Northeast

NYC subway rider attacked with hammer, suspect at large

NEWNow you can take heed to Fox Information articles!

A New York Metropolis subway rider was overwhelmed with a hammer at a Manhattan station on Tuesday evening, authorities stated.

The assault occurred round 9:30 p.m. on the platform of the 14th Avenue and seventh Avenue subway station, FOX5 New York reported, citing police.

NYC CAREER CRIMINAL SLASHES MAN AFTER HE WAS FREED FOR A PRIOR ATTACK

When the male sufferer by chance ran into one other man on the platform, the person pulled out a hammer and struck the sufferer within the head, police stated.

File – A New York Metropolis subway rider was overwhelmed with a hammer at a Manhattan station on Tuesday evening, authorities stated.

(Metropolitan Transportation Authority)

The sufferer was rushed to Bellevue Hospital for medical remedy. An replace on his situation was not instantly accessible.

The suspect fled the scene and stays on the free as of Wednesday morning. Police described him as sporting a purple jacket, purple sneakers and blue denims.

New York Metropolis has seen a surge in transit crime this yr, with 428 incidents reported year-to-date – an 81.4% enhance in comparison with the identical interval final yr, NYPD information reveals.

On Sunday, a violent profession prison allegedly slashed a subway rider within the face at about 8:30 a.m. close to the Decrease East Facet station in Manhattan.

The suspect, 40-year-old Brendan Dowling, had been launched with out bail for the same assault on a lady in Brooklyn in Dec. 2020.

Learn the total article from Here

New Hampshire

Seacoast Woman Arrested On 4th DUI Charge: Concord Police Log

CONCORD, NH — Lauren Abigail Dennett, born 2002, of Franklin, MA, was arrested at 7:55 p.m. on June 22 on simple assault, domestic violence-simple assault, obstruct report of a crime-injury and domestic violence-obstruct report of a crime-injury charges. She was arrested after an incident or investigation at Grappone Park on Liberty Street.

Jill E. Severance, born 1983, of Concord was arrested at 6 a.m. on June 18 on a bench warrant after an incident or investigation at the Holiday Inn at 172 N. Main St.

Bradley C. Reid, 29, of Concord was arrested at 9:41 p.m. on June 14 on a resisting arrest or detention charge after an incident or investigation on Fisherville Road. He has an active felony acts prohibited charge after being arrested in November 2023, after an investigation or incident at the abandoned Santander Bank on North State Street.

Anne-Marie Ruggles, 51, of Concord was arrested at 7:24 a.m. on June 1 on a warrant after an incident or investigation at the Mobil Kwik Stop at 81 S. Main St. Back in January 2021, she pleaded guilty to a felony subsequent drug possession charge out of Belmont and received a two-to-four-year sentence, suspended for three years with three years probation, as well as a $620 fine. A month later, the sentence was amended — the sentence was completely suspended and she was given credit for 55 days time served. A year later, she was accused of violation of probation and pleaded guilty to the charge in January 2023. She received a 12-month suspended sentence, a year probation, with 57 days of time served credit. Ruggles was accused of violating her probation again and a warrant was issued for her arrest on May 31. She was held on $1,000 cash bail. A probation violation hearing is scheduled for Aug. 15.

Garrett Rogenski, born 1994, of Concord was arrested at 3:45 p.m. on May 25 on two simple assault charges and a possession of alcoholic beverages-public property violation after an incident or investigationon Triangle Park Drive.

William Leroy Vinal, 55, of Concord received a summons at 6:30 p.m. on May 24 on a criminal mischief charge after an incident or investigation on North State Street.

Jonathan Ruharuka, 22, of Concord was arrested at 6:28 p.m. on May 23 on two simple assault and two criminal mischief charges after an incident or investigation at Regency Hill Estates at 12 East Side Drive. Back in September 2022, Ruharuka pleaded guilty to criminal mischief, driving under the influence, conduct after an accident, and driving after revocation or suspension, escaping felony burglary and receiving stolen property charges as part of the plea deal. He received several suspended sentences, $1,240 in fines, and was given credit for 245 days of time served. Since that plea, he has been arrested at least nine times in Concord. In May 2023, documents from a prior criminal case as well as his immigration paperwork were requested. A month later, he was accused of violating probation. After motions to continue and canceled hearings, Ruharuka has a plea and sentencing hearing slated for Aug. 28 on the violation of probation charge.

Maddison Faith Corey, born 2005, of Epsom was arrested at 3:49 p.m. on May 20 on simple assault, domestic violence-simple assault, criminal trespass, and criminal mischief charges. She was arrested after an investigation or incident on Highland Street.

Jennifer De Lellis Voege, 62, of Barrington was arrested at 4:15 p.m. on April 23 on a driving under the influence-fourth offense charge and an open container violation. She was arrested after an incident or investigation on Allison Street. Voege was arraigned on June 11 and is due back in superior court on July 30 for a dispositional conference hearing.

Do you have a news tip? Please email it to tony.schinella@patch.com. View videos on Tony Schinella’s YouTube.com channel or Rumble.com channel. Follow the NH politics Twitter account @NHPatchPolitics for all our campaign coverage.

New Jersey

New Jersey moves to ban gas powered leaf blowers – Competitive Enterprise Institute

In the latest example of the environmentalist cause going too far, the New Jersey State Senate has voted to move forward with a bill that would ban gas-powered leaf blowers within the next four years.

The original version of the bill states that the use of gas-powered leaf blowers – staple products relied upon by contractors and consumers alike for affordable and accessible lawncare – emit high levels of pollutants. This, the bill alleges, may contribute to acid rain and smog formation. It also claims that noise pollution from the machines is capable of causing hearing loss and that they blow dust and particles during their use.

Proposed by Senator Bob Smith of Middlesex and Sommerset, New Jersey Senate Bill 217 would prohibit the sale of two stroke engine leaf blowers – by far the most common and affordable type of leaf blower – within two years of the bill’s passage and prohibit use of these leaf blowers within four years. In addition, the bill would ban the use and operation of four stroke engines in residential areas. For non-residential areas, their use would be limited to just four months of the year.

Although these limits are watered down from the blanket ban initially proposed, they represent a clear attack upon consumer freedom and place a new burden on both businesses and the general public.

New Jersey’s proposed ban follows in the footsteps of other states and localities that have attempted to limit consumer choice. California banned the sale of all gas-powered leaf blowers as of January 1st, 2024, while many cities throughout the nation, including the District of Columbia, have passed local ordinances to prevent their use.

Following a warning for the first offense, the bill would impose a fine of $1,000 for infractions regarding the commercial use of these leaf blowers, and a $25 fine for anyone else using the banned blowers.

Rich Goldstein, president of the New Jersey Landscape Contractors Association, explained the problems for companies to comply with the new law saying, “New Jersey is bombarded with leaves and stuff to clean up. We’re not California, we’re not Florida. We have leaves. The average house in New Jersey, you take away 30 to 50 cubic feet of leaves each fall. That’s a lot of leaves.”

For Goldstein’s company, the new bill would represent the need to replace up to $200,000 worth of gas leaf blowers. He added that it’s more than just the cost of replacement, “It’s retrofitting your truck to be able to charge batteries throughout the day. And by doing that, you’d have to keep your diesel engine running, and that causes another issue. This is just a terrible idea.”

Although electric leaf blowers may be a good choice for some individuals, this should be a personal choice. For example, electric blowers are generally less powerful, and to achieve greater performance, gas-powered models are typically necessary. Additionally, they are largely limited to less than two hours of battery capacity, which makes them unsuitable for those living in wooded areas. These electric leaf blowers also generally come with a warranty of just 80 days, in stark contrast to the standard five-year warranty on gas-powered blowers.

New Jersey’s proposed ban limits the options of consumers and contractors. Once again, government is dictating the choices in the market, and in doing so, preventing individuals and businesses from buying and using leaf blowers that would best meet their needs.

Pennsylvania

New tax breaks, grants and assistance: Pa. task force makes recommendations on flood insurance

Monday’s report recommends Pennsylvania put in place stronger disclosure requirements so homebuyers know whether they’ll need flood insurance before buying a property, consider flood resilience when crafting its building code and create new state tax deductions for flood insurance payments and tax credits for home renovations that lower flood risk.

“We want to encourage people to do what they need to do to make their homes more resilient,” Santarsiero said.

The report also recommends the creation of a new state office that would help municipalities enroll in a FEMA program known as the Community Rating System, which rewards municipalities for flood mitigation and communication efforts with flood insurance discounts for residents.

Across the country, more than 1,500 municipalities earn discounts for their residents through the program. Only two dozen municipalities in Pennsylvania participate.

The task force heard a “common frustration with the complexity, length of time, and extensive resources necessary” to enroll in the program, according to the report.

It also recommends the state offer more grants to municipalities to help them fund floodplain management activities that would allow them to join the Community Rating System, maintain participation or earn deeper discounts for residents.

State Rep. Dave Zimmerman, a Republican representing parts of Lancaster and Berks counties who sat on the task force, said he’d like to see municipalities have the resources to elevate or even buy out flood-prone properties.

“If we’re going to have this ongoing flooding, and insurance fixing it, and then flooding again — at some point if we don’t raise up these properties a little bit, maybe they need to be just taken away,” he said.

Most flood insurance in the U.S. is provided by FEMA’s National Flood Insurance Program, but Pennsylvania’s private market has been expanding, with the number of private flood insurance policies in the state growing more than ten-fold between 2016 and 2023, according to the task force report.

State Senator Lisa Baker, a Republican whose district includes part of Luzerne County — the county in Pennsylvania with the most federal flood insurance policies, according to FEMA data — sat on the taskforce. She noted in a press release Monday that in some states, homeowners insurance companies have pulled out or restricted coverage.

“The frequency of high damage events and the rising costs of recovery efforts are roiling insurance markets,” she said. “This is a crucial juncture for us to consider some fundamental changes before our situation deteriorates into crisis.”

Several of the recommendations would require the General Assembly pass new legislation. Sen. Santarsiero said he hopes to leverage the participation of both Republicans and Democrats on the task force to garner bipartisan support for any such bills.

“We’ve agreed that we want to work together,” Rep. Zimmerman said.

State Rep. Perry Warren, whose district includes Upper Makefield where flash flooding killed seven people last summer, said in a statement he looks forward to supporting legislation that would implement the group’s recommendations.

-

News1 week ago

News1 week agoA Florida family is suing NASA after a piece of space debris crashed through their home

-

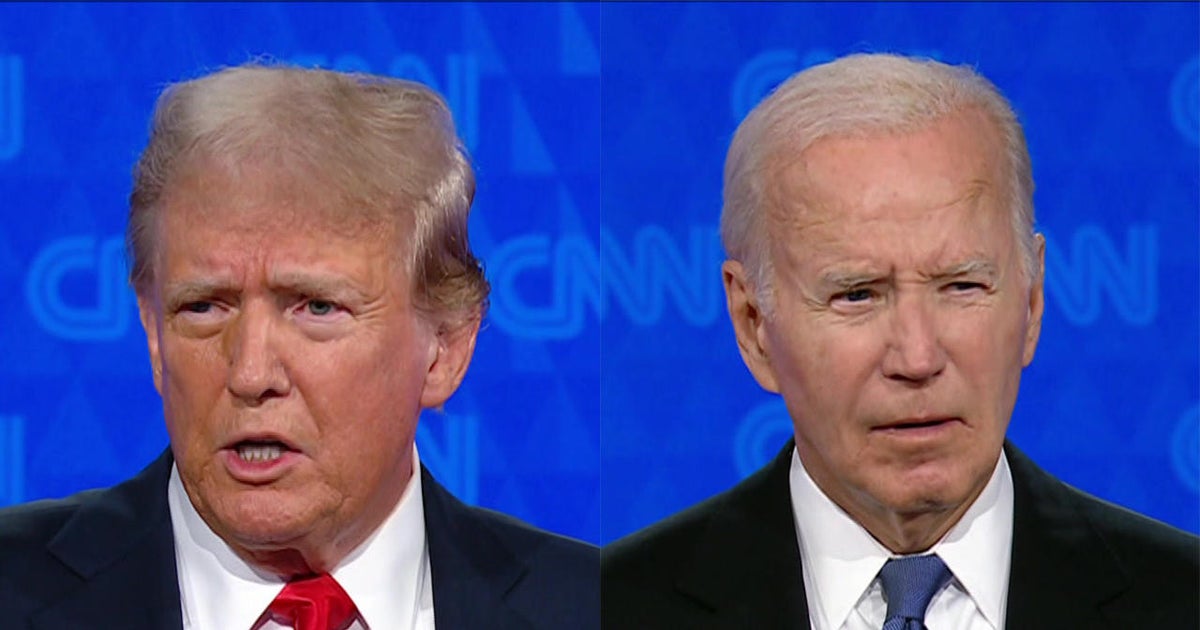

Politics1 week ago

Politics1 week agoBiden official says past social media posts don’t reflect ‘current views,’ vows to support admin ‘agenda’

-

World1 week ago

World1 week agoIsrael accepts bilateral meeting with EU, but with conditions

-

World1 week ago

World1 week agoNetanyahu says war will continue even if ceasefire deal agreed with Hamas

-

News1 week ago

News1 week agoWoman accused of trying to drown Muslim child in Texas in possible hate crime

-

World1 week ago

World1 week agoOver 10,000 Poles participate in Pride parade in Warsaw

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: “Casablanca” – A Timeless Masterpiece –

-

Politics1 week ago

Politics1 week agoSupreme Court to review Tennessee ban of puberty blockers, transgender surgery for minors