Boston, MA

Boston Omaha Stock: Financials Flag Warning Signs (NYSE:BOC)

AlizadaStudios/iStock Editorial via Getty Images

Boston Omaha (NYSE:BOC) second quarter filing reveals a widening financial loss over 6 month period belies company optimism over commercial real estate and aviation holdings. Since company has recently entered and expanded these investments, I would certainly not dismiss this stock entirely, but instead wish to urge caution until positive definitive financial results emerge. An investment here is one of pure speculation.

This holding company invests in significantly different business entities which makes analysis particularly challenging. Billboard revenues increased 11% to $21 million over the first half of 2023 but cost to achieve increased 6%. Broadband business was up 42% but costs associated with this revenue growth, surged 62%. Net loss from operations widened to $4.6 million from $3.1 million during the same timeframe in 2022. A model of making increasingly costly investments to gain smaller percentage growth is not attractive to me.

BOC continues to dilute shareholders as it issued an additional 1.6 million shares of stock bringing total to 30.3 million outstanding versus 28.7 million at the beginning of 2023. This represents a significant 6% “charge” to shareholder value. Furthermore General and Administrative (G & A) charges surged to $8 million vs. $6 million a whopping 25% increase. This theme of ever higher costs is a major red flag for investors.

The Sky Harbour (SKYH) investment is also trending in the wrong direction at this early stage. BOC owns 13,118,474 shares (22.95% stake) of this aviation hangar developer for private aircraft. The carrying value equals $7.78 per share, which reveals their purchase price at $102 million. SKYH trades at only $4.47 per share today which translates to $62.6 million equity value-a 39% decline. Furthermore the company warns they may be forced to absorb an impairment charge should this investment continue to trade below its cost.

If Sky Harbour’s stock price drops below our carrying value of $7.78 per share for a sustained period of time, it will likely result in an impairment of our investment. There may also be a future impairment of our investment if our expectations of Sky Harbour’s prospective results of operations and cash flows decline which could be influenced by a variety of factors including adverse market conditions.

SKYH is an early stage aviation company with extremely high capital expenditures of approximately $40 million per hangar. After listening to its recent conference call, it will be several years of expenditures before this business can realize significant profitability and furthermore this model is new and untested.

Boston Omaha recently finalized full control in 24th Street Asset Management which holds various commercial real estate investments. If one is looking for a positive, the company reported $3.5 million net income from operations within this large “asset management” segment. On the down side, there was a $1 million loss in “other income” inside this table, with a note referencing a decline in “mark to market” fair value adjustments of commercial real estate within these assets.

The final red flag is that Boston Omaha reported a material weakness of internal control over financial reporting as of June 30, 2023 in sec filing. Investors can read the specific language within the filing above. This material weakness could lead to misstatement in recorded investment in unconsolidated entities as well as the income within these entities.

If BOC cannot accurately report the “value” of their holdings and the income from these complex commercial real estate investments, I would recommend investors sell this stock at this time. I note the company believes that there is long term intrinsic value in their holdings. I would look to see confirmation in future financial results.

Boston, MA

Constantine Manos, photographer for landmark ‘Where’s Boston?’ exhibit, dies at 90 – The Boston Globe

Among Mr. Manos’s books were “A Greek Portfolio” (1972; updated 1999), “Bostonians” (1975), “American Color” 1995) and ”American Color 2″ (2010). Mr. Manos’s work with color was notably expressive and influential.

“Color was a four-letter word in art photography,” the photographer Lou Jones, who worked with Mr. Manos on “Where’s Boston?,” said in a telephone interview. “But he was making wonderful, complex photographs with color, and that meant so much.”

Yet for all his formal skill, Mr. Manos always emphasized the human element in his work. “I am a people photographer and have always been interested in people,” he once said.

That interest extended beyond the photographs he took. He was a celebrated teacher. Among the students he taught in his photo workshops was Stella Johnson.

“He’d go through a hundred of my photographs,” she said in a telephone interview, “and maybe he’d like two. ‘No, no, no, no, yes, no.’ Costa really taught me how to see. I remember him looking at one picture and saying, “You were standing in the wrong spot.’ Something like that was invaluable to me as a young photographer.

“He was a very, very kind man, very generous. But he was very strict. ‘How could you do that?’ He was adored by his students and by his friends, absolutely. We were all lucky to have been in his orbit.”

Mr. Manos, who moved to Provincetown in 2008, lived in the South End for four decades. The South Carolina native’s association with the Boston area began when the Boston Symphony Orchestra hired him as a photographer at Tanglewood. He was 19. This led to Mr. Manos’s first book, “Portrait of a Symphony” (1961; updated 2000).

Constantine Manos was born in Columbia, S.C., on Oct. 12, 1934. His parents, Dimitri and Aphrodite (Vaporiotou) Manos, were Greek immigrants. They ran a café in the city’s Black section. That experience gave Mr. Manos a sympathy for marginalized people that would stay with him throughout his life. As a student at the University of South Carolina, he wrote editorials in the school paper opposing segregation. Later, he would do extensive work chronicling the LGBTQ+ community with his camera.

Mr. Manos became interested in photography at 13, joining the school camera club and building a darkroom in his parents’ basement. After graduating from college, Mr. Manos did two years of Army service in Germany, working as a photographer for Stars and Stripes. He joined Magnum in 1963. This had special meaning for him. Mr. Manos’s chief inspiration as a young photographer had been Henri Cartier-Bresson, one of Magnum’s founders. He was such an admirer he made a point of using the same equipment that Cartier-Bresson did.

That same year, Mr. Manos entered a seafood restaurant in Rome that was around the corner from the Pantheon. Prodanou, his future husband, was dining with friends. Noticing Mr. Manos, he gestured to him. “Would you join us for coffee?” The couple spent the next 61 years together, marrying in 2011.

Mr. Manos lived in Greece for three years, which led to “A Greek Portfolio.” He undertook a very different project in the Athens of America. Part of the city’s Bicentennial tribute, “Where’s Boston?” was a slice-of-many-lives view of contemporary Boston.

Located in a red-white-and-blue striped pavilion at the Prudential Center, it became a local sensation. The installation involved 42 computerized projectors and 3,097 color slides (most of them taken by Mr. Manos), shown on eight 10 feet by 10 feet screens. Outside the pavilion was a set of murals, consisting of 152 black-and-white photographs of Boston scenes, all shot by Mr. Manos.

“The most important thing I had to do was to keep my picture ideas simple,” he said in a 1975 Globe interview. “Viewers are treated to a veritable avalanche of color slides in exactly one hour’s time.”

In that same interview, he made an observation about his work generally. “I prefer to stay in close to my subjects. I let them see me and my camera and when they become bored they forget about me and then I get my best pictures.”

Among institutions that own Mr. Manos’s photographs are the Museum of Fine Arts; the Museum of Modern Art, New York; the Art Institute of Chicago; the High Museum of Art, Atlanta; the Library of Congress; and the Bibliothèque Nationale, Paris.

In addition to his husband, Mr. Manos leaves a sister, Irene Constantinides, of Atlanta, and a brother, Theofanis Manos, of Greenville, S.C.

A memorial service will be held later this year.

Mark Feeney can be reached at mark.feeney@globe.com.

Boston, MA

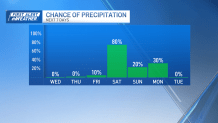

Below freezing temperatures again today

The winds are still going Wednesday, but the air temperatures remain at respectable levels. Highs will manage to weasel up to 30 in most spots. It’s too bad we’re not going to feel them at face value. Instead, we’re dressing for temps in the teens all day today.

Thursday and Friday are the picks of the week.

There will be a lot less wind, reasonable winter temperatures in the 30s and a decent amount of sun. We’ll be quiet into the weekend, as our next weather system approaches.

With mild air expected to come north on southerly winds, highs will bounce back to the low and mid-40s both days of the weekend.

Showers will be delayed until late day/evening on Saturday and into the night. There may be a few early on Sunday too, but the focus on that day will be to bring in the cold.

Highs will briefly sneak into the 40s, then fall late day.

We’ll also watch a batch of snow late Sunday night as it moves up the Eastern Seaboard.

Right now, there is a potential for some accumulation as it moves overhead Sunday night and early Monday morning.

It appears to be a weak, speedy system, so we’re not expecting it to pull any punches.

Enjoy the quieter spell of weather!

Boston, MA

Boston City Councilor will introduce

BOSTON – It could cost you more to get a soda soon. The Boston City Council is proposing a tax on sugary drinks, saying the money on unhealthy beverages can be put to good use.

A benefit for public health?

“I’ve heard from a lot of residents in my district who are supportive of a tax on sugary beverages, but they want to make sure that these funds are used for public health,” said City Councilor Sharon Durkan, who is introducing the “Sugar Tax,” modeled on Philadelphia and Seattle. She said it’s a great way to introduce and fund health initiatives and slowly improve public health.

A study from Boston University found that cities that implemented a tax on sugary drinks saw a 33% decrease in sales.

“What it does is it creates an environment where we are discouraging the use of something that we know, over time, causes cancer, causes diet-related diseases, causes obesity and other diet-related illnesses,” she said.

Soda drinkers say no to “Sugar Tax”

Soda drinkers don’t see the benefit.

Delaney Doidge stopped by the store to get a mid-day pick-me-up on Tuesday.

“I wasn’t planning on getting anything, but we needed toilet paper, and I wanted a Diet Coke, so I got a Diet Coke,” she said, adding that a tax on sugary drinks is an overreach, forcing her to ask: What’s next?

“Then we’d have to tax everything else that brings people enjoyment,” Doidge said. “If somebody wants a sweet treat, they deserve it, no tax.”

Store owners said they’re worried about how an additional tax would impact their businesses.

Durkan plans to bring the tax idea before the City Council on Wednesday to start the conversation about what rates would look like.

Massachusetts considered a similar tax in 2017.

-

Health1 week ago

Health1 week agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology6 days ago

Technology6 days agoMeta is highlighting a splintering global approach to online speech

-

Science4 days ago

Science4 days agoMetro will offer free rides in L.A. through Sunday due to fires

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png) Technology1 week ago

Technology1 week agoLas Vegas police release ChatGPT logs from the suspect in the Cybertruck explosion

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘How to Make Millions Before Grandma Dies’ Review: Thai Oscar Entry Is a Disarmingly Sentimental Tear-Jerker

-

Health1 week ago

Health1 week agoMichael J. Fox honored with Presidential Medal of Freedom for Parkinson’s research efforts

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: Millennials try to buy-in or opt-out of the “American Meltdown”

-

News1 week ago

News1 week agoPhotos: Pacific Palisades Wildfire Engulfs Homes in an L.A. Neighborhood