Business

Armed with venture capital, Skims and Kim Kardashian write their 'second chapter'

Kim Kardashian was already a successful celebrity businesswoman when she launched Skims five years ago.

But more often than not, she simply had attached her name to a string of existing companies: QuickTrim supplements, Carl’s Jr. salads, Skechers Shape-Ups, Sugar Factory confections, Midori liqueur, Silly Bandz bracelets, Beach Bunny swimwear, and so on.

“We did every product that you could imagine — from cupcake endorsements to a diet pill at the same time, to sneakers or things that I didn’t know enough about for them to be super-authentic to me,” the reality television star told The Times in 2019. “Like it all made sense a little bit, but it wasn’t my own brand.”

Skims, Kardashian’s homegrown apparel company built upon her famous curves and her love of body-cinching shapewear, was on brand — and, finally, her brand.

Kim Kardashian at a Skims pop-up at the Grove in 2021. The company pulled in nearly $1 billion in net sales last year and will open its first physical stores soon.

(Skims)

Its first years were marked by explosive growth. The start-up is now a retail juggernaut with around $1 billion in net sales and Kardashian has become a savvy entrepreneur with an eye for spotting and setting trends. Skims has made a huge dent in the shapewear market previously dominated by Spanx while adding several new categories to its merchandise mix.

This year Skims is aggressively moving into its next phase, one that will see the Hollywood company enter the competitive bricks-and-mortar space for the first time.

Underscoring Skims’ growth is the heightened interest the retailer is drawing from investors. Last year it raised $330 million in venture capital funding, ranking it second among companies in the greater L.A. area and the only retail brand in the top 10, according to a recent analysis by CB Insights.

That influx of cash was particularly notable given the tough investment climate locally: The region saw a steep decline in venture capital funding from 2021 to 2023, when the amount of investment dollars fell 74%, the analytics firm said.

Co-founded by Karadashian, who is chief creative officer, and Jens Grede, the company’s chief executive, Skims pulled in nearly $1 billion in net sales last year, according to Bloomberg, roughly double its 2022 total.

Kim Kardashian, center, in a Skims ad campaign starring Candice Swanepoel, Tyra Banks, Heidi Klum and Alessandra Ambrosio.

(Courtesy of Skims)

The company is reportedly eyeing an initial public offering this year. Kardashian and Grede declined to comment.

What began as a collection of undergarments designed to give women a more flattering, contoured silhouette has swelled into a comprehensive apparel giant: There’s underwear, bras, swimwear, dresses, tees and tanks, loungewear and pajamas. Inclusive sexy-meets-cozy clothing is the hook, with merchandise available in a wide range of sizes and skin tones.

In October, Skims launched a menswear line and became the official underwear partner of the NBA, WNBA and USA Basketball. It sells some accessories and clothing for kids, and this year will open bricks-and-mortar stores in several cities including a flagship location in Los Angeles.

“Skims has evolved into becoming a brand that can provide comfort for all audiences, not just for women,” Kardashian, 43, said when announcing the menswear line.

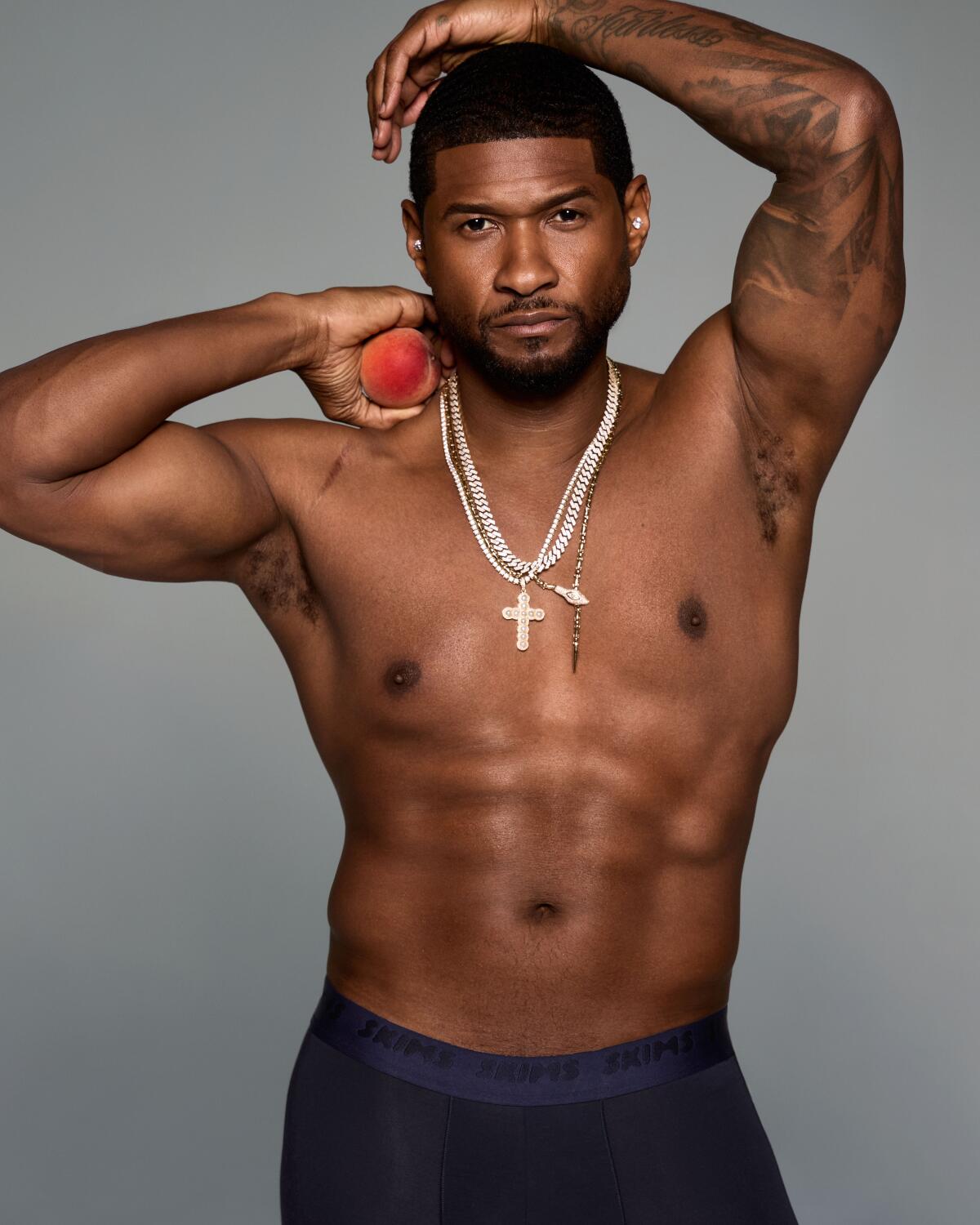

Usher in Skims. The brand launched menswear in October.

(Courtesy of Skims)

The company’s swift rise was undoubtedly fueled in part by Kardashian’s name and marketing prowess. She models the latest collections herself, posting glossy professional photos and casual at-home closet videos to her millions of social media followers, and has tapped her A-list friends to star in Skims ad campaigns including Lana Del Rey, Kate Moss, SZA, Cardi B, Sabrina Carpenter, Usher and Patrick Mahomes.

“Kim Kardashian’s visibility, I think, gives them a big leg up on marketing,” said Alex Lee, research editor at CB Insights, which compiled its data by analyzing companies in Los Angeles, Orange, Ventura, San Bernardino and Riverside counties.

But more than that, Lee said, Skims “is a really interesting example of the confluence of celebrity with technology and consumer trends.”

The rise of athleisure — stylish athletic clothing that can be worn at the gym or as everyday wear — was a game-changer in retail, said Simeon Siegel, managing director at BMO Capital Markets, who follows companies including Victoria’s Secret and Lululemon.

“That notion of comfort stretched to every possible category of apparel,” he said. “What we saw was a race among companies to figure out how to apply what Lulu revolutionized. Shapewear was a very logical category to go after with the new advancements in technology,” which includes improved fabrics and better fits.

Skims at first sold its products online only through its website before expanding to retailers including Nordstrom and Saks Fifth Avenue and hosting occasional pop-ups. Its foray into physical stores “marks the second chapter” for the company, Grede said in an interview with Bloomberg last year, and its ambitions are high.

Kim and I can envision a future where years from today there’s a Skims store anywhere in the world you’d find an Apple store or a Nike store.

— Jens Grede, Skims co-founder and CEO

In the fourth quarter, Skims is scheduled to open a 5,000-square-foot store on the Sunset Strip in West Hollywood. The company also plans to open stores in other U.S. cities and then target major international markets.

“Kim and I can envision a future where years from today there’s a Skims store anywhere in the world you’d find an Apple store or a Nike store,” Grede said.

Skims was most recently valued at $4 billion after a funding round last summer, a valuation that propelled Kardashian to sixth on Forbes’ list of the World’s Celebrity Billionaires 2024 with an estimated net worth of $1.7 billion.

“No one has cashed in on reality star fame more than Kim Kardashian, who has become a billionaire from her beauty and clothing brands,” the magazine said.

Business

Not ‘Just Ken’: Mattel shares Barbie’s longtime boyfriend’s full name

At the 2024 Oscars, Ryan Gosling, reprising his role as Ken in Greta Gerwig’s 2023 movie “Barbie,” donned a bedazzled pink suit and belted the ballad “I’m Just Ken.”

“I’m just Ken, anywhere else I’d be a 10,” the actor sang. “Is it my destiny to live and die a life of blond fragility?”

Barbie’s needy male counterpart, it turns out, is not “just Ken.” His full name is Kenneth Sean Carson, according to Mattel, which says the doll saw a uptick in popularity in the years following the hit movie’s release.

Ahead of Ken’s 65th birthday, the El Segundo-based toy giant shared a laundry list of niche biographical details about the doll, including his official “birthday” — March 11, 1961, making him a Pisces — as well as his relationship history with Barbie.

The company said in a statement Monday that Ken has “experienced a resurgence in recent years.”

A Mattel spokesperson cited the “Barbie” movie as a driving factor, as it showed a “different side” of Ken. In a meta move, the company later in 2023 released Ken dolls modeled after Ryan Gosling’s portrayal of Ken.

The “Kenbassador” line launched last year was a “great success,” the spokesperson said. The first product in that toy series was a $75 doll modeled after basketball player LeBron James released in April.

Mattel says it does not break out sales of Ken dolls, but in 2017, when Mattel unveiled Ken dolls with different body types, including one that invited “dad-bod” comparisons, the company told the Wall Street Journal that, on average, girls have one Ken doll for every seven Barbies they own.

Ruth Handler, the creator of Barbie, named the original doll after her daughter, Barbara. The glamorous doll, unique in that it depicted a grown woman rather than a baby, was an instant hit when it debuted at the New York Toy Fair in 1959. Barbie has significantly evolved in the decades since. Recent additions include Barbies with Type 1 diabetes and another with autism.

The Ken doll, created in 1961, was named after Handler’s son, Kenneth. He featured molded hair, wore red swim trunks and carried a yellow towel.

Kenneth Handler told The Times in a 1989 story that there were few similarities between him and the doll named after him. He died in 1994.

“Ken doll is Malibu,” he said. “He goes to the beach and surfs. He is all these perfect American things.”

But when Kenneth Handler was at Hamilton High School in Beverlywood, he “played the piano and went to movies with subtitles.” He continued, “I was a nerd — a real nerd. All the girls thought I was a jerk.”

Like Barbie, Ken dabbled in many different careers over the decades. There have been doctor, pilot, tennis player, firefighter, lifeguard, barista and even Olympic skier Kens, among many others. In 2006, he received a “mid-life makeover” from celebrity stylist Phillip Bloch.

According to the company, Ken and Barbie “met” on the set of their first television commercial in 1961 and soon began dating. After more than four decades, the doll couple broke up in 2004, but reunited in 2011.

Mattel was founded by Ruth Handler; her husband, Elliot Handler; and Harold “Matt” Matson in 1945 in a Los Angeles garage. The toy maker became a publicly traded company in 1960.

Mattel, which also owns Fisher-Price and Hot Wheels, wrote in its October Securities and Exchange Commission filing that “industry-wide shifts in retailer ordering patterns” pushed its third quarter net sales down 6%.

In 2024, Barbie gross billings — which measure the total value of products Mattel ships to retailers before sales adjustments — were down 12% from 2023, which had seen a boost from the movie, according to the company’s annual SEC filing.

Business

Paramount outlines plans for Warner Bros. cuts

Many in Hollywood fear Warner Bros. Discovery’s sale will trigger steep job losses — at a time when the industry already has been ravaged by dramatic downsizing and the flight of productions from Los Angeles.

David Ellison‘s Paramount Skydance is seeking to allay some of those concerns by detailing its plans to save $6 billion, including job cuts, should Paramount succeed in its bid to buy the larger Warner Bros. Discovery.

Leaders of the combined company would search for savings by focusing on “duplicative operations across all aspects of the business — specifically back office, finance, corporate, legal, technology, infrastructure and real estate,” Paramount said in documents filed with the Securities & Exchange Commission.

Paramount is locked in an uphill battle to buy the storied studio behind Batman, Harry Potter, Scooby-Doo and “The Big Bang Theory.” The firm’s proposed $108.4-billion deal would include swallowing HBO, HBO Max, CNN, TBS, Food Network and other Warner cable channels.

Warner’s board prefers Netflix’s proposed $82.7-billion deal, and has repeatedly rebuffed the Ellison family’s proposals. That prompted Paramount to turn hostile last month and make its case directly to Warner investors on its website and in regulatory filings.

Shareholders may ultimately decide the winner.

Paramount previously disclosed that it would target $6 billion in synergies. And it has stressed the proposed merger would make Hollywood stronger — not weaker. The firm, however, recently acknowledged that it would shave about 10% from program spending should it succeed in combining Paramount and Warner Bros.

Paramount said the cuts would come from areas other than film and television studio operations.

A film enthusiast and longtime producer, David Ellison has long expressed a desire to grow the combined Paramount Pictures and Warner Bros. slate to more than 30 movies a year. His goal is to keep Paramount Pictures and Warner Bros. stand-alone studios.

This year, Warner Bros. plans to release 17 films. Paramount has said it wants to nearly double its output to 15 movies, which would bring the two-studio total to 32.

“We are very focused on maintaining the creative engines of the combined company,” Paramount said in its marketing materials for investors, which were submitted to the SEC on Monday.

“Our priority is to build a vibrant, healthy business and industry — one that supports Hollywood and creative, benefits consumers, encourages competition, and strengthens the overall job market,” Paramount said.

If the deal goes through, Paramount said that it would become Hollywood’s biggest spender — shelling out about $30 billion a year on programming.

In comparison, Walt Disney Co. has said it plans to spend $24 billion in the current fiscal year.

Paramount also added a dig at Warner management, saying: “We expect to make smarter decisions about licensing across linear networks and streaming.”

Some analysts have wondered whether Paramount would sell one of its most valuable assets — the historic Melrose Avenue movie lot — to raise money to pay down debt that a Warner acquisition would bring.

Paramount is the only major studio to be physically located in Hollywood and its studio lot is one of the company’s crown jewels. That’s where “Sunset Boulevard,” several “Star Trek” movies and parts of “Chinatown” were filmed.

A Paramount spokesperson declined to comment.

Sources close to the company said Paramount would scrutinize the numerous real estate leases in an effort to bring together far-flung teams into a more centralized space.

For example, CBS has much of its administrative offices on Gower in Hollywood, blocks away from the Paramount lot. And HBO maintains its operations in Culver City — miles from Warner’s Burbank lot.

Paramount pushed its deadline to Feb. 20 for Warner investors to tender their shares at $30 a piece.

The tender offer was set to expire last week, but Paramount extended the window after failing to solicit sufficient interest among Warner shareholders.

Some analysts believe Paramount may have to raise its bid to closer to $34 a share to turn heads. Paramount last raised its bid Dec. 4 — hours before the auction closed and Netflix was declared the winner.

Paramount also has filed proxy materials to ask Warner shareholders to reject the Netflix deal at an upcoming stockholder meeting.

Earlier this month, Netflix amended its bid, converting its $27.75-a-share offer to all-cash to defuse some of Paramount’s arguments that it had a stronger bid.

Should Paramount win Warner Bros., it would need to line up $94.65 billion in debt and equity.

Billionaire Larry Ellison has pledged to backstop $40.4 billion for the equity required. Paramount’s proposed financing relies on $24 billion from royal families in Saudi Arabia, Qatar and Abu Dhabi.

The deal would saddle Paramount with more than $60 billion of debt — which Warner board members have argued may be untenable.

“The extraordinary amount of debt financing as well as other terms of the PSKY offer heighten the risk of failure to close,” Warner board members said in a filing earlier this month.

Paramount would also have to absorb Warner’s debt load, which currently tops $30 billion.

Netflix is seeking to buy the Warner Bros. television and movie studios, HBO and HBO Max. It is not interested in Warner’s cable channels, including CNN. Warner wants to spin off its basic cable channels to facilitate the Netflix deal.

Analysts say both deals could face regulatory hurdles.

Business

Southwest’s open seating ends with final flight

After nearly 60 years of its unique and popular open-seating policy, Southwest Airlines flew its last flight with unassigned seats Monday night.

Customers on flights going forward will choose where they sit and whether they want to pay more for a preferred location or extra leg room. The change represents a significant shift for Southwest’s brand, which has been known as a no-frills, easygoing option compared to competing airlines.

While many loyal customers lament the loss of open seating, Southwest has been under pressure from investors to boost profitability. Last year, the airline also stopped offering free checked bags and began charging $35 for one bag and $80 for two.

Under the defunct open-seating policy, customers could choose their seats on a first-come, first-served basis. On social media, customers said the policy made boarding faster and fairer. The airline is now offering four new fare bundles that include tiered perks such as priority boarding, preferred seats, and premium drinks.

“We continue to make substantial progress as we execute the most significant transformation in Southwest Airlines’ history,” said chief executive Bob Jordan in a statement with the company’s third-quarter revenue report. “We quickly implemented many new product attributes and enhancements [and] we remain committed to meeting the evolving needs of our current and future customers.”

Eighty percent of Southwest customers and 86% of potential customers prefer an assigned seat, the airline said in 2024.

Experts said the change is a smart move as the airline tries to stabilize its finances.

In the third quarter of 2025, the company reported passenger revenues of $6.3 billion, a 1% increase from the year prior. Southwest’s shares have remained mostly stable this year and were trading at around $41.50 on Tuesday.

“You’re going to hear nostalgia about this, but I think it’s very logical and probably something the company should have done years ago,” said Duane Pfennigwerth, a global airlines analyst at Evercore, when the company announced the seating change in 2024.

Budget airlines are offering more premium options in an attempt to increase revenue, including Spirit, which introduced new fare bundles in 2024 with priority check-in and their take on a first-class experience.

With the end of open seating and its “bags fly free” policy, customers said Southwest has lost much of its appeal and flexibility. The airline used to stand out in an industry often associated with rigidity and high prices, customers said.

“Open seating and the easier boarding process is why I fly Southwest,” wrote one Reddit user. “I may start flying another airline in protest. After all, there will be nothing differentiating Southwest anymore.”

-

Illinois6 days ago

Illinois6 days agoIllinois school closings tomorrow: How to check if your school is closed due to extreme cold

-

Pittsburg, PA1 week ago

Pittsburg, PA1 week agoSean McDermott Should Be Steelers Next Head Coach

-

Pennsylvania2 days ago

Pennsylvania2 days agoRare ‘avalanche’ blocks Pennsylvania road during major snowstorm

-

Lifestyle1 week ago

Lifestyle1 week agoNick Fuentes & Andrew Tate Party to Kanye’s Banned ‘Heil Hitler’

-

Sports1 week ago

Sports1 week agoMiami star throws punch at Indiana player after national championship loss

-

Cleveland, OH1 week ago

Cleveland, OH1 week agoNortheast Ohio cities dealing with rock salt shortage during peak of winter season

-

Technology6 days ago

Technology6 days agoRing claims it’s not giving ICE access to its cameras

-

Science1 week ago

Science1 week agoContributor: New food pyramid is a recipe for health disasters