Business

Column: Should we raise unemployment to fight inflation? No, we need to protect jobs no matter what

If financial historical past teaches us something, it’s that when occasions get powerful, working women and men get targets painted on their again.

Present occasions give us an ideal illustration. The U.S. is at or near full employment with an unemployment charge of a traditionally low 3.6%, however inflation has been rising. So the argument that the treatment to increased costs is increased joblessness is being heard an increasing number of usually.

Essentially the most distilled iteration of this argument comes from former Treasury Secretary Lawrence Summers, who put it this manner in a June 20 speech in London, as reported by Bloomberg:

Labor prices are dampening—not amplifying—worth pressures.

— Josh Bivens, Financial Coverage Institute

“We’d like 5 years of unemployment above 5% to include inflation — in different phrases, we want two years of seven.5% unemployment or 5 years of 6% unemployment or one 12 months of 10% unemployment.”

Summers referred to as these “numbers which might be remarkably discouraging relative to the Fed Reserve view,” which is that instruments within the Fed’s arsenal similar to a rise in short-term rates of interest may be sufficient to stage a “mushy touchdown” for the economic system — a discount in inflation with out scary a recession.

Translating Summers’ statistics into exhausting figures is a bit difficult, as a result of the unemployment charge doesn’t solely measure the variety of individuals unemployed. The unemployment charge of three.6% in Might was the bottom for the reason that late Nineteen Sixties.

However in June 2013, the final pre-pandemic month when the unemployment charge was 7.5%, some 11.8 million People had been unemployed, 5.8 million greater than final month, in keeping with the Bureau of Labor Statistics. About 144 million had been working, in contrast with 158.4 million final month.

So Summers is speaking about 5.8 million to fifteen million People decreased to joblessness with a purpose to carry down inflation.

Summers’ phrases have been broadly quoted not simply due to his place as a former Obama appointee, however as a result of he warned that fiscal insurance policies early within the Biden administration would ignite increased inflation.

He seems to have been prescient then, it’s felt, so maybe he’s right now. (Whether or not Summers was proper or incorrect or maybe proper for the incorrect causes is a subject of debate in the economist community.)

But there are important flaws within the specific equating of upper employment with increased inflation.

Summers himself, throughout an look in Might at Northwestern College, cautioned in opposition to overconfident generalizations in regards to the economic system.

Requested, “Do we have to get out of the new labor market utterly with a purpose to carry inflation down?” he replied, “One of many issues that I’ve realized over time is it’s greatest to assume by way of what’s most definitely and what appears possible to you. All absolute statements about this stuff are silly.”

A low unemployment charge correlates roughly with excessive inflation — and excessive unemployment with low inflation — however imperfectly.

(Created with Datawrapper)

The unemployment charge settled between 4.7% and three.9% from 1997 by way of 2000, whereas inflation ran between just one.6% and three.4%. In 1974, unemployment rose to 7.2%, but inflation hit 12.3%. In 1978-1980 unemployment soared from 6% to 7.2%, whereas inflation rose as excessive as 13.3%.

These had been the “stagflation” years, delivered to an finish by the bitter drugs of rates of interest increased than 20% delivered by then-Fed Chairman Paul Volcker.

Over the past decade, as unemployment drifted down from 9.3% in 2010 to three.9% in 2018, inflation remained properly underneath management, falling as little as 0.7% in 2015.

It’s true that components aside from employment and wage beneficial properties affected costs throughout all these intervals, however that merely underscores the number of pressures that drive costs increased or decrease.

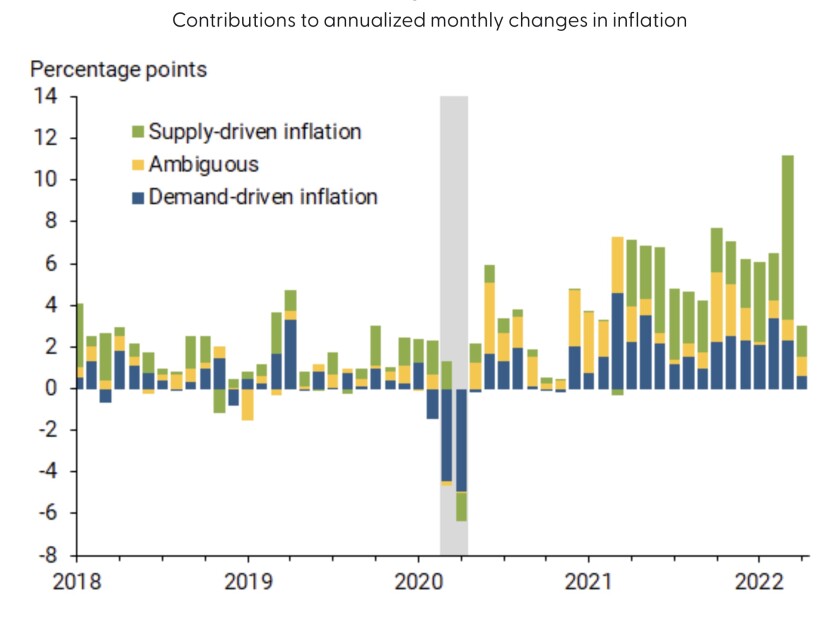

At this time’s inflation, because it occurs, seems to derive much less from extreme demand from customers, as can be a mirrored image of full employment and its consequent upward strain on wages, than from supply-chain blockages similar to shortages of uncooked supplies and merchandise. In economists’ jargon, it’s extra “cost-push” than “demand-pull” inflation.

Certainly, in an financial evaluation printed Tuesday, Adam Hale Shapiro of the Federal Reserve Financial institution of San Francisco demonstrated that provide constraints, together with “labor shortages, manufacturing constraints, and transport delays,” in addition to the warfare in Ukraine, account for greater than half of the current run-up in inflation, and better demand just for about one-third.

Labor economists additionally query the narrative that increased wages are driving inflation, and consequently that bringing wages down by way of increased unemployment is sensible as a coverage method. Historically, wages develop about 1% a 12 months sooner than shopper costs — that’s an artifact of bettering requirements of dwelling over time.

Within the final 12 months, nonetheless, “nominal wage progress…has lagged far behind inflation,” Josh Bivens, analysis director on the labor-supported Financial Coverage Institute, wrote final month. Which means “labor prices are dampening — not amplifying — worth pressures.”

Certainly, the Bureau of Labor Statistics in its most up-to-date report said that hourly earnings rose by 5.2% for all workers, and by 6.5% for manufacturing and nonsupervisory workers, throughout the 12 months resulted in Might. Over the identical interval, the buyer worth index rose by 8.6%, with the biggest contribution coming from vitality prices, together with gasoline and gasoline oil costs.

“Briefly, nonwage components are clearly the primary drivers of inflation,” Bivens noticed. Taking steps to quell inflation by rolling again employment would trigger pointless hardship for thousands and thousands, with little achieve to indicate for it.

Utilizing job losses to handle inflation is arises from what economists know because the Sacrifice Ratio — ostensibly the connection between unemployment and inflation.

Tight provides are contributing probably the most to inflation, implying that driving up unemployment gained’t assist a lot to carry inflation down.

(Federal Reserve Board)

By the reckoning of former Obama financial advisor Jason Furman, in current many years the ratio has been 6 share factors — a 6% rise in unemployment over a 12 months tends to carry down inflation by a single share level, as would two years of three% will increase, and so on., and so on.

Summers’ calculation of the connection was considerably looser, although each bit as mechanistic as one would anticipate an economist’s instrument to be.

Amongst different points, it locations your complete burden of decreasing inflation on unemployment, although inflation is a multi-factoral phenomenon. It additionally treats the connection between unemployment and inflation as an nearly immutable fixed.

This method harks again to pre-Melancholy coverage, when working women and men had been considered simply one other financial enter and downturns had been valued as needed drugs to protect the monetary wellbeing of the bondholding class.

It was the period when the prescription for an financial downturn provided by Treasury Secretary Andrew Mellon, one of many richest males in America, was “liquidate labor, liquidate shares, liquidate the farmers, liquidate actual property,” as Herbert Hoover described Mellon’s argument in his personal memoirs.

Mellon held, as Hoover recounted, “that even a panic [that is, a depression] was not altogether a foul factor. He stated: ‘It is going to purge the rottenness out of the system. Excessive prices of dwelling and excessive dwelling will come down. Individuals will work tougher, reside a extra ethical life. Values will probably be adjusted, and enterprising individuals will choose up the wrecks from much less competent individuals.’”

(Hoover, to his credit score, was appalled by the “untold quantity of struggling” that Mellon’s method would possibly trigger.)

Indicators are starting to emerge, if slowly, that the components pushing costs increased since late final 12 months are starting to ease. Crude oil costs on the New York Mercantile Trade fell throughout Thursday’s buying and selling to under $104 per barrel, down from their March 8 peak of $123.70; gasoline costs have begun to observe go well with, albeit not on the identical tempo.

Housing begins have slipped and wage beneficial properties have moderated. Retailers have reported slower gross sales and a few, caught with extra inventories of merchandise, have signaled that beneficiant reductions are within the wings.

Federal Reserve Chairman Jerome Powell, who has grow to be the face of the Fed’s coverage of elevating rates of interest sharply to chill the economic system, has hinted {that a} second sharp rate of interest improve of three-quarters of the share level could or is probably not needed subsequent month.

That view was echoed by Patrick Harker, president of the Federal Reserve Financial institution of Philadelphia, who stated Wednesday that indicators of moderation could warrant a smaller interest-rate enhance in July and that circumstances that can information the Fed’s insurance policies in September and past are even murkier.

“Let’s see how the info seems within the subsequent few weeks,” Harker informed Yahoo Finance.

Historical past, in brief, counsels warning in making use of cures for inflation. The restricted instruments obtainable to the Federal Reserve are particularly feeble when costs are pushed by the exterior components at work at this time.

“Inflation is like an sickness,” Sen. Elizabeth Warren (D-Mass.) lectured Powell throughout his look Wednesday earlier than the Senate Banking Committee, “and drugs must be tailor-made to the precise drawback.”

Below Warren’s questioning, Powell acknowledged that the Fed’s rate of interest improve would do nothing to carry gasoline or meals costs down. As Warren noticed, nonetheless, “charge will increase make it extra doubtless that firms will fireplace individuals and slash hours to shrink wage prices.”

That’s doesn’t essentially imply that the Fed ought to judiciously use the powers it has been granted to struggle inflation. Nevertheless it does imply that putting the livelihoods of working women and men in danger, as if they’re the individuals chargeable for inflation, is precisely the incorrect method.