Tags on this story

Assault, Backlog, Bitcoin, Bitcoin Miners, Blockchain, Cryptocurrency, DDoS, Monetary Know-how, lightning community, Mempool, Community Congestion, Transaction Charges, Unconfirmed Transactions

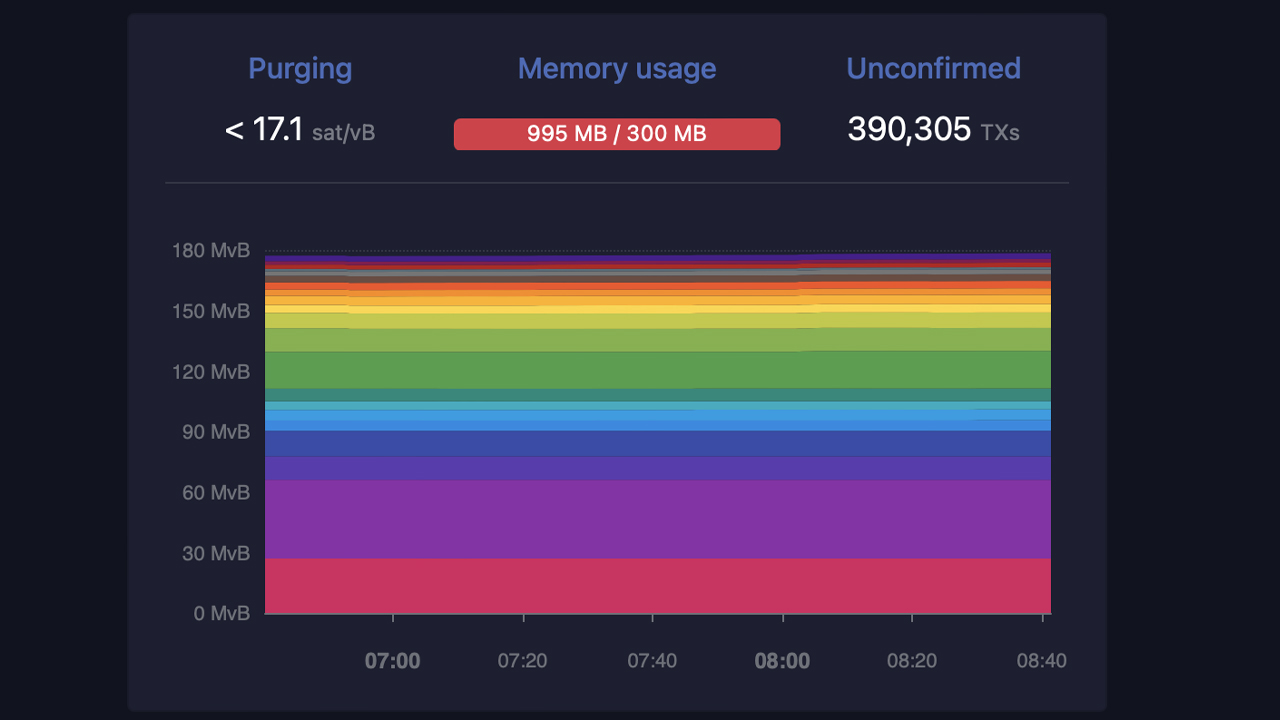

In slightly below two weeks, the variety of unconfirmed transactions on the Bitcoin community has skyrocketed from 134,000 to over 390,000, inflicting a bottleneck within the mempool. This surge in unconfirmed transactions has resulted in a staggering 343% enhance in transaction charges, which have risen from $1.99 per transaction on April 26 to a present price of $8.82 per transaction as of Could 7. Bitcoin miners are struggling to maintain up with the demand, leaving many customers pissed off and unable to finish their transactions in a well timed method.

As of Sunday, Could 7, 2023, the Bitcoin community is experiencing a serious site visitors jam attributable to an awesome variety of unconfirmed transactions. The most recent statistics reveal {that a} whopping 390,000 transfers are at the moment caught in limbo, ready for affirmation.

This backlog could be attributed to the surge in minting and transferring of Ordinal inscriptions and BRC20 tokens, which have flooded the community. In truth, the Bitcoin blockchain is now internet hosting over 13,000 BRC20 tokens and a staggering 4.17 million Ordinal inscriptions, additional exacerbating the congestion.

To clear the present backlog, a whopping 179 blocks would must be mined. Given the common block time of 10 minutes, it might take roughly 1.24 days to mine the required variety of blocks. This backlog has brought about transaction charges to skyrocket by a whopping 343% over the previous 11 days. As per bitinfocharts.com information, the common transaction charge at the moment stands at 0.00031 BTC or $8.82 per switch.

Bitinfocharts.com additional reveals the median-sized Bitcoin transaction charge at the moment stands at 0.00018 BTC or $5.16 per switch. Nevertheless, the scenario is way from splendid, as per mempool.area. The web site reveals {that a} low-priority charge will set you again $7.74, whereas a medium-priority charge prices $7.90.

For individuals who want their transactions processed urgently, a high-priority charge of $7.99 per switch. Including to the frustration is the truth that the present block time is longer than the ten-minute common, with the final block taking a whopping ten minutes and 55 seconds to be found.

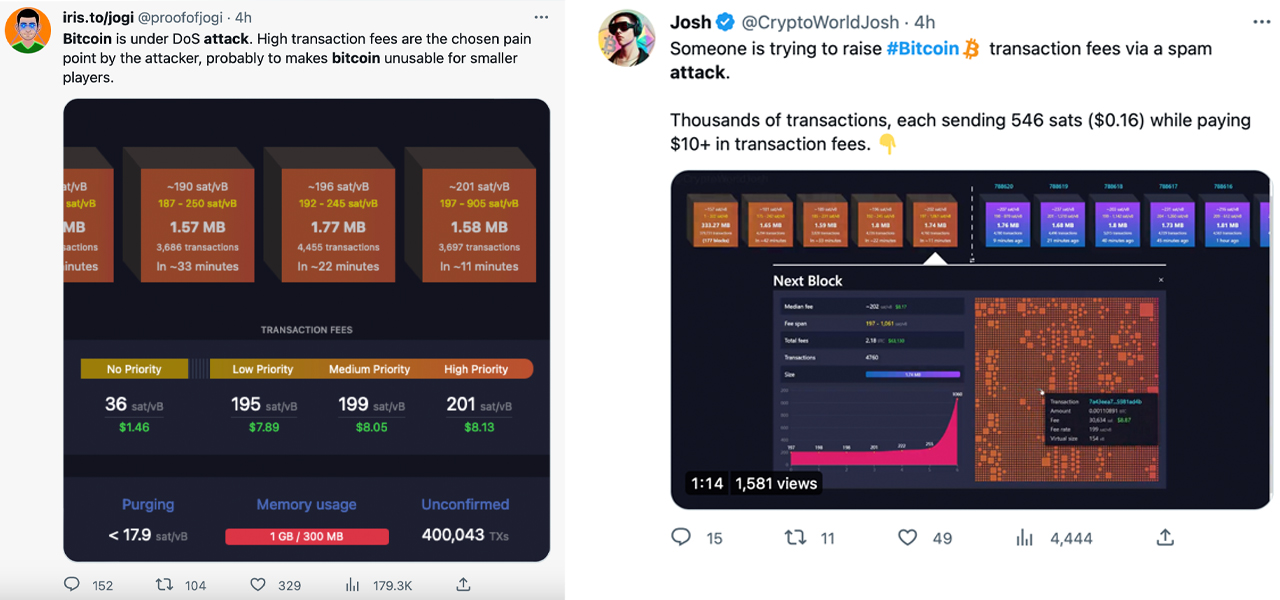

The clogged mempool has been a hot topic on social media recently, with customers expressing a variety of opinions on the matter. Whereas some are excited in regards to the surge in exercise, others have labeled the rise of non-financial transactions as a DDoS or an assault.

Bitcoin isn’t below assault.

The anemic block dimension will increase merely weren’t enough to satisfy demand, and Lightning did not see mass adoption.

Give up whining. Both settle for that an enormous mempool and excessive charges would be the norm, or correctly enhance the block dimension.

— Sam Patt (@SamuelPatt) May 7, 2023

Regardless of the optimism of some, the rise in unconfirmed transactions has not led to a major enhance in Lightning Community adoption. It’s because it’s nonetheless expensive to open and shut a channel, and non-custodial options are few and far between.

At exactly 11:07 a.m. (ET), the biggest crypto change on the earth, as measured by commerce quantity, has quickly halted bitcoin (BTC) withdrawals. The change has attributed this resolution to a “congestion situation” that the Bitcoin community is at the moment grappling with.

“Our workforce is at the moment engaged on a repair till the community is stabilized and can reopen BTC withdrawals as quickly as potential. Relaxation assured, funds are SAFU,” Binance wrote on Sunday morning.

What are your ideas on the present state of the Bitcoin community? Do you suppose the surge in unconfirmed transactions and costs is a short lived setback or an indication of deeper points? Share your opinions within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought about or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

Crypto lender Genesis Global received a significant victory in bankruptcy court on Friday, securing approval for its liquidation plan that will return approximately $3 billion in cash and cryptocurrency to its customers. The ruling, however, delivers a blow to Genesis’s owner, Digital Currency Group (DCG), which will receive no recovery from the bankruptcy.

U.S. Bankruptcy Judge Sean Lane overruled DCG’s objection to the plan, which centred on the valuation of crypto assets. DCG argued that customer claims should be capped at the value of cryptocurrencies in January 2023, when Genesis filed for bankruptcy. Crypto prices have surged since then, with Bitcoin, for example, rising from $21,084 in January 2023 to its current price of around $67,000.

Judge Lane rejected DCG’s argument, stating that even with the lower valuation, Genesis would have to prioritise paying other creditors, including federal and state financial regulators with claims totalling $32 billion, before distributing funds to its equity owner.

“There are nowhere near enough assets to provide any recovery to DCG in these cases,” Judge Lane wrote in his ruling.

Genesis aims to return funds to customers in cryptocurrency wherever possible, although it lacks sufficient crypto assets to fully repay all outstanding claims.

Sean O’Neal, an attorney representing Genesis, refuted DCG’s assertion that customers could be paid in full based on the lower January 2023 valuations. “We don’t buy into the idea that claims are capped at the petition date value,” O’Neal stated.

Genesis initially estimated in February that it could repay up to 77% of the value of customer claims, subject to future fluctuations in cryptocurrency prices.

This court approval marks a significant step forward in the resolution of Genesis’s bankruptcy, providing much-needed relief to its customers while leaving its owner, DCG, without any financial recovery.

Venezuela’s Ministry of Electric Power announced it would disconnect all cryptocurrency mining farms from the national power grid (SEN, Sistema Electrico Nacional). The measure aims to control the high energy demand from these mining farms and ensure reliable service for citizens.

AlbertoNews, a local media outlet, reported the announcement on May 18.

“The purpose is to disconnect all cryptocurrency mining farms in the country from the SEN [National Electrical System], avoiding the high impact on demand, which allows us to continue offering an efficient and reliable service to all the Venezuelan people,”

the Ministry reported in its account in Instagram.

Notably, the announcement followed the seizure of 2,000 cryptocurrency mining machines in the country. This action is part of the government’s ongoing anti-corruption campaign. Leading to the arrests of several officials from state institutions.

The National Superintendency of Cryptoassets (Sunacrip) has been under a restructuring board since the arrest of Superintendent Joselit Ramírez. Ramírez has connections to Tareck El Aissami, former Petroleum Minister and former president of Petróleos de Venezuela (PDVSA).

On that note, El Aissami was charged with treason, embezzlement, misuse of influence, money laundering, and criminal association.

Venezuela has faced an ongoing electricity crisis since 2009, worsened by massive blackouts in 2019 that left cities without power for up to seven days. Frequent power outages have negatively affected the country’s quality of life and economic activities.

Therefore, Governor of Carabobo state, Rafael Lacava confirmed restrictions on cryptocurrency mining farms due to their significant electricity consumption. He urged residents to report illegal cryptocurrency mining operations to prevent power shortages.

“If you, neighbor, see a house that you know, tell that person to turn off the farm, or else report it, because when they turn off the light, because you have to give light to a man so that he can earn some reales (money), you are left without electrical service.”

– Rafael Lacava

As reported by AlbertoNews, experts attribute the crisis to poor maintenance and inadequate investment in the power grid. Meanwhile, the government blames sabotage and has promised to modernize the state-controlled power network.

Overall, Bitcoin (BTC) and cryptocurrency mining are known worldwide for their high energy consumption. Countries like China and Cazaquistan have banned the activity to preserve their power grids, centralizing mining in fewer locations.

Therefore, the fewer countries allowing this activity, the higher the security concerns will be, as a few miners dominate block discovery.

Ooops… Error 404

Sorry, but the page you are looking for doesn’t exist.

Ohio AG defends letter warning 'woke' masked anti-Israel protesters they face prison time: 'We have a society'

Spring Finance Forum 2024: CRE Financiers Eye Signs of Recovery

India Lok Sabha election 2024 Phase 4: Who votes and what’s at stake?

Biden’s decision to pull Israel weapons shipment kept quiet until after Holocaust remembrance address: report

The Major Supreme Court Cases of 2024

Tornadoes tear through the southeastern U.S. as storms leave 3 dead

A look at Chinese investment within Hungary

Tales from the trail: The blue states Trump eyes to turn red in November