Business

Read the Criminal Indictment Against Sam Bankman-Fried

Federal prosecutors in Manhattan unsealed an eight rely indictment towards Sam Bankman-Fried on Tuesday morning, a day after the crypto entrepreneur was arrested within the Bahamas.

The indictment charged Mr. Bankman-Fried with securities fraud, wire fraud and a number of other conspiracy counts involving cash laundering and marketing campaign finance violations. The 13-page submitting mentioned Mr. Bankman-Fried and others engaged in a scheme that started again in 2019 to defraud clients of the FTX crypto alternate and lenders to Alameda Analysis, a crypto buying and selling platform that was carefully tied to FTX.

Federal prosecutors in Manhattan filed fees solely towards Mr. Bankman-Fried. However the indictment suggests a few of his associates at FTX may additionally face fees sooner or later. It’s additionally potential that some could also be cooperating with the investigation.

Mark Cohen, a lawyer for Mr. Bankman-Fried, mentioned his consumer was “reviewing the costs together with his authorized workforce and contemplating all of his authorized choices.”

The prison indictment is much less detailed than a civil securities fraud criticism filed on Tuesday morning by the Securities and Alternate Fee. The S.E.C. criticism centered on misrepresentations that Mr. Bankman-Fried had made to large traders who invested practically $2 billion within the alternate. Securities regulators additionally mentioned that buyer cash deposited with FTX for buying and selling crypto had lengthy been commingled with cash at Alameda and misused by Mr. Bankman-Fried.

The indictment additionally fees that Mr. Bankman-Fried lied to his traders and clients. Nevertheless it features a new allegation that he lied to lenders — typically different crypto buying and selling corporations — that supplied financing to Alameda. Federal prosecutors within the indictment mentioned Mr. Bankman-Fried dedicated wire fraud by acquiring these large loans and “offering false and deceptive data” to the lenders about Alameda’s monetary situation.

Prosecutors additionally cost that Mr. Bankman-Fried conspired with others to violate federal marketing campaign finance legal guidelines by making contributions within the names of different folks in violation of reporting necessities.

Mr. Bankman-Fried and FTX have been main political donors within the final federal election cycle.

Right here is the indictment:

Business

Boeing Starliner launch delayed due to possibly faulty rocket valve

The launch of Boeing’s Starliner capsule to the International Space Station was scrubbed Monday evening due to a malfunctioning valve on the Atlas V rocket that would blast it into space. It was not immediately certain when it would be rescheduled.

The rocket is a reliable workhorse and is made by the United Launch Alliance, a joint venture of Boeing and Lockheed Martin. After years of delays in Boeing’s Starliner program, the launch with two astronauts aboard is considered crucial.

NASA said an oxygen relief valve on the rocket’s Centaur second stage was “buzzing,” or rapidly opening and closing, and would be closely examined to determine whether it needed to be replaced because of cycling too many times.

The space agency said the launch could be rescheduled as soon as Tuesday or possibly Friday or Saturday. NASA officials said that the crew was never in danger and that the launch might have proceeded if it were a satellite payload.

The decision to scrub the launch was made by NASA, Boeing and the United Launch Alliance.

Boeing’s new Starliner capsule was scheduled to blast off with a crew last summer, but a problem was discovered with its parachute system and the use of flammable tape in the craft, a mile of which was removed. It had been just the most recent of several delays prior to Monday.

This week’s flight plan called for NASA astronauts Barry Wilmore and Sunita Williams to spend a minimum of eight days testing the docked Starliner before returning to Earth as soon as May 15.

Boeing’s capsule is intended to provide NASA with a second U.S. vehicle to reach the space station — along with SpaceX’s Crew Dragon capsule. A prior unmanned Starliner test flight last year docked with the station, but the first flight in 2019 failed to reach it.

The stakes are high for Boeing, which received a $4.2-billion contract from NASA in 2014 to service the International Space Station, while rival SpaceX of Hawthorne received a smaller $2.6-billion contract to also provide the service — and has already sent eight crews to the station.

Boeing is counting on the Starliner to be a success, given the company’s tarnished reputation after two crashes of its 737 Max 8 jets and a door plug that blew out of a 737 Max 9 flight this year on its way to Ontario International Airport in San Bernardino County. The company also had to absorb a reported $1.5 billion in Starliner cost overruns.

NASA selected the companies to provide it with American launch services after having to rely on the Russian program since the space shuttle program ended in 2011.

