Politics

How a Pandemic-Era Program Became a Magnet for Fraud

In early February, federal prosecutors in Utah accused Zachary Bassett and Mason Warr of cheating the United States government out of millions of dollars. The accounting firm they operated had submitted more than 1,000 fraudulent tax forms to the Internal Revenue Service on behalf of businesses trying to claim pandemic-era stimulus funds, the prosecutors said.

COS Accounting and Tax shut down later that month, leaving businesses and taxpayers that had paid the firm to help them claim federal money trying to figure out what had happened and why they were suddenly receiving audit notices from the I.R.S.

Amid the onset of the pandemic in 2020, as large swaths of the economy went into lockdown, Washington set up various programs to help keep businesses and their workers afloat. Among them was the Employee Retention Credit, a tax benefit that was created as part of the initial $2 trillion pandemic relief legislation. The program offered businesses thousands of dollars per employee if they could show that Covid-19 was hurting their bottom lines and that they were continuing to pay workers.

The money was intended to be a lifeline for struggling companies. Instead, it has become a magnet for fraud, creating a cottage industry of firms that market themselves as tax credit specialists who can help clients — even those who don’t actually qualify for the money — reap huge refunds from the I.R.S. Although the public health emergency is over, taxpayers can continue to apply for the tax credit until 2025. That has fueled a run for the money and the proliferation of financial service providers, who often charge hefty upfront fees or take cuts of around 25 percent of any tax refund.

The tax credit has become so popular that it is turning out to be far more costly than expected. In 2021, after Congress expanded eligibility for the credit, the Congressional Budget Office projected that it would cost the federal government about $85 billion over a decade — up from an earlier estimate of $55 billion. However, even that turned out to be an underestimation: the I.R.S. said it has already paid out $152 billion in refunds associated with the tax credit since it first became available and has a backlog of about 800,000 applications that it is trying to process.

The I.R.S. does not yet know how many of the approved refunds were based on fraudulent applications. But it has begun ramping up efforts to root out scams and focusing additional scrutiny on filings from firms that appear suspicious.

On Thursday, the I.R.S. issued a warning to businesses to be on the lookout for “scams” related to the tax credit, saying it was fueling a flood of “invalid” applications.

“These are Johnny-come-latelies, showing up and they’re pushing this product, pushing this activity in a way that is unethical,” Douglas O’Donnell, the deputy commissioner of services and enforcement at the I.R.S., said in an interview. “It is drawing businesses into a trap, that they will then be claiming a credit that they are not entitled to.”

Mr. O’Donnell warned that those who received refunds but were ineligible for the money would have to repay the funds with penalties. He said the I.R.S. was aggressively auditing taxpayers who collect the refunds and the firms that process them. He estimated that hundreds of thousands of tax credit “mills” have popped up across the country in the last three years.

“They seem to be everywhere,” Mr. O’Donnell said.

The tax credits are less well known than the more popular Paycheck Protection Program, which provided forgivable loans to cover payroll, rent and utility expenses during the pandemic. But for eligible taxpayers, they have the potential to provide a substantial windfall in the form of a tax refund. Businesses, including nonprofit organizations and churches, can seek up to $26,000 for each employee on the payroll if they can show that their operations were fully or partially suspended in 2020 or part of 2021, and report a significant decline in their revenues during that time.

However, the fine print that determines if a business is eligible is complicated and the I.R.S. is concerned that firms that are processing applications for the credit at high volume are overlooking important restrictions in order to rake in bigger refunds and commissions.

For instance, the I.R.S. is concerned about taxpayers dipping into multiple pots of relief money and says many tax preparation firms are not telling clients that they cannot claim the tax credit on wages if they also received money to cover payroll costs through the Paycheck Protection Program.

The ballooning cost of the program is exacerbating America’s precarious fiscal situation. The White House and Republican lawmakers are locked in a bitter fight over raising the debt ceiling, which caps how much money the United States can borrow. The Treasury Department has estimated that the government could run out of cash as soon as June 1 and has resorted to accounting maneuvers so that it can keep paying its bills.

Treasury officials last month pointed to the Employee Retention Credit payouts as a reason that federal tax revenues are more meager than expected.

