Minnesota

Approved tax bill increases credits for families, taxes on Minnesota’s wealthy

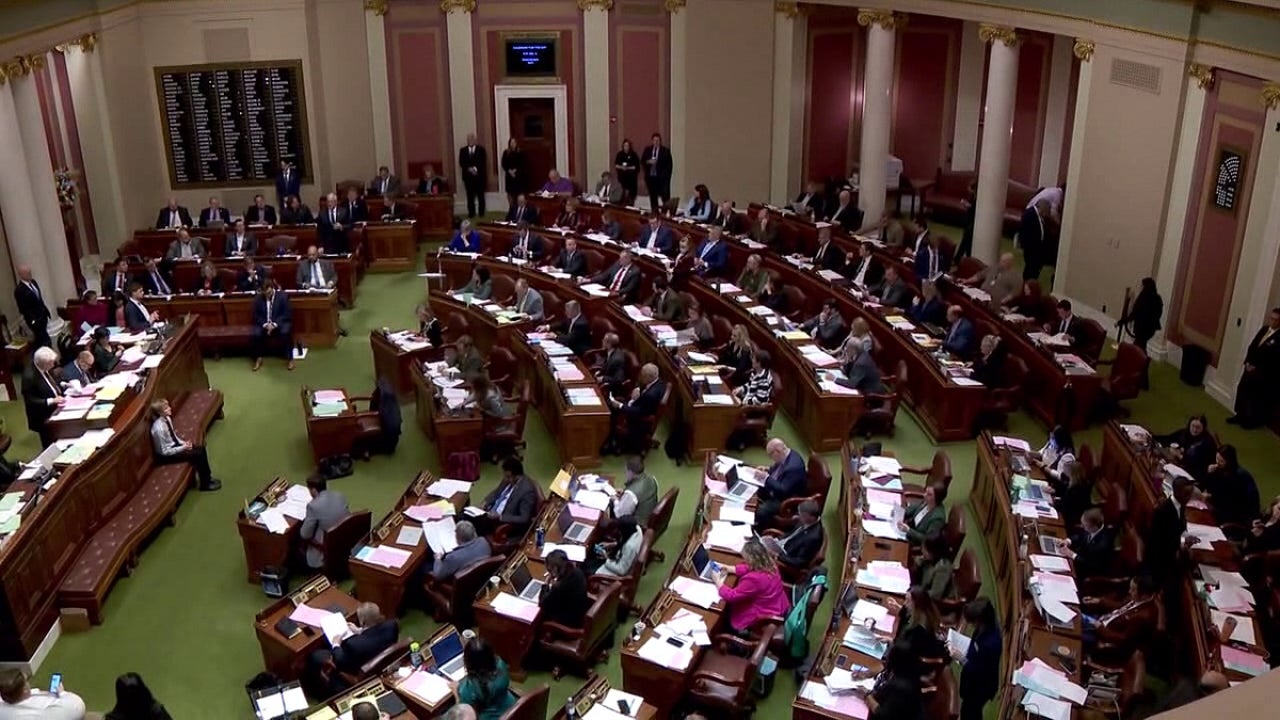

ST. PAUL, Minn. (FOX 9) – With a looming projected state surplus of greater than $17 billion in keeping with newest estimates, lawmakers have authorized a state tax invoice that prioritizes one-time credit to Minnesota households, whereas growing taxes on the wealthiest residents within the state.

Sponsored by Rep. Aisha Gomez (DFL-Minneapolis), H.F. 1938, also called the state’s omnibus commerce finance and coverage invoice, would scale back taxes on Minnesota filers by $3 billion all through the present biennium (or the tip of fiscal 12 months 2025). The invoice was authorized Thursday evening on a 69 to 57 vote.

In whole, the laws would come with $1.25 billion for a one-time refundable credit score cost for each married and single tax filers (efficient retroactively for tax 12 months 2021), $728.4 million for a tax credit score for households with youngsters to ascertain a Minnesota baby credit score of $1,175 per baby, and a modified Social Safety subtraction that may apply to 76% of Minnesotans receiving advantages.

“This invoice constitutes the biggest tax minimize in Minnesota historical past, regardless what you will have heard. It comprises focused tax cuts and places cash within the pockets of Minnesotans who want it most,” Rep. Gomez mentioned Thursday on the Home Ground previous to the vote. “This invoice goes to enhance lives. It focuses and households and kids who’re in poverty, and helps us take steps in the direction of our aim of constructing Minnesota the perfect place within the nation to lift a household.”

Nonetheless, as a part of the omnibus invoice, H.F. 442, sponsored by Rep. Kaohly Vang Her (DFL-St. Paul), would set up a fifth tier for Minnesota’s revenue tax – focusing on the state’s highest earners with a brand new, and better, tax proportion efficient for tax 12 months 2023.

The brand new price could be 10.85 %, and would apply to Minnesota taxable revenue in extra of $1 million for married taxpayers submitting joint returns, $600,000 for single taxpayers and $800,000 for heads of households. The best, or fourth tier, at the moment caps limits at the place the proposed tier would start, and taxes these filers at 9.85 %.

DFL lawmakers proposed the brand new tax as a approach to stabilize revenue for future tasks, regardless of the state’s present price range surplus, whereas GOP lawmakers argue the brand new tax is extreme, pointing to the exact same surplus for vindication.

“Anybody with widespread sense would say we will anticipate some tax aid again, however on prime of a $17.5 billion surplus, Democrats are elevating taxes one other $9.5 billion. That’s why what’s taking place on this invoice is an actual crime,” Rep. Kurt Daudt (R-Crown) mentioned Thursday on the Home Ground previous to the vote. “That is the type of factor the place you need to be sporting a masks should you’re going to steal this type of cash… If you voted for Democrats, that is what you bought, and we’ll remind Minnesota.”

The DFL at the moment holds a trifecta within the Minnesota Legislature, with management of each the Minnesota Senate and Home after final November’s election.

Because the state’s highest earners, the Income Division estimates the change would have an effect on about 24,200 tax returns or about 0.8% of all filers. These filers would see a mean tax enhance of $9,231 per return. The division additionally estimates the change would enhance the state’s revenue by $281.9 million within the fiscal 12 months 2024.

Household, baby credit

Parts of the laws will restructure the Minnesota working household credit score right into a mixed credit score primarily based on the taxpayer’s earned revenue and the variety of qualifying youngsters.

The “baby credit score” element of the credit score equals $1,175 per baby, with no cap on the variety of eligible youngsters, whereas the “working household” element of the credit score equals 4 % of the primary $12,500 of earned revenue, as much as a most credit score of $500.

The mixed quantity is phased down starting at $35,000 of earned revenue or adjusted gross revenue (whichever is bigger) for married joint filers and $28,000 for all different filers.

Accordingly, the invoice permits the Division of Income to ascertain a system of advance funds for the credit score.

For households with out youngsters, the laws creates a one-time refundable credit score cost of $550 for married {couples} submitting joint returns and $275 for single and different filers, plus $275 per dependent for as much as three dependents. The credit score relies on 2021 incomes and returns and might be filed retroactively.

One-time support supplied additionally quickly will increase the homestead credit score refund and renter’s credit by 13.8 % and would apply to 2023 refunds solely (primarily based on lease paid in 2022 and property taxes payable in 2023).

Providing further tax breaks for owners, non permanent will increase would supply further “focused” refunds for owners who skilled giant year-over-year property tax will increase.

Below present regulation, the refund applies to owners whose property tax refunds enhance by greater than 12 % and is proscribed to $1,000. For refunds primarily based on 2023 property taxes, the refund would apply to owners with will increase bigger than six %, and the utmost refund could be $2,500.

Social Safety advantages

The invoice would additionally handle Social Safety advantages for many Minnesotans.

The laws would broaden Minnesota’s Social Safety subtraction to permit taxpayers with adjusted gross revenue beneath $100,000 for married joint returns, or $78,000 for single (or head of family) returns to subtract the total quantity of the taxpayer’s taxable Social Safety advantages.

The subtraction could be phased down by 10 % for every $2,000 of adjusted gross revenue in extra of the thresholds.

An modification proposed by Rep. Bjorn Olson (R-Fairmont) would have exempted 100% of Social Safety advantages, however it was not authorized previous to the total Home vote.

Minnesota

RIVALS24 BLACK FRIDAY SALE — 75% Off Rivals Premium Subscription

RIVALS24 BLACK FRIDAY SALE — 75% Off Rivals Premium Subscription

The Minnesota Golden Gophers regular season may be coming to an end on Friday afternoon in Madison but the news and rumors never stop at Gohpers Nation. Gophers Nation is dedicated to bringing you the most in-depth wall-to-wall coverage of Minnesota football and basketball on the field of play and on the recruiting trail.

Do you want the latest recruit scoop on the football side of things? What about the latest on how the team looks heading into the 2024 season? What about who could be the next commitment? Gophers Nation has you covered on all that and everything else throughout this busy summer right here on Minnesota.Rivals.com!

So if you don’t want to miss out on another Gophers scoop then sign up now for HVI today and use the promo code RIVALS24 to get FREE Rivals premium until fall football camp.

— Join us today and get FREE Happy Valley Insider Premium until Fall Camp!

— Are you new to our site? If so, start here to enroll in the promotion.

— Already a registered user? Start here!

Use the promotional code: RIVALS24

IMPORTANT DETAILS…..

– Offer is for new subscriptions only

– The promo code offer is a LIMITED TIME OFFER and will not be around for long as there is a specific limit for this promo code.

============================

– Talk about it INSIDE GOPHER NATION.

– Follow us on Twitter: @MinnesotaRivals, @RivalsDylanCC

– SUBSCRIBE to Gophers Nation

Minnesota

Cardinals-Vikings Unveil Thursday Injury Report

ARIZONA — The Arizona Cardinals and Minnesota Vikings released their Thursday injury reports ahead of their Week 13.

The Cardinals saw Kelvin Beachum upgraded from DNP to Full after his rest day.

Emari Demercado (back), Darius Robinson (ankle), Jalen Thompson (ankle) and Jonah Williams (shoulder) all were limited for a second straight day.

It’s a fairly light injury report for the Cardinals, who again saw key defenders practice for a consecutive day – a potentially good sign for players such as Thompson and Robinson.

As for the Vikings:

DNP – Josh Oliver (wrist/ankle), Jay Ward (elbow)

Limited – Patrick Jones (knee), Cam Robinson (foot) and Andrew Van Ginkel (thigh)

Full – Harrison Phillips (rest), Jonathan Bullard (toe), Kamu Grugier-Hill (shoulder), Brandon Powell (ankle),

Phillips, Bullard, Grugier-Hill and Powell all saw upgrades in their practice status.

The Cardinals’ playoff chances again can sway either way for the squad with a win/loss in Minnesota, you can read more about their odds here.

Arizona stumbled out of their bye week against the Seattle Seahawks, and the Cardinals know defeating the Vikings on the road is a tall task.

“It goes back to the makeup of this team. We understand and ‘JG’ (Head Coach Jonathan Gannon) does a great job. After the game, I know he’s probably feeling the same way we feel, right? But at the end of the day, the message is we have to be ready for next week,” Kyler Murray said when asked about rebounding.

“We can’t let one turn into two, two turn into three. We have to get right back on the horse and keep going and the guys understand that. We’ve done a good job of bouncing back and we get another opportunity to go out there this weekend and do that again.”

Minnesota

Four Minnesota Twins Stats to be Thankful For

.jpeg.ca95269fce1db9861b700d87a34be4c6.jpeg)

In a year headlined by the Pohlads’ frugality, broadcasting issues, and a historic collapse, we often need the reminder that the Twins were a playoff-caliber club for more than two-thirds of the season. You aren’t a playoff contender without players who are producing at exceptional rates, as compared to the rest of the league. Let’s look at four(ish) statistics that stood out across the league for our local club.

Matt Wallner’s Power

Matt Wallner is a power player on both sides of the ball, with a 98th percentile exit velocity (EV) and 99th percentile arm strength. While we need to see considerable improvement in Wallner’s contact rate, the lefty hits the snot out of the ball when he makes contact, boasting elite hard-hit rates. With a 93 mile-per-hour average EV and a 116.8 mile-per-hour maximum, the lefty mashed 13 home runs in only 220 at-bats in 2024. His hardest-hit ball was “just” a single, but his second-hardest was this 116.7 MPH scorcher over the right-field fence at Guaranteed Rate Field.

And then there was the behemoth off Griffin Canning.

On the other side of the ball, Wallner might grade out as a below-average right fielder, but he has one of the best arms in the game. Runners need to tread lightly (er, quickly? Tread not at all?) when they’re thinking about extra bases on a ball hit to Wallner, as he shows off an arm that produced a maximum velocity of 101.2 MPH and an average velocity (on competitive throws) of 96.9. On Aug. 30, the Toronto Blue Jays’ Spencer Horwitz learned this this hard way.

Byron Buxton’s Speed

Twins fans are very aware of Buxton’s speed, and while we’d love to see it employed more on the basepaths, it’s helped him remain one of the best centerfielders in the game. His Sprint Speed and Outs Above Average (OAA) both sit in the 97th percentile in all of baseball, and his best catch of the season was this liner off the bat of Los Angeles Dodgers Teoscar Hernandez, which had a 35% catch probability.

Nothin’ but raindrops, folks.

Griffin Jax’s Stuff

While rumors swirl regarding Jax’s ability to be a starter, he has cemented himself as one of the best relievers in baseball, with a bevy of statistics that sit in the 90th percentile of the league or better. Most notably, his chase rate (99th percentile), whiff rate (98th), and strikeout rate (97th) lead to some of the best actual and expected stats in the majors. Sure, the highlight below is from Spring Training, but my oh my did he send the Pittsburgh Pirates’ Tsung-Che Cheng back to medieval times with this sweeper.

Joe Ryan’s Command

The Twins really missed Joe Ryan down the stretch, in large part due to his ability to control and command the strike zone. With a 96th percentile walk rate and a 98th percentile expected OBP, Ryan limited free passes better than nearly anyone in baseball – an important attribute when you don’t have traditionally overpowering stuff. His ability to live on the edge of the strike zone doesn’t just limit walks. It also limits a hitter’s quality of contact, resulting in better-than-average exit velocities and hard-hit rates for the righty.

There’s plenty more to be thankful for this season, and it gives us plenty to look forward to as the calendar inches toward 2025. One thing is for certain: No matter what happens with the team on the field in 2025, we here at Twins Daily are thankful for the owners, editors, content creators, and readers that make this all possible. Happy Thanksgiving to all who celebrate—and cheers, all the same, to those who don’t!

What are YOU thankful for this year?

-

Science1 week ago

Science1 week agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Health6 days ago

Health6 days agoHoliday gatherings can lead to stress eating: Try these 5 tips to control it

-

Health4 days ago

Health4 days agoCheekyMD Offers Needle-Free GLP-1s | Woman's World

-

Science3 days ago

Science3 days agoDespite warnings from bird flu experts, it's business as usual in California dairy country

-

Technology2 days ago

Technology2 days agoLost access? Here’s how to reclaim your Facebook account

-

Science1 week ago

Science1 week agoAlameda County child believed to be latest case of bird flu; source unknown

-

Sports1 week ago

Sports1 week agoBehind Comcast's big TV deal: a bleak picture for once mighty cable industry

-

Entertainment1 day ago

Entertainment1 day agoReview: A tense household becomes a metaphor for Iran's divisions in 'The Seed of the Sacred Fig'