Business

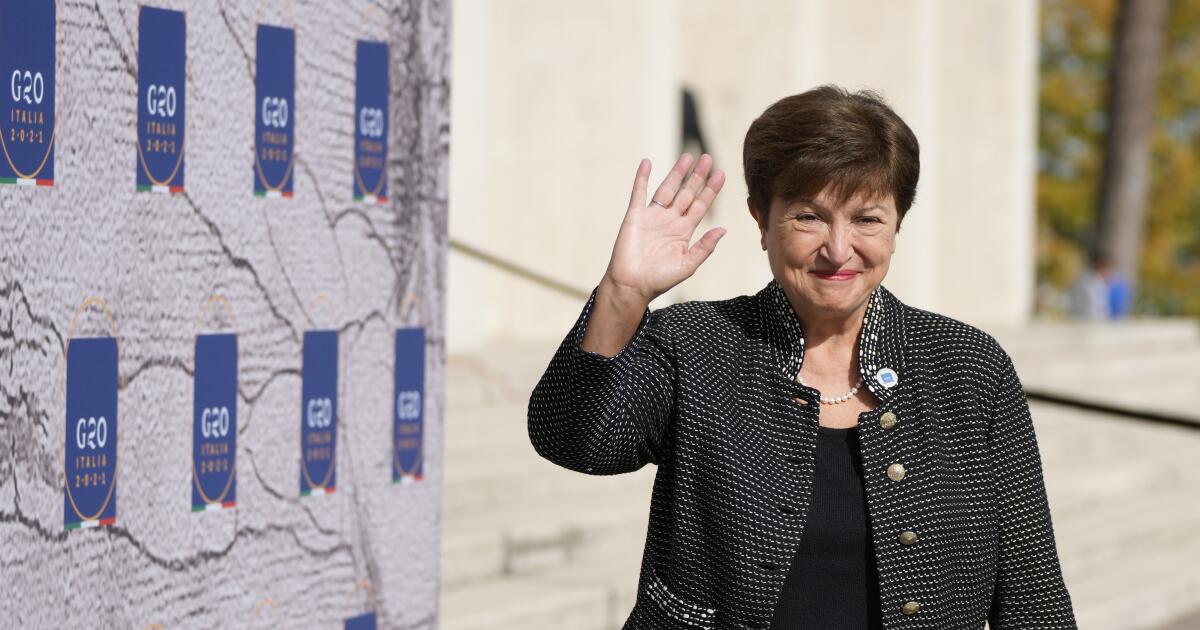

IMF chief Kristalina Georgieva calls U.S. debt load 'mind boggling'

International Monetary Fund Managing Director Kristalina Georgieva praised the strength of the U.S. economy but warned its current level of deficit spending was not sustainable and could crimp U.S. and global growth if it’s not brought under control, in remarks Monday at the Milken Institute Global Conference.

Servicing the U.S debt — now roughly $34 trillion — consumes more than 17% of federal revenue, compared to under 7% in 2015, Georgieva said in an interview that kicked off the annual conference at the Beverly Hilton, which draws thousands of businesspeople, investors and professionals from around the world.

“It cannot go like this forever, because the … burden on the U.S. is going to cripple spending that is necessary to make for servicing the debt. To pay 17-plus percent in debt service is just mind-boggling,” Georgieva said. “There is opportunity cost to this money … it doesn’t go to emerging markets where it can finance jobs and business opportunities for American companies.”

The IMF is composed of 190 member nations and is one of the leading global economic institutions, providing lending to economies in distress.

Georgieva said the U.S. needs to address its entitlement spending but said its economy is strong and remains a pillar of the world economy given its innovation, strong labor market and position as an energy exporter.

She also said she did not believe that the trend toward deglobalization was leading to the disintegration of the global economy, but warned that trade sanctions and industrial policies taken by many nations will only lead to lower growth rates — with the primary question being how much.

“We are measuring that just trade restrictions can cause the world economy to lose between 0.2% and 7% of GDP,” she said, comparing the high-end figure to removing Japan and Germany from the world economy. “So it is really costly.”

However, calling herself an “eternal optimist,” Georgieva said she expected “policymakers to take a course correction when they see that where they are headed is, you know, falling off a cliff.”

She envisioned that this decade will see advanced economies like the U.S. do well, while others will stagnate and lower-income countries continue to fall behind.

“So very likely we will have a world in which some economies transform, some economies stagnate and some parts of the world are in perpetual turbulence,” she said.

Milken Institute President Richard Ditizio introduced the IMF managing director, telling the audience that this year’s 27th annual conference, which ends Wednesday, will feature more than 200 sessions and more than 1,000 speakers.

The theme of this year’s conference is “Shaping a Shared Future,” a reference to finding common ground amid the complex issues that have arisen in the post-pandemic world, including war, the emergence of artificial intelligence and the need to create a sustainable economy amid climate change.

After the IMF managing director’s remarks, Brad Lightcap, chief operating officer of OpenAI, spoke about the San Francisco company’s artificial intelligence products — a technology that Georgieva said the world will need to rely on for growth and productivity gains.

Lightcap said that 92% of Fortune 500 companies are using the company’s ChatGPT enterprise product. He cited Moderna as an example of a business use: the Cambridge, Mass.-based maker of one of the leading COVID-19 vaccines is using the company’s AI for drug development. And the OpenAI chatbot of Swedish mobile-payments company Klarna is replacing the work of 700 customer support agents, he said.

However, Lightcap maintained that artificial intelligence will create job demand in areas that can’t be predicted, and that advancement of the technology is so rapid that in the next 12 months “the systems we use today will be like laughably bad.” He envisioned a not-distant future where “it’ll be foreign to anyone born today that you can’t talk to a computer the way you talk to a friend.”

