles to limit access to care still exerts a powerful influence on healthcare policy in the U.S. In part, this is because it makes sense, superficially. The mantra goes: “If you want less of something, tax it more.” So it has a built-in appeal to government budget hawks and corporate executives who want to reduce healthcare spending.

For some, there’s a moral component — why shouldn’t people take personal responsibility for their own health, whether by smoking and eating less or paying for healthcare partially out of their own pockets, even if they have to be forced to make treatment choices based partially on their out-of-pocket costs?

Then there’s the empirical evidence: It’s true that the higher the co-pays and deductibles, the less medical care people seek, on average.

The seminal study on this topic was Rand’s Health Insurance Experiment, reported in 1981. Starting in 1971, Rand recruited 2,750 families — 7,700 individuals — slotted randomly into five groups: One was offered free care, three groups were offered different levels of cost-sharing, and the fifth was placed in a nonprofit HMO.

Rand found that the groups with cost-sharing made one or two fewer physician visits a year and had 20% fewer hospitalizations than the group with free care. Their dental visits, prescriptions and mental health treatments were also lower. Unsurprisingly, they spent less on healthcare.

The initial findings seemed to validate the skin-in-the-game theory. As Rand continued reporting out the results over the next few years, however, air began to leak out of the balloon.

It became clear that although the cost-sharing subjects cut back on ineffective or unnecessary care, they also cut back on effective and necessary treatments. The reduced utilizations, Rand found, occurred because the subjects decided to delay or forgo treatments, possibly inadvisedly. Once they initiated care, the effect of cost-sharing dropped away, as the patients ceded their decision-making to their healthcare providers.

Some decisions weren’t affected at all by cost-sharing. “The proportion of inappropriate hospitalizations was the same (23 percent) for cost-sharing and free-plan participants, as was the inappropriate use of antibiotics,” Rand reported. Nor did cost-sharing prompt subjects to seek out higher-quality care; the general quality of outpatient and dental care was “surprisingly low for all participants.”

Although Rand found “no adverse effect on participants’ health” from the reduction in services prompted by cost-sharing, the free plan led to better healthcare for plan members in four categories: improved control of hypertension, better vision care, better dental care for the poorest patients, and fewer serious health symptoms for the poorer patients, including less chest pain when exercising and fewer episodes of loss of consciousness.

Once cost-sharing became a standard element of American health insurance, Gaffney, Himmelstein and Woolhandler write, “the consequences were dire.”

The Heritage Foundation developed a model combining extreme deductibles and tax-advantaged savings accounts to pay the out-of-pocket expenses, which Heritage argued would “transform patients into prudent consumers.” The high-deductible/health savings account model was enacted into law, but plainly has failed to create an army of prudently cost-sensitive patients.

Co-pays and deductibles became permanently etched into employer-sponsored health plans. When the initial Rand findings were published, report Gaffney, Himmelstein and Woolhandler, only 30% of private health plans had a deductible for hospital stays; today 90% of workers with employer plans have annual deductibles averaging $1,735 per participant. Conservative governors and legislatures have tried to impose cost-sharing fees on patients in Medicaid, the nation’s healthcare program for low-income households.

And, of course, the cost-sharing revolution has utterly failed to control U.S. healthcare costs or bring about a healthier nation. Per capita healthcare spending in the U.S. has risen from about $350 in 1970 to $14, 470 in 2023. In inflation-adjusted terms, it has increased nearly sevenfold.

As for health outcomes, of 13 wealthy countries tracked by the Peter G. Peterson Foundation, the U.S. spends the most per capita by a wide margin and scrapes the bottom of the barrel on outcomes — the worst average life expectancy, worst infant mortality rate, worst rate of unmanaged diabetes, worst maternal mortality and nearly the worst heart attack mortality.

Obviously, the American healthcare system has many flaws other than its reliance on cost-sharing. But all its flaws are related in some way to its economic structure, which has produced legions of uninsured and underinsured people, as well as crushing medical debt for millions. (On Tuesday, the Consumer Financial Protection Bureau made final a rule requiring medical debts to be removed from consumers’ credit reports. But the debts still remain.)

In recent years, the U.S. has started to get its arms around the uninsured crisis. That’s largely due to the 2010 Affordable Care Act, which has brought access to Medicaid and subsidized health plans for about 42.5 million people. The uninsured rate fell from nearly 18% (or 46.5 million people) in 2010 to 9.5% (25.3 million) in 2023.

Can these gains be advanced and sustained? The incoming Trump administration doesn’t present grounds for optimism. In his first term, Donald Trump and his acolytes worked tirelessly to undermine the ACA and Medicaid. The number of uninsured rose to 28.9 million in 2019 from 26.7 million in 2016.

It would surprise no one if the new administration takes a hands-off approach to the increasing corporatization of healthcare, including the takeover of hospitals and nursing homes by penny-pinching private equity firms and the pushing of more Medicare enrollees to join private Medicare Advantage plans, which have become known for costing the government more than traditional Medicare, and for profit-seeking through claim denials.

Still, it’s the installation of cost-sharing as a medical management tool that harms people day in and day out. That the tool has never fulfilled its promise doesn’t seem to faze policymakers. On the surface, after all, it should work, shouldn’t it?

Business

Mark Zuckerberg’s Political Evolution, From Apologies to No More Apologies

In November 2016, as Facebook was being blamed for a torrent of fake news and conspiracy theories swirling around the first election of Donald J. Trump, Mark Zuckerberg, the chief executive of the social network, wrote an apologetic post.

In his message, Mr. Zuckerberg announced a series of steps he planned to take to grapple with false and misleading information on Facebook, such as working with fact-checkers.

