North Carolina

Strong and severe storms are possible through tonight

A low pressure system will bring warmer air along with the chance of strong storms.

Temperatures continue to warm up thanks to a warm front moving to the north. However, the approaching cold front moving through tonight could trigger strong and even severe storms.

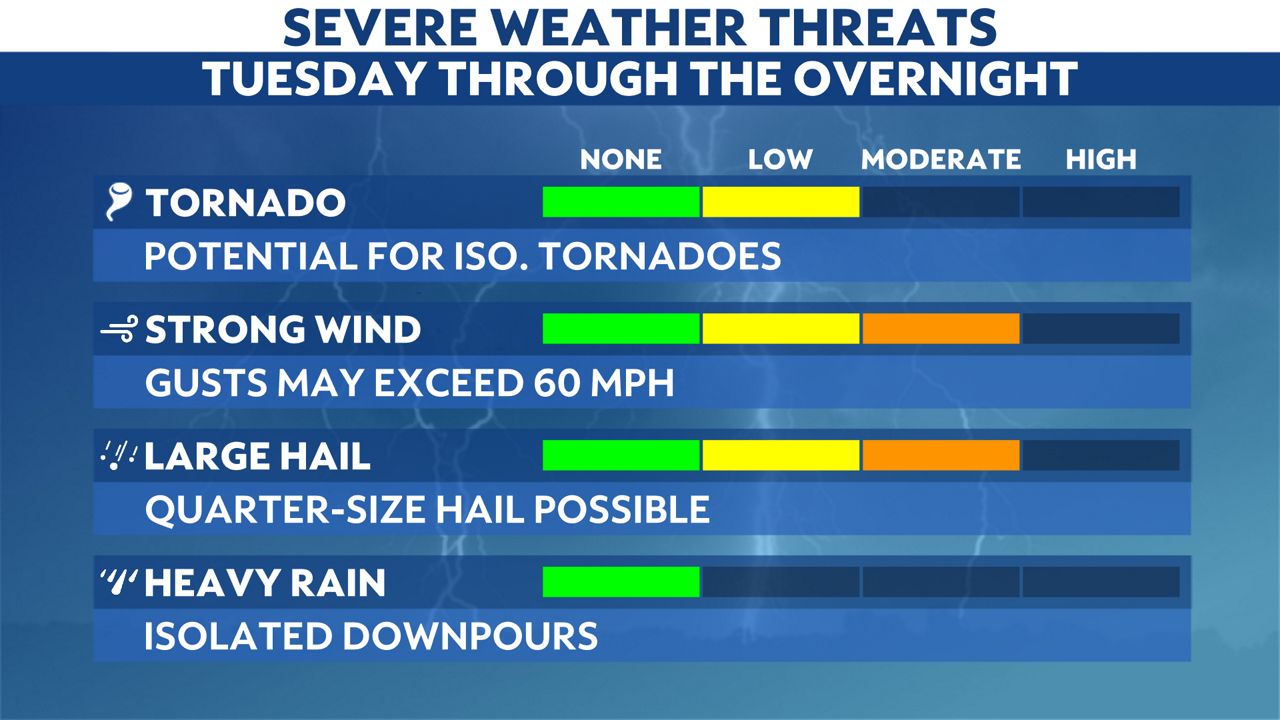

The enhanced risk (3/5) includes part of the mountains. Much of the state is under a slight risk (2/5). The primary threats with these storms include damaging winds, hail and a few tornadoes.

