Crypto

Best practices for participation in cryptocurrency markets

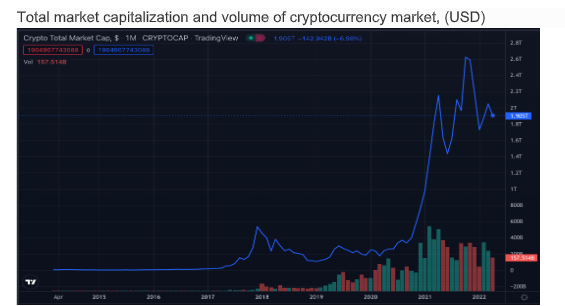

Latest years have seen a big efficiency for crypto currencies by way of its market capitalisation, buying and selling quantity, person base, individuals consciousness, and publications throughout important stream media in addition to analysis journals. In accordance with a tough estimate these parameters have risen by almost 10 instances over final 3 to 4 years. As per one of many largest listed crypto exchanges Coinbase, the institutional quantity includes almost 70% of Crypto turnover.

The rising recognition of bitcoin additionally led to the flood of different crypto currencies to check the market. The dominance, which is measured by way of its share in complete market capitalisation, of bitcoin remained very outstanding throughout early years of crypto foreign money adoptions. The dominance of bitcoin began decreasing over final 4-5 years, particularly with the rise of alternate crypto currencies like Ethereum, Tether, and so forth. The graph depicts the person proportions of the most important ten cryptoassets relative to the entire market capitalization of all property.

Main Cryptoassets By Proportion of Whole Market Capitalization

The expansion in crypto foreign money market additionally led to the expansion of blockchain and varied different modern applied sciences that resulted in enlargement of use circumstances that covers nearly each sectors of the economic system together with financials, healthcare, insurance coverage, authorized, administration, and so forth. a typical workflow of a Blockchain transaction is depicted with the under diagram.

In accordance with a survey by the monetary innovation, the highest six providers included Crypto plus Buying and selling / Buying and selling system/ Prediction / Buying and selling technique / Danger Administration / Portfolio. It signifies the curiosity of present and potential crypto market members. The and therefore the crypto market has not solely expanded by way of retail and institutional buyers but additionally witnessed rising variety of exchanges, blockchain, cryptocurrencies and NFT platforms.

With the rising capital market measurement, each by way of quantum and protection, debates about safeguarding this market from the doable frauds and market malpractices have resulted in adopting varied world greatest practises. The evolving market is struggling to maintain a advantageous steadiness of full KYC, Pseudonymity, and anonymity amidst the proponent of centralise system and decentralise system of public utility. Crypto exchanges on one hand making an attempt to implement clear KYC system whereas the block chains are shifting in direction of Pseudonymity – a state the place particular person private particulars like identify and so forth should not seen however their exercise particulars are transparently seen. Crypto exchanges are commonly making an attempt to ascertain themselves in a well-regulated jurisdiction so as to win the belief of retail in addition to institutional buyers and members.

A significant problem confronted by the crypto trade is the gateway or interface between Fiat and crypto currencies. International locations the world over are diverged however slowly shifting in direction of the facilitation of crypto-fiat conversion. Folks concerned in crypto associated policy-making are step by step getting outfitted with required data. Their enhanced training and consciousness leading to adaptive strategy for this new asset class. Emerge the divorce means of crypto adoption amongst nations the fascinating similarities of their tax construction and promoting normal or indicative of higher time in coming years.

Crypto is usually criticised for larger threat and volatility evaluate with different established asset lessons. Volatility is the end result of knowledge asymmetry for any asset class. This asset class isn’t any totally different than others by way of volatility coming down as market evolves. The latest common day by day volatility of this market as measured on IC15, India’s first index of crypto foreign money, is almost 3.5%.

The broad crypto market barometer IC15, since its base date of 01 April 2018, has proven that the chance and the volatility related to the crypto market is repeatedly coming down. That signifies market is slowly measuring up. Decentralisation and the general public management, being the very primary ideology of this crypto market, have influenced individuals to give you the modern providers and data being made out there free or at a really minimal price. One fascinating function of this market is the just about abolition of market intermediaries as a lot of the transactions are carried on peer-to-peer foundation.

Though “belief” is established by the complicated laptop algorithm (consensus mechanism and reward system) by mechanically ejecting the mal-intentioned entities, the potential for fraud and related threat can’t be ignored and therefore this market must be safeguarded, particularly from doable anti-social finish makes use of. G7, G20, World Financial institution, IMF and so forth are placing efforts to have a coordinated framework for market evolution preserving its’s inherent traits intact whereas safeguarding from terror funding or unlawful actions.

What extra could be performed to make trade higher: the persevering with training is the spine for market development and the tempo of training the market must be accelerated.

