Business

Scammers exploit Bitcoin ATMs. Will new California laws help crack down on fraud?

Jim Meduri answered a terrifying phone call in January from a man pretending to be his son.

The caller, who sounded on the verge of tears, said he’d been in a car accident. Meduri was convinced his son had been arrested for driving under the influence and injuring a pregnant woman and her daughter.

The San Jose resident later spoke to people impersonating a defense attorney and a courthouse clerk, who told him his son might be sent from the Bay Area to Nevada because of a monkeypox outbreak at the jail. Panicked and in a rush, Meduri agreed to send bail money through cryptocurrency. The fake lawyer directed Meduri, 65, to an ATM where people can buy the digital currency Bitcoin. He inserted $15,000 in cash into the machine, scanned a code provided by the scammers and transferred the money.

When Meduri realized he’d been duped, his money was gone.

“They played on fear and what a parent would do to help their kid, and it was elaborate,” said Meduri, who was able to get most of his money back with help from the Santa Clara County district attorney’s office.

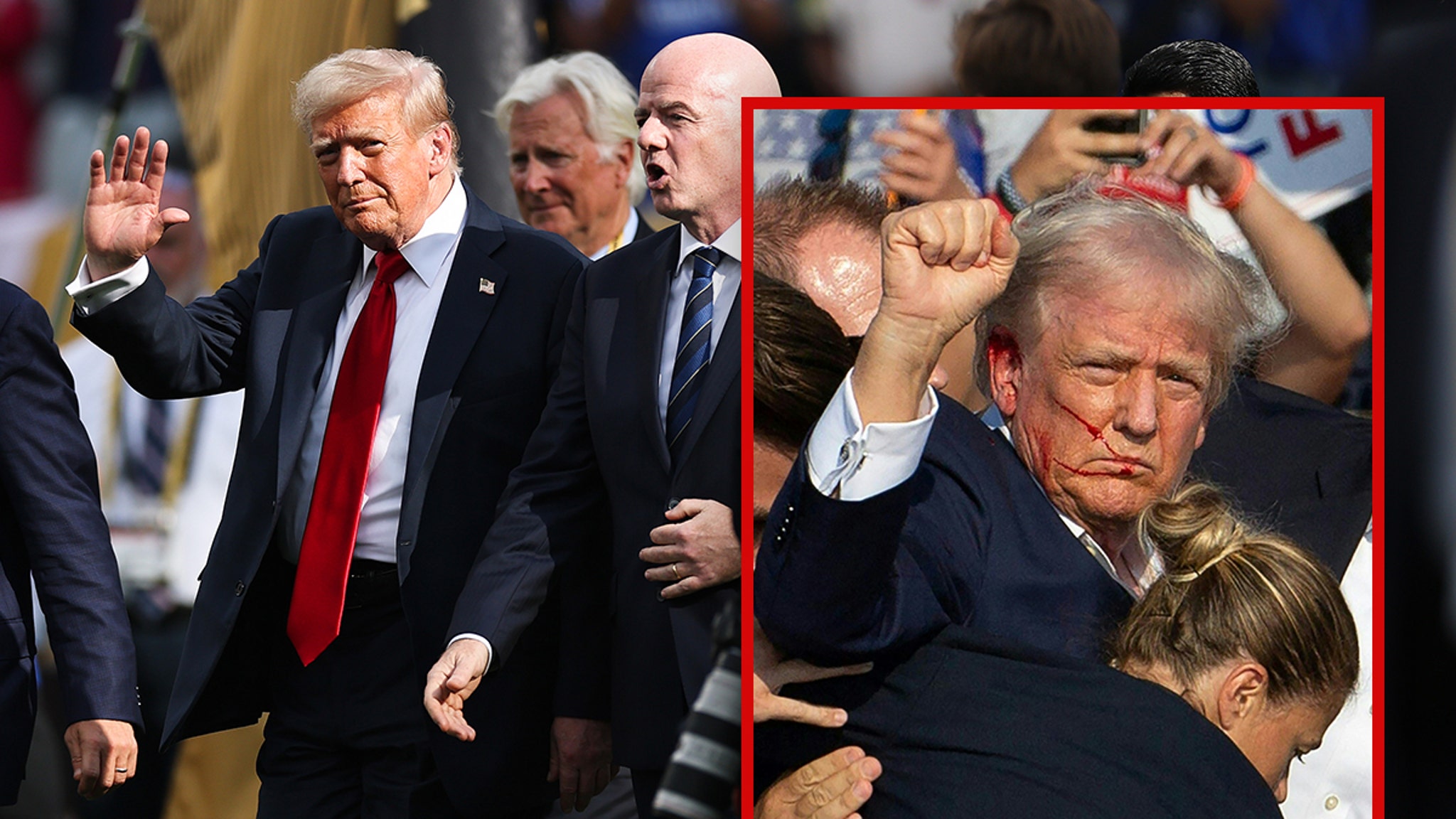

Meduri’s misfortune is just one example of how scammers are using Bitcoin ATMs to swindle victims out of thousands of dollars, fraud that law enforcement officials warn is on the rise.

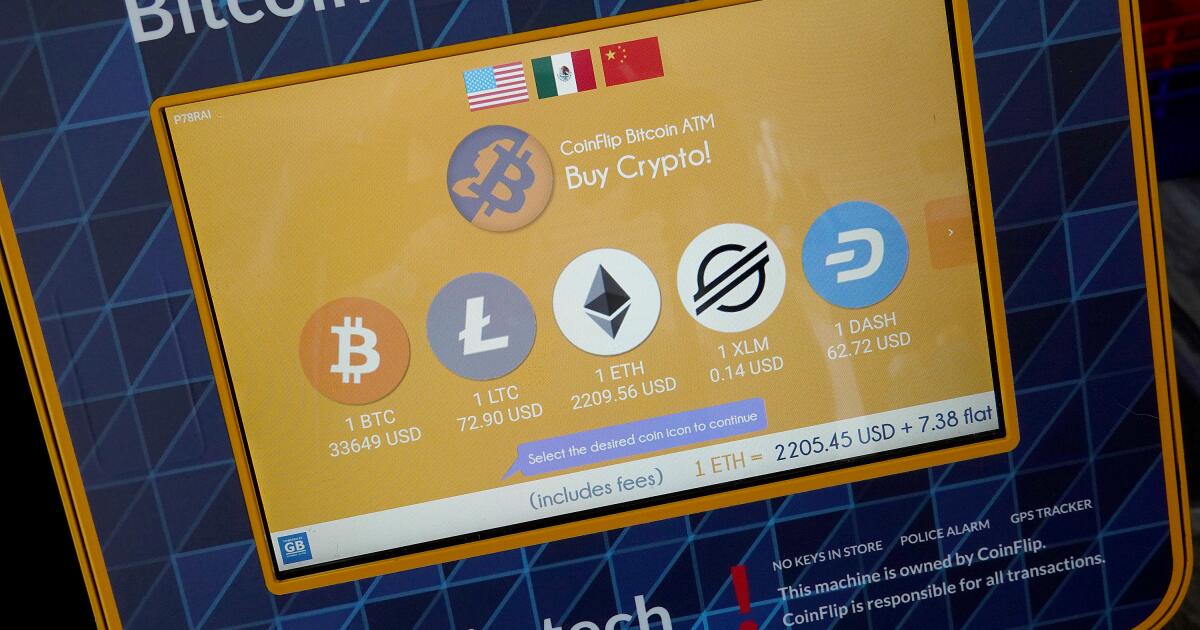

The machines, located in convenience stores, gas stations and even bakeries, are an easy way for people to buy cryptocurrency quickly with cash, which is harder to track than a wire transfer or check. As scammers exploit the convenience these machines provide, Bitcoin ATMs are also attracting the attention of lawmakers, regulators and consumer advocacy groups looking to protect people from fraud and exorbitant fees.

Starting in January, California will limit cryptocurrency ATM transactions to $1,000 per day per person under Senate Bill 401, which Gov. Gavin Newsom signed into law. Some Bitcoin ATM machines advertise limits as high as $50,000. The new law also bars Bitcoin ATM operators from collecting fees higher than $5 or 15% of the transaction, whichever is greater, starting in 2025. Legislative staff members visited a crypto kiosk in Sacramento and found markups as high as 33% on some digital assets when they compared the prices at which cryptocurrency is bought and sold. Typically, a crypto ATM charges fees between 12% and 25% over the value of the digital asset, according to a legislative analysis.

“This bill is about ensuring that people who have been frauded in our communities don’t continue to watch our state step aside when we know that these are real problems that are happening,” said Sen. Monique Limón, D-Goleta, who co-authored the bill.

While similar scams have existed long before the rising popularity of cryptocurrency, the use of these digital assets by fraudsters has been increasing, according to the Federal Trade Commission. Since 2021, more than 46,000 people reported losing over $1 billion in crypto to scams, the agency reported in 2022.

Victims of Bitcoin ATM scams say limiting the transactions will give people more time to figure out they’re being tricked and prevent them from using large amounts of cash to buy cryptocurrency. But crypto ATM operators say the new laws will harm their industry and the small businesses they pay to rent space for the machines. There are more than 3,200 Bitcoin ATMs in California, according to Coin ATM Radar, a site that tracks the machines’ locations.

“This bill fails to adequately address how to crack down on fraud, and instead takes a punitive path focused on a specific technology that will shudder the industry and hurt consumers, while doing nothing to stop bad actors,” said Charles Belle, executive director of the Blockchain Advocacy Coalition.

While California lawmakers have striven to balance the need to support the cryptocurrency industry and protect consumers, recent legislation has hewed toward tighter state regulation. Another law would by July 2025 require digital financial asset businesses to obtain a license from the California Department of Financial Protection and Innovation.

When signing the legislation, Assembly Bill 39, Newsom included a message that said the law needed further refinement to provide clarity to consumers, businesses and state regulators.

“It is essential that we strike the appropriate balance between protecting consumers from harm and fostering a responsible innovation environment,” he wrote.

In 2022, months before the collapse of cryptocurrency exchange FTX, Newsom vetoed a similar bill that would have required cryptocurrency companies to get a state license, citing concerns a new regulatory program would be costly and the actions were premature.

Erin West, a Santa Clara County Deputy District Attorney who helped Meduri recover his money, said scammers turn to Bitcoin ATM machines because they accept large amounts of cash. The value of Bitcoin can also rise, giving fraudsters a way to increase their plunder.

Scammers use different tactics to trick people into handing over their money, including creating a false sense of urgency and winning over their trust. Some befriend or seduce their victims through social media or dating apps, luring them into a web of lies that include fake emergencies. Other times, the scam starts with a text message directing victims to a fake cryptocurrency investment site.

West said her team has been able to recover $2.5 million for scam victims like Meduri by tracking down the cryptocurrency exchange that was involved in the transaction. After Meduri put $15,000 into a kiosk operated by Bitcoin ATM Services, the digital money ended up in the cryptocurrency exchange Binance. The exchange complied with a search warrant, allowing her team to retrieve the stolen funds from Binance and return them to Meduri.

While it’s possible for cryptocurrency victims to get their money back even if it travels overseas, West said it’s rare. Some cryptocurrency exchanges are more cooperative with law enforcement than others, she said.

“This whole thing is a speed game,” said West, who is part of a task force called REACT — Regional Enforcement Allied Computer Team — that combats high-tech crimes. “Can we get the victim in front of a competent investigator who knows how to find things on the blockchain in the least amount of time?” Blockchain is a type of shared digital database that stores information about crypto transactions.

An 80-year-old retired teacher in Los Angeles, whom The Times previously interviewed, said she hasn’t been able to recover $69,000 she sent to scammers through a Bitcoin ATM over multiple days in May. The stolen funds ended up in Seychelles-based cryptocurrency exchanges KuCoin and Huobi.

The scam started when Mrs. K, who wants to remain anonymous because she’s more wary about giving out her personal information, got a loud pop-up alert that her computer was infected with a virus. After calling a fake tech support number and later talking to a person impersonating the FBI, Mrs. K thought her Chase bank account had been taken over by foreign Chinese hackers involved in a child pornography case. To keep up the elaborate ruse, the scammers also sent Mrs. K fake Chase bank emails.

“If it wasn’t this convoluted mishmash, I probably would have been a little smarter and not fallen into this trap,” Mrs. K said. “I feel so disappointed in myself that I just fell hook, line and sinker.”

Mrs. K said the FBI impersonator told her to withdraw $75,000 in cash over three days from her Chase checking account and not tell anyone. If workers at the bank asked, the scammer told Mrs. K to say that she was withdrawing cash for construction.

The FBI impersonator convinced Mrs. K she could help law enforcement catch the child predators if she converted the cash to cryptocurrency and transfered the funds to a digital wallet the agency would monitor. The intricate lie eventually led Mrs. K to a Coinhub Bitcoin ATM machine at a doughnut shop in Highland Park that accepts up to $25,000 in cash daily per person.

By the time she realized it was a scam, Mrs. K had already sent $69,000 to the fraudsters. She reported the crime to police, but hasn’t been able to recover her money.

A Bitcoin ATM sits next to a regular cash ATM inside a gas station mini market in Los Angeles.

(Chris Delmas / AFP via Getty Images)

Under federal law, Bitcoin ATM operators are typically considered money services businesses so they’re required to register with the U.S. Department of Treasury’s Financial Crimes Enforcement Network, or FinCEN. The agency collects and analyzes financial information to combat money laundering and other illegal uses. The businesses must also maintain an anti-money-laundering program and report suspicious activity to the agency.

Logan Short, the CEO of LSGT Services, which does business as Coinhub Bitcoin ATM, said in an email the company does “everything in its power to protect consumers, but unfortunately fraud is not 100% preventable in any industry.” The Las Vegas-based company is registered with FinCEN but faced allegations that it operated crypto ATM machines in Connecticut without the required state license.

Bitcoin ATM Services, which operates the kiosk used by Meduri, says on its website that it is registered with FinCEN. The Times couldn’t find a record of Bitcoin ATM Services being registered as a money services business with FinCEN. A company called Cash ATM Services that has the same mailing address as Bitcoin ATM Services was registered. Bitcoin ATM Services did not respond to a request for comment.

Law enforcement has cracked down on unlicensed crypto ATMs,but it can be tough for consumers to tell how serious the industry is about addressing the concerns. In 2020, a Yorba Linda man pleaded guilty to charges of operating unlicensed Bitcoin ATMs and failing to maintain an anti-money laundering program even though he knew criminals were using the funds. The illegal business, known as Herocoin, allowed people to buy and sell Bitcoin in transactions of up to $25,000 and charged a fee of up to 25%.

Cryptocurrency regulations vary by state. California has long exempted crypto ATMs from licensing requirements for businesses engaged in money transmission.

Crypto ATM machines serve people who don’t have a bank account or just want the convenience of buying cryptocurrency at a gas station, convenience store or other shop, said Ayman Rida, CEO of Cash2Bitcoin, who works with cryptocurrency ATM operators including in California on complying with state regulations. The fees ATM charge are higher than online exchanges, he said, to cover certain expenses. That includes the cost of leased space, machine maintenance and cash management.

Crypto ATM operators aren’t opposed to having clearer rules and guidelines, he said, but they are against capping fees and transactions. Crypto ATM operators typically require more forms of identification if a customer makes a transaction more than $1,000 and in some cases flag high-value transactions, which could help stop scammers.

“Scammers are getting smarter,” he said. “My question for the regulators is, why are you killing an industry when scams also happen to other industries but they’re not doing anything about it as well?”

As for Meduri, who was duped in a Bitcoin ATM scam, he’s just relieved his son wasn’t really arrested and in a car accident. Oddly enough, finding out it was all an elaborate lie came with a sense of relief.

“My wife and I were just wrecked that day,” he said. “I didn’t even care. I was happy he was OK.”

Business

'Superman' rescues DC at the box office with a $122-million debut

James Gunn’s “Superman” soared to the top of the box office this weekend, giving Warner Bros.’s DC Studios much-needed momentum in the superhero genre after a string of underperforming movies.

“Superman,” which stars David Corenswet as the Man of Steel, hauled in a robust $122 million in the U.S. and Canada. Globally, “Superman” brought in a total of $217 million.

The movie was a big swing for Burbank-based Warner Bros. and DC, costing an estimated $225 million to produce, not including substantial spending on a global marketing campaign.

“Superman” benefited from mostly positive critics reviews — the movie notched a 82% approval rating on aggregator Rotten Tomatoes. Moviegoers liked it too, indicated by an “A-” grade from polling firm CinemaScore and a 93% positive audience rating from Rotten Tomatoes.

The performance for “Superman” fell short of expectations from some analysts, who had projected an opening weekend of $130 million. Industry observers attributed that to heavy competition from other blockbusters, including Universal’s “Jurassic World Rebirth” and Apple and Warner Bros.’ “F1 The Movie.”

Shortly before its release, “Superman” came under fire from right-wing commentators, who criticized comments Gunn made to the Times of London about how Superman (created by a Jewish writer-artist team in the late 1930s) is an immigrant and that he is “the story of America.”

“If there’s any softness here, it’s overseas,” said industry analyst and consultant David A. Gross in his FranchiseRe newsletter, after describing the domestic opening as “outstanding” for a longrunning superhero franchise.

The movie generated $95 million outside the U.S. and Canada.

Analysts had raised questions about whether Superman’s reputation for earnestly promoting truth, justice and the American way would still appeal to a global audience, particularly as other countries have bristled at the U.S. tariff and trade policies enacted by President Trump.

“Superman has always been identified as a quintessentially American character and story, and in some parts of the world, America is currently not enjoying its greatest popularity,” Gross said.

The movie’s overall success is key to a planned reboot and refresh of the DC universe. Gunn and producer Peter Safran were named co-chairmen and co-chief executives of DC Studios in 2022 to help turn around the Warner Bros.-owned superhero brand after a years-long rough patch.

While 2013’s “Man of Steel,” directed by Zack Snyder, and 2016’s “Batman v Superman: Dawn of Justice” each achieved substantial box office hauls, they did not receive overwhelmingly positive reviews. 2017’s “Justice League,” which was intended to be DC’s version of Marvel Studios’ “Avengers,” was a critical and commercial disaster for the studio.

More recently, films focused on other DC characters such as 2023’s “Shazam! Fury of the Gods,” “The Flash” and last year’s “Joker: Folie à Deux” struggled at the box office.

With Gunn and Safran at the helm, the pair are now tasked with creating a cohesive vision and framework for its superhero universe, not unlike its rival Marvel, which has long consolidated control under president Kevin Feige (though its films and shows are handled by different directors).

Starting the new DC epoch with Superman also presented its own unique challenges. Though he is one of the most recognizable superheroes in the world, Superman’s film track record has been a roller coaster. Alternatively sincere, campy or gritty, the Man of Steel has been difficult for filmmakers and producers to strike the right tone.

Gunn’s version of “Superman” — still mostly sincere but a touch of the filmmaker’s signature goofy humor — worked for critics and audiences. It was a tall order, considering some fans still hold Richard Donner’s 1978 “Superman,” starring Christopher Reeve, as the gold standard.

“Pinning down ‘Superman’ has been a challenge,” said Paul Dergarabedian, senior media analyst at Comscore. “It’s been like Kryptonite for years for many filmmakers and producers to get it right.”

“Superman” bumped “Jurassic World Rebirth” to second place, where it collected $38.8 million domestically over the weekend for a total of $231 million so far. “F1,” Universal’s “How to Train Your Dragon” and Disney-Pixar’s “Elio” rounded out the top five at the box office this weekend.

Later this month, another major superhero movie will enter the summer blockbuster marketplace: “The Fantastic Four: First Steps,” from Walt Disney Co.-owned Marvel Studios.

Business

It's peak season in Malibu, but these small businesses are still struggling after the Palisades fire

Six months after the Palisades fire roared down Pacific Coast Highway, the Country Kitchen in Malibu is open for business, but many customers have yet to return.

The no-frills eatery features a few outdoor tables and ocean views, nestled in a narrow parking lot alongside a liquor store and gift shop. The restaurant, which opened in 1972, is literally a hole in the wall. It serves breakfast burritos all day and burgers out of a window.

It wasn’t destroyed by the fires but had extensive smoke damage. It was cut off from most of its customers for close to five months, waiting for the highway to reopen. Business is a lot better than it was a couple of months ago, but still well below what the restaurant would usually see this time of year.

“Things are better, but if you compare it to last year, it’s still probably 25% less business,” said Joel Ruiz, who has worked at the Country Kitchen for 40 years.

Up and down the coast, businesses that survived the flames are still hoping for a return to normalcy. As customers slowly return to a changed landscape, the small businesses that dot Pacific Coast Highway wonder how long it will take to get back to business as usual.

1. Joel Ruiz works at the Country Kitchen on PCH as businesses reopen after being closed due to the Palisades fire. 2. A painting of the Country Kitchen hangs on the wall of the roadside restaurant.

PCH was closed to nonresidents for five months following the Palisades fire, isolating the once-bustling businesses that catered to beachgoers and tourists.

According to the California Department of Forestry and Fire Protection, the Palisades fire charred more than 23,000 acres and destroyed more than 6,000 structures. The blaze burned the vast majority of homes along the ocean from Topanga Canyon to Las Flores Canyon.

Nearly 800 structures were lost in Malibu, including the Reel Inn, a seafood restaurant just a few miles down the road from the Country Kitchen. Other popular restaurants including Duke’s Malibu are still closed due to damage. Caffe Luxxe near Carbon Beach was closed for months before reopening in May.

Jefferson Wagner, owner of Zuma Jay’s surf shop, reopens after being closed due to the Palisades fire.

It should be peak summer season for Zuma Jay’s, which has been selling boards and wax to surfers since 1975. Instead, sales are about a third less than normal.

“It’s better, but not like it was last year at the same time,” Jefferson Wagner said. He couldn’t pay his four employees for months.

Wagner holds an old young photo of himself and his daughter.

Some estimates put the total cost of the Los Angeles area wildfires at $250 billion. Gaps or delays in insurance coverage have kept many from cleaning or rebuilding their property at the pace they hoped.

“We’re still trying to get back to what we had before,” said Malibu City Councilmember Doug Stewart, who was serving as mayor during the Palisades fire. “The store owners and restaurants are telling me that things have picked up considerably, but they’re still not back to what they’d expect to see for the summer.”

Stewart said most businesses in the community were spared from being burned to the ground but are still struggling to reopen and stay viable.

“It’s less of a rebuilding issue and more of a question of making sure that they’ve been able to survive,” he said.

The businesses neighboring the Country Kitchen in the strip mall along PCH have all had to adapt to the aftermath of the fire. Even the view from the parking lot is different, with vast stretches of the ocean now visible where homes had previously stood.

Carter Crary, co-owner of scuba shop Malibu Divers, poses for a portrait shortly after his business reopened.

The scuba shop Malibu Divers officially reopened May 23, the same day Gov. Gavin Newsom reopened PCH. Co-owner Carter Crary came into the shop every day while the road was still closed, serving an occasional customer. Business was down about 90% for more than four months.

“There’s been a definite change since the highway reopened,” he said. “We are not yet where we should be for this time of year, but we’re on a trajectory that has us heading in the right direction.”

Malibu Divers doesn’t have business interruption insurance but was able to offset some of the losses caused by the fire with a Small Business Assn. emergency loan. Crary estimated his business has lost out on $150,000 in revenue since January. The shop earns between $500,000 and $1 million in a normal year.

Crary employs around 12 staff members, but he’s currently not able to pay or bring in his in-store employees. The dive shop, which offers rental gear and scuba lessons, opened in 1969 and is usually busiest between May and September.

Business has been further impacted because people aren’t diving in the areas where the Palisades fire burned. Most divers are going north for cleaner waters, Crary said.

