Washington

The Book Report: Washington Post critic Ron Charles (March 17)

By Washington Post book critic Ron Charles

This month’s books take us from pre-Civil War America to the modern-day politics, the rise of Silicon Valley, and the future of the planet.

For 140 years, people have been reading, praising and condemning “The Adventures of Huckleberry Finn.” Well, get ready to see Mark Twain’s classic in a strikingly different light.

Percival Everett, the author of “Erasure” (the novel that inspired the Academy Award-winning film “American Fiction”), has just published a new book called “James” (Doubleday).

It retells “Huckleberry Finn” from the perspective of Huck’s enslaved friend, Jim. And believe me, that one change changes everything.

With this comic, sometimes terrifying story, Everett delivers a sharp satire of racism, and more than one shocking surprise.

READ AN EXCERPT: “James” by Percival Everett

“James” by Percival Everett (Doubleday), in Hardcover, Large Print Trade Paperback, eBook and Audio formats, available via Amazon, Barnes & Noble and Bookshop.org

Also by Percival Everett: “Dr. No” (Book excerpt)

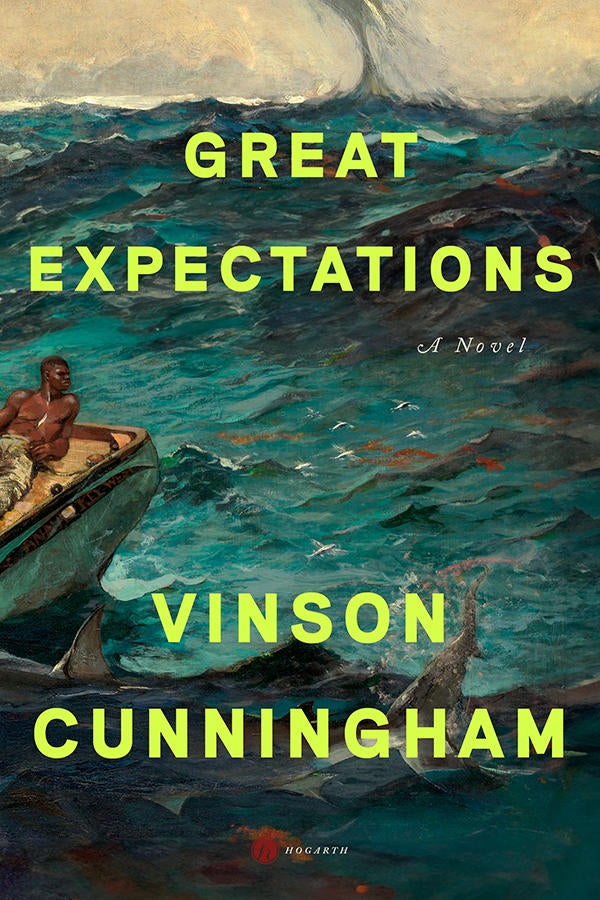

“Great Expectations” – no, not that one – is a new novel by Vinson Cunningham, a theater critic for The New Yorker. Inspired by his own experiences, it tells the story of a young man who gets a job as a fundraiser for the presidential campaign of a Black senator from Illinois. Now, the candidate is never named, but you’ll figure it out from Cunningham’s pitch-perfect descriptions.

The real subject, though, is this thoughtful narrator, raised in a Pentecostal church, looking at the candidate and his wealthy donors, and trying to figure out what kind of man he’ll become in a nation woven from money and faith.

READ AN EXCERPT: “Great Expectations” by Vinson Cunningham

“Great Expectations” by Vinson Cunningham (Hogarth), in Hardcover, eBook and Audio formats, available via Amazon, Barnes & Noble and Bookshop.org

Vinson Cunningham at The New Yorker

Téa Obreht has written magical tales involving tigers in the Balkans and camels in the Arizona Territory. Her new novel, “The Morningside” (Random House), is set in a future ravaged by climate change.

An 11-year-old girl named Silvia has immigrated with her mother to an island city that will remind you of New York. There they live with Silvia’s aunt who’s in charge of a once-grand high-rise apartment building.

But unable to go to school, Silvia turns her curious mind to her strange neighbors – particularly one woman who owns three unusual dogs that may turn into men during the day.

READ AN EXCERPT: “The Morningside” by Téa Obreht

“The Morningside” by Téa Obreht (Random House), in Hardcover, Large Print Trade Paperback, eBook and Audio formats, available via Amazon, Barnes & Noble and Bookshop.org

teaobreht.com

Kara Swisher has been chronicling the wonders and shenanigans of Silicon Valley since people were dialing up AOL to hear “You’ve got mail.”

Now, in her new memoir, “Burn Book: A Tech Love Story” (Simon & Schuster), Swisher takes us through her journey as a reporter who not only covered the rise of the Web, but became one of its leading voices – even as she became increasingly disillusioned with the arrogance of Internet billionaires and their reckless empires.

All the usual suspects are here – Steve Jobs, Mark Zuckerberg, Elon Musk and others – along with Swisher’s signature bravado and insightful criticism.

READ AN EXCERPT: “Burn Book: A Tech Love Story” by Kara Swisher

“Burn Book: A Tech Love Story” by Kara Swisher (Simon & Schuster), in Hardcover, eBook and Audio formats, available via Amazon, Barnes & Noble and Bookshop.org

Kara Swisher, host of the podcast On with Kara Swisher and co-host of Pivot

For more suggestions on what to read, contact your librarian or local bookseller.

That’s it for the Book Report. I’m Ron Charles. Until next time, read on!

For more info:

For more reading recommendations, check out these previous Book Report features from Ron Charles:

Produced by Robin Sanders and Roman Feeser.

Washington

Week Ahead in Washington: March 1

WASHINGTON (Gray DC) – Operation “Epic Fury” — the weekend military operations carried out by the U.S. and Israel against targets in Iran — tops the agenda for Congress as lawmakers return to Washington.

Sunday, President Donald Trump said the new leadership in Iran wants to talk to the Trump Administration.

Democrats in both chambers called for Congress to return as soon as possible for classified briefings on Iran, followed by a move to vote on the War Powers Act. The Constitution gives Congress the power to declare war on another country.

Congress’ return to Washington was originally delayed due to the start of the 2026 midterm elections cycle.

Tuesday, voters in Arkansas, North Carolina and Texas head to the polls for primary elections.

North Carolina and Texas are drawing significant attention, as both states are facing congressional redistricting and competitive primary races for Senate seats.

In Texas, incumbent Sen. John Cornyn (R) is facing primary challenges from state Attorney General Ken Paxton and Rep. Wesley Hunt. On the Democratic side, Rep. Jasmine Crockett is facing state Rep. James Talarico.

In North Carolina, candidates are vying to replacing retiring Sen. Thom Tillis (R) . They include former Governor Roy Cooper (D) and former Republican National Committee Chair Michael Whatley.

Also this week, the Rev. Jesse Jackson is laid to rest. He will be honored Wednesday in Washington before a final memorial service Saturday. Jackson died Feb. 17.

Copyright 2026 Gray DC. All rights reserved.

Washington

Caps Fall in Montreal, 6-2 | Washington Capitals

Cole Caufield scored in the first minute of the first period and added another goal later in the frame, sparking the Montreal Canadiens to a 6-2 win over the Capitals on Saturday night at Bell Centre.

Washington entered the game with a modest three-game winning streak and six wins in its last seven games. Although they were able to briefly draw even with the Habs after Caufield’s opening salvo, Caufield and the Canadiens responded quickly and the Caps found themselves chasing the game for the remainder of the night.

“I didn’t mind some of the things that we did tonight,” says Caps coach Spencer Carbery. “I thought we created enough offensively, we just made way too many catastrophic mistakes to be able to sustain that.”

In the first minute of the game, Caufield blocked a Jakob Chychrun point shot, tore off on the resulting breakaway and beat Charlie Lindgren for a 1-0 lead for the Canadiens, half a minute into the contest. Lindgren was making his first start since Jan. 29, following a short stint on injured reserve for a lower body injury he sustained in that game.

After the two teams traded unsuccessful power plays, the Caps pulled even in the back half of the first. With traffic in front, Declan Chisholm let a shot fly from the left point. The puck hit Anthony Beauvillier and bounded right to Alex Ovechkin, who had an easy tap-in for career goal No. 920 at 13:16 of the first.

But Montreal came right back to regain the lead 63 seconds later, scoring a goal similar to the one Ovechkin just scored.

From the left point, Canadiens defenseman Jayden Struble put a shot toward the net. It came to Nick Suzuki on the goal line, and the Habs captain pushed it cross crease for Caufield to tap it home from the opposite post at 14:19.

Less than two minutes later, Lindgren made a dazzling glove save to thwart Caufield’s hat trick bid.

Midway through the middle period, Montreal went on the power play again. Although the Caps were able to kill the penalty, the Habs added to their lead seconds after the kill was completed; Mike Matheson skated down a gaping lane in the middle of the ice and beat Lindgren from the slot to make it a 3-1 game at 12:22.

Minutes later, Montreal netminder Jakub Dobes made a big stop on Aliaksei Protas from the right circle, and Suzuki grabbed the puck and took off in the opposite direction. From down low on the right side, he fed Kirby Dach in the slot, and Dach’s one-timer made it 4-1 for the Canadiens at 16:34 of the second.

In the waning seconds of the second, Dobes made one of his best stops of the night on Beauvillier, enabling the Canadiens to carry a three-goal lead into the third.

Those two quick goals in the back half of the second took some wind out of the Caps, who were playing their third game in four nights following the three-week Olympic break.

“We kill off a penalty, and then we end up going down 3-1right after the penalty,” says Caps center Nic Dowd. “Those are challenging to give up, right? You do a good job [on the kill], it’s a 2-1 game, and then all of a sudden, before you blink, it’s 4-1 and then the game gets away from you.

“And they defended well tonight; It’s tough to score goals in this League, and you go into the third period, and you’ve got to score three. You saw that [Friday] night when we played Vegas; they were able to score two, but it’s tough to get that third one. I think we have to manage situations a little bit better. It’s a 2-1 game on a back-to-back, we just kill a penalty off, or maybe we just have a power play – whatever it is – we have to manage that, especially in an arena like this, where the crowd gets into it on nothing plays. They can really sway momentum – and in a good way – for their home team.

“We just have to understand that if we don’t have our legs in certain situations, because of travel, it’s back-to-back or whatever, we really have to key into the details of the game and not let things get away from us quickly.

With 7:28 left in the third, Ovechkin netted his second of the game – and the fifth goal he has scored in this building this season – on a nice feed from Dylan Strome to pull the Caps within two goals of the Habs, who have coughed up some late leads this season.

But Montreal salted the game away with a pair of late empty-net goals from Suzuki and Jake Evans, respectively.

In winning six of their previous seven games, the Caps had been playing with a lead most of the time. But playing from behind virtually all night against a good team in a tough building is a tall task under any circumstances. And it was exactly that for the Caps on this night.

“They score on the first shift,” says Strome. “Obviously, Saturday night in Montreal is as good and as loud as it gets. They just got a fortunate bounce; puck was off Caulfield’s leg, and a perfect bounce for a breakaway. It’s just one of those things where we got down early and now they kind of fed off the momentum of the crowd.

“But I still think our game is in a good spot, and we’ve just got to keep stacking wins. Obviously, we’ve played more games than everyone so we’re going to need some help, but we’ve just got to keep stacking wins. It’s tough on the back-to-back in Montreal, but we’ll find a way to bounce back on Tuesday [vs. Utah at home] and then go from there.”

Washington

The Fallout From the Epstein Files

The Department of Justice is facing scrutiny this week after it was revealed that records involving President Trump were missing from the public release of the Epstein files. On Washington Week With The Atlantic, panelists joined to discuss the ensuing political fallout for the Trump administration, and more.

“The key thing to remember about the Epstein story is that it is a case that has been mishandled for decades. The reason that we’re hearing about this now and why it’s exploding into public view is because, for the first time, Republicans in Congress and Democrats in Congress were willing to openly defy their leadership and call for the release of these files,” Sarah Fitzpatrick, a staff writer at The Atlantic, said last night. “That has never been done before, and I think it really is changing the political landscape in ways that we’re still just starting to learn.”

“What’s been so striking is how many of those very same Republicans who were calling for the release of those files, who had promised to get to the bottom of them, are now saying things that are just the opposite,” Stephen Hayes, the editor of The Dispatch, argued.

Joining guest moderator Vivian Salama, a staff writer at The Atlantic, to discuss this and more: Andrew Desiderio, a senior congressional reporter at Punchbowl News; Fitzpatrick; Hayes; and Tarini Parti, a White House reporter at The Wall Street Journal.

Watch the full episode here.

-

World4 days ago

World4 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts4 days ago

Massachusetts4 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Denver, CO4 days ago

Denver, CO4 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Louisiana6 days ago

Louisiana6 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Technology1 week ago

Technology1 week agoYouTube TV billing scam emails are hitting inboxes

-

Technology1 week ago

Technology1 week agoStellantis is in a crisis of its own making

-

Politics1 week ago

Politics1 week agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT