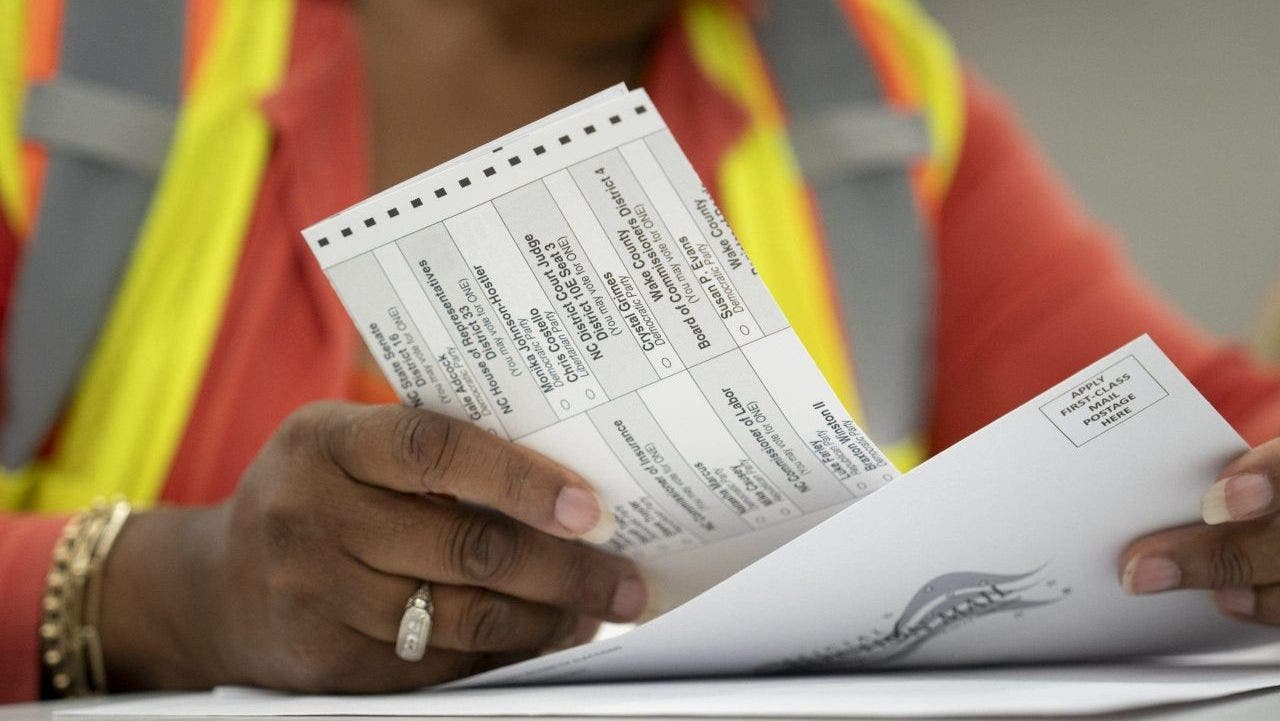

D.C. candidates have upped their spending previously month as contenders make last-minute appeals to voters who haven’t already forged their ballots, based on the ultimate spherical of marketing campaign finance studies that have been due earlier than the June 21 Democratic major.

Finance

Campaign finance reports show D.C. candidates ramping up spending

Each campaigns elevated their spending considerably since their final studies, which captured marketing campaign exercise by way of the month of April into early Might. White’s marketing campaign has spent greater than $904,000 since Might 11, with about $483,000 going towards promoting; Bowser’s marketing campaign spent greater than $1.3 million this era, $500,000 of which went towards promoting bills.

Bowser studies having considerably additional cash available, nevertheless. She has greater than $1.6 million remaining to shut out the interval, whereas White has about $181,000. Each candidates are utilizing town’s public financing program, which caps particular person donations at small greenback quantities whereas matching donations from metropolis residents, 5 to 1, with taxpayer funds.

The 2 different Democratic mayoral candidates, council member Trayon White Sr. (D-Ward 8) and former advisory neighborhood commissioner James Butler, who just isn’t utilizing public financing and thus has a better restrict on particular person contributions, had not submitted studies to the Workplace of Marketing campaign Finance by Monday afternoon. Trayon White requested an extension, OCF spokesman Wesley Williams stated.

The vast majority of candidates for mayor, legal professional normal and council opted into the Honest Elections Program — and within the contest for D.C. legal professional normal, using public financing has emerged as one of many few methods during which the three candidates have sought to tell apart themselves to voters.

Venable partner-in-charge Brian Schwalb and solo practitioner legal professional Ryan Jones opted into this system, whereas Bruce V. Spiva, a former managing companion on the Perkins Coie regulation agency, didn’t. The latest fundraising studies present that Schwalb took in about $21,400 from D.C. residents and $14,000 from nonresidents.

Schwalb has now raised a complete of $1.1 million when together with public financing, although he noticed a lower in general contributions for the reason that final reporting interval. Spiva has raised a complete of about $423,000 in his marketing campaign — and his most up-to-date report reveals that he has additionally loaned his personal marketing campaign $535,000.

Jones has obtained about $246,000 over the course of his marketing campaign however elevated his donations from D.C. residents and nonresidents since his final report, taking in $2,523 from residents and $1,112 from nonresidents this reporting interval.

On high of candidates’ particular person marketing campaign coffers, the newest filings additionally present that two training teams have poured greater than $1.3 million into the races. The D.C. chapter of Democrats for Training Reform — a gaggle that helps constitution faculties and town’s present system of mayoral management — has spent greater than 1,000,000 {dollars} to again Bowser, incumbent D.C. Council Chair Phil Mendelson and Ward 3 candidate Eric Goulet.

The group, which isn’t allowed to coordinate with particular person campaigns, has obtained vital funds from outstanding nationwide figures, together with Alice Walton, a daughter of the founding father of Walmart and backer of constitution faculties. DC Constitution College Motion, an unbiased expenditure committee, has spent almost $300,000 thus far this election cycle. No different group, based on marketing campaign finance studies, has spent even a fraction of what these teams have spent within the native elections.

The studies additionally assist present how the races for D.C. Council are shaping up within the last stretch earlier than the first.

Within the race for council chair, Mendelson, who just isn’t utilizing public financing, has taken in additional than $259,000 since March 11 and $779,464 in whole; he has $316,241 money available. In her marketing campaign to unseat Mendelson, advisory neighborhood commissioner Erin Palmer studies receiving just below $10,000 in particular person contributions previously month, with 95 % of donations coming from D.C. residents. She has greater than $88,000 money available to shut out her major marketing campaign.

Within the more and more intense race for the Ward 1 council seat, the place all three candidates are utilizing public financing, former police officer Salah V. Czapary studies elevating greater than $11,300 from D.C. residents previously month whereas two-term incumbent Brianne Ok. Nadeau raised $10,844. He has outraised her in native donations for 2 straight reporting durations, although Nadeau raised extra from nonresidents within the final reporting interval.

Nadeau and Czapary have raised a complete of about $241,000 and $209,000, respectively, and now have comparable quantities of money available to shut out the interval. Sabel Harris, who’s working on the same liberal platform as Nadeau, raised simply over $500 from particular person donors previously reporting interval and has raised a complete of about $50,000, together with taxpayer funds.

Czapary spent about $122,900 within the reporting interval — together with just below $72,000 for marketing campaign mailers — representing greater than 60 % of his whole marketing campaign expenditures. Virtually half of Nadeau’s $200,000 in spending has come within the final reporting interval as effectively, with the lion’s share going towards consulting charges.

The studies additionally assist differentiate candidates within the hotly contested Democratic major in Ward 3. Seven candidates are utilizing public financing; high-schooler Henry Cohen opted to not fundraise within the race, whereas former advisory neighborhood commissioner and housing advocate Deirdre Brown is utilizing conventional fundraising and has raised about $77,500 over the course of her marketing campaign.

Of the Ward 3 candidates collaborating in public financing, native activist Matthew Frumin leads in fundraising with a complete of $205,800; he has additionally spent probably the most, and identical to his rival candidates, nearly all of his spending has taken place within the final reporting interval.

Monte Monash, a former D.C. Library board member, ranks second in whole receipts at $146,708. She’s adopted intently by Palisades group chief Tricia Duncan — who garnered outgoing Ward 3 council member Mary M. Cheh’s help final month — in addition to Goulet and Ward 3 Democrats Chair Phil Thomas. Nonetheless, Duncan on Monday evening all of the sudden dropped out of the race, throwing her help to Frumin.

Goulet, who was endorsed final month by The Washington Put up editorial board, outraised all of the Ward 3 candidates on this reporting interval. Rounding out the pack are advisory neighborhood commissioners Ben Bergmann and Beau Finley, who’ve raised about $99,000 and $106,000 of their campaigns, respectively.

In Ward 5, 4 of seven candidates had submitted finance studies by Monday afternoon, whereas Williams stated that the others obtained extensions. Within the race for at-large member of the D.C. Council, two of 4 candidates requested extensions.

Looking forward to November’s normal election, three independents working for an at-large council seat additionally filed studies this week. Newcomer Graham McLaughlin, who’s working as a business-friendly candidate, has outraised incumbent Elissa Silverman thus far, taking in about $185,000 to Silverman’s $165,000, although Silverman raised extra in the latest reporting interval. Karim Marshall, the third candidate within the race, has raised $14,787 thus far.

Perry Stein contributed to this report.

Finance

Investors eye PCE, Costco shares under pressure: Yahoo Finance

Wall Street is digesting this morning’s release of the latest Personal Consumption Expenditures (PCE) data, the Federal Reserve’s preferred measure of inflation. Meanwhile, Costco (COST) shares are under pressure following the wholesale retail giant’s latest quarterly results. Despite recent increases in membership fees, the company fell short of sales expectations. Yahoo Finance’s trending tickers include BlackBerry Limited (BB), SuperMicro Computer (SMCI), and Coinbase (COIN).

Key guests include:

9:05 a.m. ET : Tiffany Wilding, PIMCO Managing Director and Economist

9:30 a.m. ET Angelo Kourkafas, Edward Jones Senior Investment Strategist

10:15 a.m. ET Rich Lesser, BCG Global Chair

10:45 a.m. ET Stuart Kaiser, Citi Head of U.S. Equity Trading Strategy

11:30 a.m. ET Ed Hallen, Klaviyo Chief Product Officer & Co-Founder

Finance

Biodiversity still a low consideration in international finance: Report

Biodiversity-related projects have seen an increase in international funding in recent years, but remain a low priority compared to other development initiatives, according to a new report from the Organisation for Economic Co-operation and Development (OECD).

The report found total official development finance (ODF) for such projects grew from $7.3 billion in 2015 to $15.4 billion in 2022. That’s still less than what the nearly 200 governments that signed the Kunming-Montreal Global Biodiversity Framework (GBF) in December 2022 agreed would be needed to halt biodiversity loss: at least $20 billion annually by 2025, and $30 billion annually by 2030.

Government funding made up the bulk of the ODF for biodiversity-related projects in the OECD report, which is welcome news, Campaign for Nature (CfN), a U.S.-based advocacy group, said in a statement.

“We welcome the increase in international biodiversity finance reported in 2022 but that good news is tempered by a range of concerns,” Mark Opel, finance lead at CfN, told Mongabay.

One concern, CfN notes, is that funding specifically for biodiversity as a principal objective declined from $4.6 billion in 2015 to $3.8 billion in 2022. CfN reviewed hundreds of projects from 2022, which formed the source for the OECD’s report, and found that many either had vague descriptions or focused on other policies like agriculture but were counted toward protecting or restoring nature.

“We need to see more emphasis on funding with a primary focus on biodiversity,” Opel said. “So-called ‘principal’ funding that has biodiversity as its primary goal continues to be down since its 2015 peak. Increases in this type of funding are essential to meet the goals of the GBF … These goals cannot be met through funding with biodiversity as only a ‘significant’ goal that mainstreams biodiversity into projects with other primary goals like humanitarian aid or agriculture.”

The report also found that funding for biodiversity-related activities represent just 2-7% of the total ODF portfolio.

“It is concerning that biodiversity considerations still represent a relatively low share of the total official development assistance,” Markus Knigge, executive director of Germany-based nonprofit foundation Blue Action Fund, told Mongabay. He added it was also problematic that most funding came via loans, which have to be repaid, rather than grants, which are often more appropriate for conservation finance.

CfN says grants are preferable to loans because they don’t add to the debt burden of low-income recipient countries.

At the same time, development funding from major donors such as Germany, France, EU institutions, the U.S. and Japan have been cut in recent years.

“We have seen minimal announcements of new international biodiversity finance since [the GBF signing],” Opel said. “We estimate that only the equivalent of $162 million annually has been pledged since [then], which doesn’t come close to filling the $4.6 billion gap between the $15.4 billion in 2022 and the $20 billion commitment in 2025.”

Banner image: Javan lutung by Rhett A. Butler/Mongabay.

Finance

30-year mortgage rate hits 2-year low

The average rate on a 30-year fixed-rate mortgage was nearly unchanged this week but reached its lowest level in two years.

Thirty-year mortgage rates averaged 6.08% as of Thursday, down from 6.09% a week earlier, according to Freddie Mac data.

Average 15-year mortgage rates rose one basis point to 5.16%.

As mortgage rates hover around 6%, potential buyers are tiptoeing back into the market, and some homeowners who bought when interest rates topped 7% are weighing refinancing. Mortgage applications jumped to the highest level in more than two years last week, driven largely by refinancing volumes.

“Given the downward trajectory of rates, refinance activity continues to pick up, creating opportunities for many homeowners to trim their monthly mortgage payment,” Sam Khater, Freddie Mac’s chief economist, said in a statement. “Meanwhile, many looking to purchase a home are playing the waiting game to see if rates decrease further as additional economic data is released over the next several weeks.”

Thirty-year mortgage rates have dropped more than a percentage point since May.

Read more: Mortgage and refinance rates today, September 26, 2024: Rates finally decrease

The Pending Home Sales Index, a measure of housing contract activity, rose 0.6% to 70.6 in August, improving slightly from July’s record-low reading, according to the National Association of Realtors. A level of 100 is equal to the amount of contract activity seen in 2001.

“Buyers are finally getting more comfortable with the rate,” said Selma Hepp, chief economist at real estate data provider CoreLogic. “I don’t think that’s going to mean a big boost for home sales this year given how low they’ve been so far, but still, it’s a little bit of improvement.”

Claire Boston is a senior reporter for Yahoo Finance covering housing, mortgages, and home insurance.

Click here for real estate and housing market news, reports, and analysis to inform your investing decisions

Click here for more information and tools to help you handle your finances

-

News1 week ago

News1 week agoSecret Service Told Trump It Needs to Bolster Security if He Keeps Golfing

-

Business1 week ago

Business1 week agoU.S. Steel C.E.O. Says Nippon Deal Will Strengthen National Security

-

Politics1 week ago

Politics1 week agoNew House Freedom Caucus chair reveals GOP rebel group's next 'big fight'

-

News1 week ago

News1 week agoToplines: September 2024 Inquirer/Times/Siena Poll of Pennsylvania Registered Voters

-

News1 week ago

News1 week agoDisney trips meant for homeless NYC students went to school employees' families

-

Politics1 week ago

Politics1 week agoBiden admin moves to reinstate Trump-era rule, delist gray wolves from endangered species list

-

Politics1 week ago

Politics1 week agoDem lawmakers push bill to restore funding to UN agency with alleged ties to Hamas: 'So necessary'

-

Business1 week ago

Business1 week agoVideo: Federal Reserve Cuts Interest Rates for the First Time in Four Years