The United Nations Convention on Commerce and Growth (UNCTAD) has warned that the U.S. Federal Reserve’s rate of interest hikes and the slew of different central banks elevating charges, may pose hurt to the worldwide financial system. UNCTAD calculated that for each Fed foundation level rise, the financial output of rich nations declines by 0.5%, and for poorer nations, the worth of all gross sales of products and providers is decreased by 0.8% for a length of three years.

UNCTAD Report Criticizes Central Financial institution Price Hikes Throughout International Financial Downturn

Financial tightening measures will not be a good suggestion in response to the United Nations (U.N.) company UNCTAD. The entity, created in 1964, is an intergovernmental group created to assist creating nations improve international commerce. UNCTAD notes in an annual report that the latest rate of interest hikes by the U.S. Federal Reserve and quite a few central banks worldwide will scale back the financial output of each rich and poor nations between 0.5% and 0.8% over a three-year interval.

“The world is headed in direction of a worldwide recession and extended stagnation until we shortly change the present coverage course of financial and financial tightening in superior economies,” UNCTAD’s report notes. “UNCTAD tasks that world financial progress will gradual to 2.5% in 2022 and drop to 2.2% in 2023. The worldwide slowdown would depart actual GDP nonetheless under its pre-pandemic development, costing the world greater than $17 trillion — shut to twenty% of the world’s revenue.”

The annual report instantly digs into central banks elevating benchmark lending charges and creating more durable financial coverage. UNCTAD blames the world’s financial hardships on “supply-side shocks, waning client and investor confidence,” and the Ukraine-Russia conflict. “Regardless of this, main central banks are elevating rates of interest sharply, threatening to chop off progress altogether and making life a lot more durable for closely indebted corporations, households, and governments,” the U.N. company’s report explains.

UN Company Urges Governments to Improve Public Spending and Implement Worth Controls on Power and Meals

The report, authored by UNCTAD’s secretary-general Rebeca Grynspan, says that Latin American nations and particular areas in Africa might “endure [from] among the sharpest slowdowns this yr.” “The common progress fee for creating economies is projected to drop under 3% — a tempo that’s inadequate for sustainable improvement and can additional squeeze private and non-private funds and harm employment prospects,” Grynspan particulars. UNCTAD’s name on the Fed and the remainder of the world’s central banks is sort of just like the criticism written by U.S. Senator Elizabeth Warren (D-Mass).

Warren complained concerning the Fed elevating the federal funds fee after it hiked the speed by 75 foundation factors (bps) on July 27. Utilizing the information outlet the Wall Road Journal (WSJ), Warren printed an opinion editorial that mentioned the U.S. central financial institution may set off “a devastating recession.” Warren additional talked concerning the topic once more on CNN’s State of the Union weeks later, after Fed chair Jerome Powell introduced his financial outlook on the 2022 Jackson Gap Financial Symposium. Grynspan’s report is in kindred spirit, and it particulars that “rate of interest hikes by superior economies are hitting probably the most weak hardest.”

The UNCTAD report provides:

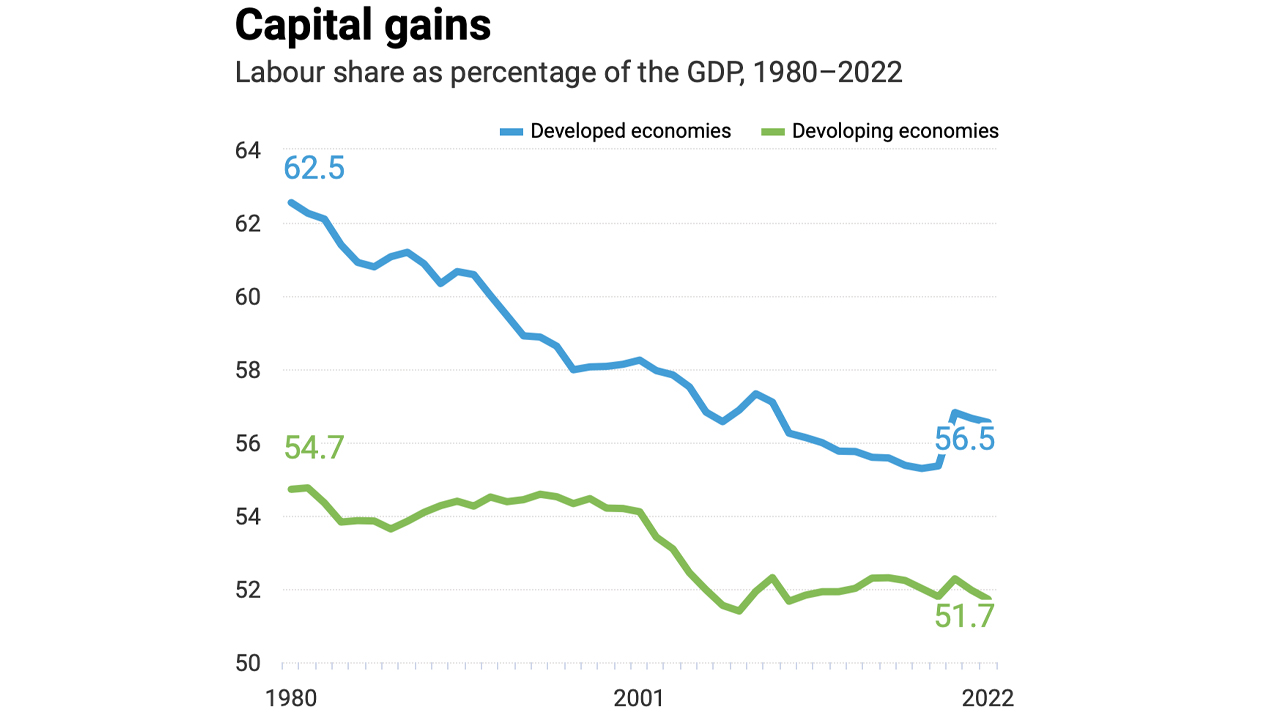

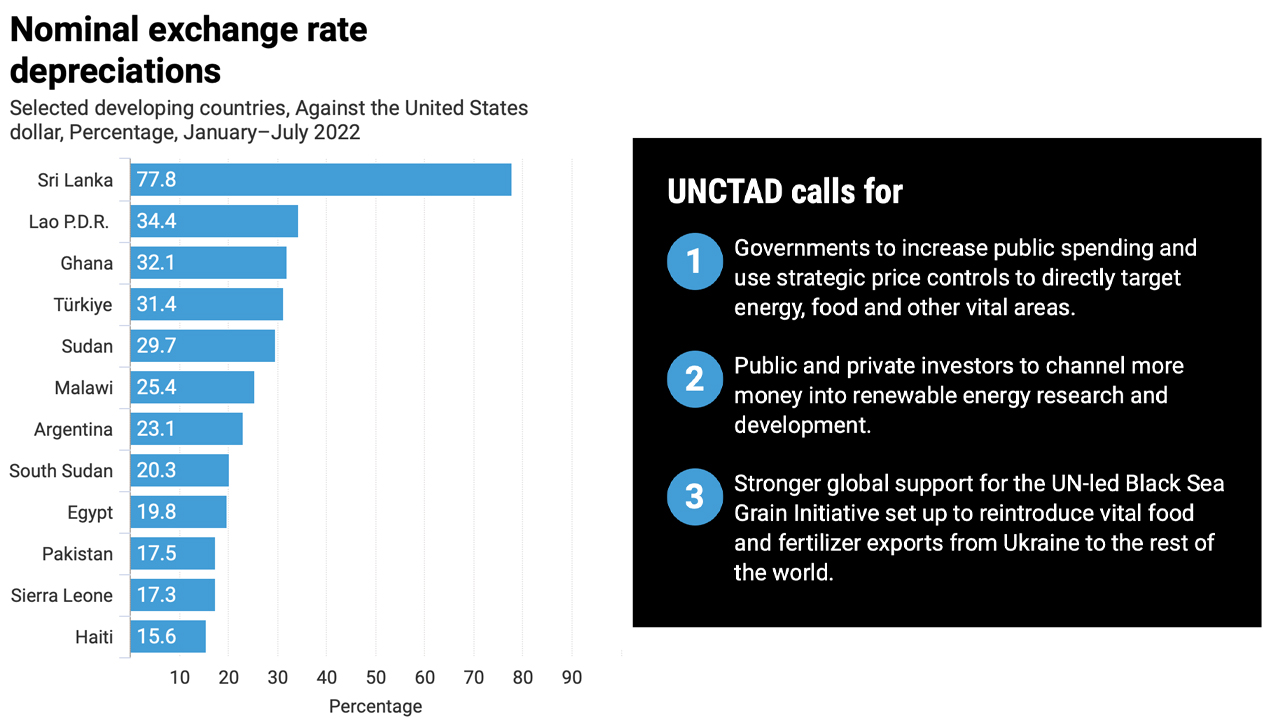

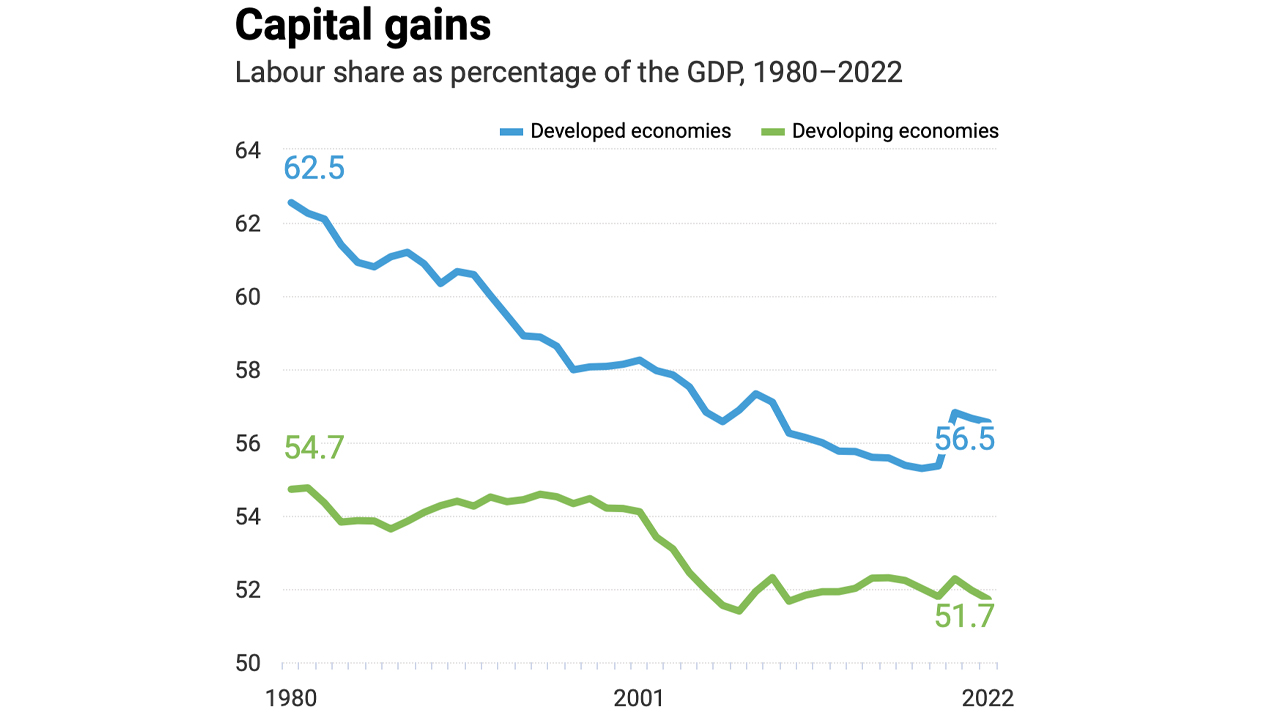

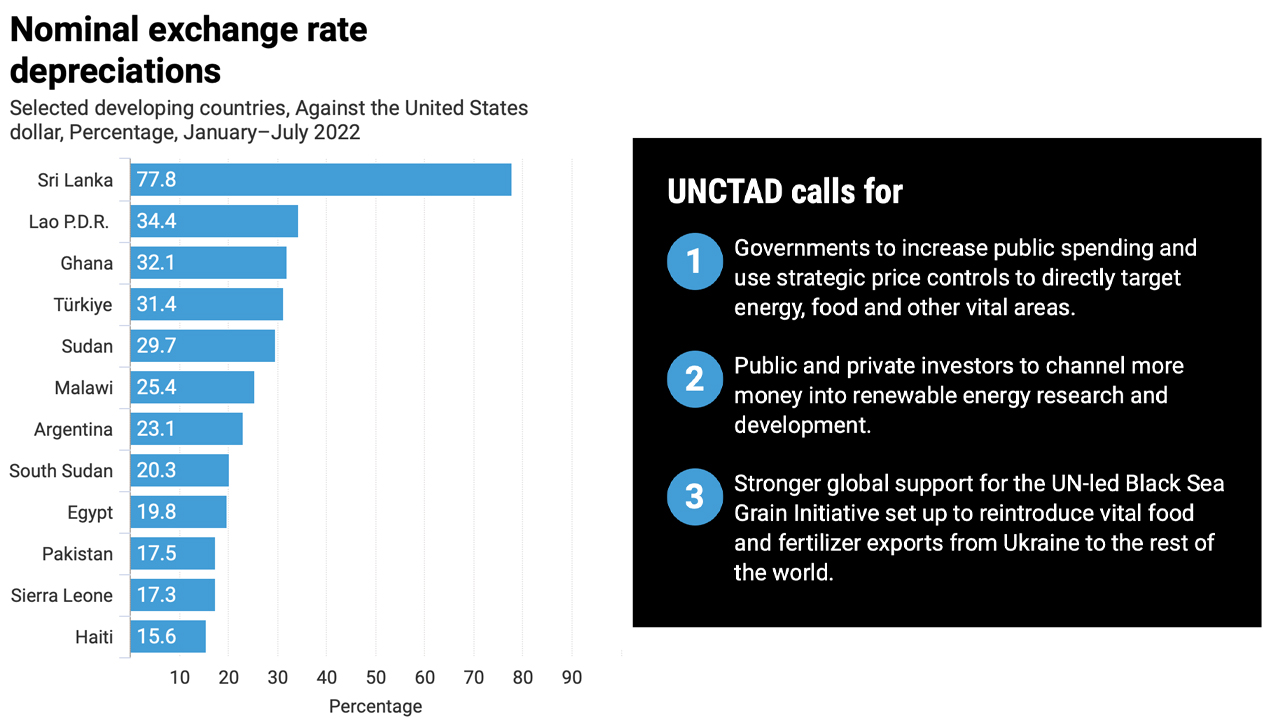

Some 90 creating nations have seen their currencies weaken in opposition to the greenback this yr – over a 3rd of them by greater than 10%.

UNCTAD’s report concludes by highlighting just a few methods international leaders can deal with the issue and one in all them is to “improve public spending.” The company additionally urges governments to implement “strategic worth controls to straight goal vitality, meals and different important areas.” The U.N. company calls on private and non-private executives to direct extra funds towards inexperienced vitality analysis and improvement. Lastly, the company desires to see international leaders get behind the Black Sea Grain Initiative. The U.N.-led initiative would enable huge volumes of meals and fertilizer exports from Odesa, Chornomorsk, and Yuzhny in Ukraine.

Tags on this story

Benchmark Charges, Black Sea Grain Initiative, Central Banks, currencies, Growing Nations, economics, Elizabeth Warren, Fed, Federal Reserve, inflation, rates of interest, jerome powell, Financial Tightening, public spending, Rebeca Grynspan, secretary-general, Provide Shocks, Ukraine-Russia conflict, un, UNCTAD, united nations, United Nations Convention on Commerce and Growth (UNCTAD), US Central Financial institution

What do you concentrate on UNCTAD’s report that calls on central banks to halt rate of interest hikes? Tell us what you concentrate on this topic within the feedback part under.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist residing in Florida. Redman has been an lively member of the cryptocurrency group since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 6,000 articles for Bitcoin.com Information concerning the disruptive protocols rising right this moment.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Editorial picture credit score: Alexandros Michailidis / Shutterstock.com

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25386604/STK471_Government_Surveillance_CVirginia_B.jpg)