Alaska

Brad Keithley’s chart of the week: The impact on Alaska families of broadening the funding base

Usually once we take a look at the distributional influence of assorted Alaska funding choices we use the evaluation developed by the Institute on Taxation and Financial Coverage (ITEP) and utilized in its April 2017 and February 2021 experiences for the legislature.

However as a result of it’s tough to make use of these instruments to take a look at the distributional influence of choices past these analyzed within the experiences, just lately we have now been spending extra time utilizing the uncooked numbers contained within the public summaries of Inside Income Service knowledge on which ITEP’s evaluation largely relies. The latest public summaries cowl tax 12 months 2019.

In its uncooked kind, the IRS knowledge isn’t damaged down into the identical quintiles – low, decrease center, center, higher center and high 20% – as ITEP develops and makes use of for its evaluation. Slightly, the IRS knowledge is summarized two methods, relying on the kind of data lined.

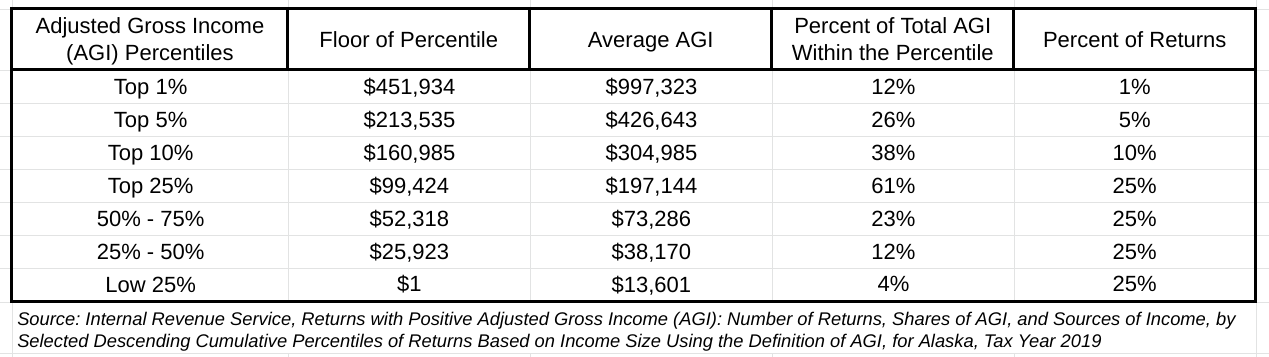

The primary is by cumulative percentiles – high 1%, high 5%, high 10%, high 25%, high 50%, high 75%, and by subtraction, the underside 25%. The second is by Adjusted Gross Earnings (AGI) ranges of various sizes, starting from lower than $1 on the backside, to $1 million and extra on the high.

Here’s what the breakdown seems to be like from the angle of percentiles:

The vary of the highest 1% of Alaska households begins at an AGI of $451,934, has a median AGI of $997,323 and on their very own represents 12% of complete Alaska adjusted gross earnings.

The highest 10% begins at $160,985, has a median AGI of $304,985 and represents greater than a 3rd – 38% – of Alaska adjusted gross earnings.

The highest 25% begins at $99,424, has a median AGI of $197,144 and represents nicely greater than half – 61% – of Alaska adjusted gross earnings.

The center 50% (from the twenty fifth to seventy fifth percentiles) ranges between $25,923 and fewer than $99,424, has a median AGI of $55,728 and, though it consists of roughly 50% of Alaska households, represents solely a few third – 35% – of Alaska adjusted gross earnings. Put one other method, within the mixture, the center 50% represents nearly the identical share of Alaska AGI when it comes to proportion as the highest 10%.

The low (backside) 25% has an AGI of lower than $25,923, a median AGI of $13,601 and represents solely 4% of Alaska adjusted gross earnings, lower than a 3rd of that managed by the highest 1% alone.

As useful as it’s in broadly describing the financial situation of Alaska households, nonetheless, the IRS’ percentile breakdown doesn’t include sufficient data to finish a few of the distributional evaluation we do. For these, we flip to the breakdown by earnings ranges.

The usefulness of this knowledge is that it additionally comprises the variety of people falling in every bracket. We use it when our evaluation requires including again to earnings the quantity diverted to authorities (i.e., taxed) in any given 12 months via reductions within the Everlasting Fund Dividend (PFD).

We have now used that knowledge on this week’s evaluation, which focuses on demonstrating how regressive PFD cuts actually are, and the constructive influence for the overwhelming majority of Alaska households which might outcome from broadening the bottom from which revenues are being raised.

In our view, PFD cuts are a type of focused earnings tax. When distributed, PFDs add to non-public earnings. Diverting a portion of that personal earnings as an alternative to authorities suits the basic definition of a tax. As a result of it falls solely on PFDs, it’s a focused tax on PFD earnings.

Each the 2016 research by the College of Alaska-Anchorage’s Institute of Social and Financial Analysis (ISER) for the then-administration of former Governor Invoice Walker and the 2017 research by ITEP for the Legislature make the purpose that PFD cuts are regressive – the quantity diverted to authorities as a share of earnings will increase as earnings decreases.

However typically we don’t assume readers and policymakers admire simply how vastly regressive they are surely.

To assist drive that time residence this week we have now achieved an evaluation to find out what kind of extra typical earnings tax would produce a comparable regressive slope to PFD cuts. Taxes based mostly on the “first xx quantity” of earnings – just like the social safety payroll tax (which relies on the primary $147,000 of wage and wages) – are extra regressive than these extra broadly based mostly. The decrease the edge the extra regressive the tax.

Throughout the confines of the 2019 knowledge, it seems a tax that applies solely to the primary $25,000 of earnings, an extraordinarily low threshold, comes closest to replicating PFD cuts.

As a result of the tax would fall solely on the primary $25,000 of earnings, each millionaires and people with solely $25,000 in earnings would pay the identical tax. As a result of it taxes all the earnings of these with $25,000 in earnings or beneath whereas solely a declining share of these in brackets above them, it’s clearly a tax that impacts center and decrease earnings households the toughest.

Together with earnings obtained by residents, non-residents with Alaska sourced earnings and including again the roughly $900 million in PFD cuts made that 12 months (as a result of the evaluation raises the cash by substituting the tax as an alternative), Alaska had roughly $29 billion in Adjusted Gross Earnings in 2019. By limiting the tax to the primary $25,000, nonetheless, the tax would apply solely to $8.1 billion of that. Of that, roughly 7% could be earnings obtained by non-residents; the remaining 93% could be earnings obtained by Alaskan households.

Listed below are the efficient tax charges on Alaskan households at numerous earnings ranges of elevating $900 million in income in that method (in crimson), in comparison with utilizing PFD cuts (in darkish blue).

Whereas there are some variations, the regressive slope is near that ensuing from PFD cuts. In essence, an earnings tax on solely the primary $25,000 of earnings is a tough practical equal of PFD cuts.

Beneath that method, households with better than $1 million in earnings (750 Alaska households fall into that class) would pay $2,750 in taxes. On common, that’s 0.1% of their earnings. These with incomes between $50,000 – $75,000 would pay the identical quantity. On common, nonetheless, that’s 4.3% of their earnings. These with incomes of $25,000 would pay the very same tax of $2,750. On common, nonetheless, that’s 11% of their earnings. These falling beneath $25,000 would pay the identical 11% of no matter their earnings is.

As mentioned above, though nonetheless regressive, tax approaches that broaden the income base through the use of the next threshold are much less regressive than these with decrease thresholds.

To exhibit the change in influence from broadening the tax base, we have now checked out what the impact could be if as an alternative of the primary $25,000, a tax was imposed on the primary $100,000 of earnings (in gentle blue). Utilizing that threshold would broaden the bottom from $7.9 billion to $20.4 billion. As anticipated, the slope improves dramatically.

On common, households with better than $1 million in earnings would pay $4,200 in taxes, which on common is 0.2% of their earnings, as an alternative of 0.1%. These with incomes $100,000 and beneath all would pay the identical 4.2% of their earnings, decrease for many center and decrease earnings Alaska households than below the earlier (first $25K of earnings) and PFD reduce approaches.

It’s clear that broadening the bottom from taxing solely the primary $25,000 to the primary $100,000 definitely would make the influence throughout the total vary of Alaska households extra equitable.

However probably the most equitable method, by far, outcomes from broadening the bottom additional to incorporate the total $29 billion in Alaska earnings (inexperienced).

Elevating the identical $900 million on that base would end in a flat fee throughout the board of solely 3.1%. Taking a look at that on a percentile foundation, that’s decrease for greater than 75% of Alaska households than both PFD cuts or a tax on the primary $100,000 of earnings.

And whereas it’s a increased fee than both of these two options for the lower than 25% of Alaska households with greater than $100,000/12 months in adjusted gross earnings, it’s nonetheless decrease than the speed which might be charged the remaining 75+% of Alaska households below both PFD cuts or a tax solely on the primary $100,000.

In brief, it’s equitable throughout the board.

Generally once we do these analyses some will accuse us of advocating “wealth envy,” searching for increased charges on increased incomes than outcome from PFD cuts or different, related regressive approaches.

There’s no reality to that, in any respect. Our motivation comes from a completely totally different place.

As ISER famous in its 2016 research, extra regressive approaches not solely extra closely burden center and decrease earnings households, additionally they “have a bigger antagonistic impact on expenditures,” and thru that, the economic system. Our push for extra equitable funding approaches is solely to place ALL Alaska households on a extra degree enjoying area relating to paying for presidency, and to pursue a fiscal coverage which has a low antagonistic influence on the general economic system.

These actually involved in regards to the antagonistic influence of fiscal measures on Alaska households and the Alaska economic system ought to push for a lot much less regressive approaches than that at the moment getting used to fund Alaska authorities. The least impactful are these which remove regressivity completely.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a challenge targeted on creating and advocating for economically strong and sturdy state fiscal insurance policies. You possibly can comply with the work of the challenge on its web site, at @AK4SB on Twitter, on its Fb web page or by subscribing to its weekly podcast on Substack.