Malibu’s scenic beaches, now contaminated with heavy metals and debris from the wildfire, usually attract customers to Roxanne Jensen’s souvenir shop, Blue Malibu, located a few doors down from Malibu Divers.

“It’s been very slow because people don’t know we’re open,” Jensen said. “We have to be patient. As long as the ocean is there, the customers will come back.”

Jensen closed her store for five months after the fire destroyed the merchandise on display and drove away tourists. July and August are typically big months for sales, said Jensen, who runs the shop with her husband.

Jensen’s landlord is allowing her to pay half her usual rent, but even that is hard to come up with, she said. She opened her shop 10 years ago and sells sweatshirts, swimwear and gifts.

Jensen said she has faith the Malibu community will rebound, like it has several times in the past after disastrous wildfires and landslides. She stood among her merchandise on a recent quiet Wednesday and was cautiously hopeful.

“Maybe next summer will be normal,” she said.

Though the Country Kitchen employees had to stay home with no pay for months, they are back now, serving chili cheese fries, omelets and buffalo burgers.

“People love this place,” Ruiz said, standing in front of spot where he has worked most of his life. “We had customers calling who wanted to come in, but for a long time they weren’t able to.”

Business

Big buildout begins at Port of Long Beach amid global trade uncertainty

A major terminal operator at the Port of Long Beach broke ground on a $365-million expansion project Friday, even as activity at the port has cooled recently in response to rising tariffs.

The terminal operator International Transportation Service plans to fill in a 19-acre area of water and extend the existing quay by 560 feet, which would allow larger ships to dock at the port.

The expansion would boost cargo-handling capacity by 50% and create jobs, the company said at a ground breaking ceremony Friday. The new terminal would be able to accommodate two vessels each capable of carrying 18,000 cargo containers.

“There is a demand coming for bigger ships,” said ITS Chief Executive Kim Holtermand. “This project strengthens America’s supply chain by investing in infrastructure the right way.”

The leap comes after container movement through the Port of Long Beach dropped sharply in recent months.

President Trump’s frequent changing of tariffs on countries including key trade partners Canada and Mexico have stunted global trade, prompting concern from public officials, laborers and business leaders.

The Port of Los Angeles has also experienced a slowdown and reported that job opportunities at the port were down by half in June.

The number of containers processed at the Port of Long Beach in May is down more than 8% from last year, and loaded containers being shipped out of the port, known as loaded exports, are down more than 18%. At the Port of Los Angeles, loaded exports dropped 4% from last May.

Shipping underway at the International Transportation Service terminal, which is undergoing a $365-million terminal expansion.

(Allen J. Schaben / Los Angeles Times)

Port of Long Beach Chief Executive Mario Cordero said the port is capable of progress in times of crisis and has learned from its perseverance through the pandemic.

“We are most definitely in a period of uncertainty in this industry,” Cordero said. “But there is one certainty here at the port. We will continue to build,” he said.

A large group gathered to celebrate the start of the project in Long Beach, including Long Beach Mayor Rex Richardson and longshore and warehouse workers union ILWU 13 President Gary Herrera.

-

Politics1 week ago

Politics1 week agoVideo: Trump Signs the ‘One Big Beautiful Bill’ Into Law

-

World1 week ago

World1 week agoRussia-Ukraine war: List of key events, day 1,227

-

Education1 week ago

Education1 week agoOpinion | The Ugliness of the ‘Big, Beautiful’ Bill, in Charts

-

News3 days ago

News3 days agoVideo: Trump Compliments President of Liberia on His ‘Beautiful English’

-

News6 days ago

News6 days agoTexas Flooding Map: See How the Floodwaters Rose Along the Guadalupe River

-

News1 week ago

News1 week agoDeath toll from Texas floods rises to 24 as search underway for more than 20 girls unaccounted for | CNN

-

Business6 days ago

Companies keep slashing jobs. How worried should workers be about AI replacing them?

-

Technology1 week ago

Technology1 week agoCyberpunk Edgerunners 2 will be even sadder and bloodier