Business

Stocks give up gains as jitters return.

World shares fell on Tuesday, giving again a few of the beneficial properties made the day earlier than. It marked a return to the downward drift in markets in latest weeks, as buyers weighed combined financial studies and firm earnings.

Monday’s rally was the strongest begin to every week since January, Jim Reid of Deutsche Financial institution famous, “a lot in order that there’s hope that the successive weekly dropping S&P streak of seven is likely to be ended.” However then, “simply whenever you thought it was protected to emerge from behind the couch,” he wrote, markets are set to fall on Tuesday.

-

The S&P 500 was down 2.2 p.c in midmorning buying and selling, whereas the tech-heavy Nasdaq fell 3.3 p.c. The yield on the 10-year Treasury notice fell barely, to only over 2.7 p.c, as demand rose for safer property.

-

Snap, the maker of the messaging app Snapchat, stated on Monday that it could miss its quarterly targets for gross sales and revenue, citing inflation, rates of interest, provide chain shortages and extra. Snap’s shares are down 40 p.c in midmorning buying and selling, with different tech platforms that depend on promoting, like Alphabet and Meta, taking successful.

-

Abercrombie & Fitch fell greater than 28 p.c in midmorning buying and selling after the attire firm reported a lack of 14.8 million within the three months ending in April amid greater prices for transportation and merchandise. The corporate additionally slashed its gross sales forecast for the 12 months from its earlier outlook. Different retailers fell on the information, with City Outfitters and American Eagle Outfitters down 5.9 p.c and 9.9 p.c.

-

“The market and buyers are having these kneejerk reactions as a result of there’s a lot uncertainty about what the way forward for development seems like for the economic system and for firms,” stated Lindsey Bell, the chief cash and markets strategist at Ally Make investments. “You bought retailers pointing to inflation as the rationale for his or her weaker earnings outcomes, so there’s a query mark in regards to the well being of the patron.”

-

The electronics retailer Finest Purchase on Tuesday reported outcomes that beat analyst expectations, initially pushing its shares decrease earlier than a slight achieve. Though the corporate’s gross sales fell in its most up-to-date quarter, the dimensions of the decline signaled that consumers is probably not as unnerved by inflation as some had feared after downbeat earnings from Walmart and Goal final week.

-

In Europe, the Stoxx 600 index fell 1.1 p.c, after enterprise surveys confirmed that enormous economies like France and Germany proceed to develop, albeit at a slower tempo than in latest months. In Japan, the same survey confirmed deteriorating situations for producers, with a pointy enhance in supply occasions associated to shortages and pandemic lockdowns in China. Japan’s Nikkei 225 index fell 0.9 p.c, China’s CSI 300 dropped 2.3 p.c and Hong Kong’s Hold Seng misplaced 1.8 p.c.

Business

Troubled EV maker Fisker closing Manhattan Beach headquarters

In an effort to stave off bankruptcy, electric-vehicle maker Fisker Inc. is closing its Manhattan Beach headquarters and has secured a $3.5-million lifeline as it continues to explore an acquisition or other strategic alternative.

The troubled company, which had about 300 employees in the 72,000-square-foot offices at the end of March, is moving its remaining workers to an engineering and distribution facility in La Palma in Orange County, said a person familiar with Fisker’s operations who was not authorized to comment.

In all, the company had roughly 1,135 employees as of mid-April, following an announced 15% cut to its workforce.

Fisker has been attempting to avoid bankruptcy since March, when it announced that talks over a strategic alliance with a major automaker had ended, squelching a deal that would have given it $150 million in new financing.

That caused its shares to collapse to pennies, prompting the New York Stock Exchange to delist the stock, which violated another debt agreement the company struck with an investor last year, according to a regulatory filing.

A major automaker, said to be Nissan, was reportedly in talks to invest in Fisker. Nissan was considering making the Fisker Alaska truck at a U.S. plant — a deal that would come with a $400-million investment, Reuters first reported. Fisker did not confirm the reports.

Fisker announced this week that it secured a $3.5 million short-term loan, as it continues to operate and sell its midsize Ocean SUV. The note is due June 24 and has the potential to increase to $7.5 million.

The Ocean, a competitor to Tesla’s Model Y, was released last year to mixed reviews; some praised its build and styling, but the car has been plagued by software glitches.

The National Highway Traffic Safety Administration has four investigations into the vehicle, including one opened this month after complaints that the SUV’s automatic emergency braking system randomly triggered.

Other probes are looking into reports that a door on the Ocean will not open and complaints about a loss of braking performance. The company has said it is working with the regulator.

Fisker said this week that it had added three dealers to its networks in California and New Jersey, which it began building after a plan to sell direct to consumers — like Tesla does — didn’t pan out. It also announced additional price cuts on some Ocean models.

In March, Fisker slashed the price on its entire lineup of 2023 Oceans by more than 30%. The company also said that it had paused production at its contract manufacturing plant in Austria, which produced about 10,200 Oceans last year.

Fisker was founded in 2016 by noted car designer Henrik Fisker, who has said the Ocean was inspired by California. The SUV features a full-length solar roof, an interior composed of “vegan” recycled plastic and a drop-down rear window that can fit a surf board.

Fisker is not the only startup that has been struggling amid a slowdown in the domestic market for electric vehicles and a rise in interest rates.

Rivian Automotive, an Irvine maker of electric trucks, has informed state officials it will lay off more than 120 employees beginning in June. In February, the company announced it was cutting 10% of its workforce. The company’s shares have lost more than half of their value since last year.

Business

Las Vegas' Mirage Resort to close after 34-year run. Volcano to go dormant

Once hailed as “Las Vegas’ first 21 Century resort,” The Mirage Hotel & Casino confirmed Wednesday that its iconic volcano outside of its front entrance is going dormant less than a quarter of a century into the new millennium.

Owner Hard Rock International announced the hotel will cease operations on July 17, with bookings being accepted until July 14. The iconic resort — sporting a jungle-fantasy theme —was perhaps best known for its exploding 54-foot man-made volcano, magicians Siegfried and Roy, and its white tigers and dolphins.

“We’d like to thank the Las Vegas community and team members for warmly welcoming Hard Rock after enjoying 34 years at The Mirage,” said Jim Allen, Chairman of Hard Rock International in a statement.

The resort is expected to be redeveloped into the Hard Rock Hotel & Casino and Guitar Hotel Las Vegas, with the volcano giving way to a nearly 700-foot guitar-shaped hotel. The project is expected to open in spring 2027. A similar 638-room hotel stands in Hollywood, Fla.

The Associated Press reported that more than 3,000 employees will be laid off. Hard Rock acknowledged it would pay roughly $80 million in severance packages for union and nonunion labor.

The Culinary and Bartenders Union accounts for about 1,700 Mirage workers. It announced Wednesday that its workers have two options.

The first was a severance package of $2,000 for every year of service plus six months of pension and health benefits. The second option gives employees a lesser, undisclosed amount while maintaining seniority rights for the duration of the property’s closure along with 36 months of recall rights for jobs at the new hotel.

“Culinary Union members at The Mirage have a strong union contract, ensuring that workers are protected, even as the property closes its doors entirely for three years from July 2024 – May 2027,” said Ted Pappageorge, Culinary Union secretary-treasurer, in a statement Wednesday.

The new hotel is projected to employ nearly 7,000 employees, according to Hard Rock management, while 2,500 construction jobs are expected during the rebuilding process.

Hard Rock said that all reservations beyond July 14 would be canceled and that guests should contact the guest services department or booking agency for a refund.

The Mirage’s closure is the second on the strip this year.

In April, the 66-year-old Tropicana closed its doors to make way for a 30,000-seat stadium that is expected to serve as the home of the Oakland A’s.

The Mirage’s opening by casino tycoon Stephen A. Wynn in 1989 was hailed as the ushering of a new era of resorts. It was the first strip hotel to open since the MGM Grand in 1973.

Wynn shelled out $600 million, then the most expensive casino project, for the sprawling 103-acre property.

The Mirage was the first fully integrated hotel, according to Alan Feldman, a Distinguished Fellow at UNLV’s International Gaming Institute.

Integration meant operating and treating all facets of the resort, including casino, food and beverage, retail, entertainment and convention space, with equal importance, according to Feldman, who rose to become an executive with the Mirage and stayed from 1989 to 2019.

Feldman said hotel owners previously cared first about the casino and “everything else was last.”

“They gave away entertainment, food and rooms as long as someone came and played,” said Feldman. “The Mirage was the first to believe you could actually make money in these areas if you invested enough.”

Its glistening 30-story white-and-gold towers were said to make neighboring Caesars Palace look “retiring by comparison.” Traffic occasionally backed up on the strip as engineers tested gas-flared flames 40 feet into the air every few minutes.

“People just got out of the cars and went over to see what was going on,” one limousine driver said at the time.

The hotel included a 20,000-gallon fish tank at its reception desk and 3,049 rooms.

Its animals — and its white tiger habitat — brought the resort fame and infamy, including in 2003 when a tiger critically injured magician Roy Horn.

The Mirage’s opening kicked off a resort building and remodeling spree that included the debut of the Circus Circus’ Excalibur in June 1990, the $250-million renovation of Caesars Palace and the opening of Treasure Island in 1994.

Business

Sony warns tech companies: Don't use our music to train your AI

Sony Music Group is sending letters to 700 artificial intelligence developers and music streaming services warning them to not use its artists’ music to train generative AI tools without its permission.

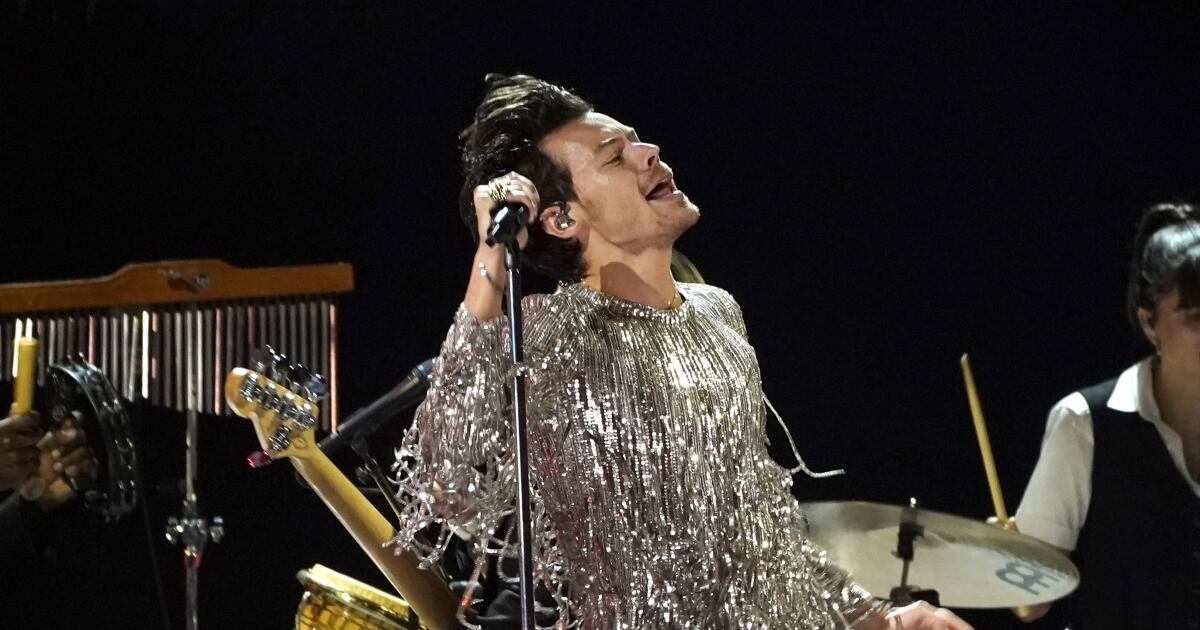

The company — one of the three largest recorded music firms — said it is explicitly opting out of the use of its music for training or developing AI models through text or data mining or web scraping as it relates to lyrics, audio recordings, artwork, musical compositions and images. Sony Music Group artists include Celine Dion, Doja Cat and Harry Styles.

“We support artists and songwriters taking the lead in embracing new technologies in support of their art,” Sony Music Group said in a statement on its website Thursday. “Evolutions in technology have frequently shifted the course of creative industries. … However, that innovation must ensure that songwriters’ and recording artists’ rights, including copyrights, are respected.”

The letters were sent to companies including San Francisco-based ChatGPT creator OpenAI and Mountain View-based search giant Google, according to a person familiar with the matter who was not authorized to speak publicly. OpenAI and Google did not immediately respond to requests for comment.

The move comes as the entertainment industry is grappling with rapid innovations in artificial intelligence technology. Writers and actors raised concerns last summer about whether leaving AI unchecked could threaten their livelihoods. Meanwhile, some creatives have marveled at the advancements that could allow them to pursue bold ideas with tight budgets.

This year, OpenAI unveiled its text-to-video tool Sora, which was used to create a four-minute music video for music artist Washed Out. The director of the video told The Times that Sora helped him depict multiple locations and visual effects that he otherwise couldn’t have.

But AI can also create chaos. Celebrities have dealt with “deep fakes” — false videos or audio depicting a celebrity endorsing certain brands or activities. To help protect their clients against unauthorized use of their voice and likeness, Century City-based Creative Artists Agency is helping talent create their own digital doubles.

On Thursday, two New York voice-over actors sued Berkeley-based AI voice generator business Lovo for unauthorized use of their voices. Lovo did not immediately return a request for comment. The lawsuit was filed in U.S. District Court for the Southern District of New York.

Some people in the entertainment industry have said they would like the AI companies to be more transparent about how they are training their tools and whether they have the appropriate copyright permissions.

OpenAI has said its large language models, including those that power ChatGPT, are developed through information available publicly on the internet, material acquired through licenses with third parties and information its users and “human trainers” provide.

The company said in a blog post that it believes training AI models on publicly available materials on the internet is “fair use.”

But some media outlets, including the New York Times, have sued OpenAI. The newspaper raised alarms about how its stories are being used by the tech company.

In Sony Music Group’s letters to AI businesses, the company said it has reason to believe its content may have been used to train, develop or commercialize artificial intelligence systems without its permission, according to a copy obtained by the Times. Sony Music Group asked the tech companies to provide information regarding that use and why it was necessary.

Sony Music Group, owned by Tokyo-based electronics giant Sony Corp., also wants music streaming providers to add language in its terms of service saying that third parties are not allowed to mine and train using Sony Music Group content, the person familiar with the matter said.

-

World1 week ago

World1 week agoPentagon chief confirms US pause on weapons shipment to Israel

-

Politics1 week ago

Politics1 week agoRFK Jr said a worm ate part of his brain and died in his head

-

World1 week ago

World1 week agoConvicted MEP's expense claims must be published: EU court

-

News1 week ago

News1 week agoStudents and civil rights groups blast police response to campus protests

-

Politics1 week ago

Politics1 week agoCalifornia Gov Gavin Newsom roasted over video promoting state's ‘record’ tourism: ‘Smoke and mirrors’

-

Politics1 week ago

Politics1 week agoOhio AG defends letter warning 'woke' masked anti-Israel protesters they face prison time: 'We have a society'

-

News1 week ago

News1 week agoNine Things We Learned From TikTok’s Lawsuit Against The US Government

-

Politics1 week ago

Politics1 week agoBiden’s decision to pull Israel weapons shipment kept quiet until after Holocaust remembrance address: report