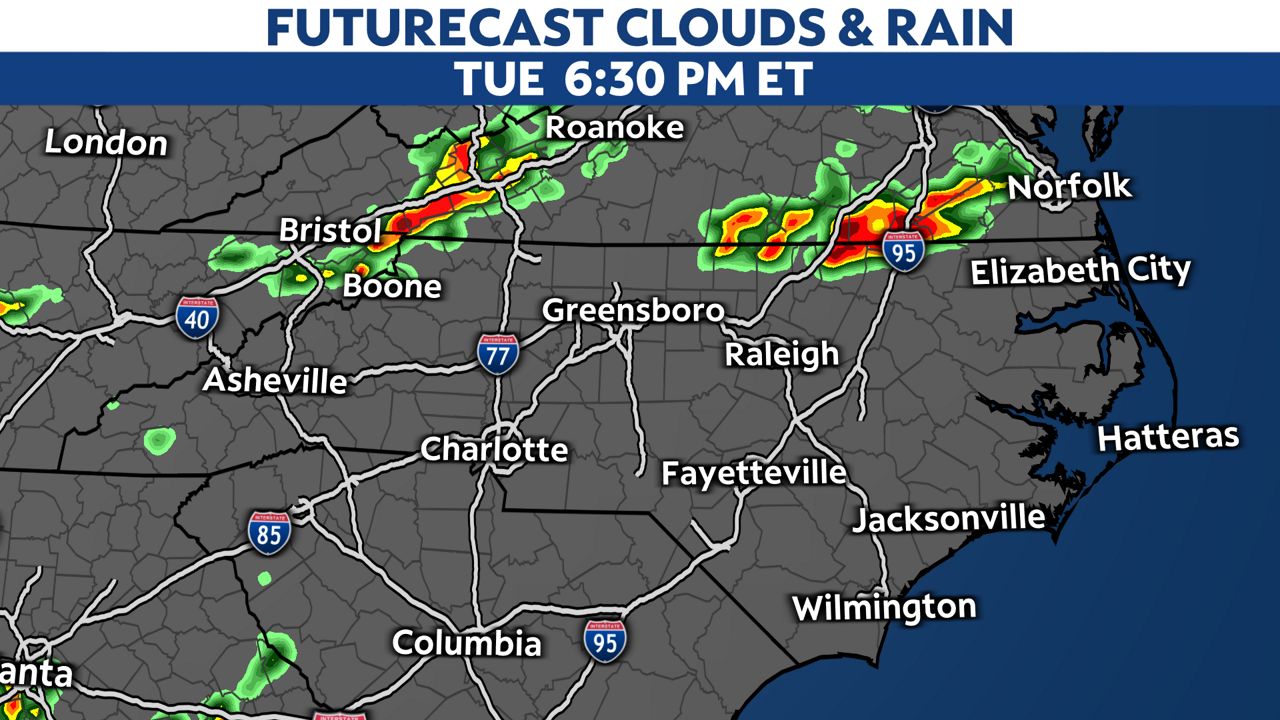

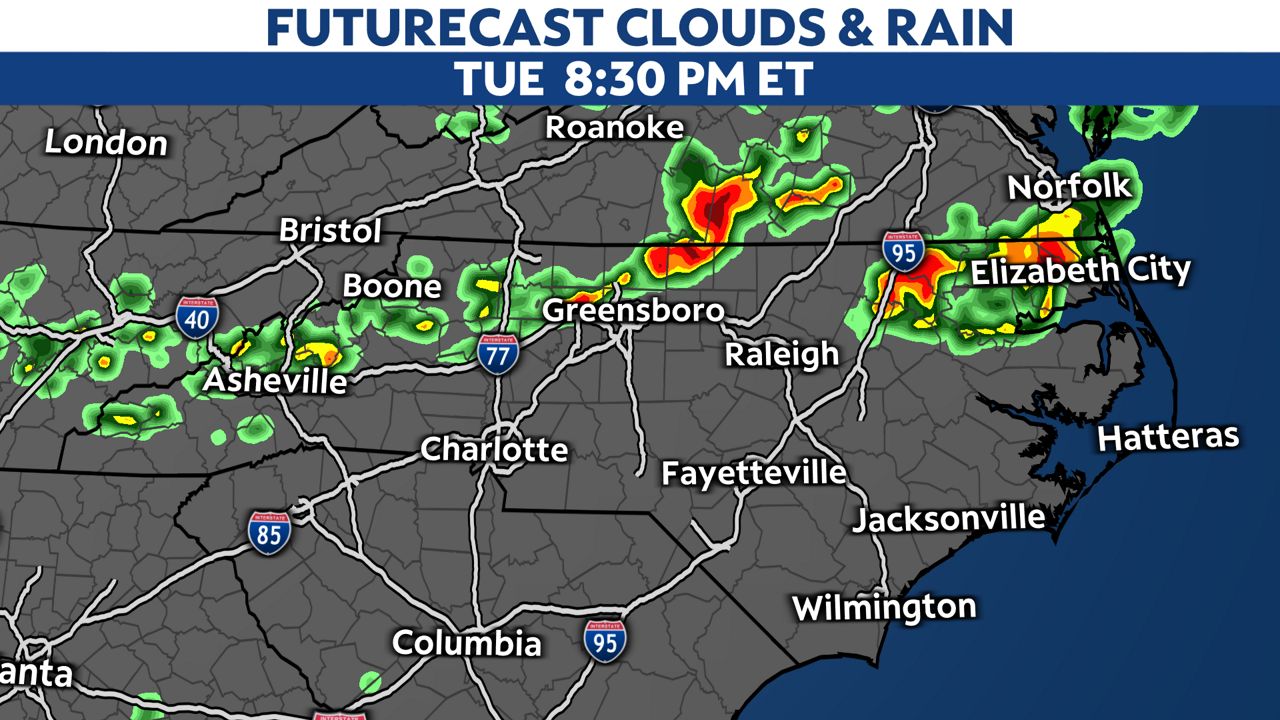

The storms will move in ahead of the cold front, from west to east. The mountains and foothills could see storms from the late afternoon and into the early evening.

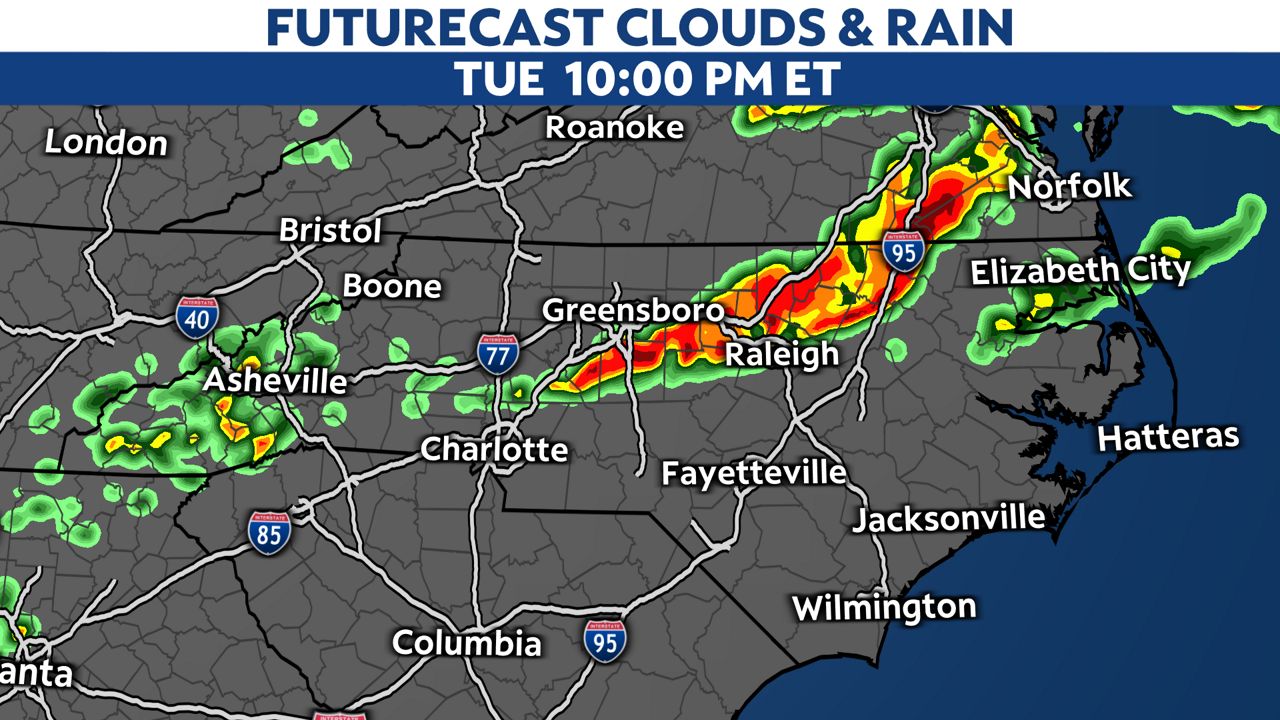

As storms move east, Charlotte, the Triad and the Triangle may deal with strong to severe storms and gusty winds this evening through tonight.

