California

California’s First Codes – California Globe

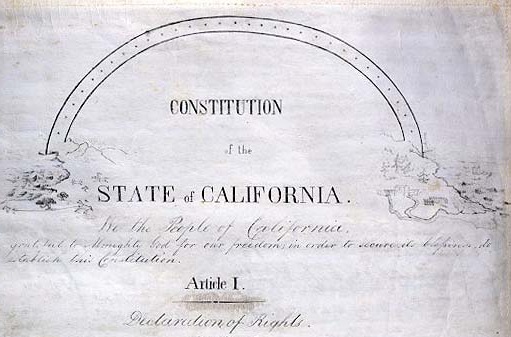

California’s first structure was adopted in 1849 after the Constitutional Conference of 1849. That first state structure was really printed in each English and Spanish. Thereafter, a second constitutional conference was held in 1878-79 and resulted in California’s second structure, which was adopted in 1879. That second structure stays in place at the moment.

Throughout the 1872 Session of the California Legislature, there have been 4 unique codes that had been adopted and which contained state statutes. The truth is, at the moment’s Civil Code comprises a number of provisions below the heading, “Impact of the 1872 Codes.” This heading was added in 1951 by Chapter 655. The unique 4 codes from 1872 had been: the Political Code (which now not exists), Civil Code, Code of Civil Process, and Penal Code.

Immediately, there are 29 codes that include all of the state’s statutes. These 29 codes are the next: Enterprise and Professions Code – Civil Code – Code of Civil Process – Business Code – Firms Code – Training Code – Elections Code – Proof Code – Household Code –

Monetary Code – Fish and Recreation Code – Meals and Agricultural Code – Authorities Code –

Harbors and Navigation Code – Well being and Security Code – Insurance coverage Code – Labor Code –

Navy and Veterans Code – Penal Code – Probate Code – Public Contract Code – Public Assets Code – Public Utilities Code – Income and Taxation Code – Streets and Highways Code – Unemployment Insurance coverage Code – Automobile Code – Water Code – Welfare and Establishments Code –

California

Tesla layoffs draw suit claiming not enough warning for California workers

By Robert Burnson

Tesla Inc. was sued by a former employee who claims the company’s decision to lay off about 10% of its workforce in a global retrenchment violated the law by failing to provide required advance notice.

Tesla “acted intentionally and with deliberate indifference and conscious disregard to the rights of its employees” by not giving a warning 60 days ahead as mandated by California law, according to the complaint filed in state court in San Jose.

Is Musk controversy responsible for Tesla’s struggles?

Tesla Chief Executive Officer Elon Musk revealed the job cuts last week in an email to staff, citing duplication of roles and the need to reduce costs. It was projected that if the dismissals apply company-wide, they would amount to more than 14,000 employees.

The electric-car maker faced similar claims when it laid off more than 500 employees at its battery factory near Reno, Nevada, in 2022. The company won a ruling that pushed the dispute out of federal court in Austin, Texas, and into arbitration.

California

Opinion: California must lead way in slashing methane emissions from landfills

Most Americans are unaware that reducing methane emissions is the single most impactful action we can take right now to slow global warming.

This super-pollutant’s ability to trap heat and warm the planet is about 80 times greater than carbon dioxide. When people think of methane, it’s often of belching cows or leaking pipes, but our trash piling up in landfills is actually the third largest source of human-caused methane pollution in the United States.

The California Air Resources Board (CARB) set the standard for regulating methane emissions from landfills. Now, thanks to huge advances in technology and ever-evolving research and data, we can see just how prevalent and damaging methane emissions continue to be.

The good news is that CARB can use this new information to do what it has always done best — take action and lead the nation in finding, capturing and controlling dangerous pollution.

Today, California ranks second in the nation for methane emissions from municipal solid waste landfills, with estimated emissions equivalent to the carbon dioxide emitted from 5 million cars driven for a year. Three hundred landfills are responsible for a disproportionate amount of the state’s overall methane emissions caused by buried food scraps and other organic waste that steadily decompose under mountains of trash.

And the latest research — led by the non-profit Carbon Mapper — reveals that landfills are sending methane into the air at a rate that’s 40% higher than previously estimated, with concentrated plumes persisting for months or even years in landfills across California. These invisible emissions represent an untapped opportunity to address climate change and help California meet its recent commitment to slash methane pollution 40% by 2030 compared to 2013 levels.

Tamping down on methane pollution also protects California communities from the other toxic pollutants spewed by landfills. Emissions like volatile organic compounds worsen respiratory illnesses and a myriad of health impacts for people living in the shadow of these facilities. Residents near the notorious Chiquita Canyon Landfill have spent years suffering from symptoms like dizziness, headaches, nausea and worse.

Achieving California’s statewide target of diverting 75% of its organic waste from landfills is critical. Millions of Californians have embraced this goal and diverted green waste to recycling centers for composting. But the existing garbage in our landfills must still be dealt with for decades to come.

One straightforward solution is for CARB to quickly update its regulations to require stronger landfill management practices that include not only aerial surveys like those used to conduct Carbon Mapper’s study, but also ground sensors, drones and satellites that can provide an accurate picture of methane emissions.

Other readily available, common-sense requirements to prevent leaks include using more protective material for landfill cover, taking steps to reduce downtime for gas collection systems, and setting more stringent methane emissions levels. None of these practices require moonshot technology or break the bank, and every one of them can be implemented with relative ease. Most importantly, they put an emergency brake on global warming at a time when it’s urgently needed.

California has always embraced technology to lead the nation on tackling our toughest environmental and public health challenges. Now, CARB has the opportunity to once again set the national standard for proven solutions to protect communities, stop pollution and slow global warming.

Gina McCarthy is the former administrator of the U.S. Environmental Protection Agency and served as the first White House National Climate Adviser. She is the managing co-chair of climate action coalition America Is All In.

California

Cannabis businesses owe California $732 million in taxes

California’s cannabis is deep in the red, but unfortunately for the state, most of those debtors are already out of business.

That’s according to a new report from Greenwave Advisors that determined that the state of California is owed approximately $732 million in cannabis sales & use, excise, and cultivation taxes, but about 72% of the companies that owe simply don’t exist anymore.

Greenwave said it reached that conclusion by analyzing data on delinquent taxes provided by the California Department of Tax and Fee Administration. In addition to the uncollected taxes, the CDTFA said it also assessed $173 million in taxes on unlicensed sales, which Greenwave says translates to $1.2 billion in sales through unlicensed channels, or a quarter of the total market.

California reported $4.4 billion in sales in 2023, a 16% increase over 2022’s $3.8 billion.

Distributors also likely owe the state $1.2 billion in taxes, which Greenwave said is higher than its previous estimate of $1 billion.

In September, one of California’s largest distributors Herbl went out of business. At the time Green Market Report wrote that vendors complained about not getting paid by the distributor, which in turn was allegedly being stiffed by strapped dispensaries after taking inventory. Herbl filed several collections claims in the Los Angeles County Superior Court against operators.

Greenwave surmises that if the distributors aren’t getting paid, then the taxes likely won’t get paid either.

High and higher taxes

According to Cova Software, “Between California’s excise tax, regular sales tax, and local business tax, adult-use customers are paying anywhere between 28% and 40% cannabis retail taxes on every purchase.”

The main excise tax of 15% is set to increase to 19% in 2025. It isn’t hard to imagine that if companies can’t pay the taxes they have now, increasing them will only amplify the problem.

Tax man cometh

If companies don’t pay the tax bill and the accompanying 50% penalty for late or missed payments, their properties can be seized. But the results of those actions often fall far short of the actual debt.

For example, the CDTFA held an auction in February to sell property seized from 10 cannabis businesses in Los Angeles. The department noted on its website that the items were seized as a result of search warrants served to collect taxes owed by 10 cannabis businesses. Nine were illegal businesses, and one was a legal dispensary with unpaid taxes.

That auction generated only $2,075 against the unpaid $14.4 million in taxes.

In April, the state announced it had also seized products from the Kush Spot and Verlton Glaspie, which does business as Whittiers Cure Cannabis Dispensary, for unpaid taxes.

“Seizing and auctioning property from cannabis businesses that evade the law is a tool to recover the taxes owed to the state,” said CDTFA Director Nick Maduros.

-

News1 week ago

News1 week agoCross-Tabs: April 2024 Times/Siena Poll of Registered Voters Nationwide

-

News1 week ago

News1 week agoCross-Tabs: April 2024 Times/Siena Poll of the Likely Electorate

-

Politics1 week ago

Politics1 week agoNine questions about the Trump trial, answered

-

World6 days ago

World6 days agoIf not Ursula, then who? Seven in the wings for Commission top job

-

World1 week ago

World1 week agoHungary won't rule out using veto during EU Council presidency

-

World7 days ago

World7 days agoCroatians vote in election pitting the PM against the country’s president

-

Movie Reviews7 days ago

Movie Reviews7 days agoFilm Review: Season of Terror (1969) by Koji Wakamatsu

-

World1 week ago

World1 week agoGroup of EU states should recognise Palestine together, Michel says