Alaska

Alaska Air Stock: Still A Strong Buy Ahead Of Earnings (NYSE:ALK)

Boarding1Now

Last December, I argued that Alaska Air (NYSE:ALK) shares had tremendous upside in 2023, with the potential to rally 75% or more within a year.

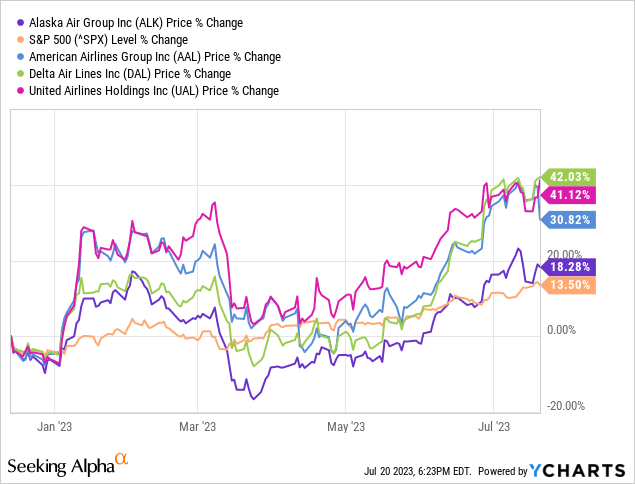

Since then, Alaska Air stock has beaten the market, but not by much, rising approximately 18%. Shares of the three big network carriers that dominate the U.S. airline industry have performed much better. American Airlines (AAL) is up more than 30%, while Delta Air Lines (DAL) and United Airlines (UAL) shares have each gained over 40%.

Despite this less-than-extraordinary start to the year, Alaska Air’s combination of strong margins, growth potential, and balance sheet strength make it the most compelling investment opportunity in the U.S. airline industry. With shares trading for just 8 times the midpoint of Alaska’s 2023 EPS guidance (which is starting to look quite conservative), Alaska Air stock could break out in the second half of 2023 and 2024 as investors begin to recognize the company’s potential.

Solid demand and lower fuel set up an earnings beat

Delta, United, and American have all released beat-and-raise earnings reports this month. I expect Alaska Air to do the same when it reports earnings on Tuesday.

Notably, air travel demand remains very strong. Despite inflationary pressures on discretionary spending, consumers (particularly higher-income consumers) remain eager to make up for lost travel opportunities during the pandemic. Meanwhile, business travel continues to return gradually, notwithstanding some belt-tightening due to recession fears.

In their recent earnings reports, American, Delta, and United have reported Q2 domestic unit revenue declines ranging from 1% to 3%. Since the domestic market accounts for nearly all of Alaska’s revenue, this is the best point of comparison. Alaska’s Q2 guidance implied a unit revenue decline of approximately 3.5% at the midpoint. This suggests that Alaska Air has a good chance of delivering revenue near or even above the high end of its guidance range.

Source: Alaska Air Q1 Earnings Report and Investor Update, p. 21.

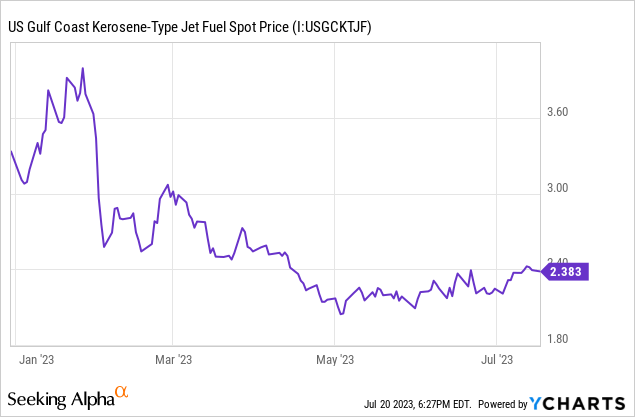

Holding all else equal, strong revenue results would support a Q2 adjusted pre-tax margin near the high end of Alaska’s 14%-17% guidance range. However, falling fuel prices have provided an incremental margin tailwind.

Alaska’s Q2 forecast assumed an average fuel price for the quarter between $2.95 and $3.15 per gallon. However, the price of Gulf Coast jet fuel fell from over $2.50/gallon on April 13 (one week before Alaska reported earnings) to an average of $2.17/gallon in May and $2.25/gallon in June. American, Delta, and United all reported average fuel prices between $2.52/gallon and $2.66/gallon for Q2.

Due to geographical differences and the cost of its fuel hedging program, Alaska’s average fuel cost will be higher than peers. During 2022, Alaska’s “raw” fuel cost per gallon (excluding hedges) was $3.64: 10 cents higher than American Airlines. A year earlier, its raw fuel cost per gallon was 7 cents higher than that of American. Furthermore, Alaska hedged 50% of its expected Q2 fuel consumption with call options, paying an average premium of $7 per barrel (see p. 34). That will add 8-9 cents/gallon to its fuel bill. Together, these factors suggest that Alaska Air likely paid an average of roughly $2.80/gallon for fuel last quarter, compared to American’s $2.62/gallon.

That savings of 25 cents per gallon compared to the midpoint of Alaska’s guidance adds nearly 2 percentage points to its pre-tax margin. Thus, I expect the company to report an industry-leading adjusted pre-tax margin of 18%-19% for the second quarter: solidly above the high end of the guidance range (17%).

Assuming revenue of $2.8 billion (just below the high end of guidance) and an effective tax rate of 25%, this implies adjusted EPS of roughly $2.90-$3.10. The analyst consensus has not caught up to reality: $2.90 is the highest estimate on Wall Street, with the average sitting at $2.70.

Cost tailwinds on the way

Alaska’s earnings power and outperformance relative to the rest of the industry is primed to expand further in the second half of 2023 and 2024, primarily due to improving cost trends.

First, due to the timing of its labor negotiations, Alaska Air has experienced greater cost headwinds than many of its peers over the past few quarters. Three of the company’s labor groups (most notably its mainline pilots) ratified new multiyear agreements in the second half of 2022, creating a 4 percentage point headwind to non-fuel unit costs. That headwind partially rolls off in Q3 and fully dissipates by Q4 of this year. By contrast, American and United don’t have ratified mainline pilot agreements yet, though they are close.

In short, whereas some competitors will just start to experience labor-related margin pressure in the second half of 2023, Alaska has nearly lapped those headwinds.

Second, Alaska Airlines is on track to retire the remainder of its Airbus (OTCPK:EADSY) fleet by the end of Q3. That will allow the carrier to unlock the cost benefits of returning to a single mainline fleet type.

Additionally, Alaska incurred substantial costs to retrain Airbus pilots to fly Boeing (BA) 737s in the first half of 2023, having retired 29 Airbus A320s between last summer and January of this year. These fleet transition costs will be much smaller in the second half of the year and will drop to negligible levels in 2024.

As a result, whereas non-fuel unit costs are still rising for American and United, Alaska expects non-fuel unit costs to decline year over year in Q3 and Q4 (see p. 22). By the fourth quarter, non-fuel unit costs could be down approximately 5% year over year, putting the airline in great position to further reduce non-fuel unit costs in 2024.

Source: Alaska Air Q1 Earnings Report and Investor Update, p. 22.

Heading towards record earnings

Alaska Air expects unit revenue to continue declining in the second half of 2023, due to tough year-over-year comparisons. However, barring a sharp rebound in jet fuel prices, the combination of lower fuel and non-fuel unit costs will enable additional margin improvement.

Other U.S. airlines are projecting Q3 all-in fuel costs to be roughly in line with Q2 levels, despite a recent rebound in oil prices. Assuming Alaska reports an average fuel price of $2.80/gallon again in Q3, compared to $3.66 a year earlier, lower fuel prices would provide a pre-tax margin tailwind exceeding 6 percentage points. Fuel efficiency gains, better non-fuel unit costs, and higher interest earned on Alaska’s cash and investments will boost pre-tax margin by another 3 percentage points or more.

In short, Alaska’s adjusted pre-tax margin could expand by approximately 5 percentage points year over year even with unit revenue down by about 5%. That would support Q3 EPS in the vicinity of $3.50: well ahead of the analyst consensus once more.

This strong earnings trajectory has Alaska Air on pace to deliver full-year adjusted EPS around the high end of its current guidance range of $5.50-$7.50. That would beat the previous full-year record of $7.32 set in 2016. I doubt management will declare victory yet, due to the unpredictability of the airline industry, but I do expect an adjusted EPS guidance increase, perhaps to $6.50-$7.50.

A coiled spring

Looking beyond 2023, Alaska Air is on track for further earnings growth in 2024 and 2025. With the Airbus fleet transition nearly complete, Alaska will finally begin expanding its mainline fleet beyond pre-pandemic levels next year. That will allow the airline to capture pent-up demand while driving non-fuel unit costs lower through scale and efficiency benefits.

Image source: Alaska Airlines.

While margin performance will vary year to year based on short-term fluctuations in fuel prices, demand, and the timing of various expenses, Alaska Air is well positioned to grow revenue at a high-single-digit CAGR over the next few years while gradually expanding its profit margin. That would enable double-digit annual growth in net income.

Furthermore, with earnings trending towards the high end of Alaska’s guidance range and aircraft delivery delays likely pushing some CapEx from 2023 into later years, Alaska Air is also on track to produce better-than-planned free cash flow this year. This may lead the company to ramp up this year’s share buybacks well beyond the $100 million target it initially communicated, given that the stock trades for 8 times the midpoint of the 2023 EPS guidance range (and 7 times the high end). Incremental buybacks would add to future EPS growth.

Thus, I believe Alaska is still likely to deliver adjusted EPS between $8 and $10 next year: well ahead of the analyst consensus of $7.39. With shares trading at a depressed valuation relative to this earnings estimate, there is plenty of upside for Alaska Air stock as the company’s earnings potential comes into greater focus over the next year or so. The stock would have to rise nearly 50% just to trade at 10 times the low end of that range.

Obviously, the market can remain irrational for quite a while. But whereas the Big Three have reported stronger earnings momentum this year (mainly due to easier comparisons), that will change over the next few quarters as Alaska starts to push non-fuel unit costs lower. This could set the stage for an abrupt change in sentiment and a big rally in Alaska Air stock.