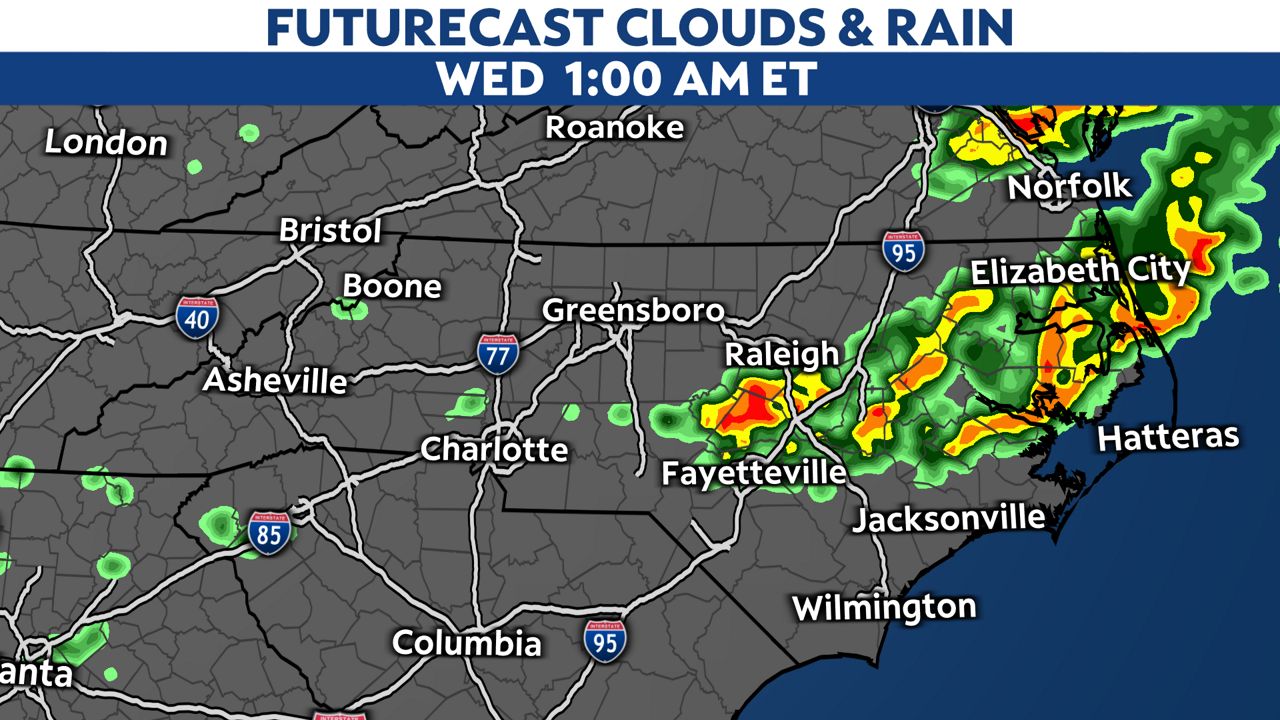

The risk for severe storms is lower toward the coastal plain, but a few strong thunderstorms are still possible through Wednesday morning.

Everyone in and near the severe weather risk area should have a way to receive weather alerts today and tonight in case they are issued.

If a Tornado Warning is issued, seek shelter in an interior room on the lowest floor of a sturdy building.

Basements, hallways, closets and windowless bathrooms often provide the best protection during a tornadic storm.

North Carolina

North Carolina Supreme Court Lets Stand Greg Lindberg’s Civil Fraud Liability

The North Carolina Supreme Court has decided that it will not, after all, review another legal filing by convicted insurance entrepreneur Greg Lindberg.

The Oct. 17 ruling lets stand a 2023 decision by the state Court of Appeals, which found that Lindberg and some of his affiliated companies were liable for fraud by misleading life insurance companies and a reinsurance firm that he once owned.

“We hold the trial court’s conclusions of law were supported by findings of fact based on competent evidence,” the appeals court judges wrote in the 2023 opinon.

The high court in December 2023 had agreed to review the appeal court’s order, at Lindberg’s behest. But after hearing oral arguments, the Supreme Court justices changed their minds, noting that “discretionary review was improvidently allowed by order on 13 December 2023.”

No further explanation was offered. But with multiple criminal and civil proceedings stemming from the bribery conviction of and the regulatory crackdown on Lindberg, the appeal court’s 24-page opinion offers a valuable recount of some of the main aspects of the voluminous litigation involving Lindberg since 2016.

“Simply put, Lindberg created a scheme in which he caused $1.2 billon held for Plaintiffs’ policyholders to be invested into other non-insurance companies that he also owned or controlled,” the appellate judges wrote in the opinion in Southland National Insurance Corp., et al, vs. Greg Lindberg, et al.

It all began in 2014 under previous North Carolina Insurance Commissioner Wayne Goodwin, the court explained. Lindberg sought to re-domesticate Southland, Bankers Life Insurance Co., Colorado Bankers Life Insurance Co., and Southland National Reinsurance Corp. to North Carolina. Lindberg struck a special agreement with Goodwin, allowing Lindberg to break what has often been considered a cardinal rule for insurance companies – keeping adequate reserves on hand and under the control of the insurance carrier.

Instead, Lindberg was allowed to invest up to 40% of the insurance companies’ assets into affiliated business entities, and Lindberg soon invested hundreds of millions into non-insurance firms he owned or controlled.

In 2016, Mike Causey defeated Goodwin in the election and took over as insurance commissioner. Causey moved swiftly to reduce the cap on affiliated investments – back to 10%, the court explained.

Lindberg in early 2018 attempted to bribe Causey with heavy campaign contributions, hoping for a relaxation of the rules as he struggled to “untangle his affiliated investments,” the appellate judges noted. Causey cooperated with federal authorities and wore a recording device during the meeting with Lindberg. Lindberg was convicted of bribery in 2020, had his conviction overturned due to improper jury instructions, then was convicted again in 2024. He’s still awaiting sentencing.

Meanwhile, in late 2018, while Lindberg’s prosecution was pending, it became obvious that Lindberg’s affiliated companies would not meet their obligations to restore funds to cover the life insurers’ policyholder liabilities. NCDOI placed Southland and the other insurance companies under administrative supervision. An out-of-state consultant was put in charge, and deadlines were set for repayment of the assets.

With it becoming clear that Lindberg’s affiliated firms would not meet the deadlines, Southland and the other insurance companies signed a memorandum of understanding and other agreements, restucturing the financial obligations, providing a $40 million line of credit to a company owned by Lindberg, and making the affiliated firms subsidiaries of a newly created holding company, the court explained.

In 2019, Lindberg’s affiliated firms failed to meet the restructuring agreements’ goals and failed to make the affiliated businesses part of the holding company. Southland filed suit, charging fraud.

The trial court in Wake County largely agreed, and the appeals court upheld the lower court’s ruling.

“Defendants attempt to convince this Court that the MOU’s main purpose was not only to rehabilitate Plaintiffs’ companies, but to ensure Lindberg would continue to benefit from the overall transaction,” the appellate judges wrote. “This argument ignores another of Defendants’ motivations: to make money using capital provided by hardworking, North Carolina policyholders.”

Lindberg’s team claimed that the memorandum of understanding was unenforceable. The appeals court didn’t buy that argument.

“Defendants and Lindberg have enjoyed the benefit of millions of dollars of debt relief provided by Plaintiffs, yet continue to claim the MOU is unenforceable,” the court wrote.

On other arguments the court was equally critical of Lindberg’s assertions.

“Put plainly, Defendants made representations about their ability to perform under the MOU, then just two weeks before performance was due, cited those exact representations as the reason why they could not perform,” Judge April Wood wrote in the opinion.

And because Lindberg understood the intricacies of the affiliated businesses’ structures, he knew that performance under the MOU was impossible, “yet made representations that induced Plaintiffs to enter into the contract. For those reasons, we hold the trial court did not err in finding Defendants’ actions satisfied the elements of fraud.”

The appeals court remanded part of the case to the lower court to determine remedies available to Southland and the other plaintiff insurance companies.

In November 2024, Lindberg pleaded guilty to $2 billion in fraud in a related prosecution. In July of this year, a federal judge approved a plan to distribute $318 million from the sale of a Lindberg-owned software firm to the life insurance policyholders. In early October, the judge allowed the release of policyholder information so that a special master in the case could finally begin distributing funds to the victims of the fraud.

Read more about Lindberg’s bribery conviction here, and other court rulings here.

Topics

Fraud

North Carolina

Liability

North Carolina

State senator accused of drunk driving in North Carolina capital city

RALEIGH, N.C. (WBTV) – A North Carolina state senator was arrested and charged with DWI and other crimes in Raleigh over the weekend, court records revealed.

Wake County records showed 74-year-old Sen. Norman Sanderson was arrested on Saturday, Oct. 18, in the area of Edwards Mill and Trinity roads, which is about half a mile from NC State’s Carter-Finley Stadium.

Records showed Sanderson blew a 0.16 BAC on a breathalyzer test, which is exactly twice the legal limit to drive.

Upon his arrest, Sanderson was charged with DWI, having an open container after drinking and failure to obey a traffic officer.

He was released from the Wake County jail late Saturday night after he posted a $2,000 bond.

Sanderson is currently in his seventh term in the North Carolina Senate, and previously served one term in the state House.

A Republican, Sanderson represents Carteret, Chowan, Halifax, Hyde, Martin, Pamlico, Warren and Washington counties — all of which are in the northeastern corner of the state.

Also Read: State representative charged with child sex crimes in North Carolina

Watch continuous news coverage here:

Copyright 2025 WBTV. All rights reserved.

North Carolina

Rain and wind Sunday in North Carolina| Secure objects outdoors and Halloween decorations tonight

-

World13 hours ago

World13 hours agoIsrael continues deadly Gaza truce breaches as US seeks to strengthen deal

-

Alaska7 days ago

Alaska7 days agoMore than 1,400 seeking shelter as hundreds wait to be evacuated after catastrophic Western Alaska storm, officials say

-

News14 hours ago

News14 hours agoTrump news at a glance: president can send national guard to Portland, for now

-

Business12 hours ago

Business12 hours agoUnionized baristas want Olympics to drop Starbucks as its ‘official coffee partner’

-

North Carolina1 week ago

North Carolina1 week agoGuide to NC State Fair 2025: Tickets, transportation, parking, new rides and special event days

-

Politics11 hours ago

Politics11 hours agoTrump admin on pace to shatter deportation record by end of first year: ‘Just the beginning’

-

Science13 hours ago

Peanut allergies in children drop following advice to feed the allergen to babies, study finds

-

World1 week ago

World1 week agoAlbanian judge killed in courtroom shooting amid growing anger over justice system reforms