“The bottom line is: we take misinformation seriously,” he wrote in a personal Facebook post. “There are many respected fact checking organizations,” he added, “and, while we have reached out to some, we plan to learn from many more.”

Eight years later, Mr. Zuckerberg is no longer apologizing. On Tuesday, he announced that Meta, the parent company of Facebook, Instagram, WhatsApp and Threads, was ending its fact-checking program and getting back to its roots around free expression. The fact-checking system had led to “too much censorship,” he said.

It was the latest step in a transformation of Mr. Zuckerberg. In recent years, the chief executive, now 40, has stepped away from his mea culpa approach to problems on his social platforms. Fed up with what has seemed at times to be unceasing criticism of his company, he has told executives close to him that he wants to return to his original thinking on free speech, which involves a lighter hand in content moderation.

Mr. Zuckerberg has remolded Meta as he has made the shift. Gone is the CrowdTangle transparency tool, which allowed researchers, academics and journalists to monitor conspiracy theories and misinformation on Facebook. The company’s election integrity team, once trumpeted as a group of experts focused solely on issues around the vote, has been folded into a general integrity team.

Instead, Mr. Zuckerberg has promoted technology efforts at Meta, including its investments in the immersive world of the so-called metaverse and its focus on artificial intelligence.

Mr. Zuckerberg’s change has been visible on his social media. Photos of him uncomfortably clad in a suit and tie and testifying before Congress have been replaced by videos of him with longer hair and in gold chains, competing in extreme sports and sometimes hunting for his own food. Long, heavily lawyered Facebook posts about Meta’s commitment to democracy no longer appear. Instead, he has posted quips on Threads responding to celebrity athletes and videos showing the company’s newest A.I. initiatives.

“This shows how Mark Zuckerberg is feeling that society is more accepting of those libertarian and right-leaning viewpoints that he’s always had,” said Katie Harbath, chief executive of Anchor Change, a tech consulting firm, who previously worked at Facebook. “This is an evolved return to his political origins.”

Mr. Zuckerberg has long been a pragmatist who has gone where the political winds have blown. He has flip-flopped on how much political content should be shown to Facebook and Instagram users, previously saying social networks should be about fun, relatable content from family and friends but then on Tuesday saying Meta would show more personalized political content.

Mr. Zuckerberg has told executives close to him that he is comfortable with the new direction of his company. He sees his most recent steps as a return to his original thinking on free speech and free expression, with Meta limiting its monitoring and controlling of content, said two Meta executives who spoke with Mr. Zuckerberg in the last week.

Mr. Zuckerberg was never comfortable with the involvement of outside fact-checkers, academics or researchers in his company, one of the executives said. He now sees many of the steps taken after the 2016 election as a mistake, the two executives said.

“Fact-checkers have just been too politically biased and have destroyed more trust than they’ve created,” Mr. Zuckerberg said in a video on Tuesday about the end of the fact-checking program, echoing statements made by top Republicans over the years.

Meta declined to comment.

Those who have known Mr. Zuckerberg for decades describe him as a natural libertarian, who enjoyed reading books extolling free expression and the free market system after he dropped out of Harvard to start Facebook in 2004. As his company grew, so did pressure to become more responsive to complaints from world leaders and civil society groups that he was not doing enough to moderate content on his platform.

Crises including a genocide in Myanmar, in which Facebook was blamed for allowing hate speech to spread against the Muslim Rohingya people, forced Mr. Zuckerberg to expand moderation teams and define rules around speech on his social networks.

He was coached by people close to him, including Meta’s former chief operating officer, Sheryl Sandberg, to become more involved in politics. After the 2016 election, Mr. Zuckerberg embarked on a public campaign to clear his name and redeem his company. He held regular meetings with civic leaders and invited politicians to visit his company’s headquarters, rolled out transparency tools such as CrowdTangle and brought on fact-checkers.

In 2017, he announced that he was conducting a “listening tour” across the United States to “get a broader perspective” on how Americans used Facebook. The campaign-like photo opportunities with farmers and autoworkers led to speculation that he was running for political office.

Despite his efforts, Mr. Zuckerberg continued to be blamed for the misinformation and falsehoods that spread on Facebook and Instagram.

In October 2019, Mr. Zuckerberg began to push back. In an address at Georgetown University, he said Facebook had been founded to give people a voice.

“I’m here today because I believe we must continue to stand for free expression,” he said.

In 2021, when the Jan. 6 riot broke out at the U.S. Capitol after the presidential election, Meta was again held responsible for hosting speech that fomented the violence. Two weeks later, Mr. Zuckerberg told investors that the company was “considering steps” to reduce political content across Facebook.

His evolution since then has been steady. Executives who pushed Mr. Zuckerberg to involve himself directly in politics, including Ms. Sandberg, have left the company. Those closest to him now cheer his focus on his own interests, which include extreme sports and rapping for his wife, as well as promoting his company’s A.I. initiatives.

In a podcast interview in San Francisco that Mr. Zuckerberg recorded live in front of an audience of 6,000 in September, he spoke for nearly 90 minutes about his love of technology. He said he should have rejected accusations that his company was responsible for societal ills.

“I think that the political miscalculation was a 20-year mistake,” he said. He added that it could take another decade for him to move his company’s brand back to where he wanted it.

“We’ll get through it, and we’ll come out stronger,” Mr. Zuckerberg said.

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics6 days ago

Politics6 days agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics5 days ago

Politics5 days agoCarter's judicial picks reshaped the federal bench across the country

-

Politics4 days ago

Politics4 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health3 days ago

Health3 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades