Business

Column: Is Elon Musk already looking to bail out of his Twitter deal?

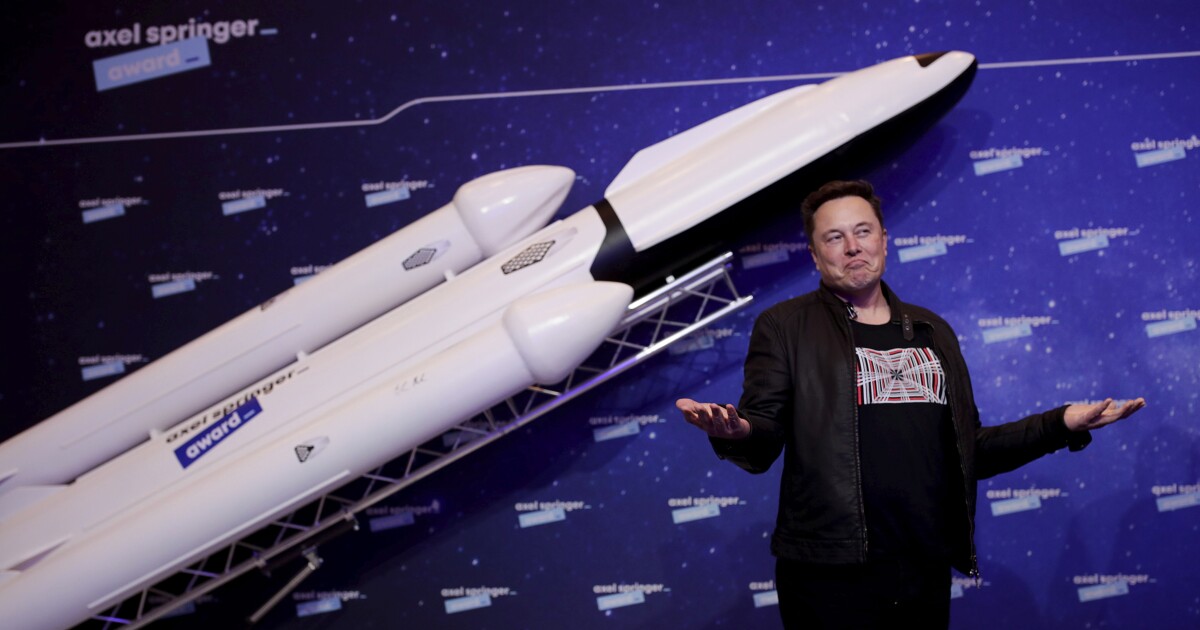

Is Elon Musk’s spectacular $44-billion acquisition of Twitter about to fall sufferer to one of many best outbreaks of purchaser’s regret of all time?

That’s what some Musk observers are asking, based mostly on the current motion in shares of Twitter and Tesla, the electric-car maker on which Musk’s fortune is predicated, together with Musk’s habits within the rapid wake of his deal for the social media platform.

The financial argument in opposition to Musk’s following via on his acquisition was laid out by Reuters in an article headlined “Elon Musk in all probability received’t purchase Twitter.” The commentary piece concluded that Musk has monetary causes to let the deal collapse.

Elon….It’s not your guidelines which is able to apply right here.

— EU Commissioner Thierry Breton

Then there’s the behavioral argument, which hinges on Musk’s actions because the deal grew to become public. He seems to have begun violating the phrases of the formal buy settlement inside hours of its public launch Tuesday.

The settlement permits Musk to problem tweets concerning the deal “as long as such Tweets don’t disparage the Firm or any of its Representatives.” In at the least three tweets since then, nevertheless, Musk has arguably disparaged the corporate and two of its executives, although the tweets didn’t instantly reference the deal.

Publication

Get the newest from Michael Hiltzik

Commentary on economics and extra from a Pulitzer Prize winner.

You could sometimes obtain promotional content material from the Los Angeles Instances.

The settlement doesn’t say what Twitter can do if Musk violates that provision. Nevertheless it’s not inconceivable that he’s giving the Twitter board an excuse to ship him packing.

Closing the deal, which is long-established as a merger between Twitter and a brand new firm owned completely by Musk, will take a number of months. If the deal blows up, both Twitter or Musk can be on the hook for $1 billion in damages. So it’s worthwhile to look at the cost-benefit calculation for Musk if he chooses to stroll away.

Let’s start by observing that Musk hasn’t purchased Twitter fairly but. He has lined up monetary backing to purchase the Twitter shares he doesn’t already personal—about 91% of them, at $54.20 every. About half of the required $44 billion would come from Musk himself, together with $21.5 billion within the type of margin loans in opposition to his Tesla shares.

Musk is often described because the world’s richest man, with a internet price of some $240 billion, however that doesn’t imply he has all that cash mendacity round for him to do with as he needs. Most of it’s tied up in his 21% possession of Tesla, however a few of these shares have already been borrowed in opposition to and the corporate has imposed limits on how way more borrowing he can do in opposition to them.

He’s additionally recognized to drift proposals with little intention of carrying them out. His well-known 2018 tweet proclaiming a plan to take Tesla personal and claiming that funding was assured is an efficient instance — funding wasn’t assured, and the proposal seemed to be mere vapor. (Musk and Tesla settled a authorities lawsuit over the tweet for $20 million every.

On this case, the funding does seem like assured and Musk’s intentions way more superior. However that doesn’t imply that he can’t again away from the deal at any level earlier than its closing.

If Musk can’t get hold of the required loans, he may need to promote a few of his Tesla inventory — which has fallen in worth by some 24% since he initially disclosed a 9.2% stake in Twitter on April 4.

On Tuesday, the day after the sale settlement was reached, Tesla shares fell by almost 13% to $873.28. They later recovered considerably; TSLA ended down $4, or 0.45%, to $877.51; TWTR closed up 47 cents, or about 1%, to 49.11. Tesla peaked final November at about $1,230.

The current motion seems to characterize actual misgivings by Tesla shareholders in Musk’s Twitter journey. They could possibly be unamused for a number of causes. One is that the extent to which he’s financing the deal by borrowing in opposition to his Tesla holdings.

That makes Musk susceptible to margin calls from his financial institution lenders, forcing him to promote shares if the inventory continues to fall; Musk as a vendor will not be a superb search for Tesla, since a lot of its worth derives from his identification with the corporate.

The value at which Musk may need to start out promoting to shore up the collateral for the banks is unclear. Bloomberg locations it at about $740. One other day like Tuesday, when Tesla fell by $121.60, would put Musk perilously near that time.

One other problem for shareholders is that new distraction for Musk is the very last thing they want, given their CEO’s notably brief consideration span.

That’s very true now, when Tesla is going through intensified competitors within the electric-vehicle market from rivals in any respect worth ranges, from Ford and Normal Motors to BMW and different luxurious manufacturers. Tesla not can declare the EV market, significantly the luxurious EV market, for itself.

Then there’s the battle that Twitter would possibly generate for Musk — that’s, Tesla — with the federal government of China.

To some extent, Beijing holds the way forward for Tesla in its fingers, and it doesn’t a lot take care of Twitter. The platform is already banned in China, and something that occurs on Twitter exterior Beijing’s management — however inside what it thinks is Musk’s management, would possibly find yourself in retaliatory steps in opposition to the carmaker.

Shareholders may additionally be involved that Tesla inventory’s day of reckoning is upon them. The corporate’s market worth of about $900 billion (on the present inventory worth) is roughly equal to these of the subsequent 10 Most worthy automobile corporations mixed, regardless that its automobile output — 930,000 in 2021 and 305,400 within the first quarter of this yr — quantities to solely a bit greater than 1% of worldwide market share.

In different phrases, Tesla has been grossly overvalued for years by any conventional inventory market metric. Corporations can stay in that situation indefinitely, however as a rule, gravity has confirmed to be a harsh mistress to highfliers, and the set off for a drastic revaluation can come from anyplace.

Simply as Tesla shareholders have been displaying disquiet concerning the deal, Twitter shareholders have been displaying skepticism. Twitter inventory has not converged decisively towards the $54.20 sale worth because the announcement, nestled beneath $50 for a lot of the week.

That’s a large hole from the supply worth for a deal that doesn’t face any vital pushback from antitrust regulators, or certainly any noticeable obstacles aside from Musk’s predilections and the solidity of the financing.

Musk has been specific about a few of what he would do with Twitter as soon as he takes over. He says he would strengthen Twitter’s function as platform for “free speech,” calling himself a “free speech absolutist.” However he might not have a really clear understanding about how that precept is outlined.

“By ‘free speech’, I merely imply that which matches the regulation,” he tweeted Tuesday, for example. “I’m in opposition to censorship that goes far past the regulation. If folks need much less free speech, they are going to ask authorities to cross legal guidelines to that impact. Due to this fact, going past the regulation is opposite to the desire of the folks.”

Besides issues are nowhere close to that easy. A lot of the discourse that has made Twitter resemble a poisonous cesspool of hate speech, violence-mongering and disinformation isn’t unlawful in the US, however noxious sufficient to undermine the platform’s utility to thousands and thousands of potential customers. Twitter has suspended or completely banned customers who violate its established requirements of civility — regardless that their speech isn’t unlawful. Restoring these accounts would possibly drive many customers away.

Musk must study that not all people lives on his road. The European Union has taken a extra aggressive stand in opposition to public hate speech than the U.S. EU officers have already got warned Musk that their guidelines should govern Twitter in Europe.

“We’re open however on our circumstances,” Thierry Breton, the EU’s commissioner for the interior market, warned this week. “A minimum of we all know what to inform him: ‘Elon, there are guidelines. You might be welcome however these are our guidelines. It’s not your guidelines which is able to apply right here.’”

Musk himself has been a purveyor of damaging misinformation and disinformation on Twitter — selling the ineffective anti-COVID nostrum hydroxychloroquine in addition to economically dubious cryptocurrencies, for instance. As soon as he turns into Twitter’s sole proprietor, its flaws shall be his flaws; if he continues to make use of it to advertise factitious narratives, he shall be chargeable for its debasement as a “public sq..”

The obvious success of his takeover bid has not appeared to get that message throughout to Musk. Begin along with his denigrating tweets about Twitter and its representatives.

On Tuesday, Musk replied to a tweet by conservative journalist Saagar Enjeti attacking Twitter government Vijaya Gadde.

Gadde, the Twitter lawyer in command of content material moderation, was related to Twitter’s blocking of tweets about Hunter Biden’s laptop computer laptop and references to a New York Publish article concerning the laptop computer. Musk referred to as that blocking “clearly extremely inappropriate.” The trade reportedly prompted a surge of tweeted assaults on Gadde.

Quickly after that, Musk replied approvingly to an assault by right-wing conspiracy-monger Mike Cernovich on Twitter lawyer Jim Baker, who he accused of getting “facilitated fraud.” Musk tweeted in reply, “Sounds pretty bad…”

On Tuesday, Musk tweeted out a report that Reality Social, the Twitter-like service launched by former President Trump to supply a social media platform to conservatives like himself, was beating Twitter in Apple Retailer downloads. Musk added: “Reality Social … exists because Twitter censored free speech.” Your mileage might fluctuate, however that appears like disparagement to me.

Nor has Musk stored his Twitter logorrhea in test in different respects. On Wednesday, he joked, “Subsequent I’m shopping for Coca-Cola to place the cocaine again in.” All in enjoyable, clearly (the final vestiges of cocaine got here out of the delicate drink in 1929), however Musk might must resolve whether or not he needs to play with Twitter as if it’s simply one other system for him to get his childish jollies, or set down real-world guidelines that can make it a extra useful gizmo for public discourse, as he says he intends.

Which approach will he go? At $44 billion, Twitter is an especially costly plaything. The service doesn’t flip a revenue, however it would have to take action to cowl the debt that it will likely be saddled with by Musk — an estimated $1 billion a yr in debt service.

In response to Twitter co-founder and former Chief Government Jack Dorsey, Musk’s aim is to show Twitter right into a service that’s “maximally trusted and broadly inclusive.” It’s by no means clear that these objectives might be reconciled, or that Musk actually needs to dedicate a lot of his free time or spending the cash to achieve that nirvana.

It’s attainable {that a} $1-billion breakup charge is his most popular out. However we might not know for months.

Business

Scott Bessent, Trump’s Billionaire Treasury Pick, Will Shed Assets to Avoid Conflicts

Scott Bessent, the billionaire hedge fund manager whom President-elect Donald J. Trump picked to be his Treasury secretary, plans to divest from dozens of funds, trusts and investments in preparation to become the nation’s top economic policymaker.

