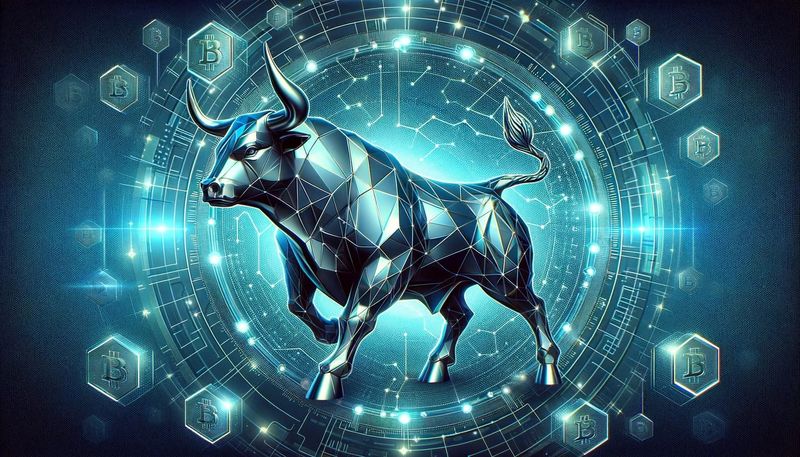

RobotBulls, a pioneering force in the cryptocurrency market, has unveiled its latest advancements in leveraging artificial intelligence (AI) and blockchain technology to streamline the trading process.

France – May 17, 2024 —

RobotBulls, a pioneering force in the cryptocurrency market, has unveiled its latest advancements in leveraging artificial intelligence (AI) and blockchain technology to streamline the trading process. This dual-technology approach not only simplifies trading operations but also enhances security and accuracy, providing traders from various backgrounds with an accessible and efficient trading platform.

AI and Blockchain: A Synergistic Approach for Streamlined Trading

At the heart of RobotBulls’ innovation is the integration of AI and blockchain technology. The platform utilizes advanced AI algorithms to analyze market data accurately and swiftly, offering users actionable insights to guide their trading decisions. Complementing this, blockchain technology ensures all transactions are securely recorded and immutable, reinforcing trust and transparency in all operations.

Key Features of RobotBulls: Elevating Trading Experience

RobotBulls’ platform is designed with several core features aimed at enhancing user experience:

- Streamlined Trading: Automated trading tasks allow users to execute strategies efficiently without the need for constant monitoring.

- Real-Time Analytics: The platform provides current market trend data, helping users make informed decisions and anticipate movements.

- Robust Security Measures: Leveraging blockchain, RobotBulls ensures all transactions are transparent and secure, significantly reducing the risk of tampering.

Benefits of Using RobotBulls: Efficient and Secure Trading Traders on RobotBulls enjoy multiple advantages:

- Time Efficiency: The automation of routine trading activities frees up time, allowing traders to focus on strategy development.

- Increased Precision: AI-driven analysis minimizes errors in data interpretation and trade execution.

- Enhanced Risk Control: Tools for managing trading risks, including customizable stop-loss settings, are readily available on the platform.

Continuous Innovation and Future Prospects

Committed to continuous enhancement, RobotBulls consistently upgrades its AI algorithms and explores more efficient blockchain technologies. These advancements aim to further expedite transactions and improve analytical capabilities, providing users with deeper insights and more robust trading options.

Supporting Traders with Educational Resources and Community Engagement

RobotBulls supports its users with an array of educational resources designed to aid both novice and experienced traders in navigating the platform effectively.

Additionally, the company fosters a strong community, enabling users to exchange strategies and insights, further enhancing their trading success.

Experience the Future of Trading with RobotBulls

For traders seeking to harness the potential of digital currencies through a secure, efficient platform, RobotBulls offers a powerful solution. To explore how RobotBulls can transform your trading experience, visit robotbulls.com.

Contact Info:

Name: Lin

Email: Send Email

Organization: Robot Bulls

Phone: +41795354362

Website: https://www.robotbulls.com/

Release ID: 89130078

Should any problems, inaccuracies, or doubts arise from the content contained within this press release, we kindly request that you inform us immediately by contacting error@releasecontact.com (it is important to note that this email is the authorized channel for such matters, sending multiple emails to multiple addresses does not necessarily help expedite your request). Our dedicated team will promptly address your concerns within 8 hours, taking necessary steps to rectify identified issues or assist with the removal process. Providing accurate and dependable information is at the core of our commitment to our readers.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25454513/New_Shepard_launch.jpg)