Business

The WGA and AMPTP are talking again. Why the studios were motivated to return to the table

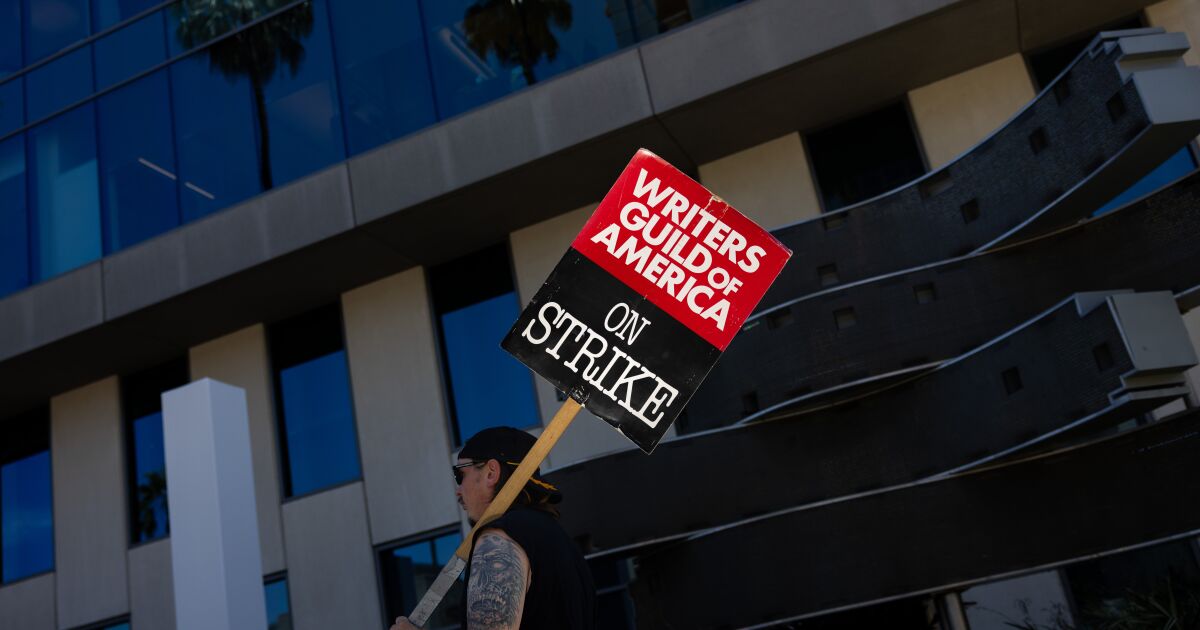

When film and television writers went on strike 108 days ago, most assumed the studios and streamers would hunker down for a long fight.

The companies, many of which are saddled with debt, could save money by cutting costly producer deals and pausing production of movies and TV shows. Industry news outlet Deadline quoted an anonymous executive who suggested that studios were ready to hold out until writers started losing their homes, which stoked outrage on picket lines.

As the negotiations resume, it’s still uncertain how much the Writers Guild of America and the studios are willing to bend to reach a compromise, or what precise shape a deal wouldtake. Sources close to the negotiations say the sides remain far apart on key issues.

But it’s become increasingly clear that the major studios and streamers, represented by the Alliance of Motion Picture and Television Producers, are motivated to end the work stoppages that have roiled Hollywood. The SAG-AFTRA actors’ union joined the WGA by going on strike last month.

What changed? Several factors have prompted a new sense of urgency, according to interviews with multiple people close to the negotiations who were not authorized to comment.

The actors’ strike dramatically upped the stakes, wreaking havoc on production plans and creating more economic uncertainty for the major companies, including streaming giant Netflix, the Walt Disney Co., Warner Bros. Discovery, Paramount Global and NBCUniversal.

The economic reverberations have been felt throughout the city, with businesses including prop houses and other small firms struggling to make ends meet, prompting politicians such as Los Angeles Mayor Karen Bass to demand an end to the strikes.

“With each day that goes on, the economic damage is further intensified,” said Todd Holmes, associate professor of entertainment media management at Cal State Northridge, who estimated that the economic damage of the dual strikes on California was at least $3 billion so far and that it could balloon to $4 billion to $5 billion if the strikes were to stretch into October.

