Business

New services for financially struggling Californians to come under more scrutiny by state regulators

Concerned that Californians were being victimized by novel types of lenders, state lawmakers gave regulators broad power in 2021 to guard against unfair, deceptive and abusive practices in the financial services industry.

On Tuesday, the California Department of Financial Protection and Innovation announced its first new regulatory targets: earned wage access, debt settlement and student loan relief services, as well as private loans with income-based repayment plans for college or trade school students. Starting in February, these services will have to register with and provide data to the department if they want to operate in California, making it easier for regulators to identify debt traps and other troublesome practices.

According to the DFPI, providers of earned wage access in California “have generally maintained that they are not subject to any existing consumer credit laws or regulations.” The rule announced Tuesday holds that these services can either be licensed and regulated as lenders subject to the California Financing Law, which limits interest rates and other terms, or register as credit providers under the 2021 law. If they choose the latter, they’ll have to submit data every month to the state about their fees, the percentage of advances repaid, the duration of the advances and the total number of advances made.

Tuesday’s rule doesn’t set any new limits on the fees charged, the amount of credit offered or other key features of the four types of services — the 2021 law doesn’t give the department that authority. What the rule will do is gather information about how these services operate and their effect on consumers, something that could lead legislators to impose new restrictions, said Suzanne Martindale, the DFPI’s senior deputy commissioner for consumer financial protection.

“The goal is to get the data,” Martindale said. “Let’s see the trends, let’s identify the risks for consumers, and then let’s have a conversation on where to go from here. … We are simply saying, come register and give us more information about your business.”

Some consumer advocates say more limits are needed on earned wage access services (also known as paycheck advances or income-based advances), which allow employees to borrow against their next paycheck based on the hours they’ve already worked. The state’s move is necessary, they say, but not sufficient.

“We really see it as the new frontier in payday lending,” Andrew Kushner, senior policy counsel for the Center for Responsible Lending, said of the services offered for a fee through employers or directly to consumers. “The problem is just like with a payday loan. It effectively creates its own ongoing demand. … It traps borrowers in a cycle of reborrowing.”

Earned wage access companies say their services give workers more control over the timing of their pay, while also helping employers reduce turnover. “Accessing accrued wages before the pay cycle ends becomes a financial lifeline, offering flexibility and confidence in financial wellness,” one provider, Rain Technologies, says on its website.

Typically, earned wage access services impose a per-use fee, a subscription charge or, in some cases, a voluntary “tip.” Two basic types of these services are covered by the rule: one that third parties offer through employers, which automatically withhold the repayment from the borrower’s next check, and one they offer directly to consumers, where the repayment is withdrawn from the borrower’s bank account.

The vast majority of those who take out advances repay them in full, the DFPI said. But the cost can be high — according to the DFPI, the fees or tips collected by the services translated to an annual interest charge of more than 330% on average in 2021 — and the repayments may lead to more borrowing.

Kushner said the earned wage access industry depends on a relatively small number of users who take out advances repeatedly. The fees they pay for the advances eat into their paychecks, deepening their financial struggles.

Lucia Constantine, a senior researcher at the Center for Responsible Lending, said the center’s research found that one-third of the people who used wage advance apps reborrowed within two weeks at least 80% of the time they used the app. Almost 40% of the users had at least six advances in one or more months, she said, and in California, those users accounted for 85% of all advances.

The center also found that more than 30% of the Californians who use wage advance apps have taken out advances from three or more different apps in a month. State residents had significantly more overdrafts from their checking accounts in the three months after using these services than before using them, the center said.

The federal Consumer Financial Protection Bureau is stepping up oversight of earned wage access services too. In July, it proposed an interpretive rule that would require these services to disclose their costs and terms more clearly, as required by the federal Truth in Lending Act.

Disclosure is important, Kushner said, but the federal government leaves it to the states to regulate the terms and conditions that lenders offer. Advance wage access products “are loans under any definition,” he said, and states should regulate the providers the same way they regulate other lenders — with caps on the fees, interest charges and other costs imposed on borrowers.

Those providers, he conceded, “are really opposed to being treated as lenders.” A number of them pushed the DFPI to ease the registration and reporting requirements, arguing they weren’t necessary to protect California consumers.

Martindale said the state’s approach to earned wage access services is a lighter regulatory touch than treating them the same as lenders under the California Financing Law. “I think we landed in a place where no one, no stakeholder got everything they wanted,” she said.

Once the registration requirement goes into effect next year, it will offer one immediate benefit for consumers: Before signing up for one of these services, they will be able to check the DFPI website to see whether the company behind it is registered and can legally operate in California.

Regardless of whether companies are licensed or registered in the state, Martindale said, the 2021 law empowers the DFPI to bring enforcement actions against them if they offer credit in unfair, deceptive and abusive ways. So far, the agency has used that power to bring more than 300 enforcement actions against financial service companies and executives.

Business

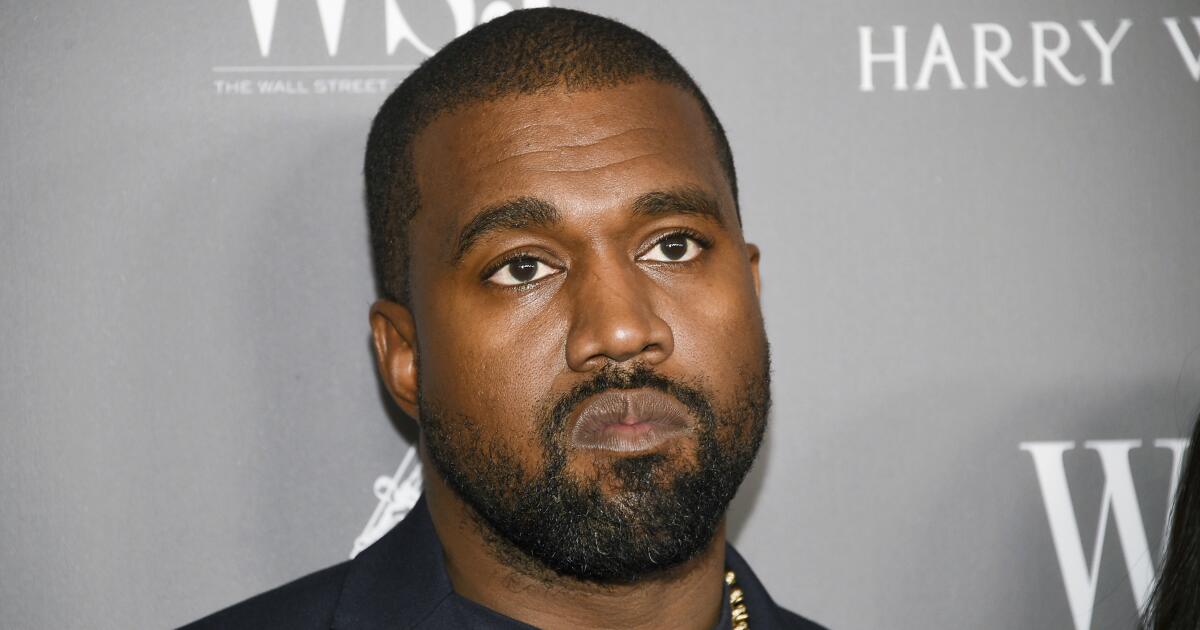

Kanye West sues ex-employee over Malibu mansion lien

Kanye West, the rapper now known as Ye, is suing his former project manager and his lawyers, alleging they wrongfully put a $1.8-million lien on his former Malibu mansion.

The suit, filed in Los Angeles Superior Court on Thursday, alleges that Tony Saxon, Ye’s former project manager on the property, and the law firm West Coast Trial Lawyers, “wrongfully” placed an “invalid” lien on the property “while simultaneously launching an aggressive publicity campaign designed to pressure Ye, chill prospective transactions, and extract payment on disputed claims already being litigated in court.”

Saxon’s lawyers were not immediately available for comment.

Saxon, who was also employed as West’s security guard and caretaker at the Malibu property, sued the controversial rapper in Los Angeles Superior Court in September 2023, claiming a slate of labor violations, nonpayment of services and disability discrimination.

In January 2024, Saxon placed the $1.8-million “mechanics” lien on the property in order to secure compensation for his work as project manager and construction-related services, according to court filings.

A mechanics lien, also referred to as a contractor’s lien, is usually filed by an unpaid contractor, laborer or supplier, as a hold against the property. If the party remains unpaid, it can prompt a foreclosure sale of the property to secure compensation.

Ye has denied Saxon’s allegations. In a November 2023 response to the complaint, Ye disputed that Saxon “has sustained any injury, damage, or loss by reason of any act, omission or breach by Defendant.”

According to Ye’s recent complaint, he listed the property for sale in December 2023. A month later, he alleged, Saxon and his attorneys recorded the lien and “immediately” issued statements to the media.

The suit cites a statement Saxon’s attorney, Ronald Zambrano, made to Business Insider: “If someone wants to buy Kanye’s Malibu home, they will have to deal with us first. That sale cannot happen without Tony getting paid first.”

“These statements were designed to create public pressure and to interfere with the Plaintiffs’ ability to sell and finance the Property by falsely conveying that Defendants held an adjudicated, enforceable right to block a transaction and divert sale proceeds,” the complaint states.

The filing contends that last year the Los Angeles Superior Court granted Ye’s motion to release the lien from the bond and awarded him attorneys fees.

The Malibu property’s short existence has a long history of legal and financial drama.

In 2021, West purchased the beachfront concrete mansion — designed by Pritzker Prize-winning Japanese architect Tadao Ando — for $57.3 million. He then gutted the property on Malibu Road, reportedly saying “This is going to be my bomb shelter. This is going to be my Batcave.”

Three years later, the hip-hop star sold the unfinished mansion (he had removed the windows, doors, electricity and plumbing and broke down walls), at a significant loss to developer Steven Belmont’s Belwood Investments for $21 million.

Belmont, who spent more money to renovate the home, had spent three years in prison after being charged with attempted murder for a pitchfork attack in Napa County. He promised to restore the architectural jewel to its former glory.

However, the property has been mired in various legal and financial entanglements including foreclosure threats.

Last August, the notorious mansion was once again put on the market with a $4.1 million price cut after a previous offer reportedly fell through, according to Realtor.com.

The legal battle surrounding Ye’s former Malibu pad is the latest in a series of public and legal dramas that the music impresario has been involved in recent years.

In 2022, the mercurial superstar lost numerous lucrative partnerships with companies like Adidas and the Gap, following a raft of antisemitic statements, including declaring himself a Nazi on X (which he later recanted).

Two years later, Ye abruptly shut down Donda Academy, the troubled private school he founded in 2020.

Ye, the school and some of his affiliated businesses faced faced multiple lawsuits from former employees and educators, alleging they were victims of wrongful termination, a hostile work environment and other claims.

In court filings, Ye has denied each of the claims made against him by former employees and educators at Donda.

Several of those suits have been settled.

Business

The rise and fall of the Sprinkles empire that made cupcakes cool

After the dot-com bubble burst in the early 2000s, Candace Nelson reevaluated her career. She had just been laid off from a boutique investment banking firm in San Francisco’s tech startup scene, and realized she wanted a change.

From her home, she launched a custom cake service that soon morphed into an idea for a cupcake-focused bakery. Nelson and her husband — whom she met at the Bay Area firm where she had worked — then pooled their savings, moved to Southern California and together opened Sprinkles Cupcakes from a 600-square-foot Beverly Hills storefront.

The store quickly sold out on opening day in 2005, and over the next two decades, the Sprinkles brand exploded across the country, opening dozens of locations of its specialty bakeries as well as mall kiosks and its signature around-the-clock cupcake ATMs in several states.

“It was an unproven concept and a big risk,” Nelson told the Times in 2013, at which point the business had 400 employees at 14 locations and dispensed upward of a thousand cupcakes a day from its Beverly Hills ATM alone.

But now, the iconic cupcake brand is no longer.

Sprinkles abruptly shut down all of its locations on Dec. 31, leaving hundreds of retail employees across Arizona; California; Washington, D.C.; Florida; Nevada; Texas; and Utah in a lurch with little notice, no severance and scrambling to fulfill a surge of orders from customers clamoring to get their last tastes.

Candace Nelson, the founder of Sprinkles cupcakes, in Beverly Hills in 2018.

(Mel Melcon / Los Angeles Times)

Although Nelson long ago exited the company, having sold it to private equity firm KarpReilly LLC in 2012, she shared her disappointment with its fate on social media.

“As many of you know, I started Sprinkles in 2005 with a KitchenAid mixer and a big idea,” Nelson said in the post. “It’s surreal to see this chapter come to a close — and it’s not how I imagined the story would unfold.”

The company, now headquartered in Austin, Texas, made no formal announcement regarding the closures and Nelson has not said more than what she posted online. The company did share a comment with KTLA, saying “After thoughtful consideration, we’ve made the very difficult decision to transition away from operating company-owned Sprinkles bakeries.” Neither Nelson nor representatives of Sprinkles and KarpReilly responded to The Times’ requests for comment.

Sprinkles’ demise comes at a tough time for the food and beverage industry. At brick-and-mortar food retail locations, the non-negotiable ingredient and labor costs can be high. And shifting consumer sentiments away from sugar-filled sweets and toward more healthy and functional options, strained pocketbooks, as well as pushes by federal and state governments to nix artificial colors and flavoring, are creating uncertainties for businesses, those in the food industry said.

A 24-hour cupcake ATM at Sprinkles Cupcakes in Beverly Hills in 2012.

(Damian Dovarganes / Associated Press)

“Over the last 10 years the consumer has wizened up tremendously and is looking at the back of the label and choosing where to spend their sweets,” said David Jacobowitz, founder of Austin-based Nebula Snacks, an online food retailer.

At the same time, it’s also not uncommon for businesses owned by private-equity firms to close on a whim, where relentlessly profit-driven decisions might be made simply to pursue more lucrative projects. In recent years, private-equity deals have been seen to milk businesses for profit by slashing costs and quality, and have appeared to play a role in the breakup of some legacy retail brands, including Toys ‘R’ Us, Red Lobster, TGI Fridays and fabrics chain JoAnn Inc. On the flip side, private equity can help infuse much-needed cash into a business and extend its life.

Stevie León and her co-workers received a text the night before New Year’s Eve informing them the franchise Sprinkles location in Sarasota, Fla., where they worked would close permanently after their shifts the next day.

León, 33, said her position as a scratch baker mixing batter and frosting cupcakes overnight had been a dream job, since she had been searching for ways to develop baking skills without paying for expensive schooling.

“I really thought it was my forever job and it was taken away literally in a day,” she said. “I’m just taking it one day at a time.”

Ivy Hernandez, 27, the general manager at the Sarasota store, said that after the news was delivered to her boss, the franchise owner, they rushed to learn their options to keep the store afloat but quickly learned it could be legally precarious to continue operating. The store had been open less than a year.

A nearby corporate store, Hernandez said, had been in disarray for months, with employees contending with broken fridges and lapsed ingredient shipments, as managers implored higher-ups to pay the bills so the business could operate properly.

“It really felt like they were trying to do everything they could to screw everyone over as hard as possible until the end,” Hernandez said.

Sprinkles did not respond to questions about the franchise program or allegations of mismanagement in the lead-up to the closure.

A person walks by Sprinkles on the Upper East Side in New York City in 2020.

(Cindy Ord / Getty Images)

The obsession with tiny cakes in paper cups traces back to an episode of “Sex and the City” aired in 2000 showing Miranda and Carrie savoring cupcakes on a bench outside a West Village bakery called Magnolia’s Cupcakes.

“Big wasn’t a crush, he was a crash,” Carrie says to Miranda as she peels down the wrapper on a cupcake topped with bright pink buttercream frosting. She punctuates the quip by taking a big bite, leaving a glob of frosting on her face.

The scene sparked a tourism phenomenon for the bakery — which went on to create a “Carrie” line of cupcakes — and helped propel the burgeoning cupcake industry and companies like Sprinkles Cupcakes, Crumbs Bake Shop and Baked by Melissa to new heights.

Within a decade there was already talk of a “Cupcake Bubble,” coined by writer Daniel Gross in a 2009 Slate article where he argued that the 2008 economic recession laid the groundwork for a proliferation of cupcake stores across America, because a lot of people could figure out how to make tasty cupcakes cheaply and scale up without a huge capital investment.

Amid the decimation of many other local retail businesses, one could take over storefronts in heavily trafficked areas for cheap. As a result, “casual baking turned into an urban industry,” Gross said.

The cupcake fervor hit its peak when Crumbs, which had started as a single bakery on Manhattan’s Upper West Side in 2003, went public in a reverse merger worth $66 million in 2011. The wildly popular mini-cakes were selling at $4.50 a pop. But it became clear very quickly that it had grown too large, too fast. It closed in 2014 after it lost its stock listing on Nasdaq and defaulted on about $14.3 million in financing.

Analysts at the time said consumers were cooling on opulent desserts and suggested tougher times were ahead for bakeries that focused solely on cupcakes.

But Baked by Melissa has thus far proved those analysts wrong. The company has remained privately owned, and according to its founder, is focused on nationwide e-commerce operations — and on expanding the brand beyond sweets. Founder Melissa Ben-Ishay has gained a following on social media by sharing recipes for nutritious, easy-to-make meals.

“Businesses that prioritize quick value increases to get acquired often crash,” Ben-Ishay told Forbes last year. “We’re committed to maintaining product quality and steady, long-term growth.”

Before its unceremonious and sudden closure, Spinkles company leadership had pushed to diversify its business as part of a strategy to recover from a pandemic-era lull.

Chief Executive Dan Mesches told trade publication Nation’s Restaurant News in 2021 that comparable sales had grown since pre-pandemic years. He said the company had ramped up its direct-to-consumer and off-premises offerings and created a line of chocolates made to look like the tops of their cupcakes. The company also introduced a new franchise program with the goal of opening some 200 locations in the U.S. and abroad over three years.

“Innovation is everything for us,” Mesches said.

Sprinkles was known for, among other things, inventive and somewhat corny methods of customer delivery. Besides the trademark ATMs, the company’s vending machines found at many airports made loud, attention-drawing jingles, drawing dramatic complaints and jokes from TikTok travelers. In the 2010s, the company debuted a custom-built truck — “the Sprinklesmobile” — to deliver cupcakes to cities without physical locations.

Frances Hughes, co-founder of online wholesale marketplace Starch, said there’s no question that gourmet sweet treats are still in vogue. But brick-and-mortar locations are much more risky, with more unpredictability. Having large fixed costs makes a business “extremely sensitive to small changes in traffic or frequency,” while online or e-commerce models can be more flexible.

“I think cupcakes as a product still have demand. But the novelty paths that support that rapid retail expansion have passed,” Hughes said.

When Nelson, the Sprinkles founder, posted her somber message about the closure, she asked people to share memories of the company. Many offered heartfelt responses, her comments flooded with stories, for example, of poor college students making the trek to the Beverly Hills location for a limited number of first-come, first-served free cupcakes.

But many of the comments also criticized Nelson’s sale to private equity.

“You sold it to PE and expected it to not close?? What planet are you living on? I don’t begrudge you for selling as that’s entirely your choice but to think any PE firm cares about a company in the slightest is insanity,” one Instagram user said.

Nicole Rucker, an L.A.-based pastry chef and owner of Fat+Flour Pie Shop, said she didn’t observe a decline in the quality of the product after the private-equity takeover. She has been a longtime admirer of the company, driving up from San Diego to sample the cupcakes when its store opened. The simple attractiveness of the box and the logo, and the consistency in the way cupcakes were decorated, “was inspiring,” she said.

“It had a strong hold on people for years,” Rucker said.

Rucker said however that when a private-equity-owned business shutters, she doesn’t feel sadness: “I would rather give my money to a fellow small-business owner, because I would rather know that every dollar and every sale matters.”

Michelle Wainwright, the owner and founder of Indiana-based bakery Cute as a Cupcake! said that although the niche cupcake industry may no longer be in its heyday — with “Sex and the City” no longer airing and competitive baking show “Cupcake Wars” (which Candace Nelson served as a judge on) now canceled — they are still versatile treats, with great potential for creativity.

And they are sentimental to her, because she uses her grandmother’s recipe.

“Cupcakes are still a winner,” Wainwright said. “It’s my belief that a life with out cupcakes is a life without love.”

Business

Bay Area semiconductor testing company to lay off more than 200 workers

Semiconductor testing equipment company FormFactor is laying off more than 200 workers and closing manufacturing facilities as it seeks to cut costs after being hit by higher import taxes.

The Livermore, Calif.,-based company plans to shutter its Baldwin Park facility and cut 113 jobs there on Jan. 30, according to a layoff notice sent to the California Employment Development Department this week. Its facility in Carlsbad is scheduled to close in mid-December later this year, which will result in 107 job losses, according to an earlier notice.

Technicians, engineers, managers, assemblers and other workers are among those expected to lose their jobs, according to the notices.

The company offers semiconductor testing equipment, including probe cards, and other products. The industry has been benefiting from increased AI chip adoption and infrastructure spending.

FormFactor is among the employers that have been shedding workers amid more economic uncertainty.

Companies have cited various reasons for workforce reductions, including restructuring, closures, tariffs, market conditions and artificial intelligence, which can help automate repetitive tasks or generate text, images and code.

The tech industry — a key part of California’s economy — has been hit hard by job losses after the pandemic, which spurred more hiring, and amid the rise of AI tools that are reshaping its workforce.

As tech companies and startups compete fiercely to dominate the AI race, they’ve also cut middle management and other workers as they move faster to release more AI-powered products. They’re also investing billions of dollars into data centers that house computing equipment used to process the massive troves of information needed to train and maintain AI systems.

Companies such as chipmaker Nvidia and ChatGPT maker OpenAI have benefited from the AI boom, while legacy tech companies such as Intel are fighting to keep up.

FormFactor’s cuts are part of restructuring plans that “are intended to better align cost structure and support gross margin improvement to the Company’s target financial model,” the company said in a filing to the U.S. Securities and Exchange Commission this week.

The company plans to consolidate its facilities in Baldwin Park and Carlsbad, the filing said.

FormFactor didn’t respond to a request for comment.

FormFactor has been impacted by tariffs and seen its growth slow. The company employs more than 2,000 people and has been aiming to improve its profit margins.

In October, the company reported $202.7 million in third-quarter revenue, down 2.5% from the third quarter of fiscal 2024. The company’s net income was $15.7 million in the third quarter of 2025, down from $18.7 million in the same quarter of the previous year.

FormFactor’s stock has been up 16% since January, surpassing more than $67 per share on Friday.

-

Detroit, MI1 week ago

Detroit, MI1 week ago2 hospitalized after shooting on Lodge Freeway in Detroit

-

Technology6 days ago

Technology6 days agoPower bank feature creep is out of control

-

Dallas, TX4 days ago

Dallas, TX4 days agoAnti-ICE protest outside Dallas City Hall follows deadly shooting in Minneapolis

-

Delaware3 days ago

Delaware3 days agoMERR responds to dead humpback whale washed up near Bethany Beach

-

Dallas, TX1 week ago

Dallas, TX1 week agoDefensive coordinator candidates who could improve Cowboys’ brutal secondary in 2026

-

Iowa6 days ago

Iowa6 days agoPat McAfee praises Audi Crooks, plays hype song for Iowa State star

-

Montana2 days ago

Montana2 days agoService door of Crans-Montana bar where 40 died in fire was locked from inside, owner says

-

Health1 week ago

Health1 week agoViral New Year reset routine is helping people adopt healthier habits