Those plans were released on Saturday along with the publication of an ethics agreement and financial disclosures that Mr. Bessent submitted ahead of his Senate confirmation hearing next Thursday.

The documents show the extent of the wealth of Mr. Bessent, whose assets and investments appear to be worth in excess of $700 million. Mr. Bessent was formerly the top investor for the billionaire liberal philanthropist George Soros and has been a major Republican donor and adviser to Mr. Trump.

If confirmed as Treasury secretary, Mr. Bessent, 62, will steer Mr. Trump’s economic agenda of cutting taxes, rolling back regulations and imposing tariffs as he seeks to renegotiate trade deals. He will also play a central role in the Trump administration’s expected embrace of cryptocurrencies such as Bitcoin.

Although Mr. Trump won the election by appealing to working-class voters who have been dogged by high prices, he has turned to wealthy Wall Street investors such as Mr. Bessent and Howard Lutnick, a billionaire banker whom he tapped to be commerce secretary, to lead his economic team. Linda McMahon, another billionaire, has been picked as education secretary, and Elon Musk, the world’s richest man, is leading an unofficial agency known as the Department of Government Efficiency.

In a letter to the Treasury Department’s ethics office, Mr. Bessent outlined the steps he would take to “avoid any actual or apparent conflict of interest in the event that I am confirmed for the position of secretary of the Department of Treasury.”

Mr. Bessent said he would shutter Key Square Capital Management, the investment firm that he founded, and resign from his Bessent-Freeman Family Foundation and from Rockefeller University, where he has been chairman of the investment committee.

The financial disclosure form, which provides ranges for the value of his assets, reveals that Mr. Bessent owns as much as $25 million of farmland in North Dakota, which earns an income from soybean and corn production. He also owns a property in the Bahamas that is worth as much as $25 million. Last November, Mr. Bessent put his historic pink mansion in Charleston, S.C., on the market for $22.5 million.

Mr. Bessent is selling several investments that could pose potential conflicts of interest including a Bitcoin exchange-traded fund; an account that trades the renminbi, China’s currency; and his stake in All Seasons, a conservative publisher. He also has a margin loan, or line of credit, with Goldman Sachs of more than $50 million.

As an investor, Mr. Bessent has long wagered on the rising strength of the dollar and has betted against, or “shorted,” the renminbi, according to a person familiar with Mr. Bessent’s strategy who spoke on condition of anonymity to discuss his portfolio. Mr. Bessent gained notoriety in the 1990s by betting against the British pound and earning his firm, Soros Fund Management, $1 billion. He also made a high-profile bet against the Japanese yen.

Mr. Bessent, who will be overseeing the U.S. Treasury market, holds over $100 million in Treasury bills.

Cabinet officials are required to divest certain holdings and investments to avoid the potential for conflicts of interest. Although this can be an onerous process, it has some potential tax benefits.

The tax code contains a provision that allows securities to be sold and the capital gains tax on such sales deferred if the full proceeds are used to buy Treasury securities and certain money-market funds. The tax continues to be deferred until the securities or money-market funds are sold.

Even while adhering to the ethics guidelines, questions about conflicts of interest can still emerge.

Mr. Trump’s Treasury secretary during his first term, Steven Mnuchin, divested from his Hollywood film production company after joining the administration. However, as he was negotiating a trade deal in 2018 with China — an important market for the U.S. film industry — ethics watchdogs raised questions about whether Mr. Mnuchin had conflicts because he had sold his interest in the company to his wife.

Mr. Bessent was chosen for the Treasury after an internal tussle among Mr. Trump’s aides over the job. Mr. Lutnick, Mr. Trump’s transition team co-chair and the chief executive of Cantor Fitzgerald, made a late pitch to secure the Treasury secretary role for himself before Mr. Trump picked him to be Commerce secretary.

During that fight, which spilled into view, critics of Mr. Bessent circulated documents disparaging his performance as a hedge fund manager.

Mr. Bessent’s most recent hedge fund, Key Square Capital, launched to much fanfare in 2016, garnering $4.5 billion in investor money, including $2 billion from Mr. Soros, but manages much less now. A fund he ran in the early 2000s had a similarly unremarkable performance.

Business

As wildfires rage, private firefighters join the fight for the fortunate few

When devastating wildfires erupted across Los Angeles County this week, David Torgerson’s team of firefighters went to work.

The thousands of city, county and state firefighters dispatched to battle the blazes went wherever they were needed. The crews from Torgerson’s Wildfire Defense Systems, however, set out for particular addresses. Armed with hoses, fire-blocking gel and their own water supply, the Montana-based outfit contracts with insurance companies to defend the homes of customers who buy policies that include their services.

It’s a win-win if the private firefighters succeed in saving a home, said Torgerson, the company’s founder and executive chairman. The homeowner keeps their home and the insurance company doesn’t have to make a hefty payout to rebuild.

“It makes good sense,” he said. “It’s always better if the homes and businesses don’t burn.”

Torgerson’s operation, which has been contracting with insurance companies since 2008 and employs hundreds of firefighters, engineers and other staff, highlights a lesser-known component of fighting wildfires in the U.S. Along with the more than 7,500 publicly funded firefighters and emergency personnel dispatched to the current conflagrations, which have burned more than 30,000 acres and destroyed more than 9,000 structures, a smaller force of for-hire professionals is on the fire lines for insurance companies, wealthy individual property owners or government agencies in need of additional hands.

Their presence isn’t without controversy. Private firefighters hired by homeowners directly have drawn criticism for heightening class divides during disasters. This week, a Pacific Palisades homeowner received backlash for putting a call out on X, the social media site formerly named Twitter, for help finding private firefighters who could save his home.

“Does anyone have access to private firefighters to protect our home in Pacific Palisades? Need to act fast here. All neighbors houses burning,” he wrote in the since-deleted post. “Will pay any amount.”

“The epitome of nerve and tone deaf!” someone replied.

In 2018, Kim Kardashian and Kanye West credited private firefighters for saving their $60-million home in the Santa Monica mountains during a wildfire. But those who serve wealthy clients make up only a small fraction of nonpublic firefighters, according to Torgerson.

“Contract firefighters who are hired by the government are the vast majority,” he said. The federal government has been hiring private firefighters since the 1980s to support its own forces. According to the National Wildfire Suppression Assn., there are about 250 private sector fire response companies under federal contract, adding about 10,000 firefighters to U.S. efforts.

Some private firefighting companies, including Wildfire Defense Systems, are known as Qualified Insurance Resources and are paid by insurance companies to protect the homes of their customers. Wildfire Defense Systems refers to its on-the-ground forces as private sector wildfire personnel.

Wildfire Defense Systems only works with the insurance industry, but other privately held firefighting companies contract with industrial clients such as petrochemical facilities and utility providers. Wildfire Defense Systems declined to disclose company revenue or what it charges for its services.

Allied Disaster Defense, a company that has sent personnel to the fires in Los Angeles, offers services to both property owners and insurance companies. Its website says its services will “enhance the insurability of properties” and “contribute to reduced claims.”

The website also has a page dedicated to services for private clients, which include emergency response and assistance with insurance claims for “high net-worth and celebrity” customers. The company does not list prices for its services and has nondisclosure agreements with its private clients.

Several other private firefighting companies are based in California, including Mt. Adams Wildfire, which contracts with government agencies, and UrbnTek, which serves Los Angeles, Orange County and San Diego among other areas. Along with spraying fire retardant on trees and brush to stop an advancing fire, the company offers “a double layer of protection by wrapping a structure with our fire blanket system.”

Torgerson, a civil engineer with 34 years in emergency services, said he has been struck by the speed of the current wildfires. While typically it takes two to 10 minutes for a fire to sweep through a home, he said, the Palisades fire is traveling at higher speeds.

“It’s moving so fast, it’ll likely take one to two minutes for these fires to pass over the properties,” he said.

He said his company responded to all 62 of the wildfires that threatened structures in California in 2024 and didn’t lose a property.

Business

As Delta Reports Profits, Airlines Are Optimistic About 2025

This year just got started, but it is already shaping up nicely for U.S. airlines.

After several setbacks, the industry ended 2024 in a fairly strong position because of healthy demand for tickets and the ability of several airlines to control costs and raise fares, experts said. Barring any big problems, airlines — especially the largest ones — should enjoy a great year, analysts said.

“I think it’s going to be pretty blue skies,” said Tom Fitzgerald, an airline industry analyst for the investment bank TD Cowen.

In recent weeks, many major airlines upgraded forecasts for the all-important last three months of the year. And on Friday, Delta Air Lines said it collected more than $15.5 billion in revenue in the fourth quarter of 2024, a record.

“As we move into 2025, we expect strong demand for travel to continue,” Delta’s chief executive, Ed Bastian, said in a statement. That put the airline on track to “deliver the best financial year in Delta’s 100-year history,” he said.

The airline also beat analysts’ profit estimates and said it expected earnings per share, a measure of profitability, to rise more than 10 percent this year.

Delta’s upbeat report offers a preview of what are expected to be similarly rosy updates from other carriers that will report earnings in the next few weeks. That should come as welcome news to an industry that has been stifled by various challenges even as demand for travel has rocketed back after the pandemic.

“For the last five years, it’s felt like every bird in the sky was a black swan,” said Ravi Shanker, an analyst focused on airlines at Morgan Stanley. “But it appears that this industry does have its ducks in a row.”

That is, of course, if everything goes according to plan, which it rarely does. Geopolitics, terrorist attacks, air safety problems and, perhaps most important, an economic downturn could tank demand for travel. Rising costs, particularly for jet fuel, could erode profits. Or the industry could face problems like a supply chain disruption that limits availability of new planes or makes it harder to repair older ones.

Early last year, a panel blew off a Boeing 737 Max during an Alaska Airlines flight, resurfacing concerns about the safety of the manufacturer’s planes, which are used on most flights operated by U.S. airlines, according to Cirium, an aviation data firm.

The incident forced Boeing to slow production and delay deliveries of jets. That disrupted the plans of some airlines that had hoped to carry more passengers. And there was little airlines could do to adjust because the world’s largest jet manufacturer, Airbus, didn’t have the capacity to pick up the slack — both it and Boeing have long order backlogs. In addition, some Airbus planes were afflicted by an engine problem that has forced carriers to pull the jets out of service for inspections.

There was other tumult, too. Spirit Airlines filed for bankruptcy. A brief technology outage wreaked havoc on many airlines, disrupting travel and resulting in thousands of canceled flights in the heart of the busy summer season. And during the summer, smaller airlines flooded popular domestic routes with seats, squeezing profits during what is normally the most lucrative time of year.

But the industry’s financial position started improving when airlines reduced the number of flights and seats. While that was bad for travelers, it lifted fares and profits for airlines.

“You’re in a demand-over-supply imbalance, which gives the industry pricing power,” said Andrew Didora, an analyst at the Bank of America.

At the same time, airlines have been trying to improve their businesses. American Airlines overhauled a sales strategy that had frustrated corporate customers, helping it win back some travelers. Southwest Airlines made changes aimed at lowering costs and increasing profits after a push by the hedge fund Elliott Management. And JetBlue Airways unveiled a strategy with similar aims, after a less contentious battle with the investor Carl C. Icahn.

Those improvements and industry trends, along with the stabilization of fuel, labor and other costs, have created the conditions for what could be a banner 2025. “All of this is the best setup we’ve had in decades,” Mr. Shanker said.

That won’t materialize right away, though. Travel demand tends to be subdued in the winter. But business trips pick up somewhat, driven by events like this week’s Consumer Electronics Show in Las Vegas.

The positive outlook for 2025 is probably strongest for the largest U.S. airlines — Delta, United and American. All three are well positioned to take advantage of buoyant trends, including steadily rebounding business travel and customers who are eager to spend more on better seats and international flights.

But some smaller airlines may do well, too. JetBlue, Alaska Airlines and others have been adding more premium seats, which should help lift profits.

While he is optimistic overall, Mr. Shanker acknowledged that the industry was vulnerable to a host of potential problems.

“I mean, this time last year you were talking about doors falling off planes,” he said. “So who knows what might happen.”

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics1 week ago

Politics1 week agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health6 days ago

Health6 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoSouth Korea extends Boeing 737-800 inspections as Jeju Air wreckage lifted

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology2 days ago

Technology2 days agoMeta is highlighting a splintering global approach to online speech

-

World1 week ago

World1 week agoWeather warnings as freezing temperatures hit United Kingdom

-

News1 week ago

News1 week agoSeeking to heal the country, Jimmy Carter pardoned men who evaded the Vietnam War draft