Technology

What to Do If You Can’t Pay Your Income Taxes

What involves thoughts first whenever you’re able to file your revenue taxes and see a quantity within the Quantity You Owe discipline that’s bigger than your checking account stability?

Two teams of taxpayers are the more than likely to owe cash to the IRS on tax day (April 18 in 2023): self-employed people who didn’t make estimated tax funds (or didn’t pay sufficient), and W-2 workers who didn’t have sufficient withheld from their paychecks. Each issues may be fastened for the next 12 months, however what do you do when you’ll be able to’t pay your tax invoice by the April deadline?

As soon as the preliminary shock wears off, you may attempt to safe a mortgage from household or buddies. An alternative choice, although it’s not an ideal selection in as of late of rising rates of interest, is to place it on a bank card. You may also apply for a mortgage.

Or, you’ll be able to ask the IRS for assist. The company has a number of applications in place to assist taxpayers fulfill their obligations, although chances are you’ll find yourself having to pay further charges, penalties, and curiosity.

We’re right here to interrupt all of those eventualities down for you.

The Finest On-line Tax Software program We have Examined

The place Can You Get a Mortgage to Pay Your Taxes?

In case your family don’t come by and also you wish to both pay on time or file an extension with a cost and you left your self a while to attempt to purchase a mortgage, there are a number of locations you’ll be able to look.

Bankrate.com(Opens in a brand new window) has been round since 1976 when it was a print publication referred to as Financial institution Charge Monitor. It’s an ideal useful resource for evaluating charges for monetary merchandise like bank cards, CD charges, dwelling fairness loans, and private loans. The location additionally presents associated editorial content material, critiques, and monetary calculators.

Lendio(Opens in a brand new window) is geared towards small enterprise wants and has a community of greater than 75 lenders. The service claims you’ll be able to full your software in roughly quarter-hour and get funding in as little as 24 hours.

QuickBridge(Opens in a brand new window), too, presents quick loans, nevertheless it says funding happens in a matter of days. Software solely requires a driver’s license and financial institution assertion.

OnDeck(Opens in a brand new window) presents attainable same-day funding in some states on loans of as much as $100,000. It presents two choices: time period loans and contours of credit score.

Fundbox(Opens in a brand new window) presents small companies a revolving line of credit score that may be accredited in as little as three minutes. Funds could also be accessible as quickly as the subsequent day if accredited.

What Cost Plan Choices Does the IRS Have for Taxes?

Getting a mortgage from a monetary establishment could also be your finest option to preserve issues easy. Should you desire to not go that route, you’ll be able to apply for one of many two plans the IRS presents that assist you to pay over time.

Quick-Time period Cost Plan

The Quick-Time period Cost Plan is an possibility in the event you pays the quantity you owe in 180 days or much less. You continue to accrue penalties and curiosity (extra on that later) till the entire quantity is paid. You possibly can apply on-line in the event you owe lower than $100,000 in mixed tax, penalties, and curiosity. This plan is barely accessible to people, together with sole proprietors and impartial contractors.

Lengthy-Time period Cost Plan (Installment Settlement)

You possibly can apply on-line for the Lengthy-Time period Cost Plan (Installment Settlement) if you’re a person owing $50,000 or much less in mixed tax, penalties, and curiosity, or a enterprise that owes lower than $25,000.

You’ll discover extra particulars and hyperlinks to on-line software pages for each plans on the IRS’s on-line cost settlement web page(Opens in a brand new window). This IRS system is barely accessible throughout particular hours. Should you’re not eligible to use on-line, you should still be eligible to pay in installments by finishing Type 9465(Opens in a brand new window) and mailing it in. You can too apply by cellphone. People ought to name 800-829-1040. Companies can name 800-829-4933. You can too name the cellphone quantity in your invoice or discover.

Learn how to File for a Tax Extension and Make a Partial or Estimated Cost

Should you’ve secured funding for at the least a part of what you suppose you’ll owe however you gained’t have your return prepared in time, you’ll be able to ask the IRS for extra time by submitting an extension. You simply need to submit IRS Type 4868(Opens in a brand new window) by April 18, 2023. The hitch? The IRS nonetheless expects you to incorporate all or a part of what you suppose you’ll owe, so you continue to need to discover a funding supply. With the extension, you’ve got till October 16, 2023, to finish and submit your tax return. You possibly can print and mail the shape together with your cost or use private tax preparation software program.

You can too submit your cost electronically in 3 ways, which signifies you’re submitting for an extension. The primary is the IRS’s Direct Pay With Financial institution Account(Opens in a brand new window) service. Should you select this selection, you do not have to file Type 4868 and also you get a affirmation quantity. Second is the Digital Federal Tax Cost System(Opens in a brand new window), which additional safeguards any funds you make as a result of it requires three types of identification. Lastly, the IRS additionally makes use of third-party cost processors(Opens in a brand new window) for taxpayers who wish to put their cost on a debit or bank card or choose digital wallets like PayPal. This technique comes with further processing charges.

What Sort of Penalties Does the IRS Impose If You Don’t Pay Taxes?

There’s an extended checklist of penalties(Opens in a brand new window) the IRS can assess, relying on how the taxpayer has erred. The company sends out notices (letters) about them. Two you need to find out about are Failure to Pay and Failure to File.

Failure to Pay(Opens in a brand new window) is the much less critical of the 2. Should you file however don’t pay your taxes, you’ll pay a penalty calculated by the IRS primarily based on how lengthy your overdue taxes stay unpaid. You’ll be assessed 0.5% of the entire of your unpaid taxes for every month or partial month till the debt is paid. This penalty can’t exceed 25% of your complete unpaid taxes. There’s additionally a penalty if the IRS learns you owe greater than you claimed.

Failure to File(Opens in a brand new window) is a penalty with a a lot heftier high quality: 5% of your unpaid taxes each month or a part of a month your return is late. It, too, can’t exceed 25% of the entire of your unpaid taxes.

The IRS additionally prices curiosity(Opens in a brand new window) on penalties, because it does for underpayment of taxes, even in the event you file an extension.

Really useful by Our Editors

You could possibly have penalties decreased or eliminated in the event you “acted with affordable trigger and in good religion.” The Penalty Reduction for Affordable Trigger(Opens in a brand new window) program accepts or rejects taxpayers on a case-by-case foundation after contemplating all of the details introduced. Some examples of legitimate causes for not submitting or paying on time embrace:

-

Fires, different pure disasters, or civil disturbances

-

Severe sickness or demise

-

Lack of ability to acquire information

-

An digital submitting or cost that was delayed by system points

You possibly can apply for this aid over the cellphone by calling the quantity within the higher proper nook of your discover. Or you’ll be able to submit Type 843(Opens in a brand new window).

Can You Negotiate With the IRS on Taxes?

There is an possibility that permits you to pay lower than you owe. You possibly can request an Provide in Compromise(Opens in a brand new window) in the event you’re unable to pay your tax legal responsibility or if “doing so creates a monetary hardship.” The IRS usually approves requests whenever you make a proposal that’s the most the IRS might count on to gather from you inside an inexpensive time. The company suggests you discover all different prospects earlier than making an attempt an Provide in Compromise.

The IRS considers 4 issues earlier than deciding: your skill to pay, revenue, bills, and asset fairness. You might be eligible to use for this system in the event you:

-

Have filed the entire required tax returns and submitted all quarterly estimated funds

-

Usually are not within the strategy of declaring chapter

-

Filed a sound extension for the present 12 months (until you’re making use of for a unique 12 months)

-

Are an employer who has submitted tax deposits for the present quarter and the previous two quarters

You possibly can full the Provide In Compromise Pre-Qualifier right here(Opens in a brand new window). Extra data and the required types can be found right here(Opens in a brand new window). In case your provide is rejected, you’ll be able to enchantment the ruling(Opens in a brand new window).

What Occurs If You Merely Don’t Pay Your Taxes?

You in all probability already know the reply to this one. Should you do not pay your taxes, first you obtain notices about penalties and curiosity. Then chances are you’ll hear from a group company, and the IRS will ultimately begin to slap liens in your belongings. Should you don’t reply, the IRS will ultimately try to gather by seizing belongings like your paycheck, your Social Safety cost, your financial institution accounts, and your property.

One of the best answer, in fact, is to maintain up together with your taxes throughout the 12 months. Should you’re a W-2 worker and also you needed to pay a large chunk in your 2022 taxes, change your withholding. Should you’re self-employed and getting at the least a few of your revenue reported on 1099s, use a private finance software or small enterprise accounting web site to trace your revenue and bills all year long, so you’ll be able to estimate and pay your quarterly taxes.

Should you do begin getting notices from the IRS about funds due, talk promptly. There are many choices, and the company work with you so long as you present good religion efforts.

For extra tax protection, see 7 Methods to Begin Minimizing Subsequent Yr’s Taxes Now.

Like What You are Studying?

Join Suggestions & Methods e-newsletter for professional recommendation to get essentially the most out of your know-how.

This text might include promoting, offers, or affiliate hyperlinks. Subscribing to a e-newsletter signifies your consent to our Phrases of Use and Privateness Coverage. You might unsubscribe from the newsletters at any time.

Technology

BlizzCon 2024 has been canceled

/cdn.vox-cdn.com/uploads/chorus_asset/file/25418050/869916952.jpg)

Blizzard has announced it will not hold BlizzCon, the publisher’s annual fan convention, this year. “After careful consideration over the last year, we at Blizzard have made the decision not to hold BlizzCon in 2024,” Blizzard wrote on its website.

Instead of BlizzCon, Blizzard wrote that it would be holding other, smaller events throughout the year and mentioned participating in other trade shows, such as Gamescom. Additionally, 2024 marks the 30th anniversary of World of Warcraft, with Blizzard stating that it’s planning “multiple, global, in-person events” as well as sharing updates for WoW’s 10th expansion, The War Within, and Diablo IV’s first expansion, Vessel of Hatred.

Despite this year’s cancellation, Blizzard says the event will return in the future: “While we’re approaching this year differently and as we have explored different event formats in the past, rest assured that we are just as excited as ever to bring BlizzCon back in future years.”

The cancelation of BlizzCon 2024 comes as another notable video game event, E3, finally gave up the ghost last year and amidst a video game industry grappling with unprecedented layoffs and financial struggles. Earlier this year, Microsoft laid off 1,900 employees across Activision Blizzard and Xbox, one of the largest single video game industry layoff events of the last two years.

Technology

The AI camera stripping away privacy in the blink of an eye

It’s natural to be leery regarding the ways in which people may use artificial intelligence to cause problems for society in the near future. On a personal level, you may be concerned about a future where artificial intelligence takes your job or creates a Terminator that comes back in time to try to eliminate a younger you. (We admittedly might be overthinking that one.)

One fear regarding AI on a personal level that you should know about because it’s very much in the present is the creation of deepfake photos, including those that strip you of the most basic of privacy rights: the right to protect images of your body.

Two German artists recently created a camera called NUCA that uses AI to create deepfake photos of subjects by stripping away their clothing. The automated removal of the photo subject’s clothing occurs in close to real-time, speeding up the creepy factor exponentially.

CLICK TO GET KURT’S FREE CYBERGUY NEWSLETTER WITH SECURITY ALERTS, QUICK VIDEO TIPS, TECH REVIEWS AND EASY HOW-TO’S TO MAKE YOU SMARTER

Why would someone create an AI camera that removes clothing?

The two German artists, Mathias Vef and Benedikt Groß, decided to create the camera to show the implications of AI’s rapid advancements. The pair were trying to think of the worst possible uses of AI to affect someone’s privacy, and they realized that the technology needed to create a camera like NUCA was already possible.

