Finance

Sturgis talks finance for possible adventure park

/cloudfront-us-east-1.images.arcpublishing.com/gray/HZUNQWCD3ZHTXE4X4BPH46NBCQ.jpg)

RAPID CITY, S.D. (KEVN) – The Sturgis Planning Committee recommends approving a Tax Increment Financing District (TIF) to assist finance the event of the brand new Sturgis Journey Park, which has been within the works for two years.

On Monday, the Sturgis Metropolis Council thought-about the proposal on whether or not to maneuver ahead with the TIF or to rethink the plan.

Town supervisor says the plan has taken some time to type out as a result of the planning committee’s objective from the start was to be sure that taxes wouldn’t be raised within the space. He added that the personal growth adjoining to the park would assist pay for the undertaking.

”That’s why the committee then appeared for a unique possibility and that possibility can be tax increment financing. The place the brand new personal growth that may happen adjoining it will create new tax income that may be used to repay the bonds the mortgage that may really fund the development of the park,” mentioned Sturgis Metropolis Supervisor Daniel Ainslie.

Ainslie added that this might alleviate among the housing points Sturgis has seen, particularly with the inflow of individuals to the Black Hills.

In line with statistics supplied by the Metropolis of Sturgis, the housing emptiness charge is lower than 1%, which Ainslie says will not be unhealthy however is inflicting points in relation to households transferring into the realm.

“So, it’s actually necessary that we proceed to extend the variety of obtainable heaps. In order that we will proceed rising our availability of housing and likewise the choice of housing,” mentioned Ainslie.

Copyright 2022 KEVN. All rights reserved.

Finance

Finance Trailblazer Donna Gambrell Receives 2025 Ned Gramlich Lifetime Achievement Award for Responsible Finance

Opportunity Finance Network gives its highest honor to Gambrell for her career-long commitment to expanding economic opportunity in rural, urban, and Native communities through community development finance

WASHINGTON, Oct. 23, 2025 /PRNewswire/ — Last night, Opportunity Finance Network (OFN), the nation’s leading network and intermediary focused on community development investment, presented Donna Gambrell with the 2025 Ned Gramlich Lifetime Achievement Award for Responsible Finance during The Opportunity Honors: Award Ceremony and Reception. The Gramlich Award is the community development finance industry’s highest individual honor recognizing people of distinction and their impact on the community development financial institution (CDFI) industry.

Donna Gambrell receives the 2025 Ned Gramlich Lifetime Achievement Award for Responsible Finance during The Opportunity Honors in Washington, D.C.

As Director of the U.S. Department of the Treasury’s CDFI Fund (2007–2013), Gambrell helped double funding through the flagship Financial Assistance Awards program and launched cornerstone initiatives—including the Capital Magnet Fund, Healthy Food Financing Initiative, and the CDFI Bond Guarantee Program—that expanded the reach of CDFIs nationwide. Following federal service, she joined OFN’s Board of Directors in 2017 and served as Chair from 2020–2024, guiding the network through the COVID-19 response and sector stabilization.

“Donna Gambrell has dedicated her career to expanding economic opportunity for communities long excluded from traditional finance,” said Harold Pettigrew, President and CEO of OFN. “As a trailblazer and fierce advocate, Donna has grown and expanded the organizations she led, helping community development finance to reach more people and underinvested communities. Donna is a titan of the community development finance industry, and the impact of her work can be felt in almost every community across our nation.”

Today, as President & CEO of Appalachian Community Capital (ACC), Gambrell leads a membership network with more than 40 members managing $4 billion in assets and supporting 20,000 regional businesses. Under her leadership, ACC has advanced initiatives such as Opportunity Appalachia—helping 80+ communities raise over $160 million for priority projects—and launched the Green Bank for Rural America to catalyze climate-smart investment in rural markets.

“Local communities know what they need to best support themselves, and CDFIs put the power back in their hands,” said Gambrell. “That’s what first drew me to community development finance; watching communities thrive and people build generational wealth because of CDFIs is what continues to inspire me many years later. It is an honor to receive the Gramlich Award, and I am grateful to my peers for this recognition of my career.”

Gambrell was also the first African American woman to lead the CDFI Fund—an important accomplishment that underscores a career defined by durable institutional achievements and industry-wide impact.

“Not only is Donna Gambrell a tireless champion for equitable community and business development, but she is a mentor and role model to so many in the industry,” said Darrin Williams, CEO of Southern Bancorp, Inc. “Donna brings people together to help advance community development finance and bolster connections to support communities across all areas of the country. I am proud to call her a colleague, friend, and inspiration.”

About the Ned Gramlich Lifetime Achievement Award for Responsible Finance

Established in 2007, the Ned Gramlich Lifetime Achievement Award for Responsible Finance is the community development finance industry’s highest individual honor. It is awarded annually at OFN’s Annual Conference to individuals whose careers exemplify leadership, integrity, and a deep commitment to expanding economic opportunity.

The spirit of the award is to celebrate people of distinction who have produced a body of work that sets them apart within the CDFI industry. These individuals have shaped the field through innovation, institution-building, and a relentless focus on impact—leaving a legacy that continues to influence the sector and the communities it serves.

The award is named for Ned Gramlich, a staunch, longtime advocate for responsible finance. As the former Board of Governors’ primary liaison to the Federal Reserve’s Consumer Advisory Council, Gramlich advised on community development and consumer finance policy matters. He was an outspoken voice against predatory lending and a strong defender of the Community Reinvestment Act. He served on the OFN Board of Directors from October 2006 until his death in 2007.

About Opportunity Finance Network

Opportunity Finance Network (OFN) is the nation’s leading network and intermediary focused on community development investment, managing more than $1 billion in total assets and a membership of more than 490 community development financial institutions (CDFIs), which includes community development loan funds, credit unions, green banks, banks, minority depository institutions, and venture capital funds. Our network of CDFIs works to ensure communities left behind by mainstream finance have access to affordable, responsible financial products and services, with a deep focus on serving rural, urban, and Native communities across the United States. OFN is a trusted investment partner to the public, private, and philanthropic sectors – foundations, corporations, banks, government agencies, and others – and, for more than 40 years, has helped partners invest in communities to catalyze change and create economic opportunities for all.

Since its founding in 1986, OFN members have originated $124 billion in cumulative financing, helping to create or maintain nearly 3.4 million jobs, start or expand more than 1 million businesses and microenterprises, and support the development or rehabilitation of more than 3 million housing units and more than 15,000 community facility projects.

SOURCE Opportunity Finance Network

Finance

State treasurers push CFPB on third-party financial data access rule

Rep. Byron Donalds, R-Fla., on his bill to eliminate the Consumer Financial Protection Bureau, Elon Musks directive to federal workers over documenting work, Congress budget reconciliation process and his political future.

A dozen state financial officers are writing to the Consumer Financial Protection Bureau (CFPB) to uphold consumers’ right to share financial data with authorized third parties as the agency weighs a rule that could restrict their ability to do so, according to a letter exclusively reviewed by FOX Business.

The CFPB is considering revising a regulation under section 1033 of the Dodd-Frank Act, which would revise the definition of a “representative” who makes a request on behalf of the consumer, as well as how to assess fees to cover costs incurred by a covered person responding to a customer request.

Twelve state financial officers — including nine treasurers, two auditors and one controller — wrote in favor of the rule recognizing consumer-authorized third parties as “representatives” while preserving existing authorization and conduct requirements.

They wrote that Section 1033 gives consumers a right to access their financial information upon request and that the rule includes agents, trustees or representatives acting on their behalf, including those who aren’t fiduciaries, upon the consumer’s authorization, which is the “touchstone” of the process that needs to be preserved.

KEY GOP LAWMAKERS BACK TRUMP’S EXECUTIVE ORDER FOR CRYPTO, OTHER ALTERNATIVE ASSETS IN 401(K) PLANS

A dozen state financial officers are arguing for the CFPB to preserve the ability of consumers to authorize non-fiduciary representatives to access their data. (Anna Moneymaker/Getty Images)

“Preserving this interpretation promotes competition and innovation (including for real-time payments, budgeting tools, alternative credit assessment, AI, and crypto) and it reduces the risks of debanking and market concentration,” the financial officers wrote.

“In contrast, narrowing ‘representative’ would harm consumers by reducing choice and entrenching incumbents — outcomes counter to Section 1033’s competitive purpose,” they explained.

The group of state financial officers wrote that the CFPB should affirm the text of the rule by clarifying that a consumer-authorized third-party qualifies as a representative acting on their behalf.

SEC CHAIR WANTS PRIVATE MARKET INVESTMENTS AVAILABLE FOR AMERICANS’ 401(K) PLANS

The CFPB’s proposed rule is revising regulations under the Dodd-Frank Act. (Samuel Corum/Bloomberg via Getty Images)

They also wrote the definition of “representative” shouldn’t be limited to fiduciary relationships as it’s not required by the text and would “unduly restrict consumer choice.”

“Consumers should be able to exercise their Section 1033 rights directly or through an authorized representative of their choosing. A text-faithful interpretation of ‘representative’ sustains competition and innovation and reduces risks of debanking and market concentration,” the state financial officers explained.

State financial officers who signed onto the letter include Kansas Treasurer Steven Johnson, Kentucky Treasurer Mark Metcalf, Mississippi Treasurer David McRae, Nebraska Auditor Mike Foley, Nebraska Treasurer Tom Briese, Nevada Controller Andy Matthews, North Dakota Treasurer Thomas Beadle, Ohio Treasurer Robert Sprague, South Carolina Treasurer Curtis Loftis, Utah Auditor Tina Cannon, Utah Treasurer Marlo Oaks and Wyoming Treasurer Curt Meier.

ANTI-WOKE GROUPS IN US AND FRANCE JOIN FORCES TO COMBAT DEBANKING AND CORPORATE IDEOLOGICAL POLICIES

The state financial officers want to ensure consumers can authorize a third party to look at their financial data. (Yuki Iwamura/AFP via Getty Images)

The public comment period for the CFPB’s rule closed on Tuesday night and the rule attracted nearly 14,000 comments.

Sen. Cynthia Lummis, R-Wyo., sent a letter to the CFPB in support of open banking policies as the agency considers the rule, while consumer groups have also weighed in.

“Major financial institutions are attempting to consolidate their power and maintain monopolistic control over consumer data,” Will Hild, executive director of Consumers’ Research, said in a statement.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“If these major banks are allowed to continue to control access to consumer data, they will have even greater leverage to punish Americans for their beliefs and to coerce compliance with their radical left-wing ideology.”

Finance

Equipment finance leaders urge collaboration as uncertainty persists

Facing excess inventory, elevated equipment prices and tightening credit, leaders in the equipment finance industry say collaboration among dealers, lenders and OEMs is key to finding stability amid economic uncertainty.

As dealer and finance operations expand nationwide, lenders must collaborate with trusted dealers to inspect and deliver quality equipment that meets customer needs, Jody Ray, vice president and relationship manager at BMO Bank North America, said during Equipment Finance News’ webinar today.

“That collaboration piece is crucial and critical,” he said. “In my world, we trust our dealers and we depend on them, almost solely, to be the eyes and ears, sometimes, of the lending team and the asset management team.”

Watch the webinar here

Dealers are the critical link between lenders and customers, providing visibility into real-world equipment conditions that influence credit and valuation decisions that would otherwise need third-party assistance for equipment monitoring, John Gougeon, president and chief executive of UniFi Equipment Finance, said during EFN’s High-priced used equipment inventory: The no-man’s land of equipment finance webinar.

“Nothing beats having eyes on the equipment,” he said. “We have some internal hurdles that may be deal size, cost of equipment or age of equipment that require us to seek third-party support or an inspection.”

Lenders, in turn, are rethinking financing structures, using flexible floorplans and tailored repayment schedules to protect dealer liquidity and accelerate inventory turnover.

“At the same time, we also have to look at the retail side of that when they sell the piece of equipment, and we’re looking at the customer of the dealership’s ability to purchase the piece of equipment,” he said. “As the lender, we’ll need to make sure that we’re on top of every piece of the transaction, so that we can make that a smooth and seamless transaction for our customer, the dealer and their customer purchasing the equipment.”

Excess inventory collaborations

Collaboration can also enable dealers, lenders and OEMs to address excess inventory, especially with strategic programs, Kevin Pate, director of fleet and heavy-duty equipment at Shoppa’s Material Handling, said during the webinar. More than 70% of ag equipment dealers and nearly 30% of truck dealers reported excess late-model inventory in the second quarter, according to IronAdvisor Insights.

The collaboration “would be something in the vein of a shared remarketing program, whether it’s a joint site where dealers that work with that vendor are able to load their assets, maybe not just what’s with that company,” he said. “You’d be looking for OEM-supported programs, similar to a certified pre-owned program, where they come with finance options, extended warranty options and things like that.”

Check out our exclusive industry data here.

-

World3 days ago

World3 days agoIsrael continues deadly Gaza truce breaches as US seeks to strengthen deal

-

Technology3 days ago

Technology3 days agoAI girlfriend apps leak millions of private chats

-

News3 days ago

News3 days agoTrump news at a glance: president can send national guard to Portland, for now

-

Business3 days ago

Business3 days agoUnionized baristas want Olympics to drop Starbucks as its ‘official coffee partner’

-

Politics3 days ago

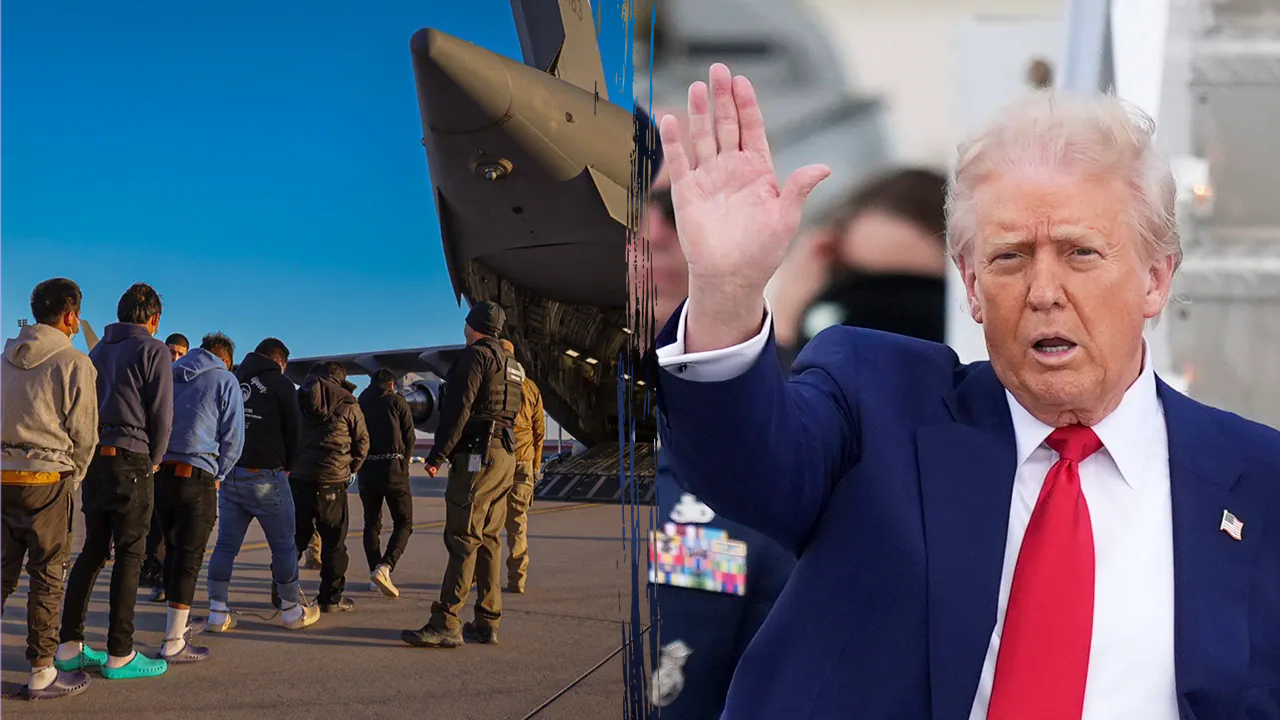

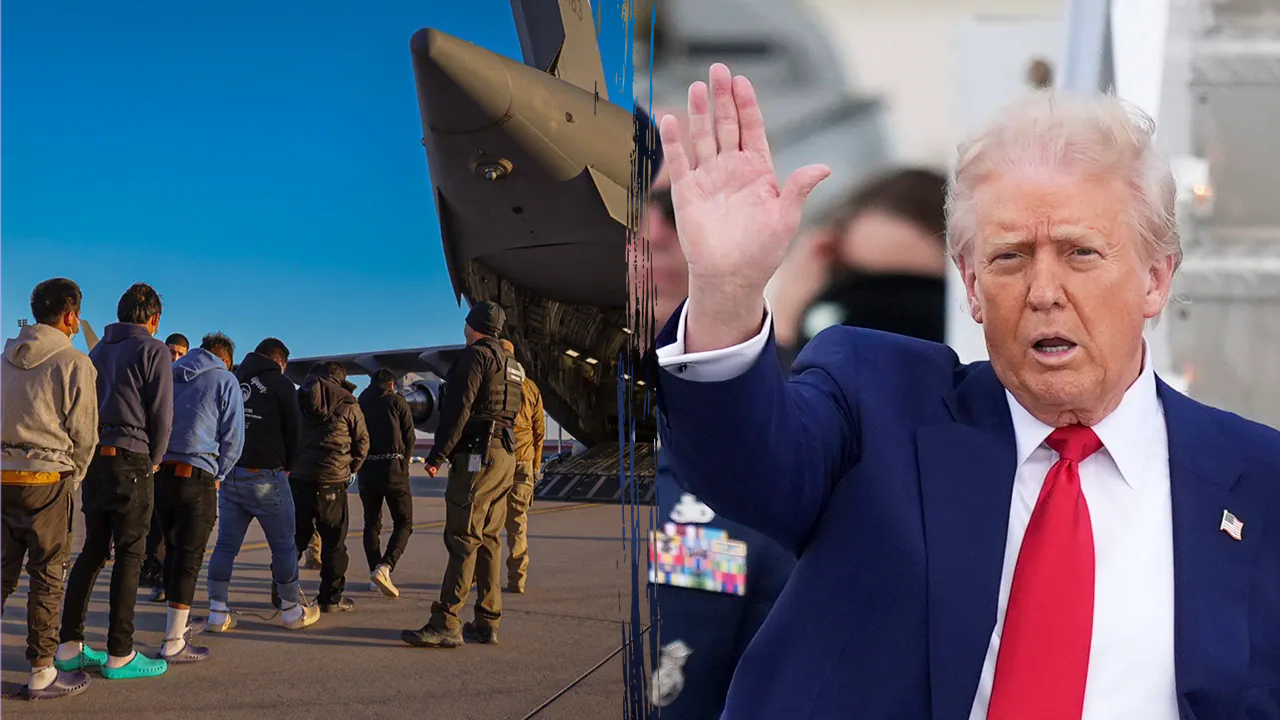

Politics3 days agoTrump admin on pace to shatter deportation record by end of first year: ‘Just the beginning’

-

News2 days ago

News2 days agoVideo: Federal Agents Detain Man During New York City Raid

-

Science3 days ago

Peanut allergies in children drop following advice to feed the allergen to babies, study finds

-

News2 days ago

News2 days agoBooks about race and gender to be returned to school libraries on some military bases