Alaska

Brad Keithley’s chart of the week: How much would “government take” from oil need to increase to balance the budget

In our column a few weeks in the past we checked out how a lot oil manufacturing would wish to extend to stability the finances over the following decade. As we concluded there, it’s loads. A lot, the truth is, that it’s unrealistic to assume it can happen.

That led some to ask us, within the different, to have a look at how a lot the extent of “authorities take” from oil would wish to extend to perform the identical goal. The extent of presidency take is the % of oil revenues (normally expressed as $/bbl) obtained by the producer, in flip paid to the state as royalty and taxes.

Earlier than we begin down this highway allow us to counsel that, similar to an “oil manufacturing improve solely,” an “oil tax solely” method to fiscal coverage additionally appears unrealistic. Simply two years in the past Alaska voters overwhelmingly rejected Poll Measure 1 – a proposal to extend oil taxes on sure producers and fields on the North Slope by what the proponents estimated to be about $1 billion – by a margin of roughly 16% (58% to 42%).

Heck, the previous two periods the Legislature hasn’t come shut even to addressing what some discuss with because the Hilcorp loophole, an apparent and simply fixable glitch by way of which the Division of Income (DOR) lately estimated Hilcorp avoids paying on common roughly $90 million/yr in company taxes that beforehand have been paid by its predecessor.

Leaving that glitch untouched alone prices Alaskans practically $150/Everlasting Fund Dividend (PFD). If the Legislature isn’t as much as fixing that, why on earth would anybody assume its concerned with elevating much more by way of taking up manufacturing or different oil associated taxes.

However the query is an fascinating one and, as we focus on a bit later on this column, one that will show useful going ahead as a part of an total fiscal resolution.

As we did in analyzing how a lot further manufacturing can be required to shut the deficit, we have to begin by defining what the dimensions of the deficit is.

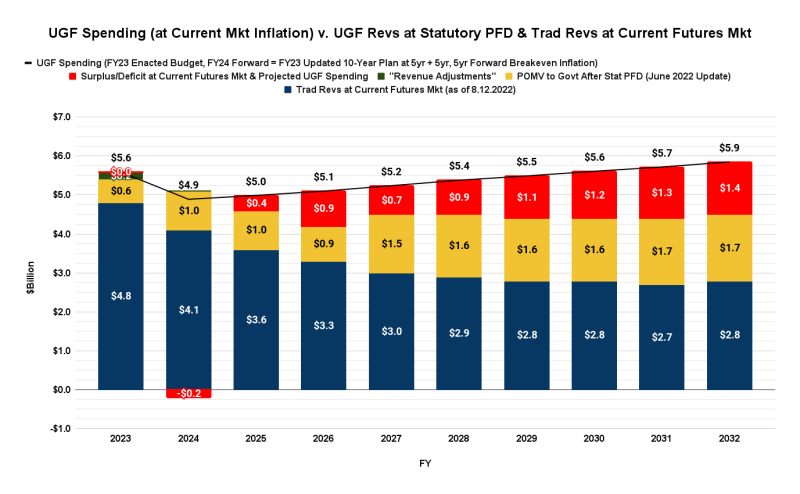

On the manufacturing ranges projected in DOR’s Spring 2022 Income Forecast – and utilizing the latest oil futures costs – here’s what the outlook for the “present legislation” (statutory Everlasting Fund Dividend) finances seems to be like over the identical span, utilizing our most up-to-date “Goldilocks charts”:

At at the moment projected income and spending ranges, deficits (pink, on the high of the bars) start in FY 2025 and construct all through the rest of the present decade and past.

So, what further ranges of presidency take from oil can be required to shut these deficits.

There are a number of methods to have a look at the difficulty. Let’s begin with a fundamental one. In keeping with the latest Spring Income Forecast, below its current fiscal construction the state is projected to obtain the next in unrestricted funds (per barrel) over the following decade from Alaska North Slope (ANS) oil.

Absent different income contributions, right here’s the extra quantity (in gold) the state would wish to obtain per barrel to shut the projected present legislation (statutory PFD) deficits:

One other method to have a look at the affect is to concentrate on the required proportion improve over the at the moment projected authorities take ranges. Right here is the federal government take stage, per barrel, at the moment projected within the Spring Forecast (blue) and the extra quantity which might be required to stability the finances, absent different income contributions, below present legislation (statutory PFD, gold):

Actually, many will instantly protest that the oil business couldn’t probably afford making any further contributions; it’s fascinating to notice, nevertheless, that even with the additions, the share take ranges in any given yr don’t even attain, a lot much less exceed, that already projected for the present fiscal yr (FY23).

Nevertheless it’s laborious to dispute the argument that rising the take stage probably would have some affect on funding ranges, and thru that, future manufacturing.

That ought to not finish the dialogue, nevertheless.

For instance, if, to select a quantity, the impact of elevating the common take stage over the following decade from the at the moment projected 17% to 22% was a corresponding discount in manufacturing of 5% from at the moment projected ranges, that may nonetheless be a very whole lot for state revenues.

Sure, the state would lose the revenues from roughly 25 thousand barrels a day of manufacturing, however the elevated income it made on the remaining 500 thousand barrels would nonetheless produce a major internet acquire. And that acquire actually would cut back the quantity of income the state must take from different sources (e.g., PFD cuts) to shut its deficits.

Then again, if the impact on funding of elevating the common take by that quantity was a discount in manufacturing of fifty% from at the moment projected ranges, pursuing that course can be a foul deal for state revenues. The elevated revenues on the remaining 250-ish thousand barrels wouldn’t be sufficient to make up for the discount in revenues from the manufacturing which is misplaced.

Between the 2 examples is a “income maximizing” level – what those that work within the space discuss with as a “candy spot.” However discovering it requires plenty of info, making some assumptions about decline curves and a few devoted work. To be trustworthy, over the previous ten years we’ve not been conscious of any governors, group of legislators – or for that matter, voters – who’ve demonstrated the curiosity and endurance required to pursue calculating it and, extra importantly, making use of it in follow.

As we talked about above, nevertheless, whereas we imagine relying solely on the method of elevating the extent of presidency take to stability the finances is unrealistic, pursuing the difficulty nonetheless might show useful going ahead as a part of an total fiscal resolution.

Often, some discuss of pursuing an “all the above” fiscal resolution that may be composed, partly, of a income package deal of some PFD restructuring (e.g., to % of Market Worth 50/50), some improve in oil taxes and a few particular person taxes.

Usually talking, discuss of any improve in oil taxes, whilst a part of an “all the above” resolution, normally is met by howls of protest from the state’s oil sector, together with High 20% led Preserve Alaska Aggressive, which appears to personify the previous Sen. Russell Lengthy adage of “don’t tax you, don’t tax me, tax these guys behind the tree.” (The Alaska model is “don’t tax oil, don’t tax the High 20%, tax the opposite 80% of Alaska households behind the tree utilizing PFD cuts.”)

However even the present administration’s Division of Income contains some improve in oil taxes as a part of the fiscal choices it has placed on the desk.

In its most up-to-date “Fiscal Plan Mannequin,” DOR contains two oil tax-related choices for consideration. The primary is, primarily, fixing the Hilcorp Loophole, which raises, on common, roughly $90 million per yr over the following decade. The second is “Scale back Present $8.00 Per Barrel Tax Credit score by $3.00”. That raises, on common, roughly $400 million per yr over the following decade. (Curiously, the DOR projection doesn’t seem to ascribe any loss in funding or manufacturing to these will increase.)

Mixed, that’s the equal of elevating authorities take ranges over the following decade, on common, from roughly 17% to twenty%. Not a full resolution, which might require elevating authorities take ranges by a mean of 5 proportion factors, however a cloth contribution.

With a purpose to obtain even that materials contribution, nevertheless, Alaskans, and extra particularly, legislators, have to be keen to have interaction in a minimum of some dialogue about modifying oil taxes, and that requires some numbers, in addition to some factual – not arm-waiving – dialogue about what the marginal affect of these numbers could also be on funding, and thus, manufacturing ranges. The open query is whether or not legislators, particular curiosity teams and on a regular basis Alaskans are keen to have interaction in that dialogue.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a mission targeted on growing and advocating for economically sturdy and sturdy state fiscal insurance policies. You’ll be able to observe the work of the mission on its web site, at @AK4SB on Twitter, on its Fb web page or by subscribing to its weekly podcast on Substack.