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

The two artists hope that people will consider the dangers of continuing to develop AI technologies like this, which could eliminate the expectation of privacy. They hope it will spark debates about the direction of AI.

MORE: HOW SCAMMERS HAVE SUNK TO A NEW LOW WITH AN AI OBITUARY SCAM TARGETING THE GRIEVING

How does a camera that digitally strips away clothing work?

The German artists used 3D design and print software to create the lenses and the shell for controlling the camera. It then uses a smartphone on the inside of the shell that handles the image capture. NUCA passes the photo to the cloud for the application of AI that removes the subject’s clothing.

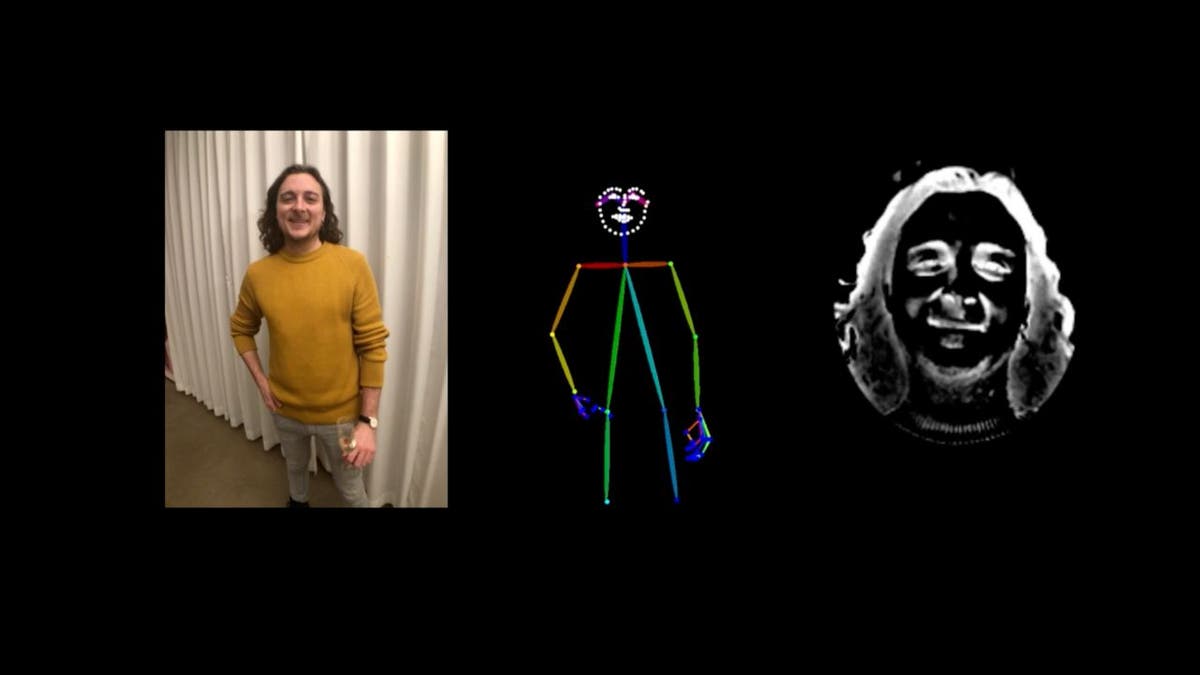

The result of NUCA camera using AI to strip away clothing. (NUCA)

Of course, NUCA is not actually creating a photo of your naked body. Instead, it analyzes your gender, face, age and other aspects of your body shape to develop a replication of what AI believes your naked body would look like.

Illustration of what NUCA camera analyzes to create image. (NUCA)

MORE: ARE AI DEEPFAKES THE END OF ACTING AS WE KNOW IT

Doesn’t deepfake nude photo technology already exist?

Deepfake nude photos, usually of celebrities, have been around for a long time on pornography websites, but the photos from NUCA require almost no technical know-how.

Even more frightening, NUCA is able to perform the process within about 10 seconds. The immediacy of the creation of the deepfake nude photo is what sets NUCA apart from other fake nude photos that typically require quite a bit of editing skill and time.

MORE: AI WORM EXPOSES SECURITY FLAWS IN AI TOOLS LIKE CHATGPT

NUCA’s deepfake dilemma: Artistic innovation or ethical Invasion?

Bottom line: Anyone could use the technology that’s found with NUCA to create a deepfake nude photo of almost anyone else within several seconds. NUCA doesn’t ask for permission to remove your clothing in the photo.

It’s worth emphasizing again that the two artists have no plans to allow others to use NUCA for commercial gain. They will showcase its capabilities in late June at an art exhibition in Berlin all in an effort to spark public debate.

However, the next people who develop a similar technology may choose to use it in a far different way, such as to potentially blackmail people by threatening to release these fake nude photos that other people won’t necessarily know are fake.

Kurt’s key takeaways

If it feels like AI is expanding wildly in dozens of different directions all at once, you aren’t all that far off. Some of those directions will be helpful for society, but others are downright terrifying. As deepfakes continue to look more and more realistic, the line between a fake digital world and reality will become increasingly difficult to discern. Guarding our privacy will almost certainly be more and more difficult as AI strips away our safeguards … and, potentially, even our clothing.

Are you concerned about AI-created deepfake photos and videos affecting you personally? What safeguards should exist around the use of AI? Let us know by writing us at Cyberguy.com/Contact

For more of my tech tips & security alerts, subscribe to my free CyberGuy Report Newsletter by heading to Cyberguy.com/Newsletter

Ask Kurt a question or let us know what stories you’d like us to cover.

Answers to the most-asked CyberGuy questions:

Copyright 2024 CyberGuy.com. All rights reserved.

Technology

The next big game from Clash of Clans developer Supercell launches in May

/cdn.vox-cdn.com/uploads/chorus_asset/file/25415594/Squad_Busters_key_art.jpg)

Supercell doesn’t release a lot of games, but the studio’s mobile releases tend to be big hits. Think Clash of Clans, Brawl Stars, and Clash Royale. Now, the developer is gearing up for its next major release: Squad Busters, which will be out globally on both Android and iOS on May 29th.

It’s a competitive multiplayer game, but one on a larger scale than a typical mobile release. In each match, 10 players compete to collect the most gems while building up a squad of computer-controlled characters. It’s sort of like a simplified MOBA: you move your team around fighting minions, earning cash that lets you improve and grow your squad before you eventually start fighting other players and going for the big gem pile in the middle of the map. It also has a bit of a Smash Bros. vibe, as the cast of characters are all pulled from popular Supercell games.

The studio is known for experimenting with different games and genres, and it’s also known for not moving forward with titles that it doesn’t think will become a Clash-level hit — which means the developer seems to have a lot of faith in Squad Busters, which is currently in soft launch in a number of territories, including Canada, Mexico, Spain, Denmark, Norway, Sweden, Finland, and Singapore.

“Our dream is to create great games that as many people as possible play for years and that are remembered forever,” Supercell CEO Ilkka Paananen said in a statement. “Huge credit to the Squad Busters team — it’s already apparent that the game has such high potential, making it our first company game launch since Brawl Stars in 2018.”

-

World1 week ago

World1 week agoIf not Ursula, then who? Seven in the wings for Commission top job

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: Season of Terror (1969) by Koji Wakamatsu

-

News1 week ago

News1 week agoGOP senators demand full trial in Mayorkas impeachment

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: The American Society of Magical Negroes

-

Movie Reviews1 week ago

Movie Reviews1 week agoShort Film Review: For the Damaged Right Eye (1968) by Toshio Matsumoto

-

World1 week ago

World1 week agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week ago'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

-

Politics1 week ago

Politics1 week agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial