Politics

A Complete List of Everything in the Republican Bill, and How Much It Would Cost or Save

Depreciation allowance for qualified production property

Allow immediate deductibility of 100 percent of the cost of certain new factories and improvements

Business interest deduction

Change calculation of adjusted taxable income

Depreciation allowance for certain property

Allow immediate expensing of 100 percent of the cost of qualified property acquired from 2025 to 2030

Expensing of certain depreciable business assets

Increase dollar limitations

Deduction of domestic research and experimental expenditures

Allow immediate deductibility for expenditures paid or incurred from 2025 to 2030

Charitable contributions to organizations with scholarships

Provide new tax credit for gifts to organizations that provide scholarships. For calendar years 2026-2029.

“MAGA accounts”

Create new savings accounts for children, with a government contribution of $1,000 per child born from 2024 to 2028

The name was changed to “Trump accounts”

Small manufacturing businesses

Change accounting rules

Low-income housing credit

Modifies credit allocations and bond-financing thresholds, and gives a basis boost to Indian and rural areas

Reporting threshold for payments

Increase thresholds for reporting payments to independent contractors and other payees

Employer payments of student loans

Make the exclusion from gross income permanent and index for inflation

Opportunity zones

Renew and make changes to the existing program

Adoption tax credit

Make credit partially refundable and change rules for tribal governments

Interactions between provisions

Firearm silencers

Eliminate transfer tax

A last-minute change would deregulate silencers and eliminate a manufacturer tax on them.

Loans secured by rural or agricultural real estate

Partially exclude interest on certain loans

Certain income earned in the U.S. Virgin Islands

Exempt income for the purposes of a “GILTI” deduction

Employer-provided child care credit

Permanently increase, add a new separate amount for small businesses, index for inflation

Repeal excise tax on indoor tanning

This provision was removed from the bill.

Sound recording productions

Increase ability to expense certain costs of producing sound recordings

529 savings plans

Expand allowed expenses

Disaster-related personal casualty losses

Extend rules

Certain purchases of employee-owned stock

Disregard for purposes of foundation tax on excess business holdings

Exclusion of research income from unrelated business taxable income

Limit to publicly available research

I.R.S. Direct File program

Replace program with a public-private partnership to offer free tax filing

Increase penalties for unauthorized disclosures of taxpayer information

Postpone tax deadlines for those wrongfully detained abroad

Restrict regulation of contingency fees

Terminate tax-exempt status of certain organizations

Organizations that “provided more than a minor amount of material support or resources to a listed terrorist organization”

Wagering losses

Permanently extend limit

Qualified bicycle commuting reimbursement

Permanently eliminate the exclusion

American opportunity and lifetime learning credits

Require that students or taxpayers filing on behalf of students include their Social Security Numbers on tax returns

Sports franchises

Limit amortization deductions for certain sports-related intangibles

Increase penalties connected to Covid-related employee retention credits

Unrelated business taxable income of a tax-exempt organization

Increase by amount of certain fringe benefit expenses for which deduction is disallowed

Name and logo royalties

Treat as unrelated business taxable income

Tax on excess compensation within tax-exempt organizations

Expand application of tax

Mortgage, casualty loss and other itemized deductions

Permanently lower the home mortgage interest deduction to the first $750,000 in debt, limit the casualty loss deduction to losses resulting from federally declared disasters and terminate miscellaneous itemized deductions

Investment income of certain private colleges and universities

Increase excise tax for wealthier institutions

Excise tax for tobacco products

Limit drawback of taxes paid with respect to substituted merchandise

Moving expenses exclusion and deduction

Permanently eliminate both, except for active-duty military

Earned income tax credit

Make changes to prevent duplicate claims and create a program integrity task force

Compensation paid to certain high-earning employees

Change deduction limitation rules

Investment income of tax-exempt private foundations

Increase excise tax rates

Charitable contributions made by corporations

Establish a floor of one percent of taxable income on deduction

Excise tax on on money sent abroad

Impose new excise tax on remittance transfers by those who are not U.S. citizens or U.S. nationals

Limitation on excess business losses by noncorporate taxpayers

Make permanent

De minimis entry privilege

Repeal the privilege, which currently allows shipments under $800 to enter the U.S. duty-free

New limitation on itemized deductions

Permanently change

Raise certain taxes to retaliate against “unfair foreign taxes”

State and local tax deduction

Permanently cap itemized deductions for state and local taxes at $30,000 per household. The current cap is set to expire next year, so any cap imposed would save the government money.

Late negotiations increased the SALT cap to $40,000. That change is not reflected in the savings shown here.

Politics

Paxton vows he’s ‘staying in this race’ even if Trump backs Cornyn in Texas GOP clash

NEWYou can now listen to Fox News articles!

Texas Attorney General Ken Paxton is making it clear: he’s staying in the race for the Republican Senate nomination even if President Donald Trump endorses Paxton’s rival, longtime Sen. John Cornyn.

“I’m staying in this race,” Paxton said in an interview Wednesday evening. “I owe it to the people of Texas.”

Trump says he’ll soon take sides in the costly and combustible GOP primary showdown Cornyn and Paxton.

“I will be making my Endorsement soon,” the president wrote in a social media post hours after Cornyn and Paxton advanced to a May 26 runoff election.

The two heated rivals topped a crowded field of contenders in Tuesday’s primary, but since no one cleared the 50% threshold, the nomination race heads into overtime.

Texas Governor Greg Abbott, second from left, President Donald Trump, center, Sen. Ted Cruz (R-Texas), second from right, and Secretary of Energy Chris Wright, right, take part in a briefing on energy at the Port of Corpus Christi in Corpus Christi, Texas, Feb, 27, 2026. (Mandel NGAN/AFP via Getty Images)

Trump added that he “will be asking the candidate that I don’t Endorse to immediately DROP OUT OF THE RACE!”

A Republican operative in Trump’s political orbit told Fox News Digital it’s expected Cornyn will get the president’s endorsement. However, the president has been known to change his mind on candidates or even reverse endorsements.

A second source in Trump’s political orbit told Fox News that while there’s still jockeying to influence the president’s decision, given Cornyn’s better-than-expected performance in the primary, Trump is expected to back the senator and prevent a messy and expensive runoff.

CONTENTIOUS REPUBLICAN SENATE PRIMARY IN TEXAS HEADED INTO OVERTIME

Asked if he would end his Senate bid if Trump backed Cornyn, Paxton, a MAGA firebrand and longtime Trump supporter and ally, said no in an interview with Real America’s Voice.

“I’ve spent a year of my life campaigning against John Cornyn because John has not represented the people of Texas well,” Paxton argued. “He’s been against Trump in both of his elections, said he shouldn’t run last time. … The people of Texas, at least the Republicans, would like something different.”

Texas Attorney General Ken Paxton, a Republican candidate for the U.S. Senate, speaks during a primary election night watch party March 3, 2026, in Dallas. (Julio Cortez/The Associated Press )

And a source in Paxton’s political orbit emphasized to Fox News Digital that the Texas attorney general isn’t getting out of the race.

Cornyn or Paxton will face off in the general election against rising Democratic Party star state Rep. James Talarico, who topped progressive firebrand Rep. Jasmine Crockett, a vocal Trump critic, in the Democrats’ primary. Talarico is trying to become the first Democrat in nearly four decades to win a Senate election in right-leaning Texas.

‘OPEN BORDERS, TRUMP-HATING RADICAL’—REPUBLICANS QUICKLY POUNCE ON TALARICO

The 2026 Senate showdown in Texas is one of a handful across the country that could determine if Republicans hold their majority in the chamber in the midterm elections. The GOP currently controls the chamber 53–47.

The Cornyn campaign and aligned super PACs spent nearly $100 million to run ads attacking Paxton and Republican Rep. Wesley Hunt — who came in third — with the senator charging in the closing weeks of the primary campaign that Democrats would flip the seat in the general election if Paxton was the GOP’s nominee.

Cornyn, his allies and the National Republican Senatorial Committee (NRSC), the campaign arm of the Senate GOP, repeatedly pointed to the slew of scandals and legal problems that have battered Paxton over the past decade, as well as his ongoing messy divorce.

“Over the next 12 weeks, Texas Republican primary voters will hear more about my record of delivering conservative victories in the United States Senate, and learn more about Ken’s indefensible personal behavior and failures in office,” Cornyn told reporters on Tuesday night.

“Just like the primary, we have a plan to win the runoff, and we are in the process of executing it,” Cornyn said. “Judgment day is coming for Ken Paxton.”

Sen. John Cornyn, R-Texas, speaks during a campaign stop in The Woodlands, Texas, Feb. 28, 2026. (Annie Mulligan/AP Photo)

Paxton, a MAGA firebrand and longtime Trump supporter and ally who grabbed significant national attention by filing lawsuits against the Obama and Biden administrations, told supporters on primary night, “As we head into this runoff, we’re going to make the choice even clearer. While John Cornyn was cutting deals on gun control and amnesty, I was suing corrupt Joe Biden over 107 times.”

And he charged, “John Cornyn spent around $100 million trying to buy this seat. We’ve spent around $5 million.”

ROUND TWO OF CORNYN VS. PAXTON GETS UNDER WAY

Trump on Wednesday urged, “for the good of the Party, and our Country, itself, be allowed to go on any longer. IT MUST STOP NOW!”

And pointing to Talarico, the president argued, “We have an easy to beat, Radical Left Opponent, and we have to TOTALLY FOCUS on putting him away, quickly and decisively.”

State Rep. James Talarico, a Democratic candidate for the U.S. Senate, speaks at a primary election watch party Tuesday, March 3, 2026, in Austin, Texas. (Eric Gay/AP Photo)

“Both John and Ken ran great races, but not good enough. Now, this one, must be PERFECT!” Trump warned.

Trump, whose clout over the GOP remains immense, stayed neutral in the Republican primary race. All three candidates, who sought the president’s endorsement, were in attendance Friday as Trump held an event in Corpus Christi, Texas.

“They’re in a little race together,” Trump said of Cornyn and Paxton. “You know that, right? A little bit of a race. It’s going to be an interesting one, right? They’re both great people, too.”

Meanwhile, on Capitol Hill, the lobbying campaign to clinch the endorsement for Cornyn hasn’t stopped, and if anything, is intensifying in the hours since primary night.

Senate Majority Leader John Thune, R-S.D., told reporters that Cornyn had “a great night” against Paxton. The top Senate Republican has spent the last several months bending Trump’s ear at every opportunity to jump into the race and back the longtime incumbent.

“He’s positioned to win the runoff, and if the president endorses early, it saves everybody a lot of money, and a lot of, you know, just 10 weeks of another spirited campaign on our side that keeps us from spending time focusing on the Democrats,” Thune said.

Thune spoke with Cornyn on Wednesday morning, and believed that Talarico was the more formidable match-up for Republicans in November — one that Cornyn was better suited to win.

“The matchup that’s good for us is John Cornyn at the top of the ticket,” Thune said.

NRSC communications director Joanna Rodriguez told Fox News Digital, “John Cornyn remains the only candidate who guarantees state Rep. Talarico never becomes a United States senator and ensures the fight for President Trump’s Senate majority is waged in true battleground states, not Texas.”

And the Thune-aligned Senate Leadership Fund (SLF), the top super PAC backing Senate Republicans, which spent millions on behalf of Cornyn in the primary campaign, made it clear in a statement early Wednesday that it will continue to support the senator in the runoff.

“SLF and its sister organizations were proud to support Senator Cornyn early, and we look forward to him securing the Republican nomination on May 26,” the group’s executive director, Alex Latcham, said in a statement.

Meanwhile, a GOP political operative in Trump’s orbit told Fox News Digital, “Talarico being the nominee makes President Trump’s endorsement of Cornyn more important than ever.”

While Trump stayed neutral, his top pollster, Tony Fabrizio, helped the Cornyn campaign. And veteran Republican strategist Chris LaCivita, who served as co-campaign manager of Trump’s 2024 White House bid, consulted for a top Cornyn-aligned super PAC.

LaCivita, in a social media post Tuesday night aimed at Paxton and his top political consultant, wrote, “The second wave is going to be a (bi–h.)”

But on the Paxton side of the playing field, operatives and donors are confident they can unseat the senator.

Dan Eberhart, an oil drilling chief executive officer and prominent Republican donor and bundler who supports Paxton, told Fox News Digital, “This was Cornyn’s shot to fend off his challenger by getting over 50%, and he couldn’t do it. The runoff voters will be even less friendly territory for Cornyn.”

Pointing to former longtime Senate GOP leader Sen. Mitch McConnell, R-Ky., who has often acted as a Trump foil, Eberhart said, “This race is about MAGA vs. McConnell.”

Texas Attorney General Ken Paxton speaks to supporters at a campaign event on primary eve, in Waco, Texas on March 2, 2026. (Paul Steinhauser/Fox News)

Meanwhile, Lone Star Liberty, a pro-Paxton super PAC, circulated a memo ahead of Tuesday’s election that shrugged off threats that Cornyn would succeed in the runoff by continuing to hammer the attorney general over his litany of scandals, arguing there was nothing new to offer.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

“Cornyn’s talk of ‘unleashing’ new attacks in the runoff is bluster,” the memo states. “The truth is that from day one, his forces fired every bullet they had. There are no new attacks left — only more of the same, at ever-greater cost and with ever-diminishing returns.”

Fox News’ Rich Edson contributed to this report

Politics

Fears mount at CBS News and CNN over merger, consolidation

Paramount’s $111-billion deal to acquire Warner Bros. Discovery will put two of the most storied journalism brands — CNN and CBS News — under one roof.

The combination has been proposed before with the aim of consolidating news-gathering costs. Those plans fell apart largely over who would be in control.

But if the Paramount-WBD transaction is approved by regulators, CNN and CBS News will be forced into potentially rocky marriage where they will have to sort out leadership roles, personnel and editorial direction.

It’s still too early to determine what those moves will be and how widely they will be felt.

Last week CNN Chief Executive Mark Thompson told his troops to avoid “jumping to conclusions about the future.”

But what is certain is that every permutation will be scrutinized closely due to the fraught relationships both CNN and CBS News have with the Trump administration.

“There have been many conversations over the years about combining CBS News and CNN,” said Jon Klein, a digital media entrepreneur who previously held leadership roles at both organizations. “But this time, it’s different. The business case always made sense — but today you’ve got the overlay of the political agenda.”

Before Paramount prevailed in its bid for CNN’s parent, Paramount Chief Executive David Ellison’s father Larry Ellison reportedly discussed changes to the network with Trump. For years, Trump has made CNN the poster child of his “fake news” claims and impugned many of its journalists.

“What has David Ellison and Larry Ellison promised Donald Trump with regard to what they’re going to do with CNN?” said one former executive. “Before you even get through the hurdles of doing this, that’s the overriding question. Are they going to fire anchors Trump doesn’t like?”

There is also apprehension at CBS News, where David Ellison installed Bari Weiss as editor-in-chief in October, with a mandate to have network’s coverage appeal to the political center.

CBS News editor-in-chief Bari Weiss with Turning Point USA’s Erika Kirk at a town hall that aired Dec. 20.

(CBS Photo Archive / CBS via Getty Images)

Weiss — founder of the independent media company The Free Press — came into the role with no experience running a TV news organization, building her reputation as an opinion writer with contrarian views and a disdain for woke ideology.

The former New York Times opinion writer, who is staunchly pro-Israel, drew criticism over the weekend for putting a fire emoji over a comment criticizing New York City Mayor Zohran Mamdani’s condemnation of the U.S. military action in Iran — an unusual public reaction for the head of a major news organization.

Weiss wasted no time taking on the prestigious CBS news magazine “60 Minutes,” which has long been a stubbornly independent operation. She delayed a story on the harsh El Salvador prison used by the U.S. to house undocumented migrants saying it needed more reporting. The story’s correspondent Sharyn Alfonsi accused CBS News management of placating the White House, turning the decision into a public relations fiasco for the network.

Significant changes are coming to “60 Minutes” later this spring, with one or more of its correspondents possibly being replaced, according to people familiar with Weiss’ plans who were not authorized to comment. Weiss has also expressed interest in hiring right-leaning on-air talent for CBS News.

Some CBS News leadership is already heading for the exit. Shana Thomas, longtime “CBS Mornings” executive producer, told staff Thursday she is leaving at the end of the month. “I’ve been thinking about this for a while and frankly, I’m tired y’all,” she wrote in a memo.

Weiss arrived after Paramount settled a Trump lawsuit with the dubious claim that a “60 Minutes” interview with then-Vice President Kamala Harris was deceptively edited to aid her 2024 presidential election campaign against him.

The willingness to settle the suit was largely seen as Paramount capitulating to Trump in order to get government approval of its merger with Skydance Media. The Ellisons’ tight relationship with Trump was also seen as an asset in their successful pursuit of Warner Bros. Discovery.

The stew of issues bubbling through the transactions is why most of the rank and file at CNN rooted for Netflix to prevail in its bidding for Warner Bros. Discovery. The Netflix bid for WBD did not include CNN or the company’s cable networks, which in the words of one insider would have made it “a stay of execution.”

Now CNN staffers, speaking on the condition of anonymity, are bracing for upheaval. When they look at CBS News navigating the changes under Weiss, they are reminded what they went through after Warner Bros. Discovery took over their network and tried to push the coverage to the center.

After a declaration by WBD Chief Executive David Zaslav that the network needed to be more accommodating to conservative voices — and the telecast of a rowdy Trump town hall — CNN experienced an exodus of viewers.

But the biggest fear that the merger brings is consolidation and the loss of jobs. CNN has 3,400 employees while CBS News is at around 1,000. Cost-cutting is expected to be aggressive across the combined Paramount-WBD, which will have a mountain of debt to service.

The parent companies of CBS and CNN have discussed merging or sharing news-gathering operations and on-air talent numerous times over several decades. In 2019, Viacom, the CBS News parent at the time, had a deal in place to pay CNN an annual license fee to provide international coverage.

Under that plan, CBS would have maintained a few of its signature overseas correspondents, while shuttering its bureaus around the world. But Viacom backed out of the deal.

CNN’s international coverage has long been its calling card and its likely the network will handle that reporting for CBS News once Paramount takes ownership.

Combining the news-gathering operation stateside will be trickier, as CBS News has employees and vendors that operate under contracts with the Writers Guild of America East, SAG-AFTRA and other unions. CNN is a non-union shop.

Resolving the union issue has been a snag in every previous discussion to combine CBS News and CNN over the years, according to several former executives at both outlets.

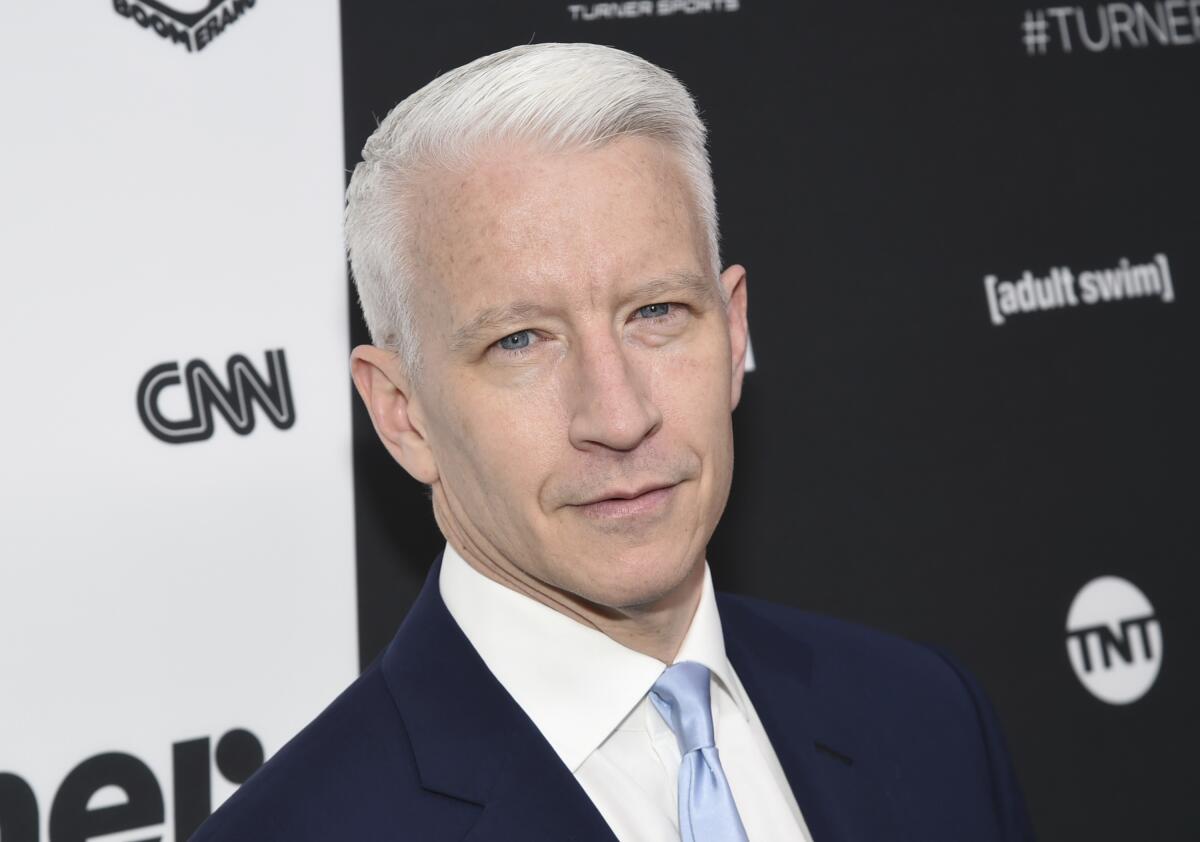

CNN news anchor Anderson Cooper in New York in 2016.

(Associated Press)

Another development worth watching is what role Anderson Cooper will play in the merged operation. Cooper signed a new deal with CNN last year, but turned down an offer to remain as a “60 Minutes” correspondent, a role he’s had since 2007.

CBS News has pursued Cooper several times over the years to be its evening news anchor. There was even a proposal in 2018 for him to helm “CBS Evening News” while keeping his nightly prime time program on CNN. That idea was shot down at CNN, where leadership believed he was unique to the network’s brand.

In a statement, Cooper cited a desire to spend more time with his two children as the reason for passing on another “60 Minutes” deal. However, associates have said his wariness over the direction of CBS News under Weiss made his decision easier.

Now Cooper is likely headed into the CNN-CBS News tent, which may make him feel a bit like Michael Corleone in “Godfather III” when he said “Just when I thought I was out, they pull me back in!”

Politics

Video: Senate Republicans Block Limits to Trump’s War Powers

new video loaded: Senate Republicans Block Limits to Trump’s War Powers

transcript

transcript

Senate Republicans Block Limits to Trump’s War Powers

Senate Republicans voted against a Democratic bill that would have required President Trump to obtain congressional authorization to continue waging war against Iran.

-

“The yeas are 47. The nays are 53. The motion to discharge is not approved.” “President Trump decided to attack Iran. That decision was profound, deliberate and correct. The president understands the weight of war.” “Why is Donald Trump hellbent on making history repeat itself? Why is he plunging America headfirst into a war that Americans do not want, and which he cannot even explain? The American people deserve a say, and that is what our resolution is about.”

By Shawn Paik

March 5, 2026

-

World1 week ago

World1 week agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Wisconsin3 days ago

Wisconsin3 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Maryland4 days ago

Maryland4 days agoAM showers Sunday in Maryland

-

Florida4 days ago

Florida4 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Massachusetts2 days ago

Massachusetts2 days agoMassachusetts man awaits word from family in Iran after attacks

-

Oregon6 days ago

Oregon6 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling