West

Exclusive: Illegal immigrant released under Biden ‘catch and release’ allegedly kills driver in police chase

NEWYou can now listen to Fox News articles!

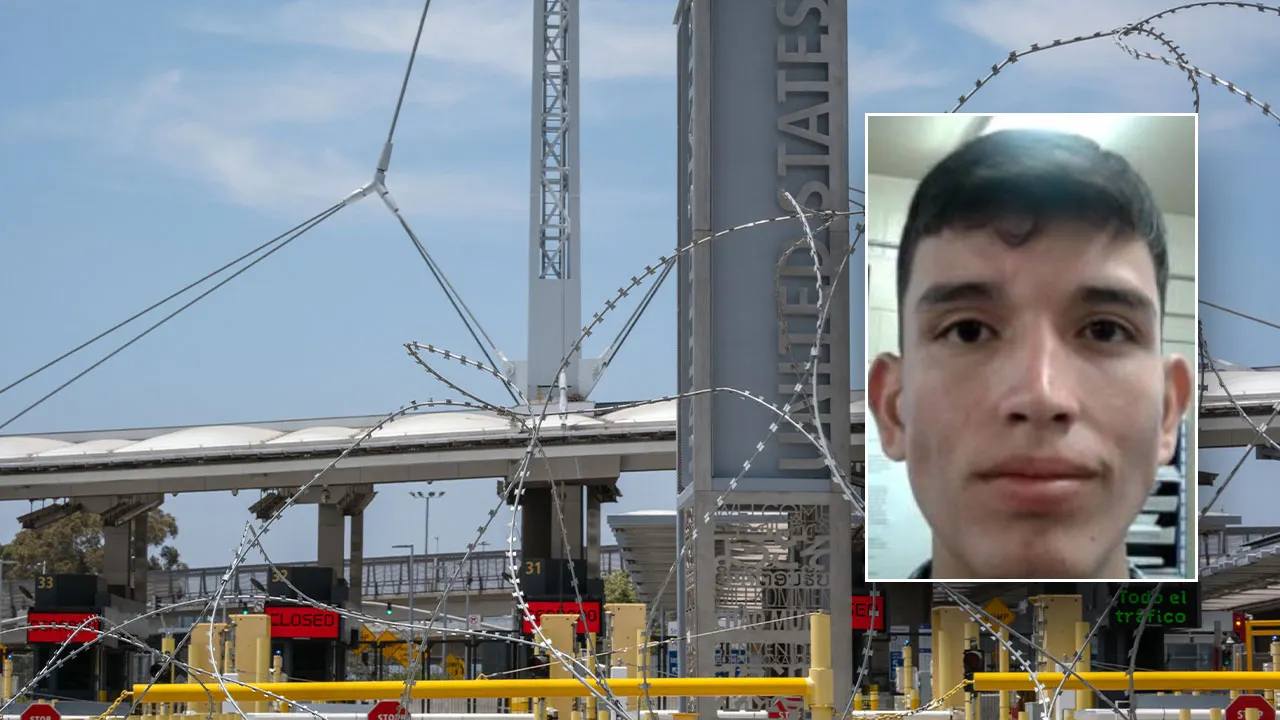

EXCLUSIVE: An illegal immigrant from Colombia killed a motorist in Southern California last month during a police chase, authorities said.

Darwin Felipe Bahamon Martinez, 21, was caught entering the United States near San Diego in 2023 and released by the Biden administration, U.S. Immigration and Customs Enforcement (ICE) said.

“Bahamon Martinez illegally entered the U.S. near Chula Vista, California, in August 2023,” a statement from ICE Los Angeles field office leadership said.

“He was released into the U.S. under the Biden administration’s so-called ‘catch-and-release’ policies, but if that hadn’t happened, the innocent 59-year-old driver he allegedly killed may still be alive today.”

DHS HONORS ILLINOIS WOMAN WHOSE CORPSE WAS ALLEGEDLY ABUSED BY ILLEGAL IMMIGRANT FREED UNDER SANCTUARY LAWS

Martinez was driving a Jeep Gladiator in Anaheim Jan. 21 when police officers initiated a traffic stop for reckless driving. When the officers approached the Jeep on foot, Martinez sped away, authorities said.

A brief chase ensued before the Jeep collided with a Honda driven by a 59-year-old man in the neighboring city of Placentia.

The driver was pronounced dead at the crash site.

Another driver, an 83-year-old woman, was taken to a hospital and treated for minor injuries.

MAJOR COUNTY SHERIFF REJECTS ICE DETAINER ON ILLEGAL IMMIGRANT WHO KILLED YOUNG BOY IN HIT-AND-RUN

The Anaheim Police Department’s police vehicle. ( Jeff Gritchen/MediaNews Group/Orange County Register via Getty Images)

Bahamon Martinez is being held in the Orange County Jail while awaiting criminal proceedings on his homicide charge. ICE lodged an immigration detainer against him Jan. 22.

However, because of California’s sanctuary state laws, local authorities are not compelled to cooperate with ICE to transfer illegal immigrants charged or convicted of crimes into federal custody.

California school board members believe there is a lot of “fearmongering” happening over immigration enforcement as teachers unions and major city school districts are scolding U.S. Immigration and Customs Enforcement. (Getty Images)

“If local officials in Gavin Newsom’s sanctuary California choose to release Bahamon Martinez into the community, they will put ALL Californians at risk,” ICE said in a news release. “California must honor our immigration detainer. Otherwise, ICE will be forced to re-arrest this criminal illegal alien at-large.”

In jurisdictions with sanctuary laws, ICE officers typically have to go into communities to look for illegal immigrants targeted for deportation. The agency has called for greater cooperation with local authorities amid confrontations between federal officers and agitators in Minnesota, where local officials have accused ICE of terrorizing neighborhoods.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Critics of sanctuary laws say such laws are responsible for releasing dangerous criminals back onto the street.

Read the full article from Here

California

What is the California Billionaire Tax Act? Is it actually happening?

How do billionaires avoid paying taxes? Here’s what we know now.

The super wealthy can afford to avoid paying taxes, but how? Here’s what we know now.

A major labor union is working to put a new wealth tax proposal in front of Californians in November. But the proposal would only actually impact a small few — billionaires.

The California Billionaire Tax Act is a one-time tax that, if realized, would unlock revenue from the wealthiest in the state to support a health care system that some elected officials and leaders have warned faces major strain due to federal funding cuts.

The statewide proposal, led by Service Employees International Union-United Healthcare Workers West, has been in the works for some time. Attorney General Rob Bonta issued the official title and summary for the tax act at the end of December, paving the way for proponents to collect the tens of thousands of signatures they’ll need to get this proposal on the ballot in November.

Vermont Sen. Bernie Sanders joined the proposal’s campaign kickoff in Los Angeles on Wednesday, Feb. 18, tossing out numerous figures that illustrated wealth disparities in the United States and likening billionaires having to pay a few billion dollars more in taxes as “pocket change.”

His clear support comes as Gov. Gavin Newsom has opposed it and as the proposal has generated fears it’d force California’s wealthiest residents to flee. Rep. Kevin Kiley of California’s 3rd Congressional District is set to introduce a bill fighting the tax proposal, saying it’s making California’s “leading job creators” leave preemptively.

Meanwhile, Los Angeles County leaders have turned to a proposed temporary sales tax increase to offset health care funding cuts. In June, county voters will decide whether to back it.

Here’s what to know about the California Billionaire Tax Act.

Who is taxed under the California Billionaire Tax Act?

Californians with a net worth of $1 billion or more and certain trusts would see a one-time 5% tax, according to a filing for the proposal. Proponents said this tax will apply to about 200 people in California.

How is health care changing for Californians under Trump?

President Donald Trump’s “One Big Beautiful Bill Act” implements changes in eligibility for both Medi-Cal, the state’s Medicaid program, and CalFresh, the state’s Supplemental Nutrition Assistance Program.

The changing work requirements, paired with “administrative burden,” could leave one to two million people without Medi-Cal, according to the nonpartisan Legislative Analyst’s Office. By 2028, up to three million people could lose Medi-Cal, both due to OBBA and changes made in California’s budget, Miranda Dietz, director of the Health Care Program at UC Berkley Labor Center, told California lawmakers in February.

Dietz, citing a previous look at the impact of OBBA, said that a projected $20 billion decrease in federal funding would mean 200,000 fewer jobs in the state, nearly two-thirds of which are “directly” in health care.

Also at risk: Hospitals will face lower margins due to fewer Medi-Cal enrollees and more uninsured patients, according to Jason Constantouros of the LAO, citing recent studies. Public hospital systems face $3.4 billion a year in federal funding cuts, the California State Association of Counties said in a report estimating the costs of OBBA.

What does this wealth tax in California do?

The revenue would be used to respond to “urgent, existing health care, education, and nutrition needs,” according to a filing for the initiative. Ninety percent of the revenue this tax generates would go to the Billionaire Tax Health Account, while 10% would go to the Billionaire Tax Education and Food Assistance Account.

Where would the money from the California Billionaire Tax Act go?

It’s supposed to create revenue to fund health care, education, and food assistance through a one-time tax.

Among what the money that goes into the Billionaire Tax Health Account could be used for, according to a filing, include:

- Spending to restore or address funding cuts or reductions

- Investments to protect or enhance Medi-Cal

- Prevention or mitigation of facility closures

- Other investments to support health care access, coverage and more

The money that goes into the Billionaire Tax Education and Food Assistance Account could be used for:

- Spending related to education and food assistance to restore or address funding cuts or reductions

- To make investments in the public education system or further investments in CalFresh, CalFAP, CalFood, or California’s Universal Meals Program

When would this wealth tax occur?

The tax would be due in 2027, although taxpayers could opt to spread the payments out over five years at a higher cost, according to the LAO.

The LAO said the wealth tax would “probably” collect tens of billions of dollars, but it’s hard to determine the exact figure. One reason is that it’s “hard to know what actions billionaires would take to reduce the amount of tax they pay.”

Paris Barraza is a reporter covering Los Angeles and Southern California for the USA TODAY Network. Reach her at pbarraza@usatodayco.com.

Colorado

Castle Rock Water in Colorado says chlorine smell tied to routine maintenance, water safe to drink

There’s something in the water in Castle Rock. Chlorine. Castle Rock Water says it’s all part of routine maintenance and the water is completely safe to drink.

CBS Colorado reporter Olivia Young tested the tap water in a Castle Rock home using a store-bought strip. She found the chlorine was 3.0 ppm. The EPA requires at least 0.2 ppm of chlorine in tap water but no more than 4.0.

Young found the pH of the tap water was around 7.6. Castle Rock Water says they keep the pH of the water between 7.5 and 8.5.

“Something’s not right within our water,” said Apres Coffee owner and Castle Rock resident Madison Vonderach.

While Vonderach says she uses a water filter at home and hasn’t noticed a difference, she says her customers have complained of a chlorine taste in their tap water.

“I have had a frequent amount of people, I would say, close to five different families, actually communicate to me that they’ve been noticing some concerns within their family’s health,” Vonderach said.

One Castle Rock resident told CBS Colorado her tap water has been making her family nauseous and giving her dog diarrhea. Another said his shower smells “like a swimming pool,” and the water has been giving him a sore throat.

“One of them in particular actually shared with me at some point that their wife fell ill and their animal fell ill,” Vonderach said. “Headaches and the stomach bug.”

“The water is safe to drink, but we make this transition to clean up the pipes,” said Castle Rock Water Director Mark Marlowe.

Marlowe says there is chlorine in the water, and that’s a good thing.

“Chlorine has been used for over a century in drinking water to disinfect it and keep it safe,” said Marlowe. “Disinfecting drinking water has been one of the most important achievements of public health in the history of the world, really. So it’s a very important thing.”

Marlowe says water utilities are required by state and federal laws to have a low level of chlorine in their water as a disinfectant. In 2013, Castle Rock Water switched from using chlorine to chloramine as a disinfectant.

“It’s chlorine plus ammonia that creates chloramines, and that’s what we typically use,” said Marlowe.

But Marlowe says when a certain type of biofilm develops on the pipes, chlorine needs to be used, so they’re making a temporary switch back.

“Lots of utilities will make this transition from chloramines to chlorine just to do maintenance on the system and clean that up,” said Marlowe.

Castle Rock Water warned neighbors they may notice discolored water and changes in taste and smell starting Feb. 2. Those impacts are most noticeable in the early days or in water taps closer to treatment plants.

“Down here, I haven’t tasted anything,” said T.A. Ike, assistant general manager at Wide Awake Eatery in downtown Castle Rock.

“The bottom line is, water is safe to drink,” said Marlowe. “There’s no danger to public health.”

Castle Rock Water says chlorine at the current level should not cause digestive or other health issues, and that anyone experiencing health issues should consult a doctor.

Castle Rock Water will switch back to chloramine in May.

This is the first time the utility has had to do maintenance like this. They anticipate having to do so again in the future, but it could be anywhere from four to 10-plus years before it is necessary.

