Finance

City minister sets out post-Brexit reform of financial services

Andrew Griffith, the Metropolis minister, has pledged that the “Edinburgh” bundle of post-Brexit reforms for the monetary companies business will make the sector “as internationally aggressive as attainable”.

On Friday, chancellor Jeremy Hunt will launch wide-ranging consultations on guidelines for monetary companies as a way to discard EU requirements and make the Metropolis extra aggressive in opposition to world rivals.

The reforms, at first dubbed Large Bang 2.0 by ministers, vary from loosening insurance coverage guidelines underneath the Solvency II regime, releasing some retail banks from ringfencing their operations, and loosening EU-imposed Mifid 2 curbs on analyst analysis that restricted protection of firms and deterred buyers.

In an interview with the Monetary Instances earlier than the announcement, Griffith mentioned the proposed modifications would enable the UK to “maintain or make the most of new alternatives, new improvements, new methods of constructing markets extra liquid and efficient”.

He promised that the reforms can be the “first out of the block making the most of Brexit freedoms”. Different sectors, comparable to life sciences, will observe.

Griffith highlighted a few of the proposals within the 30-point reform plan. They embrace “retiring” packaged retail funding and insurance coverage merchandise (PRIIPS), consulting on a brand new central financial institution digital foreign money utilizing blockchain expertise, and exploring the best way to speed up settlement of trades in London in order compete with quicker US rivals.

Griffith mentioned the federal government would launch a session of the 2016 senior managers regime however added this may not abandon having “some kind of fit-and-proper particular person regime” to make sure these in positions of energy had been accountable and succesful.

Different areas embrace a brand new inexperienced finance technique and plans to provide the Monetary Conduct Authority energy to supervise scores on environmental, society and governance.

New UK long-term asset funds — an open-ended construction that permits funding in illiquid belongings — will even be launched.

Griffith mentioned a lot of the work can be delivered in 2023, setting a timetable way more speedy than is feasible within the EU, the place rule modifications often take years to agree and implement.

Griffith mentioned the UK was “blessed with high-quality regulators” however that “it was proper that we lay down the framework and if the framework says that we need to pursue development and have internationally aggressive monetary markets, then that’s completely proper”.

He added: “It’s not for ministers to make these operational judgments for them. They make these every day.”

The UK’s post-Brexit method to rulemaking offers regulators extra direct energy than they’d underneath the EU regime, the place extremely detailed rules are agreed at political stage.

Regulators have promised to be extra “agile” and attentive to the wants of business and to evolving market dynamics. Finance executives and lobbyists say such a change might have extra impression than particular person rule tweaks.

On financial institution ringfencing, Griffith mentioned the federal government would implement a earlier evaluate of the system that will “not abandon ringfencing [but] is trying in the long term at how [it] sits alongside the decision regime . . . it talks about, for instance, taking a few of the retail-only banks out”.

Ringfencing was designed to insulate the retail arms of banks from losses of their riskier buying and selling companies. Nevertheless, the prevailing rules additionally apply to banks comparable to Santander, TSB and Virgin Cash, that are overwhelmingly engaged in retail banking.

Metropolis executives have lengthy known as on the federal government to keep away from a “bonfire of pink tape”, as soon as touted as a advantage of Brexit. World monetary corporations flock to London for the excessive requirements in governance demanded by their house regulators.

Griffith pressured the necessity to keep excessive requirements of regulation: “When you have a look at the bundle of measures that we’re taking a look at, it isn’t a wholesale abandonment or retirement of the rule guide in any respect.”

He added: “We’ll all the time compete on the premise of the highest-quality regulation in alignment with worldwide requirements.”

Finance

Brace for ‘third wave’ of China bond defaults on financing costs, tighter policies: S&P

Local government financing vehicles (LGFVs) and consumer companies could trigger a new round of debt failures because of their bigger maturity walls and greater refinancing needs, the rating company said in a report on Tuesday. The most recent distress cases are just entering full restructuring and more will come this year, it added.

“Policies aimed at reining in excessive leverage have driven two default waves so far,” Charles Chang, S&P’s Greater China country lead for corporate ratings, said in the report. “More policies with similar aims, scale and effects may lead to the next wave of defaults.”

Companies in the industrial and commodities sectors led the first wave between 2015 and 2016, when the country experienced 80 defaults triggered by excess capacity and asset management, said Chang, who co-authored the report with China country specialist Chang Li. Beijing’s “three red lines” policy has led to the second wave from 2021, with real estate developers accounting for most of the 108 default cases since, he added.

China Evergrande Group, which was ordered to liquidate in January amid an accounting scandal, first fell into distress in June 2021 after China squashed weak developers to contain systemic risks in the financial system. The cash crunch at Country Garden Holdings, once China’s largest home builder, showed the crisis has yet to run its course, S&P said in the report.

“Market access for privately owned firms has been negative for most months since 2021,” Chang said in the report. “For LGFVs, only higher rated firms were able to issue bonds but in lower volumes. Tightened regulation has restricted the market access of weaker LGFVs.”

Still, this year may mark a trough as the repayment amount drops, S&P said. Chinese entities have US$92 billion in offshore corporate bonds coming due, compared with US$111 billion that matured in 2023 and US$104 billion that will be payable in 2025, Chang said. As a result, China’s offshore default rate has fallen to 0.3 per cent in the first quarter, from 1.3 per cent in 2023 and 6.7 per cent in 2022.

Country Garden to raise funds for US$13 million bond coupon within grace period

Country Garden to raise funds for US$13 million bond coupon within grace period

China’s 5.3 per cent growth last quarter should not be viewed as a “significant slowdown”, said Kenny Ng, a strategist at Everbright Securities in Hong Kong. The country’s monetary policy is still quite accommodative and financing costs are still going down overall.

While there has been no default among onshore borrowers in the first three months of 2024, S&P said debt maturities are peaking this year at 8 trillion yuan (US$1.1 trillion). LGFVs face 3.5 trillion yuan of repayments, while the capital goods and power sectors each have 757 billion yuan and 738 billion yuan of obligations, respectively.

“Corporate debt is a rigid burden that is largely dependent on a company’s operations,” said Shen Meng, director at Beijing-based investment firm Chanson & Co. “The tightening of financing will further compress the flexibility of a company’s operations and shake the foundation of its financial stability.”

Finance

Next Gen Personal Finance Celebrates Milestone 100,000 Teacher Accounts as Financial Education Gains National Support

BURLINGAME, Calif., April 23, 2024 /PRNewswire/ — The community of teachers who use resources from financial education nonprofit Next Gen Personal Finance (NGPF) hit a milestone of 100,000 members this week.

NGPF’s mission is to guarantee that, by 2030, all high school students receive a personal finance course prior to graduating. The organization produces high-quality, engaging personal finance curriculum and professional development at no cost to educators. Next month, NGPF will celebrate its tenth anniversary.

“The growth in educators seeking personal finance resources for their classroom reflects the increase in support from advocates and policymakers across the country who want to ensure high schoolers graduate with a foundational understanding of how to navigate their finances,” said Tim Ranzetta, co-founder of NGPF.

Demand for NGPF’s resources has mirrored the proliferation in state policies guaranteeing a Personal Finance course. In 2020, only eight states guaranteed a personal finance course to all public high school students. At the end of 2023, 25 states had enacted laws.

NGPF teacher accounts more than tripled in the last four years. At the end of June 2020, NGPF had nearly 33,000 account users. Now, at least 84% of students attend a U.S. high school where a teacher has an NGPF account.

“As a former high school teacher and principal, one of my favorite things about personal finance education is that students want to learn it,” said Jessica Endlich, co-founder of NGPF. “They see the immediate connection to their lives, they can share the knowledge with their friends and family, and they’re truly motivated to engage with the materials. That’s a win for any school or community.”

According to a survey by the National Endowment for Financial Education, more than 88 percent of adults support requiring financial education in high school.

“As an early adopter of NGPF resources, the collaborative community fueled my professional growth, inspiring me to continuously innovate in my classroom and improve my own content knowledge,” said Amanda Volz, the first teacher to create an NGPF account, who now works as NGPF’s Director of Professional Development. “This led to transformative learning experiences for my students as they benefited from the high-quality NGPF resources that have been, and always will be, free for everyone.”

Of the teachers with NGPF accounts, 37 percent identified as personal finance teachers, 20 percent as math teachers, nine percent as Economics and eight percent as Career Prep.

“I recall the initial days with NGPF vividly. It was astonishing to discover a company offering such a wealth of pertinent content for my students completely free of charge,” said Brenda Martin-Lee, Business Educator at Seneca High School in N.J., who was the second teacher account with NGPF. “As time passed, I gradually incorporated the majority of these excellent resources into my Personal Finance classes.”

Research has clearly demonstrated that a Personal Finance course improves long-term financial decision-making and positively impacts student debt decisions and credit scores, helps graduates avoid predatory lenders, helps to increase savings rates among teachers, and even generates positive spillover effects on parents.

“I simply can’t say enough about the positive impact NGPF has had on my life. It goes far beyond the curriculum, the professional development, our Fellows group, scholarships, and the advocacy,” said Jacqueline Collins, a business educator at Mansfield High School in Mansfield, Mass. “NGPF built a community of amazing, like-minded colleagues that I speak with each day, whether through Finlit Fanatics or in our FinLitFam text group. It’s priceless!” Collins was the fourth teacher to create an account with NGPF.

A recent report from Tyton Partners found that taking a one-semester course in personal finance results in an average per-student lifetime benefit of approximately $100,000. The report also found the cost of implementing a standalone course can be kept low given the availability of high-quality curricular resources and teacher professional development made available by providers at no or minimal cost.

About Next Gen Personal Finance

Next Gen Personal Finance (NGPF) is a nonprofit committed to guaranteeing that all high school students receive a personal finance course prior to graduating. NGPF has become the number one source for 100,000 educators looking for high-quality, engaging personal finance curriculum to equip students with the skills they need to thrive in the future. NGPF invests in teacher professional development with live Virtual Professional Development, 10 Certification Courses, and 40+ asynchronous On-Demand modules. NGPF has been recognized by Common Sense Education as a “Top Website for Teachers to Find Lesson Plans” and “Best Business and Finance Games” and also named NGPF a “Selection for Learning.” Visit ngpf.org for more.

MEDIA CONTACT

Tim Ranzetta

NGPF Mission 2030 Fund

Next Gen Personal Finance

[email protected]

SOURCE Next Gen Personal Finance

Finance

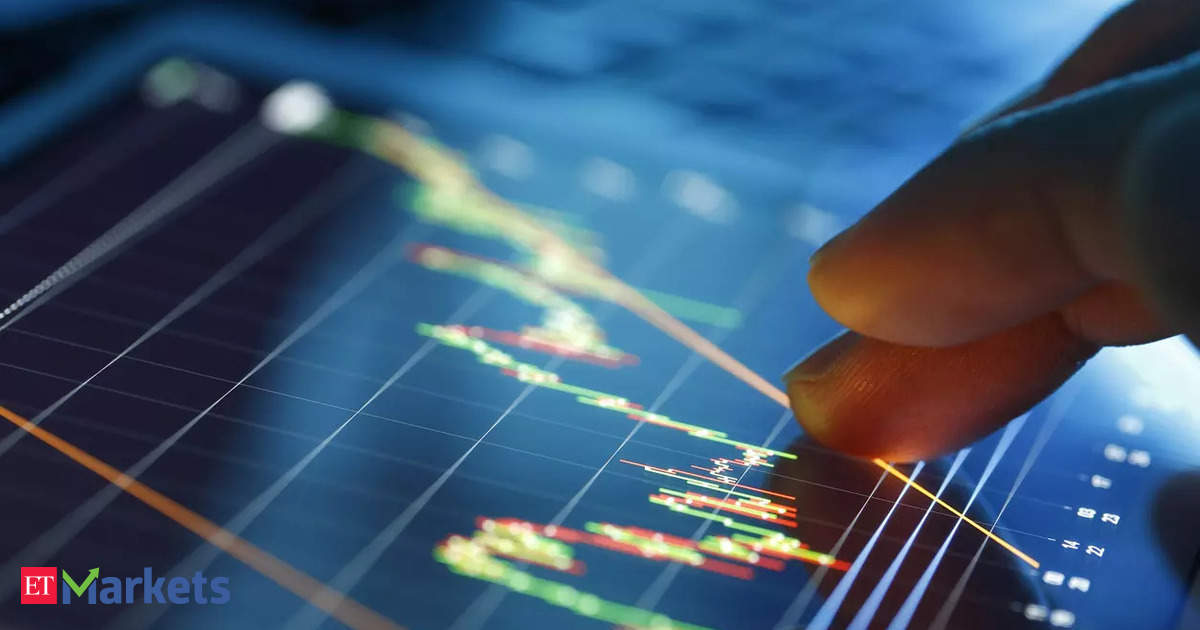

M&M Finance postpones results after fraud

In a stock exchange notice post midnight, the company said the fraud involved forgery of KYC (know your customer) documents leading to embezzlement of company funds and pegged the total financial impact of the fraud at Rs 150 crore.

“Investigations in the matter are at an advanced stage. The company estimates that the financial impact of this fraud is unlikely to exceed Rs.150 crores… necessary corrective actions have been identified and are at various stages of implementation, including arrest of few persons involved,” the company said.

The company’s shares fell close to 8% in early trade to Rs 257 a piece but had recovered and was trading at Rs 270 apiece down 3% from Monday’s close of Rs 279 a piece on the BSE.

The company said that the discovery of the fraud, agenda matters pertaining to approval of the audited standalone and consolidated financial results of the company for the fourth quarter and financial year ended 31 March 2024, recommendation of dividend, AGM and related matters, which were to be considered at the board meeting on Tuesday are being deferred to a later date, which shall be intimated in due course.

However, the company’s audit committee and the board meeting to consider other matters like increase in aggregate borrowing limits and fund raise via issue of non-convertible debentures will go ahead as per schedule.The company did not specify which branch the fraud took place.

-

News1 week ago

News1 week agoCross-Tabs: April 2024 Times/Siena Poll of Registered Voters Nationwide

-

Politics1 week ago

Politics1 week agoNine questions about the Trump trial, answered

-

World6 days ago

World6 days agoIf not Ursula, then who? Seven in the wings for Commission top job

-

World1 week ago

World1 week agoHungary won't rule out using veto during EU Council presidency

-

Movie Reviews1 week ago

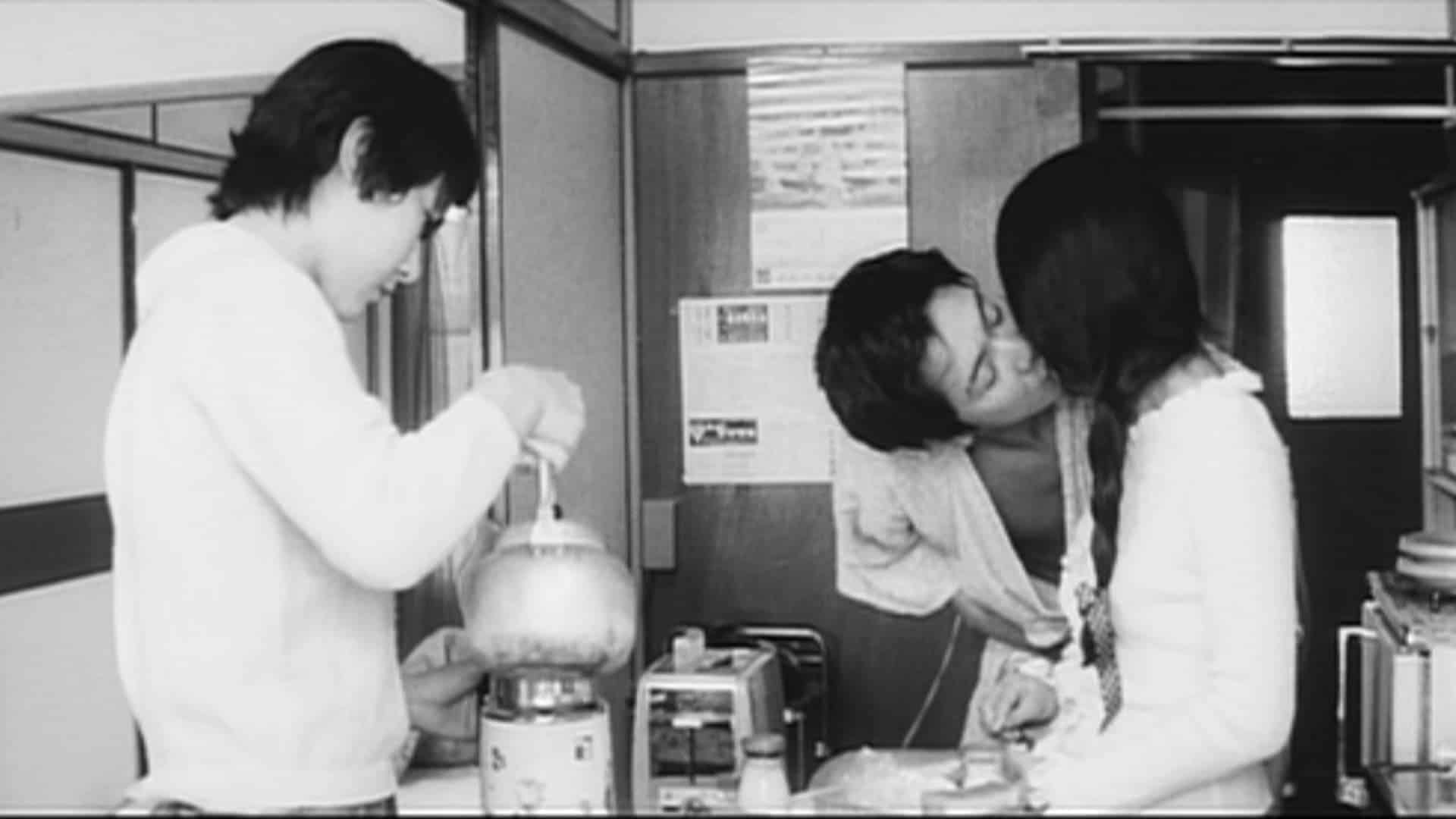

Movie Reviews1 week agoFilm Review: Season of Terror (1969) by Koji Wakamatsu

-

World7 days ago

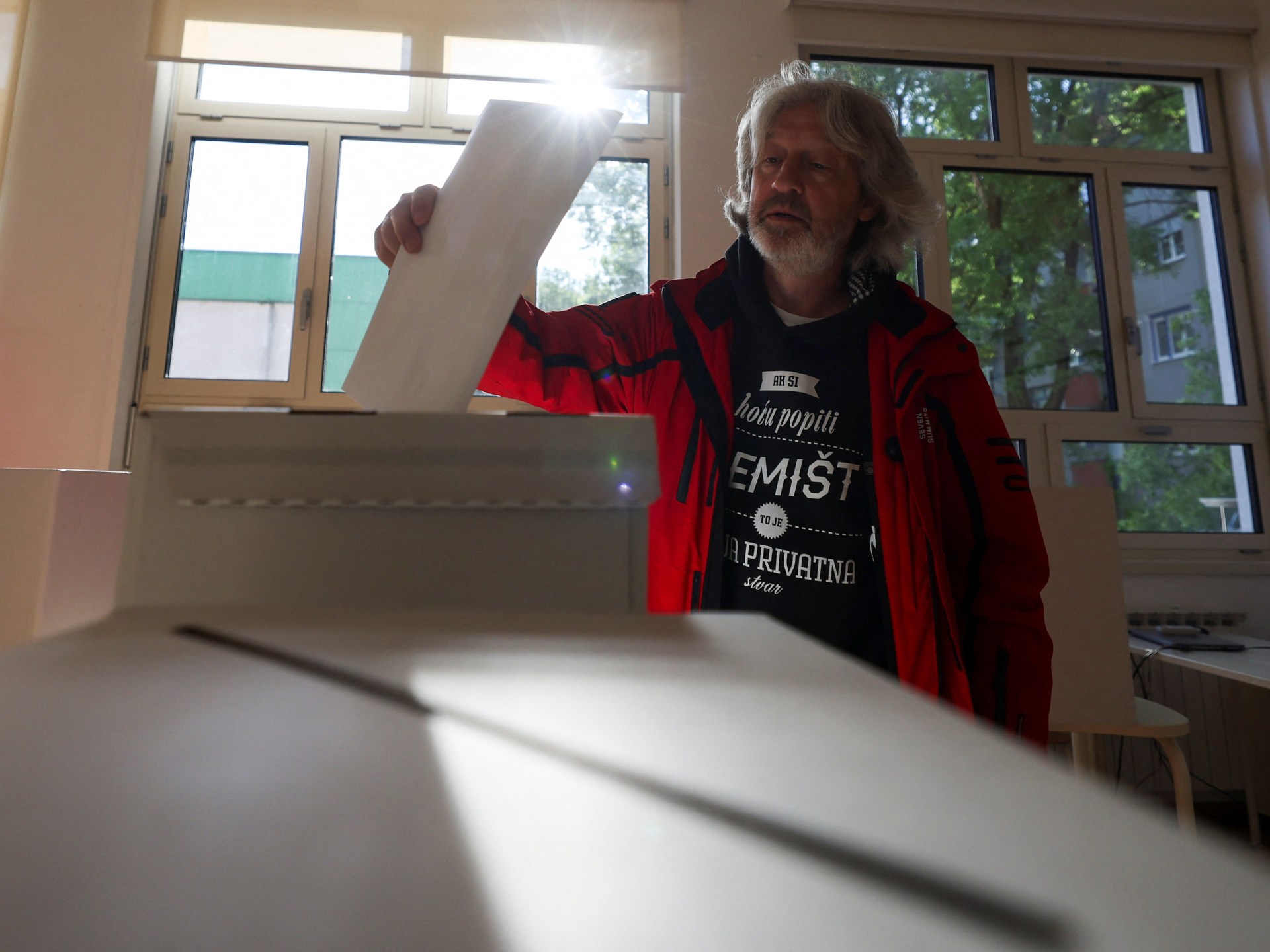

World7 days agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week agoGroup of EU states should recognise Palestine together, Michel says

-

Politics6 days ago

Politics6 days agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial