Science

Column: Eli Lilly is slashing insulin prices, but hold your applause

Eli Lilly & Co. performed the altruism card like a champ on Mar. 1, when it introduced steep worth cuts on its insulin merchandise of as a lot as 70%.

The massive drug firm stated its motion was all about serving to diabetes sufferers, its purpose being to “assist Individuals who might have problem navigating a posh healthcare system which will preserve them from getting reasonably priced insulin.”

In line with Lilly Chairman and Chief Govt David Ricks, America’s healthcare system “nonetheless doesn’t present reasonably priced insulin for everybody, and that should change.”

Lilly goes to financial institution lots of goodwill for this, with out taking essentially a giant hit to their backside line.

— Andrew Mulcahy, Rand Company

Lilly basked in public reward after the announcement. President Biden noticed that Lilly’s cuts would power its two principal opponents, Novo Nordisk and Sanofi, to observe swimsuit.

If you happen to’re inclined to assume higher of Lilly for taking this dramatic step, right here’s our recommendation: Maintain your applause.

The reality is that Lilly’s worth cuts received’t price it a skinny dime in income; it might even gather larger income. Wall Avenue acknowledged that instantaneously: The value of Lilly shares rose on the day of the announcement and has continued to maneuver larger ever since, gaining practically 6% by Thursday’s buying and selling.

Furthermore, the value rollback nonetheless doesn’t carry Lilly insulin again to the place it must be on an inflation-adjusted foundation in contrast with the value of its key product, Humalog, upon its launch in 1996.

Again then, Humalog price $21 per vial, which might be about $40 in at the moment’s cash; the rollback will scale back the value of a vial from $274.70 to $66.40, in response to calculations by the Washington consulting agency Veda Companions. So it’s nonetheless larger by two-thirds than it must be, accounting for inflation.

One other issue driving Lilly’s announcement is the extraordinary public scrutiny on insulin’s inflated worth. The Inflation Discount Act handed final August together with a provision capping the out-of-pocket price of insulin for Medicare prescription drug enrollees at $35 a month. That profit has been extensively and loudly touted by President Biden as proof of his dedication to pro-consumer policy-making.

Consistent with that laws, one ingredient of Lilly’s price-cut announcement is a cap of $35 per 30 days on out-of-pocket expenses for insured prospects. As I’ve reported earlier than, these patient-assistance applications solely camouflage for customers the true prices of their prescriptions — insurers nonetheless pay the drugmakers’ excessive costs, which find yourself in larger premiums for everybody.

“Lilly goes to financial institution lots of goodwill for this, with out taking essentially a giant hit to their backside line,” says Andrew Mulcahy, senior researcher at Rand Corp. and lead writer of a 2020 Rand comparability of insulin costs within the U.S. and different nations.

That evaluation confirmed that U.S. insulin costs have been approach out of line with the remainder of the world: For instance, a benchmark unit price (in U.S. {dollars}) $6.94 in Australia, $12 in Canada and $7.52 in Britain —however practically $100 within the U.S. Even when Lilly’s worth cuts are adopted by its opponents, “U.S. costs are nonetheless larger than costs within the different nations,” Mulcahy instructed me, although by two to a few instances reasonably than by 10 instances.

Insulin’s excessive record worth has fueled efforts to create various sources. California Gov. Gavin Newsom final yr introduced a $100-million program to fabricate a state-branded low-cost insulin, probably by contracting with a generics agency; an announcement of particulars may come inside days. An identical effort is underway in Michigan.

Lilly’s worth cuts received’t do something to deal with the elemental dysfunction of America’s drug-pricing system, which bristles with rent-seeking entities — not simply drug producers, however pharmacy profit managers, or PBMs, middlemen who provide to barter decrease costs on behalf of well being insurers by extracting rebates however preserve a share of the purported financial savings for themselves.

Drugmakers and PBMs level their fingers at each other when excessive drug costs are challenged in lawsuits or congressional hearings. However there’s no query that the system creates incentives for top producer costs, as a result of these are obligatory to supply the headroom for rebates.

Certainly, in 2021 a Senate committee reported that Lilly executives have been reluctant to cut back costs on diabetes medication as a result of they feared PBMs would object: The lowered costs would cut back the charges the PBMs may cost their well being plan shoppers and scale back their capability to satisfy the rebate ensures that they had promised the shoppers.

The connection between drugmakers and PBMs is the difficulty in a lawsuit filed in Los Angeles state court docket by California Atty. Gen. Rob Bonta in January.

The lawsuit alleges that the three producers conspired with the three dominant PBMs, CVS Caremark, Categorical Scripts and OptumRx, to “artificially inflate” insulin costs nicely past the conventional inflation fee. Not one of the defendants has but responded to the allegations in court docket.

Because it occurs, diabetics aren’t even among the many drug customers most victimized by excessive costs within the U.S. That’s as a result of having three competing producers for what is basically a commodity drug results in massive rebates that stream by to insured sufferers a minimum of to some extent.

Rebates from record costs on insulin have averaged 70% to 80%, Mulcahy and his Rand colleagues reported in 2021. That’s not the case for most cancers medication, which may carry record costs of a whole bunch of 1000’s of {dollars} however have a tendency to not be rebated, or “disease- modifying anti-rheumatic medication” used to deal with autoimmune circumstances reminiscent of lupus, a number of sclerosis and Crohn’s illness, for which about one-third of record costs are rebated.

“Oncology is the clearest instance of medicine the place the reductions from record worth are slim to none,” Mulcahy says. That’s as a result of the motion of those medication could also be particularly focused, making it troublesome to shift a affected person from one drug to a different in quest of a cheaper price.

Almost 40 million Individuals endure from diabetes, a illness through which the physique both can’t produce insulin, the hormone wanted to manage blood sugar ranges, or can’t effectively use insulin. Some 7 million of them require every day injections of insulin.

Of these, in response to a research by Yale researchers printed final yr, 14% face “catastrophic” spending on insulin, outlined as 40% of their earnings past what they spend on meals and housing. Almost half have reported rationing their insulin provide due to its price. That’s a life-threatening technique.

They’re the victims of an infinite run-up in drugmakers’ insulin costs over the past 30 to 40 years. These costs fall into two classes: The record costs, which within the U.S. can at the moment run to greater than $200 per vial, and the out-of-pocket worth.

Every vial accommodates 1,000 doses, and the typical affected person can use two to 4 vials a month.

Few sufferers persistently pay the record worth, nevertheless. Most are charged solely a co-pay by their well being plan and even obtain insulin at no cost by Medicaid.

The excessive record worth principally harms sufferers who’ve to purchase insulin instantly, usually as a result of they’re uninsured or have high-deductible well being plans that don’t cowl all the prices. However even sufferers with good insurance coverage aren’t completely protected against the record worth, says Shaina Kasper, a diabetes sufferer who’s USA coverage supervisor for T1International, a world advocacy group for diabetics.

“Generally even folks with insurance coverage have to purchase it out of pocket,” she says. “You break a vial once you’re away on trip. You run out as a result of one thing occurs. A few weeks in the past, my canine sitter put a cargo that got here into the freezer, and all of it died. Having an possibility of with the ability to get a extra reasonably priced insulin goes to avoid wasting lives.”

Insulin has change into the “poster baby for runaway incentives for larger record costs,” as Mulcahy places it, for a number of causes.

These embrace the sheer scale of the run-up in costs, the huge markup over what it prices to supply — as little as $6 a vial — and the loopholes that insulin makers have exploited to protect their advertising rights for a product for which the patents would usually have expired a long time in the past.

One widespread approach is for producers to carry out new formulations or gadgets they declare signify vital medical enhancements. These enhancements are sometimes extra modest than the producers say, or is probably not appropriate for all customers.

Nonetheless, observes Robin Feldman, an skilled on pharmaceutical regulation on the College of California School of the Legislation, the modifications enable drugmakers to increase their advertising rights.

Sanofi, for instance, has filed 74 patent functions for its Lantus long-acting insulin drug, Feldman studies in an upcoming journal article; most have been filed after the drug got here available on the market in 2000 however have allowed Sanofi to increase its advertising rights by 2031.

Coming again to Lilly’s initiative, among the many firm’s incentives to announce its insulin worth cuts now could be Medicaid guidelines kicking in subsequent yr that penalize drugmakers for elevating costs quicker than inflation. The brand new guidelines may end in as a lot as $430 million in expenses to Lilly, by Veda’s estimates.

Due to the peculiarities of Medicaid pricing, Lilly’s reductions may end in its amassing greater than $85 million in new Medicaid revenues. Put these two elements collectively, and Lilly’s worth cuts will produce about $517 million in beneficial properties.

“Corporations act in their very own pursuits,” Feldman says. “This worth discount is not any exception. The corporate is managing to do nicely by doing good.”

Science

Opinion: The decline in American life expectancy harms more than our health

American life expectancy started dropping even before the pandemic. It’s a critical barometer of our nation’s health and a sign that all is not well in the U.S.

Much of the increase in preventable, premature death is attributable to drug overdose, which increased five-fold over the last couple decades. But this malaise is far broader, driven largely by growing chronic illness.

Rates of depression are reaching new highs. Obesity rates among adults have risen from 30% to 42% since the turn of the century, with severe obesity nearly doubling and driving up the risk of cardiovascular disease, diabetes and other serious health conditions. The return of vaccine-preventable illnesses has been a concern since the 2010s. Sexually transmitted infections have surged in the last decade. And for the first time since 1937, an infectious disease, COVID-19, became one of the top three causes of death in the country.

These health problems are alarming on their own. They also have a devastating impact on our economy. A one-year increase in life expectancy could boost economic output by 4%. On the other hand, as Americans’ health declines, our health expenditures continue to soar. As a country, we spend $4.5 trillion annually on health, representing 17% of GDP. Out-of-pocket healthcare costs have risen dramatically, straining workers’ finances and pushing people into bankruptcy. All this fuels a cycle of a sicker workforce and a weaker economy.

Policymakers acknowledged the link between the economy and public health at the height of the pandemic, providing federal relief programs such as cash assistance and paid sick leave designed to keep the nation’s workforce and economy as healthy as possible. But our abandonment of these efforts since getting COVID relatively under control sets our country up for mounting crises. We need to revive a historical source of support for public health measures: the business case for a healthy workforce.

In 1842, Edwin Chadwick argued in his landmark “Report on the Sanitary Conditions of the Labouring Population of Great Britian” that public health investments are crucial not only from a moral perspective, but also for economic productivity. Writing for the Atlantic in 1909, C.-E. A. Winslow, an American public health pioneer, wrote that employers who try welfare measures for workers “find that it pays.” And around that time, Wickliffe Rose, an American philanthropist, oversaw the Rockefeller Sanitary Commission to tackle hookworm disease as a controllable health problem, spurring economic productivity.

Hookworm, which can cause anemia and fatigue and impair development in children, was a significant problem in southern states in the late 1800s and early 1900s resulting from lack of access to clean water, poor sanitation and poor hygiene. Its symptoms were blamed on “laziness” — a stigma often attached today to symptoms of chronic illnesses, disabilities and mental health issues — and perpetuated cycles of poverty. Rose all-but-eradicated hookworm through education campaigns, expanding access to treatment and improving public sanitation.

Similarly, during World War II, the U.S. government invested in public health initiatives to curb the transmission of malaria in tropical and subtropical battlefronts; vaccinate against smallpox, typhoid fever and tetanus; and control sexually transmitted infections, which during World War I cost the U.S. Army more than 7 million workdays and 10,000 preventable discharges.

When it functions well, such public health infrastructure makes it easier for working people to lead healthy lives. The results have been dramatic, contributing in the last century to the average human lifespan doubling around the world.

Despite the impression given by COVID-19, public health has historically been about so much more than tracking disease outbreaks. It’s been about preventing disease. Access to healthcare and insurance play a role, but doctors and hospitals most often come into play after someone is already sick. Research shows that simple resources such as clean air and water, affordable healthy food, stable housing and safe workplaces are much better predictors of good health and longevity.

During the pandemic, programs addressing basic needs — eviction freezes, expanded food assistance and mandated paid sick and family leave for employees in smaller companies — enhanced housing stability, curbed COVID spread and protected Americans’ mental health. Since then, home affordability has plummeted; half of American renters spend more than 30% of their income on rent and utilities. In 2022, more than 40 million Americans lived in food-insecure households, adding to health issues in adults and children.

The U.S. is one of the only high-income nations that still lacks universal paid sick leave and family medical leave, forcing many people to go to work sick or risk losing a day’s wages. Interventions to improve workplace air quality, a vital component of a healthy workplace appreciated even by 19th and 20th century health reformers, have been overlooked.

The pandemic-era measures were dropped in part because of their cost. But what is much more expensive, and what is causing American workers needless suffering as our national health declines, is our current approach to health. Of our $4.5-trillion annual health spending in the U.S., the vast majority goes to treating people when they are already sick; only 4% supports programs to keep people and workers healthy in the first place. This focus on treating individuals after they have already fallen ill is much of the reason we pay dramatically more than other countries yet still have some of the worst health indicators in the world.

Once again treating public health as an economic imperative could help broaden support for the type of interventions that became polarizing during the pandemic — but have a long track record of improving wellbeing and productivity.

Céline Gounder (@CelineGounder), an infectious-disease physician and epidemiologist, is the senior fellow and editor-at-large for public health at KFF Health News. She is also the host of the podcast “Epidemic.” Craig Spencer (@Craig_A_Spencer) is an emergency medicine physician and professor of public health at Brown University.

Science

Column: Two Rutgers professors are accused of poisoning the debate over COVID's origins. Here's why

In a Dec. 2 tweet, Richard H. Ebright, a professor of chemistry and chemical biology at Rutgers University, stated that Anthony Fauci, the respected virologist and retired official of the National Institutes of Health, “is likely a murderer and provably a felon.”

In another tweet a few weeks earlier, he had compared Fauci to the Cambodian dictator Pol Pot, who was responsible for the genocidal massacre of as many as 2 million people in the 1970s.

Referring to an event at Case Western Reserve University honoring Fauci, Ebright wrote: “You may have missed the chance to hobnob with Pol Pot, but, Case Western will give you the chance to hobnob with Fauci, whose policy violations … likely killed 20 million.”

Every time I speak publicly, I now have a thought that there might be someone who has ingested this steady stream of distortions who might shoot me while I’m speaking.

— Michael Worobey, University of Arizona

In a tweet Aug. 25, 2022, Ebright’s colleague Bryce Nickels, a professor in the Rutgers department of genetics, called the “coordination” among virology researchers including Angela Rasmussen of the University of Saskatchewan and Michael Worobey of the University of Arizona an example of “pure, unfiltered evil.”

He illustrated the tweet with a GIF from the 1976 movie “Marathon Man” showing Dustin Hoffman being tortured by a character played by Lawrence Olivier and plainly inspired by Nazi doctor Josef Mengele.

This is the landscape on which a conflict over two theories about the origin of COVID-19 has been waged. One theory attributes the origin to unregulated trading in China of disease-susceptible wildlife, from which the virus that causes the disease is thought to have leaped to humans in a process known as a zoonotic spillover.

The other, the lab leak hypothesis, posits that the virus escaped from a virology lab in Wuhan, China, where it may have been deliberately concocted.

Let’s be clear: There is no evidence for a lab leak. No one has ever produced anything in its favor other than innuendo and conjecture. By contrast, evidence for a zoonotic transfer is almost overwhelming, has grown ever stronger over the years and is widely accepted by virologists and epidemiologists.

Ebright and Nickels are advocates of the lab-leak theory. For years they have been posting online insinuations or outright accusations of fraud, perjury, felonies and murder aimed at scientists who advocate for the zoonotic transfer theory.

Now a dozen scientists, some of whom have been direct targets of Ebright and Nickels, have called on Rutgers to open a formal investigation into whether its two faculty members have crossed the line distinguishing between responsible scientific debate and defamation, harassment, intimidation and threats.

Among the concerns the signatories aired in their March 14 complaint letter is that the professors’ actions and “inflammatory language,” such as “comparisons of working scientists to historical war criminals and mass murderers,” could “put some of us and … our colleagues in physical danger.”

Ebright’s and Nickels’ behavior, the complaint says, has unfolded in an atmosphere that had already produced “harassment including threats of death and/or violence because of our … scientific research.”

Ebright and Nickels say the complaint misrepresents their words and activities. “I never have compared any of the signatories to Josef Mengele or Pol Pot, and I never have characterized any of the signatories as murderers,” Ebright told me by email. He adds, “I also never have threatened or incited violence against any of the signatories.”

He did acknowledge calling four signatories “fraudsters,” based on their authorship of a 2020 scientific paper that favored zoonosis as the origin of COVID-19 and dismissed the lab-leak theory as implausible. “I stand by this characterization,” he wrote. He called the complaint “an effort to silence opponents and to prop up a collapsing narrative.”

Nickels told me by email, “the assertion that I have labeled any of the 12 signatories as murderers or endangered them or their colleagues is false and is defamatory with malice.” In his email, he accused the same four signatories mentioned by Ebright of fraud.

More on that shortly.

The complaint letter says that Ebright and Nickels have engaged in online harassment, intimidation and threats for years. According to Kristian Andersen, an evolutionary biologist at Scripps Research in La Jolla and the organizer of the complaint, a new element in their approach recently appeared: encouraging their followers to engage in physical contact with zoonosis advocates.

On March 12, Nickels tweeted a notice of a scientific conference in Washington at which Peter Daszak, the head of a research funding organization who has long been the target of vituperation by lab-leak advocates, would appear on a panel.

“Don’t miss your chance to meet Peter Daszak, author of the grant many consider the ‘Blueprint’ for SARS-CoV2!” he wrote. The reference was to a groundless accusation beloved by lab-leak advocates that a grant proposal sponsored by Daszak’s organization involved creating a virus in a Chinese lab that became SARS-CoV-2, the virus that causes COVID. Virologists say the grant proposal would not have produced such a virus. In any event, it was not funded.

“That was so far outside of what I would consider to be normal and ethical conduct in science that I said, we need to file a formal complaint,” Andersen told me. The scientists’ letter to Rutgers administrators doesn’t ask for any disciplinary action, but calls for “immediate and serious review by the administration” of public behavior by Ebright and Nickels.

The call by Ebright and Nickels for followers to show up at a talk by Daszak stepped up the anxiety many scientists feel about their own public appearances.

“Every time I speak publicly, I now have a thought that there might be someone who has ingested this steady stream of distortions who might shoot me while I’m speaking,” says Worobey, a signatory of the complaint whose research helped to establish a seafood and wildlife market in Wuhan, not a lab, as the likely site of the first zoonosis transfers. “With those escalations recently, I thought it was time to deal with it head-on.”

Vaccine science, immigration and elections are all battlegrounds for the war between information and disinformation today. The temperature of debates on these topics is only heightened by the tendency of social media platforms such as Twitter (now X) to encourage intemperate speech. But science and health seem to be areas especially vulnerable to efforts at falsification.

A brief primer on the lab-leak hypothesis may be useful here. During the earliest weeks of the COVID pandemic, many virologists examining the SARS-CoV-2 virus, including Andersen, spotted unfamiliar features, some so unusual that they conjectured the features might have been man-made.

Further research in the ensuing weeks revealed, however, that these features were not unusual, but common, and that they could develop in viruses such as SARS2 through natural processes. Andersen and others eventually concluded that a laboratory role in COVID’s emergence was implausible.

That conclusion was written into a seminal paper on the virus published in Nature Medicine on March 17, 2020, and titled “The proximal origin of SARS-CoV-2.” Its authors included Andersen, Robert F. Garry of Tulane University, Andrew Rambaut of the University of Edinburgh and Edward C. Holmes of the University of Sydney.

All four signed the complaint letter to Rutgers. They’re the four scientists Ebright and Nickels accused of fraud in their emails to me, based on the Rutgers scientists’ claim that the proximal origin paper was fashioned to serve what Ebright and Nickels assert was the authors’ and Fauci’s desire to downplay

Fauci’s role in funding virology research in China.

Ebright further accused Andersen and Garry of perjury, based on their denials at a congressional hearing in July that Fauci pressured them to advocate for the zoonosis theory in their paper.

After the paper’s publication, the lab-leak hypothesis moved into the partisan political realm. Republicans in Congress cherish the notion that Andersen and his colleagues deliberately minimized a laboratory role at Fauci’s behest.

There is not a scintilla of evidence for that assertion, as Andersen and Garry made clear by cogently explaining at the July hearing called by conspiracy-addled House Republicans how the normal process of scientific research led them to the paper’s conclusions.

Last March, FBI Director Christopher Wray stated in an interview with Fox News that the bureau had concluded with “moderate confidence” that the virus had escaped from the Chinese lab, but he cited no evidence and didn’t explain its grounds.

The FBI’s assessment had been part of a survey of all U.S. intelligence agencies that largely contradicted the FBI’s position. In June, it was further contradicted by a report from the Office of the Director of National Intelligence, which refuted claims that the Chinese lab had played a role in the pandemic.

That brings us back to Ebright and Nickels. Although insults and invective are hardly uncommon in exchanges over COVID’s origins, their contributions have often carried a remarkably noxious tone.

The defense by both that they never compared the complainants to Pol Pot or Mengele or characterized them as murderers may be true as far as it goes. But it’s too clever by half. The complainants didn’t say in their letter to Rutgers that they themselves were necessarily the targets of Ebright’s and Nickels’ odious comparisons. Their complaint says the pair had “made comparisons of working scientists” — i.e., other scientists — “to historical war criminals and mass murderers.”

So let’s look at the record.

Ebright has repeatedly intimated that Fauci is a murderer, based on his view that his agency funded dangerous virology research in the Chinese lab that produced the pandemic. There is no evidence that any research the U.S. government funded in China produced the SARS-CoV-2 virus, or even that any such research at that lab was scientifically possible.

On Nov. 13, Ebright wrote of Fauci, “any person whose violations of U.S. government policies … resulted in 20 million deaths is, by any rational standard, a murderer.” It’s unclear what “violations” he was referring to.

In a June 27 tweet, Ebright described Fauci as “an octogenarian serially misfeasant, serially malfeasant, serially perjurious, former bureaucrat likely to face criminal charges after Jan 2025” (i.e., presumably assuming that Donald Trump would then take office again).

On Dec. 23 he tweeted that the “only option” to “mitigate the negative effects” of the proximal origin paper was the referral of Andersen and his colleagues “for criminal prosecution.”

On July 10, 2021, Ebright responded with the following comment to a tweet that apparently had alluded to critics of the lab-leak theory: “Sociopaths will be sociopaths … See Mengele. See Ishii.” The latter reference is to Shirō Ishii, who headed Japan’s World War II bioweapons program, which has been blamed for the deaths of as many as 300,000 people.

On Sept. 5 and 6, 2022, Ebright summarized the case for the lab-leak hypothesis, which he tied to “labs conducting world’s largest research program on bat SARS-like coronaviruses.” He ended the thread with the phrase “The banality of evil” — philosopher Hannah Arendt’s description of the impression left on her by Adolph Eichmann, the architect of the Nazi program of Jewish genocide, whose trial in Israel she reported on.

Nickels, in addition to posting the Mengele-linked film clip, earlier this month tweeted “massive respect to … military veterans that have taken a stand” against scientists he asserted had lied about research “impacting national security.” He called the behavior of such scientists “treasonous” and he specifically named among those deserving respect, one Andrew G. Huff.

One day earlier, Huff, who labels the zoonosis theory a “lie,” tweeted a call for Fauci, Daszak and virologist Ralph Baric of the University of North Carolina to be hauled before a military tribunal. Subsequently, he tweeted that his followers had voted in an online poll that if convicted, they should be hanged. He illustrated that tweet with a film clip of three people plunging to their deaths on a gallows.

The ball is now in Rutgers’ court. The university says the complaint “will be forwarded to the appropriate offices for review.” It didn’t say what issues would be considered. But certainly a determination would be warranted of whether its faculty members’ actions conform to the school’s policy on free expression, which frowns on actions or behaviors that “threaten individuals or cause an injury to someone” or “harass, threaten violence, or intimidate others.”

Whatever the outcome is of any such inquiry, the scientific community is right to be appalled by Ebright’s and Nickels’ activities. There’s vast latitude in science for disagreement and debate, but calling one’s adversaries or critics criminals or traitors, or placing them in the same category as Mengele, Eichmann and Pol Pot? That isn’t scientific debate.

In the world of science, the reputations of Andersen, Worobey, Garry, Holmes and Rambaut are secure; their finding that COVID most likely originated in the wildlife trade has not only held up over time but also been validated by subsequent studies. The same is true of the other eight signatories of the complaint letter, and Fauci and Daszak (who are not signatories).

Ebright and Nickels? They may be a different story.

Science

Too expensive, too slow: NASA asks for help with JPL's Mars Sample Return mission

After months of turmoil over the future of a vaunted mission to bring samples of the Red Planet back to Earth, NASA has its verdict on Mars Sample Return.

The space agency is “committed” to bringing those rocks back from Mars, Administrator Bill Nelson said Monday, but will have to do it with way less money and in far less time than currently designed.

And how exactly is NASA going to pull that off? Right now it has no idea — and it’s looking for someone who does.

“I have asked our folks to reach out with a request for information to industry, to [the Jet Propulsion Laboratory] and to all NASA centers, and to report back this fall an alternate plan that will get [the samples] back quicker and cheaper,” Nelson said in a press conference at NASA headquarters.

His comments came in response to an independent review commissioned by NASA last year that declared there was “near zero probability” of Mars Sample Return making its proposed 2028 launch date, and “no credible” way to fulfill the mission within its current budget.

Pulling off the mission as designed would likely cost up to $11 billion, the review board found, with the samples not reaching Earth until at least 2040.

“The bottom line is that $11 billion is too expensive, and not returning samples until 2040 is unacceptably too long,” Nelson said. “It’s the decade of the 2040s that we’re going to be landing astronauts on Mars.”

The announcement comes as something of a blow to JPL, the La Cañada Flintridge institution tasked with managing the mission. JPL has already laid off more than 600 employees and 40 contractors this year after NASA ordered it to reduce spending in anticipation of budget cuts spurred by the challenges of Mars Sample Return.

Proposals go out soon to all NASA centers and the private aerospace sector for “a revised plan that utilizes innovation and proven technology to lower risks, to lower costs and to lower mission complexity so we can return these really precious samples to Earth in the 2030s,” said Nicky Fox, associate administrator, Science Mission Directorate. The due date for proposals is next month, and those selected for further study will get NASA grants this summer.

This essentially puts JPL in a position of having to compete for its own project.

“Right now if JPL were to come up with the answer, then I’d say JPL is gonna be sitting pretty good,” Nelson said during Monday’s news conference. “But we’re opening this up to everyone because we want to get every new and fresh idea that we can.”

NASA’s decision to outsource a solution to the Mars Sample Return problem frustrated some Mars scientists.

“What I expected is for NASA to step up and say, ‘These things are hard and we choose to do them,’ ” said Bethany L. Ehlmann, a planetary scientist at Caltech. “That is the leadership required to be the nation leading the world in space exploration.”

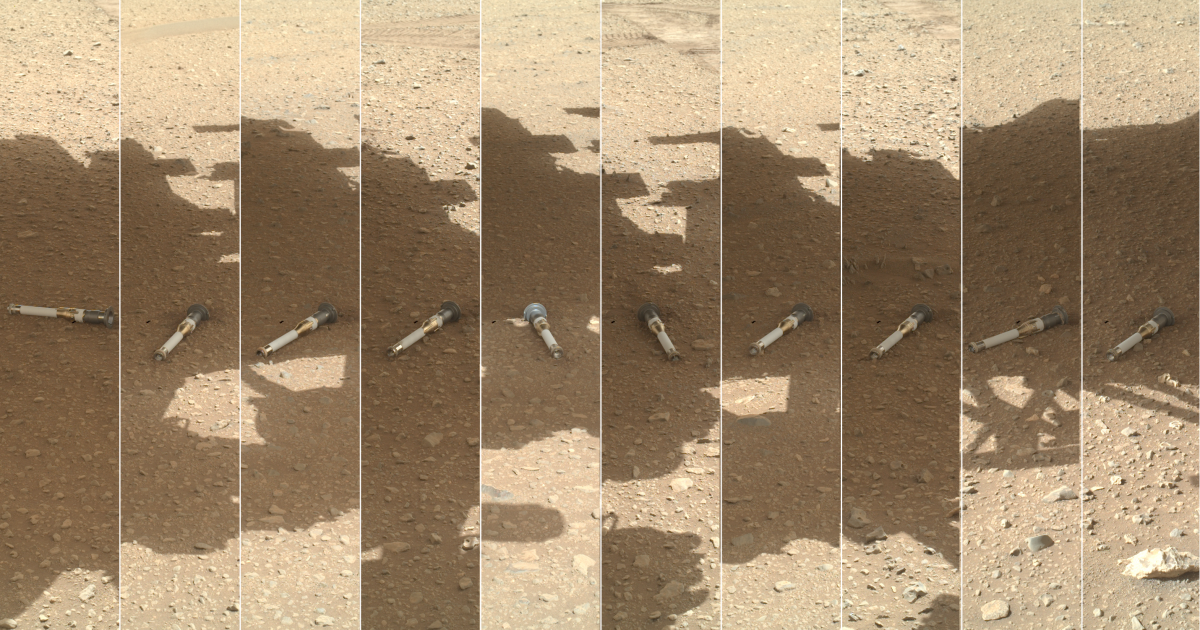

A joint project with the European Space Agency, Mars Sample Return would deliver rocks, rubble and dust that have already been gathered and sealed into tubes by the Perseverance rover.

The current design relies on a lander that would retrieve those tubes from the Red Planet’s Jezero Crater and use a small rocket to ferry them into Martian orbit, where they would rendezvous with a spacecraft that would make the journey back to Earth. The rocket would touch down on Earth roughly five years after the orbiter’s launch.

The ultimate goal is to comb the samples for evidence that life has ever existed on Mars, and to help NASA plan for future crewed missions, Nelson said.

In the most recent planetary science decadal survey, a report prepared for NASA every 10 years by the National Academy of Sciences, Engineering, and Medicine, planetary scientists named the Mars Sample Return mission as the “highest scientific priority of NASA’s robotic exploration efforts this decade” and argued that the program should be completed “as soon as is practicably possible with no increase or decrease in its current scope.”

But the authors cautioned that the ambitious mission shouldn’t come at the cost of other planetary science, suggesting a roughly $5-billion to $7-billion cap.

“Mars Sample Return is of fundamental strategic importance to NASA, U.S. leadership in planetary science, and international cooperation and should be completed as rapidly as possible,” the report stated. “However, its cost should not be allowed to undermine the long-term programmatic balance of the planetary portfolio.”

The agency is committing to keeping the mission within that recommended budget, Nelson said. Allowing Mars Sample Return’s costs to reach the $8 billion to $11 billion the review board estimated would require NASA “to cannibalize other programs, other science programs, and there are so many that are absolutely important,” Nelson said.

-

News1 week ago

News1 week agoVideo: Election Officials Continue To Face Violent Threats

-

World1 week ago

World1 week agoHope and anger in Gaza as talks to stop Israel’s war reconvene

-

News1 week ago

News1 week agoArizona Supreme Court rules that a near-total abortion ban from 1864 is enforceable

-

Midwest1 week ago

Midwest1 week agoFormer Chicago Mayor Lori Lightfoot hired to investigate so-called 'worst mayor in America' at $400 an hour

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25382021/V4_Pro_Beta_PressKit_LaunchImage.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25382021/V4_Pro_Beta_PressKit_LaunchImage.jpg) Technology1 week ago

Technology1 week agoAdobe overhauls Frame.io to make it a little more Trello-like

-

World1 week ago

World1 week agoEU migration reform faces tight vote as party divisions deepen

-

Movie Reviews1 week ago

Movie Reviews1 week agoCivil War Movie Review: Alex Garland Offers ‘Dystopian’ Future

-

Politics1 week ago

Politics1 week agoBillionaire who helped Trump with $175M bond says he 'probably didn't charge enough'