Technology

Android 101: how to use Google Pay

Google Pay is a digital pockets and on-line fee system that’s developed by Google to make it straightforward so that you can make purchases. It routinely syncs your saved bank cards wherever your Google account is logged in for fast funds, and it’ll import loyalty playing cards, tickets, and gives out of your Gmail account. Google Pay is supported at most main markets, gasoline stations, and shops.

Methods to arrange Google Pay

Organising Google Pay is easy.

You want a debit / bank card or PayPal account, a Google account, and a supported Google Pay system (an Android telephone, a Put on OS watch, or a desktop / laptop computer laptop). You possibly can even use it with an iOS system. On this article, we’ll think about tips on how to use Google Pay along with your Android telephone.

Likelihood is you’ll have already got the Google Pay app in your telephone. Should you don’t, obtain the app from the Play Retailer.

Including fee accounts to Google Pay

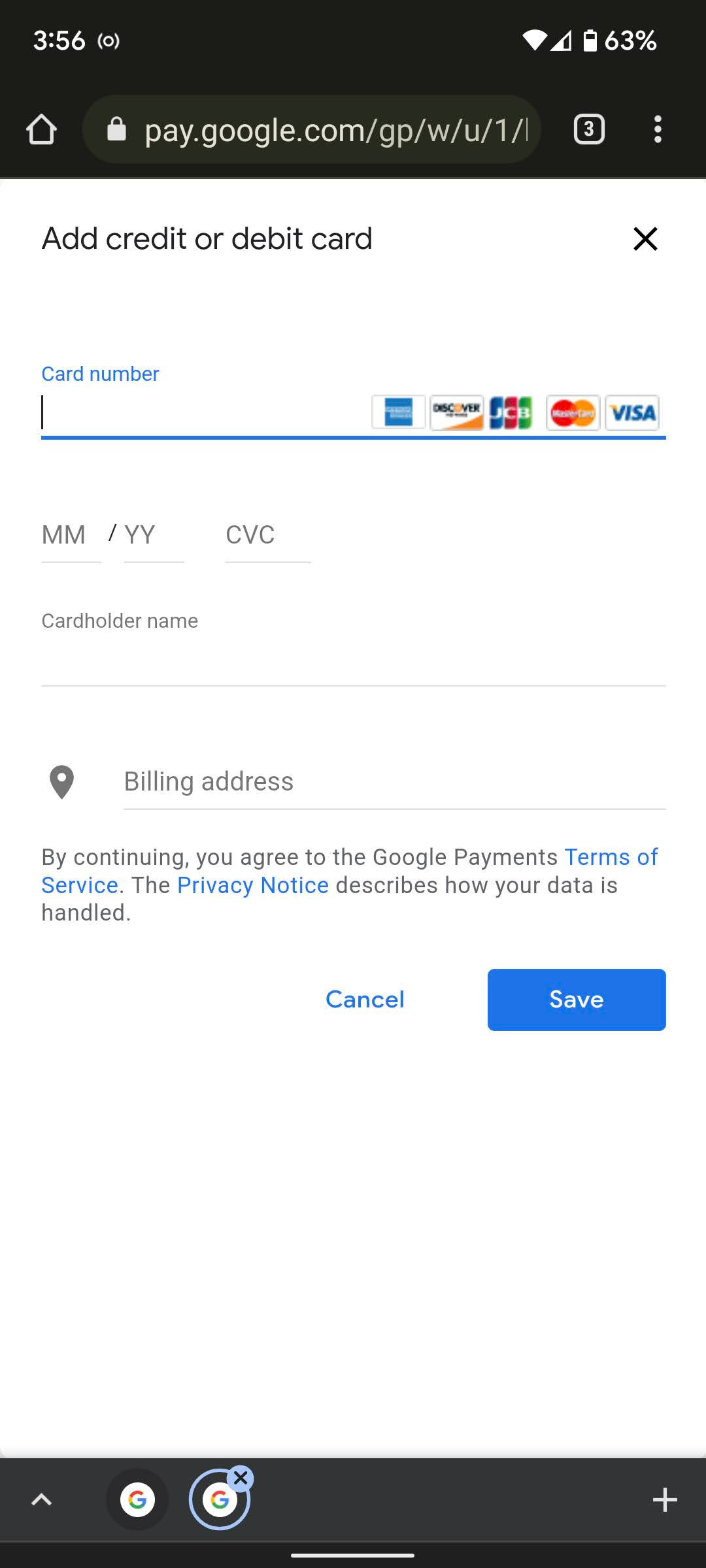

If you first open the Google Pay app, you could be requested to comply with the Google Pay phrases of service and the Google privateness coverage. As soon as that’s achieved, you’ll be taken by means of an preliminary sign-in course of that can assist you add a fee technique.

The Google Pay app

There are a selection of options you possibly can entry from the principle G Pay display. To start with, 4 buttons allow you to make contactless funds, ship or request funds, view gives from Google companions, or observe your spending.

On the very prime of the display, faucet the “Able to pay” button or the “Pay contactless” button decrease right down to go to a web page that lets you transmit fee information to a reader. (Remember that many Google Pay readers can settle for the digital fee with out you having to truly go into the app.) This identical web page reveals the bank cards and different monetary sources you’ve registered with G Pay.

You possibly can swipe throughout so as to add a brand new credit score or debit card, or PayPal account, to G Pay. Should you’ve already used a card or your PayPal account to pay for one thing on Google Play — an app, say, or a film — then your different playing cards could also be listed there already if you faucet on “Add a fee technique.” Nevertheless, you’ll have to allow them with a purpose to use them as sources for contactless fee.

On the backside of the principle display, there are three icons: a label that reveals you numerous sponsored offers, the principle house display icon, and a greenback signal that reveals you “spending insights” — in different phrases, how a lot you’ve spent. You can even hyperlink your financial institution and different accounts right here if you happen to select to.

Lastly, if you happen to swipe down on the house display, you’ll find companies that settle for G Pay and an inventory of individuals to whom you’ve despatched cash or who you may have requested cash from.

If you need, you too can handle your account on the internet by going to the Google Pay account web page.

The place can I take advantage of Google Pay?

In the actual world, you should use Google Pay nearly wherever you see a bank card terminal with the G Pay emblem. From there, all you’ll want to do is unlock your telephone and transfer it as much as the terminal’s contact level.

Is Google Pay safe?

In accordance with Google, it protects your information by sharing a short lived, encrypted quantity (relatively than your precise card quantity) with retailers. You will discover extra details about Google’s safety and privateness controls right here.

Should you lose your telephone, Google’s Discover My Gadget will be accessed from any laptop along with your Google account. From there, you possibly can lock, find, or remotely wipe your telephone and all of its contents.

You possibly can monitor the safety of your account by going into the settings of the Google Pay app. To take action, faucet in your private icon within the upper-right nook and choose Settings > Privateness & safety > Knowledge & personalization. That is the place you possibly can decide whether or not Google can ship your information to 3rd events, share information about your creditworthiness, or share information with different Google firms for advertising and marketing functions.

The Privateness & safety pane additionally allows you to decide the way you authorize purchases and whether or not you possibly can see different information comparable to payments from Gmail inside Google Pay.

Replace March eleventh, 2022, 1:10PM ET: This text was initially printed on Could sixteenth, 2018. It has been up to date to permit for modifications in Google Pay’s interface and options since that date.