Media executives, many of whom remember the bruising writers’ strike 15 years ago, have insisted that they never wanted a prolonged fight, for these very reasons. The chief executives also recognized that they needed to be more involved after weeks of little progress.

Netflix co-Chief Executive Ted Sarandos and Sony Pictures chief Tony Vinciquerra were initially among the most active executives to try to facilitate compromises, but in the last two weeks other leaders, including Universal’s Donna Langley and CBS Chief Executive George Cheeks — have helped to find common ground among the various companies.

Disney Chief Executive Bob Iger has also taken a more active role, along with producer and former studio chief Peter Chernin, who played a prominent role in the previous writers’ strike.

In recent weeks, movie studio executives have grown increasingly worried about the threat to their 2024 release slates. The studios need A-list talent to help them promote their projects, and they need to finish the ones in production. Sony recently pushed back the release of films including “Spider-Man: Beyond the Spider-Verse.”

“You don’t want to give the audience more reasons to leave,” said one veteran executive.

Streamers are also under pressure, but for their own reasons.

Netflix’s Sarandos has advocated for renewing talks, sources say, despite the fact that many writers blame his company for fueling the labor dispute, which some have dubbed the “Netflix strike.”

Also, the writers’ strike has shined a harsh light on labor tensions Netflix is facing in such countries as Korea, home of the popular series “Squid Game.” Korean artists, including actors and writers such as “Squid Game” creator Hwang Dong-hyuk, are pushing Netflix for more pay for creators — echoing demands of writers marching outside the company’s Sunset Boulevard offices.

In earnings presentations this year, Sarandos has struck a conciliatory tone, saying he was “super committed” to getting agreements done. Other executives have taken a similar tack to tamp down the rhetoric. Iger, who previously took heat for describing union demands as “not realistic,” more recently told investors that he was “personally committed” to finding solutions to the WGA and SAG-AFTRA strikes.

The alliance that represents the major studios met with the WGA negotiating committee Tuesday, during which the union responded to the companies’ latest proposals. The AMPTP declined to comment. The WGA has not commented on any of specifics of the alliance’s new offer.

Union members such as “The Wire” creator David Simon have warned fellow writers against trusting press leaks from studio sources, calling such disclosures “tactical.”

There has been movement on two major sticking points, sources said, raising hopes that the two sides might finally find a path to a deal.

The WGA has demanded that there be a minimum number of staffing for TV series writers’ rooms. Writers said they have suffered economically as the number of episodes in a season has gotten shorter on streaming services, with fewer writers involved in development.

Studios have attempted to address that issue in their latest proposal, which indicates a step forward. Variety reported that showrunners would get “significant authority to set the size of the staff,” factoring in a show’s budget. It is not clear, however, that such a system would sufficiently address the WGA’s concerns.

The topic is fraught for studios, in part, because they don’t want writers to set quotas on the number of people the companies must hire. Studio executives said some writer-producers have indicated that they want more flexibility to determine their own staffing needs.

Studio executives say they want a solution that would allow some leeway while providing more opportunities for early-career writers to be more involved in the process to learn what it takes to run a show.

Streamers also have been criticized by actors and writers for not providing enough data to explain how they determine success. Writers are seeking a payment system that would reward them financially in the event that their shows were to succeed. The studios offered to share data on how many hours people watched programs on streaming services, Bloomberg first reported.

Despite glimmers of hope, the strikes drag on.

Bryan Behar, a writer, executive producer and showrunner on “Fuller House,” posted on social media this week that while a lot of his enthusiasm had gone after 106 days of striking, his “resolve” hadn’t gone away.

“And it won’t,” Behar posted on X, formerly known as Twitter, with a selfie at the Fox lot. “Not until the AMPTP steps up to make a fair deal. Hasn’t happened yet.”

Business

An Illustrated Guide to Who Really Benefits From ‘No Tax on Tips’

There’s no question that President Trump’s proposal to stop taxing tips has broad appeal. It’s popular in polling, lawmakers in both parties support it, and now a version of the idea is on its way to becoming law.

But the effect of the policy would actually be quite narrow. About 3 percent of American workers receive tips, but about a third of those employees would not see a gain from the change.

That’s because of the way Republicans structured the policy in the tax legislation they passed through the House recently. Here’s who would benefit under their plan — and who wouldn’t.

The proposal would leave out workers who are not tipped.

The tax break is good news for people in industries like dining, where tips are a big part of worker pay. But it also means that two employees making the same amount, one a bartender and one a retail salesperson, could soon face very different tax bills.

These two workers each make $40,000, but the tipped worker would owe a lot less in taxes.

The tax exemption would create a huge incentive for more people to try to earn tips. The Republican legislation lays out some ground rules, tasking the Treasury Department to limit the tax break to jobs in which workers have traditionally received tips. This could become the subject of intense lobbying, as companies try to convince the government that their employees deserve the tax break. Uber and DoorDash have already pushed to make sure their drivers can qualify for tax-free tips.

Many of the lowest-earning tipped workers wouldn’t benefit much, or at all.

Another obstacle to benefiting from the tax break is the way income is taxed in America. In general, before they pay taxes, Americans subtract deductions from their income, and then the government assesses tax on that smaller amount of money.

Everyone can take the standard deduction, which would be worth $16,000 for individuals and $32,000 for married couples this year under the Republican tax bill. “No tax on tips” would take the form of a deduction people can claim on top of the standard deduction, shrinking their taxable income even more.

But for a tipped worker who doesn’t make much more than the standard deduction — say a college student who waits tables over the summer — the ability to claim an additional deduction would not generate much in tax savings. Someone making less than the standard deduction would have no taxable income to begin with.

The policy would save this low-wage waiter a small amount.

It’s important to note that the tips exemption applies only to the federal income tax. Workers would still owe payroll taxes, like the 6.2 percent Social Security tax, on their tipped income. They may also owe state income taxes on their tips.

For many low-income Americans, payroll taxes, rather than the income tax, are the biggest taxes they pay. Roughly 37 percent of tipped workers already don’t owe any federal income tax, according to an estimate from the Budget Lab at Yale.

Others wouldn’t gain because other benefits already eliminate their tax burden.

There are other tax breaks that could eliminate a worker’s tax liability before “no tax on tips” comes into the picture. For example, a full-time Uber or Lyft driver who can take advantage of the mileage deduction, which increases with every mile driven, may not have much use for another tax break.

The policy wouldn’t make a difference for this ride-share driver.

An exception to this would be tax benefits that are “refundable.” These are tax credits, like the earned- income tax credit, that give money to Americans even if they don’t owe anything in income tax. So these tax credits can become cash payments to low-income Americans. Because of that, workers could conceivably use the tips deduction to reduce their tax bills to zero and still receive the same benefit from a refundable tax credit.

The more money someone makes, the bigger the benefit.

The deduction would be most meaningful for those who make enough to owe a fair amount in income taxes. A typical tax cut for someone earning enough to benefit from the plan could be worth roughly $1,800.

This hairdresser would save the typical amount among those who would benefit.

This dynamic is a microcosm of how cuts to income taxes often work: The more money you make, the more you pay in tax and therefore the more you save from a tax cut. In this case, though, your benefit would depend both on how much you make and what share of your income comes in the form of tips.

This Las Vegas blackjack dealer would save a lot based on his significant tips.

This would be true up to a point. The Republican legislation would bar tipped workers making more than $160,000 from claiming the break. (That level would apply for this year and increase over time.)

The cut-off is a stark one. A tipped worker making $160,001 would, under the bill, receive nothing, potentially encouraging people to try to lower their earnings to claim the tax break. Making that extra dollar could mean thousands in additional taxes.

“No tax on tips” could end up as a short-lived experiment. In the House-passed bill, the policy would last only through 2028, though the legislation could change in the Senate.

Many tax-policy experts are rooting for the demise of the deduction, which they see as another potential hole in a tax system so strewn with carve-outs that it is often compared to Swiss cheese. In general, they would prefer a system that charges roughly the same tax on workers with roughly the same earnings, rather than creating a tax advantage for certain types of work.

“It’s the exact opposite of the general principles that tax policy purists advocate for,” said Joseph Rosenberg, a senior fellow at the Urban Institute.

About the data

Illustrated examples were constructed using data from a summary of the House Republican bill (proposed tips policy, standard deductions and tax rates); the Bureau of Labor Statistics (typical wages by occupation); companies and industry groups (estimated typical tip shares); and analyses from the Budget Lab at Yale and the Tax Policy Center (distributional effects of the policy). Workers in all examples have a single tax-filing status.

Business

California Senate passes bill that aims to make AI chatbots safer

California lawmakers on Tuesday moved one step closer to placing more guardrails around artificial intelligence-powered chatbots.

The Senate passed a bill that aims to make chatbots used for companionship safer after parents raised concerns that virtual characters harmed their childrens’ mental health.

The legislation, which now heads to the California State Assembly, shows how state lawmakers are tackling safety concerns surrounding AI as tech companies release more AI-powered tools.

“The country is watching again for California to lead,” said Sen. Steve Padilla (D-Chula Vista), one of the lawmakers who introduced the bill, on the Senate floor.

At the same time, lawmakers are trying to balance concerns that they could be hindering innovation. Groups opposed to the bill such as the Electronic Frontier Foundation say the legislation is too broad and would run into free speech issues, according to a Senate floor analysis of the bill.

Under Senate Bill 243, operators of companion chatbot platforms would remind users at least every three hours that the virtual characters aren’t human. They would also disclose that companion chatbots might not be suitable for some minors.

Platforms would also need to take other steps such as implementing a protocol for addressing suicidal ideation, suicide or self-harm expressed by users. That includes showing users suicide prevention resources.

Suicide prevention and crisis counseling resources

If you or someone you know is struggling with suicidal thoughts, seek help from a professional and call 9-8-8. The United States’ first nationwide three-digit mental health crisis hotline 988 will connect callers with trained mental health counselors. Text “HOME” to 741741 in the U.S. and Canada to reach the Crisis Text Line.

The operator of these platforms would also report the number of times a companion chatbot brought up suicide ideation or actions with a user, along with other requirements.

Dr. Akilah Weber Pierson, one of the bill’s co-authors, said she supports innovation but it also must come with “ethical responsibility.” Chatbots, the senator said, are engineered to hold people’s attention including children.

“When a child begins to prefer interacting with AI over real human relationships, that is very concerning,” said Sen. Weber Pierson (D-La Mesa).

The bill defines companion chatbots as AI systems capable of meeting the social needs of users. It excludes chatbots that businesses use for customer service.

The legislation garnered support from parents who lost their children after they started chatting with chatbots. One of those parents is Megan Garcia, a Florida mom who sued Google and Character.AI after her son Sewell Setzer III died by suicide last year.

In the lawsuit, she alleges the platform’s chatbots harmed her son’s mental health and failed to notify her or offer help when he expressed suicidal thoughts to these virtual characters.

Character.AI, based in Menlo Park, Calif., is a platform where people can create and interact with digital characters that mimic real and fictional people. The company has said that it takes teen safety seriously and rolled out a feature that gives parents more information about the amount of time their children are spending with chatbots on the platform.

Character.AI asked a federal court to dismiss the lawsuit, but a federal judge in May allowed the case to proceed.

Business

Commentary: MAHA report's misrepresentations will harm public health and hit consumers' pocketbooks

Serious followers of healthcare policy in the U.S. didn’t expect much good to emerge from its takeover by Donald Trump and his secretary of Health and Human Services, the anti-vaccine activist Robert F. Kennedy Jr.

But the agency and its leadership managed to live down to the worst expectations May 27, when HHS released a 73-page “assessment” of the health of America’s children titled “The MAHA Report” (for “Make America Healthy Again”).

A sloppier, more disingenuous government report would be hard to imagine. Whatever credibility the report might have had as a product of a federal agency was shattered by its obvious errors, misrepresentations and outright fabrications of source materials, some of it plainly the product of the authors’ reliance on AI bots.

I, and my co-authors, did not write that paper.

— Epidemiologist Katherine Keyes says a citation to her work by the MAHA report was fabricated

At least seven sources cited in the report do not exist, as Emily Kennard and Margaret Manto of the journalism organization NOTUS uncovered. HHS hastily reissued the report with some of those citations removed, but without disclosing the changes — an extremely unkosher action in the research community.

“I, and my co-authors, did not write that paper,” epidemiologist Katherine M. Keyes of Columbia told me by email, referring to a citation to a purported paper about anxiety among American adolescents resulting from the COVID pandemic. “It does make me concerned given that citation practices are an important part of conducting and reporting rigorous science.”

Keyes said she has done research on the topic at hand: “I would be happy to send this information to the MAHA committee to correct the report, although I have not yet received information on where to reach them,” she said.

We’ll go deeper into the fabrication fiasco in a moment. What’s important is its context: concerted attacks by Kennedy and his associates on the fundamentals of public health in America.

Those attacks have profound implications not only for Americans’ health, but on pocketbook issues and the U.S. economy generally. HHS bowed toward the latter issue by asserting in the report that the health profile of American children poses “a threat to our nation’s health, economy, and military readiness.”

As it happens, the recent actions at HHS and its subagencies, the Food and Drug Administration and the Centers for Disease Control and Prevention, increase those threats.

Take the agencies’ May 20 decision to remove COVID boosters from the CDC’s list of recommended vaccinations for healthy children and pregnant women. The decision opens the door for insurance companies to start charging full price for the shots, rather than covering them without copays as the law requires for preventive services.

That could mean out-of-pocket charges of $100 or more each booster, which could itself discourage families from getting vaccinated. This is a reminder of how family economics affect health.

The original version of RFK Jr.’s MAHA report cited this paper by Katherine Keyes and associates about adolescents’ pandemic-era mental health. The paper doesn’t exist; the citation to the Journal of the American Medical Assn. goes to a page saying it can’t be found. However …

(HHS)

The MAHA report attributes the rise in childhood obesity and diabetes in part to ultraprocessed foods, or UPFs. But it’s silent on what experts call the “social determinants of disease,” which are heavily related to economics. The report doesn’t mention “food deserts,” mostly low-income neighborhoods in which “children do not have access to anything other than UPFs, … or the cost of fresh food vs. the hyperpalatable and cheap UPFs,” observed the Delaware Academy of Medicine in its gloss on the report.

… after the fabrication was exposed, Heath and Human Services reissued the report, removing the citation without explanation.

(HHS)

And although the report mentions that safety net programs such as the Supplemental Nutrition Assistance Program — SNAP, or food stamps, school lunch and breakfast programs, and the Special Supplemental Nutrition Program for Women, Infants, and Children, or WIC, could play a role in promoting healthy eating, it doesn’t mention that those programs face severe budget cuts from the Trump White House.

Last month, HHS canceled nearly $800 million in grants to the pharmaceutical company Moderna for the development of a human vaccine against bird flu, part of a Biden administration effort to prepare for possible future pandemics, the potential social and economic impact of which should be self-evident, given our experience with COVID. Bird flu already has devastated the dairy and poultry industries in many regions and sickened dozens of farmworkers.

There was some hope in the research community that sound science might still live at HHS because some HHS appointees had scientific or medical credentials that Kennedy lacked. Those hopes get dashed on a regular basis.

On Sunday, for instance, FDA Commissioner Marty Makary — a former professor of medicine at Johns Hopkins — was reduced to incoherence when CBS’ “Face the Nation” moderator Margaret Brennan reminded him that on May 20 he co-authored a report in the New England Journal of Medicine that identified pregnancy as factor increasing the risk of “severe COVID-19” — warranting that pregnant women get the vaccine.

“Yet seven days later,” Brennan said, Makary joined with Kennedy in a video announcement recommending against giving pregnant women the booster. “So what changed in the seven days?” Makary argued that only 12% of pregnant women got the shot last year, “so people have serious concerns.”

What he didn’t say was that those concerns have been ginned up by FDA critics — including Makary — and vaccine opponents, even though clinical trials involving tens of thousands of subjects have validated the recommendation that pregnant women get the vaccine.

That brings us back to the MAHA report.

Let’s start with its core assertion — that “today’s children are the sickest generation in American history.” As soon as the report was issued, this trope was picked up uncritically by the news media, before the report’s citation errors were discovered. But it’s undoubtedly wrong, the product of cherry-picking official statistics and ignoring what they really say.

An attack on childhood vaccination gets a subject heading all its own in this report, which asserts that the number of recommended vaccines for children by 1 year of age has increased from three in 1986 to 29 now, including vaccines for pregnant mothers.

Pediatrician Vincent Iannelli has ably punctured this claim, which he identifies as anti-vax “propaganda.”

The report reaches its count of 29 by including some vaccines given to children older than 1 year and double-counting shots such as the RSV vaccine, given to either the mother or the infant, not both. An honest count would be as few as 17, not all of which are injections. The report also counts combination vaccines such as MMR and TDaP as three shots rather than one.

In pushing the “sickest generation” trope, the report glides over the heath threats faced by children — and adults — before vaccines were available for specific diseases. In the U.S., measles cases averaged more than 530,000 per year throughout the 20th century; as of 2023, the average was 47, according to the CDC.

Mumps fell from more than 162,000 cases annually to 429 and rubella from nearly 48,000 to three. Whooping cough, or pertussis, fell from nearly 201,000 cases to 5,611. And polio, the fearsome nemesis of American families in the 1950s, from 16,300 to zero.

One can trace the “sickness” of children in bygone generations through child mortality statistics. In 1900, the average life expectancy of a 1-year-old in the U.S. was about 56 years; that bespeaks a morbid population of infants. In 1950 it was still only about 70. Now it’s 79.

For all that the MAHA report purports to identify the leading health threats to America’s kids — processed foods, environmental chemicals, vaccines — it totally ignores what we know to be the single biggest cause of childhood mortality in the U.S.: firearms.

The CDC has reported that in 2021, firearm injuries killed 2,571 children. That rate of 3.7 deaths per 100,000 children aged 17 and younger was an increase of 68% since 2000. The firearm death rate of 6.01 per 100,000 children aged 1-19 was 10 times the rate in Canada and 20 times the rates in France and Switzerland. Why the silence in the MAHA report? What does that say about how far you should trust the MAHA team at HHS?

As for the multiple false citations in the report, they point to the sheer irresponsibility of a federal agency’s outsourcing of research to AI.

I asked HHS for an explanation of how these errors got into the MAHA report, but I received no reply. White House spokeswoman Karoline Leavitt, however, responded to a reporter’s question about the fiasco by claiming there were “formatting issues” with the report.

Her excuse made me laugh, because it was the same excuse offered by the big law firm Latham and Watkins when it was caught submitting AI fabrications to a judge as part of a legal filing, as I reported recently. In neither case did the excuses explain how “formatting issues,” whatever that means, resulted in the fabrication of source citations.

HHS attributes the report to a 14-member “Make America Healthy Again” commission, composed mostly of cabinet members and other officials with no responsibility for or expertise in public health, such as the secretaries of Housing and Urban Development, Education, Agriculture and Veterans Affairs and directors of White House budget and economic offices. Makary and Bhattacharya are on the panel. They lent their names and reputations to this product, much to their discredit.

But it’s unclear about who actually put pen to paper. Some of its language can be traced back to Kennedy’s own words. The report’s assertion that “today’s children are the sickest generation in American history” was picked up and amplified by media coverage of the report’s release, even though it’s not supported by the facts. It is a verbatim echo of a claim Kennedy has made repeatedly, however, mostly as a plank in his anti-vaccination platform. It was part of the title of a book his anti-vaccine organization, Children’s Health Defense, issued in 2018 (“The Sickest Generation”).

The most frightening aspect of the MAHA report is that it’s likely to be the blueprint for a comprehensive attack on public health; scarier in that news media and political leaders are citing it as though it has scientific value. It’s so infected with falsehoods, misrepresentations and ideological blinkers that it will only subject the health of American children to the greatest risk they’ve faced in, yes, American history.

-

Movie Reviews1 week ago

Movie Reviews1 week agoMOVIE REVIEW – Mission: Impossible 8 has Tom Cruise facing his final reckoning

-

Politics1 week ago

Politics1 week agoTrump honors fallen American heroes, praises God in Memorial Day address: 'Great, great warriors'

-

Politics1 week ago

Politics1 week agoTrump admin asking federal agencies to cancel remaining Harvard contracts

-

Culture1 week ago

Culture1 week agoCan You Match These Canadian Novels to Their Locations?

-

Politics1 week ago

Politics1 week agoHomeland Security chief Noem visits Netanyahu ahead of Jerusalem Day

-

News1 week ago

News1 week agoHarvard's president speaks out against Trump. And, an analysis of DEI job losses

-

News1 week ago

News1 week agoRead the Trump Administration Letter About Harvard Contracts

-

Technology1 week ago

Technology1 week agoThe Browser Company explains why it stopped developing Arc