“The bottom line is they should not notice anything really going forward, except maybe a slight smell of chlorine,” said Marlowe. “You get used to your water, and you’ll stop noticing it, quite frankly.”

If Castle Rock neighbors are testing the water at home and seeing chlorine levels above 4.0, or if they have other concerns, Marlowe says they should contact Castle Rock Water. They can come test the water and make sure everything is okay.

“Call us if you have any concerns, if you think that there’s something that you need someone to look at, have us come out and test the water. We’re very responsive. We’ll be out there right away,” said Marlowe. “We just encourage people to give us a call. We’re friendly here. We like to talk to our customers, and we’d be happy to go out and meet with them and help them understand what we’ve done and explain everything to them.”

Community members can visit CRgov.com/WaterQuality for additional details. Customers with questions can contact Castle Rock Water at 720-733-6000 or by email at Water@CRgov.com.

Other solutions neighbors can try are to buy a water filter. Most Brita-type filters can reduce the level of chlorine and improve taste. Marlowe says neighbors can also leave water out for 24 hours, and most of the chlorine will dissipate.

Hawaii

Hawaii Proposes Higher Tax for Luxury Homes

Abu Dhabi Property Market Had a Record 2025

Abu Dhabi’s real estate market had its strongest year on record in 2025. More than 42,800 properties changed hands, valued at AED 142 billion (US$38.66 billion), according to the Abu Dhabi Real Estate Centre. The number of transactions was a 52% jump from 2024 while the total value was up by 44%. Gulf News

Malibu Suing Los Angeles and California Over Wildfire Damage

The city of Malibu is suing Los Angeles and the state of California, among other state and local entities. Malibu claims their actions led to the extensive damage it suffered in 2025’s wildfires, which destroyed hundreds of homes and dozens of businesses in the coastal enclave. Realtor.com

Hawaii Proposes Higher Tax for Luxury Homes

Luxury homes in Hawaii worth at least $4 million could soon face new, higher property taxes. The Hawaii County Council’s Bill 128 is proposing a third tax tier for such homes, adding to the two existing tiers—one for properties valued under $2 million and the other for those over that threshold. It passed through its first council reading on Wednesday. Hawaii Public Radio

Demand Growing for Multi-Generational Homes in Calgary

The appetite for multi-generational homes is growing in the Canadian city of Calgary as single-family homes become increasingly costly. “With the way our market has gone, and home pricing across Canada for that matter, it’s just not affordable for the younger generation,” said Michael Cain, broker and owner of Re/Max House of Real Estate in Calgary. Calgary Herald

-

Science1 week ago

Science1 week agoA SoCal beetle that poses as an ant may have answered a key question about evolution

-

Oklahoma3 days ago

Oklahoma3 days agoWildfires rage in Oklahoma as thousands urged to evacuate a small city

-

Health1 week ago

Health1 week agoJames Van Der Beek shared colorectal cancer warning sign months before his death

-

Technology1 week ago

Technology1 week agoHP ZBook Ultra G1a review: a business-class workstation that’s got game

-

![“Redux Redux”: A Mind-Blowing Multiverse Movie That Will Make You Believe in Cinema Again [Review] “Redux Redux”: A Mind-Blowing Multiverse Movie That Will Make You Believe in Cinema Again [Review]](https://i1.wp.com/www.thathashtagshow.com/wp-content/uploads/2026/02/Redux-Redux-Review.png?w=400&resize=400,240&ssl=1)

![“Redux Redux”: A Mind-Blowing Multiverse Movie That Will Make You Believe in Cinema Again [Review] “Redux Redux”: A Mind-Blowing Multiverse Movie That Will Make You Believe in Cinema Again [Review]](https://i1.wp.com/www.thathashtagshow.com/wp-content/uploads/2026/02/Redux-Redux-Review.png?w=80&resize=80,80&ssl=1) Movie Reviews1 week ago

Movie Reviews1 week ago“Redux Redux”: A Mind-Blowing Multiverse Movie That Will Make You Believe in Cinema Again [Review]

-

Politics1 week ago

Politics1 week agoCulver City, a crime haven? Bondi’s jab falls flat with locals

-

Politics1 week ago

Politics1 week agoTim Walz demands federal government ‘pay for what they broke’ after Homan announces Minnesota drawdown

-

Culture1 week ago

Culture1 week agoRomance Glossary: An A-Z Guide of Tropes and Themes to Find Your Next Book