CryptoWire, CryptoTv and Crypto College are investing massive assets and their plans on training, data sharing, Worth, and Information and data dissemination. The nations taking a leap ahead in facilitating this market additionally offers essential learnings for different nations so as to formalise their insurance policies. Some regulatory regime which offers trade particular regulation in order that the regulation is formed based on trade and never the trade is made to form itself to regulation. Insurance policies need to be oriented from the context of world market greatest practices slightly than different asset class coverage. Presumably the creation of SRO would get trade on similar web page for facilitation of digital and clear purchasers assist operate. Certainly companies like IOSCO will begin conceiving some world greatest practices for finish person safety and consciousness and trade requirements. Since most trades are p2p, many dangers of intermediation are eradicated on this market. These residual dangers that are alternate particular or coin particular could be redressed by training or the SRO discovering greatest practices to develop the market and in addition guarantee shopper safety and transparency. Cash and Initiatives are actually being rated additionally to convey higher confidence out there. Institutional funding can also be rising the arrogance of the market in these property.

Disclaimer

Views expressed above are the writer’s personal.

END OF ARTICLE

Crypto

Man Invests $10,000 in Cryptocurrency, Earns $3 Million in 30 Minutes

In what can be called the greatest trade of 2024, a cryptocurrency investor put in $10,000 and earned $3 million. The trade was completed in just 30 minutes making the investor turn into a millionaire in the shortest period possible. This is what dreams are made of and the investor turned the dream into reality this month.

Also Read: Which Cryptocurrency Could GTA 6 Integrate in the Game?

Cryptocurrency Investor Turns $10,000 Into $3 Million in Just 30 Minutes

So how did the investor turn $10,000 into $3 million in 30 minutes? Well, the investor took an entry position into BAKED cryptocurrency on July 1, 2024, purchasing 70 Solana (SOL) for under $10,000. The investor swapped the Solana tokens to BAKED and accumulated 82 million tokens.

Also Read: BRICS: Saudi Arabia Makes Massive Oil and Gas Discovery

Just 30 minutes after buying BAKED cryptocurrency, an investor sold it for 21,581 Solana (SOL). This means that the investor made $3 million in the cryptocurrency in less than an hour after purchasing it. Leading on-chain metrics firm Lookonchain was the first to dish out the transaction on the blockchain.

Also Read: Data Breach: US Bank Exposes Customers Name, Acc Number, Date of Birth

However, doubts arise if the investor is an insider or a genuine trader who just got lucky. Investors use the cryptocurrency ‘snipping’ method and buy tokens just hours before it gets listed and open for trading. This gives them the leverage of being a step ahead before other investors begin to purchase the tokens. BAKED saw a listing on the Bitget platform opening the floodgates to new investors.

There are several other stories where cryptocurrency investors just got lucky and made millions in a short period. While these stories are promising, there are only a handful of them that actually made it. The majority of holders have lost money in the markets and only dream of making it big. Luck favors a few while the others mostly face the wrath of the broader cryptocurrency market.

Crypto

Cryptocurrency Titans Bitcoin and Ethereum Poised for Robust July Based on Historical Patterns

As tradition guides us in the financial world, history often sheds light on what might be forthcoming. In this context, July has consistently proven to be a favorable juncture for the titans of the cryptocurrency market, Bitcoin and Ethereum. As we gingerly step into July, market experts are observing with keen interest, the patterns of the past, hoping for another lucrative period in the digital currency realm.

Time-honored market pundits from QCP Capital have deduced that over the years, Bitcoin has shown a median yield of 9.6% in July, bearing a consistent pattern of recuperating substantially after a rather lethargic performance in June. This year, following a dip of roughly 10% in its June performance, Bitcoin is set to possibly see an uplift this July, guided by these historical pointers.

Adding more colors of positivity to this promising picture, David Duong and David Han, two-discerning analysts from Coinbase, have affirmed this trend. They reckon that the expected bonanza of liquidity in July could provide an additional springboard to the market.

June’s downturns have purged the financial market of excess, potentially smoothing the path ahead for more secure and optimistic price shifts. Furthermore, Bitcoin and Ethereum’s trading volumes, which include spot and futures transactions on global exchanges, dwindled from $90 billion in May to $75 billion in June. Market watchers perceive this constriction in trade volumes as laying a sturdier groundwork for the next surge of market activity.

The favorable July seasonality has not been exclusive to leading cryptocurrencies but is also buttressed by broader market dynamics. Analysts including the likes of Ali underscore that recovery patterns ensuing June’s lapses historically denote a “vigorous bounce back” in July performances.

This observation holds notably true for Bitcoin, which has consistently delivered an average return of approximately 8% during this period.

The recent technical analysis of Bitcoin’s price fluctuations also provides credence to the hypothesis for a bullish July. Bitcoin noted a significant upsurge of 2.7% in just the past 24 hours. Now trading at $63,104, Bitcoin has started the month on a strong note. This recent rise has nudged its weekly gains also to 2.7%, echoing an uptick in investor confidence.

However, predictions are not without their hurdles. Factors including macroeconomic influences and regulatory advancements could still steer cryptocurrency prices in a direction contrary to expectations. And while analysts maintain an optimistic outlook based on statistical and historical evidence, the characteristic volatility of the cryptocurrency markets implies that significant deviations from past trends can still transpire.

Crypto

Cryptocurrency: 3 Bullish July Meme Coins To Stack For Maximum Gains

Bullish July is a serendipitous term prevalent in the cryptocurrency domain. It seems that July has often been noted to usher in significant price surges for tokens such as Bitcoin and Shiba Inu, making it a “lucky” month for crypto tokens to document new highs. The phenomenon as mentioned earlier might be a random fluke, but it has now transformed into an event that investors often watch.

With the onset of July, here are the top three trending token recommendations that one should stash to earn stellar gains soon.

Also Read: Cryptocurrency: 3 Coins To Majorly Rebound This July

Bullish July Meme Coins to Stack for Robust Profits

Cryptocurrency#1- Bonk

The Solana-based crypto coin BONK is now surging at an impeccable price pace, rising and peaking by 10% in the last 24 hours. According to CoinMarketCap, BONK is currently trading at $0.00002602, with prospects hinting at the token’s future price hike.

The dog-themed token was launched in 2022 and since then has grown exponentially, gaining nearly 23,674% in valuation. CoinCodex, a notable crypto analytics platform, predicts that the token may spike even more, surging to trade at levels behind 200%.

“The price of Bonk may rise by 227.72% and reach $0.00008520 by August 1, 2024. Per our technical indicators, the current sentiment is bullish, while the Fear & Greed Index is showing 51 (neutral). Bonk recorded 15/30 (50%) green days with 16.81% price volatility over the last 30 days.”

The platform further states the bonk is emanating a bullish sentiment, making it a lucrative coin to hold and stash for future gains.

Cryptocurrency #2: Dogwifhat

Dogwifhat, or WIF, recently took the crypto domain by surprise by peaking and surging by nearly 58% in the last seven days, trading at $2.32 at press time. The Solana-based token is currently basking in the glory of the recent SOL ETF filings that have been lodged by financial giants Ark 21 Shares and VanEck.

According to CoinCodex, WIF may peak further, surging nearly 200% in the process. CC shares that the token may peak to trade at a new ATH of $7 by the end of July 2024.

“The price of Dogwifhat may rise by 228.25% and reach $7.38 by August 1, 2024. Per our technical indicators, the current sentiment is bullish, while the Fear & Greed Index is showing 51 (neutral). Dogwifhat recorded 12/30 (40%) green days with 21.62% price volatility over the last 30 days.”

The technical indicators also categorize WIF as coin trading in the bullish realm. This makes WIF a suitable crypto coin to explore in the long run.

Cryptocurrency #3: Shiba Inu

The Shiba Inu Ecosystem is currently undergoing massive changes. For instance, the latest tweet by Shytoshi Kusama, Shiba Inu tech lead, has spurred a major shift in space. Kusama has teased his personality reveal in the upcoming IVS2024 event in Kyoto, Japan, a development that has sent shivers of excitement within the Shiba inu community.

At the same time, the token is known to make the most out of the bullish July phase, basking in the after-effects of the phenomenon by trading at higher price levels each July.

According to CoinCodex, SHIB may initially display a bearish sentiment. CC predicts the token will surge by 60% by July 9, 2024.

Also Read: Shiba Inu: Bullish July To Help SHIB Heal & Hit $0.000375, Here’s How?

“The Shiba Inu price forecast for the next 30 days is a projection based on the positive and negative trends. SHIB will be changing hands at $0.00002822 on July 9, 2024, gaining 64.80% in the process.”

-

News1 week ago

News1 week agoA Florida family is suing NASA after a piece of space debris crashed through their home

-

Politics1 week ago

Politics1 week agoBiden official says past social media posts don’t reflect ‘current views,’ vows to support admin ‘agenda’

-

World1 week ago

World1 week agoIsrael accepts bilateral meeting with EU, but with conditions

-

World1 week ago

World1 week agoNetanyahu says war will continue even if ceasefire deal agreed with Hamas

-

News1 week ago

News1 week agoWoman accused of trying to drown Muslim child in Texas in possible hate crime

-

World1 week ago

World1 week agoOver 10,000 Poles participate in Pride parade in Warsaw

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: “Casablanca” – A Timeless Masterpiece –

-

Politics1 week ago

Politics1 week agoSupreme Court to review Tennessee ban of puberty blockers, transgender surgery for minors