Lawmakers have been debating clawing back some unused pandemic relief funds as part of the debt limit and budget negotiations, but the tax credit does not appear to be part of those discussions. Senator Kirsten Gillibrand, Democrat of New York, sent the I.R.S. a letter this month urging it to clear its backlog and issue refunds faster.

More applications for tax credits are coming in every day as firms continue to blitz social media sites and TV and radio stations with ads touting the ease of getting federal money. In some cases, the firms are cold-calling potential customers.

Since last October, there have been about 9,000 advertisements promoting application services for employee retention tax credits airing on national cable and broadcast television networks, according to the ad tracking firm Vivvix/CMAG.

About three-quarters of those were sponsored by one of the biggest players in the industry, Innovation Refunds, which advertises on networks such as CNBC and claims that it takes just eight minutes for the firm to determine if an applicant is eligible. The firm says it has helped businesses claim over $1 billion in payroll tax refunds.

“That easy,” a narrator says in one of the ads. “But it’s only available for a limited time.”

Innovation Refunds, which takes a 25 percent cut of whatever refund a customer receives from the I.R.S., uses a network of tax attorneys to review the applications and process the forms. It received financing from the investment firm Raistone to expand its ability to advertise and process more amended tax returns.

“If you don’t have the knowledge, then you’re not going to seek this out,” said Mireille Rosselli, a spokeswoman for Innovation Refunds. “We’re on a shot clock.”

Ms. Rosselli added that Innovation Refunds has a rigorous system of vetting applications: “Our process is designed to deliver what Congress has intended to do — ensure that only eligible businesses apply for and receive government incentives and credits.”

Firms providing employee retention tax credit services use different models. Some do not have certified public accountants on staff and rely instead on lawyers, offshore workers or software to crunch the numbers. Others rely on customers to “attest” that they are eligible for the tax credits, leaving those customers more liable in the event of an audit.

Brian Anderson, who has a background in software, co-founded E.R.T.C. Express in 2021 after learning that traditional accountants did not seem to have the time to help their clients go through the cumbersome process of applying for the credits. His business, which has offices in Atlanta and Tampa, has a team of in-house accountants and a more rigorous monthlong process to determine if a client is eligible to apply. Customers can either pay an upfront fee or a percentage of their eventual refund.

“It’s complex to figure out the answer to the question of, are you eligible,” said Mr. Anderson, estimating that about a third of his potential clients do not qualify. “If you’re not eligible, it’s a lot of work for nothing.”

The I.R.S. acknowledges that applying for the tax credit is a complicated process, made more difficult by the fact it must be done by amending previous tax returns using paper forms. The agency cautions that firms who say the process can be accomplished quickly and easily are likely misleading their customers.

Traditional accountants have been watching with concern as applications for the employee retention tax credit have boomed. Many have since been hired to help taxpayers who suddenly find themselves under I.R.S. scrutiny.

“These guys are preying on people, promising the moon,” said Mark C. Wagner, an accountant who is based near Dallas. “If your sales did not meet the criteria for the credit, then you have to pay the credit back, plus penalties, plus interest.”

A lawyer for Mr. Bassett, who pleaded not guilty, said that COS Accounting and Tax took seriously its responsibilities to comply with the I.R.S. requirements when applying for benefits for their clients. The lawyer, Kathryn Nester, explained that the regulations and guidance about the credit “were not often clear and were revised frequently.”

That has provided little solace for clients of the business that have been looking for answers about their applications or left to contend with audits.

Wanchai Chab was working for a Utah-based company selling pest control supplies in California in 2020. Because he had set up a limited liability company, he was advised that he could apply for the employee retention tax credit through COS Accounting and Tax. He paid $500 up front and was told that he would get a credit of $3,500.

But instead of getting a big refund, Mr. Chab, 25, received an audit notice earlier this year and ended up having to pay additional taxes.

Fortunately for Mr. Chab, he was not penalized by the I.R.S. because he never received the credit.

“The auditor said she understood what was going on and knew of lots of people who got ripped off like this,” Mr. Chab said.

Politics

Alabama lawmakers advance bills ensuring Biden appears on November ballot

- Committees in both chambers of the Alabama Legislature advanced bills Wednesday to ensure President Biden appears on the November ballot.

- The legislation mirrors accommodations made in 2020 for then-incumbent President Trump.

- “We want to make sure every citizen in the state of Alabama has the opportunity to vote for the candidate of his or her choice,” Democratic state Sen. Merika Coleman, who sponsored her chamber’s version of the bill, said.

Alabama lawmakers advanced legislation Wednesday to ensure President Joe Biden will appear on the state’s November ballot, mirroring accommodations made four years ago for then-President Donald Trump.

Legislative committees in the Alabama House of Representatives and Senate approved identical bills that would push back the state’s certification deadline from 82 days to 74 days before the general election in order to accommodate the date of Democrats’ nominating convention.

The bills now move to to the full chambers. Alabama has one of the earliest candidate certification deadlines in the country which has caused difficulties for whichever political party has the later convention date that year.

FIGURES AND DOBSON TO FACE OFF IN CLOSELY WATCHED RACE FOR ALABAMA’S NEW 2ND CONGRESSIONAL DISTRICT

“We want to make sure every citizen in the state of Alabama has the opportunity to vote for the candidate of his or her choice,” Democratic Sen. Merika Coleman, the sponsor of the Senate bill, told the Senate Judiciary Committee.

The issue of Biden’s ballot access has arisen in Alabama and Ohio as Republican secretaries of state warned that certification deadlines fall before the Democratic National Convention is set to begin on Aug. 19. The Biden campaign has asked the two states to accept provisional certification, arguing that has been done in past elections. The Republican election chiefs have refused, arguing they don’t have authority, and will enforce the deadlines.

U.S. President Joe Biden, on March 31, 2022. (REUTERS/Kevin Lamarque/File Photo)

Democrats proposed the two Alabama bills, but the legislation moved out of committee with support from Republicans who hold a lopsided majority in the Alabama Legislature. The bills were approved with little discussion. However, two Republicans who spoke in favor of the bill called it an issue of fairness.

Republican Rep. Bob Fincher, chairman of the committee that heard the House bill, said this is “not the first time we’ve run into this problem” and the state made allowances.

“I’d like to think that if the shoe was on the other foot, that this would be taken care of. And I think that Alabamians have a deep sense of fairness when it comes to politics and elections,” Republican Sen. Sam Givhan said during the committee meeting.

Trump faced the same issue in Alabama in 2020. The Republican-controlled Alabama Legislature in 2020 passed legislation to change the certification deadline for the 2020 election. The bill stated that the change was made “to accommodate the dates of the 2020 Republican National Convention.” However, an attorney representing the Biden campaign and DNC, wrote in a letter to Alabama Secretary of State Wes Allen that it was provisional certification that allowed Trump on the ballot in 2020, because there were still problems with the GOP date even with the new 2020 deadline.

Allen has maintained he does not have the authority to accept provisional certification.

Similarly, in Ohio, Attorney General Dave Yost and Secretary of State Frank LaRose, both Republicans, rejected a request from Democrats to waive the state’s ballot deadline administratively by accepting a “provisional certification” for Biden.

In a letter Monday, Yost’s office told LaRose that Ohio law does not allow the procedure. LaRose’s office conveyed that information, in turn, in a letter to Democratic lawyer Don McTigue. LaRose’s chief legal counsel, Paul Disantis, noted it was a Democrats who championed the state’s ballot deadline, one of the earliest in the nation, 15 years ago. It falls 90 days before the general election, which this year is Aug. 7.

Ohio Senate Democratic Leader Nickie Antonio said she is waiting to hear from the Democratic National Committee on how to proceed. One of her members, state Sen. Bill DiMora, said he has legislation for either a short- or long-term fix ready to go when the time comes.

Politics

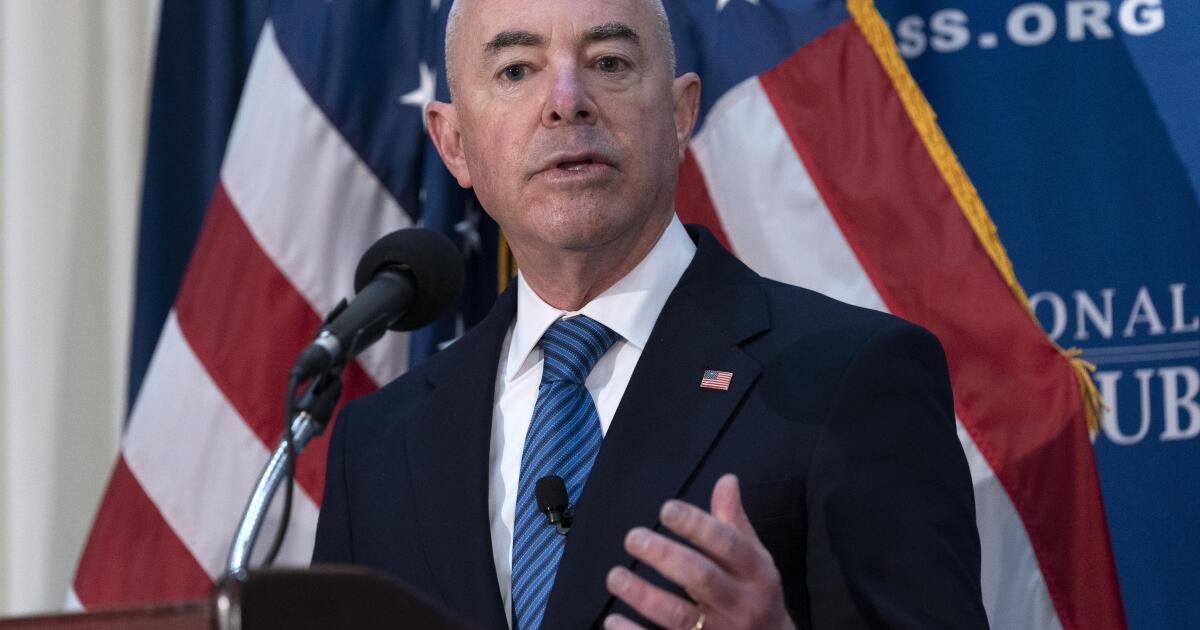

Senate rejects impeachment of Homeland Security Secretary Mayorkas

Senators were sworn in at 1 p.m. Wednesday for their third impeachment trial in four years, this time of Homeland Security Secretary Alejandro N. Mayorkas.

Three hours later, they had voted along party lines to dismiss both counts against Mayorkas.

House Republicans, who say Mayorkas has failed to fulfill his duties in upholding immigration law, pushed for a full Senate trial of the case against him. Senate Democrats called the allegations baseless.

The impeachment of President Biden’s top immigration official comes as Republicans make migration across the southern border an election-year issue.

“By doing what we just did, we have in effect ignored the directions of the House, which were to have a trial,” Senate Minority Leader Mitch McConnell (R-Ky.) said. “Today is not a proud day in the history of the Senate.”

Mayorkas, a Cuban immigrant who grew up in California, is the first U.S. Cabinet official impeached in nearly 150 years.

Wednesday’s proceedings also marked the first time the Senate has ever declined to hold a trial after impeachment by the House.

It has been two months since Mayorkas was narrowly impeached in the House by a single-vote margin, with three Republicans and all Democrats opposed.

As the Senate convened Wednesday, Mayorkas was in New York City, where he held a news conference announcing a public awareness campaign to combat child sexual exploitation and abuse. As the trial got underway, Mayorkas was in transit back to Washington.

“Today’s decision by the Senate to reject House Republicans’ baseless attacks on Secretary Mayorkas proves definitively that there was no evidence or Constitutional grounds to justify impeachment,” Department of Homeland Security spokesperson Mia Ehrenberg said in a statement. “It’s time for Congressional Republicans to support the department’s vital mission instead of wasting time playing political games and standing in the way of commonsense, bipartisan border reforms.”

Ian Sams, a White House spokesperson, added that “President Biden and Secretary Mayorkas will continue doing their jobs to keep America safe and pursue actual solutions at the border.”

Senate Majority Leader Charles E. Schumer (D-N.Y.) sought to accommodate the wishes of Republican colleagues in agreeing to a period of debate before moving to dismiss the case against Mayorkas.

Engaging in a full trial “would be a grave mistake and could set a dangerous precedent for the future,” he said, urging colleagues to save impeachment “for those rare cases we truly need it.”

Schumer said the first impeachment article — for “willful and systemic refusal to comply with the law” — does not allege conduct that rises to the level of a high crime or misdemeanor and is therefore unconstitutional.

Republicans began stalling by initiating a series of increasingly far-fetched motions, which failed:

To adjourn the court of impeachment until April 30 at noon.

To adjourn until May 1 at noon.

To adjourn until Nov. 6 at noon — the day after the election.

Democrats pushed ahead and dismissed both impeachment articles on a vote of 51 to 49.

Along with their fellow Democrats, both senators from Mayorkas’ home state rejected his impeachment. Sen. Alex Padilla (D-Calif.) called Mayorkas an exemplary public servant and said House Republicans failed to provide a shred of evidence that he had committed impeachable offenses.

Sen. Laphonza Butler (D-Calif.) said, “Republicans would rather stand in the way of solving our challenges than do the hard work of leading our nation. … We don’t resolve policy disagreements by impeachment. We talk with the American people, get in a room, and do the work. The charged crime here is a farcical substitute for doing the hard work.”

Some experts raised concerns that Democrats’ decision to dismiss the impeachment before hearing evidence, even if the evidence was weak, further trivialized the process for what’s intended as Congress’ greatest power to hold officials accountable.

“A refusal to even consider something like this coming out of the House, it will allow Republicans, should Democrats advance a case of impeachment on their watch down the road, to say, ‘We’re just not even going to consider it, we’re going to follow the practice of Senate Democrats,’” said William Howell, director of the Center for Effective Government and a politics professor at the University of Chicago.

With the trial over, Howell said Republicans could pursue additional congressional oversight — hearings, investigations, and restrictions on discretionary funding for the Department of Homeland Security.

But Mayorkas’ impeachment, he said, illustrates the current struggle in Congress to determine the purpose of government. The impeachment might have ended with a fizzle, he said, but in the background remain questions about the direction of immigration and administrative policy.

“When Republicans lament what is going on in the administrative state, it almost always is the case that their arguments are about overreach,” he said. “There is a certain irony in Republicans coming forward and saying, ‘We’re going to impeach this person … for not doing enough, for not pursuing their legal mission as fully as they ought to.’”

Times staff writer Sarah D. Wire contributed to this report.

Politics

Inside GOP plan to force as many votes on Mayorkas impeachment trial as possible

Senate Republicans are looking to hold as many votes as possible during the initial proceedings of the impeachment trial into Department of Homeland Security Secretary Alejandro Mayorkas before Democrats in the chamber are expected to succeed in dismissing the trial.

Majority Leader Chuck Schumer, D-N.Y., explicitly stated his intent to seek a dismissal of the House-passed articles of impeachment during a speech on the Senate floor on Wednesday morning. While he had previously indicated that he wanted to quickly get past the proceedings, he had yet to confirm the Democratic plan to dismiss the trial.

According to five Senate Republican sources familiar with the discussions, the structure of the proceedings is being negotiated with the Democrats.

SENATORS TO BE SWORN IN FOR MAYORKAS IMPEACHMENT TRIAL AHEAD OF EXPECTED DISMISSAL

Sen. Ted Cruz (R-TX) speaks during a press conference with other senators and House impeachment managers at the U.S. Capitol on April 16, 2024 in Washington, D.C. The bicameral group of legislators called the press conference to urge Senate Minority Leader Sen. Chuck Schumer to hold an impeachment trial after the House delivered articles of impeachment today against Secretary of Homeland Security Alejandro Mayorkas. (Photo by Win McNamee/Getty Images)

The two parties are looking into a potential agreement for unanimous consent, in which Republicans are allowed to propose eight total points of order against the motions to dismiss. Each point of order, or fact that senators determine whether there is agreement on, will require its own vote. Lengthening the process and requiring Democrats to go on record on several components of the impeachment articles against Mayorkas.

Schumer noted in his chamber floor speech on Wednesday that he would look to appease Republicans by allowing both points of order and debate time. “When we convene in trial today to accommodate the wishes of our Republican Senate colleagues, I will seek an agreement for a period of debate time that would allow Republicans to offer a vote on trial resolutions, allow for Republicans to offer points of order and then move to dismiss,” he said.

HOUSE DELIVERS MAYORKAS IMPEACHMENT ARTICLES TO SCHUMER, SETTING UP TRIAL PROCEEDINGS

Senate Majority Leader Chuck Schumer, D-N.Y., joined by Sen. Sheldon Whitehouse, D-R.I., right, speaks to reporters following a closed-door policy meeting at the Capitol in Washington, D.C., on Tuesday, March 7, 2023. (AP Photo/J. Scott Applewhite)

This agreement will require that no senator objects, and Schumer urged them not to.

The unanimous consent agreement which is being sought between the parties would allow 90 minutes of open debate after the senators are sworn in as jurors at 1:00 p.m. Then, two resolutions would receive votes, one from Sen. Mike Lee, R-Utah, calling for a full Senate trial, and another from Sen. Ted Cruz, R-Texas, that would refer the matter to a Senate Impeachment Trial committee first.

Representatives for Lee and Cruz did not confirm the unanimous consent agreement discussions before the time of publication.

GOP SENATOR EYES LEGISLATION TO DEFUND ‘PROPAGANDIST’ NPR AFTER SUSPENSION OF WHISTLEBLOWER

Sen. Mike Lee (R-UT) and Republican Senators criticize Democrats and Senate Majority Leader Chuck Schumer (D-NY) for his expected use of procedural hurdles to avoid trying to impeach Secretary of Homeland Security Alejandro Mayorkas, Washington, D.C., on April 9, 2024. House impeachment managers are expected to deliver articles of impeachment on April 10, 2024. (Photo by ALLISON BAILEY/Middle East Images/AFP via Getty Images)

One source noted the GOP was making an effort to use every option possible to require more votes within the impeachment trial process, putting their Democratic colleagues on record as much as possible.

Following the proposal of each point of order and prior to voting, the deal being discussed for unanimous consent would require four minutes of debate ahead of each vote. This time would be equally divided between the parties. One source explained that some Republican senators see this debate time as an opportunity to have the case for Mayorkas’s impeachment heard on the floor, even if it is not in the context of a full trial.

SENATE DEMS REVEAL MASSIVE $79M AD SPEND TO PROTECT MAJORITY AHEAD OF KEY MATCHUPS

If Democrats’ motion to table an impeachment trial of DHS Secretary Alejandro Mayorkas in the Senate, five vulnerable lawmakers, Sens. Bob Casey, Sherrod Brown, Jacky Rosen, Tammy Baldwin and Jon Tester, could determine the outcome. (Getty Images)

Several Senate Republican sources also indicated that the dismissal route, which Schumer revealed he planned to take, was preferable to a motion to table. Tabling the trial has never happened with an impeachment, as GOP senators have noted, and it also does not provide the ability for any arguments from impeachment managers or defense counsel or debate between senators.

If agreed to, the Mayorkas impeachment trial is likely to ultimately see dismissal, but Republicans will have several opportunities to put Democrats, particularly vulnerable ones who are up for re-election in pivotal states, on the record on multiple immigration and border related topics.

-

News1 week ago

News1 week agoVideo: Election Officials Continue To Face Violent Threats

-

Movie Reviews1 week ago

Movie Reviews1 week agoSasquatch Sunset (2024) – Movie Review

-

Fitness1 week ago

This exercise has a huge effect on our health and longevity, but many of us ignore it

-

Science1 week ago

Science1 week agoThe Eclipse Across North America

-

World1 week ago

World1 week agoHope and anger in Gaza as talks to stop Israel’s war reconvene

-

Uncategorized1 week ago

Uncategorized1 week agoANRABESS Women’s Casual Loose Sleeveless Jumpsuits Adjustbale Spaghetti Strap V Neck Harem Long Pants Overalls with Pockets

-

News1 week ago

News1 week agoArizona Supreme Court rules that a near-total abortion ban from 1864 is enforceable

-

Finance1 week ago

Finance1 week agoSponsored: Six Ways to Use Robinhood for Investing, Retirement Planning and More

)