Crypto

What The Hell Is Cryptocurrency | Robots.net

Introduction

Welcome to the world of cryptocurrency! If you’re new to the concept, you might be wondering what all the buzz is about. Cryptocurrency has made headlines in recent years, captivating the attention of investors, tech enthusiasts, and even governments. But what exactly is cryptocurrency, and why is it gaining so much traction?

Cryptocurrency is a digital or virtual form of currency that relies on cryptography for security. Unlike traditional currencies that are issued and regulated by central authorities like banks and governments, cryptocurrencies operate on decentralized networks using blockchain technology. This decentralized nature is one of the key factors that make cryptocurrency appealing to many people.

The most well-known cryptocurrency is Bitcoin, which was introduced in 2009 by an anonymous person or group of people known as Satoshi Nakamoto. Since then, numerous other cryptocurrencies have emerged, each with its own unique features and functionalities.

Cryptocurrencies make transactions possible without the need for intermediaries such as banks, reducing costs and increasing efficiency. They also offer greater security and privacy compared to traditional financial systems. With cryptocurrencies, individuals have more control over their own wealth and can easily send and receive funds across borders.

One of the most fascinating aspects of cryptocurrency is its underlying technology – blockchain. A blockchain is a distributed ledger that records every transaction made using a particular cryptocurrency. These transactions are grouped into blocks and linked together in a chain, creating a transparent and tamper-proof record of all activities.

Over the years, cryptocurrency has gained popularity and adoption across various industries. Many businesses now accept cryptocurrencies as a form of payment, and some countries have even started exploring the use of government-backed digital currencies.

While cryptocurrency offers numerous benefits, it is important to be aware of the risks and challenges involved, such as price volatility, regulatory uncertainties, and security vulnerabilities. Additionally, navigating the world of cryptocurrency can be overwhelming, especially for newcomers.

In this article, we will delve deeper into the world of cryptocurrency, exploring how it works, the different types of cryptocurrencies, and the benefits and risks associated with their use. We will also provide some guidance on how to get started with cryptocurrency and introduce common terminology you will come across in your journey. So, fasten your seatbelt and let’s dive into the exciting world of cryptocurrency!

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that utilizes cryptography for secure financial transactions, control the creation of additional units, and verify the transfer of assets. Unlike traditional currencies issued by banks or governments, cryptocurrency operates on decentralized networks known as blockchain technology.

At its core, cryptocurrency is a digital representation of value that can be used as a medium of exchange. It exists solely in electronic form and has no physical counterpart like paper bills or coins. Cryptocurrencies are built on advanced cryptographic algorithms which enhance security, ensuring that transactions remain secure and transparent.

The decentralized nature of cryptocurrencies separates them from traditional financial systems. There is no central authority or governing body that controls or regulates cryptocurrencies. Instead, transactions are verified and recorded on a distributed ledger called a blockchain. This means that the power and responsibility of managing and securing transactions are distributed among the network participants.

Bitcoin, the first and most well-known cryptocurrency, paved the way for the existence of thousands of other cryptocurrencies. Bitcoin was created in 2009 by an individual or group of individuals using the pseudonym Satoshi Nakamoto. It introduced the concept of decentralized digital currency based on blockchain technology.

Each cryptocurrency operates on its own set of rules and protocols. Some cryptocurrencies, like Bitcoin and Litecoin, function mainly as digital currencies, enabling peer-to-peer transactions. Others, such as Ethereum, go beyond simple transactions and support the execution of smart contracts. These contracts are self-executing contracts with the terms of the agreement directly written into lines of code.

One of the key features of cryptocurrencies is their limited supply. Unlike fiat currencies that can be easily inflated by central banks, most cryptocurrencies have a set maximum supply. This scarcity ensures that cryptocurrencies retain their value over time, similar to precious metals like gold.

Overall, cryptocurrencies offer numerous advantages over traditional systems. They provide secure and efficient means of conducting financial transactions, with lower fees and faster processing times. Cryptocurrencies also empower individuals by giving them full control over their assets and eliminating the need for intermediaries like banks.

In the next sections, we will dive deeper into how cryptocurrencies work, explore the different types of cryptocurrencies, and discuss the benefits and risks associated with their use. So, let’s continue the journey and unravel the mysteries of cryptocurrency.

How Does Cryptocurrency Work?

Understanding how cryptocurrency works requires a grasp of several key components, including blockchain technology, decentralized networks, and cryptographic algorithms. Together, these elements create a secure, transparent, and efficient system for conducting financial transactions.

At the heart of cryptocurrency is blockchain technology. A blockchain is a distributed ledger that records all transactions made with a particular cryptocurrency. This ledger is decentralized, meaning it is not stored in a single location but duplicated across multiple computers, or nodes, that make up the network. This ensures transparency and prevents any single point of failure or tampering.

When a transaction occurs, it is verified by network participants known as miners. Miners use powerful computers to solve complex mathematical problems that validate transactions and add them to the blockchain. In return for their efforts, miners are rewarded with newly created cryptocurrency units, a process known as mining.

Transactions within the blockchain are secured using cryptographic algorithms. These algorithms encrypt the transaction data in such a way that it becomes virtually impossible to alter or forge. The most commonly used cryptographic algorithm is called SHA-256, which is employed by Bitcoin and many other cryptocurrencies.

One of the defining features of cryptocurrencies is their decentralized nature. Unlike traditional financial systems that rely on central authorities like banks or governments, cryptocurrencies operate on decentralized networks. This means that no single entity has complete control or authority over the currency or its transactions. The power and responsibility of managing the network are distributed among all network participants.

Another important aspect of cryptocurrency is the concept of digital wallets. A digital wallet is a software application or hardware device that securely stores an individual’s cryptocurrency units. It also provides a unique address that can be used to send and receive funds. Digital wallets offer a high level of security, using encryption and private keys to protect the user’s assets.

As transactions are processed and recorded on the blockchain, they become immutable and transparent. Anyone can view the transaction history of a particular cryptocurrency, providing a level of transparency and accountability not found in traditional financial systems.

In order to send or receive cryptocurrency, users need to have a digital wallet address. When initiating a transaction, the sender includes the recipient’s wallet address, the amount of cryptocurrency to be transferred, and any additional information required by the particular cryptocurrency. The transaction is then broadcasted to the network, validated by miners, and added to the blockchain.

Overall, cryptocurrency works by leveraging blockchain technology, decentralization, and cryptographic algorithms to create a secure, transparent, and efficient system for conducting financial transactions. The decentralized and transparent nature of cryptocurrencies ensures greater security and control for users, and also eliminates the need for intermediaries like banks. With an understanding of how cryptocurrencies work, let’s explore the different types of cryptocurrencies available.

Types of Cryptocurrency

The world of cryptocurrency is vast and diverse, with thousands of different cryptocurrencies available today. While Bitcoin remains the most well-known cryptocurrency, numerous other cryptocurrencies have emerged, each with its own unique features and functionalities. Let’s explore some of the major types of cryptocurrencies:

1. Bitcoin (BTC): Bitcoin was the first cryptocurrency to be introduced, and it continues to dominate the market. It functions as a digital currency and a store of value, allowing for quick and secure peer-to-peer transactions. Bitcoin is known for its scarcity, with a limited supply capped at 21 million coins.

2. Ethereum (ETH): Ethereum is more than just a digital currency. It is a decentralized platform that enables the execution of smart contracts and the development of decentralized applications (DApps). Ethereum introduced the concept of programmable money, allowing for the creation of custom tokens and the establishment of decentralized autonomous organizations (DAOs).

3. Ripple (XRP): Ripple is a cryptocurrency and a payment protocol designed for fast and efficient cross-border transactions. Unlike Bitcoin and Ethereum, Ripple aims to bridge the gap between traditional financial systems and blockchain technology by collaborating with banks and financial institutions.

4. Litecoin (LTC): Created by Charlie Lee, a former Google engineer, Litecoin is often referred to as the silver to Bitcoin’s gold. It offers faster transaction confirmation times and a different hashing algorithm, making it more accessible for everyday transactions.

5. Bitcoin Cash (BCH): Bitcoin Cash is a result of a hard fork from Bitcoin. It was created to address the scalability issues of Bitcoin by increasing the block size, allowing for more transactions to be processed in each block.

6. Cardano (ADA): Cardano is a blockchain platform that aims to provide a secure and scalable infrastructure for the development of decentralized applications and smart contracts. It puts a strong emphasis on security and formal verification methods.

7. Stellar (XLM): Stellar is both a cryptocurrency and a decentralized payment platform. It focuses on enabling fast, low-cost cross-border transactions and facilitating the issuance and management of digital assets.

These are just a few examples of the vast array of cryptocurrencies available in the market. Each cryptocurrency has its own unique features, use cases, and communities. It’s important to conduct thorough research and understand the characteristics of each cryptocurrency before investing or using them for transactions.

In addition to individual cryptocurrencies, there are also token standards such as ERC-20 (used on the Ethereum blockchain) and BEP-20 (used on the Binance Smart Chain). These standards allow for the creation and management of tokens that can be used for various purposes, such as fundraising through Initial Coin Offerings (ICOs) or interacting with decentralized applications.

With the growing popularity and adoption of cryptocurrencies, it’s exciting to see new innovations and projects emerge. The world of cryptocurrency is constantly evolving, and the possibilities are endless.

Benefits of Using Cryptocurrency

Cryptocurrency offers many advantages that make it appealing to individuals, businesses, and even governments. Let’s explore some of the key benefits of using cryptocurrency:

1. Decentralization: One of the primary benefits of cryptocurrency is its decentralized nature. It operates on a peer-to-peer network, eliminating the need for intermediaries such as banks. This decentralized structure gives individuals greater control over their finances and removes barriers to financial inclusion for the unbanked population.

2. Security: Cryptocurrency transactions are secured using advanced cryptographic techniques. These techniques make it extremely difficult for unauthorized parties to manipulate or counterfeit transactions. Additionally, the use of blockchain technology ensures transparency and immutability, making it almost impossible to alter transaction records.

3. Privacy: Cryptocurrency transactions provide a certain level of privacy and anonymity. While blockchain transactions are transparent, the identities of the users involved in the transactions are often pseudonymous. This privacy feature is particularly appealing to individuals who value their financial privacy.

4. Global Accessibility: Cryptocurrencies have no geographic boundaries, allowing people from all over the world to access and use them. Transactions can be made quickly and easily, regardless of the sender and receiver’s location. This global accessibility opens up new opportunities for cross-border commerce and financial inclusion.

5. Lower Transaction Fees: Traditional financial systems often involve high transaction fees, especially for international transfers. In contrast, cryptocurrency transactions typically have lower fees, making them more cost-effective for users. This benefits both individuals and businesses, reducing the costs associated with financial transactions.

6. Fast and Efficient Transactions: Cryptocurrency transactions are processed quickly, especially compared to traditional banking systems that often involve delays and lengthy settlement times. Cryptocurrency transactions can be completed within minutes, providing users with instant access to funds and enabling faster business transactions.

7. Innovation and Opportunity: Cryptocurrencies and blockchain technology have sparked a wave of innovation and new opportunities. They have paved the way for the development of decentralized applications, smart contracts, and tokenized assets. This has the potential to revolutionize traditional systems across various industries, including finance, supply chain management, healthcare, and more.

8. Investment Potential: Cryptocurrencies have experienced significant growth in value over the years. Many early adopters and investors have profited from the rise in cryptocurrency prices. While investing in cryptocurrencies carries risks, it also offers the potential for high returns compared to traditional investment options.

These advantages demonstrate the potential of cryptocurrency to reshape our financial systems and empower individuals. However, it’s important to note that cryptocurrencies also come with risks and challenges, such as market volatility and regulatory uncertainty. Understanding these risks is essential for anyone considering using or investing in cryptocurrency.

Now that we have explored the benefits of using cryptocurrency, it’s important to understand the potential risks and challenges associated with it. Let’s dive into the next section to learn more.

Risks and Challenges of Cryptocurrency

While cryptocurrency offers numerous benefits, it also comes with its fair share of risks and challenges. Understanding and acknowledging these risks is crucial for anyone involved in the world of cryptocurrency. Let’s take a closer look at some of the main risks and challenges:

1. Price Volatility: Cryptocurrencies are notorious for their price volatility. The value of cryptocurrencies can fluctuate dramatically within short periods of time. This volatility can result in substantial gains or losses for investors, making it a high-risk investment option.

2. Lack of Regulation: Cryptocurrencies operate in a largely unregulated environment. While this decentralization is one of the key advantages, it also opens the door to scams, fraud, and illegal activities. The absence of comprehensive regulation increases the risk of fraud, hacking, and market manipulation.

3. Security Vulnerabilities: Although blockchain technology is considered secure, the surrounding infrastructure and platforms may be vulnerable to security breaches. Cybercriminals can exploit weaknesses in exchanges, wallets, and other cryptocurrency-related services to steal funds or gain unauthorized access to sensitive information.

4. Regulatory Uncertainty: Governments and regulatory authorities around the world are still grappling with how to regulate cryptocurrencies. The evolving regulatory landscape and differing stances from different jurisdictions can create confusion and uncertainty for businesses and individuals, potentially impacting the adoption and usage of cryptocurrencies.

5. Lack of Consumer Protection: Unlike traditional financial systems, cryptocurrencies typically lack the same level of consumer protection mechanisms. In the event of fraud, hacking, or technical issues, recovering lost funds can be challenging or even impossible. This places the responsibility on individuals to secure their own cryptocurrencies and make informed decisions.

6. Scalability and Speed: As cryptocurrencies gain popularity and usage increases, scalability and transaction speed become significant challenges. Blockchain networks like Bitcoin and Ethereum may face congestion and slower transaction processing times during periods of high demand, affecting user experience and the efficiency of transactions.

7. Market Manipulation: With a relatively low market capitalization compared to traditional financial markets, cryptocurrencies are particularly vulnerable to market manipulation. Large investors or groups of investors can influence prices by buying or selling significant amounts of a particular cryptocurrency, leading to price manipulation and volatility.

8. Technical Complexity: Cryptocurrency and blockchain technology can be complex for newcomers to understand and navigate. The technical jargon, wallet management, and understanding of private keys can be daunting for those unfamiliar with the technology. This complexity can pose challenges for widespread adoption.

Despite these risks and challenges, the cryptocurrency industry continues to evolve and innovate. Steps are being taken to address these issues, such as the development of improved security measures, regulatory frameworks, and scalability solutions.

It’s essential for individuals to conduct thorough research, exercise caution, and stay informed when dealing with cryptocurrencies. By understanding and managing these risks, one can take advantage of the benefits that cryptocurrencies offer and navigate this exciting and dynamic space.

Now that we have explored the risks and challenges of cryptocurrency, let’s move on to the next section and discuss how to get started with cryptocurrency.

How to Get Started with Cryptocurrency

Getting started with cryptocurrency may seem daunting at first, but with the right knowledge and guidance, you can navigate this exciting world. Here are some steps to help you get started:

1. Educate Yourself: Start by educating yourself about the basics of cryptocurrency. Read articles, watch videos, and explore reputable resources to gain a solid understanding of how cryptocurrencies work, different types of cryptocurrencies, and the underlying technology.

2. Choose a Wallet: A digital wallet is essential for securely storing your cryptocurrencies. There are several types of wallets available, including software wallets, hardware wallets, and online wallets. Research different wallet options and choose one that suits your needs in terms of security, convenience, and the cryptocurrencies you plan to hold.

3. Select a Cryptocurrency Exchange: To buy, sell, and trade cryptocurrencies, you’ll need to choose a reliable cryptocurrency exchange. Research different exchanges, consider factors like security, fees, available cryptocurrencies, and user experience. Some popular exchanges include Coinbase, Binance, and Kraken.

4. Complete the Verification Process: After choosing an exchange, you’ll typically need to complete a verification process to comply with Know Your Customer (KYC) regulations. This involves providing necessary identification documents to validate your identity. Follow the instructions provided by the exchange to complete the verification process.

5. Fund Your Account: Once your account is verified, you can fund it with traditional fiat currency (such as USD, EUR, or GBP) to start buying cryptocurrencies. Most exchanges offer various funding options, including bank transfers, credit/debit cards, and sometimes even PayPal.

6. Start with Small Investments: As a beginner, it’s advisable to start with small investments and gradually increase your exposure to cryptocurrencies. Remember that the crypto market is highly volatile, and prices can fluctuate rapidly. It’s crucial to only invest what you can afford to lose.

7. Practice Security Measures: Protect your cryptocurrencies and personal information by implementing security measures. Enable two-factor authentication (2FA) for your accounts, regularly update your passwords, and be cautious of phishing attempts and suspicious links. Keep your wallet and private keys secure, and consider using a hardware wallet for added security.

8. Stay Informed: Stay up to date with the latest developments and news in the cryptocurrency space. Follow reputable cryptocurrency news sources, join online forums or communities to engage with other enthusiasts, and consider subscribing to newsletters or podcasts to expand your knowledge.

9. Diversify Your Portfolio: Avoid putting all your eggs in one basket by diversifying your cryptocurrency portfolio. Explore different cryptocurrencies and allocate your investments across multiple coins to reduce risk. Conduct thorough research and consider factors like market capitalization, past performance, and the technology behind each cryptocurrency.

10. Be Mindful of Taxes: Cryptocurrency taxation laws vary by jurisdiction, and it’s essential to understand your tax obligations regarding crypto investments. Consult with a tax professional or research the tax laws applicable to your country to ensure compliance and avoid any legal issues.

Remember that investing in cryptocurrency carries risks, and it’s crucial to make informed decisions based on thorough research and understanding. Start with caution and gradually expand your knowledge and investment as you become more comfortable in the cryptocurrency space.

Now that you have the necessary steps to get started, you’ll be well on your way to exploring and engaging with the exciting world of cryptocurrency.

Common Cryptocurrency Terminology

As you venture into the world of cryptocurrency, you’ll encounter various technical terms and jargon. Familiarizing yourself with these common cryptocurrency terminology will help you better understand the concepts and discussions surrounding cryptocurrencies. Here are some essential terms to get you started:

1. Blockchain: A decentralized ledger that records and verifies transactions across multiple computers or nodes. It is the underlying technology behind cryptocurrencies.

2. Cryptocurrency: A digital or virtual form of currency that utilizes cryptography for secure transactions and operates independently of central authorities.

3. Wallet: A software application or a physical device used to store and manage cryptocurrencies. It contains the public and private keys necessary to access and authenticate transactions.

4. Public Key/Private Key: A pair of cryptographic keys used in asymmetric encryption. The public key is shared with others to receive funds, while the private key is kept secret and is used to sign transactions and gain access to the funds.

5. Mining: The process of validating and verifying transactions on a blockchain network. Miners solve complex mathematical puzzles to add new blocks to the blockchain and are rewarded with newly minted cryptocurrency units.

6. ICO (Initial Coin Offering): A fundraising method used by cryptocurrency projects to raise capital. It involves selling a portion of the project’s native tokens or coins to investors in exchange for funding.

7. Altcoin: Any cryptocurrency other than Bitcoin. Altcoin stands for “alternative coin.”

8. Fork: A split or divergence in the blockchain network, resulting in two separate and independent chains. Forks can be hard forks (permanent divergence) or soft forks (temporary divergence).

9. Smart Contracts: Self-executing contracts with the terms of the agreement directly written into lines of code. They automatically execute predefined actions when specified conditions are met.

10. Exchange: An online platform where users can buy, sell, and trade cryptocurrencies with other users. Examples include Coinbase, Binance, and Kraken.

11. FOMO (Fear of Missing Out): The feeling of anxiety or apprehension that one may miss out on a potentially profitable opportunity in the cryptocurrency market.

12. Whale: A term used to describe individuals or entities that hold a significant amount of a particular cryptocurrency. Whales have the potential to influence the market due to their large holdings.

13. HODL: A slang term derived from a misspelling of “hold.” It refers to the act of holding onto cryptocurrencies for the long term, regardless of short-term market fluctuations.

14. Pump and Dump: A manipulative tactic involving artificially inflating the price of a cryptocurrency and then selling it off quickly to make a profit, causing smaller investors to suffer losses.

15. Market Cap: Short for market capitalization, it represents the total value of a cryptocurrency. It is calculated by multiplying the current price of a coin by its circulating supply.

These are just a few common cryptocurrency terms to help you navigate the terminology-rich world of cryptocurrencies. As you delve deeper into your cryptocurrency journey, you will undoubtedly encounter more specialized terms and concepts. Continuously learning and staying informed will empower you to make informed decisions and engage in meaningful discussions within the cryptocurrency community.

Conclusion

Cryptocurrency is revolutionizing the way we think about money and financial transactions. With its decentralized nature, enhanced security features, and global accessibility, cryptocurrency offers numerous benefits for individuals and businesses alike. The underlying technology of blockchain provides transparency, immutability, and efficiency, enabling secure and efficient peer-to-peer transactions.

Throughout this article, we have explored the concept of cryptocurrency, its workings, and the various types of cryptocurrencies available. We have discussed the benefits of using cryptocurrency, such as decentralization, security, and lower transaction fees. However, it is crucial to be aware of the risks and challenges associated with cryptocurrency, including price volatility, regulatory uncertainty, and security vulnerabilities.

To get started with cryptocurrency, education is key. It is important to understand the basic concepts, familiarize yourself with common cryptocurrency terminology, and stay informed about the latest developments in the industry. Taking steps such as choosing a secure wallet, selecting a reputable exchange, and practicing good security measures will help you navigate the world of cryptocurrency confidently.

The cryptocurrency industry is continuously evolving and showing immense potential for innovation and disruption. As more businesses and individuals recognize the benefits, cryptocurrencies are becoming increasingly integrated into our daily lives. However, it’s important to approach cryptocurrency investments and transactions with caution and make informed decisions based on thorough research and understanding.

With the right knowledge and diligent approach, you can explore the exciting possibilities and opportunities that cryptocurrencies offer. Whether you choose to invest, use cryptocurrencies for transactions, or participate in the broader blockchain ecosystem, continuously expanding your knowledge and staying updated with developments will empower you to fully harness the power of cryptocurrency.

Crypto

Kevin O’Leary Explains Which Cryptocurrency Is a Smarter Bet: Bitcoin or Ethereum

The cryptocurrency market offers hundreds of different investment options, but two of them control most of the action: bitcoin and ethereum. As recently as last year, the combined market cap of both platforms made up more than 70% of the global crypto market, according to U.S. News & World Report.

Advertisement: High Yield Savings Offers

Powered by Money.com – Yahoo may earn commission from the links above.

Read Next: 13 Cheap Cryptocurrencies With the Highest Potential Upside for You

Check Out: 5 Types of Cars Retirees Should Stay Away From Buying

So which is a better bet for investors? During a recent interview with CoinDesk, businessman and “Shark Tank” star Kevin O’Leary suggested his preference.

Also see five reasons you need at least one bitcoin.

O’Leary shared during the interview that his preference is bitcoin. “If you want exposure to crypto volatility, it’s bitcoin,” O’Leary said. “There’s a lot of people that say, ‘I don’t need anything else … I’ll just buy bitcoin.’ And they haven’t been wrong … I think it’ll be very hard to dethrone it.”

As for ethereum, O’Leary spent much of his time bemoaning its lack of speed and efficiency.

“Goodness, ETH is slow,” he said. “I’m sorry, but it’s slow, and I think a lot of people know that. And the more transactions get piled on it, it doesn’t get any better.”

Learn More: Coinbase Fees: Full Breakdown of How To Minimize Costs

O’Leary has plenty of company in backing bitcoin over ethereum.

Part of bitcoin’s allure is that it has become a dominant crypto force in both size and name recognition. It has grown so big that it recently leapfrogged Google parent Alphabet to rank as world’s sixth-largest asset by market cap, The Market Periodical reported.

From a pure investment standpoint, bitcoin has definitely been the better bet recently. Its price is up about 12% in 2025 as of June 13 and has gained about 56% over the past year. In contrast, ethereum’s price is down about 23% in 2025 and has lost more than 27% over the past year.

If you’re new to crypto, it’s important to understand the differences between bitcoin and ethereum, because it’s not an apples-to-apples comparison.

As U.S. News reported, bitcoin’s network uses a proof-of-work verification system. Ethereum, on the other hand, uses a proof-of-stake system, which U.S. News called “less energy-intensive.” Additionally, the main purpose of bitcoin is to serve as a digital currency that’s an alternative to other currencies, while ethereum is a platform that runs smart contracts, U.S. News explained.

According to VanEck, a New York-based investment management firm, both bitcoin and ethereum have seen their prices fluctuate significantly over the years. Despite that, VanEck noted that bitcoin has been the outperformer, remaining more stable than ethereum.

Crypto

Alchemy Pay Partners With Backed to Integrate xStocks on Its Platform, Pioneering the First Direct Fiat Access to Tokenized Stocks and ETFs – Branded Spotlight Bitcoin News

Crypto

DN Miner Introduces Free Cloud Mining Access to Promote Broader Cryptocurrency Participation

New UK-based program allows first-time users to begin regulated Bitcoin mining with no upfront costs or hardware requirements

LONDON, June 11, 2025 (GLOBE NEWSWIRE) — DN Miner, a FCA regulated crypto platform, has announced a new initiative that offers free cloud mining access to newly registered users. The program is designed to provide a hands-on introduction to Bitcoin mining without the technical barriers traditionally associated with the process.

By offering complimentary starting balances upon account creation, DN Miner allows individuals to engage in short-term cloud mining contracts using its hosted mining infrastructure. This setup enables users to observe and understand how cryptocurrency mining functions in practice—without investing in specialized equipment or software.

Available mining contracts vary in duration and estimated yield, giving users the ability to select options aligned with their comfort level and goals. Once minimum balance thresholds are reached, users can request withdrawals through multiple supported channels. In an effort to maintain simplicity.

Mining Contract Options:

| Contract Term | Contract Price | Daily Reward | Total Reward(Principal Returned) | Daily Return Rate | ||

| 1 day | $350 | $10.5 | $350+$10.5 | 3.0% | ||

| 3 day | $500 | $16 | $500 + $48 | 3.2% | ||

| 4 days | $1000 | $35 | $1000 + $140 | 3.5% | ||

| 5 days | $3000 | $114 | $3000 + $570 | 3.8% | ||

| 2 days | $12000 | $576 | $12000+$1152 | 4.8% | ||

The company notes that while the platform is accessible to beginners, the underlying activity of mining remains subject to market-driven volatility. Factors such as network difficulty, asset valuation, and mining congestion can influence daily returns. DN Miner encourages users to consider these variables when evaluating their participation in digital asset operations.

DN Miner operates under regulatory supervision by the UK’s Financial Conduct Authority (FCA). This oversight ensures that the platform maintains a high standard of transparency, user data security, and legal compliance. All mining infrastructure is hosted in certified data centers that use industrial-grade ASIC equipment to support consistent uptime and competitive performance across supported cryptocurrencies.

About DN Miner

DN Miner is a UK-regulated digital asset platform providing cloud-based access to cryptocurrency mining. Through remote infrastructure hosted in secure data centers, DN Miner enables users to participate in digital asset production without the need for hardware ownership or software management. The platform prioritizes regulatory compliance, operational transparency, and user education in all of its offerings.

Media Contact:

Darlene Evan

info@dnminer.com

+4407787938609

https://dnminer.com/

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e42f006e-7ab6-4512-aae9-5efcf195d024

Image by DN Miner

Image by DN Miner

-

West7 days ago

West7 days agoBattle over Space Command HQ location heats up as lawmakers press new Air Force secretary

-

Technology1 week ago

Technology1 week agoiFixit says the Switch 2 is even harder to repair than the original

-

World1 week ago

World1 week agoEU-Ukraine trade reset: What comes after tariff-free access expires?

-

Technology1 week ago

Technology1 week agoThe single best wireless controller I’ve ever used

-

Politics1 week ago

Politics1 week agoHawley clashes with UPenn law professor over judicial injunctions

-

Business1 week ago

Business1 week agoHow Hard It Is to Make Trade Deals

-

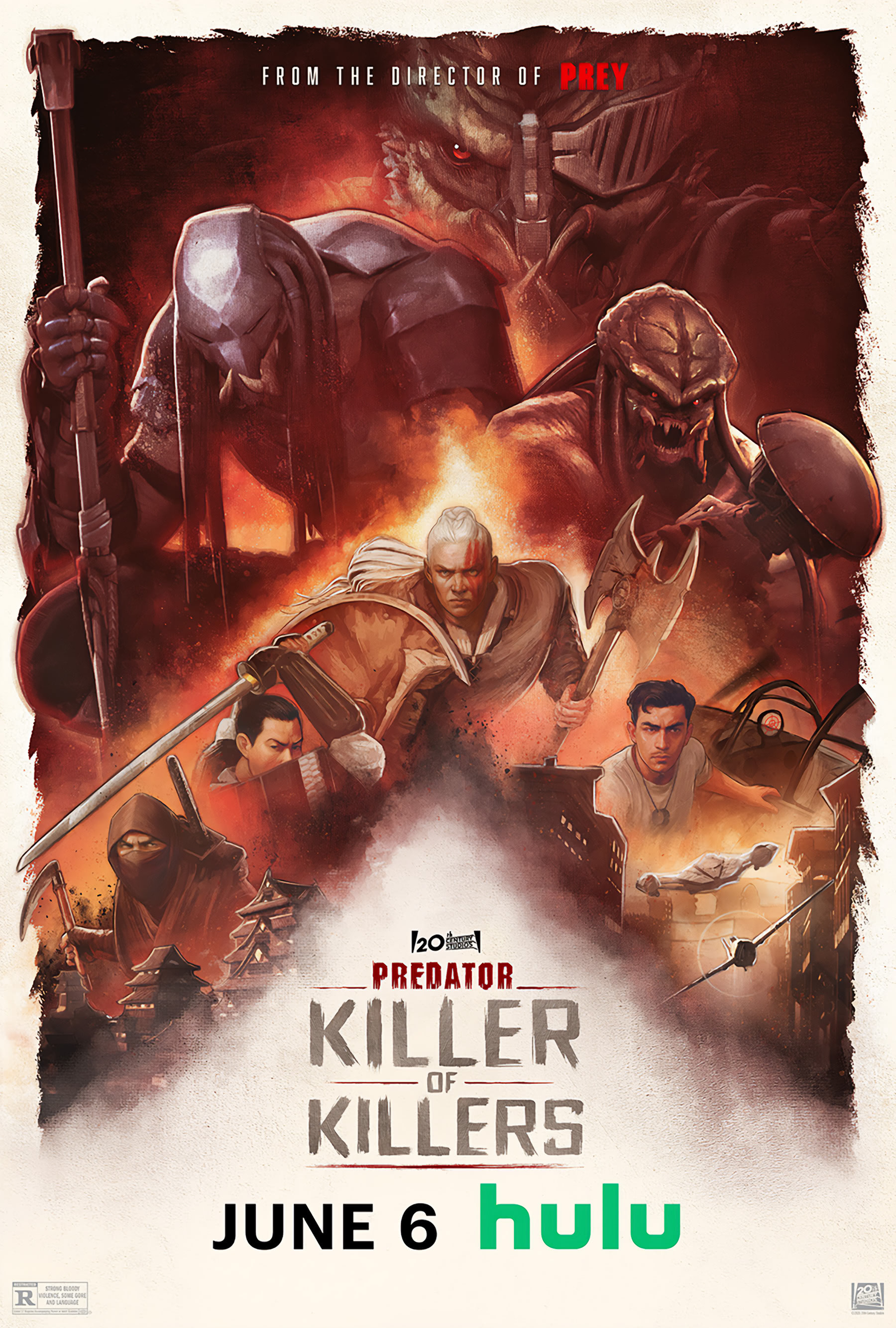

Movie Reviews1 week ago

Movie Reviews1 week agoPredator: Killer of Killers (2025) Movie Review | FlickDirect

-

News1 week ago

News1 week agoTrump’s Higher Steel Tariffs Sour Mood at Deal-Making Table