All public panels are being livestreamed on the institute’s website. Argentina President Javier Milei and Elon Musk are scheduled to speak later in the day.

Business

Jeannie Epper, trailblazing Hollywood stuntwoman, dies at 83

Jeannie Epper, a pioneering stuntwoman who performed in more than 100 films and television series, has died. She was 83.

Epper died Sunday night of natural causes surrounded by family at her home in Simi Valley, a spokesperson confirmed Monday.

In a long career spent bursting through doors, kicking down walls and falling off roofs, Epper changed the course for women in the industry when she became Lynda Carter’s stunt double on the 1970s TV series “Wonder Woman.” It was Epper, standing in for Kathleen Turner, who was swept down a mudslide in “Romancing the Stone” — for which she received a 1985 Stuntman Award for most spectacular stunt in a feature film.

In a blond wig, Epper took the blows for Linda Evans in those iconic catfights with Joan Collins on the nighttime soap “Dynasty.” It’s Epper’s stunt-driving that audiences see when Shirley MacLaine throws Jack Nicholson from her Corvette in the movie “Terms of Endearment.”

Epper’s prolific credits include stunt work in “The Bionic Woman,” “Charlie’s Angels,” “Robocop,” “The Italian Job” and “Kill Bill: Vol. 2.” Epper was profiled alongside fellow stuntwoman Zöe Bell in the 2004 documentary “Double Dare.”

She has been called the “godmother of stuntwomen” and “the grand matron of Hollywood stuntwomen,” working well past retirement age. At age 74, she performed stunts in the 2015 comedy “Hot Pursuit,” starring Sofia Vergara and Reese Witherspoon.

“She certainly qualifies to be one of the greatest stunt coordinators,” said director Steven Spielberg, who worked with Epper on “Catch Me if You Can” and “Minority Report.”

She was born Jean Luann Epper in 1941 to John and Frances Epper, both professional stunt performers. In the 1920s, Epper’s father immigrated to the United States from Switzerland and established a riding academy in Los Angeles where he later became a stuntman for movies, specializing in horseback stunts and doubling for actors including Ronald Reagan and Gary Cooper.

Jeannie Epper grew up in North Hollywood with five brothers and sisters — all of whom worked as stunt people. Her three children and grandchildren also went into the family business.

Epper was a skilled rider, and at age 9, she broke into stunt work, riding a horse bareback down a mountain for a 1950s TV show, becoming one of the first professional child stunt doubles.

“My father said it could be dangerous, but he knew I was an excellent rider,” she told The Times in 1999. “He kept telling me to keep my head up, but that’s about all. I think he didn’t want to over-concern me. There’s a fine line between being concerned and destroying someone’s confidence.”

The series marked the start of Epper’s game-changing career in the male-dominated industry.

Although Epper came from a family of stunt people, it was typical when she began working for men to wear wigs while doing stunts for female actors. But thanks to persistence and shifts in attitudes and fashion, Epper changed the business.

“Actresses began saying, ‘I don’t want a hairy-legged guy doing this for me,’” she told The Times in 1999. “And women were wearing less and less clothes in front of the camera, and it was so obvious it was a man.”

Later, as a stunt coordinator, Epper recalled dealing with men who resented taking orders from a woman.

While working on the 1980s police series “Cagney & Lacey,” she described a guest actor who not only couldn’t throw a convincing punch but also refused to be instructed by a woman, allowing only other stuntmen on set to show him what to do.

“He threw the punch well enough to shoot the scene,” she said. “But he still couldn’t throw it like a man.”

In 2019, on the occasion of being honored at the Artemis Women in Action Film Festival, Melanie Wise — a producer, actor, stuntwoman and founder of the organization — said of Epper, “Jeannie inspired a wave of women to get into stunts. They are in awe of her.”

Epper was a founding member of the Stuntwomen’s Assn. of Motion Pictures and an honorary member of the Stuntmen’s Assn. of Motion Pictures.

She is survived by husband Tim Kimack, daughter Eurlyne Epper, son Richard Epper, five grandchildren and seven great-grandchildren. She was preceded in death by son Kurtis Epper, who was also a stunt performer.

Times staff writer Nardine Saad contributed to this report.

-

News1 week ago

News1 week agoBoth sides prepare as Florida's six-week abortion ban is set to take effect Wednesday

-

Politics1 week ago

Politics1 week agoGOP Rep. Bill Posey won't seek re-election, endorses former Florida Senate President as replacement

-

World1 week ago

World1 week agoRussian forces gained partial control of Donetsk's Ocheretyne town

-

Politics1 week ago

Politics1 week agoHouse Republicans brace for spring legislative sprint with one less GOP vote

-

World1 week ago

World1 week agoZelenskyy warns of Russian nuclear risks on Chernobyl anniversary

-

Movie Reviews1 week ago

Challengers Movie Review

-

World1 week ago

World1 week agoAt least four dead in US after dozens of tornadoes rip through Oklahoma

-

Politics1 week ago

Politics1 week agoAnti-Trump DA's no-show at debate leaves challenger facing off against empty podium