Insurers are bracing themselves for large losses from the Atlantic hurricane season as record-breaking Hurricane Beryl fuels fears that warming oceans will lead to more destructive storms.

Beryl, which is expected to hit Jamaica on Wednesday, became the first Atlantic hurricane this early in the year to develop into a category five storm, the most severe.

Its magnitude and arrival so early in the region’s hurricane season, which starts in June, peaks in August and September and runs until November, has already hit shares of some insurers and reinsurers.

“It’s being felt that we are overdue for a bad season,” Stephen Catlin, executive chair at insurer Convex and a veteran of the insurance market, told the Financial Times. “Having an early hurricane of this magnitude suggests that might be the case.”

A variety of factors contribute to the intensity of hurricanes, but climate scientists have highlighted the effects of warming oceans and rising sea levels. The head of the UN’s climate arm said climate change was “pushing disasters to record-breaking new levels of destruction”.

Meteorologists at AccuWeather said the storm could bring “significant flooding, coastal inundation, and wind damage” to Jamaica, after it caused widespread damage in Grenada and St Vincent and the Grenadines, and left several people dead.

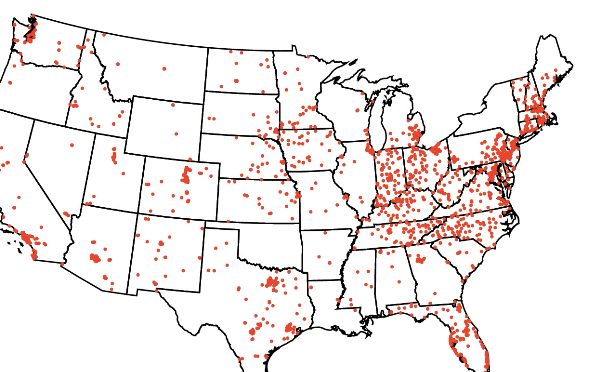

The insurance industry was already expecting a busier hurricane season after a quieter 2023. In May, the US National Oceanic and Atmospheric Administration warned that there was an 85 per cent higher chance of an above-average Atlantic hurricane season, citing several factors including warmer oceans.

Steve Bowen, chief science officer at reinsurance broker Gallagher Re, said it was a “remarkable, concerning, and ominous start” to the Atlantic hurricane season and should be a “massive wake-up call” on the outlook for losses.

Bowen said we were seeing the results of ocean waters that were “as warm in June as they typically should be in September”, which for storms provide “proverbial rocket fuel”.

While any financial losses from Beryl’s impact on Jamaica are expected to be manageable, industry executives said the storm’s future path remained unclear. It has since been downgraded to a category 4 storm.

“It could continue west into Mexico, or curve into the Gulf and then on to the US,” noted analysts at Twelve Capital. Hurricane Harvey in 2017, one of the costliest US storms, struck the Caribbean before heading into the Gulf of Mexico and making landfall at Texas.

It is too early for reliable estimates of insurance claims, but attention is focused on the Caribbean public-backed risk pools and catastrophe bonds, a form of reinsurance where risks are shared with investors.

Last month, the World Bank renewed its $150mn catastrophe bond covering Jamaica against big named storms, which if triggered would mean some losses for investors.

How the Atlantic hurricane season unfolds will be critical to the path of prices in the global property reinsurance market, which property insurers use to lay off their risks. Prices have surged in recent years.

Robert Muir-Wood, chief research officer for insurance at rating agency Moody’s, said there was now “every indication this is an intense hurricane season likely to break more records”.